State Auto Insurance Review for 2026

State Auto, now owned by Liberty Mutual, offers only business and farm insurance. The minimum monthly auto insurance rate of $85 is offered through Liberty Mutual. This State Auto insurance review helps drivers explore Liberty’s Safety 360 with a 10% sign-up discount and up to 50% off for safe driving habits.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated September 2025

Our State Auto insurance review highlights State Auto’s shift to exclusively offering business and farm insurance following its acquisition by Liberty Mutual in 2022.

State Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.9 |

| Business Reviews | 4.0 |

| Claims Processing | 2.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.9 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 1.7 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.2 |

| Plan Personalization | 4.0 |

| Policy Options | 4.1 |

| Savings Potential | 4.5 |

Policyholders can benefit from specialized programs, such as Prime of Life, which includes identity theft protection, roadside assistance, home-sharing liability, and cyber protection that covers lost wages during digital recovery.

Liberty Mutual now underwrites all former State Auto personal policies, offering up to 30% off through RightTrack for safe drivers. Get tips on how to buy auto insurance with usage-based features.

- State Auto insurance offers Prime of Life to drivers aged 45 and up

- Safety 360 requires an app download and activation within 30 days

- Cyber add-on includes up to $25K in identity fraud reimbursement

Find top-rated coverage options in our State Auto insurance company review by entering your ZIP code into our free quote comparison tool.

State Auto Insurance Coverage Rates

State Automobile Mutual Insurance Company rates now follow Liberty Mutual’s pricing style, showing clear changes based on age and gender. Young male drivers typically have higher premiums, while older drivers with more experience, especially women, generally pay less.

This breakdown shows how demographic factors affect monthly costs. Knowing these patterns helps you understand your position in Liberty Mutual’s rating system and why age and gender are so important in deciding your car insurance rate.

State Auto’s pricing is notable in a competitive market, highlighting its comparison with major insurers. Some companies offer lower rates for drivers who are mindful of their budget, while others charge more to provide wider coverage options.

State Auto vs. Competitors: Monthly Car Insurance Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $105 | $165 | |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

This comparison illustrates State Auto’s position in the monthly cost spectrum, typically around the mid-range, influenced by Liberty Mutual’s pricing. Whether you prioritize cost or value, this breakdown reveals which insurers best balance affordable prices with benefit-driven programs.

The cheapest car insurance is available to drivers with a clean driving record and no history of claims or accidents. Drivers with no record pay $105 a month for minimum coverage and $165 per month for full coverage. However, after a DUI, the rates increase to $210 per month for minimum coverage and $245 per month for full coverage.

State Auto Insurance Monthly Rates by Driving Record| Driving Record | Minimum Coverage | Full Coverage |

|---|---|---|

| Clean Record | $105 | $165 |

| One Accident | $175 | $210 |

| One DUI | $210 | $245 |

| One Ticket | $140 | $175 |

If there is one accident, monthly costs increase by $70, while one ticket adds an extra $35 to the monthly minimum coverage. Since average premiums are more expensive, it’s important to drive safely to keep State Auto rates low and avoid costly penalties for violations.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Auto Insurance Coverage Options

After State Auto was bought in 2022, it now only provides insurance for businesses and farms. All the old personal policies, such as car, home, and renters, are now given and managed by Liberty Mutual.

Below is a breakdown of the main auto insurance coverages, clearly showing what Liberty Mutual now offers to individuals and what State Auto still provides for business clients.

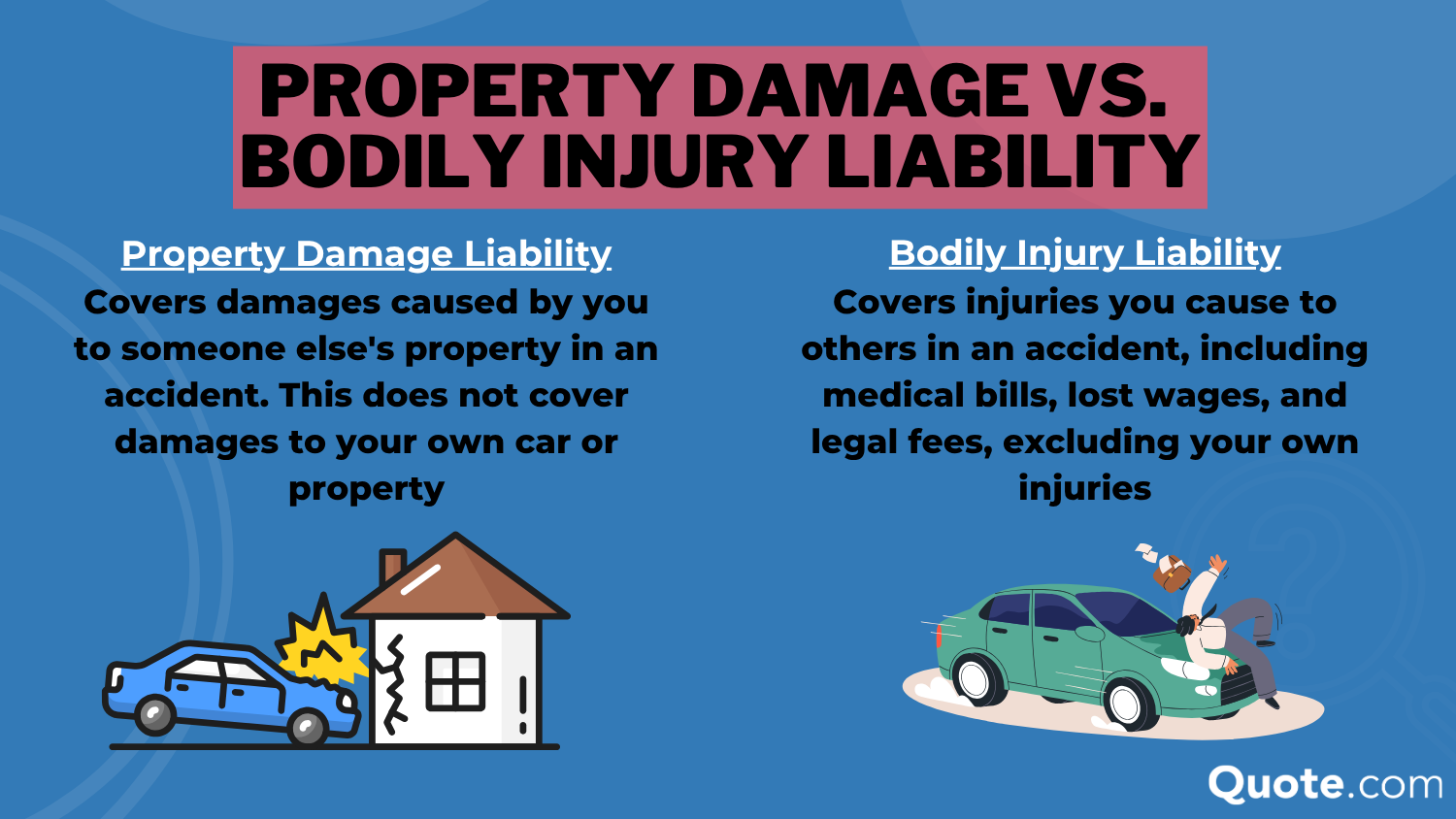

- Bodily Injury Liability: Covers medical expenses, lost wages, and legal costs if you cause an accident that hurts others.

- Property Damage Liability: Covers damage you cause to someone else’s car, fence, or building when the accident is your fault. Most states require it.

- Collision Coverage: Assists in fixing or replacing your vehicle after an accident, no matter who was at fault. Many times, lenders require this for cars that are leased or financed.

- Comprehensive Coverage: It safeguards your vehicle from losses unrelated to collisions, such as theft, hail damage, fire, or vandalism.

- Uninsured/Underinsured Motorist Coverage: Steps to take when you are hit by a driver who has little or no insurance can help cover medical bills and sometimes property damage.

State Auto continues to offer specialized insurance policies tailored to the needs of commercial and agricultural businesses, serving business owners, vehicle fleets, and farm operators.

- Business Auto Insurance: Includes liability, physical damage, and optional coverage for hired/non-owned vehicles used in business, from delivery vans to company cars.

- Farm Auto Insurance: Gives protection for farming vehicles and trailers, covering liability, collision, and comprehensive coverage for trucks, tractors, and utility vehicles.

- General Liability Insurance: Protects companies from claims made by others regarding bodily harm, property damage, and personal injuries, such as slander or misleading advertising.

- Commercial Property Insurance: It protects buildings, equipment, tools, and inventory from risks like fire, storms, and theft.

- Cyber Protection: Offers small businesses protection from digital risks, including data recovery, identity theft prevention, and compensation for income loss resulting from cyber incidents.

Today, State Auto focuses only on business and farm clients. Liberty Mutual takes care of all personal coverage that was once provided by State Auto.

Whether you are protecting a home, car, or commercial vehicles, knowing which company underwrites your policy is important for getting the right support and savings from the correct provider.

Learn More: Best Homeowners Insurance Companies

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

State Auto Insurance Discounts

Since Liberty Mutual acquired State Auto in 2022, all personal car insurance policies previously handled by State Auto are now managed by Liberty Mutual. Former State Auto customers can now qualify for various discounts from Liberty Mutual. These discounts reward factors such as safe driving, modern safety features in cars, and smart choices when selecting insurance policies.

Driving Habits & Vehicle Safety Discounts

- RightTrack Telematics Discount: Liberty Mutual offers the RightTrack program, which provides a start discount and up to 30% off, depending on your driving habits.

- Accident-Free Discount: Available to drivers who maintain a record free of accidents for 3–5 years, this discount varies by state and policy type.

- Alternative Vehicle Discount: Provides savings for hybrid or electric vehicles, which are statistically involved in fewer claims.

- Anti-Theft Device Discount: Applies if your car is equipped with certain anti-theft features, such as alarms, VIN etching, or GPS recovery.

- Passive Restraint/Airbag Discount: Offered for vehicles with factory-installed airbags and other qualifying safety restraint systems.

Smart policy handling and specific life events might also help you get more discounts with Liberty Mutual’s discount system.

Policy-Based & Personal Profile Discounts

- Multi-Policy Discount: If you combine Liberty Mutual car insurance with renters, condo, or homeowners insurance, you might save as much as 20%.

- Multi-Car Discount: Includes two or more vehicles on the same Liberty Mutual policy, often making per-vehicle premiums lower.

- Preferred Payment Discount: Discounts may be available when you pay your premium in full or enroll in automatic electronic payments.

- Good Student Discount: Full-time students under 25 maintaining a B average (3.0 GPA) or higher may qualify.

- Newly Married or Retired Discount: Some states offer discounts associated with life events, such as marriage or retirement.

State Auto now mainly covers business and farm insurance. However, people who had personal auto policies with them have moved to Liberty Mutual. They still get advantages from a wide discount system based on performance.

With Liberty Mutual, you can find real methods to reduce your monthly premiums through programs that look at your vehicle, how you drive, or changes in your life – all without losing any coverage.

Read more: Collision Auto Insurance

State Auto Insurance Customer Reviews and Ratings

The State Auto rating from A.M. Best is an A rating for financial stability. It also scored 717 out of 1,000 with J.D. Power, which is high but still just below the scores of its best competitors.

State Auto Insurance Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A- Good Business Practices |

|

| Score: 74/100 Good Customer Satisfaction |

|

| Score: 717 / 1,000 Avg. Satisfaction |

|

| Score: 4.28 More Complaints Than Avg. |

Consumer Reports gave them a rating of 74/100, and their complaint ratios from NAIC averaged at 4.28, which is slightly higher than the industry standard. While the company provides strong support, customer opinions vary depending on their experience with claims and policy services.

Comment

byu/Vistawag from discussion

inInsurance

Some drivers report that the Liberty Mutual acquisition made customer service worse, which is not surprising since Liberty Mutual consistently ranks below average in J.D. Power surveys and receives two times the number of complaints.

Read More: What Happens If You Cancel Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding to Buy State Auto Insurance

Our State auto review found that while it offers more than just standard coverage, featuring Safety 360, its rates are higher than average. It was recently purchased by Liberty Mutual, which is known for having higher rates but offers more comprehensive coverage for new autos. Discover savings in the ultimate guide on the best time to buy a new car.

Safe Auto Safety 360 gives a 10% discount when you sign up and up to 50% off if you drive safely. It also offers the Prime of Life bundle, which includes identity theft protection, roadside assistance, and home-sharing liability all in one package.

State Auto’s cyber protection add-on helps with digital identity fraud. Notably, it includes lost wage coverage during recovery.

Melanie Musson Published Insurance Expert

For individuals seeking to save money and receive personalized benefits, State Auto is a viable option to consider. Find custom State Auto insurance discounts by using our free quote comparison tool today

Frequently Asked Questions

Is State Auto Insurance a good company?

State Auto Insurance is considered a reliable provider with strong financial backing from Liberty Mutual, offering tech-driven programs like Safety 360. Find related savings options in the Liberty Mutual auto insurance review.

Who owns State Auto Insurance as of the latest acquisition?

State Auto Insurance is owned by Liberty Mutual Insurance, which acquired the company in 2022 in a $1 billion deal that expanded its network of independent agents.

Did State Auto merge with SafeCo?

No, but SafeCo is also owned by Liberty Mutual, making them sister companies.

How can drivers get a State Auto Insurance quote?

A State Auto Insurance quote can be obtained online through the official website or via independent agents, with minimum monthly rates starting at $105 for qualified drivers. Get multiple auto insurance quotes to save more on coverage.

What does a State Auto Insurance refund notification mean?

A State Auto Insurance refund notification typically indicates a premium overpayment, policy cancellation credit, or billing adjustment, and is usually issued by mail or electronically, with next steps.

Is a State Auto Insurance refund legit?

A State Auto Insurance refund is legitimate when triggered by reasons such as overpayment, policy cancellation, or premium adjustments, and is typically processed through secure channels, including mailed checks or direct deposit notifications.

What does State Auto home insurance typically cover?

State Auto home insurance provides coverage for dwelling protection, personal property, liability, and loss of use, with optional add-ons including equipment breakdown, identity restoration, and water backup coverage. Find out how much homeowners insurance you need.

How does State Auto Insurance customer service assist policyholders?

State Auto Insurance’s customer service is available to assist with claims, billing, and coverage changes and can be reached via phone, online portal, or through appointed agents.

What is the State Auto Insurance phone number for policyholder support?

The State Auto Insurance customer service phone number is 833-724-3577, available Monday through Friday from 8 a.m. to 8 p.m. ET for policy inquiries, claims, and billing support.

What is the phone number for State Auto home insurance inquiries?

The phone number for State Auto home insurance support is 833-724-3577, which connects homeowners to assistance with claims, coverage questions, or policy updates. Match your needs with offerings from the best homeowners insurance companies.

How can policyholders access the State Auto login portal?

Where does State Farm rank in auto insurance compared to State Auto?

Is State Auto better than Geico in terms of coverage and pricing?

Is Geico owned by State Auto?

Is State Auto better or Progressive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.