10 Best Auto Insurance Companies in South Carolina (2026)

Farmers, State Farm, and Nationwide are the best auto insurance companies in South Carolina. Auto-Owners has the cheapest rates at $52 a month. State Farm excels with affordable comprehensive policies, Farmers offers great add-ons, and Nationwide helps good drivers save up to 40%.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated November 2025

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in SC

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in SC

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in SC

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsThe best auto insurance companies in South Carolina are Farmers, State Farm, and Nationwide. Farmers is great if you want extra features like accident forgiveness and OEM part coverage.

Our Top 10 Picks: Best Auto Insurance Companies in South Carolina| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 676 / 1,000 | A | Great Add-ons | Farmers | |

| #2 | 673 / 1,000 | A++ | Comprehensive Coverage | State Farm | |

| #3 | 669 / 1,000 | A+ | Low-Credit Drivers | Nationwide | |

| #4 | 651 / 1,000 | A++ | Budget-Friendly | Geico | |

| #5 | 650 / 1,000 | A++ | Family Drivers | Auto-Owners | |

| #6 | 642 / 1,000 | A++ | Young Drivers | Travelers | |

| #7 | 637 / 1,000 | A+ | High-Risk Drivers | Progressive | |

| #8 | 637 / 1,000 | A | Quick Claims | Liberty Mutual |

| #9 | 634 / 1,000 | A+ | Bundling Discounts | Allstate | |

| #10 | 607 / 1,000 | A | Diminishing Deductible | Safeco |

State Farm is a top choice for full coverage and is known for being reliable. Nationwide works well for flexible payment options and strong safe driver discounts up to 40%.

South Carolina auto insurance premiums start as low as $52 per month. See more rates in our State Farm vs. Farmers, Geico, Progressive, and Allstate review.

- South Carolina requires minimum liability coverage of 25/50/25 for all drivers

- Farmers is the top pick for South Carolina drivers seeking great add-ons

- State Farm is the best SC insurance company for drivers who want full coverage

These top companies combine high satisfaction rates with comprehensive coverage. Find the best South Carolina car insurance companies near you by entering your ZIP code.

Best Auto Insurance Rates in South Carolina

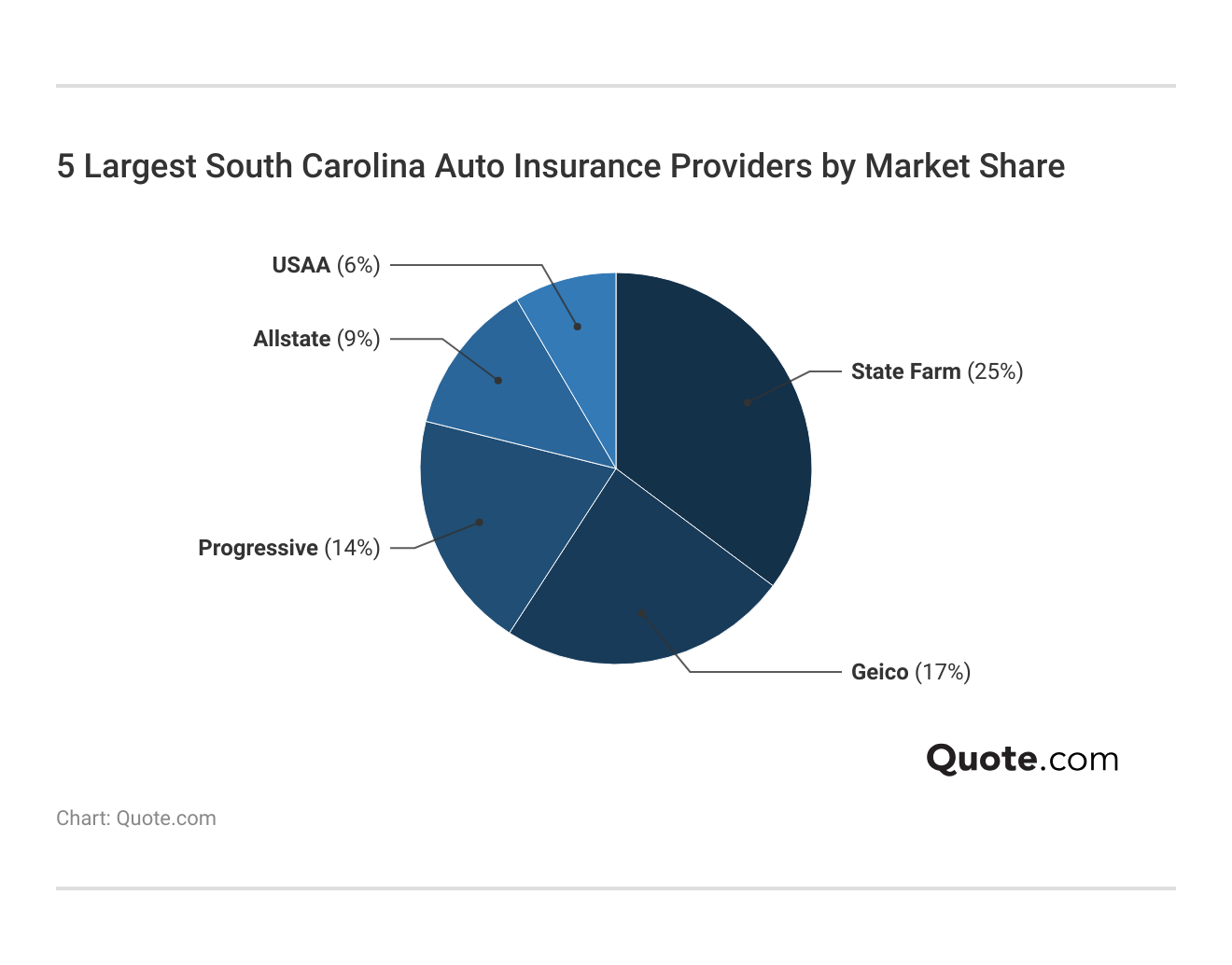

While Auto-Owners and Geico offer some of the lowest monthly rates in South Carolina, starting at $52 and $54 for minimum coverage, price isn’t the only factor that matters when choosing the right provider.

South Carolina Auto Insurance Monthly Rates by Coverage| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $219 | |

| $52 | $128 | |

| $113 | $273 | |

| $54 | $130 | |

| $125 | $303 |

| $80 | $193 | |

| $70 | $171 | |

| $87 | $218 | |

| $60 | $144 | |

| $71 | $172 |

Farmers, State Farm, and Nationwide may not always be the cheapest car insurance in South Carolina, but they consistently rank among the best for customer satisfaction, policy features, and dependable claims service for auto insurance in South Carolina.

Farmers offers many extra coverage options you can add to your policy, and while it costs more, you can customize it to fit what you need, making it a smart choice for drivers looking for flexibility and protection beyond basic minimum coverage.

In South Carolina, don't just meet minimums. Consider your daily driving habits and whether your policy could cover unexpected costs from a serious accident.

Michelle Robbins Licensed Insurance Agent

State Farm combines strong financial reliability with excellent customer service and comprehensive coverage options, making it ideal for those who want long-term peace of mind. Meanwhile, Nationwide is especially helpful for drivers with low credit, offering competitive rates and solid coverage despite financial challenges.

Comparing SC Auto Insurance Costs for Different Drivers

Younger drivers in South Carolina pay significantly more, but rates drop quickly as drivers age. Drivers over 55 enjoy the lowest rates overall, but you should still shop around for quotes from top car insurance companies in South Carolina.

Age is a significant factor in SC insurance pricing, but it isn’t the only variable local providers consider. Maintaining a clean driving record as you age will help you secure the best car insurance in South Carolina. Drivers with clean records will find that Auto-Owners and Geico offer the lowest monthly rates at $54, followed by State Farm at $60.

South Carolina Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $90 | $144 | $126 | $120 | |

| $54 | $82 | $107 | $74 | |

| $113 | $170 | $136 | $152 | |

| $54 | $80 | $139 | $54 | |

| $125 | $169 | $225 | $152 |

| $80 | $118 | $161 | $92 | |

| $71 | $146 | $103 | $103 | |

| $87 | $129 | $165 | $118 | |

| $60 | $72 | $64 | $64 | |

| $71 | $100 | $148 | $97 |

However, State Farm stands out for consistency — rates stay relatively stable across citations, rising only to $72 per month for an accident and just $64 a month for a DUI, which is rare among major providers. Compare State Farm vs. Progressive auto insurance for more quotes.

How Claims and Risk Raise Your Rates in South Carolina

Drivers in South Carolina don’t have to worry much about car theft, but things like hurricanes and busy roads can still affect insurance prices. The average cost of claims in the state isn’t too high, which helps keep rates lower than in places with bigger claims.

South Carolina Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A | Low incidence of vehicle theft |

| Weather-Related Risks | B | Hurricanes affect coastal risk zones |

| Traffic Density | B- | Moderate congestion in urban areas |

| Average Claim Size | C | Moderate repair and medical costs |

Big cities like Charleston, Columbia, and Greenville have more car accidents and claims, which can make insurance more expensive there. Drivers in smaller towns like Florence or Rock Hill might pay less because there’s less risk.

Annual Traffic Accidents and Insurance Claims by South Carolina City| City | Accidents | Claims |

|---|---|---|

| Charleston | 12,000 | 7,500 |

| Columbia | 11,000 | 6,800 |

| Florence | 4,200 | 2,500 |

| Greenville | 9,500 | 5,700 |

| Mount Pleasant | 6,500 | 3,900 |

| Myrtle Beach | 8,500 | 5,200 |

| North Charleston | 7,000 | 4,300 |

| Rock Hill | 5,000 | 3,000 |

| Spartanburg | 4,500 | 2,700 |

| Summerville | 5,500 | 3,300 |

Property damage and collision auto insurance claims are the most frequent types in South Carolina, though bodily injury claims, while less common, carry significantly higher costs.

5 Most Common Auto Insurance Claims in South Carolina| Rank | Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|---|

| #1 | Collision | 28% | $4,200 |

| #2 | Property Damage Liability | 23% | $3,800 |

| #3 | Comprehensive (weather, theft) | 18% | $2,400 |

| #4 | Bodily Injury Liability | 16% | $18,000 |

| #5 | Uninsured/Underinsured Motorist | 15% | $6,300 |

This mix of high-frequency and high-cost claims underscores why experts recommend carrying more than just minimum liability car insurance in South Carolina.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

South Carolina Auto Insurance Coverage Requirements

South Carolina requires drivers to have liability car insurance to help cover costs if there’s an accident. Here’s a table showing the required minimum coverage limits for drivers in the state:

South Carolina Minimum Auto Insurance Coverage Requirements| Required Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person / $50,000 per accident |

These limits meet the law, but they might not be enough if a crash costs a lot. That’s why drivers should think about adding more coverage for better protection.

Optional coverage types in South Carolina give drivers the flexibility to tailor their policies beyond the state’s minimums, including options like rental reimbursement.

South Carolina Auto Insurance Coverage Options| Coverage | What It Covers |

|---|---|

| Bodily Injury Liability | Others’ injuries in an at-fault accident |

| Collision | Damage to your vehicle in a crash |

| Comprehensive | Theft, weather, fire, or animal damage |

| Medical Payments (MedPay) | Medical bills for you and passengers |

| Property Damage Liability | Damage to others’ vehicles or property |

| Rental Reimbursement | Temporary rental car after an accident |

| Towing & Labor | Towing, battery jump, or roadside help |

| Uninsured/Underinsured Motorist | Injuries or damage by uninsured drivers |

Choosing add-ons like collision, MedPay, or roadside assistance can help fill critical gaps and let SC drivers customize their policies for better financial protection, especially in areas with higher accident rates or weather-related risks.

Ways to Save on South Carolina Auto Insurance

Discounts in South Carolina can significantly reduce your premium, especially if you qualify for good driver incentives or bundle policies like home and auto. Drivers can save through common discounts with top providers in South Carolina:

Top Auto Insurance Discounts in South Carolina| Company | Anti- Theft | Claims- Free | Good Driver | Multi- Policy | New Car |

|---|---|---|---|---|---|

| 10% | 10% | 25% | 25% | 10% | |

| 12% | 10% | 25% | 16% | 8% | |

| 10% | 9% | 30% | 20% | 12% | |

| 25% | 12% | 26% | 25% | 10% | |

| 35% | 8% | 20% | 25% | 8% |

| 5% | 14% | 40% | 20% | 15% | |

| 25% | 10% | 30% | 10% | 10% | |

| 20% | 5% | 20% | 15% | 12% | |

| 15% | 11% | 25% | 17% | 15% | |

| 15% | 13% | 10% | 13% | 8% |

Liberty Mutual offers the highest anti-theft discount at 35%, while Nationwide provides the best good driver savings at 40%. Drivers should explore each company’s full discount offerings and consider eligibility to maximize savings.

In addition to stacking discounts, South Carolina drivers can take advantage of smart strategies to keep premiums low. These tips are especially helpful for those who don’t qualify for traditional discounts or want to save even more.

- Take a Defensive Driving Course: Completing a state-approved course can lead to discounts, especially for older drivers or those with minor violations.

- Shop Around Annually: Comparing rates from multiple providers each year ensures you’re not overpaying as your driving profile or local rates change.

- Raise Your Deductible: A higher deductible lowers your monthly premium, but only choose this option if you can afford a larger out-of-pocket expense after a claim.

- Reduce Unnecessary Coverage: If your vehicle is older or has depreciated significantly, consider dropping collision or comprehensive coverage to cut costs.

- Maintain Continuous Coverage: Avoiding coverage gaps keeps your risk profile low in the eyes of SC insurers, helping you secure better long-term rates.

Even if you’re already receiving discounts, using these strategies can unlock car insurance discounts you can’t miss and keep your auto insurance affordable year after year in South Carolina.

10 Best Auto Insurance Companies in South Carolina

Farmers, State Farm, and Nationwide are the best insurance companies in South Carolina, offering strong coverage, discounts, and service. See how each provider stacks up with detailed pros and cons, and get multiple auto insurance quotes to help you find the right SC policy.

#1 – Farmers: Top Overall Pick

Pros

- Great Add-Ons: Farmers offers extensive add-on options in South Carolina, including accident forgiveness and new car replacement. Find everything you need to know about Farmers Insurance.

- Local Value: Despite higher prices, Farmers’ SC minimum coverage rate includes access to unique features like OEM parts and enhanced rental car coverage.

- Strong Good Driver Discount: SC drivers can save up to 30% through Farmers’ good driver program, significantly offsetting higher base premiums.

Cons

- High Base Rate: Farmers’ SC minimum coverage cost is $113 a month, which is the most expensive among the top 10 providers.

- Limited Bundling Discount: At 20%, Farmers’ SC bundling discount is smaller than rivals like Geico or Allstate, reducing multi-policy savings.

#2 – State Farm: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: State Farm offers the most robust full coverage policies in South Carolina, including roadside assistance and rideshare options.

- Affordable Rates: With SC minimum coverage starting at $60 a month, State Farm delivers excellent value without compromising on financial strength or claims support.

- Bundling Incentives: SC drivers can save up to 17% by bundling auto and home insurance with State Farm, making it a practical choice for families.

Cons

- Limited Anti-Theft Savings: State Farm’s 15% SC anti-theft discount is lower than competitors like Liberty Mutual or Geico. See what SC drivers are saying in the State Farm auto insurance review.

- Premium Increase Risk: Rate hikes after claims are more common with State Farm in SC than some other providers, especially for newer drivers.

#3 – Nationwide: Best for Low-Credit Drivers

Pros

- Low-Credit Flexibility: Nationwide provides some of the most stable SC rates for drivers with poor credit, starting at $80 a month for minimum coverage.

- Top Good Driver Discount: SC drivers can get up to 40% off for maintaining a clean driving record with Nationwide. Explore savings and features in this Nationwide insurance review.

- Broad Coverage Options: SC customers benefit from features like gap insurance and vanishing deductibles, supporting financial recovery after claims.

Cons

- Small Anti-Theft Discount: Nationwide’s 5% SC anti-theft savings are among the lowest, limiting options for vehicle security benefits.

- Higher Full Coverage Rates: Full coverage in SC costs $193 a month, which may be too steep for budget-conscious drivers without discount eligibility.

#4 – Geico: Best for Budget-Friendly

Pros

- Low Price Leader: Geico offers one of the cheapest SC minimum coverage rates at $54 a month while still providing dependable customer service.

- Strong Discount Stack: SC drivers can save up to 25% for bundling and 26% for good driving, making Geico one of the most discount-friendly options.

- Digital Tools: Geico’s app provides SC drivers with convenient access to ID cards, roadside help, and claims tracking. Get everything you need to know about Geico in our review for claims handling.

Cons

- Limited Coverage Add-Ons: Geico’s add-on options in SC are not as robust as Farmers or State Farm, potentially limiting protection upgrades.

- Low Claims Satisfaction: Geico’s 651/1,000 claims score in SC ranks below several other providers, raising concerns about resolution speed.

#5 – Auto-Owners: Best for Family Drivers

Pros

- Family Discounts: SC drivers with teen or college drivers benefit from strong family savings and stable rates as low as $52 a month for minimum coverage.

- Customer Service Reputation: With a claims score of 650 and A++ rating, Auto-Owners is one of the most trusted providers for South Carolina families. Get full ratings in our Auto-Owners review.

- Package Enhancements: SC policies include optional protection for rental cars, gap coverage, and accident forgiveness tailored to family needs.

Cons

- Limited Digital Access: Auto-Owners’ mobile tools and online quote options are less advanced than top SC competitors like Geico or Progressive.

- Below-Average Bundling: The 16% SC bundling discount is lower than other family-focused insurers, reducing multi-line savings.

#6 – Travelers: Best for Young Drivers

Pros

- Youth Discounts: SC young drivers may qualify for driver training and good student savings with Travelers, supporting rates from $71 a month for minimum coverage.

- Strong Claims-Free Discount: A 13% SC discount for claims-free driving encourages responsibility among newer drivers. See what stands out in our expert Travelers auto insurance review.

- Financial Stability: A++ rating and solid claims processing make Travelers a reliable choice for long-term SC policyholders.

Cons

- Weak New Car Discount: Travelers offers only an 8% SC new car discount, less competitive than Nationwide’s 15%.

- Limited Bundling Benefits: SC bundling discount is only 13%, offering less value for multi-policy households.

#7 – Progressive: Best for High-Risk Drivers

Pros

- High-Risk Acceptance: Progressive is one of the most lenient auto insurers in South Carolina for drivers with DUIs or multiple violations, with rates starting at $70 a month.

- Telematics Savings: SC drivers using Snapshot can qualify for personalized savings based on real-time driving habits. Before buying, browse everything you need to know about Progressive insurance.

- Strong Good Driver Discount: Progressive’s SC good driver discount of 30% is among the highest, especially for high-risk profiles who clean up their record.

Cons

- Higher Post-Accident Rates: Progressive premiums in SC can spike significantly after an at-fault accident, affecting long-term affordability.

- Modest Bundling Discount: With just 10% for SC bundling, Progressive offers weaker multi-policy savings than its major rivals.

#8 – Liberty Mutual: Best for Quick Claims

Pros

- Fast Claims Turnaround: Liberty Mutual ranks well in SC for digital claims filing and quick reimbursements, offering efficiency after an incident.

- Top Anti-Theft Discount: SC drivers can get up to 35% off for anti-theft systems, the highest available among the top 10 providers.

- Flexible Coverage Options: Liberty Mutual offers roadside assistance, new car replacement, and gap coverage in South Carolina. See full details about Liberty Mutual auto insurance review.

Cons

- Expensive Base Rate: SC minimum coverage starts at $125 a month, making it the highest-priced among major insurers.

- Lower Good Driver Discount: With only 20% savings, Liberty Mutual’s SC good driver discount is lower compared to Nationwide and Farmers.

#9 – Allstate: Best for Bundling Discounts

Pros

- Top Bundling Deal: Allstate offers up to 25% off for bundling policies in SC, ideal for households with auto, renters, or homeowners insurance.

- Reliable Digital Tools: SC customers benefit from the Allstate app for accident documentation and claims tracking. Learn about policy benefits in the Allstate auto insurance review.

- Safe Driving Rewards: Allstate offers Drivewise in SC, a usage-based program that rewards drivers with lower rates based on performance.

Cons

- Above-Average Rates: Allstate’s SC minimum coverage starts at $90 a month, higher than most of the competition.

- Modest Claims Satisfaction: With a 634 score, Allstate ranks below top SC providers for claims resolution and customer satisfaction.

#10 – Safeco: Best for Diminishing Deductibles

Pros

- Deductible Rewards: SC drivers can earn a lower deductible annually with Safeco’s diminishing deductible program, promoting safe habits.

- Decent Price Point: With SC minimum coverage starting at $87 a month, Safeco offers mid-tier pricing with strong optional coverage.

- New Car Discount: SC customers can save up to 12% on newer vehicles, making it a smart option for recent car buyers. Delve more details in our Safeco auto insurance review.

Cons

- Low Claims Score: Safeco’s 607/1,000 SC claims rating is the lowest among the top 10, raising red flags about service consistency.

- Fewer Discounts: Compared to other South Carolina insurance companies, Safeco offers smaller discounts for anti-theft and claims-free drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Choose the Best Company in South Carolina

To avoid costly out-of-pocket expenses from South Carolina’s frequent collision and property damage claims, it’s essential to choose a provider that goes beyond the state’s 25/50/25 minimum liability limits. Farmers, State Farm, and Nationwide are the best auto insurance companies in South Carolina for comprehensive coverage.

Securing a policy that meets or exceeds SC minimum insurance requirements not only protects you against lawsuits and repair bills but also ensures peace of mind while navigating the risks of South Carolina’s roads, from busy city traffic to unpredictable coastal weather.

Choosing the right provider and coverage can make all the difference when it comes to safeguarding your finances and driving privileges. Get fast and cheap SC car insurance online today with our quote comparison tool.

Frequently Asked Questions

Who has the best car insurance in South Carolina?

Farmers, State Farm, and Nationwide rank as the best car insurance companies in South Carolina. Farmers stands out for its robust add-ons, State Farm offers robust full coverage with affordable comprehensive and collision auto insurance, and Nationwide provides affordable options for drivers with low credit scores.

Which company has the highest customer satisfaction in South Carolina?

Auto-Owners and State Farm consistently receive the highest customer satisfaction ratings in South Carolina thanks to their responsive claims handling, policy reliability, and strong local agent support. Both companies also maintain high renewal rates among SC drivers. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What is the average cost of auto insurance in SC?

The average monthly cost of auto insurance in South Carolina ranges from $54 to $125 for minimum coverage and from $128 to $303 for full coverage, depending on the provider, driver profile, and location. Use these hacks to save money on car insurance and lower your SC insurance costs.

Why is South Carolina car insurance so expensive?

Why are car insurance rates so high in South Carolina? Auto insurance rates in South Carolina are high because of factors like bad weather, a lot of accidents, and many uninsured drivers. These risks make it more expensive even for the best South Carolina car insurance companies to offer low rates.

Do you need auto insurance in SC?

Yes, South Carolina law requires all drivers to carry at least 25/50/25 liability insurance and uninsured motorist coverage. Driving without insurance can result in license suspension, fines, and reinstatement fees.

What is full coverage car insurance in SC?

Full coverage car insurance in South Carolina typically includes liability, collision, and comprehensive auto insurance coverage. It may also include medical payments, uninsured motorist protection, and optional add-ons like roadside assistance or rental reimbursement.

Who is the highest-rated auto insurance company in South Carolina?

Based on A.M. Best’s financial strength, State Farm, Auto-Owners, and Travelers receive A++ ratings, making them among the highest-rated auto insurance companies in South Carolina.

What is the cheapest full coverage insurance in South Carolina?

Auto-Owners offers the cheapest full coverage in South Carolina at around $128 per month. Geico and State Farm also offer affordable full coverage options at $130 and $144 per month, respectively.

How do I find the best car insurance in South Carolina?

Farmers, State Farm, and Nationwide are great SC auto insurance companies, but they are pricier than other providers. To find the best car insurance rates in South Carolina, compare quotes from multiple insurers, review discounts available for your profile, consider liability vs. full coverage auto insurance options, and factor in claims satisfaction and financial strength ratings.

Does Progressive cover South Carolina?

Yes, Progressive car insurance in South Carolina starts at $70 a month, with flexible coverage options and discounts for safe drivers. Enter your ZIP code to compare South Carolina auto insurance rates and see if you qualify for cheaper coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.