10 Best Auto Insurance Companies in California (2026)

American Family, State Farm, and AAA are the best auto insurance companies in California. Geico insurance rates in California cost just $49 a month. American Family excels in customer service, State Farm is trusted for reliable claims, and AAA stands out for senior-focused coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated November 2025

2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in California

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in California

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in California

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsThe best auto insurance companies in California are American Family, State Farm, and AAA. State Farm auto coverage in California starts as low as $49 per month.

Our Top 10 Picks: Best Auto Insurance Companies in California| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 672 / 1,000 | A+ | Customer Service | American Family |

| #2 | 658 / 1,000 | A++ | Reliable Claims | State Farm | |

| #3 | 642 / 1,000 | A+ | Senior Focused | AAA |

| #4 | 635 / 1,000 | A+ | Coverage Options | Progressive | |

| #5 | 634 / 1,000 | A++ | Policy Flexibility | Safeco | |

| #6 | 634 / 1,000 | A+ | Discount Variety | Allstate | |

| #7 | 627 / 1,000 | A+ | Balanced Value | Nationwide | |

| #8 | 626 / 1,000 | A++ | Low Rates | Geico | |

| #9 | 617 / 1,000 | A | Local Expertise | Farmers | |

| #10 | 596 / 1,000 | A | Custom Coverage | Mercury |

State Farm also earns high marks for reliable claims handling and financial strength, making it a trusted choice for many drivers. AAA is ideal for seniors, offering tailored discounts and benefits designed to meet their unique needs.

This guide covers the types of coverage available, including state-required liability protection, and highlights valuable discounts offered by top California providers. Browse more success stories from people who got auto insurance right for more ways to save.

- American Family stands out as the top pick for service and overall value

- AAA is a top CA insurance company for its roadside assistance

- Geico has the cheapest car insurance in California at $51 per month

Finding cheap auto insurance rates can be difficult for California drivers, so enter your ZIP code to find the most affordable quotes in your area.

Auto Insurance Rates in California

While American Family, State Farm, and AAA aren’t the cheapest options in California, they stand out in key service areas that justify their slightly higher premiums. American Family, starting at $71 per month for minimum coverage, leads in customer service, offering responsive support and high satisfaction rates.

California Auto Insurance Monthly Rates by Coverage| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $242 |

| $102 | $312 | |

| $71 | $216 |

| $85 | $261 | |

| $51 | $157 | |

| $62 | $187 | |

| $73 | $223 | |

| $68 | $207 | |

| $76 | $235 | |

| $55 | $169 |

State Farm, at $49 per month, delivers unmatched reliability in claims handling and boasts superior financial strength, ensuring long-term policy stability. AAA, though priced at $78 per month, is tailored to senior drivers with specialized benefits, roadside assistance, and strong retention due to its trusted member service.

These companies prioritize quality, dependability, and driver-specific needs, providing more value than just the lowest price to help California drivers buy auto insurance with confidence.

California Auto Insurance Rates by Age

Auto insurance rates in California vary significantly by age, with 16-year-olds paying the highest premiums across all providers. Geico offers the best car insurance in California for young adults at $215 per month for 16-year-olds.

California Auto Insurance Monthly Rates by Age| Company | Age 16 | Age 25 | Age 35 | Age 45 | Age 55 | Age 65 |

|---|---|---|---|---|---|---|

| $460 | $125 | $108 | $98 | $93 | $97 |

| $437 | $121 | $105 | $102 | $96 | $100 | |

| $330 | $89 | $76 | $71 | $67 | $69 |

| $511 | $110 | $95 | $85 | $80 | $85 | |

| $215 | $60 | $52 | $51 | $49 | $50 | |

| $390 | $102 | $85 | $78 | $75 | $78 | |

| $324 | $94 | $78 | $73 | $69 | $72 | |

| $562 | $94 | $74 | $68 | $64 | $66 | |

| $405 | $107 | $89 | $82 | $78 | $80 | |

| $240 | $70 | $60 | $55 | $52 | $55 |

Premiums drop steadily with age, and companies give drivers in their mid-30s to mid-50s the cheapest car insurance. However, American Family stays low across all ages at just $67 a month for 55-year-olds.

California Auto Insurance Rates by Driving Record

Driving history has a major impact on California auto insurance rates. Just one accident or ticket can raise rates by 30–60%.

California Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $78 | $116 | $135 | $95 |

| $102 | $144 | $172 | $119 | |

| $71 | $107 | $117 | $83 |

| $85 | $122 | $119 | $107 | |

| $51 | $85 | $139 | $67 | |

| $62 | $92 | $107 | $75 | |

| $73 | $102 | $150 | $88 | |

| $68 | $119 | $89 | $89 | |

| $76 | $113 | $132 | $93 | |

| $55 | $66 | $72 | $61 |

State Farm and Geico offer the cheapest rates for clean drivers, at $55 and $51 per month, respectively, but American Family keeps post-violation costs more reasonable.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

California Auto Insurance Claims

Filing a claim in California can lead to a noticeable increase in your auto insurance rates, especially if you’re found at fault. This is the state’s higher average claim sizes, like $4,000 for rear-end collisions or $7,500 for theft, push costs up across the board.

California Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Low risk, mild overall weather |

| Average Claim Size | B | Slightly higher due to repair costs |

| Traffic Density | B | Urban traffic varies, moderate overall |

| Uninsured Drivers Rate | C | Above average uninsured driver rate |

| Vehicle Theft Rate | C | High theft in specific regions |

Even common incidents like parking lot accidents or single-vehicle crashes can result in rate hikes of 20% or more, particularly for drivers with multiple claims on record.

California Annual Traffic Accidents & Claims by Major City| City | Annual Accidents | Annual Claims |

|---|---|---|

| Los Angeles | 3,500 | 4,200 |

| San Diego | 2,500 | 2,900 |

| San Francisco | 1,200 | 1,400 |

| Sacramento | 1,100 | 1,300 |

| Oakland | 1,000 | 1,200 |

| Fresno | 900 | 1,100 |

| Riverside | 900 | 1,050 |

| Long Beach | 800 | 950 |

| Santa Ana | 700 | 850 |

| Anaheim | 600 | 750 |

Drivers in densely populated or high-risk areas like Los Angeles, Oakland, and San Francisco often pay more due to increased traffic, accident frequency, and theft rates.

5 Common Car Insurance Claims in California| Rank | Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|---|

| #1 | Rear-End Collisions | 25% | $4,000 |

| #2 | Parking Lot Accidents | 18% | $2,500 |

| #3 | Single Vehicle Accidents | 15% | $6,500 |

| #4 | Weather-Related Damage | 12% | $3,000 |

| #5 | Vandalism/Theft | 10% | $7,500 |

Cities with more annual claims and vehicle damage tend to carry higher premiums, even if the state’s overall weather risk is low.

California Auto Insurance Requirements

To drive legally in California, you must carry at least the state’s minimum liability insurance. Meeting these limits keeps you legal, but they may not cover the full cost of a serious accident.

California Minimum Auto Insurance Coverage Requirements| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $5,000 per accident |

Many California drivers choose to go beyond the basics with higher limits or added protection with full coverage to cover the increased risk of theft or rear-end collisions in the state (Learn More: Liability vs. Full Coverage Auto Insurance).

There are several optional coverages available in California that can strengthen your policy, covering everything from vehicle repairs to medical bills and rental cars.

California Auto Insurance Coverage Options| Coverage | What It Covers |

|---|---|

| Liability | Injuries or property damage you cause |

| Collision | Damage to your vehicle in a crash |

| Comprehensive | Theft, vandalism, weather, or animal damage |

| Uninsured/Underinsured Motorist | Injuries or damage by uninsured drivers |

| Medical Payments (MedPay) | Medical costs for you and passengers |

| Personal Injury Protection (PIP) | Medical, lost wages, and essential services |

| Roadside Assistance | Towing, fuel delivery, lockout help |

| Rental Reimbursement | Rental car during covered vehicle repair |

| Gap Insurance | Loan balance if car is totaled |

These optional coverages can be especially valuable if you have a newer vehicle, live in a high-theft area, or want more complete peace of mind. Tailoring your policy to fit your needs can save you money in the long run.

Read More: Medical Payments Coverage

Ways to Save on Auto Insurance in California

Several top car insurance companies in California offer generous discounts that can significantly lower your auto insurance premiums. Nationwide leads with the highest good driver discount at 40%, rewarding safe driving behavior more than any other company.

Top Auto Insurance Discounts in California| Company | Accident- Free | Bundling | Good Driver | Loyalty | New Vehicle |

|---|---|---|---|---|---|

| 15% | 15% | 30% | 12% | 3% |

| 25% | 25% | 25% | 15% | 10% | |

| 25% | 25% | 25% | 18% | 15% |

| 20% | 20% | 30% | 12% | 12% | |

| 22% | 25% | 26% | 10% | 10% | |

| 18% | 20% | 25% | 10% | 10% | |

| 20% | 20% | 40% | 8% | 15% | |

| 10% | 10% | 30% | 13% | 10% | |

| 30% | 15% | 20% | 10% | 12% | |

| 17% | 17% | 25% | 6% | 15% |

American Family, Allstate, and Geico also stand out by offering well-rounded savings across multiple categories, including bundling, loyalty, and new vehicle discounts, each offering up to 25% or more in several areas.

Farmers and Progressive provide strong good driver and accident-free discounts, while Safeco boasts a standout 30% accident-free discount. These discounts can add up quickly, especially when combined with other savings opportunities available through each provider.

Beyond discounts, California drivers can also save by taking additional steps. Use these expert tips to help reduce your CA auto insurance rates:

- Safe Driving Habits: Avoid accidents, claims, and traffic violations to prevent premium increases.

- Reduced Vehicle Use: Drive less overall to lower your risk profile, especially in high-traffic California cities.

- Vehicle Choice: Opt for a car with high safety ratings, low repair costs, and strong anti-theft features.

- Higher Deductibles: Choosing a higher deductible can lower your monthly premium, as long as you can afford the out-of-pocket cost in a claim.

- Continuous Coverage History: Maintain active coverage without lapses to show insurers you’re a responsible policyholder.

These strategies, paired with the right discounts, can help California drivers secure quality coverage at a more affordable price, no matter where you live in the state. Check out our guide about defensive driving insurance discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

10 Best Auto Insurance Companies in California

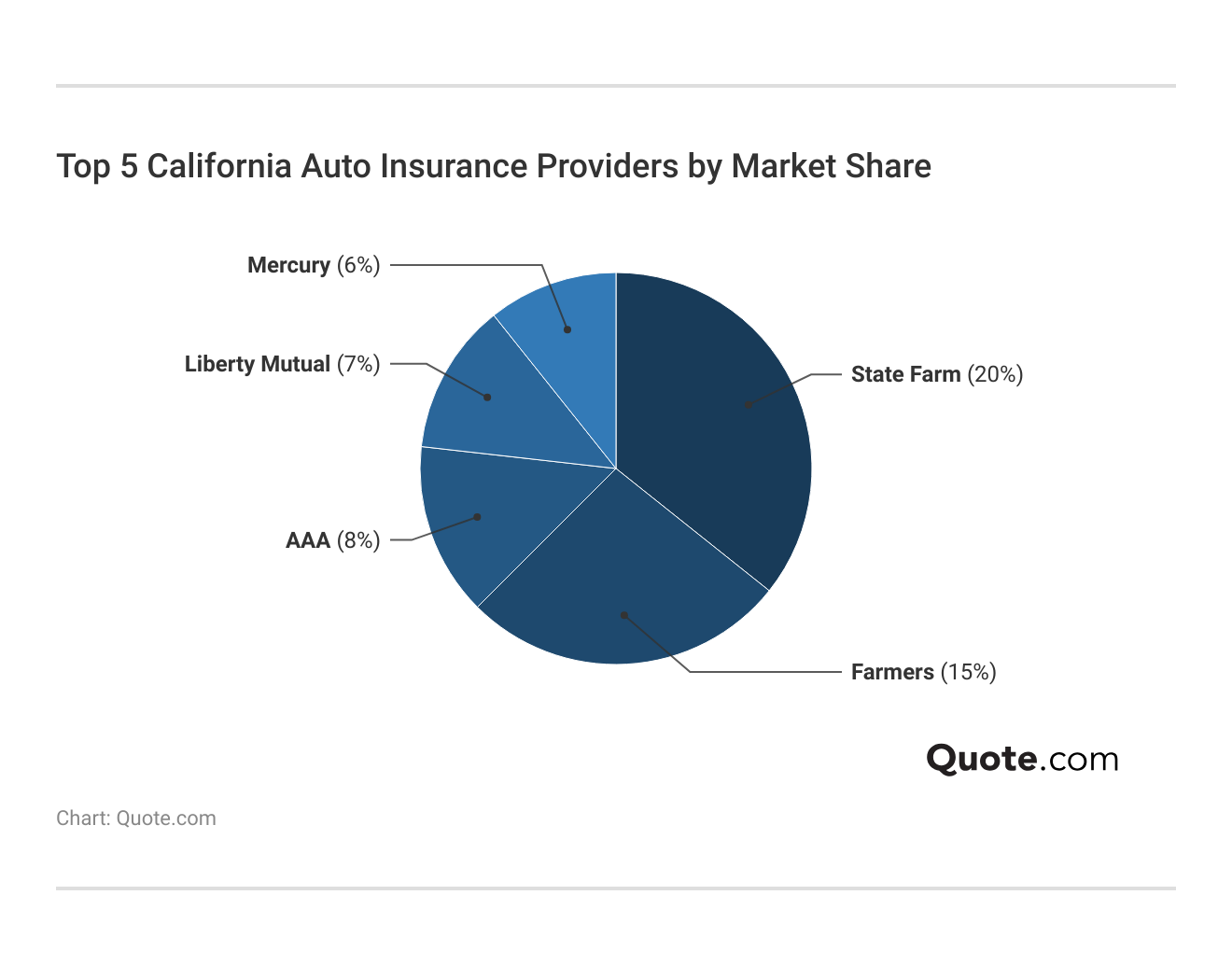

American Family, State Farm, and AAA lead the list of the best car insurance companies in California, offering reliable service and competitive rates. And when it comes to the California insurance market, these top three providers lead the pack.

Even mid-sized players like Safeco and Progressive hold significant shares, indicating a competitive landscape where a few key companies serve the majority of California drivers. That’s why it’s important to compare multiple insurance companies.

Just because a company is the largest auto insurer doesn’t mean it’s the best fit for every driver. Always compare quotes online to find the insurer that's right for you.

Leslie Kasperowicz Farmers CSR for 4 Years

Each provider on this list of auto insurance companies in California has been evaluated for key strengths and weaknesses. Review the pros and cons below to see which California insurer is the best fit for you.

#1 – American Family: Top Overall Pick

Pros

- Customer Support Excellence: American Family is known for high-touch claims assistance and policyholder support, especially in high-traffic regions like Los Angeles and San Diego.

- Competitive CA Rates: Minimum coverage starts at $71 a month in California, beating major competitors like Allstate and AAA while maintaining solid policy value.

- Strong CA Discounts: Offers up to 25% for safe driving, bundling auto and home, and loyalty, which are stackable for greater savings in California. See full details in our American Family review.

Cons

- Limited Agent Reach: American Family has fewer agent offices in Northern California and rural Central Valley, which can reduce access to personalized service.

- Not the Absolute Cheapest: While competitive, it’s still $20 a month more than Geico’s $51 a month minimum coverage in California.

#2 – State Farm: Best for Reliable Claims

Pros

- Claims Dependability: State Farm consistently ranks above average for fast, responsive claims service in CA, especially for rear-end and weather-related incidents.

- Low CA Rates: Minimum liability policies start at just $49 per month, one of the lowest for major carriers in California. See more in our State Farm auto insurance review.

- Financial Strength: With an A++ rating and extensive agent network, State Farm ensures claim payments and support throughout all of CA’s 58 counties.

Cons

- Fewer Discounts: Maximum loyalty and bundling discounts in California cap at 17%, while competitors like Nationwide and Farmers offer 20% or more.

- Basic Online Tools: The CA mobile app lacks customization tools like Progressive’s Name Your Price or Geico’s coverage calculator.

#3 – AAA: Best for Senior Focused

Pros

- Senior Benefits: AAA offers exclusive mature driver training discounts and enhanced medical payments options for seniors in CA. Our AAA auto insurance review provides full policy details.

- Roadside Assistance: Every auto policy in California includes free roadside coverage with lockout, towing, and battery service, making it ideal for older drivers.

- Established Service Reputation: With minimum coverage at $78 a month, AAA has high retention rates among senior members in metro areas like Sacramento and Riverside.

Cons

- Higher Base Rate: AAA costs more than Geico, State Farm, or Mercury for minimum CA coverage, even with discounts applied.

- Membership Requirement: CA drivers must pay an annual membership fee (typically $60–$120) to access auto insurance services.

#4 – Progressive: Best for Coverage Options

Pros

- Policy Customization: Progressive offers unique tools like Name Your Price, allowing CA drivers to personalize deductibles, coverage limits, and add-ons.

- Affordable CA Rate: With minimum coverage priced at $68 a month, Progressive is budget-friendly without sacrificing online features or claims ease.

- Snapshot Program: CA drivers can use Progressive’s UBI program to earn up to 30% off by tracking safe driving behaviors over 6 months. Read everything you need to know about Progressive Insurance.

Cons

- Below-Average Claims Score: At 635/1,000, Progressive ranks lower than State Farm or American Family in CA for claims satisfaction, especially for collision repairs.

- Limited Agent Interaction: California customers relying on in-person support may be disappointed, as Progressive prioritizes digital-first service.

#5 – Safeco: Best for Policy Flexibility

Pros

- Policy Flexibility: Safeco allows CA drivers to choose between six different deductible tiers, varying liability limits, and optional gap coverage.

- Financial Security: With an A++ A.M. Best rating and backing from Liberty Mutual, Safeco ensures reliable claims payments in all CA regions. Browse more ratings in our expert Safeco review.

- Solid CA Pricing: Minimum coverage averages $76 a month, offering mid-tier affordability and useful customization tools via its mobile platform.

Cons

- Mixed Claims Experience: Some CA drivers report longer claim resolution times, particularly in high-volume cities like Oakland and San Jose.

- Limited Discount Depth: California bundling and loyalty savings typically max out at 15%, which is lower than top rivals like Farmers or Nationwide.

#6 – Allstate: Best for Discount Variety

Pros

- Discount Variety: CA drivers can combine up to five discount types—accident-free, bundling, loyalty, new vehicle, and good driver—for total savings of nearly 25%.

- Agent Access: Allstate has one of the largest agent networks in CA, with over 700 representatives, including in smaller cities like Bakersfield and Oxnard.

- Digital Claims Process: CA policyholders benefit from Allstate QuickFoto Claim, which allows app-based photo submissions for damage assessments.

Cons

- High Entry Cost: Minimum coverage costs $102 per month, the highest among all the top 10 providers in California.

- Post-Claim Increases: Many CA drivers report 20–30% rate hikes after just one at-fault accident. Discover policy benefits and savings in the Allstate auto insurance review.

#7 – Nationwide: Best for Balanced Value

Pros

- Safe Driver Savings: Offers up to 40% off with SmartRide for Californians who maintain safe braking, speed, and mileage habits. See more discounts in our Nationwide auto insurance review.

- Strong CA Rates: At $73 per month, Nationwide sits in the middle of the pack for minimum coverage while offering robust policy perks.

- Easy Online Access: The CA customer portal allows drivers to manage billing, policy changes, and telematics all from one dashboard.

Cons

- Weak Loyalty Discount: Loyalty savings in CA are only 8%, less than half of what American Family and Allstate offer.

- Limited High-Risk Coverage: Nationwide isn’t ideal for CA drivers with a DUI, multiple violations, or lapse in coverage history.

#8 – Geico: Best for Low Rates

Pros

- Cheapest Rate: At just $51 per month, Geico offers the cheapest car insurance in California to drivers with clean records.

- Highly Rated Mobile App: Geico’s insurance app in California includes real-time roadside help, ID cards, and accident photo reporting tools.

- Strong Discounts: CA customers can save up to 26% with good drivers, 25% with bundling, and 10% on new vehicles. Learn everything you need to know about Geico.

Cons

- Few Local Offices: Geico has minimal brick-and-mortar support in California; most customer service is handled online or by phone.

- Large Premium Spikes: Geico’s premiums can increase by 50% or more after a DUI or accident in CA, depending on severity.

#9 – Farmers: Best for Local Expertise

Pros

- Strong Agent Network: With over 900 agents statewide, Farmers excels in personalized service across suburban and rural parts of CA.

- Decent CA Pricing: Minimum coverage averages $85 a month, with higher value in areas prone to traffic accidents like Stockton and Fresno.

- Robust Discount Suite: CA drivers can save up to 30% with good driving and 20% with multi-policy bundling. Find everything you need to know about Farmers Insurance in one place.

Cons

- Slower Claims Turnaround: Claims satisfaction is below average at 617/1,000, with delays in body shop coordination noted in CA reviews.

- Basic Mobile Tools: Farmers’ CA mobile app lacks advanced features like live agent chat or real-time claims tracking.

#10 – Mercury: Best for Custom Coverage

Pros

- Flexible Policy Add-Ons: Mercury offers optional roadside assistance, ride-hailing endorsements, and mechanical breakdown insurance tailored for CA drivers.

- Low Cost Option: With minimum coverage at $62 per month, Mercury is among the most affordable in California. Delve more details in our Mercury insurance review.

- Strong Safety Discounts: Safe CA drivers may qualify for up to 25% in premium reductions, plus 20% off when bundling renters or homeowners insurance.

Cons

- Poor Claims Experience: Mercury has the lowest CA claims satisfaction at 596/1,000, with frequent complaints about communication and delays.

- Limited Reach Outside Cities: Rural Californians may struggle to find agents or local service centers under the Mercury brand.

How to Find the Best Company in California

Choosing the best auto insurance company in California means looking beyond just price. With the state’s higher-than-average premiums, it’s important to compare top 10 car insurance companies in California based on coverage options, customer service, financial strength, and the types of drivers they serve best

Among the many options, American Family, State Farm, and AAA stand out for their balance of service, reliability, and tailored benefits, whether it’s exceptional customer support, strong claims handling, or cheap auto insurance for seniors.

Discounts are key to lowering California auto insurance costs. Look for safe driving, loyalty, and new vehicle discounts for the best rates.

Jimmy McMillan Licensed Insurance Agent

Buying from the best auto insurance companies in California ensures you stay protected while getting the most value for your money. Get fast and cheap CA auto insurance coverage today with our quote comparison tool.

Frequently Asked Questions

Who is the best auto insurance company in California?

The best auto insurance companies in California are American Family, State Farm, and AAA. American Family ranks highest for customer service, State Farm is known for reliable claims handling, and AAA offers senior-focused perks.

Who is the largest auto insurer in California?

What insurance company is most used in California? State Farm is one of the most widely used auto insurance companies in California due to its strong claims reputation, wide agent network, and competitive pricing. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Who is the second-largest insurance provider in California?

Farmers is considered the second-largest among the top car insurance companies in CA, with 15% of the market share (Read More: Farmers vs. USAA auto insurance review).

Who is the highest-rated auto insurance company in CA?

State Farm holds an A++ financial strength rating from A.M. Best and consistently scores high in customer satisfaction and claims reliability, making it one of the highest-rated providers in California.

Which car insurance is cheaper in CA?

Geico offers the cheapest minimum coverage in California, starting at just $51 per month, making it an excellent choice for budget-conscious drivers. Discover ways to pay less for car insurance.

Who has the lowest car insurance rates in California?

Geico offers the cheapest car insurance rates in California, with minimum coverage starting at just $51 per month. Other affordable options include State Farm and Progressive, but Geico consistently ranks as the lowest-priced provider for many driver types.

How much should full coverage car insurance cost in California?

Full coverage car insurance in California typically costs between $157 and $312 per month. Geico offers one of the best full coverage car insurance options in California at $157/month, while other providers like American Family and State Farm offer strong full coverage policies with added service value.

What is the recommended auto insurance coverage in California?

While California requires minimum liability coverage of 15/30/5, most experts recommend adding uninsured motorist coverage and full coverage with collision and comprehensive auto insurance for better protection.

Who has the best coverage in California?

Progressive, Safeco, and Mercury have the most flexible auto insurance coverage in California, which drivers can customize based on budget, driving habits, and vehicle type.

Does California have the highest car insurance rates?

California has higher-than-average rates, but it doesn’t have the highest in the U.S. Rates vary by location, driving history, and coverage level, with cities like Los Angeles and San Francisco seeing the highest premiums. Get details about car insurance discounts you can’t miss to make it easier for CA policyholders to lower premiums.

How can I lower my car insurance premiums in California?

How much is Progressive car insurance in California?

Is Allstate leaving California?

How many insurance companies operate in California?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.