21st Century Auto Insurance Review for 2025 (+Options & Cost)

21st Century offers auto insurance only in California, offering minimum coverage starting at $59 per month. Drivers can save 25% with a multi-car policy, 20% for a clean driving record, and 15% for good grades. 21st Century auto insurance review covers liability, gap insurance, and free $75 roadside assistance.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 29, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Jun 29, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

21st Century Insurance

Monthly Rates:

$111A.M. Best:

AComplaint Level:

LowPros

- Competitive rates starting at $64/month for minimum coverage

- Free $75 roadside assistance included

- Offers gap insurance and customizable coverage options

Cons

- Limited availability outside of California state

- Higher rates for liability-only insurance policies

Explore rates, discounts, and coverage in this 21st Century auto insurance review to see how the 21st Century Premier Insurance Company compares to major providers.

21st Century Auto Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 3.6 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 4.6 |

| Coverage Value | 3.2 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 3.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 3.0 |

| Policy Options | 2.8 |

| Savings Potential | 4.3 |

With minimum coverage starting at $59/month, the company offers competitive pricing for California drivers. It factors in age, credit, and driving history to calculate personalized premiums.

Policyholders also benefit from up to 25% in discounts, including savings for multi-car policies, safe driving, and good student performance, making it one of the best auto insurance for good drivers.

- 21st Century Insurance offers minimum coverage starting at just $59/month

- Policyholders get free $75 roadside help and optional gap insurance coverage

- 21st Century Insurance provides up to 25% in discounts for eligible drivers

Don’t be held back by costly insurance rates. Enter your ZIP code and compare local insurers in seconds for the best quote.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

21st Century Auto Insurance Costs

21st Century Insurance offers competitive auto insurance rates, averaging $64 per month for minimum coverage and $159 for full coverage. Its minimum coverage is cheaper than Allstate, Farmers, and Liberty Mutual but slightly higher than low-cost options like Geico, State Farm, and Progressive.

21st Century vs. Top Competitors: Auto Insurance Monthly Rates

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $64 | $159 |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

For full coverage, it remains more affordable than Allstate, Farmers, and Liberty Mutual, though Geico, State Farm, Travelers, and Progressive offer lower rates. Overall, 21st Century provides solid mid-range pricing with the added reliability of being part of the Farmers Insurance Group.

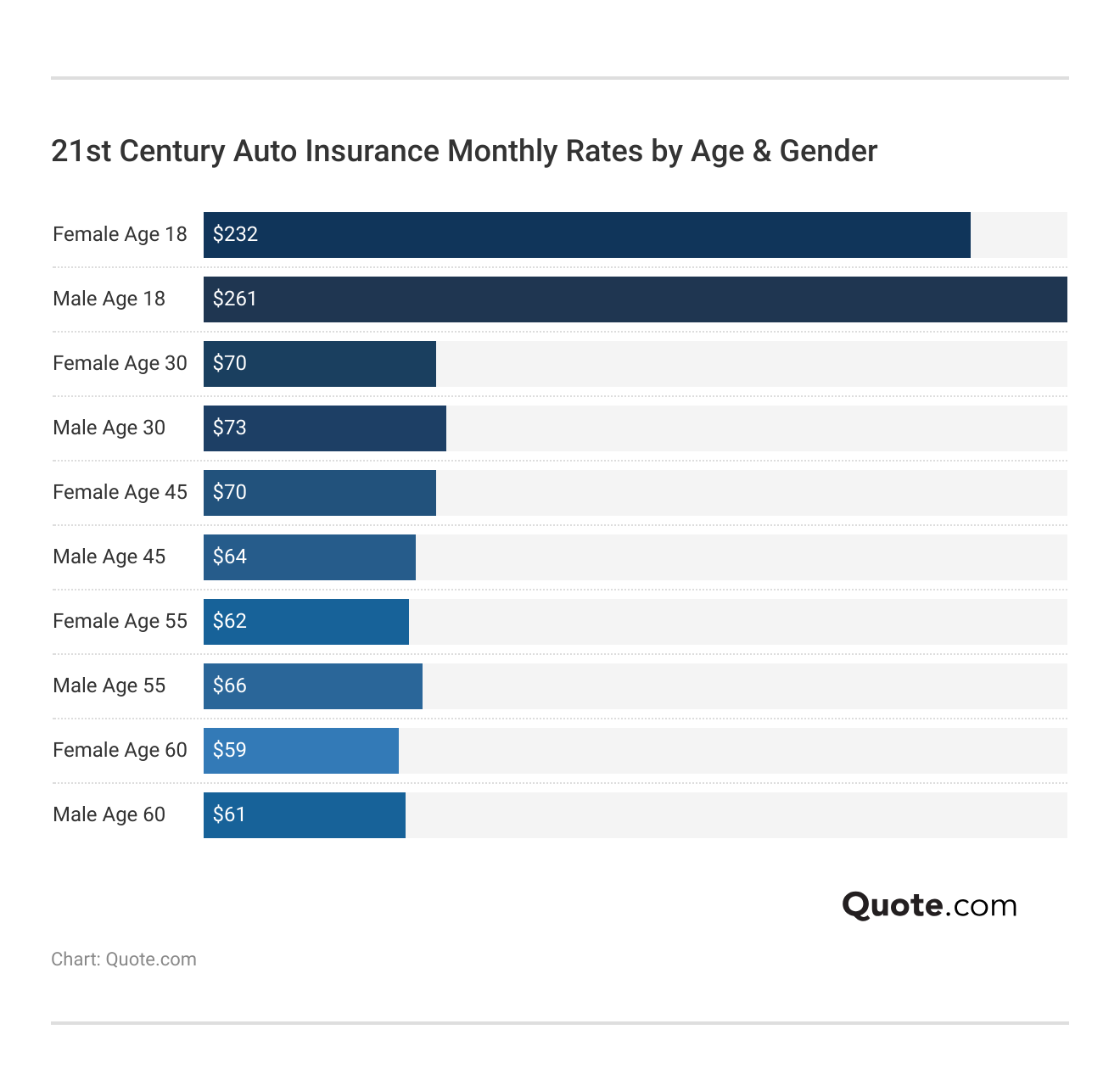

21st Century’s auto insurance rates vary by age and gender, with younger drivers paying the most. An 18-year-old female pays around $232 per month, while an 18-year-old male pays $261. Rates drop significantly by age 30, with females paying $70 and males $73.

Auto insurance rates drop with age and experience, while gender gaps narrow over time. For example, adding an experienced driver to your policy can help lower costs.

Michelle Robbins Licensed Insurance Agent

Middle-aged drivers see the lowest premiums, by age 60, females pay $59 and males $61. Overall, rates decrease with age, and the gender gap in pricing narrows over time, reflecting reduced risk for more experienced drivers.

21st Century Auto Insurance Rates by Credit Score

21st Century Insurance Company offers competitive full coverage auto insurance rates across all credit tiers. Drivers with good credit pay about $130/month, cheaper than most major insurers except Geico. With fair credit, the rate rises to $155, still below companies like Allstate and Liberty Mutual.

For bad credit, the premium is $205, more affordable than most competitors, though slightly higher than Geico. Overall, 21st Century remains a cost-effective choice, especially for those with good or fair credit.

Auto Insurance Full Coverage Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $130 | $155 | 205 |

| $170 | $200 | 275 | |

| $150 | $180 | 245 |

| $165 | $190 | 260 | |

| $125 | $145 | 200 | |

| $180 | $215 | 295 |

| $140 | $170 | 235 | |

| $150 | $180 | 250 | |

| $135 | $160 | 220 | |

| $145 | $175 | 240 |

21st Century offers competitive auto insurance rates across various driving records. Drivers with a clean record pay about $64 per month, cheaper than Allstate and Liberty Mutual but higher than Geico and State Farm.

21st Century vs. Top Competitors: Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $64 | $77 | $91 | $110 |

| $87 | $103 | $124 | $152 | |

| $62 | $73 | $94 | $104 |

| $76 | $95 | $109 | $105 | |

| $43 | $56 | $71 | $117 | |

| $96 | $116 | $129 | $178 |

| $63 | $75 | $88 | $129 | |

| $56 | $74 | $98 | $75 | |

| $47 | $53 | $57 | $65 | |

| $53 | $72 | $76 | $112 |

With a ticket or accident, rates increase to $77 and $91, but 21st Century still offers some of the cheapest car insurance compared to providers like Allstate and Farmers.

For drivers with a DUI, 21st Century charges $110 monthly, which is lower than most but higher than State Farm and Progressive. Overall, it provides solid mid-range pricing for drivers with both clean and imperfect records.

21st Century Auto Insurance Discounts & Saving Tips

21st Century offers a range of auto insurance discounts that can help policyholders save significantly on premiums. These features offer as much as a 25% discount for insuring more than one vehicle, 20% for being claims-free and 15% for being a good student.

21st Century Auto Insurance Discounts

| Discounts |  |

|---|---|

| Multi-Car | 25% |

| Good Driver | 20% |

| Good Student | 15% |

| Defensive Driving | 10% |

| Anti-Theft | 5% |

| AutoPay | 5% |

| Low Mileage | 5% |

| Prior Insurance | 5% |

| Electronic Payment | 3% |

| Paperless Billing | 2% |

Additional discounts include 10% for completing a defensive driving course, and 5% each for having anti-theft devices, enrolling in autopay, driving low annual mileage, and maintaining prior insurance coverage.

- Increase Your Deductible: Having a higher monthly payment can mean a lower premium, but make sure you can afford the out-of-pocket costs should you ever have to file a claim.

- Maintain a Clean Driving Record: Avoiding tickets, accidents, and DUIs helps you earn good driver discounts and keep rates low, with some insurers rewarding accident-free years.

- Usage-Based Programs: Many insurers offer usage-based insurance (UBI) programs that track driving habits. Safe drivers can earn extra discounts by braking gently and avoiding late-night driving.

- Shop Around and Compare Quotes: Prices vary between insurers for the same coverage. Compare quotes every 6–12 months, especially before renewal, to get the best rate.

Smaller savings are also available with 3% off for electronic payments and 2% for going paperless, as listed in the 17 car insurance discounts you can’t miss.

Beyond standard discounts, you can save more by raising your deductible, keeping a clean driving record, using usage-based programs, and regularly comparing quotes for the best rate.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

21st Century Auto Insurance Coverage Options

Knowing your auto insurance options helps you make the right coverage decisions. 21st Century offers policies beyond the basics to protect a range of driving needs.

- Liability Coverage: Protects you when you cause bodily injury or property damage to others during an accident. That’s the legal minimum in most states.

- Collision Coverage: Coverage that pays for damage to your car caused by a collision, regardless of who is at fault. This is often mandatory if you finance or lease your car.

- Comprehensive Coverage: Protects against non-collision damage such as theft, vandalism, fire, hail, or hitting an animal. It’s typically paired with collision for full coverage.

- Gap Insurance: Available in select states, this coverage pays the difference between what your car is worth and what you still owe on your loan or lease if it’s totaled.

- Roadside Assistance: Included at no additional cost with most auto policies, it covers up to $75 in towing and labor expenses for roadside emergencies like breakdowns or flat tires.

Whether you’re a new driver or a seasoned motorist, 21st Century offers affordable, customizable coverage, including liability, collision auto insurance, comprehensive, gap insurance, and roadside assistance.

With 21st AUTO PAY®, payments are automatically deducted monthly, and the 21st Mobile App lets you manage your policy, pay bills, access ID cards, and file claims on the go.

21st Century Auto Insurance Reviews

21st Century Insurance earns mixed reviews across major rating agencies. It scores 865/1,000 from J.D. Power for above-average customer satisfaction and holds an A+ rating from the BBB for excellent business practices.

Consumer Reports gives it a 72/100, reflecting average satisfaction, while the NAIC complaint index of 2.85 indicates more complaints than the industry average.

21st Century Auto Insurance Business Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: 865 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 72/100 Avg. Customer Satisfaction |

|

| Score: 2.85 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Financially, it’s strong, with an A rating from A.M. Best, showing excellent ability to pay claims. Overall, the company is financially stable and reputable but has room to improve customer satisfaction.

Comment

byu/frugalhelp from discussion

inInsurance

A Reddit user from Farmers Insurance called 21st Century’s service friendly and helpful. They often refer clients and note no complaints, echoing tips from how to file an auto insurance claim & win it each time.

Pros and Cons of 21st Century

In the process of choosing an auto insurance company, you need to consider both the advantages and potential negatives, in order to identify if the company is a good match for you.

- Competitive Pricing: Offers affordable rates, especially for drivers with clean records or good credit, with average minimum coverage around $64/month.

- Free Roadside Assistance: Includes up to $75 in towing and labor costs at no extra charge, unlike many competitors who charge extra.

- Simple Online Tools: Easy-to-use website for quotes, claims filing, and policy management; claims can also be filed by phone 24/7.

21st Century Insurance has benefits for many drivers, but it may not suit everyone. Check out 17 tips to pay less for car insurance before reviewing the pros and cons.

- Basic Coverage Transparency: The company website provides limited detail on coverage options and policy terms, making it harder for customers to compare plans up front.

- Premium Increases at Renewal: Many customers report unexpected rate hikes at policy renewal, even with no changes in driving history.

Ultimately, 21st Century excels in its affordability and extras such as free roadside assistance, but its California-only availability and high complaint rate may be concerns to some drivers.

By learning these pros and cons, you’ll be better equipped to determine whether 21st Century aligns with your insurance needs and expectations.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Find Affordable 21st Century Auto Insurance

21st Century provides affordable auto insurance exclusively in California, with minimum coverage rates starting at $64 per month. Drivers can save up to 25% through multi-car, clean driving, and good student discounts.

While it delivers value with features like free $75 roadside assistance, gap insurance, and comprehensive auto insurance, this 21st Century auto insurance review also highlights key weaknesses, including limited state availability and a higher-than-average complaint index.

Start comparing affordable insurance options by simply entering your ZIP code into our free quote comparison tool< today.

Frequently Asked Questions

Is 21st Century Insurance part of Farmers Insurance Group?

Yes, 21st Century Insurance is a wholly owned subsidiary of the Farmers Insurance Group of Companies, one of the largest personal lines insurers in the United States.

Does 21st Century Insurance cover rental cars after an accident?

Yes, if you have rental reimbursement coverage included in your policy, 21st Century Insurance can help pay for a rental car while your vehicle is being repaired after a covered accident.

Looking for more affordable premiums? Insert your ZIP code to get started on finding the right provider for you and your budget.

Can I get a 21st Century insurance quote if I live outside of California?

No, 21st Century only offers auto insurance in California, so a 21st Century insurance quote is currently limited to California residents with vehicles registered in the state. To explore more options, learn how to get multiple auto insurance quotes and compare providers beyond California.

How do the rates compare for 21st Century vs Safe Auto?

21st Century generally starts at $59–$64/month for minimum coverage in California and rewards good drivers with steep discounts, while Safe Auto often has higher premiums due to catering to high-risk drivers but is available in more states.

How does 21st Century automobile insurance handle claims and customer service?

21st Century automobile insurance provides claim support via phone and online. While financial strength ratings are high, customer reviews report mixed experiences, and the company has a higher-than-average NAIC complaint index.

Does coverage differ significantly between Esurance vs 21st Century?

Yes, Esurance offers a wide range of standard and optional coverages in multiple states, as detailed in everything you need to know about Esurance. In contrast, 21st Century provides core policies like liability, comprehensive, and gap insurance but only serves California drivers.

Are there any common complaints mentioned in 21st Century Insurance reviews?

Some 21st Century Insurance reviews point out a higher-than-average complaint index, mainly related to delays in claims processing and limited availability outside California.

Can I get coverage nationwide with 21st Century vs American Family?

21st Century auto insurance is available only in California, limiting its accessibility, while American Family operates in 19 states, offering more flexible coverage options across the U.S.

How do customer satisfaction and complaints compare for The General vs 21st Century?

21st Century earns strong financial ratings but has a higher-than-average complaint index. The General caters to high-risk drivers with quick coverage but higher rates. Learn more in our The General auto insurance review.

How long does it take to process a 21st Century Insurance claim?

The timeline for a 21st Century Insurance claim can vary depending on the complexity of the incident, but most auto claims are reviewed and resolved within 7 to 15 business days after all necessary documentation is submitted.

How does the 21st Century Insurance rating compare to major competitors?

The 21st Century Insurance rating is comparable to other top-tier insurers, holding an “A” from A.M. Best, similar to Geico and State Farm. However, it falls short in complaint index performance compared to those same companies.

Are there any major differences in state availability between 21st Century vs Travelers?

Yes. 21st Century is only available in California, making it a regional provider, whereas Travelers operates in most U.S. states with broader availability, discover details in our Travelers auto insurance review.

Can I schedule future 21st Century Insurance payments in advance?

Yes, if you are a policyholder, customers can arrange for future 21st Century Insurance payments using its online service, or the mobile app, and have greater control over a payment date as well as avoiding the risk of a service interruption.

How do I manage my 21st Century Insurance in California policy?

You can easily manage your 21st Century Insurance in California policy using their 21st Mobile App, which allows you to pay bills, access digital ID cards, and file claims directly from your smartphone.

Is a 21st Century auto insurance quote binding or does it require a purchase?

No, a 21st Century auto insurance quote is non-binding, meaning you can receive a rate estimate without any obligation to buy a policy, an important step in learning how to buy auto insurance wisely.

How do I manage my 21st Century car insurance policy online or through a mobile app?

Policyholders can manage their 21st Century car insurance through the 21st Mobile App, which allows users to pay bills, access ID cards, file claims, and review coverage from their smartphone.

Is 21st Century roadside assistance included automatically with all auto insurance policies?

21st Century roadside assistance is typically included with certain coverage packages, but it’s important to review your policy or speak with an agent to confirm if it’s part of your plan.

Can 21st Century Insurance customer service help me cancel my policy?

Yes, you can cancel your policy by calling 21st Century Insurance customer service directly. They will guide you through the process and explain any fees, as well as what happens if you cancel auto insurance, including potential coverage gaps or penalties.

Shopping around for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code into our free comparison tool to get started.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.