Best Auto Insurance for GMCs in 2026

You can get the best auto insurance for GMCs through Erie, Liberty Mutual, and Nationwide for as low as $68 per month. GMC insurance costs are higher on XL models like the GMC Yukon or Sierra 1500HD, but these top companies specialize in tailored insurance coverage for pickups and heavy-duty trucks.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2026

Erie, Liberty Mutual, and Nationwide offer the best auto insurance for GMCs, with coverage rates starting at $68 a month.

- Erie has the highest customer satisfaction for GMC insurance

- The cheapest auto insurance for GMCs starts at $68 monthly

- A single accident raises GMC insurance rates by 20%–40%

Finding the right GMC auto insurance means comparing providers that deliver a strong balance of coverage, affordability, and vehicle-specific discounts designed to enhance protection for these high-value trucks and SUVs.

Liberty Mutual and Nationwide both offer tailored policy options for new car replacement, OEM coverage, and heavy-duty truck protection.

Top 10 Companies: Best Auto Insurance for GMCs| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Personal Agents |

| #2 | 730 / 1,000 | A | OEM Coverage |

| #3 | 729 / 1,000 | A+ | Trucks & SUVs |

| #4 | 716 / 1,000 | A++ | Customer Satisfaction | |

| #5 | 702 / 1,000 | A | Loyalty Rewards | |

| #6 | 697 / 1,000 | A++ | Low Rates | |

| #7 | 693 / 1,000 | A+ | New Drivers | |

| #8 | 691 / 1,000 | A++ | Fleet Coverage | |

| #9 | 690 / 1,000 | A | Safe Drivers | |

| #10 | 673 / 1,000 | A+ | Custom Plans |

Savings strategies such as bundling, anti-theft devices, and safe-driving programs can help you find affordable GMC insurance coverage and reduce costs by up to 35% (Read More: Best Auto Insurance for Good Drivers).

GMC insurance reviews provide additional guidance on choosing the best provider. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Finding Affordable GMC Car Insurance

How much does GMC insurance cost? That depends on the company you choose, the level of coverage you need, and your age and driving history.

There’s a significant range of GMC insurance quotes across major providers, so compare multiple companies before buying.

How Coverage Requirements Can Raise GMC Insurance Rates

Drivers in every state are required to carry a minimum level of liability auto insurance to protect other drivers on the road.

Geico and Erie offer the cheapest minimum coverage at $68 and $69 per month, while Liberty Mutual and Allstate are the most expensive.

GMC Insurance Monthly Rates by Coverage Level| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $74 | $180 | |

| $70 | $170 |

| $68 | $165 |

| $76 | $185 | |

| $69 | $168 |

| $78 | $185 |

| $71 | $172 | |

| $73 | $178 |

| $70 | $170 |

| $75 | $180 |

Full coverage is recommended because minimum liability policies will not pay to repair your GMC after an accident. You’ll be required to carry full coverage if you drive a new GMC or lease a model.

Erie stands as the leading insurer for full coverage at $165 per month, while State Farm and Geico provide competitive options.

Read More: State Farm vs. Progressive Auto Insurance

GMC Car Insurance for High-Risk vs. Safe Drivers

A solid driving record is the most effective way to get affordable GMC auto insurance. Safe drivers pay the lowest rates, starting at $68 a month at Erie.

A reckless driving history will raise premiums for all drivers, but Erie, Geico, and State Farm remain the cheapest GMC insurance companies for high-risk drivers.

GMC Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $74 | $104 | $126 | $163 | |

| $70 | $98 | $119 | $154 |

| $68 | $95 | $116 | $150 |

| $76 | $106 | $129 | $167 | |

| $69 | $97 | $117 | $152 |

| $78 | $109 | $133 | $172 |

| $71 | $99 | $121 | $156 | |

| $73 | $102 | $124 | $161 |

| $70 | $98 | $119 | $154 |

| $75 | $105 | $128 | $165 |

GMC insurance prices increase by 15% to 30% when drivers get a speeding ticket, and premiums go up by 20% to 40% after an at-fault accident.

If you’re a high-risk driver, then expect to pay more for GMC auto insurance. Fortunately, comparing multiple companies at once can unlock long-term savings for drivers with multiple accidents or DUIs.

DUI convictions cause the most severe penalties, often doubling GMC insurance premiums with some carriers.

Jeff Root Licensed Insurance Agent

When you compare top companies, Erie vs. Liberty Mutual, Erie is the most affordable for high-risk insurance quotes.

Nationwide is also pricier, but both Liberty Mutual and Nationwide offer big discounts that can make rates more competitive for GMC drivers who qualify.

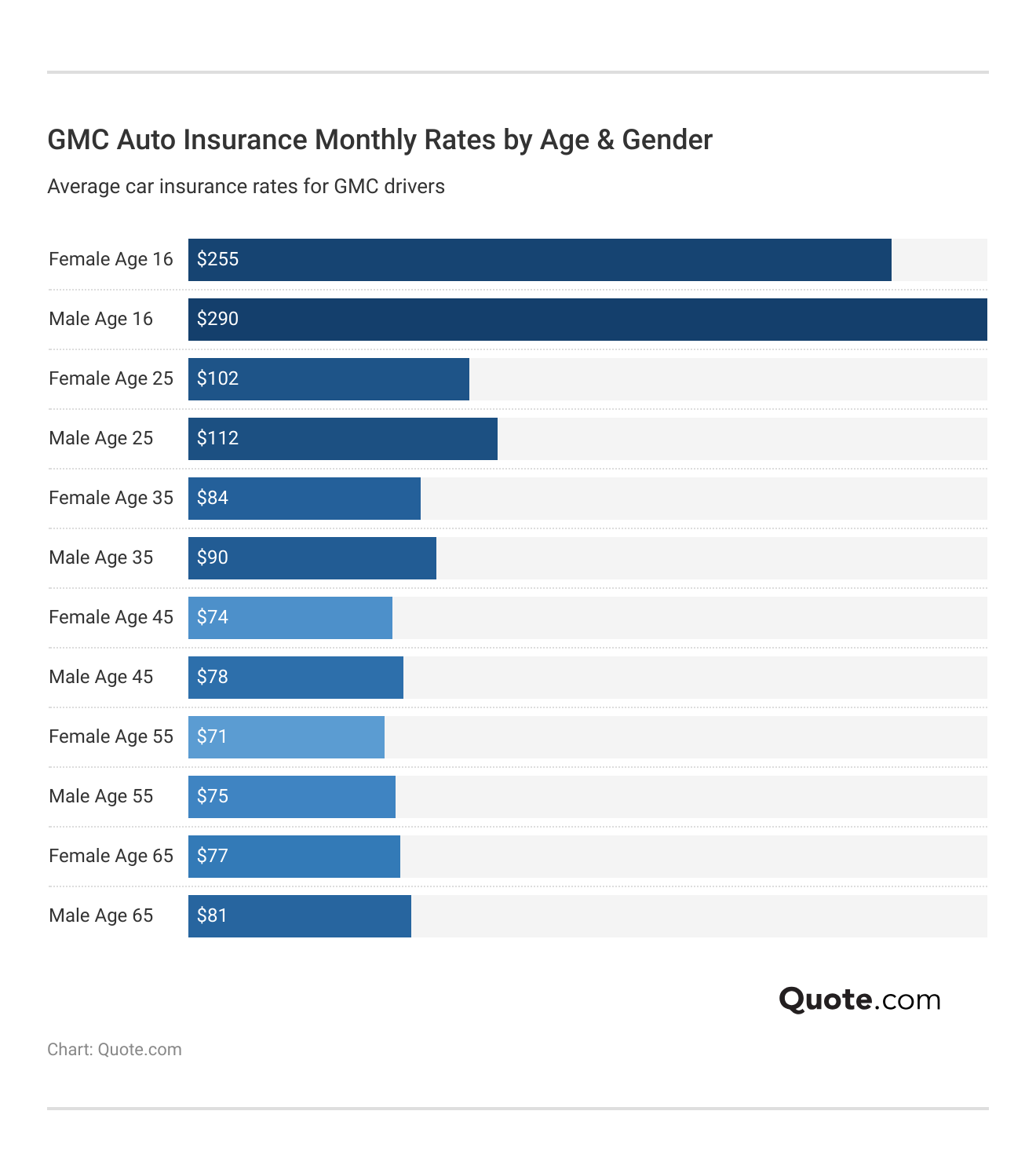

How Age Affects GMC Insurance Costs

Along with your driving record, age, and gender have the biggest impact on your GMC auto insurance quotes.

Insurers consider teens as risky as drivers with tickets or accidents, so they have the highest rates.

Allstate is the best GMC car insurance company for new drivers, with an online learning center that helps teens build driving skills.

GMC insurance rates steadily drop as drivers enter their 20s, but you can shop around to find cheap auto insurance for teens.

Comparing Auto Insurance Rates for Different GMCs

Looking at GMC insurance rates by model, there is a clear pattern where high-end GMC vehicles cost more to insure because of their higher replacement value and technology.

GMC Canyon car insurance is pricier than average at $180 a month, but not as high as GMC Hummer rates at $230 monthly.

GMC Auto Insurance Monthly Rates by Model| Vehicle Model | Minimum Coverage | Full Coverage |

|---|---|---|

| GMC Acadia | $72 | $165 |

| GMC Canyon | $78 | $180 |

| GMC Envoy | $70 | $155 |

| GMC Hummer | $95 | $230 |

| GMC Jimmy | $60 | $145 |

| GMC Savana | $80 | $175 |

| GMC Sierra 1500 | $78 | $185 |

| GMC Sierra 2500HD | $82 | $195 |

| GMC Sierra 3500HD | $85 | $205 |

| GMC Terrain | $68 | $155 |

| GMC Yukon | $76 | $180 |

GMC Acadia insurance rates are much lower at $165 per month, while coverage for the GMC Jimmy and GMC Envoy is even cheaper than GMC Acadia car insurance.

GMC Yukon car insurance is more expensive at $180 monthly for full coverage, and GMC Yukon XL car insurance will be slightly higher due to the increased size and performance of the XL line.

GMC Sierra insurance also increases with truck size. GMC Sierra 2500HD car insurance is slightly cheaper than GMC Sierra 3500HD car insurance, but pricier than the Sierra 1500.

GMC insurance reviews also reveal a steady annual decrease in premiums as vehicles age. So, the average insurance cost for 2018 GMC Sierras will be much lower than a 2025 or 2026 model.

Read More: The Best Time to Buy a New Car

How GMC Sierra Insurance Compares to Other Trucks

Compared to other pickups, GMC Sierra 1500 car insurance is affordable. Full coverage costs less than a Dodge Ram and a Ford F-150.

Car insurance for a GMC Sierra is also cheaper than for a Toyota Tundra (Learn More: Auto Insurance Rates by Vehicle).

GMC Sierra vs. Similar Pickups: Auto Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| GMC Sierra 1500 | $78 | $185 |

| Chevrolet Silverado 1500 | $76 | $180 |

| Dodge Ram 1500 | $80 | $190 |

| Ford F-150 | $82 | $195 |

| Honda Ridgeline | $72 | $170 |

| Jeep Gladiator | $80 | $185 |

| Nissan Frontier | $74 | $175 |

| Rivian R1T | $95 | $230 |

| Tesla Cybertruck | $90 | $220 |

| Toyota Tundra | $85 | $205 |

Cheaper trucks, like the Honda Ridgeline and Nissan Frontier, have lower premiums than the GMC Sierra because they are smaller trucks and less likely to cause serious damage in collisions with other vehicles.

If you’re shopping around for a new truck or car, get multiple GMC auto insurance quotes based on the model you want to drive. Each insurer will consider the vehicle’s risk against your age, gender, and driving history.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Popular Insurance Coverage for GMCs

If you’re looking to build the right GMC insurance policy, start with the minimum coverage that’s required in your state. Here are the basic auto insurance coverage options GMC owners should consider.

Understanding the available coverage options with each company can significantly impact your level of protection and potential savings.

- Collision & Comprehensive: Pays for repairs to your GMC after accidents with other vehicles or objects, theft, vandalism, fire, floods, hail, and animal strikes.

- Gap Coverage: Covers the remaining amount on an auto loan or lease if your GMC is totaled in a covered claim before you finish paying it off.

- Liability Insurance: Covers damages and injuries you cause to others in an accident. This coverage is legally required in most states and protects your assets from lawsuits.

- Rental Reimbursement: Pays for a temporary replacement vehicle while your GMC is being repaired after a covered claim.

- Roadside Assistance: Covers emergency services like towing, jump-starts, lockout help, flat tire changes, and emergency fuel delivery when you’re stranded.

While all major providers offer essential roadside assistance and rental reimbursement, only Allstate, American Family, Erie, and Travelers provide comprehensive coverage across all five categories.

If you compare American Family vs. Geico, Geico doesn’t offer gap insurance, which can result in a financial loss if your GMC is totaled.

GMC Auto Insurance Coverage Options by Provider| Company | Claim Forgiveness | Gap Plans | New Car Replacement | Roadside Assistance |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ❌ | ✅ | ❌ | |

| ❌ | ❌ | ❌ | ✅ |

| ✅ | ❌ | ✅ | ✅ |

| ❌ | ❌ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ✅ |

| ✅ | ❌ | ❌ | ✅ |

| ✅ | ✅ | ✅ | ✅ |

If you’re buying a new GMC truck, then look for insurance that covers new car replacement, something you won’t find with Geico, Progressive, or State Farm.

Liberty Mutual offers the best auto insurance for new GMCs, with new-car and better-car replacement add-ons that will replace a totaled GMC with the same model or a slightly newer one with fewer miles.

Saving Money on GMC Car Insurance

To find the right insurance for your GMC, focus on providers who offer coverage and discounts that align with your specific situation rather than simply comparing base premiums.

Liberty Mutual offers the most generous anti-theft auto insurance discount for GMC. At the same time, bundling consistently delivers substantial savings across most providers.

GMC Auto Insurance Discounts From Top Providers| Company | Anti-Theft | Bundling | Loyalty | New Car |

|---|---|---|---|---|

| 10% | 25% | 15% | 10% | |

| 25% | 25% | 18% | 15% | |

| 15% | 25% | 10% | 12% |

| 10% | 20% | 12% | 12% | |

| 25% | 25% | 10% | 10% | |

| 35% | 25% | 10% | 8% |

| 5% | 20% | 8% | 15% |

| 25% | 10% | 13% | 10% | |

| 15% | 17% | 6% | 15% | |

| 15% | 13% | 9% | 8% |

When you compare American Family vs. Erie, Geico, and Liberty Mutual, all offer 25% multi-policy discounts. For long-term customers, American Family rewards loyalty most generously at 18%.

Along with discounts, here are a few more easy ways to lower your average GMC insurance costs:

- Picking a Basic Trim: Newer GMCs tend to have higher premiums, especially for new GMC Sierra insurance. Opting for a basic trim for your truck can reduce premiums.

- Reducing Coverage: Reviewing coverage as your GMC ages will also help you save money. You may be able to carry a liability-only policy for the lowest possible rates.

- Stacking Discounts: One of the best hacks to save more money on car insurance is to combine multiple discounts.

- Using Telematics: Signing up for usage-based insurance (UBI) with telematics that tracks driving habits can lower rates for safe GMC drivers.

Pairing a strong bundling discount with either anti-theft protection or usage-based programs often yields the biggest savings.

Nationwide offers the biggest UBI discount up to 40% if you avoid speeding, hard braking, and driving at night.

High-risk drivers may not be eligible for UBI with some providers, but you can still lower GMC insurance rates by maintaining a clean driving record after an accident and avoiding filing claims in the future.

Using these strategies helps you avoid one of the most common ways you’re wasting money on your car through unnecessarily high insurance payments.

The 10 Best GMC Auto Insurance Providers

The best auto insurance for GMCS is with Erie, Liberty Mutual, and Nationwide. However, State Farm is the largest GMC insurance company, with an A++ superior financial stability rating and cheap full coverage at $170 a month.

Erie has the cheapest GMC car insurance per month at $68 for minimum and $165 for full coverage, but it’s only available in 12 states.

Geico is available in all 50 states and offers budget-friendly $69 monthly minimum coverage with 25% bundling discounts.

Progressive, the third-largest company, helps GMC drivers on a budget with its unique Name Your Price and Snapshot tools.

The most popular insurer isn’t automatically the best choice. Smaller companies can offer benefits like faster claims decisions and stronger local support, with easier access to knowledgeable agents.

Kristen Gryglik Licensed Insurance Agent

The best tips for paying less for car insurance include keeping a clean driving record, bundling policies, and using anti-theft devices for up to 35% savings.

Find your cheapest GMC insurance quotes by entering your ZIP code into our free comparison tool.

#1 – Erie: Top Pick Overall

Pros

- Personal Agent: All GMC owners receive specialized care from a personal, local agent, and GMC agents have the highest-rated customer service in J.D. Power surveys.

- Low Prices: Full coverage for a GMC costs $165 a month, below the market rate. See more rates in our Erie Insurance review.

- Price Lock: Erie’s Rate Lock system keeps rates the same on qualified GMC vehicles until you switch vehicles or ZIP codes.

Cons

- Limited Geographic Coverage: GMC auto insurance through Erie is available only in 12 states.

- Less Streamlined: GMC owners don’t have the same easy online or mobile claim submission options as larger companies do with Erie.

#2 – Liberty Mutual: Best for OEM Coverage

Pros

- Manufacturer Parts Guarantee: Specialized coverage guarantees original manufacturer parts for GMC vehicles during repairs following covered accident claims.

- Exceptional Bundling Discounts: GMC owners save 25% when bundling policies with homeowners coverage. We list all discounts in our Liberty Mutual review.

- First-Accident Protection: First-time collision claims will not increase GMC insurance rates for safe drivers who have avoided claims in the past.

Cons

- Expensive Premiums: GMC owners face the highest insurance prices at $185 monthly for full coverage.

- Stricter Application Process: GMC drivers must submit vehicle specifications and driving history as part of the application.

#3 – Nationwide: Best for Trucks & SUVs

Pros

- Model-Tailored Protection: Specialized protection packages provide comprehensive coverage for the unique features of the GMC Terrain and Acadia.

- Progressive Deductible Reduction: Safe driving reduces out-of-pocket expenses for GMC owners by $100 annually, up to $500 in total savings.

- Transparent Claims Platform: Our Nationwide insurance review explains its transparent digital claim tracking throughout the repair process.

Cons

- Location-Based Disparities: Coverage and discount limitations in certain states may affect GMC insurance rates for different drivers.

- Less Competitive Rates: It’s not the most expensive, but Nationwide’s rates for GMCs are higher than State Farm, Progressive, and Geico.

#4 – State Farm: Best for Customer Satisfaction

Pros

- Industry-Leading Satisfaction: Customer satisfaction surveys show that GMC drivers file significantly fewer complaints about claim denials than industry averages.

- Superior Financial Stability: With the A++ rating, GMC policyholders can expect timely settlements of their claims countrywide.

- Cheap Full Coverage: Full coverage car insurance for GMCs starts at $170 per monthly. Compare quotes in our State Farm auto insurance review.

Cons

- Smaller Discounts: The maximum 17% discount for bundling policies yields GMC owners less savings than most competitors.

- Limited Digital Tools: The mobile app lacks advanced GMC vehicle-diagnostic features that many competitors already offer.

#5 – American Family: Best for Loyalty Rewards

Pros

- Long-Term Customer Rewards: Premium reductions automatically increase every year when GMC owners maintain continuous coverage with AmFam.

- Young Driver Advantages: Young GMC drivers receive specialized rate adjustments after completing approved defensive driving courses through certified programs.

- Deductible Reduction: GMC owners can reduce deductibles by $100 a year for accident-free driving.

Cons

- Limited Geographic Availability: AmFam GMC vehicle coverage is not available in 15 states. Use our American Family insurance review to find coverage near you.

- Tough Claim Process: Accident claims require GMC owners to submit more vehicle repair documentation than the industry standard.

#6 – Geico: Best for Low Rates

Pros

- Budget-Friendly Minimum Plans: Budget-conscious drivers can insure their GMC vehicles for only $69 monthly with basic liability protection plans.

- Generous Multi-Policy Discounts: Combining home insurance with GMC auto coverage offers a 25% discount on annual premiums.

- Rock-Solid Financial Strength: Geico’s A++ rating ensures GMC owners consistently receive reliable claim payments (Read More: Everything You Need To Know About Geico).

Cons

- Fewer Choices for Customization: It is difficult for owners of modified GMC trucks to obtain coverage for aftermarket parts and specialty upgrades.

- Customer Service Varies by State: GMC insurance customer satisfaction varies by state.

#7 – Allstate: Best for New Drivers

Pros

- Comprehensive Learning Center: New GMC drivers learn about coverage needs through interactive online resources, as mentioned in our Allstate auto insurance review.

- Beginner-Friendly Protection: Specially designed coverage options protect new and teen GMC drivers through educational materials and monitoring technology.

- Maximized Bundle Incentives: Families who insure their GMC vehicles alongside home insurance can receive up to a 25% discount on their premiums.

Cons

- Tight Requirements: Some discounts’ requirements prevent some GMC drivers from qualifying for the maximum savings.

- Premium Rates: The $180 monthly rate for full coverage is much higher than rates from other GMC car insurance companies on this list.

#8 – Travelers: Best for Fleet Coverage

Pros

- Fleet Coverage: Travelers offers specialized coverage for drivers who use multiple GMC vehicles for their businesses.

- Record Protection: GMC owners who remain claim-free for three years will have their driving record points disregarded when calculating their rates.

- Safe Driver Incentives: Our Travelers auto insurance review shows big discounts for GMC drivers with clean records for extended periods.

Cons

- Underdeveloped Mobile App: The mobile app lacks real-time claim tracking capabilities, and GMC owners frequently request improved service transparency.

- Inflexible Commercial Payments: Flexible payment plans remain unavailable for GMC commercial vehicles compared to personal auto insurance payment schedules.

#9 – Farmers: Best for Safe Drivers

Pros

- Tiered Safe Driver Program: Accident-free periods of three years qualify GMC owners for bigger discount tiers with substantial savings benefits.

- Heavy-Duty Truck Expertise: Protection packages for heavy-duty trucks use detailed vehicle data, including factors like GMC Sierra 1500 insurance cost, for tailored coverage.

- Senior Driver Advantages: Farmers offers premium reductions for GMC drivers over 50 with clean records. (Read More: Everything You Need to Know About Farmers).

Cons

- Elevated Coverage Costs: Monthly costs for full coverage start at $185, placing Farmers among the more expensive GMC insurance providers.

- Weak New Purchase Benefits: Replacement coverage for brand-new GMC vehicles lacks competitive terms compared to similar offerings from Liberty Mutual.

#10 – Progressive: Best for Usage-Based Plans

Pros

- Usage-Based Discounts: GMC drivers who sign up for Progressive Snapshot save over $200 a year on insurance rates. Here’s everything you need to know about Progressive.

- Budget Protection Packages: The Name Your Price tool helps drivers buy GMC car insurance that perfectly fits their budget.

- Streamlined Claims Technology: The mobile claims system enables GMC drivers to submit accident photos directly for faster repair authorizations.

Cons

- Minimal Multi-Policy Savings: The 10% savings when combining GMC auto policies with homeowners insurance rank lowest among major providers nationally.

- Confusing Coverage Terms: Many GMC truck owners report difficulty understanding coverage exclusions for towing and payload.

Frequently Asked Questions

Who has the best car insurance for GMCs?

Erie, Liberty Mutual, and Nationwide have the best GMC auto insurance, with excellent claims handling and competitive discounts for safe drivers and GMC owners who bundle car insurance with home or renters policies.

What is the most trusted insurance company for GMCs?

State Farm ranks as the most trusted insurer for GMCs with its A++ financial strength rating and high customer satisfaction scores. Its industry-leading claim settlement process particularly benefits GMC owners.

Read More: State Farm vs. Geico, Progressive, Allstate, & Farmers Insurance

Is GMC insurance expensive?

GMC vehicles cost between $54 and $185 monthly to insure, with premium models like Denali commanding higher rates. State Farm offers the best full coverage value at $143 monthly, while Geico provides the cheapest minimum coverage at $54.

How much is GMC Terrain car insurance?

GMC Terrain insurance rates range from $82 to $143, depending on trim level and coverage level.

How much does GMC Yukon insurance cost?

GMC Yukon insurance rates typically fall right in the middle, starting at $76 monthly for minimum coverage. It’s cheaper to insure than a GMC Canyon, but more expensive than GMC Sierra 1500 car insurance.

How much is insurance for a GMC truck?

GMC truck insurance costs around $180-$190 a month for full coverage, with insurance for GMC Sierra models typically costing more than GMC Canyon insurance. Car insurance discounts you can’t miss can help you lower rates.

Is GMC Sierra 3500HD CC car insurance more expensive?

Insurance for the GMC Sierra 3500HD Crew Cab (CC) will be higher due to its greater carrying capacity and the commercial auto rates typically associated with these work trucks.

What year GMC is best for car insurance?

The 2018-2020 GMC models offer the best value proposition for insurance costs, with rates around $145-$150 monthly. These model years balance modern safety features with depreciation benefits that reduce premium costs compared to newer vehicles.

Is a GMC good or bad for insurance?

Is car insurance cheaper with a GMC? Yes, GMC vehicles are a solid choice for insurance due to their strong reliability and lower risk of mechanical issues, although premiums are slightly higher for high-tech features. The cheapest car insurance options are available for older, base-model GMC Terrain and Canyon vehicles with fewer luxury features and lower replacement costs.

Is GMC more expensive to insure than Chevy?

Yes, GMC vehicles usually cost more to insure than Chevy models due to their premium materials and features, which can raise repair costs and lead to higher insurance premiums. Get the cheapest GMC auto insurance quotes by entering your ZIP code into our free comparison tool.

Who offers the best insurance for GMCs in California?

Are GMC cars expensive to maintain?

At what point should you drop full coverage on your GMC?

Is GM car insurance good?

Is GM insurance only for GMCs?

What is the most common problem with GMC auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.