How to File an Auto Insurance Claim & Win It Each Time

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jul 14, 2021

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Jul 14, 2021

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Here’s one thing we can all agree on: Getting into a car accident, even a small one, is one of the most annoying things that can happen to you.

In my family, one thing our financial advisers suggested was having an auto insurance policy that could cover for almost any accident imaginable simply because we drive higher end vehicles.

The assumption is: If you drive, for example, a new Cadillac, you must have money, right?

While that might be true, you don’t want the person you were in an accident with to automatically assume they hit the jackpot when you hit them!

Having a higher auto insurance policy might just protect you from a personal lawsuit above and beyond what your insurance policy would pay out, in the event you are in a serious accident.

Filing a car insurance claim is something all of us will most likely have to deal with at some point, so it’s important to know exactly how to do it right.

That is, until you realize that after the accident you need to deal with the insurance companies.

It is a stressful process, in which often you discover that you may be fighting an insurance company that is supposed to be on your side.

You also need to get through the stress of reliving a million times the accident you were involved in.

From the moment the accident happened, you may have to repeat and rethink tiny details about the accident to a number of people, from the police to the car insurance claims adjuster.

Even worse: If you don’t do it right and you don’t get adequate compensation, you’ll hurt your wallet by having to pay for some of the damages yourself.

Because there is a right result here: getting paid for your damages and the grievances caused by the accident.

It can be achieved if you follow the right steps.

Since 1998, we’ve been helping to educate consumers on financial issues while providing the tools and solutions they need to effectively manage these issues.

Among the emails we get from our thousands of subscribers every day, insurance-related topics are among their primary concerns.

We have researched how to file a claim up and down, so you can be confident you’ll get the best results every single time.

Learn the Basics of Car Insurance

There are two types of car insurance, and which kind you have depends on where you live.

The rules the states have put in place fall into one of these two categories: “full tort insurance” and “no-fault.”

In a “full tort insurance” system, whoever caused the accident pays. This doesn’t mean that the driver actually pays out of pocket: his/her insurance company does.

So if you live in a full tort insurance system and the accident was caused by the other driver, you will be seeking compensation from their car insurance company.

Most states have a tort system, but the specific regulations vary from state to state, so it’s helpful to find out what the laws are in your state before filing a claim.

In the “no-fault state” system, you deal with your own insurance company. Under these regulations, your insurance provider automatically pays for your damages, regardless of who was at fault, up to a limit.

In no-fault states, you can only sue the other driver when the accident and the personal and property damages meet certain conditions.

In other words, there is a “threshold” under which you can’t sue.

The following states currently have true no-fault insurance laws:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Puerto Rico

- Utah

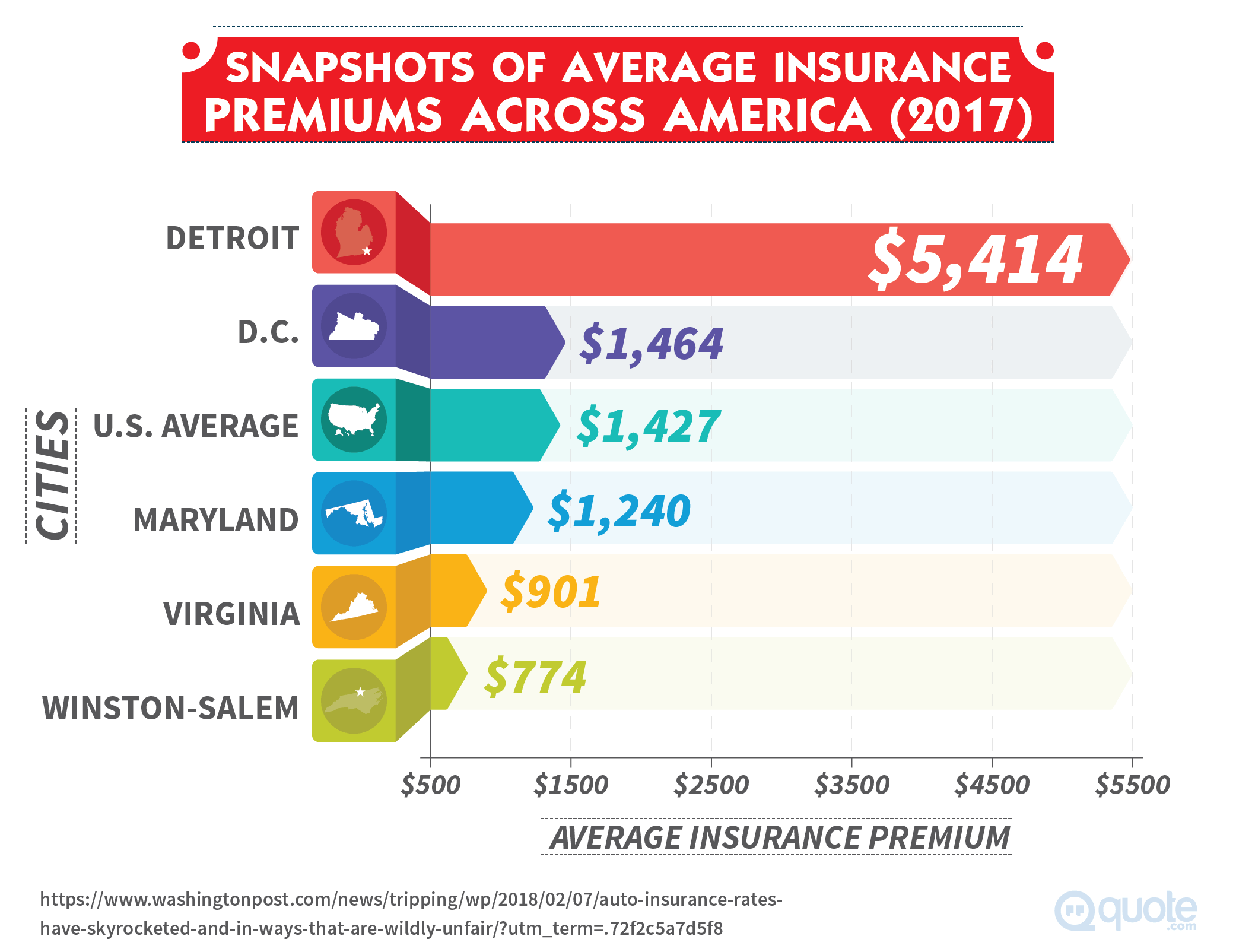

The state you live in may not only determine the possible outcome of your insurance claim: It may also impact the cost of your insurance premium the following year.

The bottom line is that on top of the quality of insurance you have,your home state will also impact your coverage.

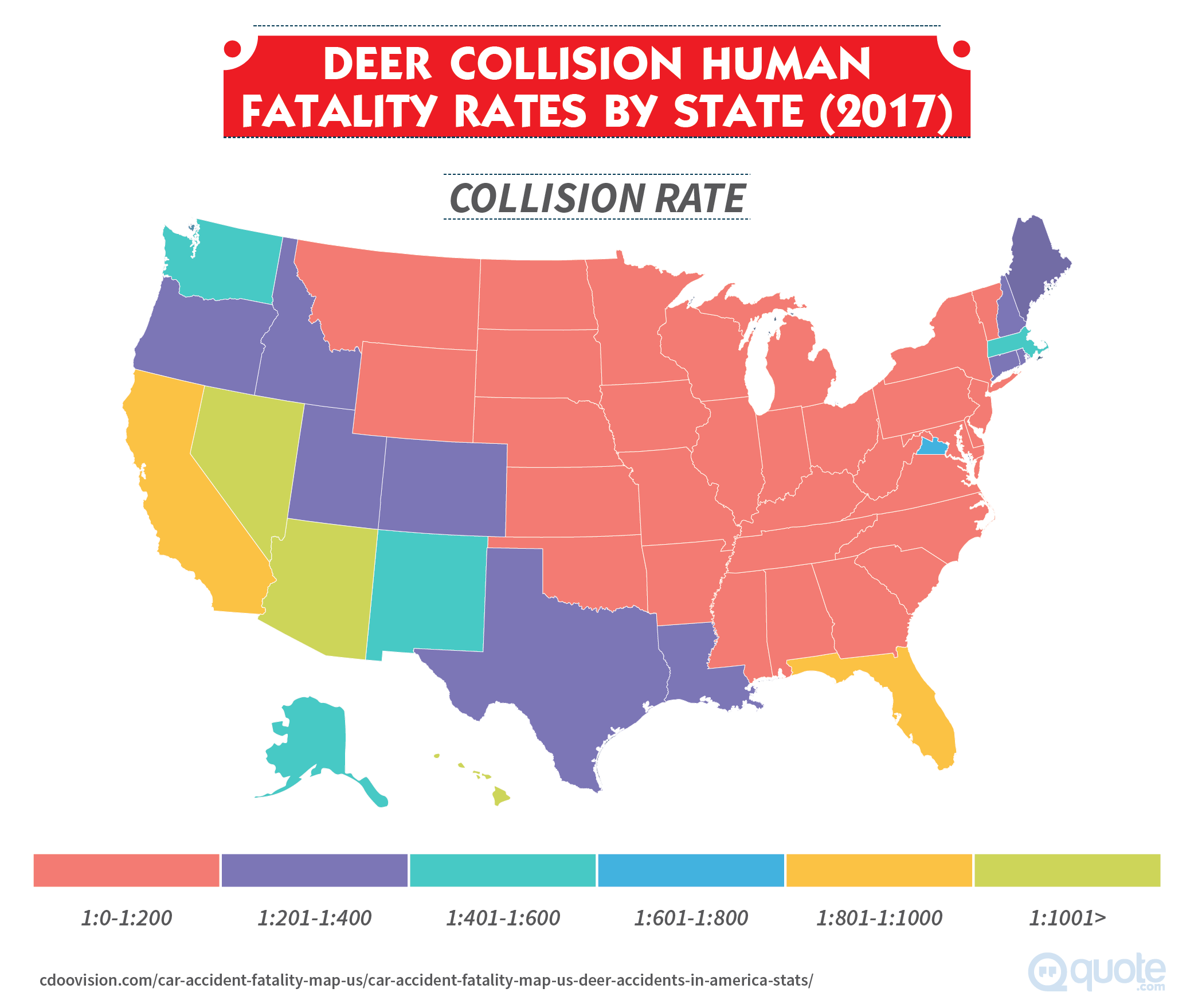

Other concepts you should know include “comprehensive auto policy.” Under a comprehensive insurance auto policy, your car is protected against a number of extra damages, including those caused by animals and natural disasters.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Things to Do Immediately After the Accident

Being in a car accident is obviously a stressful experience, but what you do right after getting out of your car can determine the results of your auto insurance claim.

So it’s important to know and follow these steps in the scene of the collision.

The keys here are staying calm and gathering evidence

Stay calm. You should not argue with the other driver, even if you believe you have absolutely no responsibility for the accident.

Arguing with the other driver may make them angry and not want to cooperate.

It may also make them try to blame the accident on you, even if it wasn’t your fault.

Check to see if anyone is injured. Most legislation doesn’t require you to give help, but you could be sued if you don’t help an injured party and it turns out that the accident was your fault.

Don’t say you’re sorry about the accident, even if it was your fault. You should be polite and cooperative, but don’t put yourself in the position of saying anything you may regret later when dealing with the car insurance company or in a court of law.

Call the police, or at least make sure someone does. When the officers come and take your statement, give them a precise and truthful version of what happened.

Get the other driver’s information. You’ll need the other driver’s name, driver’s license number, vehicle model, license plate number, and the name of their insurance company.

Take pictures of the scene of the accident. These photos, as well as any details you write down that help you remember what happened will be useful when you deal with the insurance company later on.

For instance, if it was raining, or if a tree branch was blocking a stop sign, you should write it down and take a photo.

Find witnesses. If anyone saw what happened, take their name and contact information, and ask them if they can stick around until the police show up.

If you think your car could qualify for a total loss, get it towed. If your car is totaled, the claim might take longer.

A good tip here for speeding the damages claim is to get it towed to your insurance company’s preferred body shop.

How to File a Car Insurance Claim

Filing an auto insurance claim may sound intimidating, but it’s actually a simple procedure.

Basically, you do it by calling your insurance company and following their instructions on how to submit your statement and the evidence.

The important thing is to know your story and to document everything that supports your version of the accident and the damages it caused to you.

Make sure check the essentials before filing the claim

Contacting the police and the DMV when it’s required by your state’s law are essential first steps after an accident and before filing your auto insurance claim.

If you didn’t do it at the scene of the accident, contact the police. Besides being mandatory in some states to call the police after an accident, the police report comes in handy when you need to file your insurance.

You may need to contact the DMV. Some states also require that you contact the DMV after an accident, mainly if there were injuries or substantial damages to a vehicle.

File the claim by reaching out to your insurance company

Tell your insurance company about the accident right away. As soon as you can, call your insurer and inform them that you’ll be filing a car accident claim.

The need to get in touch with your car insurance company is even more important if the accident caused a total loss of the vehicle.

Don’t forget that you’re fighting to get the largest possible sum. It can be easy to forget that even if you’re paying the insurance company, the insurance adjuster works for them, so be careful what information you give.

You don’t need to tell every detail of the accident to your insurance company. Just tell the claims adjuster that you are going to file a claim and that you want to know what the steps are.

If the accident was caused by the other driver, briefly explain how it happened.

Don’t share your medical records with your insurance company. You have the right to go see the doctor of your choice if you were injured in any way by the car accident.

This step is essential not only for taking care of yourself but for documenting the injuries and the extent of your personal damages.

Remember: if the insurance company suggests that you should go see a doctor they have picked, you don’t have to do it.

Ask about the terms of your insurance policy. It’s essential that you know what you’re dealing with and what your rights are under your insurance contract.

Keep all receipts and documents related to the accident. This includes costs and expenses connected to any impact caused by the accident, from repairs to the car to medical expenses and missed work days.

Don’t give any estimation of the damages from the accident. If you rush to provide them with a sum before you know the exact amount of the damages, you’re most likely setting the amount that company will offer.

This will be a huge mistake if the personal or property damages end up being higher than you estimated in the long run.

Prepare yourself to give an interview. The insurance company’s claims adjuster will probably request to interview you about the accident.

You may want to write down what happened during the accident before this interview.

That will help you not get confused or contradict yourself when the insurance adjuster asks about tiny details of the accident.

How to Handle an Insurance Company Claim

Filing the claim was just the beginning of the road.

Now comes the important part: dealing with the insurance company to make sure you get everything you deserve from them.

This process may seem daunting and stressful at first, but it really isn’t.

At the end of the day, you are two parts of the negotiation, and you don’t need to settle until you’re satisfied with that they’re offering.

Be polite, keep your cool, and don’t settle for less than the cost of your damages

Find out who is handling your car accident claim. You should get the name, email, and phone number of the person who has been assigned to manage your case.

Keep the claim adjuster on your side as much as possible. Being friendly and polite, even if the insurance adjustment process is not enjoyable, will increase your chances of getting the largest possible settlement.

If you’re under a tort system, avoid blaming yourself. If it was your fault, the evidence would show it, but don’t blame yourself in any way.

Focus your answers on the other driver’s behavior. For instance, avoid saying:

We were both approaching the intersection and then crashed into each other.

Instead, say:

The other driver hit me when I was at the intersection.

Don’t accept the first settlement offer the insurance company offers. They may make you an offer right away before you have a clear idea of the total amount of your damages.

If you accept a settlement too soon and your damages keep going up, you will end up paying them out of pocket.

Examine the company’s offer and negotiate. You have no obligation of accepting the offer made by your insurance company—much less to do it right away.

You can take your time to study the offer and to ask exactly how they came up with that number.

If you think your damages are higher than what you were offered, present the documents to prove it.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How to Negotiate with the Claims Adjuster

The insurance’s adjuster is not your friend.

It’s actually a bit like a frenemy: You need to keep him/her on your side while pushing for the highest possible settlement.

So stick to these points when conducting the insurance claim process and the negotiation:

Yes, you can handle this negotiation by yourself

If you keep your head cool and gather all the necessary information and documents, you should be able to get a satisfying settlement.

Stick to the facts that support your story. You should demonstrate the adjuster that you are well informed of the details of the accident and that you understand both your rights and the value of your claim.

The facts will come from your own account of the accident, but be on the lookout for sections from the police report or statements from witnesses that support your version of the crash.

Have the total sum of your damages, and be ready to explain every item. In the end, the insurance company should reimburse you for the damages up to the limits of your insurance policy if you have the documents to prove them.

In other words, if there is no question about who is at fault for the accident (either because it’s clear, or because you’re in a no-fault state), the insurance company will want to settle with you.

Know the minimum you are willing to take but aim high in the beginning. This is, perhaps, the most important aspect of this negotiation process.

Keep in mind that this is a negotiation, a bargaining process and that the insurance company will try to make you settle for as little as possible until you build a solid case for your damages.

Knowing how low are you willing to settle for will help you through the negotiation process.

It will put a threshold for the initial low offers you can expect from the company, it will give you the incentive to go above it, and it will tell you when you have reached a satisfactory settlement.

The important thing, though, is to be tough in the beginning when the insurance settler tries to offer a low sum.

Show good faith and stay calm. Even if the negotiation gets hard or you feel that they are disrespecting you by offering you a low amount the first time around, you don’t want to lose your patience.

If you think the settler is not giving your claim or your demands enough professional attention, you can always ask to speak to his or her supervisor, or even to switch to a different adjuster.

Gradually reduce your settlement demand. Once you are sure you know the extent of your damages and have provided all the evidence, you can make a counteroffer that is smaller than your original demand.

This will most likely show the settler that you’re willing to negotiate and prompt him/her to increase the original offer.

Settle only once you’ve reached an amount that you consider acceptable. You shouldn’t agree to settle unless the sum will cover all your most important damages and costs derived from the accident.

What to Do if You Can’t Reach an Agreement

Sometimes, the negotiation can reach a blockage.

You may think the insurance agent is not taking your demands seriously or is not giving your claim the attention it deserves.

Here’s what to do:

Not being able to reach an agreement with the insurer is not the end of the road

There are several options if you feel the company is not giving your claim the respect it deserves.

Within the company, you can ask to speak to the adjuster’s supervisor. Even though the adjuster will probably try to talk you out of this, if you request to speak with the supervisor, they have to escalate the claim.

It is likely that the supervisor will try to find a solution to the claim, especially if you show that you have a good case and you’re willing to escalate your claim in case there’s no satisfactory resolution.

Get in touch with the Department of Insurance of your state. When you reach out to them, you’ll be arguing that the company has not shown good faith during the negotiation and settlement process.

If you do this, gather any information (emails come in handy here) about delays in the negotiation, as well as documents that prove that they’re not making offers that actually do justice to the merits of your claim.

Get in touch with an attorney. Hiring an attorney with experience in car accidents and insurance matters can tell you if your compensation request has merits, conduct the negotiations on your behalf, and even sue.

Very frequently, the mere involvement of an attorney in an insurance claim makes the company increase their offer immediately.

When all is settled, consider moving to a new insurance provider and bundling your policies so that if you get life insurance, for example, you get a discount on car insurance.

Getting what you deserve from the insurance company is not rocket science

The insurance company will certainly try to pay you a low amount if they can, but they’re also supposed to negotiate and settle in good faith.

If you follow the steps mentioned above, you should get a reasonable settlement.

The key elements here are documenting your damages, negotiating politely, and not settling for anything that is less than fair.

Have you won a claim before?

What was the one thing that worked for you (or didn’t)?

Is there anything we’ve missed?

Let us know in the comments!

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.