Allstate vs. Geico Auto Insurance in 2026

Geico vs. Allstate auto insurance comes down to value, digital convenience, and driver rewards. Geico offers $43 monthly with app-based claims, helpful digital tools, and a 26% safe driver discount. Allstate costs $87 monthly and offers agent support plus 30% Drivewise savings for full coverage drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated December 2025

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,640 reviews

11,640 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsWhen comparing Geico vs. Allstate auto insurance, the biggest differences are in pricing, discounts, and how each company delivers service.

Geico offers a $43 monthly rate with a 26% safe driver discount and 40% off for air bags, making it a strong choice for low-mileage, tech-savvy drivers who prefer managing everything through an app.

Geico vs. Allstate Auto Insurance Rating| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 3.8 |

| Business Reviews | 4.5 | 4.0 |

| Claim Processing | 4.8 | 3.0 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.4 | 3.5 |

| Customer Satisfaction | 2.3 | 2.0 |

| Digital Experience | 5.0 | 4.5 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 4.5 | 3.4 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.1 | 3.4 |

| Savings Potential | 4.5 | 3.9 |

| Geico Review | Allstate Review |

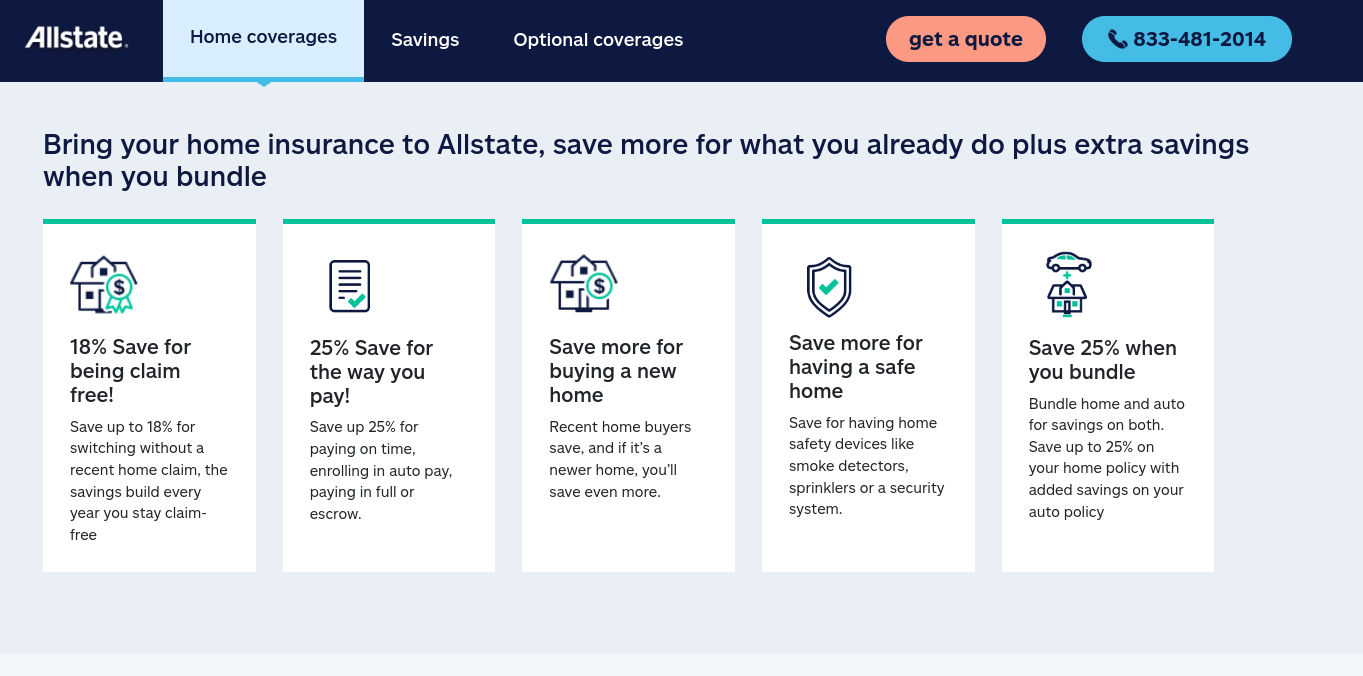

In contrast, Allstate charges $87 per month but includes a 30% Drivewise discount, 20% off for good students, and personalized support from a local agent.

While Geico leans into speed and affordability through digital tools, Allstate focuses on rewarding safe driving and offering hands-on help. This comparison breaks down their pricing, coverage perks, and which type of driver each provider serves best.

- Geico customers can file claims 24/7 using the mobile app only

- Geico vs. Allstate auto insurance compares $500 vs. $1,000 deductibles

- Allstate offers bundle discounts with home, auto, and life insurance

The fastest way to secure the cheapest car insurance tailored to your situation is to use our free comparison tool and instantly check rates from multiple providers.

Comparing Geico vs. Allstate Auto Insurance Rates

Insurance costs shift a lot depending on your age and gender, and the Geico vs. Allstate auto insurance comparison shows just how big that gap can get. For young drivers—especially 16-year-old males—premiums are sky-high and can make full coverage feel out of reach with pricier providers.

Geico vs. Allstate Full Coverage Auto Insurance Monthly Rates| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $425 | $868 |

| 16-Year-Old Male | $445 | $910 |

| 30-Year-Old Female | $128 | $240 |

| 30-Year-Old Male | $124 | $252 |

| 45-Year-Old Female | $114 | $231 |

| 45-Year-Old Male | $114 | $228 |

| 60-Year-Old Female | $104 | $214 |

| 60-Year-Old Male | $106 | $220 |

Geico charges $445 to insure a teen male, while the Allstate car insurance price jumps to $910, which could be a dealbreaker for families trying to stay insured. By age 30, rates do drop, but Allstate still adds over $100 more per month for males, totaling around $1,500 extra each year.

At 45, Geico maintains the rate level for both genders, while Allstate’s pricing still shifts based on gender. The Geico full coverage price remains more stable as drivers age, offering a predictable option for long-term planning.

Older drivers close to retirement can save over $100 a month with Geico, which makes a real difference when living on a fixed income. These rate differences go beyond numbers—they shape how people budget, manage risk and choose between Geico’s app-based service or Allstate’s agent-driven model. For a clearer breakdown, explore our visual guide to auto insurance now.

Claim History Can Change Your Rates Fast

Your driving record doesn’t just follow you—it directly affects how much you’ll pay each month. The Allstate vs. Geico auto insurance comparison shows just how costly different violations can be, especially over time.

Geico vs. Allstate Full Coverage Auto Insurance Monthly Rates by Driving Record| Driving Record | ||

|---|---|---|

| Clean Record | $114 | $228 |

| Not-At-Fault Accident | $189 | $321 |

| Speeding Ticket | $151 | $268 |

| DUI/DWI | $309 | $385 |

With a clean record, Geico can save drivers around $1,368 a year compared to Allstate, which is a big win for careful drivers looking to keep their premiums down. After a not-at-fault accident, Allstate bumps rates $93 higher than Geico, showing how even small incidents can lead to high costs if you’re with the wrong company.

If you’re forced to file an auto insurance claim, especially after an accident that wasn’t your fault, the difference in premium hikes could significantly affect your renewal decisions. Speeding adds $54 with Geico, but Allstate tacks on another $40, which could make price-sensitive drivers rethink their choice.

A DUI spikes rates with both companies, but Allstate’s pricing still comes in $76 higher, which can be hard for anyone trying to recover financially. Geico rates stay relatively lower across most violation types, helping drivers avoid steep financial setbacks. All of this shows how much your past affects what you’ll pay—and how much it matters to choose a provider that doesn’t over-penalize mistakes.

How Credit Score Impacts Your Rate

Your credit score doesn’t just affect your loan approval—it also plays a big role in what you’ll pay for car insurance. The Geico vs. Allstate auto insurance numbers show how even small changes in your credit can make a noticeable difference in your monthly premium.

Full Coverage Insurance Monthly Rates by Credit: Geico vs. Allstate| Credit Score | ||

|---|---|---|

| Good Credit (670–739) | $135 | $150 |

| Fair Credit (580–669) | $165 | $190 |

| Bad Credit (300–579) | $220 | $270 |

For drivers with good credit, the $15 gap between Geico and Allstate might not be a dealbreaker, especially if other features matter more. But if your credit falls into the fair range, Geico’s $165 rate is easier to manage than Allstate’s $190, helping mid-credit drivers keep full coverage without stretching their budget.

If you’re thinking about the best time to buy a new car, it’s smart to factor in how your credit affects your insurance costs, too. For those with poor credit, Allstate’s $270 rate might mean cutting coverage or raising deductibles, while Geico’s $220 rate offers some breathing room without sacrificing key protection—something drivers should keep in mind when comparing insurance companies like Geico.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Discounts Shape What You Pay

Discounts can make a big difference in what you pay each month and often determine which insurer offers better long-term value. The Geico vs. Allstate auto insurance breakdown shows how your savings can depend on how you drive, what you drive, and even your financial habits.

Auto Insurance Discounts and Savings: Geico vs. Allstate| Discount | ||

|---|---|---|

| Multi-Policy (Bundling) | 25% | 25% |

| Multi-Vehicle | 25% | 10% |

| Safe Driver / Accident-Free | 22% | 45% |

| Good Student | 15% | 20% |

| Defensive Driving Course | 10% | 10% |

| Anti-Theft Device | 23% | 10% |

| Vehicle Safety Features (Airbags, etc.) | 23% | 15% |

| Good Credit / Financial Stability | 20% | 25% |

| Low Mileage | 10% | 20% |

| Telematics (DriveEasy / Drivewise) | 15% | 40% |

| Military / Emergency Deployment | 25% | ❌ |

| Federal Employee / Affinity Group | 12% | 10% |

| Early Signing | ❌ | 10% |

| New Car / Vehicle Discount | 15% | 15% |

| Homeowner Discount | 10% | 15% |

| Paperless / AutoPay / Online Quote | 5% | 10% |

Allstate rewards safe driving with up to 40% off through its Drivewise program, which could save some drivers over $1,200 a year. Geico’s telematics savings top out at 15%, so it’s less rewarding for cautious commuters. On the flip side, Geico offers a 25% multi-vehicle discount compared to Allstate’s 10%, which can really add up for families with more than one car.

Allstate edges ahead with a 25% discount for strong credit, while Geico comes in at 20%. But Geico offers 23% off for anti-theft features and airbags—more than double what Allstate gives—making it a better fit for drivers with newer, well-equipped vehicles.

Households with multiple vehicles should prioritize insurers offering high multi-car discounts to maximize long-term savings.

Daniel Walker Licensed Insurance Agent

These discounts aren’t just numbers—they can help shape which provider actually brings down your total cost of ownership. Unlock savings now by exploring car insurance discounts you can’t miss.

Coverage Flexibility in Geico vs. Allstate Auto Insurance Options

Geico vs. Allstate auto insurance both offer a solid lineup of coverages, but when you dig into the details, the differences can really affect how claims play out, how much you pay for repairs, and your financial risk. Knowing what each coverage actually does makes it easier to pick the provider that fits your real-world needs—not just check boxes.

Geico vs. Allstate: Auto Insurance Coverage Options| Coverage Type | ||

|---|---|---|

| Liability Coverage | ✅ | ✅ |

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Mechanical Breakdown Insurance | ✅ | ❌ |

| Gap Insurance | ❌ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| Custom Parts/Equipment Coverage | ✅ | ✅ |

| New Car Replacement | ❌ | ✅ |

| Accident Forgiveness | ✅ | ✅ |

| Deductible Rewards / Reduction | ❌ | ✅ |

Most states mandate liability coverage, which covers damages or injuries you cause to other people. Collision covers your car in at-fault accidents, while comprehensive covers theft, fire, hail, and falling trees. Both Geico and Allstate offer MedPay and PIP, but only PIP helps with lost wages, rehab, and childcare after serious injuries, making it essential if you’re unable to work.

Uninsured/Underinsured motorist coverage from both providers protects you if you’re hit by someone with little or no insurance, avoiding out-of-pocket medical or repair bills. The real difference shows in Geico’s mechanical breakdown insurance, which covers major system failures like engines or transmissions for newer cars—repairs that can easily exceed $3,000.

Allstate’s gap insurance helps cover the difference if your car gets totaled and you still owe more on the loan than it’s worth—super useful for new car buyers. Geico doesn’t offer that, so you’d be on the hook for the balance. Learn the best tips to pay less for car insurance and compare smarter.

Customer Satisfaction Trends in Geico vs. Allstate Auto Insurance

When it comes to more than just price, things like reputation, customer satisfaction, and financial strength play a big role in how well an insurance company takes care of its customers. The Geico vs. Allstate auto insurance ratings show where each one shines—and where they fall a little short.

Insurance Business Ratings & Consumer Reviews: Geico vs. Allstate| Agency | ||

|---|---|---|

| Score: 692 / 1,000 Avg. Satisfaction | Score: 691 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 74/100 Good Customer Satisfaction |

|

| Score: 0.52 Fewer Complaints Than Avg. | Score: 1.02 Avg. Complaints |

|

| Score: A++ Superior Financial Strength | Score: A+ Superior Financial Strength |

Geico earns an A++ from A.M. Best, indicating industry-leading financial stability, while Allstate holds a slightly lower A+—still strong but not top-tier. The Geico rating also includes a 692 customer satisfaction score from J.D. Power, nearly identical to Allstate’s 691, showing both companies deliver a similar overall experience.

But complaint data makes a bigger difference. Both earned a 74 from Consumer Reports, yet Geico’s complaint index is just 0.52 with the NAIC, while Allstate’s is 1.02—nearly double. That suggests Geico customers are less likely to run into issues when it comes to claims or billing.

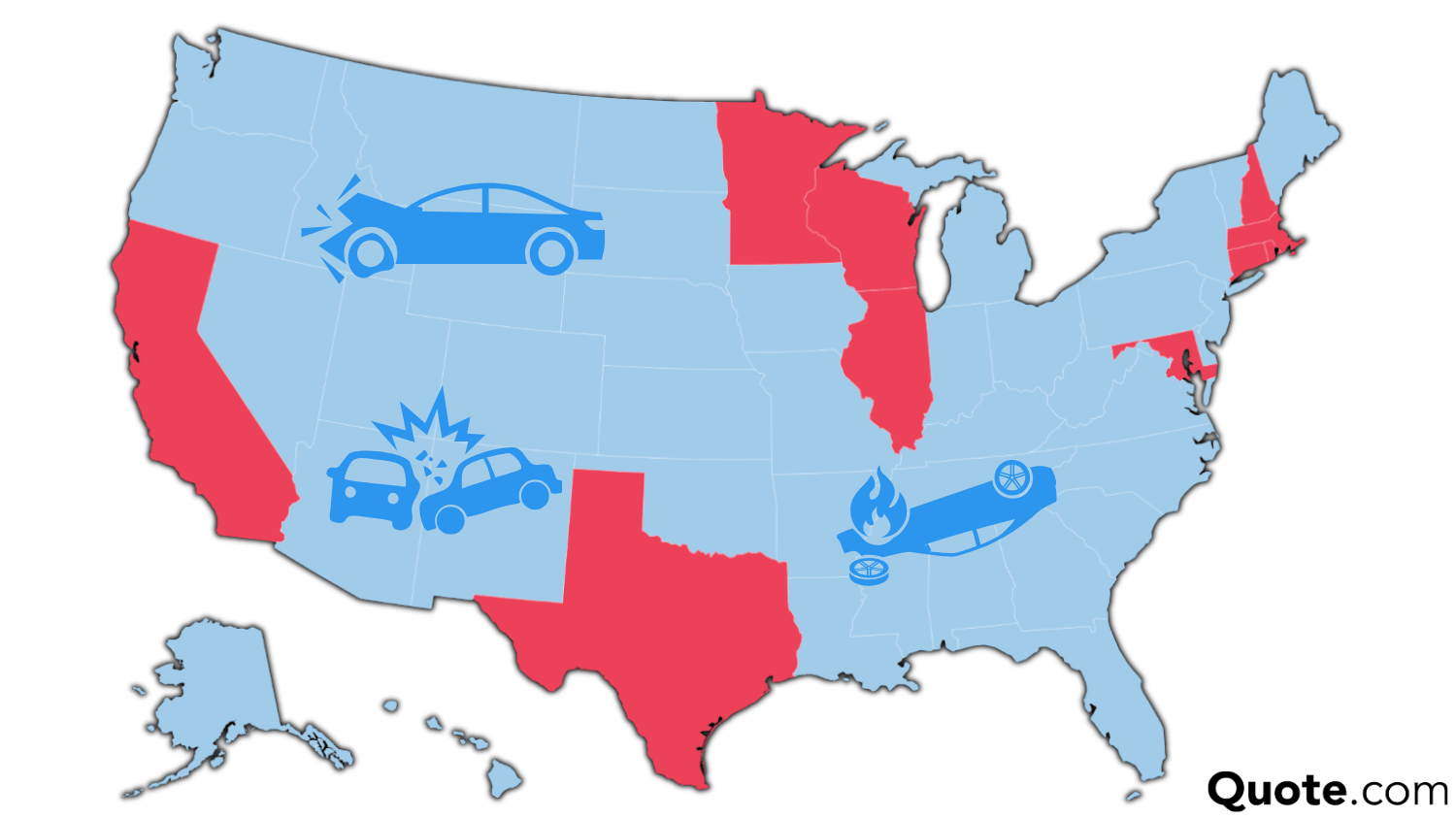

Choosing the right insurer gets easier when you know who’s getting picked most. This Geico vs. Allstate auto insurance chart breaks down their market share and shows who’s leading.

Geico holds 12.30% of the market, slightly ahead of Allstate’s 10.40%, likely thanks to its budget-friendly rates and mobile-first service model. Meanwhile, 77.30% of the market is split among other providers, proving how many drivers still go beyond the big names. Geico may lead in share, but Allstate’s loyal base and agent-first approach still hold weight in the industry.

Over on Reddit, a user shared their story about switching from Geico to Allstate for both home and auto insurance. They said Allstate saved them around $800 a year on their home policy, mainly because they bundled it—and Geico didn’t have that option locally.

Comment

byu/Yipyip34 from discussion

inInsurance

The car rate was about the same, but they liked having access to a local agent, which Geico didn’t offer in their area. They’re not totally sure it was the right move, but they figured it’s worth trying for a year since they can always switch back. That kind of flexibility really stood out in the Reddit post and shows how bundling and agent access can make a difference when comparing Geico vs. Allstate auto insurance.

Learn more: How to Compare Auto Insurance Companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Geico: Pros and Cons

Pros

- $43 Full Coverage Rate: Geico’s average full coverage rate is just $43 per month, undercutting Allstate’s $87.

- High-Value Tech Discounts: Geico offers 26% off for safe drivers, 25% for anti-theft systems, and 23% for airbag-equipped vehicles, making it ideal for drivers with safety-forward cars.

- Mechanical Breakdown Coverage: Unlike Allstate, Geico includes mechanical breakdown insurance, covering engine and transmission repairs on newer vehicles for far less than extended warranties.

Cons

- No Gap Insurance Availability: Geico does not offer gap insurance, meaning drivers with auto loans could face thousands in out-of-pocket costs if their vehicle is totaled and worth less than what they owe.

- Digital-Only Claims Support: Everything you need to know about Geico includes the fact that it doesn’t have in-person agents—claims are handled entirely online or by phone, which can be frustrating if you prefer face-to-face help during stressful situations.

Allstate: Pros and Cons

Pros

- Top-Tier Telematics Discount: Allstate offers up to 40% off with its Drivewise program, making it a great fit for drivers who are consistently safe behind the wheel and open to monitoring their habits.

- Gap Insurance Included: Unlike Geico, Allstate provides gap insurance, which protects drivers who owe more on their loan than their car is worth—especially helpful for those financing a new vehicle.

- Personalized Agent Support: With over 14,000 agents nationwide, Allstate delivers one-on-one service that appeals to drivers who want in-person help when managing policies or filing claims.

Cons

- Higher Full Coverage Cost: Allstate’s average full coverage rate sits at $87 per month, more than double Geico’s $43, which may push budget-conscious drivers to look elsewhere.

- Above-Average Complaint Ratio: According to the latest Allstate auto insurance review, the company holds a 1.02 complaint index with the NAIC—nearly double Geico’s 0.52—indicating more reported issues with billing, claims handling, or customer service.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Geico and Allstate Coverage Backed by Specialized Subsidiaries

Geico vs. Allstate auto insurance presents a contrast between tech efficiency and agent-led customization. Geico General and Geico Casualty serve high-risk drivers with low-cost coverage, while Geico Indemnity supports standard policies with full protection. Geico’s DriveEasy rewards safe habits but lacks gap coverage.

Allstate Indemnity Company provides full coverage with options like accident forgiveness and rideshare add-ons. Allstate’s Drivewise mobile program personalizes rates and offers up to 40% off for safe drivers. A major edge for Geico is its 25% multi-vehicle discount, while Allstate benefits families with a 30% good student discount.

Both companies have programs built for different driving styles and risk levels, so it’s a good idea to check a few auto insurance quotes online—just like people got auto insurance right—by finding what truly fits their needs. You can view Geico auto insurance quotes online to see how they compare to your situation. It’s easy to lower your premium when you use our free comparison tool today.

Frequently Asked Questions

What does Geico business insurance cover?

Geico business insurance covers general liability, commercial auto, and professional liability, with tailored options for over 300 industries. It’s ideal for sole proprietors, contractors, and small businesses that need flexible, affordable protection.

How does Geico vs. Safe Auto compare for budget drivers?

Geico vs. Safe Auto reveals that Geico averages $43 per month for full coverage with a 26% safe driver discount, while Safe Auto caters to high-risk drivers with basic state-minimum coverage and limited policy features.

What are Geico similar companies with competitive rates?

Geico similar companies include Progressive, which offers Name Your Price tools, and Nationwide, which provides SmartRide discounts. All offer digital servicing and rates close to Geico’s national average of $43 per month.

If you’re considering switching providers, it’s important to understand is it bad to cancel car insurance—doing so without immediate replacement can lead to coverage gaps, higher future premiums, or even legal penalties in most states.

How do I find Geico car insurance quotes online?

You can get Geico car insurance quotes online by entering your ZIP code, vehicle details, and driving history at Geico.com. You may qualify for discounts like 15% for seatbelt use, 25% for multiple vehicles, or up to 26% for safe driving.

What’s the difference between Allstate vs. Geico home insurance?

Allstate vs. Geico home insurance shows Allstate writes its own policies and offers claim-free rewards, while Geico partners with third-party carriers and does not offer direct claims handling for home insurance customers.

What is a typical Geico deductible?

A Geico deductible ranges from $250 to $1,000 for collision auto insurance or comprehensive coverage. A $0 deductible is available in select states for glass-only claims under comprehensive policies.

How does Geico vs. Mercury compare in terms of claims and price?

Geico vs. Mercury shows that Geico offers faster claims processing through its mobile app and averages lower premiums. Mercury may offer competitive pricing in California but receives more frequent billing and service complaints.

Is Allstate cheaper than Geico for full coverage?

Typically, no—Geico averages $43 per month for full coverage, while Allstate averages $87 per month. However, Allstate may offer bigger discounts for good students or Drivewise users who drive safely.

Which company offers better value in Allstate vs. Mercury?

Allstate versus Mercury illustrates Allstate has broader coverage with extras such as accident forgiveness and new car replacement, whereas Mercury may appeal to California drivers looking for lower state-minimum coverage. Both are often included in discussions about the best car insurance companies, though their value depends on whether you prioritize coverage options or low-cost premiums.

How do I contact Geico Insurance customer service?

Geico Insurance customer service is available 24/7 by calling 1-800-861-8380. You can also manage your policy, file claims, and access digital ID cards through the Geico mobile app.

How does Allstate vs. The General compare for high-risk drivers?

What should I know about Geico vs. Allstate vs. Progressive?

How do I get a Geico motorcycle insurance quote?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.