Single Premium Life Insurance in 2026

Single premium life insurance is a permanent life insurance policy that is paid for in one lump sum. The sum for a single payment life insurance policy can start as low as $14,250 for a 20-year-old, but will be higher for older customers or customers with pre-existing health conditions.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated September 2025

Single premium life insurance is a type of permanent life insurance that is paid for in one lump sum. Instead of making ongoing monthly or annual payments, you make a one-time payment upfront, often tens or hundreds of thousands of dollars, and in return, your policy remains active for life.

It provides a guaranteed death benefit to your beneficiaries and typically builds immediate cash value that grows tax-deferred.

- Single premium life insurance is often more expensive

- Cash values in single premium insurance are tax-deferred until withdrawn

- Single premium life insurance is best for those looking to get coverage quickly

This type of policy is often used for wealth transfer, estate planning, or by individuals who want to secure lifelong coverage without the hassle of ongoing premium payments. Compare life insurance rates today and find the perfect policy for your needs by entering your ZIP in our free tool.

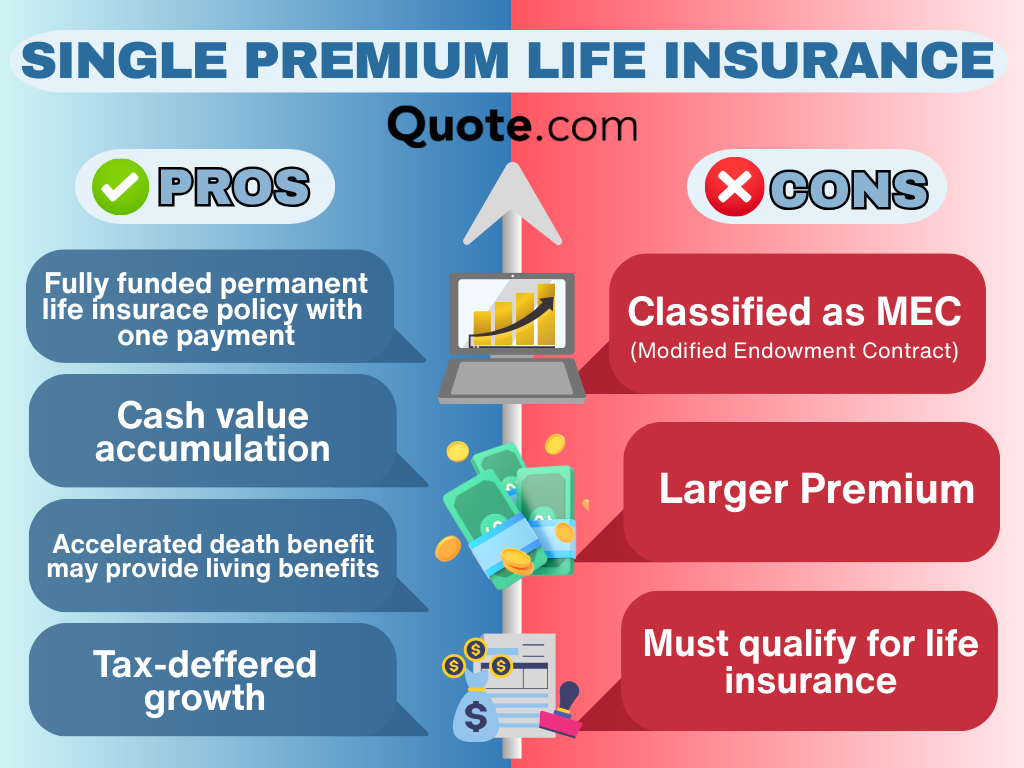

Pros and Cons for Single Premium Life Insurance

A single premium life insurance policy may not be right for everyone, so it’s important to weigh the pros and cons of this type of life insurance policy before committing to making a large payment on a permanent policy.

The biggest pro of a single payment life insurance policy is that there are no ongoing premium payments, which means you don’t have to budget a payment into your monthly expenses. There are also living benefits to a single premium life insurance policy if you apply riders like an accelerated death benefit.

Single Premium Life Insurance: Pros and Cons| Pros | Cons |

|---|---|

| One-time payment for lifetime coverage | High upfront cost may be unaffordable for some |

| Lifetime coverage with no future premiums | No flexibility after the lump sum is paid |

| Builds cash value over time | Tax implications if classified as MEC |

| No future premium payments required | Opportunity cost, as money could be invested elsewhere |

| Potential for dividends | Lower return compared to other investment vehicles |

| Guaranteed death benefit for beneficiaries | Can be complex with varying terms depending on insurer |

| Ideal for estate planning | Not ideal for short-term insurance needs |

Of course, there are some cons that may deter customers from a single premium life insurance policy, with one of the biggest cons being the higher upfront cost.

Customers without the funds for a large payment will be better off with a different type of life insurance policy, such as a cheaper term life insurance policy (Read More: Whole vs. Term Life Insurance).

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Single Premium Life Insurance Cost: What to Expect

The cost of a single premium life insurance policy will depend partly on the coverage amount you choose. A million-dollar death benefit policy is going to cost more than a hundred thousand death benefit.

Single Premium Life Insurance Rates by Coverage Amount| Insurance Company | $100,000 | $500,000 | $1,000,000 |

|---|---|---|---|

| $23,500 | $84,100 | $156,700 | |

| $22,300 | $82,200 | $153,100 | |

| $22,100 | $81,900 | $152,600 | |

| $22,000 | $81,500 | $152,000 | |

| $22,800 | $83,000 | $154,300 | |

| $22,400 | $82,000 | $153,200 | |

| $21,923 | $81,513 | $152,425 | |

| $22,600 | $82,700 | $153,800 |

| $22,000 | $81,500 | $152,000 | |

| $22,200 | $81,800 | $152,500 |

The lump sum you pay will also depend on the company you choose. For example, State Farm’s life insurance policies are generally cheaper than Allstate’s life insurance policies (Read More: Allstate Insurance Review).

How Age Affects Single Premium Life Insurance Rates

Like with all types of life insurance policies, the cost will be cheaper the younger a customer is when they purchase a policy. This is because older customers will contribute less financially to a life insurance policy before the death benefit is paid out.

Single Premium Life Insurance Rates by Age ($100k Plan)| Insurance Company | Age: 20 | Age: 30 | Age: 40 | Age: 50 | Age: 60 | Age: 70 |

|---|---|---|---|---|---|---|

| $15,275 | $19,975 | $23,500 | $29,375 | $37,600 | $49,350 | |

| $14,495 | $18,955 | $22,300 | $27,875 | $35,680 | $46,830 | |

| $14,365 | $18,785 | $22,100 | $27,625 | $35,360 | $46,410 | |

| $14,365 | $18,785 | $22,100 | $27,625 | $35,360 | $46,410 | |

| $14,820 | $19,380 | $22,800 | $28,500 | $36,480 | $47,880 | |

| $14,560 | $19,040 | $22,400 | $28,000 | $35,840 | $47,040 | |

| $14,250 | $18,635 | $21,923 | $27,404 | $35,077 | $46,038 | |

| $14,690 | $19,210 | $22,600 | $28,250 | $36,160 | $47,460 |

| $14,300 | $18,700 | $22,000 | $27,500 | $35,200 | $46,200 | |

| $14,430 | $18,870 | $22,200 | $27,750 | $35,520 | $46,620 |

While life insurance may not be the first thing on a younger person’s mind, purchasing life insurance at a younger age may be the better financial decision.

While lower costs are one perk of buying life insurance at a younger age, life insurance policies also allow younger customers to substantially build their cash value.

Jeff Root Licensed Insurance Agent

Buying a life insurance policy at a younger age also allows young families to provide for any dependents in the case of an untimely death by listing them as life insurance beneficiaries.

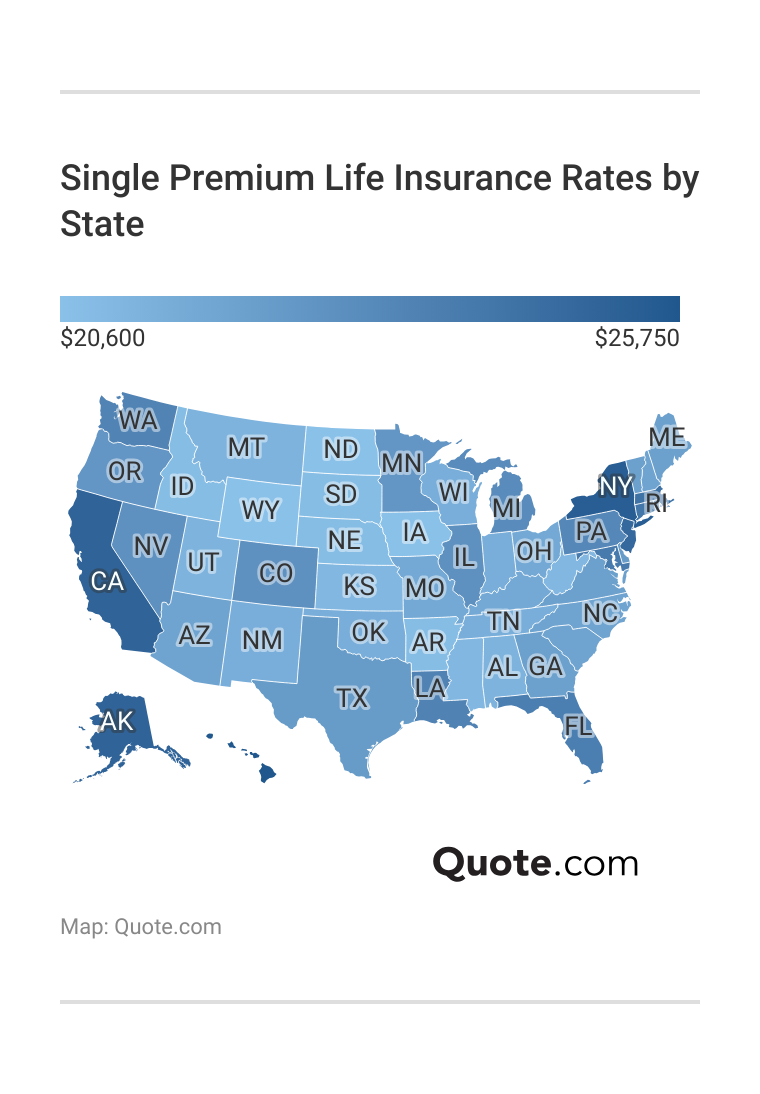

How Location Affects Single Premium Life Insurance Rates

Where you live can also affect what you pay for a single-premium life insurance policy. Location can come with risks like natural disasters, crime, and other factors (Read More: The Most Unhealthy City In America).

Some of the most expensive states to purchase a life insurance policy in are California, New York, and New Jersey.

How Your Health Affects Single Premium Life Insurance Rates

Health also has a huge impact on life insurance rates. Insurance companies will charge customers with heart disease, diabetes, and other chronic health conditions higher rates. The healthier you are, the lower your life insurance rate will be.

Single Premium Life Insurance Rates by Health Condition ($100k Plan)| Insurance Company | High Blood Pressure | Diabetes | Heart Disease | Cancer History |

|---|---|---|---|---|

| $27,025 | $29,375 | $35,250 | $39,950 | |

| $25,645 | $27,875 | $33,450 | $37,910 | |

| $25,415 | $27,625 | $33,150 | $37,570 | |

| $25,300 | $27,500 | $33,000 | $37,400 | |

| $26,220 | $28,500 | $34,200 | $38,760 | |

| $25,760 | $28,000 | $33,600 | $38,080 | |

| $25,211 | $27,404 | $32,885 | $37,269 | |

| $25,990 | $28,250 | $33,900 | $38,420 |

| $25,300 | $27,500 | $33,000 | $37,400 | |

| $25,530 | $27,750 | $33,300 | $37,740 |

The best way to find out exactly what you’ll pay for a policy based on your age, location, and health is to get a single premium life insurance quote (Learn More: What We Learned Analyzing 815 Insurance Companies).

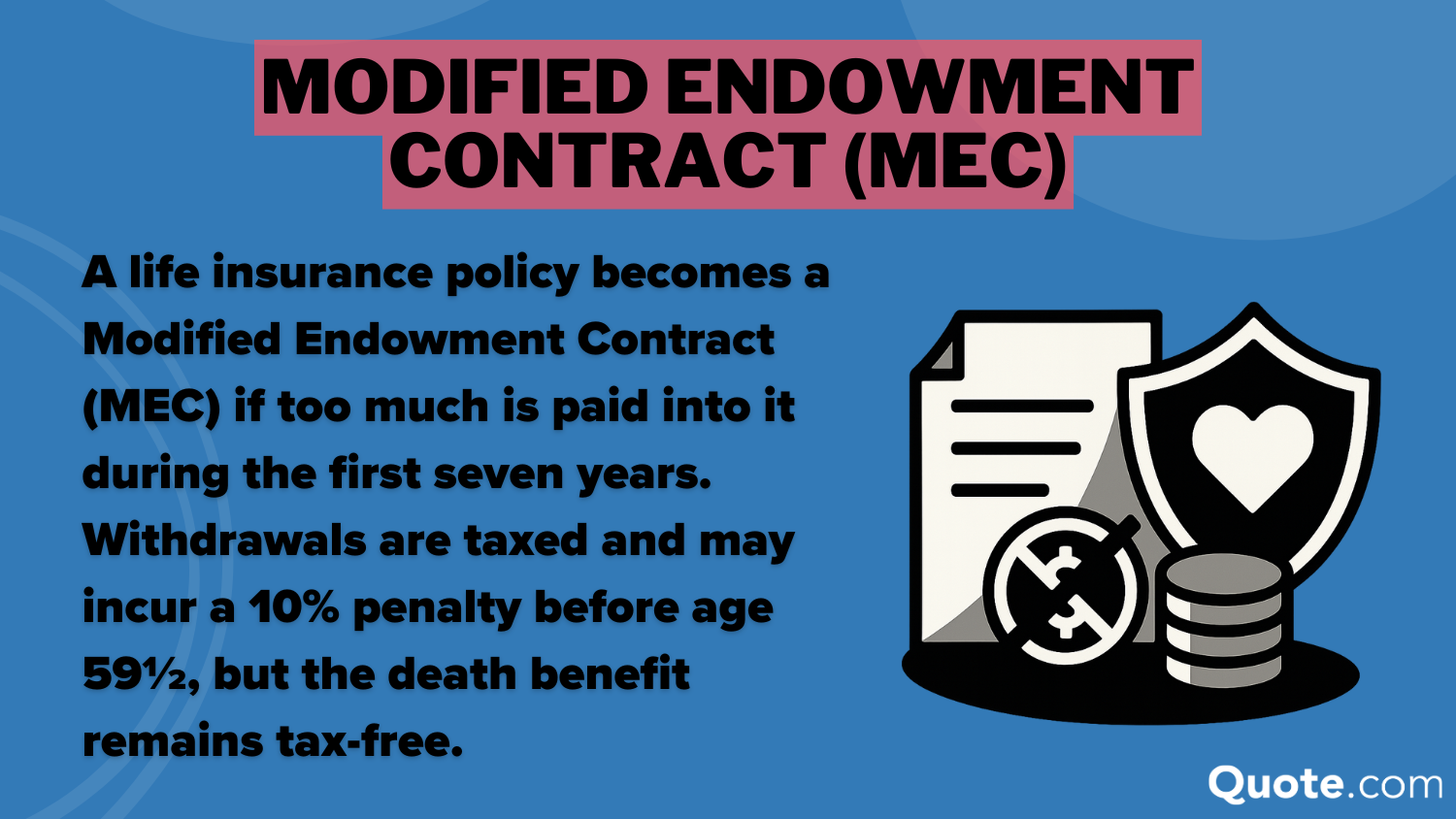

Single Premium Life Insurance and MEC Status

One of the most important things to understand about single premium life insurance is that it almost always triggers Modified Endowment Contract (MEC) classification.

This happens because you’re funding the entire policy up front, which exceeds the IRS’s 7-pay test limits.

- Withdrawals and loans are taxable (on a last-in, first-out basis)

- Early withdrawals (before age 59½) may incur a 10% IRS penalty

- The death benefit remains tax-free, but the living benefit flexibility is reduced

That said, some high-net-worth individuals are comfortable with MEC status if the policy is primarily intended to transfer wealth efficiently and not for cash access during life.

Best Single Premium Life Insurance Providers

Choosing the right provider for your single premium life insurance policy is important. You’ll want to make sure they have good claims-handling scores for death benefit claims and that they are financially secure.

10 Best Companies for Single Premium Life Insurance| Company | Rank | Claims Handling | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 930 / 1,000 | A++ | High cash value growth, wellness rewards program | |

| #2 | 905 / 1,000 | A++ | Convenient online access, strong brand recognition | |

| #3 | 890 / 1,000 | A++ | Strong mutual company history, robust living benefits | |

| #4 | 885 / 1,000 | A++ | Excellent long-term value, strong customer support | |

| #5 | 880 / 1,000 | A+ | Dividend-paying, strong finances, flexible payouts | |

| #6 | 875 / 1,000 | A+ | Competitive pricing, good accelerated death benefit rider | |

| #7 | 870 / 1,000 | A+ | Flexible premium options, strong investment performance |

| #8 | 865 / 1,000 | A | Wide range of coverage amounts, strong claims reputation | |

| #9 | 860 / 1,000 | A+ | Great service, wide age range, easy agent access | |

| #10 | 855 / 1,000 | A+ | Affordable single-premium with hybrid LTC feature |

We found that John Hancock is the best life insurance company, with a strong financial rating of A++ from A.M. Best and a good claims handling score. Allstate is also a great second choice out of the best life insurance companies, with scores close to John Hancock’s.

Other companies, such as Prudential or Nationwide, are lower on the list, but they are still great companies with good claims handling scores and financial stability.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alternatives to Single Premium Life Insurance

If you’re interested in permanent life insurance but don’t want to pay a large lump sum, consider whole or universal life insurance with annual or monthly premiums.

If you are looking for a cheaper option that isn’t permanent, then term life insurance may be better for you.

Term life insurance provides life insurance policies for short-term needs at a lower cost.

You may also consider investing separately in retirement or brokerage accounts while maintaining a smaller life insurance policy or looking into a life insurance annuity.

Deciding if a Single Premium Life Insurance Policy is Right for You

Single premium life insurance offers a unique blend of simplicity, permanence, and tax-deferred growth. It’s best for individuals who want to fund a policy once and secure a guaranteed death benefit for life—without worrying about future premium payments.

This type of policy is best suited for:

- Individuals with significant liquid assets who want to secure lifelong coverage quickly

- Those doing estate or legacy planning

- Retirees looking to pass on wealth tax-efficiently

- People who want guaranteed coverage without managing ongoing premiums

- Donors interested in leaving a tax-free benefit to a charity

However, the large upfront investment and potential tax consequences (especially if the policy becomes an MEC) mean it’s not right for everyone.

At Quote.com, we help you explore all your life insurance options so you can choose the policy that fits your financial goals (Learn More: The Ultimate Insurance Cheat Sheet). Compare single premium policies today with our free tool to see if this efficient, one-and-done approach is right for you.

Frequently Asked Questions

What is single premium life insurance?

With single premium life insurance, you pay a one-time premium—often tens or hundreds of thousands of dollars—when the policy is issued. This funds the entire policy for life, eliminating the need for future payments.

The policy starts accumulating cash value immediately, and that value grows over time, often earning interest or being tied to investment options depending on the policy type (such as fixed, indexed, or variable). Because the policy is fully funded, it offers guaranteed coverage and often immediate loan or withdrawal access through the policy’s cash value.

What are the key features of single premium life insurance policies?

The key features of single premium life insurance that attract customers are:

- Lump-Sum Funding: A single payment activates the policy for life.

- Lifelong Coverage: As long as the terms are met, the death benefit is guaranteed.

- Tax-Deferred Cash Value: The cash value grows without being taxed until accessed.

- Policy Loans and Withdrawals: You can borrow against the cash value or withdraw funds (though this may affect the death benefit).

- Flexible Death Benefit Options: Some policies allow for level or increasing death benefits based on policy structure.

If you are looking for a life insurance policy with these features, then a single premium life insurance policy may be the right choice for you.

How much does single pay life insurance cost?

Premiums vary based on your age, health, and desired death benefit, but minimum investments for a $100,000 policy start at $21,923. Larger policies may require six figures or more (Learn More: How to Get the Best Plan Possible for the Lowest Premium).

Is single premium life insurance taxable?

The death benefit is typically income tax-free. However, if the policy is classified as an MEC, any withdrawals or loans from the cash value may be taxable and subject to a penalty if taken before age 59½.

Where can I get single-premium life insurance quotes?

You can get life insurance single premium quotes using an online quote tool or by visiting a life insurance provider’s page. To quickly compare multiple life insurance quotes, enter your ZIP code in our free tool.

Can I access the cash value?

Yes. You can usually take loans against the cash value with interest (Learn More: Expert Guide To Different Loans). You may also make partial withdrawals. However, these options may reduce the death benefit and trigger taxes if the policy is an MEC.

What happens if I cancel the policy?

You’ll receive the surrender value, which is the cash value minus any surrender charges or loan balances. Canceling early in the policy’s life may lead to less favorable returns due to front-loaded costs.

How much does single premium life insurance cost?

Single premium life insurance rates for a lump sum payment start at $14,250, but rates will vary greatly based on your age, health, and other relevant factors.

What is single-premium whole life insurance?

A single premium whole life insurance policy is a permanent life insurance policy that you pay for in one lump sum. Life insurance like this is beneficial for customers who don’t want to pay monthly or annually for coverage (Read More: One Quote That Convinced Me to Get Life Insurance).

Is there single-premium term life insurance?

Some companies may offer single-premium term insurance, but are more likely to offer single-premium universal life insurance that lasts a person’s whole life, rather than a set period of time.

Who has the best single-premium life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.