10 Best Auto Insurance Companies in Virginia (2026)

Erie, AAA, and State Farm are the best auto insurance companies in Virginia. The cheapest car insurance in Virginia starts at $32 per month with Erie. Many car insurance companies in VA offer exclusive discounts and policy perks to military members and government employees for even lower rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated November 2025

The best auto insurance companies in Virginia are Erie, AAA, and State Farm. Erie is top-rated for its exceptional customer service and claims satisfaction.

- Erie is the best Virginia insurance company for customer satisfaction

- Rates are $32 a month with the cheapest auto insurance companies

- Claim-free drivers in VA can earn accident forgiveness perks

AAA auto insurance comes with cheap roadside assistance, including free towing, and State Farm provides excellent customer support with local agents throughout VA.

Monthly VA auto insurance quotes start at $32, but the best car insurance company in Virginia for you will match affordability with high customer service ratings and policy perks for safe drivers (Learn More: Best Auto Insurance for Good Drivers).

Our Top 10 Picks: Best Auto Insurance Companies in Virginia| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 706 / 1,000 | A+ | Local Service |

| #2 | 676 / 1,000 | A | Roadside Help |

| #3 | 673 / 1,000 | A++ | Usage-Based Plans | |

| #4 | 643 / 1,000 | A++ | Federal Employees | |

| #5 | 636 / 1,000 | A | Discount Options | |

| #6 | 636 / 1,000 | A+ | Multiple Policies | |

| #7 | 633 / 1,000 | A++ | Affordable Rates | |

| #8 | 632 / 1,000 | A+ | Accident Forgiveness | |

| #9 | 632 / 1,000 | A | Custom Plans |

| #10 | 625 / 1,000 | A+ | High-Risk Drivers |

Looking for the cheapest car insurance in Arlington, VA, and surrounding cities in the DMV? Use our free quote tool to compare the best auto insurance rates in Virginia, Maryland, and D.C.

Comparing Auto Insurance Rates in Virginia

Virginia car insurance rates can really vary depending on which company you go with and how much coverage you want.

Always compare quotes from at least three different providers to find the best Virginia car insurance.

Virginia Auto Insurance Monthly Rates by Coverage Level| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $71 | $168 | |

| $32 | $125 |

| $68 | $163 | |

| $47 | $113 | |

| $89 | $211 |

| $59 | $140 | |

| $42 | $99 | |

| $43 | $103 | |

| $50 | $120 |

Erie and Progressive have the cheapest auto insurance in VA, starting at $32 and $42 a month, respectively.

Geico is also affordable at $47 per month, and it offers exclusive discounts to federal and state government employees for lower rates (Read More: Cheap Auto Insurance for Disabled Veterans).

Driving History & Virginia Car Insurance Costs

If you’ve got a clean record, car insurance in Virginia stays pretty reasonable. But one slip, like a ticket or accident, can cause your monthly bill to shoot up, and not by just a few bucks.

Erie keeps costs low for all drivers, with high-risk Virginia auto insurance quotes under $60 a month.

Virginia Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $71 | $81 | $58 |

| $71 | $114 | $103 | $91 | |

| $32 | $45 | $60 | $38 |

| $68 | $98 | $94 | $85 | |

| $47 | $73 | $130 | $47 | |

| $89 | $119 | $160 | $108 |

| $59 | $59 | $103 | $72 | |

| $42 | $70 | $55 | $55 | |

| $43 | $52 | $47 | $47 | |

| $50 | $70 | $104 | $68 |

Other companies, like Geico and Liberty Mutual, are much less forgiving, especially after a DUI.

That’s why knowing a few hacks to save money on car insurance can make a real difference.

Credit History & Virginia Auto Insurance Costs

You might not expect it, but your credit score can raise or lower your car insurance bill in Virginia, even if your driving record is spotless. With bad credit, Erie, Geico, and Progressive offer the lowest insurance rates in VA.

Virginia Auto Insurance Monthly Rates by Credit Score| Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $65 | $110 | $185 |

| $71 | $120 | $200 | |

| $32 | $70 | $135 |

| $68 | $115 | $195 | |

| $47 | $85 | $150 | |

| $89 | $140 | $230 |

| $59 | $100 | $175 | |

| $42 | $80 | $155 | |

| $43 | $85 | $160 | |

| $50 | $90 | $165 |

Once your credit score slips, rate increases get steep. For many drivers in Virginia, this means fewer affordable options and a harder time staying insured. Check out our guide on what to do if you can’t afford your auto insurance before canceling coverage.

If your credit is less-than-perfect and you’re having trouble finding VA car insurance companies, drivers can take advantage of our free quote comparison tool to compare local providers.

Virginia Car Insurance Rates for Different Vehicles

Your Virginia auto insurance quote doesn’t just depend on your driving — it depends on what you’re driving, too.

Some cars cost more to insure because they cause more accidents or are more expensive to fix. Knowing the best time to buy a new car could help you save even more up front.

Virginia Auto Insurance Monthly Rates by Vehicle Type| Company | Crossover | Minivan | Pickup Truck | Sedan | SUV |

|---|---|---|---|---|---|

| $68 | $72 | $78 | $65 | $70 |

| $76 | $80 | $85 | $71 | $78 | |

| $35 | $38 | $42 | $32 | $36 |

| $71 | $75 | $80 | $68 | $73 | |

| $50 | $55 | $60 | $47 | $52 | |

| $92 | $98 | $102 | $89 | $95 |

| $62 | $66 | $72 | $59 | $64 | |

| $45 | $48 | $53 | $42 | $46 | |

| $46 | $50 | $55 | $43 | $48 | |

| $53 | $57 | $62 | $50 | $55 |

If you drive a pickup, you’ll likely pay slightly more each month, with Allstate and Nationwide charging the most.

Travelers and Erie have competitive rates, charging $55 and $42 per month for pick-ups, respectively.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Virginia Auto Insurance Rates vs. Local Risks

Car insurance rates in Virginia are influenced by local traffic trends, weather, and how often people file claims.

These report card-style grades help explain why you’re paying what you’re paying with some Virginia car insurance companies.

Virginia Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A- | Theft rates are low, helping keep premiums down. |

| Traffic Density | B+ | Urban congestion is balanced by rural areas. |

| Weather-Related Risk | B | Occasional storms cause moderate weather-related claims. |

| Average Claim Size | B | Claims are mid-range due to mix of urban and rural costs. |

| Uninsured Drivers Rate | C+ | Slightly above-average rate of uninsured drivers raises costs. |

Virginia scores an A- for vehicle theft, helping lower premiums in smaller cities like Roanoke. Traffic gets a B+ since rural roads offset city congestion in the DMV.

However, the moderate B grade for weather-related risks makes it hard to find cheap car insurance in Norfolk, Virginia Beach, and other coastal cities.

High traffic in areas like Northern Virginia and the I-95 corridor increases the likelihood of accidents and claims, which drives up premiums.

Chris Abrams Licensed Insurance Agent

The C+ for uninsured drivers pushes rates up in places like Richmond, where you’re more likely to be hit by someone (Read More: How to File an Auto Insurance Claim & Win It Each Time).

Auto Insurance Claim Trends in VA

Some types of car insurance claims pop up more often than others in Virginia, and they’re a big reason your premium is what it is.

Rear-end collisions are the most common, making up 30% of claims and costing about $4,500 each, which pushes rates up even if you’re not at fault.

5 Most Common Auto Insurance Claims in Virginia| Rank | Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|---|

| #1 | Rear-End Collision | 30% | $4,500 |

| #2 | Fender Bender | 25% | $2,000 |

| #3 | Single Vehicle Accident | 20% | $7,800 |

| #4 | Side-Impact Collision | 15% | $6,200 |

| #5 | Theft Claim | 10% | $9,000 |

Fender benders might seem minor, but they still average $2,000 and often lead to rate hikes. Theft isn’t as common, but when it happens, it costs insurers around $9,000 per claim.

Those losses get passed on to policyholders, especially in cities like Richmond or Norfolk (Learn More: Worst States For Filing an Auto Insurance Claim). Thousands of claims drive up monthly costs to $80 or more, even for careful drivers.

Virginia Annual Traffic Accidents & Claims by Major City| City | Accidents per Year | Claims per Year |

|---|---|---|

| Alexandria | 3,700 | 3,000 |

| Arlington | 3,500 | 2,800 |

| Chesapeake | 4,800 | 3,900 |

| Hampton | 3,900 | 3,100 |

| Newport News | 4,300 | 3,400 |

| Norfolk | 6,100 | 4,900 |

| Portsmouth | 2,800 | 2,200 |

| Richmond | 6,900 | 5,600 |

| Roanoke | 2,600 | 2,000 |

| Virginia Beach | 7,200 | 5,800 |

It can be hard to find the cheapest car insurance in Virginia Beach, VA, because it sees the most action, with over 7,000 accidents and 5,800 claims each year, which helps explain why rates there tend to run high, over $70 per month.

On the flip side, Roanoke has fewer than 2,000 claims a year, and that kind of low activity often leads to cheaper premiums for local drivers.

Auto Insurance Rate Trends in Virginia

Where you live in Virginia plays a bigger role in your car insurance rate than most people realize. Cheap car insurance in Richmond, VA starts at $82 per month, making it the most expensive city for coverage.

Insurers look closely at how many crashes and claims happen in your area, and the Virginia car insurance cost difference from one city to the next can be huge.

Virginia Auto Insurance Monthly Rates by City| City | Minimum Coverage | Full Coverage |

|---|---|---|

| Alexandria | $72 | $148 |

| Arlington | $74 | $152 |

| Chesapeake | $65 | $138 |

| Hampton | $69 | $142 |

| Newport News | $70 | $145 |

| Norfolk | $78 | $160 |

| Portsmouth | $80 | $163 |

| Richmond | $82 | $168 |

| Roanoke | $63 | $132 |

| Virginia Beach | $71 | $147 |

Portsmouth, Norfolk, and Virginia Beach are all coastal cities with a higher risk of comprehensive claims. Enter your ZIP code to get the cheapest car insurance in Richmond, VA.

Due to their proximity to Washington, D.C., and the increased cost of living, cheap car insurance in Alexandria, VA, and nearby cities like Arlington and Fairfax can be hard to find. Drivers here pay around $10 more per month, despite having fewer claims.

Read More: Auto Insurance Rates by State

Smart Ways to Save on VA Auto Insurance

To get the best car insurance, Virginia drivers can take advantage of these helpful tips to lower their rates, even with bad credit or a poor driving record.

Explore our guide to usage-based car insurance to learn how drivers with multiple claims or bad credit can still get cheap auto insurance in VA.

- Use Public Transportation: Taking the Metro or carpooling in other drivers’ vehicles can reduce mileage and risk, helping drivers get cheap car insurance in Arlington, VA, and surrounding areas in the DMV.

- Lower Your Coverage: Carrying minimum coverage will get you the cheapest car insurance quotes in VA, so consider dropping full coverage if you drive an older vehicle.

- Choose Higher Deductibles: If you don’t want to drop coverage for cheaper car insurance quotes, VA drivers can lower their rates by choosing deductibles of $1,500 or more.

- Get Usage-Based Insurance: You can qualify for usage-based insurance (UBI), which uses telematics to track actual mileage and driving habits, rewarding safe drivers with lower rates.

No matter where you live in VA, safe driving habits and low monthly mileage, when combined with multiple discounts, will significantly reduce premiums.

Depending on your car, driving habits, or even where you live, some of these savings can stack up fast.

If you’re a safe driver who rarely brakes hard or speeds, enrolling in a usage-based program could lead to the biggest long-term savings.

Michelle Robbins Licensed Insurance Agent

If you’re looking for the best ways to save money on premiums, these are the kinds of Virginia auto insurance discounts you can’t miss.

Erie offers competitive 25% discounts for bundling multiple policies in Virginia, along with Geico and Liberty Mutual.

Auto Insurance Discounts From Top Providers in Virginia| Company | Anti-Theft | Good Driver | New Car | Multi-Policy |

|---|---|---|---|---|

| 8% | 30% | 3% | 25% |

| 10% | 25% | 10% | 25% | |

| 15% | 23% | 12% | 10% |

| 10% | 30% | 12% | 20% | |

| 25% | 26% | 10% | 25% | |

| 35% | 20% | 8% | 25% |

| 5% | 40% | 15% | 20% | |

| 25% | 30% | 10% | 12% | |

| 15% | 25% | 15% | 20% | |

| 15% | 10% | 8% | 8% |

Liberty Mutual also gives a 35% discount just for having anti-theft features in your vehicle.

AAA may offer smaller discounts for bundling or anti-theft devices, but its 30% safe driver discount and additional savings for members are what set it apart from other car insurance companies in Virginia (Read More: Mercury Insurance vs. CSAA/AAA).

AAA also offers a rare 20% discount for going claims-free, a benefit that can really add up for families who tend to drive safely.

The biggest discount is offered by Nationwide, which provides a substantial 40% discount for safe drivers.

Minimum VA Auto Insurance Requirements

What is the recommended auto insurance coverage in Virginia? Auto insurance wasn’t always mandatory in the Old Dominion State.

New laws enacted in July 2024 now require VA drivers to carry minimum liability and uninsured motorist insurance, and policy limits increased in July 2025.

- $50,000 bodily injury liability per person, $100,000 per accident

- $25,000 property damage liability

Virginia drivers must carry matching 50/100/25 limits in uninsured motorist protection (UM/UIM), which kicks in if the other driver doesn’t have enough or any insurance to cover your damages.

Requiring UM/UIM coverage helps mitigate the risks associated with uninsured drivers as Virginia transitions to the new minimums.

Minimum liability coverage helps pay for the other person’s injuries or damage if you’re the one who caused the accident, but it doesn’t cover your own injuries or repairs.

You’ll need additional policies to protect your property, including gap insurance if you’re still making payments on a new car.

Auto Insurance Coverage Options| Coverage | What it Covers |

|---|---|

| Liability | Injuries to others in accidents you cause |

| Collision | Harm to your vehicle in a collision |

| Comprehensive | Destruction from non-collision events |

| Personal Injury Protection (PIP) | Medical expenses for you and passengers |

| Uninsured/Underinsured Motorist (UIM) | Protection from uninsured drivers |

| Medical Payments (MedPay) | Medical costs regardless of fault |

| Rental Reimbursement | Rental car costs while yours is repaired |

| Towing and Labor | Towing and roadside assistance |

| Roadside Assistance | Tire changes, lockouts, fuel delivery |

| Gap Insurance | Difference between car's value and loan balance |

In the event that your vehicle collides with an object, such as another vehicle, a pole, or even a guardrail, collision coverage helps cover the cost of repairs. Comprehensive coverage steps in for things like theft, hail, falling trees, or flooding.

You can buy a full coverage policy to combine collision vs. comprehensive auto insurance with your minimum Virginia liability coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Companies in Virginia

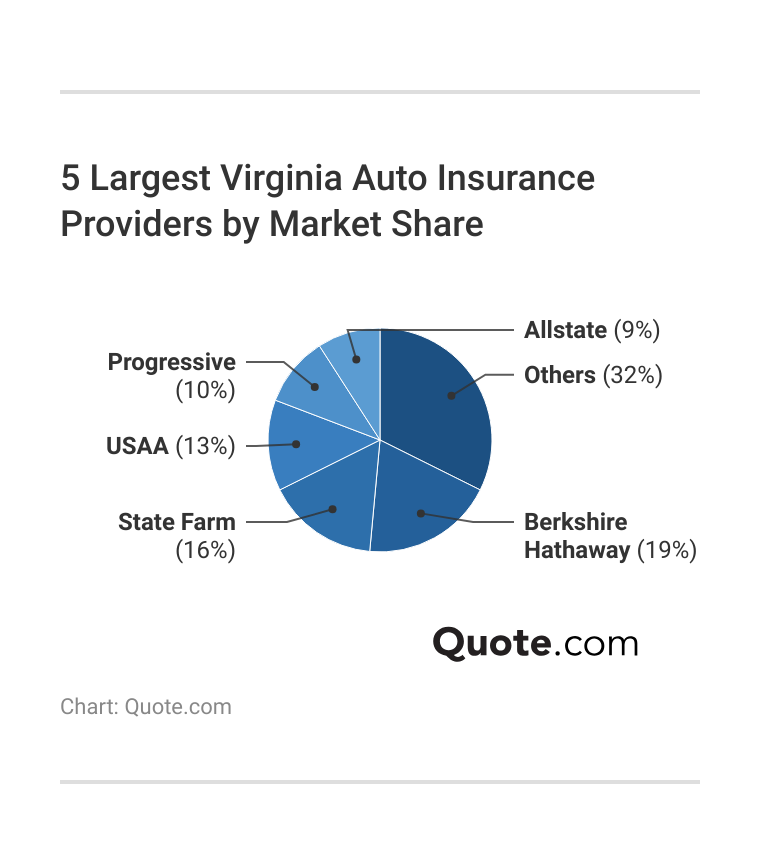

Who is number one in auto insurance in Virginia? Geico and State Farm are the largest VA insurers by market share, but being the biggest doesn’t mean they’re the best (Read More: Geico vs. Allstate Auto Insurance).

Smaller, regional providers like Erie often have better customer service and lower average rates.

Erie, AAA, and State Farm are the best car insurance companies in Virginia. Erie and State Farm have the highest customer satisfaction ratings.

AAA is highly rated by its members for claims handling and roadside assistance perks. Use our expert list of car insurance companies in Virginia to pick the right provider for you.

#1 – Erie: Top Pick Overall

Pros

- Highest Customer Service Ratings: Erie is the #1 company for car insurance shopping and claims resolution in Virginia. See full ratings in our Erie insurance review.

- Cheap Monthly Rates: Erie is on our list of cheap Virginia car insurance companies thanks to its consistently competitive rates and solid customer service reputation.

- Rate-Lock Guarantee: Erie won’t raise VA auto insurance rates after an accident or claim, and guarantees to lock premiums until you add a new driver, buy a new car, or move.

Cons

- Limited Availability: Erie is only sold in 11 states, so if you move out of Virginia, you may not be able to keep your policy.

- Fewer Digital Features: The Erie Insurance app lacks some of the mobile convenience perks that larger car insurance companies in Virginia offer.

#2 – AAA: Best for Roadside Assistance

Pros

- Free Roadside Assistance: Virginia drivers with AAA memberships have free roadside assistance included with their auto insurance policies.

- Additional Discounts: Along with competitive 30% safe driving discounts, AAA members can get additional discounts on rental cars and travel expenses.

- Local Agent Support: AAA has local agencies throughout the state that help Virginia drivers get in-person assistance with claims, policy changes, and more.

Cons

- Membership Required: AAA is only available to members in Virginia, and membership fees can offset insurance savings. Learn more in our AAA auto insurance review.

- Higher Average Rates: While AAA’s not one of the most expensive car insurance companies, VA drivers get better rates at Geico, State Farm, and Erie.

#3 – State Farm: Best for Usage-Based Insurance

Pros

- Drive Safe & Save UBI: Virginia drivers who track their driving habits with an app can earn up to 30% off, and State Farm won’t raise rates for tracking bad driving.

- Affordable Rideshare Coverage: State Farm extends personal policies in Virginia to cover drivers while they work, only charging 15%-20% of the current premium for the add-on.

- New Car Discount: A 15% discount applies in Virginia for insuring vehicles less than three years old. See all discounts in our State Farm insurance review.

Cons

- Limited Digital Claims Tools: The digital auto insurance claims process in Virginia lacks live chat support or AI photo estimators.

- Coastal Coverage Fluctuations: State Farm may raise rates or drop coverage in coastal cities like Portsmouth and Virginia Beach.

#4 – Geico: Best for Federal Employees

Pros

- Federal Employee Discount: Civil servants in Virginia, including the DOJ, DOD, and military staff, receive exclusive Geico Eagle discounts.

- Accident Forgiveness Add-On: Virginia drivers with five clean years can purchase protection from first-at-fault increases.

- Top Financial Security: Geico’s A++ A.M. Best rating backs over 2 million Virginia policyholders with reliable claim support.

Cons

- Fewer In-Person Agents: Virginia’s rural areas, such as Wise and Alleghany counties, have limited agent access.

- No New Car Replacement: Geico policies in Virginia do not offer new vehicle replacement after total loss. Discover everything you need to know about Geico before picking a policy.

#5 – Farmers: Best for Discount Options

Pros

- Long List of Discounts: Farmers offers more auto insurance discounts in Virginia than other providers on this list, including 30% off for good drivers.

- High Claims Satisfaction: Virginia drivers leave positive reviews regarding Farmers’ auto insurance claims handling and service. Read more in our Farmers Insurance review.

- Local Agents: Farmers has multiple insurance offices throughout Virginia to help policyholders manage claims or update their coverage.

Cons

- Discount Variability: Discounts aren’t available in all ZIP codes, so some Virginia drivers could miss out on savings.

- Expensive Monthly Premiums: Farmers is one of the more expensive car insurance companies in Virginia, starting at $68 a month, which is twice what Erie charges.

#6 – Nationwide: Best for Multiple Policies

Pros

- Multi-Policy Discount: Virginia policyholders can save up to 20% when bundling home, renters, or motorcycle insurance. See why drivers choose it in our Nationwide review.

- High Claims Satisfaction: Nationwide ranks among the top five car insurance companies for claims service and digital filing convenience.

- SmartRide Telematics: Safe Virginia drivers earn discounts up to 40% based on braking, acceleration, and nighttime driving.

Cons

- High Urban Rates: Drivers in Richmond and Virginia Beach often pay $55 to $65 more per month without safe driver discounts.

- Coverage Restrictions: Accident Forgiveness isn’t available in all Virginia ZIP codes and requires five clean driving years.

#7 – Travelers: Best for Affordable Rates

Pros

- Affordable Rates: Drivers in Virginia with clean records pay $50 monthly or less for minimum coverage. Get more Virginia car insurance quotes in our Travelers review.

- IntelliDrive Discount: Virginia drivers save up to 20% after 90 days of app-tracked driving with smooth braking habits.

- Coverage Variety: Travelers offers more policy options than other auto insurers in Virginia, including rideshare insurance and new car replacement.

Cons

- Post-App Rate Hikes: Aggressive braking or fast night driving during IntelliDrive in Virginia may trigger premium increases.

- No SR-22 Filings: High-risk drivers in Virginia needing SR-22 certification must look to other providers.

#8– Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Available in Virginia after enrolling, prevents rate hikes after the first at-fault accident. Get a full breakdown of coverage in our Allstate insurance review.

- Deductible Rewards: Virginia drivers get $100 off immediately and $100 more per claim-free year, up to $500.

- New Car Discount: Virginia drivers can save 10% immediately for driving a car that’s less than a year old.

Cons

- Above-Average Premiums: Allstate has the most expensive auto insurance quotes in Virginia at $71 a month for minimum coverage and $168 monthly for full coverage.

- Limited Usage-Based Savings: Drivewise participation is optional and yields smaller discounts than rival usage-based car insurance in VA.

#9 – Liberty Mutual: Best for Customizable Plans

Pros

- Customizable Add-Ons: Virginia auto insurance comes with unique add-ons, like better car replacement and lifetime repair guarantees.

- RightTrack Telematics: Virginia drivers can save up to 30% for good habits like moderate speed and gentle braking. See more perks in our Liberty Mutual insurance review.

- Reliable Claim Payment: Liberty Mutual ranks in the top three nationally and in the top 10 best insurance companies in Virginia for claims satisfaction.

Cons

- High Starting Premiums: Liberty Mutual is the most expensive provider on this list of Virginia auto insurance companies. Its minimum coverage rate is $89 per month.

- Limited Local Support: Some regions in Virginia lack Liberty Mutual representatives for local servicing needs.

#10 – Progressive: Best for High-Risk Drivers

Pros

- Cheap High-Risk Insurance: Progressive is one of the more affordable Virginia auto insurance companies for drivers with accidents or speeding tickets.

- Cheap Rates With Bad Credit: Drivers with a low credit score can still get cheap insurance quotes in VA from Progressive, starting at $85 per month.

- Name Your Price Online: Progressive’s suite of online tools includes the Name-Your-Price tool, which can help high-risk drivers pick and choose coverage based on their budget.

Cons

- Low Customer Satisfaction: It scores lower for customer service and claims handling than other Virginia car insurance companies. Learn why in our Progressive review.

- Annual Rate Increases: Many Virginia drivers report higher rate increases at renewal with Progressive, even without claims or a change in credit history.

Choose the Right VA Auto Insurance Company

Erie, AAA, and State Farm are the best auto insurance companies in Virginia for high claims satisfaction ratings.

Erie is one of the most affordable providers in VA, with rates starting at $19 a month.

Virginia drivers can reduce their risk and car insurance rates by avoiding rush-hour commutes and enrolling in usage-based insurance programs that reward safe driving.

Jeff Root Licensed Insurance Agent

Rates in Virginia vary significantly, so compare auto insurance companies online to find the right balance of price and customer service.

The best move is to enter your ZIP code to see who offers the best car insurance in VA for your situation.

Frequently Asked Questions

What is the best auto insurance company in Virginia?

Which is the best company to buy car insurance from in VA? Erie, AAA, and State Farm have the best car insurance in Virginia, with high claims satisfaction and exclusive perks for policyholders who qualify.

Which car insurance company has the highest customer satisfaction in VA?

USAA ranks highest in customer satisfaction in VA, but it’s limited to military families. According to J.D. Power regional studies, Erie and State Farm also score well for customer service and claims handling.

Who has the best auto insurance rates in Virginia?

The most affordable car insurance in Virginia is offered by Erie, Geico, and State Farm. Compare State Farm vs. Farmers, Geico, Progressive, and Allstate insurance for more car insurance quotes in Virginia.

Which insurance company is best at paying claims in Virginia?

State Farm and Erie are best at paying claims in Virginia, with fast claims response times, strong financial backing, and low complaint ratios according to NAIC data.

Is Liberty Mutual a good insurance company in Virginia?

Liberty Mutual is a good choice in Virginia for drivers looking for custom parts coverage or high anti-theft discounts up to 35%.

Is State Farm a good auto insurance company in Virginia?

Yes, State Farm is a good car insurance company in Virginia, offering full coverage starting at $103 a month, up to 30% off through Drive Safe & Save, and a strong A++ A.M. Best financial strength rating (Learn More: State Farm vs. Progressive Auto Insurance).

Is State Farm cheaper than Erie auto insurance in Virginia?

Erie is one of the cheapest Virginia auto insurance companies, but State Farm may offer better rates to drivers who sign up for its Drive Safe & Save UBI.

Who is cheaper in Virginia, Geico or Progressive?

Who is offering the best car insurance in Virginia between Geico and Progressive? Geico is typically cheaper than Progressive for minimum coverage in Virginia, but Progressive may be lower for drivers with DUIs or long commutes when using its Snapshot UBI program.

Should you shop for auto insurance every year in Virginia?

Yes, you should shop for car insurance every year in Virginia, especially if your driving habits, credit score, or ZIP code have changed—this helps ensure you’re not missing out on better deals or new discounts. It’s also important to understand what happens if you cancel your auto insurance, as even a short lapse in coverage can lead to penalties, higher rates, or legal issues.

How much is the average car insurance per month in Virginia?

So, how much is the average car insurance cost in Virginia per month? The average car insurance rate in VA is around $103 per month for full coverage and $47 per month for minimum liability, though rates can be over $160 per month in urban areas like Norfolk or Alexandria.

To find the best fit for your driving profile, it’s smart to get multiple auto insurance quotes and compare real-time rates side by side.

Who has the cheapest full coverage car insurance in Virginia?

Who has cheap car insurance in Chesapeake, VA?

How do I get the best price for car insurance in VA?

Will auto insurance rates in Virginia go down?

Why is auto insurance going up in Virginia?

Does AARP offer auto insurance in Virginia?

At what age is car insurance most expensive in Virginia?

What is the best auto insurance in Virginia for young drivers?

Which insurance is best for a car after ten years in Virginia?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.