Direct Auto Insurance Review for 2026

Our Direct Auto insurance review finds cheap minimum coverage rates for high-risk drivers at $58 monthly. Now owned by Allstate, it offers SR-22 filings, flexible payments, no credit checks, making it ideal for drivers needing affordable, nonstandard coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated September 2025

Start here with our Direct Auto insurance review to see how high-risk drivers with violations or suspended licenses can get $58 monthly rates, SR-22 filings, and no-credit-check policies. Now owned by Allstate, Direct Auto keeps operating independently, offering flexible coverage for drivers others may turn away.

Direct Auto Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 3.3 |

| Business Reviews | 3.5 |

| Claims Processing | 2.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.4 |

| Coverage Value | 3.3 |

| Customer Satisfaction | 2.2 |

| Digital Experience | 3.0 |

| Discounts Available | 4.0 |

| Insurance Cost | 4.1 |

| Plan Personalization | 3.0 |

| Policy Options | 3.4 |

| Savings Potential | 4.1 |

Its DynamicDrive program gives the cheapest car insurance to safe drivers, slashing rates by up to 25%, while bi-weekly payment plans help folks keep coverage without stretching their budget.

Drivers get instant proof of coverage—handy when you need to show it on the spot—and in some states, bundling roadside assistance can knock another $120 off per year.

- Direct Auto receives a 3.3/5 for limited availability in only 16 states

- Drivers can get up to $50 off by enrolling online through Direct Auto

- ID card delivery takes less than 10 minutes after policy activation

If you’re a high-risk driver, you could be overpaying for car insurance. Discover the cheapest options available when you use our free comparison tool for side-by-side company comparisons.

Comparing Direct Auto Insurance Monthly Rates

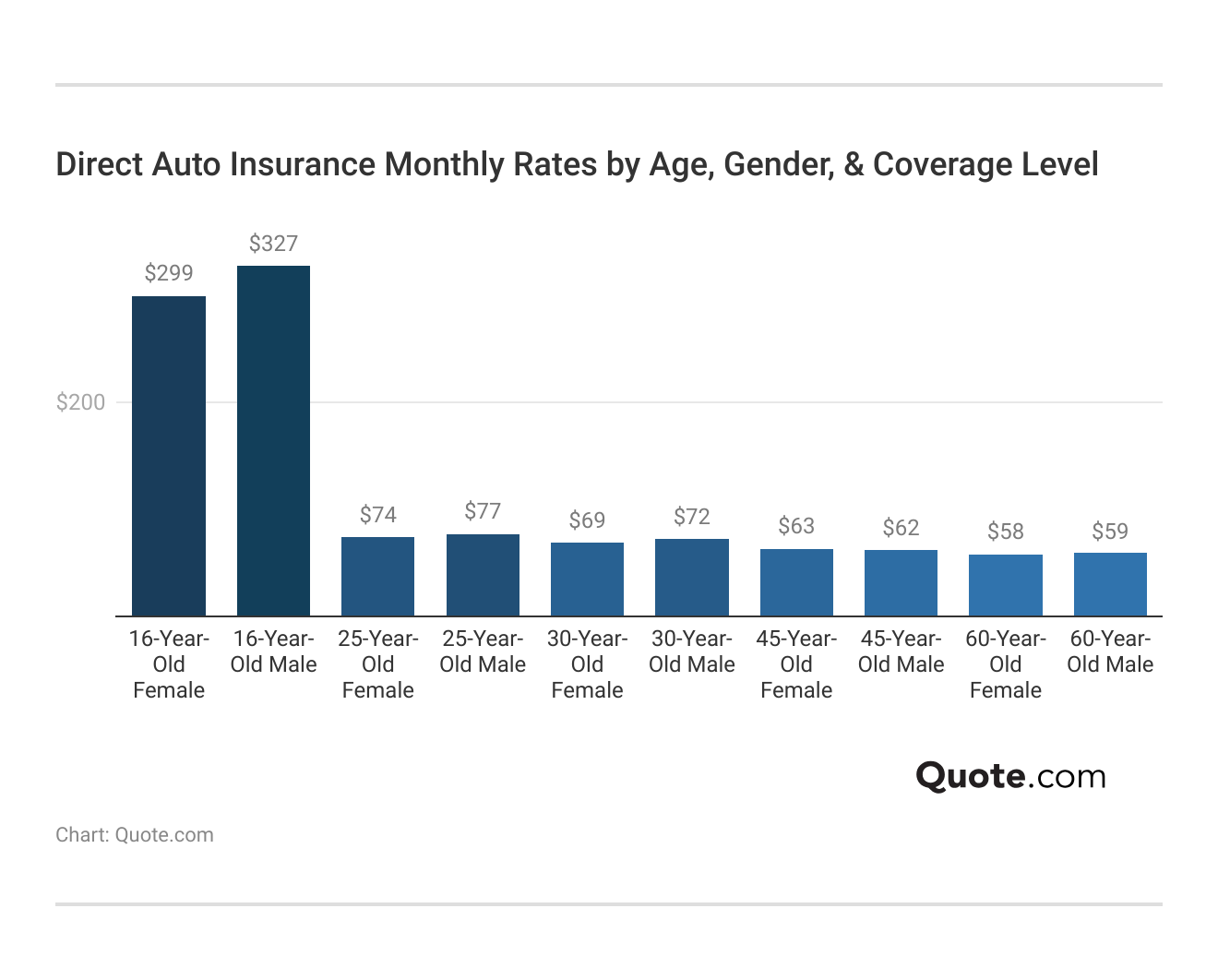

Direct Auto insurance rates clearly show how age and driving history affect what you pay. For some, the difference is dramatic. If you’re a parent with a 16-year-old son, expect to pay around $805 a month for Direct Auto insurance full coverage.

By the time most drivers hit 25, Direct Auto insurance quotes are cheaper than average. A 60-year-old woman can get minimum coverage for just $58 a month, making it easy to stay insured without cutting into retirement income. However, it’s not the cheapest for teen drivers.

See More: How to Get Multiple Auto Insurance Quotes

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Direct Auto Insurance Discounts

Direct Auto’s discounts make full coverage auto insurance feel more affordable. If you qualify for a few of these, your premium could drop enough to cover other everyday expenses.

Direct Auto Insurance Discounts| Discount | |

|---|---|

| Multi-Car | 25% |

| Military | 25% |

| Safe Driver | 10% |

| Multi-Policy | 10% |

| Good Student | 10% |

| Safety Features | 10% |

| Homeowner | 10% |

| Prior Coverage | 10% |

| Senior Citizen | 5% |

| Paperless/AutoPay | 5% |

If you’re in the military or insuring more than one car, that 25% discount could take a $164 premium down to around $123 a month, which is a big deal when you’re budgeting for a household. Students may save almost $32 a month by stacking two 10% discounts if they have high grades and no moving violations, which could cover a tank of gas.

Maintaining continuous insurance, even on a low-cost policy, can unlock prior coverage discounts and keep your rates from spiking.

Jeff Root Licensed Insurance Agent

If you’ve had insurance with another company recently, the 10% prior coverage discount gives you a break just for staying consistently insured. Even smaller perks like paperless billing or setting up AutoPay come with 5% off.

Many Direct Auto car insurance reviews highlight how these discounts help high-risk drivers get more value without sacrificing coverage. These kinds of incentives make Direct Auto Insurance a competitive choice when you’re searching for the best auto insurance for good drivers who consistently follow the rules.

Coverage Options From Direct Auto Insurance

Direct Auto insurance coverage is built for real-life situations, not just legal checkboxes. It provides mandatory coverages, like liability, MedPay, PIP, and uninsured motorist protection, as well as popular add-ons, like roadside assistance.

Direct Auto Insurance Coverage Options| Coverage | |

|---|---|

| Liability | Injuries or damage you cause to others |

| Collision | Damage to your car from a crash |

| Comprehensive | Theft, weather, fire, or vandalism |

| Uninsured Motorist | Injuries from uninsured or underinsured drivers |

| Medical Payments (MedPay) | Your accident-related medical bills |

| Personal Injury Protection (PIP) | Medical and lost wages (in select states) |

| Rental Reimbursement | Rental car costs after a covered claim |

| Roadside Assistance | Towing, flat tires, lockouts, jump starts |

| SR-22 Filing | Proof of insurance for high-risk drivers |

If you’ve had a few bumps in your driving record, SR-22 filing helps you stay covered and legal, and Direct Auto won’t raise rates as high after an SR-22 as other companies.

Direct Auto also offers a usage-based program called DynamicDrive. It tracks driving behavior through an app and rewards safe habits with lower rates. Policyholders automatically get a 10% discount when signing up. Learn how it works in our guide to usage-based car insurance.

Customer Reviews and Ratings of Direct Auto Insurance

In 2021, Allstate bought the Direct General Insurance Agency — including Direct Auto and National General — to expand into high-risk markets. Even after the deal, Direct Auto still runs its own website, offices, and customer service. A.M. Best gave it an A rating, meaning it’s financially strong and likely to pay claims reliably.

Direct Auto Insurance Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 70/100 Mixed Customer Feedback |

|

| Score: 810 / 1,000 Avg. Satisfaction |

|

| Score: 1.25 Avg. Complaints |

Direct Auto Insurance has a solid financial foundation, but reviews from policyholders are a bit mixed. Based on Direct Auto Insurance reviews and complaints in Consumer Reports, the 70/100 score points to average service—some drivers mention delays or spotty communication when filing a claim. With a J.D. Power score of 810 and an NAIC score of 1.25, Direct Auto ranks slightly below the top insurers with above-average complaints.

That said, Direct Auto insurance reviews from the BBB tell a different story. With an A+ rating, the company shows it takes customer concerns seriously and runs things fairly. Many customers say they appreciate the personal help they get at local offices—it’s often the human touch that makes all the difference.

Read Byrdman M.‘s review of Direct Auto Insurance on Yelp

Additionally, Direct Auto Insurance reviews on Yelp often point to exceptional service from in-person agents, particularly during claims and policy updates, showing how local staff can make a major difference in customer satisfaction.

Read More: These 3,000 People Got Auto Insurance Right

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Direct Auto Insurance

Direct Auto Insurance is a go-to for high-risk drivers who need something fast, flexible, and local. It’s a solid option for people who might not qualify with traditional insurers, like those skipping credit checks or needing quick SR-22 filings.

- Fast Approval and ID Cards: Drivers can get valid proof of insurance within ten minutes of buying a Direct Auto insurance policy online.

- Competitive Full Coverage After Tickets: Direct Auto car insurance after a speeding ticket costs hundreds less per month when compared to competitors like Farmers and Liberty Mutual.

- Broad Discount Stackability: Paperless billing, AutoPay, homeowner status, and vehicle safety features can combine for up to 40% in total discounts, allowing even high-risk drivers to reduce premium costs.

If you’re considering the Direct Auto Insurance Company for affordable, flexible coverage, it helps to weigh these pros and cons before you decide. Some negatives to consider are:

- No Nationwide Availability: Direct Auto provides personalized support through local agents but only operates in 16 states.

- Expensive for Teen Drivers: While its rates are competitive for experienced drivers, teens and young drivers under 25 will find cheaper rates elsewhere. If you’re a teen, look into tips to pay less for car insurance.

It’s not packed with extras, but if you’re looking for simple, face-to-face service and coverage that gets you back on the road legally, Direct Auto gets the job done.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Find Affordable Coverage With Direct Auto Insurance

Our Direct Auto insurance review finds that the company is ideal for high-risk drivers needing SR-22 filings or affordable coverage after violations.

Don’t underestimate local agents; personalized service often leads to better claims support, especially for nonstandard policies.

Melanie Musson Published Insurance Expert

A standout feature is DynamicDrive, a usage-based program that tracks habits like speeding, hard braking, and phone use through a mobile app to reward safe drivers. Maintaining prior insurance earns a 10% discount, and AutoPay adds 5% more — these small hacks can save money on your auto insurance.

Comparing quotes online is the smartest way to find the best value, especially for drivers with complex records or unique coverage needs. Before you settle on a policy, take a minute to compare free quotes with our online comparison tool.

Frequently Asked Questions

Is Direct Auto Insurance a good company?

Direct Auto Insurance Company is a solid option if you need flexible premium payments or an SR-22 filing. The company has an A rating from A.M. Best for financial strength and operates with its own customer service and offices even after being acquired by Allstate.

Is Direct Auto Insurance cheap?

Yes, Direct Auto can be affordable depending on your driving history and discount eligibility. For example, full coverage after a DUI starts at $281 per month, about $166 less than some major competitors.

Why is Direct Auto so expensive?

Monthly rates rise for high-risk drivers, and Direct Auto is a nonstandard provider that caters to drivers who need insurance after a DUI, accident, or suspended license. It’s important to compare auto insurance companies before choosing a policy to find the cheapest provider for you.

Which states does Direct Auto sell policies in?

You can get Direct Auto coverage in 16 states, including Florida, Texas, Georgia, South Carolina, Mississippi, and Alabama. It’s predominant in areas with high rates of uninsured drivers and demand for SR-22 filings.

How do you submit a claim with Direct Auto?

Call 1-800-403-1077, submit online through its claims portal, or visit one of Direct Auto’s offices to file in person with an agent.

Is Direct Auto owned by Allstate?

Yes, Allstate acquired Direct General Insurance Agency in 2021, which was the parent company of National General and Direct Auto. Learn more in our Allstate auto insurance review.

Is it better to pay out of pocket or claim auto insurance with Direct Auto?

If the repair cost is below your deductible or less than $500, it’s often better to pay out of pocket to avoid triggering rate hikes at renewal.

Is Direct Auto a standard insurance company?

No, it’s a nonstandard insurer catering to drivers with gaps in coverage, past violations, or SR-22 needs. It’s ideal for people who’ve been declined elsewhere.

Does Direct Auto offer full coverage?

Yes, full coverage includes liability, collision auto insurance, comprehensive, uninsured motorist, MedPay or PIP, and optional add-ons like rental reimbursement.

Is Direct Auto good at paying claims?

Direct Auto has an A rating from A.M. Best, but its NAIC complaint index of 1.25 suggests a slightly higher-than-average number of complaints filed compared to similar insurers.

How to reduce car insurance prices for Direct Auto?

Should you be concerned about a Direct Auto Insurance lawsuit?

Is Direct Auto Insurance a good choice for drivers in Florida?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.