Gap Insurance in 2026

Gap insurance helps pay the difference between your car’s actual cash value and what you owe on a loan or lease if it’s totaled or stolen. Gap coverage is ideal for drivers financing or leasing a new car. While gap insurance prices start at just $14 per month, not every company offers this coverage as an add-on.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated September 2025

Gap insurance — or Guaranteed Asset Protection — is a valuable auto insurance add-on that protects you from having to pay for a car that’s been totaled.

Essentially, gap auto insurance pays the difference between your car’s actual cash value and how much you still owe on a loan when an insurer totals your vehicle. It starts as low as $14 per month, but it’s only available for newer cars.

- Gap insurance pays the difference on an underwater loan

- Vehicles typically have to be three years old or newer to qualify for coverage

- Gap car coverage starts as low as $14 per month

Learn how to buy auto insurance with gap coverage and whether it’s the right choice for your policy in our guide. Then, enter your ZIP code into our free comparison tool to see the lowest rates in your area.

How Gap Insurance Works

Gap insurance, short for “guaranteed asset protection,” is an optional auto insurance coverage that helps cover the difference between what you owe on your car loan or lease and the car’s actual cash value (ACV) if it’s totaled or stolen.

When a vehicle is declared a total loss, standard auto insurance typically pays out only what the car is currently worth. Even if you know how to file an auto insurance claim and win each time, most payouts will be less than what you originally paid for your car.

For example, if you owe $25,000 on your loan but your car is only worth $20,000 at the time of a total loss, gap car insurance would help pay the $5,000 difference. That way, you’re not left paying out of pocket for a car you no longer have.

Gap insurance is beneficial for drivers who have a long-term loan, lease their vehicle, or have made a small down payment on their car.

Michelle Robbins Licensed Insurance Agent

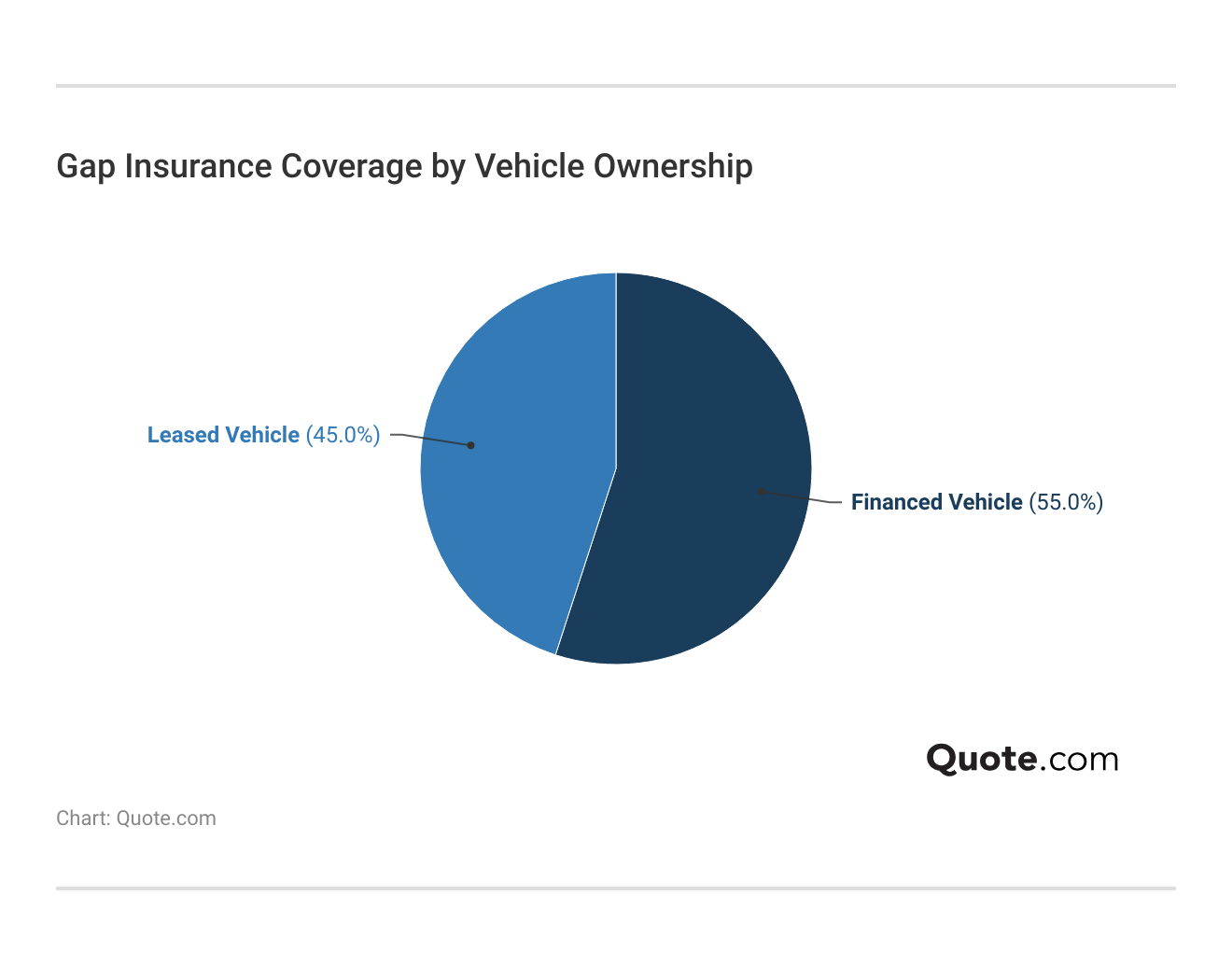

Gap insurance isn’t the right choice for everyone, but it can save you thousands of dollars if your car loan is underwater. While it’s most popular among drivers with a car loan, it’s also useful for those with a lease.

Additionally, not every company sells gap insurance. Take a look below to see more information about gap insurance from the top companies that sell it.

Gap Insurance Company Requirements

While gap insurance is valuable to some drivers, not every car qualifies for coverage. Most companies only offer it to cars that are three model years or newer, and there will likely be a mileage cap as well. Additionally, most providers only allow drivers to add gap insurance within 30 days of purchasing a new vehicle.

Gap Insurance Coverage Limits and Policy Details| Company | Limits | Eligibility | Term Length | Add-Ons |

|---|---|---|---|---|

| $50,000 | Loan/Lease Required | 72 months | $1k Deductible Waiver | |

| $30,000 | Full Coverage | 60 months | Policy Add-On |

| $50,000 | Comprehensive | 60 months | Flexible Limits | |

| $100,000 | Under 5 Years Old | 60 months | Bundling Discount | |

| $30,000 | Loan/Lease Required | 72 months | Loan Payoff Cover |

| $75,000 | New under 4 Years | 60 months | Collision Discount | |

| $30,000 | Loan/Lease Required | 72 months | Deductible Add-On | |

| $100,000 | Loan/Lease Required | 60 months | Dealer Access | |

| $100,000 | Nearly-New Cars | 60 months | Dealer Integration | |

| $100,000 | Military/Veteran Only | 60 months | Military Discount |

As you can see, some of the top insurance companies are missing from the list. For example, Geico doesn’t sell gap insurance. It’s always important to compare multiple gap insurance companies when you’re shopping for loan/lease payoff coverage.

Learn More: How to Compare Auto Insurance Companies

What Gap Insurance Doesn’t Cover

While gap insurance can be a financial lifesaver in certain situations, it doesn’t cover everything. Before you purchase gap coverage, make sure you understand what it doesn’t cover:

- Car Repairs or Maintenance: Gap insurance only applies if your car is totaled or stolen. It won’t help cover the cost of mechanical repairs or routine maintenance.

- Deductibles: Some gap policies don’t cover your auto insurance deductible, though a few may offer limited help with it.

- Late or Missed Payments: Any overdue payments, interest, or late fees on your loan or lease typically aren’t covered.

- New Vehicle Replacement: Gap insurance covers the financial “gap” between the loan balance and ACV, not the cost of a brand-new replacement vehicle.

- Negative Equity From a Trade-In: If you rolled over negative equity from a previous loan into your current one, that extra amount usually isn’t covered.

Always read your policy carefully and ask your insurer about specifics to make sure you’re fully protected in the event of a loss.

Read More: What to Do if You Can’t Afford Your Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Gap Insurance Rates

Although it can save you thousands, finding cheap gap insurance is usually easy. Take a look below to see the average cost of gap insurance from the top companies:

Gap Insurance Rates by Provider

| Insurance Company | Monthly | Annually |

|---|---|---|

| $20 | $240 | |

| $18 | $216 |

| $21 | $252 | |

| $15 | $180 | |

| $17 | $204 |

| $19 | $228 | |

| $16 | $192 | |

| $22 | $264 | |

| $23 | $276 | |

| $14 | $168 |

Like all types of auto insurance, you’ll need to compare rates to find the best gap insurance prices for you. If you’re ready to find cheap gap insurance, enter your ZIP code into our free comparison tool now.

You’ll likely need to buy a full coverage policy if you want to add gap insurance. Full coverage consists of liability, comprehensive, and collision insurance.

Jeff Root Licensed Insurance Agent

The rates above are affordable, but you should only purchase gap insurance if you actually need it, especially if you’re looking for the cheapest auto insurance possible. If you’re confused about whether or not gap insurance would be a good investment, check out this Reddit user’s gap insurance review.

Comment

byu/bubblydimples17 from discussion

inpersonalfinance

As this Reddit user demonstrates, it doesn’t have to be difficult to decide if gap insurance is right for you. While you typically need to purchase gap insurance, you may already have it. Depending on your loan or lease, the cost of your vehicle may have included this additional expense when you purchased it.

How to Check for Gap Insurance

If you’re not sure whether you have gap insurance, there are a few easy ways to find out. Knowing whether you’re covered can prevent surprises if your car is ever totaled or stolen.

- Review your loan paperwork: Many dealerships include gap insurance in lease agreements or as part of financing packages.

- Check your insurance policy: Review the declarations page in your policy or contact your insurance company to ask if it’s included.

- Ask your lender: If you financed or leased your vehicle through a bank or dealership, they can tell you whether gap insurance was included and who provides the coverage.

If you plan to finance a new car from a dealership soon, you can always ask if your loan or lease includes gap coverage. Additionally, some policies ask if you want gap insurance when you buy it. For example, the best auto insurance for luxury and exotic vehicles often includes gap insurance to cover the larger loans associated with these cars.

When to Drop Gap Insurance

Gap insurance is most valuable during the early years of a car loan or lease, but you won’t need it forever. Consider dropping gap coverage when:

- You owe less than the car’s value: Once your loan balance is equal to or less than your vehicle’s ACV, there’s no “gap” left to insure.

- You’re near the end of your loan: As your car loan matures and you build equity, the risk of being upside down on your loan decreases.

- You’ve paid off the loan: If you own the car outright, gap insurance no longer serves a purpose.

- You refinanced your vehicle: Gap coverage doesn’t always carry over to refinanced loans, so check with your insurer. If you have equity in the car, you may not need it at all.

Although gap insurance is typically inexpensive, knowing when to cancel it can help reduce your insurance costs. In fact, keeping coverage you no longer need is one of the top ways drivers are wasting money on their car insurance.

Review your finances and coverage limits annually to ensure you’re not paying for insurance you no longer need. If you need help, a representative from your company should be able to walk you through your coverage. You can also have a representative verify that you’re receiving all the auto insurance discounts you qualify for, ensuring maximum savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alternatives to Gap Insurance

Gap insurance may be one of the best options to protect you when you have a car loan or lease, but it’s not the only thing on the market. Consider the following add-ons as alternatives to gap insurance:

- New Car Replacement: This add-on pays for a replacement vehicle of the same make and model as your totaled car, rather than just paying for its ACV.

- Better Car Replacement: Some insurance providers offer better car replacement coverage, which replaces your totaled vehicle with a newer model.

- Loan/Lease Payoff: Loan/lease payoff coverage is similar to gap coverage in that it pays the difference between your car’s ACV and your total loan, but it has fewer eligibility limits.

These alternatives are a great way to find the coverage you want, especially if you have a policy from a company that doesn’t offer gap coverage.

Read more: How to Lease a Car When You Can’t Afford to Buy One

Find the Best Gap Insurance Today

Whether you have a car loan or lease, gap insurance can protect you from having to pay for a vehicle you no longer own. It’s not right for everyone, but gap insurance could save you thousands of dollars in the right circumstances.

Since some companies don’t offer gap insurance, you’ll need to compare rates to find the right coverage for your vehicle. Learning how to get multiple auto insurance quotes can make finding gap insurance much easier. To see which companies offer gap insurance – and which have the cheapest rates — enter your ZIP code into our free comparison tool today.

Frequently Asked Questions

What is gap insurance?

Gap insurance covers the difference between what you owe on your car loan or lease and the vehicle’s ACV if it’s totaled or stolen. It’s especially useful early in a loan when the car’s value depreciates faster than the loan balance. Gap insurance coverage helps prevent you from paying out of pocket for a vehicle you no longer have.

How much is gap insurance per month?

Gap insurance prices depend on several factors, including where you buy it, what type of car you drive, and how large your loan is. However, the average gap insurance price is about $14 per month. To see how much you might pay for gap insurance, enter your ZIP code into our free comparison tool today.

Can you buy standalone gap insurance?

There are two main ways to buy gap insurance. You can often buy standalone gap insurance through a dealership when you purchase a new car. Alternatively, you can buy gap insurance as an add-on for an existing policy.

When does gap insurance not pay?

Gap insurance doesn’t pay if your car isn’t declared a total loss or stolen. It won’t cover repairs, maintenance, or normal depreciation. It also won’t cover late loan payments, overdue fees, or negative equity from a previous loan rolled into your current one.

Who sells the best gap insurance?

Wondering where to buy gap insurance? The best gap insurance companies depend on your specific needs, but Farmers, Liberty Mutual, and Nationwide are typically considered the best providers. These companies offer affordable gap insurance, high policy limits, and have excellent customer reviews.

Do I need gap insurance if I have full coverage?

Full coverage usually includes liability, collision, and comprehensive auto insurance, but doesn’t typically include gap coverage. If you have an underwater loan on your vehicle, you’ll most likely need to add gap coverage to your policy.

Who has the cheapest gap insurance?

USAA’s gap insurance, called Total Loss Protection, is the most affordable option on average, starting at just $14 per month. USAA Total Loss Protection coverage works similarly to gap insurance but is only available to cars financed through USAA. To learn more about how to qualify, check out our USAA auto insurance review.

Is it worth getting gap insurance?

It depends on your situation. If you’ve recently purchased or leased a car, buying gap insurance might be worth it. While there are several factors to look at, you should purchase gap insurance during times when you owe more on your vehicle than it’s worth.

Are gap insurance and loan/lease payoff coverage the same?

Although they are similar, there is one main difference between gap insurance and loan/lease payoff coverage. Gap insurance is only available for newer cars, while you can purchase loan/lease payoff for older vehicles.

Does Geico sell gap insurance?

No, Geico is not one of the companies that sell gap insurance or a similar alternative. To see what it does offer, read our Geico auto insurance review.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.