SR-22 Auto Insurance in 2026

SR-22 auto insurance is required after violations like a DUI or driving uninsured. Your insurer files the SR-22 form for you with the DMV. The SR-22 insurance form costs $15–$35, but the cost of SR-22 auto insurance is higher due to increased risk. Learn how SR-22 auto insurance works and compare quotes to save.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Updated November 2025

SR-22 auto insurance is a form your insurer files with the state to prove you have the minimum coverage after a serious violation like a DUI or driving without insurance.

- SR-22 car insurance is needed after serious DUIs and other serious violations

- The SR-22 form proves coverage and usually costs $15–$35 to file

- Compare SR-22 auto insurance quotes to find the cheapest rates from top insurers

The SR-22 form typically ranges from $15 to $35, but the total cost of SR-22 auto insurance is higher due to your classification as a high-risk driver. Your rates can increase by 40% to 90%, so it’s smart to shop around and compare SR-22 auto insurance quotes.

Companies like The General often offer cheap auto insurance for high-risk drivers who need reliable SR-22 coverage. Enter your ZIP code into our free quote tool to find the best SR-22 auto insurance providers.

SR-22 Auto Insurance Explained

SR-22 insurance is something you might need if you’ve had a serious driving issue, like a DUI, driving without insurance, or too many tickets. It’s not an actual insurance policy but a form your insurance company files with the DMV to prove you have the minimum required coverage.

SR-22 Auto Insurance Top Questions Answered| Question | Answer |

|---|---|

| What is an SR-22? | Proof of minimum liability coverage |

| Who needs an SR-22? | High-risk drivers (DUI, no insurance, etc.) |

| How long is an SR-22 required? | Usually 3 years |

| How does an SR-22 affect cost? | Increases monthly premiums |

| Where is an SR-22 filed? | Insurer files with DMV |

| Is an SR-22 an insurance policy? | No, it's a certificate proving coverage |

| Can an SR-22 lapse? | Yes, if your coverage ends |

| What are SR-22 alternatives? | FR-44, but limits are higher (VA, FL only) |

The SR-22 form is often required to reinstate a license that has been revoked or suspended. Insurance companies like State Farm, Geico, and Progressive offer assistance with filing the SR-22 form and provide SR-22 car insurance quotes online, allowing you to compare prices.

SR-22 auto insurance isn't a separate policy but proof your current insurance meets legal requirements after serious violations like DUIs or driving uninsured.

Daniel S. Young Managing Editor

The form itself typically costs between $15 and $35, but your insurance rates may increase since you’re considered a high-risk driver. It’s really important to keep your coverage active because if it lapses, you could lose your license again. Keeping your SR-22 in place helps you stay legal and get back on track.

Read More: What to Do If You Can’t Afford Your Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How SR-22 Affects Your Insurance Rates

When you’re told to file an SR-22, your car insurance rates will most likely go up. This happens because you’re now considered a high-risk driver after something serious like a DUI, too many tickets, or driving without insurance.

Once your insurance company sends the SR-22 auto insurance form to the state, your rates may increase immediately. How much they go up depends on your driving history and the company you choose.

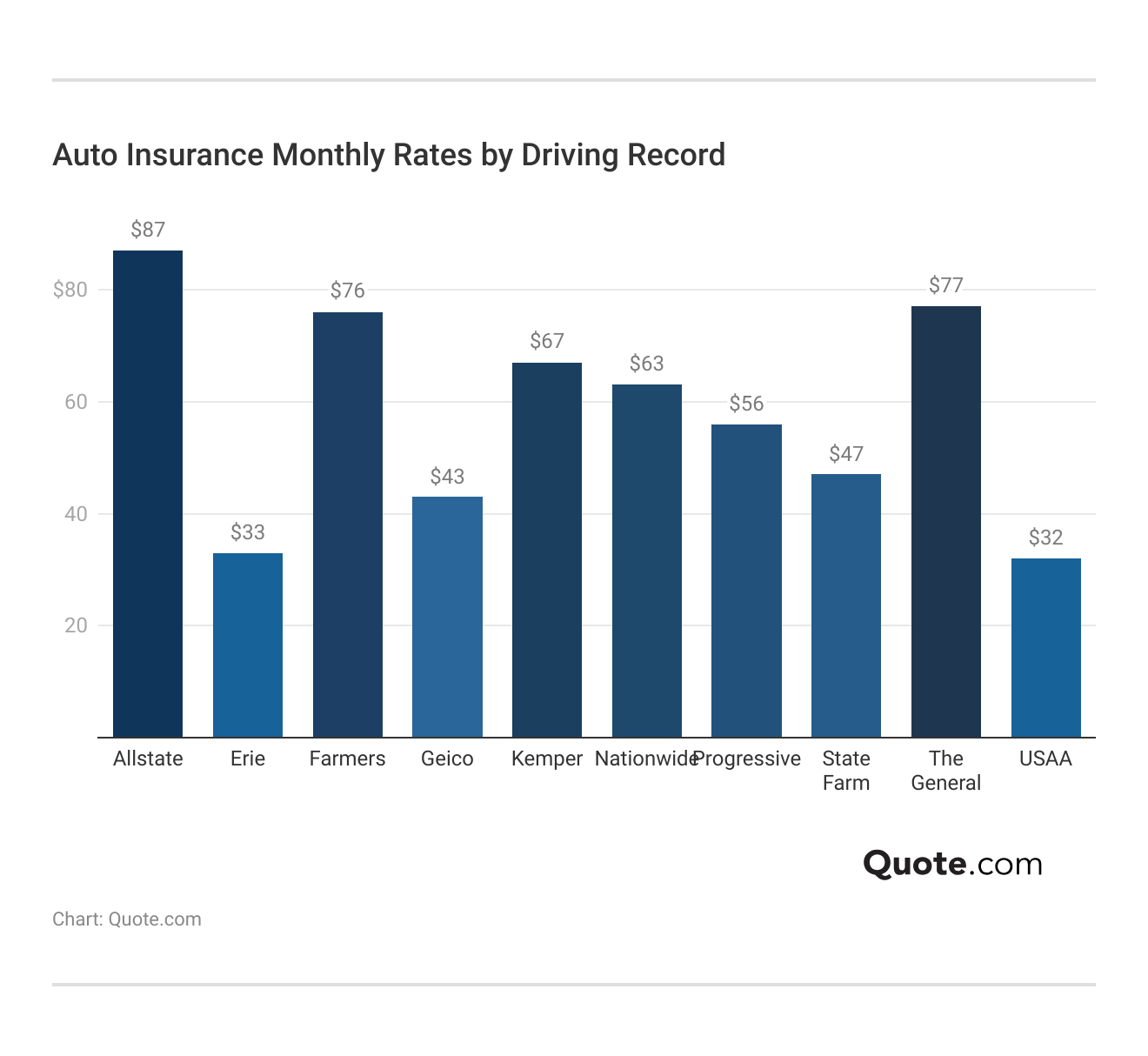

To save money, it’s smart to compare SR-22 car insurance quotes online from different providers. Companies like The General, Geico, Progressive, and State Farm offer coverage for drivers who need to file an SR-22. The General is known for working with high-risk drivers and may offer good options.

Just make sure your policy stays active. If it gets canceled or lapses, your SR-22 becomes invalid, and your license could be suspended again. Keeping coverage helps you stay legal and rebuild your record. Find out what happens if you cancel car insurance.

Comparing SR-22 Auto Insurance Costs

The cost of SR-22 car insurance is usually higher than regular insurance because it’s required after serious driving violations like a DUI, reckless driving, or driving without insurance. Most insurance companies charge a one-time SR-22 filing fee, typically ranging from $15 to $35.

Auto Insurance Rate Increases: Before & After SR-22| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $56 | |

| $76 | $129 |

| $43 | $75 | |

| $67 | $112 | |

| $63 | $105 | |

| $56 | $101 | |

| $47 | $81 | |

| $77 | $132 | |

| $32 | $54 | |

| $32 | $84 |

However, the real cost comes from your monthly premiums going up. On average, drivers with an SR-22 pay about 40% to 90% more than standard rates. The total yearly cost of SR-22 auto insurance in Virginia and other states can range from $800 to over $2,500, depending on the violation, your age, and your driving record.

Insurance providers like The General, Progressive, and State Farm offer SR-22 coverage, but prices can vary a lot between companies. Read our State Farm auto insurance review to learn more. To save money, it’s a good idea to compare quotes and ask about any available discounts.

When You’re Required to File an SR-22

You’ll be required to file an SR-22 if you’ve had a serious driving problem like a DUI, reckless driving, or driving without insurance. It’s also needed if your license was suspended and you want to get it back. For example, SR-22 insurance in Nebraska is often required by the DMV when drivers need to prove they have the right amount of insurance.

SR-22 vehicle insurance isn’t a special kind of policy — it’s just a form your insurance company sends to the state to show you’re covered. Most national providers, like Geico, can file the form and help you find the cheapest SR-22 auto insurance that fits your needs (Learn More: Everything You Need to Know About Geico).

Missing a payment on your SR-22 auto insurance can lead to immediate license suspension, so staying covered is key.

Melanie Musson Published Insurance Expert

It’s important to keep your insurance active while you have an SR-22 because if your coverage ends, the state could suspend your license again. Filing the form and staying insured helps you stay legal on the road.

Steps to Get SR-22 Auto Insurance

How long do you need to maintain SR-22 insurance coverage? Most drivers are required to maintain SR-22 auto insurance for approximately three years, although the exact duration varies by state and the type of violation. Some states may only require it for one year, while others could extend it to five years. The countdown usually starts from the date your license is reinstated, not the date of your violation.

SR-22 auto insurance is commonly required after serious offenses like DUI, reckless driving, or driving without insurance. To get SR-22 car insurance, follow these steps.

Read More: How to Get Multiple Auto Insurance Quotes

Step #1: Contact Your Insurance Company

The first step is to contact your insurer. If you’re denied insurance coverage, find a high-risk company that offers SR-22 filings. Let them know you need to file an SR-22, which is usually required after serious driving problems like a DUI, driving without insurance, or having your license suspended.

For example, SR-22 insurance in Illinois is often required to reinstate your license after it has been suspended for multiple DUIs. If you’re wondering how SR-22 auto insurance works, it’s basically a form that proves you have the minimum coverage your state requires. It’s not a different kind of insurance; it just gets added to your current policy.

Step #2: Insurance Company Contacts DMV

The insurance company will add the SR-22 to your policy and submit the form to the DMV on your behalf. Providers like State Farm, Progressive, and The General can assist with filing the form. There’s usually a small fee, and it’s very important to keep your insurance active to avoid more trouble.

Read More: How to Buy Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maintaining SR-22 Insurance Coverage

If you’re required to carry SR-22 auto insurance, it’s very important to keep your policy active without any lapses during this period. If you cancel car insurance early, your insurance company will notify the state, and your license could be suspended again.

If you’re denied coverage for being too high-risk after an SR-22, many drivers switch to trusted providers like Geico, State Farm, or The General (learn more: The General Auto Insurance Review).

Once the required time has passed and your record remains clean, the SR-22 can be removed, and your rates will return to normal. In the meantime, to find out if you can get cheaper SR-22 auto insurance rates, enter your ZIP code into our free quote tool and instantly compare prices from various companies near you.

Frequently Asked Questions

What is SR-22 auto insurance?

SR-22 auto insurance is not a type of insurance policy. It’s a form that your insurance company files with the state to prove you have the minimum car insurance required after a serious driving violation, such as a DUI or driving without insurance.

How does SR-22 auto insurance work?

SR-22 auto insurance works by having your insurance company file an SR-22 form with the state. This form shows that you are carrying the legally required insurance. If your policy is canceled or lapses, the state will be notified, and your license could be suspended again. Find the cheapest SR-22 auto insurance quotes by entering your ZIP code into our free comparison tool.

What is SR-22 insurance in Texas?

SR-22 insurance in Texas is required when you’ve had serious driving violations, such as a DUI or driving without insurance. It proves to the Texas Department of Public Safety that you’re insured and meet the minimum liability auto insurance coverage.

What is the difference between SR-22 and SR22T insurance?

The difference is that SR-22 is for people who own a car, while SR-22 insurance is for people who don’t own a car. SR22T is also known as a non-owner SR-22 and is used to demonstrate insurance responsibility even without owning a vehicle.

When was SR-22 auto insurance first introduced?

SR-22 auto insurance was first introduced in the 1950s as part of efforts to enforce financial responsibility laws. It was designed to ensure that high-risk drivers had active insurance coverage after major violations.

What company has the cheapest SR-22?

The cheapest SR-22 varies by state and driving history. However, companies like Dairyland, The General, Geico, and Progressive are often known to offer low rates for drivers who need SR-22 filings.

Read more: Progressive Auto Insurance Review

What does SR stand for in insurance?

SR in insurance stands for Safety Responsibility. It refers to the legal requirement for certain drivers to demonstrate that they have the financial responsibility to cover damages in the event of an accident.

Do I need an SR-22 auto insurance to reinstate my license?

Yes, in most cases, you do need SR-22 auto insurance to get your license reinstated after a suspension. This indicates that you’re now properly insured and meeting the legal requirements.

What is an SR-22 auto insurance used for?

SR-22 auto insurance is used to prove that a high-risk driver has the required insurance coverage. It is most often required after serious driving offenses or when your license has been suspended.

Read more: 17 Tips to Pay Less for Car Insurance

Can I get SR-22 insurance without a vehicle?

Yes, you can obtain SR-22 insurance without owning a vehicle by purchasing a non-owner SR-22 policy. This covers you when you drive someone else’s car and helps you meet state legal requirements, even if you don’t own a car.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.