The Hanover Insurance Review for 2026

Our The Hanover insurance review found it offers minimum coverage starting at $103 per month, with competitive auto, home, renters, and business insurance options. The Hanover Insurance Group provides broad protection across personal and commercial lines, plus bundling discounts of up to 20%.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshir...

Kristen Gryglik

Updated September 2025

Our The Hanover insurance review explains how its agent-driven model and wide-ranging coverage through The Hanover Insurance Group and Citizens Insurance compare to the cheapest car insurance options.

The Hanover Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.5 |

| Claim Processing | 3.3 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.2 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 1.9 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.5 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.6 |

The company offers specialized programs for teen drivers and high-value homeowners, plus auto insurance add-ons like accident forgiveness and roadside assistance.

All policies are sold through independent agents, offering personalized support instead of online quotes. While rates may be higher than the cheapest car insurance providers, this review details where The Hanover adds value through coverage strength and flexible options.

- The Hanover auto insurance rates start at $103 per month

- It offers policies through Citizens Insurance with flexible agent-based support

- The Hanover Insurance Group offers auto, home, renters, and business insurance

You can find affordable auto insurance, no matter your driving record, by entering your ZIP code into our free quote comparison tool.

The Hanover Auto Insurance Rates Compared

Hanover Insurance rates shift quite a bit depending on your age and gender. Young drivers, especially 16- to 18-year-olds, see the highest monthly premiums, with 16-year-old males paying $725 a month for minimum coverage and $1,777 monthly for full coverage.

The Hanover Auto Insurance Monthly Rates by Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $687 | $1,764 |

| 16-Year-Old Male | $725 | $1,777 |

| 18-Year-Old Female | $559 | $1,301 |

| 18-Year-Old Male | $621 | $1,445 |

| 25-Year-Old Female | $143 | $379 |

| 25-Year-Old Male | $151 | $401 |

| 30-Year-Old Female | $133 | $353 |

| 30-Year-Old Male | $141 | $373 |

| 45-Year-Old Female | $117 | $309 |

| 45-Year-Old Male | $115 | $302 |

| 60-Year-Old Female | $103 | $264 |

| 60-Year-Old Male | $107 | $275 |

| 65-Year-Old Female | $116 | $303 |

| 65-Year-Old Male | $113 | $296 |

The Hanover auto insurance coverage can become significantly more expensive for inexperienced drivers. In contrast, drivers in their 60s benefit from much lower rates, around $103 to $116 a month for minimum coverage and under $300 per month for full coverage.

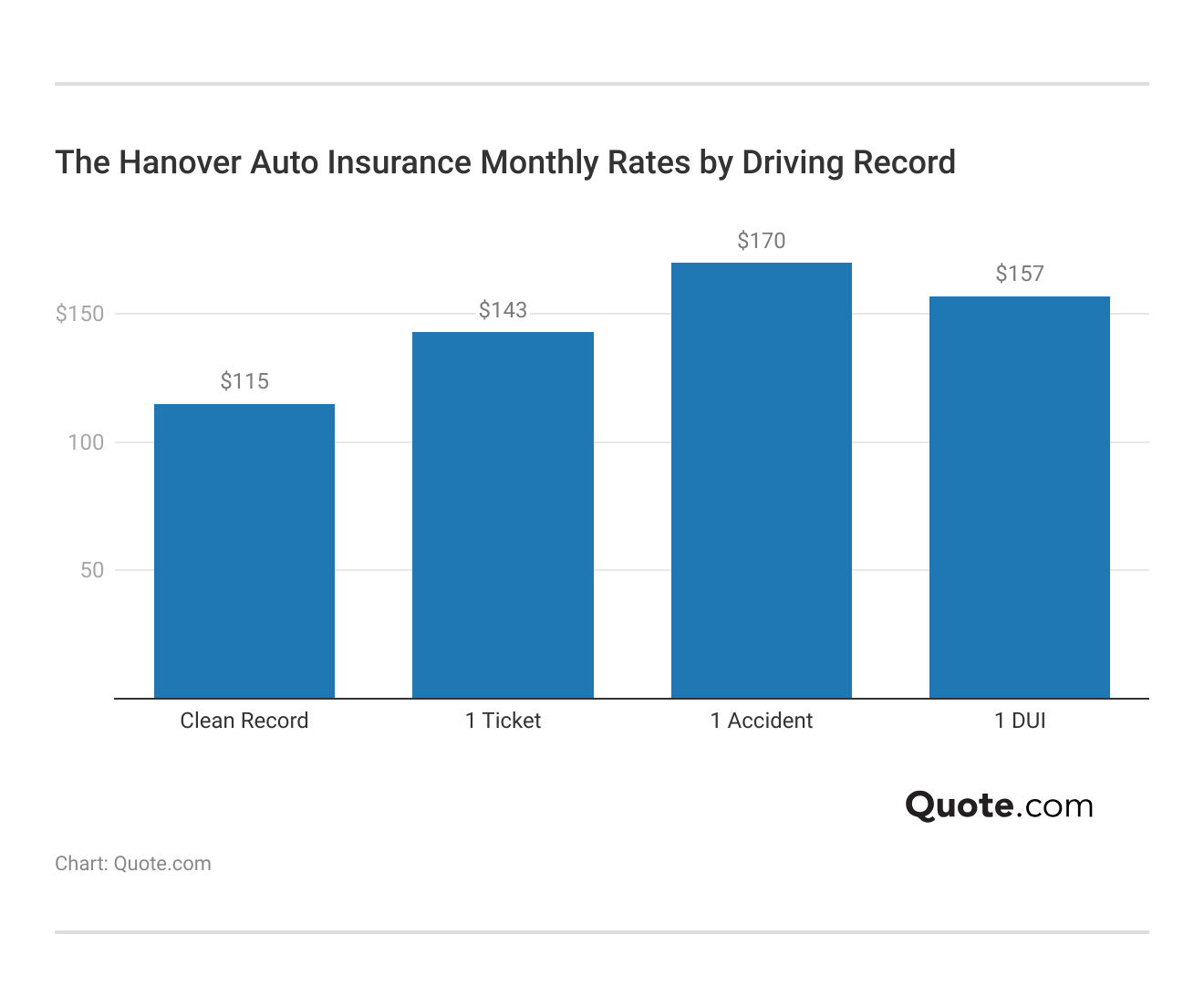

Driving history plays a major role as well. A clean record keeps minimum coverage close to $115 per month and full coverage at $302 per month. However, a single accident bumps full coverage to $446 a month, while a DUI raises it to $408 monthly. Even one ticket leads to a noticeable increase.

If you’re bundling auto and home, The Hanover’s one-bill, one-claim setup can save you time and reduce hassle. Just be sure to compare agent quotes to maximize discounts.

Jeff Root Licensed Insurance Agent

The Hanover prices risk aggressively, which rewards safe, experienced drivers with the best auto insurance for good drivers but creates higher barriers for younger or high-risk individuals.

The Hanover Auto Insurance Rates by Coverage

This table shows how The Hanover compares to other major insurers regarding monthly costs. At $115 per month for minimum coverage and $302 monthly for full coverage, The Hanover is on the higher end, especially when you compare it against Geico.

The Hanover vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $115 | $302 | |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 |

Companies like State Farm, Progressive, and American Family all offer prices well below The Hanover car insurance average rate across both coverage levels. In fact, The Hanover insurance vs. State Farm highlights a significant gap in pricing, with State Farm offering more competitive rates for similar coverage.

That’s why it’s important to compare quotes from multiple insurance providers. If affordability is a key concern, you’ll want to weigh the value of The Hanover auto insurance and its agent-based service with specialized coverage against these lower-priced competitors to see if the extra service justifies the higher cost.

Read More: Hacks to Save More Money on Car Insurance

The Hanover Auto Insurance Rates by Credit Score

This table gives you a good idea of how much your credit score can impact what you’ll pay for full coverage with different insurers. The Hanover charges $128 a month if you have good credit, which puts it somewhere in the middle of the pack, consistent with trends mentioned in The Hanover insurance reviews.

The Hanover vs. Top Competitors: Auto Insurance Monthly Rates by Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $75 | $97 | $135 | |

| $72 | $95 | $132 | |

| $66 | $84 | $118 |

| $69 | $91 | $127 | |

| $60 | $75 | $101 | |

| $78 | $104 | $144 |

| $65 | $83 | $114 | |

| $68 | $88 | $121 | |

| $59 | $73 | $98 | |

| $64 | $82 | $112 |

If your credit drops to fair or poor, monthly rates jump to $164 and $228, which is higher than what you’d see from Geico or State Farm. Liberty Mutual and Allstate are the most expensive for drivers with poor credit, going as high as $250 and $243 a month, respectively. So if your credit isn’t perfect, it’s worth comparing closely in our Allstate auto insurance review to see how those differences can really add up month to month.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hanover Auto Insurance Coverage Options

The Hanover offers more than just the basics, and if you’re looking for flexibility in how your policy is built, there’s quite a bit to work with. Whether you need standard liability or more tailored protection, they give you options that aren’t just plug-and-play. Here’s a closer look at some of the key coverage options they offer:

- Standard Auto Coverage: Includes liability, comprehensive, and collision coverage for at-fault accidents, theft, vandalism, weather damage, and collisions — core protection required in most states.

- Motorcycle Insurance: Covers a wide range of motorcycles, with optional coverage for accessories and safety gear.

- Collector Car Insurance: Designed for classic and collector vehicles, this policy offers agreed-value coverage and flexible mileage limits.

- Off-Road Vehicle Insurance: Protects ATVs, snowmobiles, dirt bikes, and other off-road vehicles used for recreation.

- Watercraft Insurance: Provides coverage for small boats, jet skis, and other watercraft, including liability, collision, and theft protection on and off the water.

These options are usually arranged through local agents, which means you’ll get a policy built around your needs, not just a standard online quote. This opens the door for personalized tips to pay less for car insurance based on your specific situation, which is frequently noted in Hanover auto insurance reviews by customers.

Other Insurance Products From The Hanover

Beyond auto coverage, The Hanover Insurance Group has a full lineup of policies for homeowners, renters, and businesses. Based on The Hanover homeowners insurance reviews, its property coverage protects everything from the structure of your home to your personal belongings and liability risks. Renters can also find affordable coverage options that guard against theft, fire, and personal liability.

The Hanover business insurance offers coverage for small and large companies, including global operations. Its commercial packages include general liability, commercial auto, workers’ comp, and cyber insurance. Industry-specific options are available for healthcare, construction, technology, and marine.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

The Hanover Home, Renters, and Specialty Insurance Options

While The Hanover is best known for its personalized auto policies, it also provides a robust lineup of property and specialty insurance products. Whether you own a home, rent, or need protection for specialty items like motorcycles or watercraft, The Hanover offers flexible coverage tailored through independent agents.

Homeowners Insurance

The Hanover homeowners insurance covers the structure of your home, personal property, and liability risks. Policyholders can access the Hanover Prestige program, which is designed for high-value homes and includes features like guaranteed replacement cost coverage, extended limits, and single-deductible bundling with auto policies.

You can also add equipment breakdown protection, identity theft coverage, and water backup endorsements for more complete protection.

Renters Insurance

Hanover renters insurance protects your personal belongings against theft, fire, and water damage. It also includes personal liability and additional living expenses if you’re displaced from your rental due to a covered loss. Policies are customizable and often bundled with auto insurance for a 20% discount.

Motorcycle Insurance

The Hanover offers coverage for a wide range of motorcycles, from cruisers to sport bikes. You can add optional protection for safety gear, accessories, custom parts, and roadside assistance. This policy is a good fit for seasonal riders or anyone seeking more tailored protection beyond basic liability insurance.

Collector Car Insurance

Classic and collector car enthusiasts can benefit from The Hanover’s agreed-value coverage, which locks in a pre-determined value in case of total loss. Mileage-based plans, storage protection, and spare parts coverage make this ideal for vintage car owners who don’t drive daily but still want full protection.

Off-Road Vehicle Insurance

Hanover’s off-road vehicle insurance covers ATVs, dirt bikes, snowmobiles, and similar recreational vehicles. Optional protections include collision, comprehensive, trailer coverage, and uninsured motorist protection—especially useful for off-road use where liability risks can be high.

Watercraft Insurance

The Hanover provides insurance for personal watercraft, small boats, and jet skis. Policies typically include liability, physical damage, medical payments, and theft coverage, both in and out of the water. You can also add trailer coverage and protection while transporting your boat.

Cyber Insurance

With data breaches and cyber threats becoming more common, The Hanover’s cyber insurance is a unique offering among personal and business insurers. It covers expenses tied to identity theft, fraud resolution, and data loss, making it a strong option for households or small businesses managing sensitive information online.

The Hanover Auto Insurance Discounts

If you’re trying to cut down your premium with The Hanover, there are plenty of discount options worth exploring. Their usage-based car insurance (UBI) program offers the biggest potential savings at 30%, which could be a solid fit if you’re a low-mileage or careful driver.

The Hanover Auto Insurance Discounts| Discount | |

|---|---|

| UBI | 30% |

| Bundling | 20% |

| Good Driver | 20% |

| Good Student | 15% |

| Multi-Car | 15% |

| Defensive Driving | 10% |

| Federal | 10% |

| Loyalty | 10% |

| Safe Driver | 10% |

| Pay-in-Full | 8% |

| Auto Pay | 6% |

It also offers 20% off for bundling policies or maintaining a clean driving record, and you can stack on additional savings for being a good student, insuring multiple cars, or completing a defensive driving course. Even smaller discounts like auto-pay or paying in full can add up.

To review your discounts or manage your policy, you can access your account through The Hanover insurance login portal or speak with an agent by calling The Hanover insurance phone number at 800-628-0250. If you qualify for several of these, it’s worth asking your agent to walk you through how much you could save, especially when weighing your potential premium against the Hanover insurance rating for value and service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hanover Insurance Ratings & Consumer Reviews

The Hanover Insurance Group scores well when it comes to customer service and business practices. J.D. Power gives it an 835 out of 1,000 for overall satisfaction, which is comfortably above the industry average compared to other insurers (Learn More: How to Compare Auto Insurance Companies).

The Hanover Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: 835 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Good Customer Feedback |

|

| Score: 0.80 Fewer Complaints Than Avg. |

|

| Score: B- Fair Financial Strength |

The Hanover Insurance BBB rating is A+, reflecting strong business ethics and responsiveness. Consumer Reports also gives it a solid 78 out of 100 based on customer feedback. On top of that, The Hanover Insurance Group review from the NAIC shows it has fewer complaints than the typical insurer, supporting the positive trend seen in The Hanover insurance complaints data.

Where The Hanover falls a bit short is in financial strength. A.M. Best gives it a B-, which isn’t bad, but it’s not as reassuring as the A or A+ ratings you’ll find with some larger national insurers. The Hanover home insurance reviews also rank below average for claims and policy satisfaction. However, The Hanover business insurance claims have better reviews.

Pros and Cons of The Hanover Insurance

The Hanover Insurance Group really shines if you want more than just basic coverage. They’ve built out solid options for things like high-value homes, teen drivers, and business owners.

- Bundled Coverage & Convenience: With Hanover Platinum, you can combine auto and home under one account, with one bill and one claims contact, making management a lot simpler.

- Specialized Programs for Unique Needs: Whether you’re insuring a high-value car or adding a teen driver, programs like Hanover Prestige and SafeTeen offer tailored coverage and extra peace of mind.

- Wide Insurance Selection: Along with car insurance, you can bundle home, renters, cyber, and The Hanover business insurance for bigger discounts and better monthly rates.

That said, it’s not the right fit for everyone. Some drivers may find the higher cost hard to justify, especially if they’re only looking for basic coverage. And depending on where you live, availability could be an issue.

- Higher Rates Across Some Policies: The Hanover’s auto, home, and business insurance rates may run higher than some competitors, depending on your coverage.

- Limited Availability: Hanover doesn’t write policies in every state, so you’ll need to check with a local agent to see if it’s offered where you live.

Overall, The Hanover makes the most sense for people who value hands-on support and tailored coverage options, especially if you’re insuring a high-value home, teen driver, or need affordable auto insurance for luxury and exotic vehicles. The Hanover Insurance review shows that if you’re willing to pay a little more for added service and bundled convenience, it could be well worth it.

Comment

byu/Significant_Ad_5521 from discussion

inInsurance

Just make sure to speak with a local agent who can walk you through what discounts apply and whether The Hanover fits your coverage needs. The Hanover insurance reviews on Reddit also mention reliable claims handling and helpful paid-in-full discounts, with agents noting positive customer experiences.

Drivers with clean records can unlock up to 30% in savings through The Hanover’s usage-based program—just ask your agent if you're eligible before locking in a policy.

Melanie Musson Published Insurance Expert

If The Hanover is available in your state and you prefer help from a local agent, it’s worth getting a quote to see how it stacks up. Get the best insurance rates possible by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What is Moody’s rating for The Hanover Insurance Group, and how does it impact auto policyholders?

Moody’s currently gives The Hanover a Baa2 rating, reflecting moderate creditworthiness. While not as strong as an A rating, it still indicates that the company is financially stable enough to meet claims obligations.

Does The Hanover offer coverage for rideshare drivers using Uber or Lyft?

The Hanover does not currently offer rideshare-specific personal policy endorsements. Drivers using their vehicles for Uber or Lyft should consult an agent about commercial or hybrid coverage options to avoid coverage gaps.

Don’t let expensive insurance rates hold you back. Enter your ZIP code and shop for affordable premiums from the top companies.

What does The Hanover Insurance Group Inc. say about its auto insurance offerings?

Customer reviews highlight strong agent-based service and well-rounded coverage, but also note that premiums are typically higher than competitors, especially for young drivers or high-risk drivers.

Is Hanover a good insurance company for high-value auto policies?

Yes, through its Prestige program, Hanover offers expanded auto protection for high-value vehicles, which includes additional liability limits, agreed value coverage, and concierge-level service.

Who owns The Hanover business insurance?

It’s all part of The Hanover Insurance Group, an independent, U.S.-based insurer that has been protecting businesses and individuals since 1852.

How can I file an auto insurance claim with The Hanover?

You can file a claim by calling 800-628-0250 or contacting your agent directly. The process is agent-led and often more personalized than fully digital systems, offering added clarity for drivers who want to understand how to file an auto insurance claim, especially when bundled with other policies.

How does Hanover Citizens Insurance reflect on auto insurance quality?

Hanover Citizens point to strong satisfaction in regional markets, especially where local agents provide hands-on support and policy bundling that includes roadside assistance and rental reimbursement.

Is The Hanover a good insurance company?

Yes, The Hanover Insurance Group is a strong pick for drivers who want agent-based support and custom coverage. It holds a 4.2 out of 5 overall rating. Monthly rates start at $103—higher than some competitors—but programs like Connections Auto and Hanover Prestige make it a better fit for those who want more than basic coverage.

What is the A.M. Best rating for The Hanover?

The Hanover Insurance Group has a B- rating from A.M. Best, which indicates fair financial strength. While this rating is lower than those held by larger national insurers like State Farm or Geico (typically rated A or higher), it still reflects The Hanover’s ability to meet policyholder obligations. However, if financial strength is your top priority, you may want to compare it with other companies rated A or A+.

What kind of insurance does The Hanover offer?

The Hanover Insurance Group offers personal and commercial policies, including auto, home, renters, motorcycle, collector car, and business insurance. It also covers off-road vehicles, watercraft, cyber, marine, and workers’ compensation. All plans are sold through independent agents and built around your specific needs.

What is The Hanover insurance headquarters address?

How do I cancel my The Hanover insurance policy?

How good is The Hanover at paying claims?

Does The Hanover offer classic car insurance?

Where is The Hanover available?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.