Liberty Mutual Auto Insurance Review for 2025 (See Ratings & Cost Here!)

Safe drivers benefit most from Liberty Mutual, with rates from $85 per month and up to 30% off via RightTrack. Explore our Liberty Mutual auto insurance review to see how its quotes stand out with strong digital tools, flexible coverage, and competitive pricing based on age, credit, and driving history.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: May 29, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: May 29, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

3,792 reviews

3,792 reviews

Liberty Mutual Insurance

Monthly Rate

$174A.M. Best:

AComplaint Level:

HighPros

- Lots of coverage options

- Customizable policies

- Good mobile app for claims and roadside help

Cons

- Higher rates for some drivers

- Mixed customer service reviews

Liberty Mutual auto insurance review provides insights into how this company excels when it comes to prices, customer experience, and coverage features.

Minimum coverage for some drivers begins as low as $95, an affordable option that has many available discounts. It’s a reliable option for youthful or high-risk drivers who require flexible plans.

Liberty Mutual Auto Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.0 |

| Claims Processing | 3.3 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.1 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

While Liberty Mutual offers strong digital tools and coverage, customer feedback is mixed. Check out the 26 hacks to save more money on car insurance to maximize savings and improve your overall experience.

- Liberty Mutual auto insurance offers rates from $95 and 30% RightTrack savings

- Flexible coverage and digital tools support convenient policy management

- Liberty Mutual offers strong discounts and solid financial strength, despite reviews

Not sure how to compare auto insurers? This Liberty insurance review covers pricing, discounts, and digital tools to help you decide. Enter your ZIP code to compare quotes and start saving.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual Monthly Auto Insurance Costs

Liberty Mutual car insurance rates are priced based on your age, gender and coverage level. Younger drivers are also hit with higher costs because they’re the riskiest. For example, 16-year-old males, the riskiest group to insure, pay as much as $1,121 a month for full coverage, compared with $1,031 for females of the same age.

Liberty Mutual Auto Insurance Monthly Rates by Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $404 | $1,031 |

| 16-Year-Old Male | $464 | $1,121 |

| 18-Year-Old Female | $329 | $745 |

| 18-Year-Old Male | $398 | $893 |

| 25-Year-Old Female | $103 | $267 |

| 25-Year-Old Male | $119 | $306 |

| 30-Year-Old Female | $96 | $249 |

| 30-Year-Old Male | $110 | $285 |

| 45-Year-Old Female | $95 | $244 |

| 45-Year-Old Male | $96 | $248 |

| 60-Year-Old Female | $85 | $211 |

| 60-Year-Old Male | $91 | $227 |

| 65-Year-Old Female | $93 | $239 |

| 65-Year-Old Male | $95 | $243 |

As drivers age, premiums decrease significantly, stabilizing by age 25 and reaching the lowest at age 45. Both genders pay around $95 for minimum coverage and $244 to $248 for full coverage. Male drivers consistently pay more than females, especially at younger ages, though the gap narrows with age.

Rates often drop with age, but full coverage costs more. For example, a 30-year-old may pay less with full coverage than an 18-year-old with basic coverage.

Michelle Robbins Licensed Insurance Agent

Full coverage remains 2.5 to 3 times more expensive than minimum coverage across all groups, reflecting its broader protection. This data helps illustrate how Liberty Mutual adjusts pricing based on demographic risk factors.

Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 | |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $90 | $110 | $130 |

This data shows how full coverage auto insurance rates vary by provider and credit score. Rates increase as credit scores drop, with USAA and State Farm offering the lowest prices from $90 for good credit. The State Farm auto insurance review confirms strong pricing for drivers with higher credit.

Liberty Mutual falls in the mid-range with rates from $100 to $140. The comparison highlights the importance of credit score and provider choice in determining insurance costs.

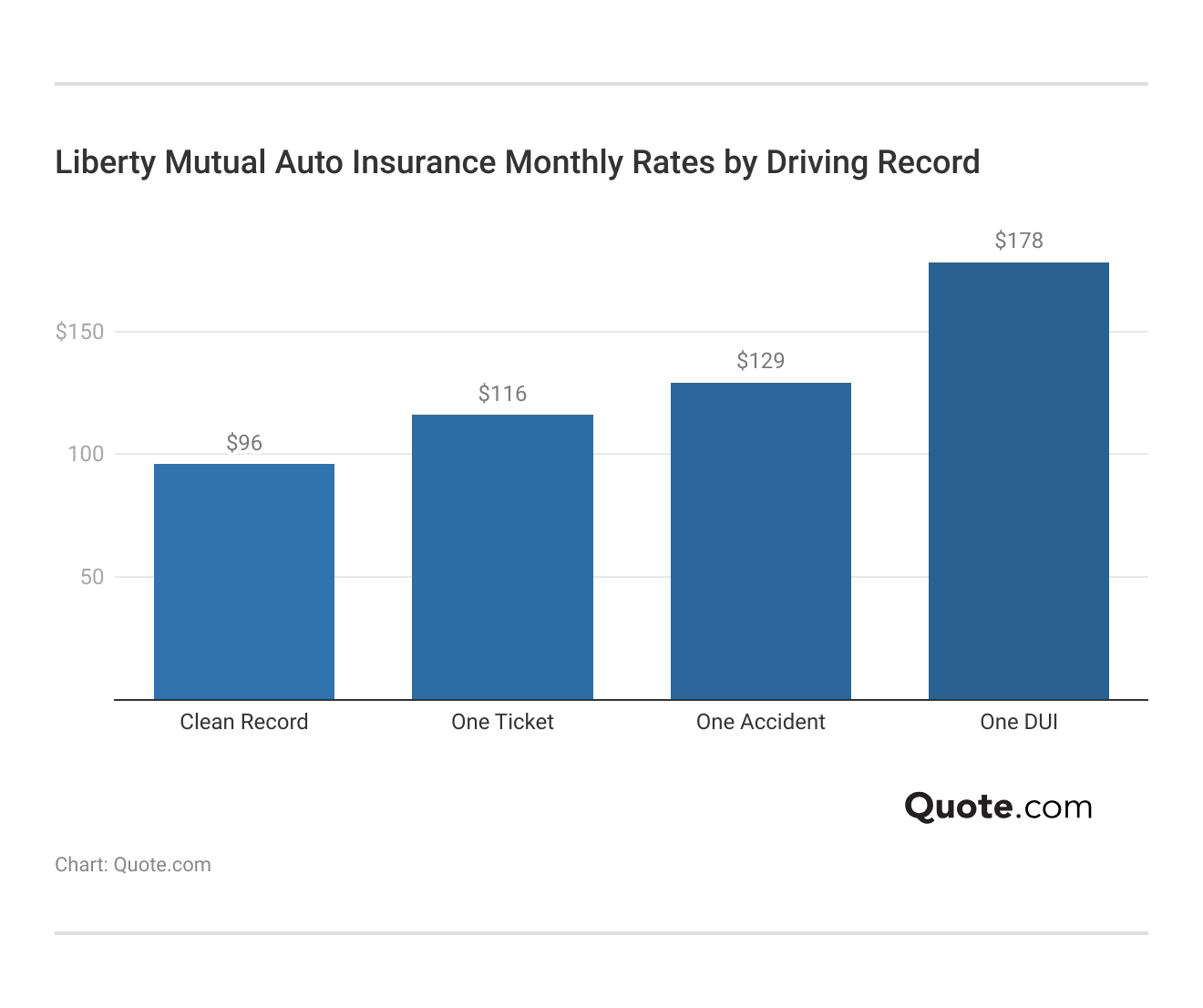

This data highlights how driving history affects monthly auto insurance rates with Liberty Mutual. Drivers with a clean record pay the lowest rates at $96 for minimum and $100 for full coverage.

One ticket or accident increases rates modestly, but a DUI increases full coverage rates to the most expensive available at $178. The statistics indicate that driving violations lead to huge hikes in insurance rates.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Auto insurance rates vary significantly by provider and coverage level. USAA offers the most affordable options, charging $32 for minimum and $84 for full coverage. Liberty Mutual has the highest rates at $96 and $248, respectively.

Geico, State Farm, and Progressive offer lower-cost alternatives, while Allstate and Farmers are higher-end providers. Depending on the coverage selected, choosing the right provider can yield substantial savings.

Liberty Mutual Auto Insurance Discounts and Other Ways to Save

Liberty Mutual provides a range of auto insurance discounts that reward safe driving, smart habits, and lifestyle choices, helping you save without compromising coverage.

Liberty Mutual Auto Insurance Discounts| Discount |  |

|---|---|

| RightTrack | 30% |

| Accident-Free | 23% |

| Good Student | 22% |

| Violation-Free | 15% |

| Multi-Policy | 12% |

| New Vehicle | 12% |

| Alternative Energy | 10% |

| Military | 10% |

| Multi-Car | 10% |

| Student Away at School | 10% |

| New Graduate | 8% |

| Online Purchase | 8% |

| Early Shopper | 7% |

| Preferred Payment | 7% |

| Homeowner | 5% |

In addition to everyday savings, Liberty Mutual offers extra discounts for safe driving, green choices, and membership in select groups. These options help reduce auto insurance costs while keeping the coverage you need.

- Low Annual Mileage Discount: Liberty Mutual may offer a discount if you drive fewer miles than average per year, as lower mileage typically reduces your risk of accidents.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can lower premiums, especially for mature drivers or those looking to refresh their safe driving knowledge.

- Employer or Affinity Group Discount: Working for a partnered company or joining a corporate benefits program may qualify you for Liberty Mutual affinity discounts.

- Professional Association Discounts: Liberty Mutual offers exclusive discounts to members of partnered universities, employers, and professional groups. Eligible members may receive lower rates.

- Paperless Policy Discount: Opting to receive documents and billing electronically instead of via mail can qualify you for a paperless discount, making your policy more environmentally friendly.

These extra discounts can lead to actual savings. Whether you drive less or belong to a group, check with Liberty Mutual or go online to see what you qualify for.

Liberty Mutual makes lowering your premium effortless through familiar and lesser-known discounts. Explore the 17 car insurance discounts you can’t miss to maximize your savings. Check online or ask an agent which offers you qualify for.

Liberty Mutual Auto Insurance Coverage Options and Add-Ons

Liberty Mutual provides lots of auto coverage options to keep you and your car safe on the road. Whether you want the peace of mind that comes from knowing you’re covered or a way to maintain the value of your vehicle, these options are designed to meet all of your driving needs from the ordinary to the extraordinary.

- Comprehensive Coverage: This protects the significant investment that you made and your vehicle from the non-collision damages like theft, vandalism, fire or natural disasters.

- Collision Coverage: Pays for damage to your car when your car hits, or is hit by, another vehicle, or some other object, regardless of fault.

- Liability Coverage: Covers bodily injury and property damage liability to pay for costs when you are found at-fault for an accident that injures another person or their property.

- Medical Payments Coverage: Assigns coverage for medical bills for you and your passengers near the time of an accident, no matter who was at fault.

- Uninsured/Underinsured Motorist Coverage: You need this in case a driver hits you without insurance or enough coverage to cover the damages.

Choosing the right combination of coverages can significantly improve your financial protection and overall peace of mind.

- Roadside Assistance: Offers help if you’re stranded due to a flat tire, dead battery, lockout, or towing needs. Having this service may make you eligible for bundling or loyalty discounts.

- Rental Car Reimbursement: Covers the cost of renting a vehicle while your car is being repaired after a covered accident. It is often paired with other coverages for added savings.

- Gap Insurance: Pays the difference between your car’s actual value and the remaining loan or lease balance if your vehicle is totaled. Bundling this with standard coverage may offer cost benefits.

- Original Parts Replacement: Ensures damaged parts are replaced with original manufacturer parts when available. Some insurers, including Liberty Mutual, offer discounts for including enhanced repair options.

Liberty Mutual provides more than just standard coverage, such as liability and collision auto insurance. It offers several additional services such as roadside assistance, rental car reimbursement, gap insurance, original parts replacement and more.

These options add convenience, flexibility, and potential savings while offering extra protection in unexpected situations. Reviewing your coverage regularly helps ensure it stays aligned with your current needs and provides the best value for your insurance.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual Insurance Ratings and What Customers Are Saying

Liberty Mutual holds strong ratings for financial stability and solid customer satisfaction, with some areas needing improvement. A.M. Best gives it an “A” for excellent financial strength, and the BBB rates it A- for good business practices.

Liberty Mutual Auto Insurance Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A- Good Business Practices |

|

| Score: 74/100 Good Customer Satisfaction |

|

| Score: 717 / 1,000 Avg. Satisfaction |

|

| Score: 4.28 More Complaints Than Avg. |

Consumer Reports scores it 74/100, and J.D. Power gives 717/1,000, while the NAIC score of 4.28 shows more complaints than average. Reviewing how to compare auto insurance companies can help weigh Liberty Mutual’s financial strength against its customer service record.

Comment

byu/Help_Me_Reddit01 from discussion

inInsurance

One Reddit user wrote a thorough review of his Liberty Mutual experience, stating how he really liked the excellent direct sales of the company and customer service that he thought was more beneficial than agents.

Bundling your Liberty Mutual car insurance with renters or home insurance lets you get one bill and may qualify you for multi-policy discounts to lower your total premium.

Daniel Young Insurance Content Managing Editor

They said the rate was competitive, particularly with the group discount, but without it, another insurer might be able to offer a lower rate. The user also mentioned having a good claims experience being rear-ended in an accident, saying that the procedure was well managed and what they expected.

Liberty Mutual Auto Insurance Pros and Cons

Liberty Mutual auto insurance offers affordability, helpful digital tools, and a range of discounts that are attractive to drivers with good records and those who want options for policy management.

Pros

- Low Prices for Safe Drivers: Liberty Mutual provides low prices at $95 for safe drivers, a cost-effective option for drivers with good records.

- High Discounts: Up to 30% off with the RightTrack program and additional discounts for good students, bundling policies, and multi-vehicle, a lower-cost provider.

- Powerful Digital Tools: With Liberty Mutual’s app, customers can easily manage their policy, file claims, and access discounts, making it easy for customers to do business with Liberty Mutual digitally.

Like any insurance provider, it has benefits and potential drawbacks that should be weighed carefully. The following pros and cons outline what Liberty Mutual does well and where it may fall short for specific drivers.

Cons

- Mixed Customer Satisfaction: Customer satisfaction is mixed, and issues with claims handling and billing affect its reputation as a service provider.

- Increased Premiums for Younger Drivers: Young adults and teenage drivers pay more, particularly young men, making Liberty Mutual unaffordable for those under 25.

While Liberty Mutual is a strong choice for safe drivers seeking low rates and easy digital access, it may not be the best fit for younger drivers or those concerned with consistent customer service.

Evaluating these factors alongside your budget and coverage needs can help you determine if Liberty Mutual is the right provider, especially when you understand how to get multiple auto insurance quotes to compare rates, coverage options, and discounts across top insurers.

Maximize Savings With Liberty Mutual Auto Insurance

Liberty Mutual offers competitive auto insurance rates from $95 per month and multiple discounts. This Liberty Mutual auto insurance review highlights strong financial stability and affordability for safe drivers, though it lags in customer satisfaction and pricing for younger drivers.

While it’s a strong choice for those with clean records seeking flexible coverage, it’s important to weigh its benefits and drawbacks when comparing providers, especially if you’re looking for the cheapest car insurance options.

Compare the best auto insurance quotes. No matter how little or how much you want to buy, by entering your ZIP code into our comparison tool now.

Frequently Asked Questions

Do Liberty Mutual car insurance reviews mention good discounts?

Yes, reviews frequently highlight the variety of discounts available, including savings for good students, military personnel, multi-policy bundling, and safe driving through the RightTrack program. These discounts help lower the overall cost of coverage.

Does Liberty Mutual have a teacher discount on auto insurance?

Yes, Liberty Mutual offers special savings for teachers in many states. Educators may qualify for exclusive discounts on auto insurance as part of the company’s affinity partnerships and appreciation programs.

Comparing quotes is integral to finding the best rates possible. Enter your ZIP code into our free tool today to see what quotes might look like for you.

What do Liberty Mutual insurance claims reviews say about the overall claims process?

Liberty Mutual insurance claims reviews note a user-friendly process via app or online, though some report delays and communication issues, especially in complex cases needing traffic collision reconstruction.

Does Liberty Mutual automobile insurance offer accident forgiveness?

Yes, Liberty Mutual automobile insurance offers accident forgiveness in most states. This feature prevents your premium from increasing after your first at-fault accident, provided you qualify based on your driving history and other underwriting criteria. It’s an optional add-on, so be sure to ask about availability when getting a quote.

How do customer satisfaction ratings compare for Liberty Mutual vs Safe Auto?

Liberty Mutual receives average to above-average ratings in customer satisfaction according to sources like J.D. Power and Consumer Reports, while Safe Auto tends to receive lower ratings due to limited coverage, fewer digital tools, and mixed claims service reviews.

Can I customize coverage options during the Liberty Mutual auto insurance quote process?

Absolutely. When getting a Liberty Mutual auto insurance quote, you can adjust coverage, add features like roadside assistance, and change deductibles to fit your budget. If you’re worried about cost, learn what to do if you can’t afford your auto insurance, such as lowering coverage or asking about discounts.

How does Liberty Mutual handle claims, based on Liberty Mutual car insurance review feedback?

According to Liberty Mutual car insurance review insights, the company offers 24/7 claims service and an easy-to-use mobile app for filing. However, some customers report inconsistent experiences with claim processing times and communication, especially during high-volume periods.

Can I escalate unresolved Liberty Mutual claims complaints?

Yes, if your claim issue remains unresolved, you can escalate your Liberty Mutual claims complaint to the company’s internal review team or file a formal complaint with your state’s Department of Insurance.

Is Liberty Mutual auto protection available for leased or financed vehicles?

Yes, Liberty Mutual auto protection is available for leased or financed vehicles and may include gap insurance, making it a smart option if you’re learning how to lease a car when you can’t afford to buy one.

Does Liberty Mutual have classic car insurance coverage for vintage or collector vehicles?

Yes, Liberty Mutual offers coverage for classic and collector cars, but it may vary by state. Policyholders should check with a representative to confirm availability and requirements for classic car insurance.

Are there Liberty Mutual insurance discounts for bundling policies?

Liberty Mutual offers bundling discounts when you combine auto insurance with other types of coverage, such as home or renters insurance. This multi-policy discount can help reduce your overall insurance costs significantly.

Is there a separate Liberty Mutual phone number for filing an auto insurance claim?

Yes, to file an auto insurance claim, you can call the Liberty Mutual phone number dedicated to claims at 1-844-825-2467. You can also file a claim online or through the Liberty Mutual mobile app. For a smoother experience, review our guide on how to file an auto insurance claim & win it each time to maximize your chances of a successful outcome.

Is roadside assistance for motorcycles mentioned in Liberty Mutual motorcycle insurance reviews?

Many Liberty Mutual motorcycle insurance reviews point out the availability and reliability of roadside assistance, which includes towing, battery jump-starts, and fuel delivery tailored for motorcycles.

Does the Liberty Mutual total loss adjuster handle the towing and salvage process?

Yes, once your vehicle is deemed a total loss, the Liberty Mutual total loss adjuster coordinates with a towing company and may assist in transferring the vehicle to a salvage yard. They also help finalize paperwork related to ownership transfer.

How do Liberty Mutual vs Esurance compare in terms of pricing and discounts?

Liberty Mutual offers competitive rates and up to 30% off with RightTrack, while Esurance may have lower base premiums but fewer discounts. Bundling, loyalty perks, and following tips to pay less for car insurance make Liberty Mutual a strong option for long-term savings.

Is the Liberty Mutual car rental discount available in all states?

The Liberty Mutual car rental discount is generally available nationwide, but terms and availability may vary by state due to differences in insurance regulations and rental company partnerships. It’s best to confirm discount eligibility based on your state of residence.

Can Liberty Mutual car insurance rating change over time?

Yes, the Liberty Mutual car insurance rating can change based on financial performance, regulatory actions, market conditions, or shifts in customer satisfaction and service quality. It’s wise to check current ratings before purchasing a policy.

How do Liberty Mutual vs Infinity compare in availability and market presence?

Liberty Mutual operates nationwide with consistent service, while Infinity auto insurance serves select states, focusing on urban and Spanish-speaking communities, making Liberty Mutual more accessible.

Is Liberty Mutual good auto insurance for young drivers?

Liberty Mutual offers flexible coverage and student discounts, but young drivers, especially males under 25, may pay higher rates; however, features like accident forgiveness and new driver tools add value.

Can I manage my policy through Liberty car insurance customer service?

Yes, Liberty car insurance customer service allows you to manage your policy through its website and mobile app. You can update personal information, add or remove vehicles or drivers, make payments, and access your digital ID cards quickly and easily.

Understanding how insurance works can feel complicated, but finding affordable rates doesn’t have to be. Enter your ZIP code for the best insurance rates possible.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.