Pacific Life Insurance Review for 2026

Pacific Life term policies start at just $19 a month. They also offer universal life insurance with flexible permanent coverage and no upfront fees for policyholders. This Pacific Life insurance review helps you explain how the Living Needs Benefit offers up to 50% of the death benefit early for terminal illness.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated September 2025

Our Pacific Life insurance review details term and universal policies that offer tax-deferred cash value growth, with no upfront fees on universal plans.

Pacific Life Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 4.5 |

| Business Reviews | 4.5 |

| Claims Processing | 4.0 |

| Company Reputation | 5.0 |

| Coverage Availability | 4.5 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 2.7 |

| Digital Experience | 3.5 |

| Discounts Available | 3.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 3.5 |

| Savings Potential | 3.5 |

Pacific Life offers term and universal life insurance policies featuring the Living Needs Benefit program, which allows policyholders to access up to 50% of their death benefit early in the event of a serious illness.

Applicants between 20 and 100 can qualify for coverage with no upfront fees on universal life plans and a guaranteed minimum interest rate of 3%.

- Pacific Life insurance offers survivorship plans with $250k minimum face value

- Joint life policies help couples save up to 15% on shared premium costs

- Guaranteed purchase option lets the insured increase coverage without exams

Find detailed insights and ratings in our Pacific Life insurance review by entering your ZIP code into our free quote comparison tool.

Cost of Pacific Life Insurance

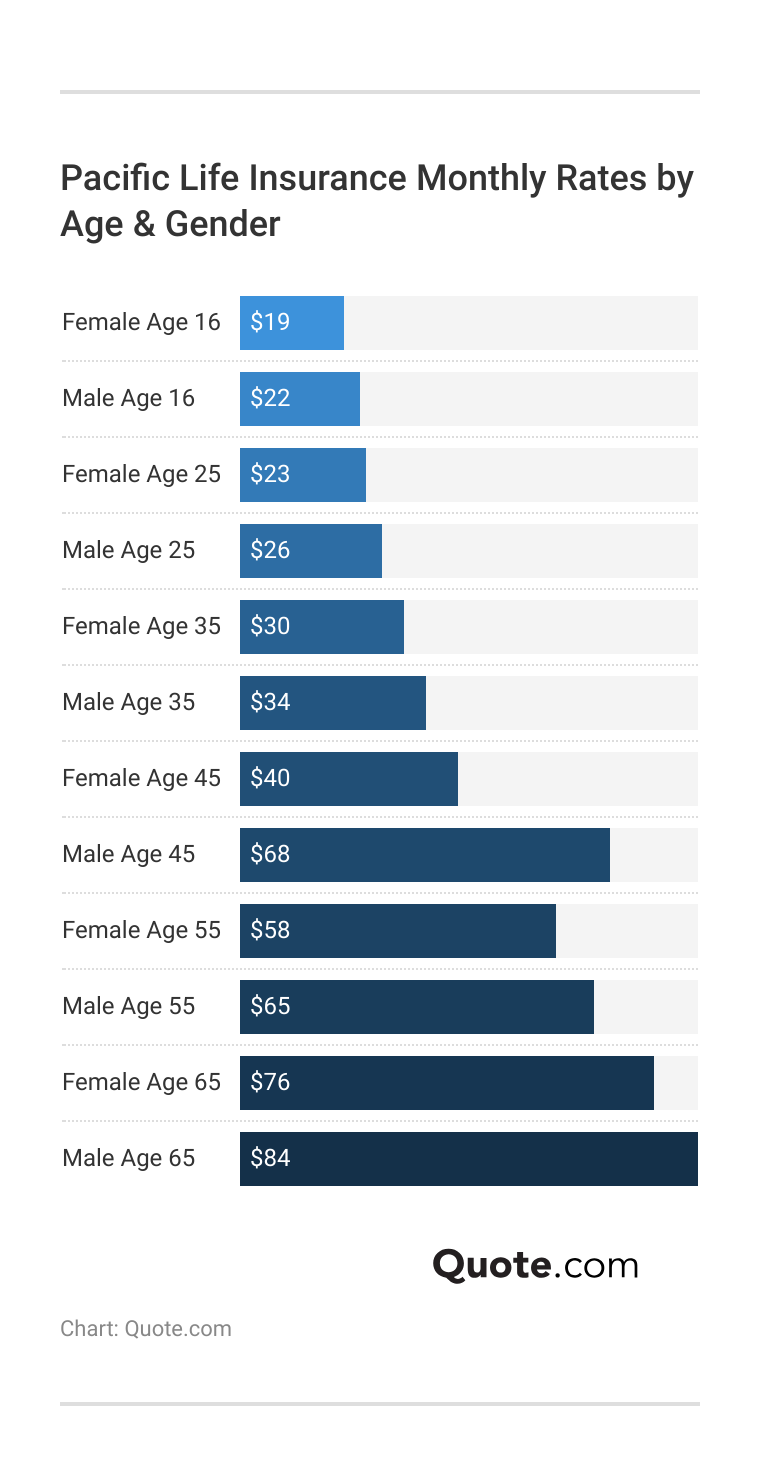

As people get older, Pacific Life insurance costs not only go up but also become more varied. Initially, premiums for men and women are quite similar. However, as they reach middle age, significant differences start to appear.

This happens because the way risk is calculated changes between genders over time. This chart shows not only rate changes, but also illustrates how age and gender influence affordability. It makes your birthdate and gender almost as crucial as your health history when getting a long-term policy.

Pacific Life remains a strong choice among many life insurance companies, offering good value with flexible benefits and options for early access. While some other companies focus on whole life policies that build up cash value, Pacific Life mixes long-term growth potential with useful features that are easy to use.

Pacific Life vs. Top Competitors: Life Insurance Monthly Rates| Insurance Company | 20-Year Term | Whole Policy |

|---|---|---|

| $19 | $165 |

| $32 | $390 |

| $34 | $410 | |

| $31 | $385 | |

| $36 | $455 | |

| $33 | $472 |

| $39 | $475 | |

| $37 | $400 |

| $38 | $435 | |

| $30 | $380 |

The real difference is evident in how providers prioritize liquidity, growth guarantees, and policy flexibility, making the details more important than the brand name when selecting your next life insurance plan.

Read more: Whole vs. Term Life Insurance

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pacific Life Insurance Coverage Options

The backbone of the company’s offerings and what it’s most commonly known for, Pacific Life insurance, comes with a variety of options depending on your lifestyle and goals. Pacific Life provides a range of main life insurance coverages that aim to match diverse financial and personal requirements.

Every type of policy is created with particular benefits, eligibility rules, and characteristics that attract different life stages, risk levels, and investment objectives. Here is an overview of Pacific Life’s main life insurance coverages, highlighting unique features and benefits for each.

- Term Life Insurance: Provides coverage for a set period (such as 10, 20, or 30 years) with a minimum death benefit of $500,000.

- Whole Life Insurance: Permanent life insurance that grows guaranteed cash value slowly over time, gives a set death benefit, and attracts people looking for coverage that lasts whole life.

- Universal Life Insurance (UL): A flexible, lasting policy that combines life insurance with tax-deferred savings, offering at least $25,000 as a death benefit.

- Variable Universal Life Insurance (VUL): Long-term insurance providing at least a $25,000 death benefit with investment choices connected to mutual funds.

- Living Needs Benefit Rider: An optional rider lets policyholders get up to 50% of their death benefit early if they find out they have a serious illness that qualifies.

These different coverages show Pacific Life’s dedication to giving specific solutions for various financial aims, whether you focus on cost-effectiveness, investment opportunities, or quick access during tough times. By carefully looking at each type of coverage, you can match your policy choice with your long-term goals.

The rate for your Pacific Life Insurance premium will depend on a number of factors, including your age, gender, health, whether or not you are a smoker/use tobacco, how long you want your (Term) insurance to run, and how much insurance you want to purchase, as well as the state you live in.

To get an accurate rate quote for life insurance from Pacific Life, it’s a good idea to start by getting an online quote and then comparison shop between life insurance providers to find the best deal that also gives you the benefits you want.

Pacific Life Insurance Add-ons

Depending on the insurance type you choose, you may be able to add on different features, such as a disability benefit, or add financial protection for your children in the event of your death.

Pacific Life’s Guaranteed Insurability rider lets you increase coverage later without medical proof. Such options help adjust as needs grow.

Melanie Musson Published Insurance Expert

Not all add-ons are available for all types of policies, so it’s a good idea to decide which type of life insurance you want first and then determine if the benefits of add-ons outweigh the costs.

Pacific Life insurance monthly rates change sharply with health status, showing clear cost tiers. A 20-year term starts at $19 for excellent health but jumps to $33 with minor health issues and $52 for chronic conditions.

Pacific Life Insurance Monthly Rates by Health Condition| Health Condition | 20-Year Term | Whole Policy |

|---|---|---|

| Excellent Health | $19 | $165 |

| Minor Health Issues | $33 | $155 |

| Chronic Conditions | $52 | $210 |

| Smoker | $65 | $260 |

| Advanced Age (60+) | $85 | $310 |

Smokers see rates at $65, while those aged 60 and above reach $85. Whole policies climb from $155 for minor risks to $310 for higher-risk categories, making health a defining factor in Pacific Life Insurance pricing.

Pacific Life Dental Insurance offers two PPO options with the same $50 per person deductible but different maximum payouts.

Pacific Life Dental Insurance Plans| Category | High PPO Plan | Low PPO Plan |

|---|---|---|

| Annual Deductible | $50 per person ($150 max per family) | $50 per person ($150 max per family) |

| Preventive Services | 100% coverage, no deductible | 100% coverage, no deductible |

| Basic Services | 80% coverage after deductible | 80% coverage after deductible |

| Major Services | 50% coverage after deductible | 50% coverage after deductible |

| Orthodontics | 50% coverage up to $1,750 lifetime max | 50% coverage up to $1,000 lifetime max |

| Annual Benefit | $1,750 per person per calendar year | $1,000 per person per calendar year |

Both cover preventive care at 100% without applying the deductible and handle basic services at 80% after the deductible is met. Major work gets 50% coverage, while orthodontics caps at $1,750 lifetime under the High PPO and $1,000 under the Low PPO. Annual benefits reach $1,750 per person for the High plan and $1,000 for the Low.

Pacific Life Vision Insurance Plans| Category | In-Network | Additional Features |

|---|---|---|

| Eye Exam | $10 copay | Diabetic eye exams covered every 6 months |

| Single-Vision Lenses | $25 copay | Free lens replacement for children under 19 |

| Frames Allowance | $130 allowance + 20% off balance | Access to exclusive eyewear discounts |

| Contact Lenses | $130 allowance | 15% discount on non-prescription lenses |

| Lens Coatings | Covered for kids under 19 | Optional upgrades at discounted rates |

| Laser Eye Surgery | Discounted rates available | Contact lens reimbursement for certain conditions |

Pacific Life Vision Insurance delivers practical in-network coverage paired with useful extras. Eye exams are just $10, with diabetic eye checks offered every six months. Single-vision lenses cost $25, and children under 19 receive free replacements.

Discover more by reading our guide: What is a life insurance beneficiary?

Pacific Life Insurance Customer Reviews and Complaints

Pacific Life demonstrates strong ratings on industry standards, combining sound financial practices, ethical behavior, and a customer-centric focus. Pacific Life insurance reviews from BBB show a solid B grade rating, along with an 86/100 from Consumer Reports, highlighting the insurer’s trustworthiness. It also received an A+ rating from A.M. Best, showing superior financial strength.

Pacific Life Insurance Business Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: B Excellent Business Practices |

|

| Score: 86/100 Good Customer Feedback |

|

| Score: 805 / 1,000 Above Avg. Satisfaction |

|

| Score: 0.19 Fewer Complaints Than Avg. |

J.D. Power’s 805/1,000 indicates better than average satisfaction, and NAIC’s 0.19 shows a very low complaint ratio. This means it is a trustworthy and reliable company.

Understanding what single premium life insurance is reveals how Pacific Life earns strong customer reviews for upfront flexibility.

How to Cancel Your Pacific Life Insurance Policy

If you want to cancel your Pacific Life Insurance policy, you’ll need to contact an agent directly. Fortunately, Pacific Life works with agents nationwide, so there’s likely one near you. If you cancel your Pacific Life policy early, learn what a modified endowment contract (MEC) could mean for your taxes.

You can cancel your life insurance plan beyond the initial period (usually 30 days), where you can cancel at no charge with no penalty. Otherwise, you can generally cancel at any time without cost, but you will not be refunded the monthly premiums you’ve paid so far.

It also may be more difficult to get insurance again in the future when you’ve grown older (or potentially developed other health conditions). You may need to write Pacific Life Insurance or call directly to cancel. On their website, you can find the most common numbers and addresses where you can reach them for various insurance products.

How to File a Claim With Pacific Life Insurance

In order to file an insurance claim with Pacific Life, you’ll want to contact the Life Insurance division at 1-800-347-7787, 5 am to 5 pm Monday-Friday, Pacific time. Should you need to change ownership of a policy, change the beneficiary, or change the name on the policy, customer service can direct you to the appropriate form.

Pacific Life Insurance Reviews Say About Complaints

Many of the most common processes can be handled online through Pacific Life’s website. However, you cannot change your payment details online or your address.

Updating beneficiaries or canceling your policy also requires a paper form. This can seem cumbersome and unwieldy if you’re used to handling things digitally, but it also provides an extra layer of security.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pacific Life Insurance Pros & Cons

Pros

- No Medical Exams Needed: Term policies up to certain limits (maximum $249,999) might qualify without a medical exam, making the approval process faster for those who are eligible.

- Living Needs Benefit Policy: This rider lets you get up to 50% of the death benefit early if a doctor says you have a qualifying terminal or chronic illness.

- Available Nationwide: Coverage is provided in every one of the 50 states. However, for policies in New York, they are issued by Pacific Life & Annuity Company (Learn More: What is a life insurance annuity?).

Cons

- No Direct Email Service: For customer questions, you must contact agents or call service centers, as email support is not available. Check out our “Life Insurance Guide” for essential coverage information.

- Third-Party Seller: Policies are available only through licensed agents or partner institutions, not directly from Pacific Life.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What to Know Before Choosing Pacific Life

Founded in 1868 as Pacific Mutual Life, the company originally only offered life insurance policies but added accident policies in 1885. They’ve survived a number of national catastrophes, including the 1906 San Francisco earthquake and the Great Depression in the 1930s.

It underwent a name change back in 1997, from Pacific Mutual Life to Pacific Life Insurance, due to corporate restructuring. As a mutual holding company, they are owned by policyholders, not shareholders. Currently, they are the fourth-largest insurance company in total life insurance sales. They are also one of the few companies to offer policies in all 50 states.

Pacific Life reached $239 billion in assets, $1.5 trillion in life insurance in force and ranked 282 on the FORTUNE 500 list by total revenue rank. Read the full Annual Report here: https://t.co/vp1CcOVOi7 pic.twitter.com/H1ZwYBeKZr

— Pacific Life (@pacificlife) April 10, 2025

Pacific Life offers three major types of products: Life insurance, mutual funds, and annuities. For the purposes of this review, we’ll be focusing exclusively on the different types of life insurance the company offers.

Their most sought-after product and the one that is rated highest in terms of sales is their universal life insurance policies. Universal life is a highly popular alternative to traditional term and whole life insurance. See more details about each type of life insurance offered by Pacific Life by continuing to read.

Pacific Life, supported by more than a hundred years of solid financial history, has built its name as a trusted and dedicated life insurance company. By focusing only on life insurance, the firm offers expert and caring service while handling claims very quickly. This makes Pacific Life a dependable option for both families and individuals.

Custom underwriting programs cater to high-net-worth individuals. In essence, it accommodates complex financial profiles seamlessly.

Jeff Root Licensed Insurance Agent

Pacific Life has coverage all over the 50 states, so if you move, your policy can go with you. However, some extras and benefits might be different based on where you live.

Pacific Life provides many kinds of policies, like term, whole, universal, and variable universal life insurance. They also have a strong list of optional add-ons called riders that let you adjust the coverage to fit your special money goals and situations. Begin comparing policies and add-ons with our Pacific Life insurance review by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

Do products/services offered by Pacific Life differ from state to state?

Yes. Depending on where you live, you may or may not have access to certain features or policy riders. Because Pacific Life insurance is sold by third parties, there may be some restrictions or exclusions from one state to another.

What is the Pacific Life insurance phone number for inquiries?

The main Pacific Life insurance phone number for life insurance inquiries is 1-800-347-7787, available Monday through Friday during business hours. Compare Pacific Life insurance review details by entering your ZIP code into our free quote comparison tool.

How can a Pacific Life insurance quote be obtained?

A Pacific Life insurance quote can be requested through a licensed agent, as the company does not sell policies directly to consumers online.

How does the Pacific Life insurance login work for policyholders?

The Pacific Life insurance login portal allows policyholders to view account details, make payments, and manage policies securely online. Learn how the Pacific Life insurance login experience aligns with findings in the Mutual of Omaha insurance review for users.

What do Pacific Life annuity reviews highlight about performance?

Pacific Life annuity reviews often highlight competitive growth options, strong financial ratings, and customizable retirement income features.

How much is a Pacific Life term life insurance quote per month?

A Pacific Life term life insurance quote starts around $14 per month for qualifying applicants, though actual rates vary by age, health, and coverage amount.

What is notable about Pacific Life’s customer service quality?

Pacific Life’s customer service is recognized for being knowledgeable and responsive, providing personal assistance through agents and direct support channels.

Is Pacific Life life insurance good?

Pacific Life life insurance is considered good due to strong financial ratings, customizable policies, and a low complaint ratio compared to industry averages. Learn what to do when you’re denied insurance coverage if Pacific Life life insurance is not the right fit for you.

Who owns Pacific Life Insurance?

Pacific Life Insurance is owned by its policyholders through a mutual holding company structure rather than shareholders.

Is Pacific Life financially stable?

Pacific Life is financially stable, earning consistent high ratings such as an A+ from A.M. Best, reflecting its ability to meet policy obligations.

Does Pacific Life insurance require a medical exam?

Is Pacific Life being bought out?

Is Pacific Life a fiduciary?

Does Pacific Life insurance have living benefits?

Is Pacific Life the most trusted life insurance company?

Does Pacific Life have the best term life insurance?

What is the financial rating of Pacific Life?

How much do Pacific Life executives make?

How much is $100,000 in Pacific Life insurance a month?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.