Root Insurance Review for 2026

Our Root Insurance review found it a cost-effective option for drivers looking for coverage based on driving habits, with auto insurance rates starting at $23 per month. Drivers can also bundle Root auto insurance with its affordable renters policies for a 10% discount. Root Insurance is sold in 35 states.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated September 2025

Our Root Insurance review found the company offers the cheapest car insurance among competitors, and it also has affordable renters insurance.

Root Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 3.0 |

| Claim Processing | 4.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.4 |

| Coverage Value | 3.8 |

| Customer Satisfaction | 1.7 |

| Digital Experience | 4.0 |

| Discounts Available | 3.7 |

| Insurance Cost | 4.1 |

| Plan Personalization | 4.0 |

| Policy Options | 3.4 |

| Savings Potential | 3.9 |

Root Insurance offers a discount to customers who buy both car and renters insurance from Root, and it also has SR-22 insurance for higher-risk drivers.

However, Root’s rates are based on tracked driving behaviors, which not all drivers may be comfortable with. Read on to learn more about what Root Insurance offers and if it’s the right fit for you.

- Root Insurance rates start at $23 for minimum auto coverage

- Root also sells rental insurance that can be bundled for 10% discounts

- Root auto insurance is not available in 15 states

No matter which company you go with, it is wise to compare quotes from a few different companies before committing. Use our free quote tool to start finding affordable coverage for all your insurance needs.

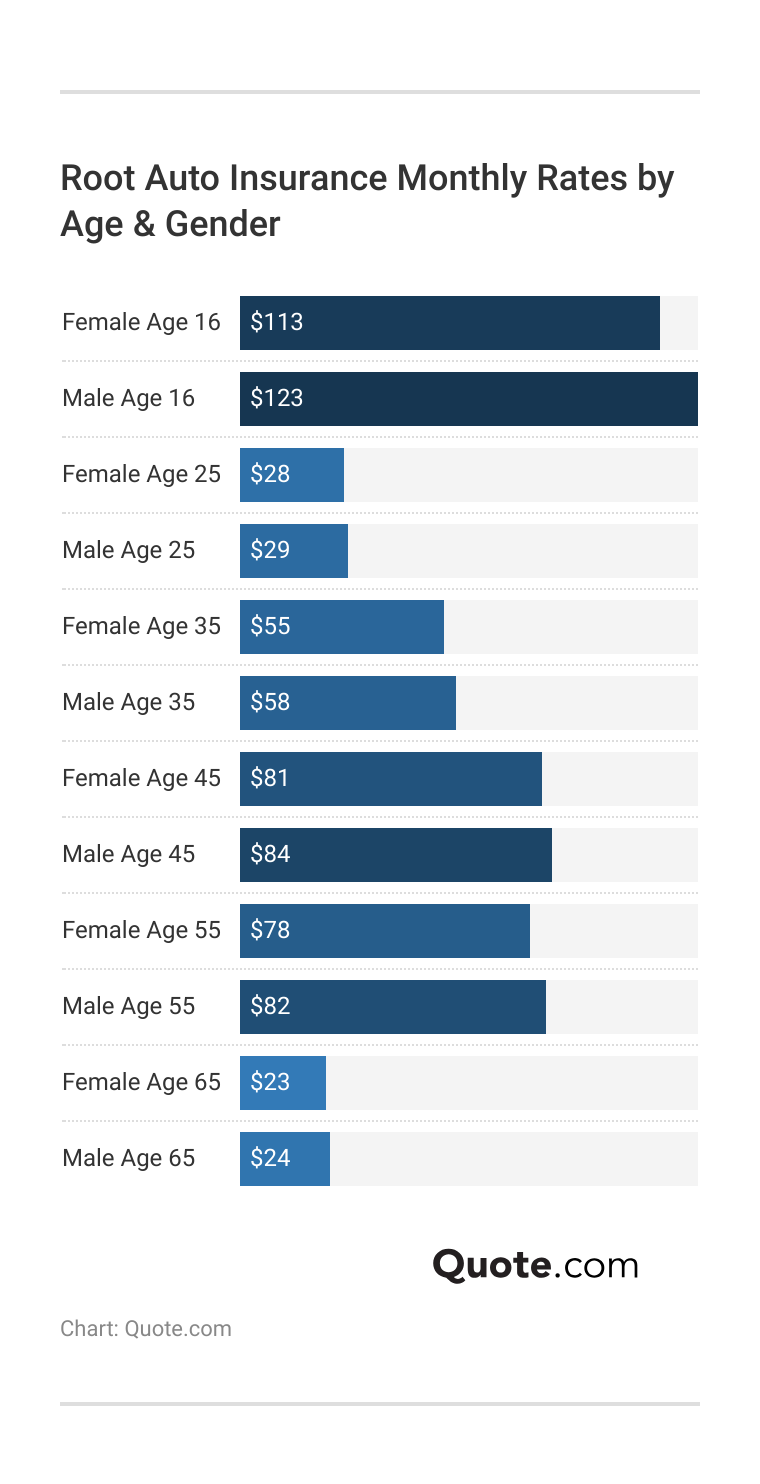

Root Auto Insurance Rates

How much will insurance cost you at Root Insurance? To get an idea of what Root Insurance charges by age and gender, take a look at the rates below.

Root has a unique payment system. While other companies give you a fixed monthly rate, Root has you do a test drive for a few weeks, where it tracks your driving behavior.

It then gives you a rate based on your driving, but rates could be lower in the future if your driving behaviors improve on the tracking app. Root Insurance may choose not to insure you if you aren’t a good driver (Read More: What to Do When You’re Denied Insurance Coverage).

Root Insurance claims that it does not base rates on factors like credit score but instead tracks routes, driving times, braking, and speed to determine which drivers are the safest.

Brandon Frady Licensed Insurance Producer

Bear in mind that while Root Insurance primarily looks at your current driving habits to base its rates, it will also consider your driving record.

DUI drivers will pay the most at Root, Inc., but may be able to score lower rates in the test drive period if they prove they are currently safe drivers.

Root Auto Insurance vs. The Competition

When you compare Root Insurance rates to traditional auto insurance companies, Root stands out for providing some of the cheapest rates, while companies like Liberty Mutual are some of the most expensive (Learn More: Liberty Mutual Auto Insurance Review).

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $23 | $61 |

| $47 | $123 | |

| $53 | $141 |

The same is true when you compare Root Insurance rates to those of other companies based on your driving record.

Full Coverage Insurance Monthly Rates by Provider & Driving Record| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 | |

| $150 | $199 | $265 | $200 | |

| $61 | $75 | $90 | $105 |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 |

While drivers with less-than-perfect records can score cheaper rates at Root Insurance, the exact amount depends on the test drive period.

Root Auto Insurance Coverage

You can buy all the coverage you need to meet state minimums at Root Insurance, like liability auto insurance, as well as extras like roadside assistance or rental reimbursement.

Root Auto Insurance Coverage Options| Coverage Type |  |

|---|---|

| Liability Coverage | ✅ |

| Collision Coverage | ✅ |

| Comprehensive Coverage | ✅ |

| Personal Injury Protection | ✅ |

| Medical Payments Coverage | ✅ |

| Uninsured/Underinsured Motorist Coverage | ✅ |

| Roadside Assistance | ✅ |

| Rental Reimbursement | ✅ |

| Glass Coverage | ❌ |

| Custom Equipment Coverage | ❌ |

Root Insurance also offers SR-22 coverage for high-risk drivers. SR-22 coverage is verification that your insurance company shows the DMV that you are carrying the required state coverage.

Root Auto Insurance Discounts

There are several ways you can save on your Root Insurance. Take a look at the Root discounts below. The biggest discount is for safe drivers.

Root Auto Insurance Discounts by Savings Potential| Discounts |  |

|---|---|

| Good Driver | 30% |

| Military | 20% |

| Multi-Car | 15% |

| Good Student | 10% |

| Multi-Policy | 10% |

| Pay in Full | 10% |

| Vehicle Safety Features | 10% |

| Low Mileage | 6% |

| Paperless | 5% |

Bundling your renters and auto insurance at Root is an easy discount to qualify for. You can also save by insuring more than one car with Root, Inc.

Some other easy ways to save at Root Insurance include going paperless, paying for your policy in full, and being a good student (Learn More: Car Insurance Discounts You Can’t Miss).

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Root Renters Insurance

Root Insurance Company also offers renters insurance (Learn More: Best Renters Insurance Companies). Your rates will depend on what limits you choose for your policy.

Renters Insurance Rates at Root by Coverage Limits| Coverage Limit | Monthly Premium | Description |

|---|---|---|

| $10,000 | $8 | Basic coverage for minimal personal belongings (e.g., student or minimalist renters) |

| $20,000 | $12 | Moderate coverage for common apartment furnishings and electronics |

| $30,000 | $16 | Suitable for small families or renters with mid-tier valuables |

| $50,000 | $22 | Comprehensive coverage for high-value items like tech, furniture, jewelry, and more |

| $75,000 | $30 | High-limit protection for renters in larger apartments with premium contents |

| $100,000 | $38 | For renters with luxury goods, or higher liability requirements |

The higher your coverage limit, the higher your monthly rate will be. However, it’s important to pick a coverage amount that will cover the majority of your belongings so you are properly compensated in case of a claim.

Root Renters Coverage Options

Root Insurance renters’ coverage offers personal liability and personal property rental insurance, similar to home insurance coverages (Read More: Homeowners Insurance Coverage Explained).

- Personal Liability: Protects you if someone is unintentionally injured on your property, such as tripping over your step.

- Personal Property: Protects your personal property, like electronics or jewelry, if the items inside your rental are damaged or stolen.

You can choose the limits and deductibles you want on your rental insurance from Root Insurance. This allows you to find a rental policy that fits your budget.

Root vs. Top Competitors: Home Insurance Monthly Rates| Insurance Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $55 | $70 | 105 | $170 |

| $60 | $85 | 125 | $190 | |

| $62 | $88 | 130 | $200 | |

| $58 | $82 | 122 | $195 | |

| $65 | $92 | 135 | $210 |

| $60 | $86 | 128 | $200 | |

| $63 | $90 | 133 | $205 | |

| $65 | $89 | 130 | $200 | |

| $61 | $87 | 128 | $198 | |

| $56 | $78 | 118 | $185 |

The good news is that Root Insurance rental policies are affordable, while still offering you full property and injury protection.

Customer Reviews of Root Insurance

You can find multiple customer reviews by checking out Root Insurance Google reviews, Root Insurance reviews on Yelp, or Root Insurance reviews on Reddit. Reading through customer reviews can reveal red flags or perks of a company. Take a look at the Reddit thread discussing Root Insurance below for an idea of what customers think of the company.

Just spoke to an agent and purchased Root for a new vehicle, what to expect?

byu/rizzrizzington inInsurance

The general consensus among customers seems to be that while Root Insurance can be much cheaper than traditional auto insurance companies, its claims services are lacking (Learn More: How to File an Auto Insurance Claim & Win It Each Time).

Business Ratings of Root Insurance Company

Wondering, can I trust Root Insurance? Root’s business ratings give insight into Root Insurance reviews and complaints. For example, the Root Insurance reviews on BBB resulted in an A+ for business practices, showing the company is generally trustworthy.

Root Insurance Business Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: A- Excellent Business Practices |

|

| Score: 78/100 Good Customer Feedback |

|

| Score: 0.85 Fewer Complaints Than Avg. |

Root Insurance also has a strong customer satisfaction rating from J.D. Power, meaning most customers are satisfied with the service and rates from Root Insurance.

Read More: What We Learned Analyzing 815 Insurance Companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Root Insurance Pros and Cons

Root Insurance has several pros that attract customers to the company, especially low-mileage drivers, retirees, or those who work from home, such as:

- Affordable Rates: Root has cheap rates for both auto insurance and renters insurance.

- SR-22 Insurance: Auto insurance customers who are high-risk can still qualify for Root and get SR-22 coverage if they do well in the test drive.

- Coverage Options: Root offers rental insurance coverage and several add-ons for auto insurance customers, like comprehensive auto insurance and roadside assistance.

When looking at companies, it’s also important to consider the cons. The downsides to Root Insurance as a company include:

- Not Rated by A.M. Best: A.M. Best has not rated Root Insurance’s financial stability, which could lead to issues if you ever need to file a claim.

- Availability: Not sold in Alaska, Hawaii, Idaho, Maine, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Rhode Island, South Dakota, Vermont, Washington, and Wyoming.

Weighing the pros and cons in this Root car insurance review will help you decide if it’s the right fit for your auto or renters’ needs.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Choosing Root Insurance for Your Insurance Needs

One of the biggest pros we found in our Root Insurance review is its low rates for auto insurance and renters insurance. High-risk drivers who do well in the test drive portion of Root Insurance can get much lower rates at Root.

However, A.M. Best has not rated the company, so its financial stability is unknown, and some customers have complained about claims filing. For rental or auto customers looking for quick, cheap coverage, though, Root Insurance is a decent option (Learn More: How to Compare Auto Insurance Companies).

If you are looking to find the best insurance coverage, enter your ZIP in our free tool. It will compare rates from companies in your area to help you find the best deal on insurance.

Frequently Asked Questions

Is Root Insurance full coverage?

Yes, you can buy full coverage from Root Insurance, which includes liability, collision, and comprehensive insurance. Rates start at $61 per month for full coverage.

Why is Root Insurance so cheap?

Root only insures drivers who do well in the test drive period, so it is only ensuring good drivers. Good drivers are less likely to file claims, allowing Root Insurance Company to keep its rates low.

Is Root Insurance better than Progressive?

It depends on what you are looking for in a company. Root Insurance will likely be cheaper, but Progressive has a strong financial rating of A+ from A.M. Best (whereas Root is unrated) and offers coverage in every state (Learn More: Everything You Need to Know About Progressive Insurance).

Does Root Insurance pay claims?

Yes, Root pays claims, as it has a score of 850 / 1,000 from J.D. Power for claims satisfaction.

Why does my Root Insurance keep going up?

Rates going up at Root could be due to changes in your driving behaviors on the app if you have auto insurance with them, or just due to inflation if you have renters insurance. If you aren’t happy with your Root Insurance rates, shop for affordable insurance today with our free quote tool.

Does Root Insurance track your speed?

Yes, the Root Insurance app tracks your speed to determine your rate (Learn More: The Definitive Guide to Usage-Based Car Insurance).

Who owns Root Insurance?

Root, Inc. owns Root Insurance.

How much is Root auto insurance a month?

Root car insurance rates start at $23 per month.

What insurance is similar to Root?

Companies that offer similar insurance to Root include Lemonade and Metromile (Read More: Lemonade Insurance Review).

How does Root know who is driving?

Root uses several algorithms to determine who is driving, such as common route patterns.

How can I lower my Root Insurance?

How do you cancel Root Insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.