When Animals or Natural Disasters Damage Your Vehicle in 2026 (Advice + Coverage Guide)

When animals or natural disasters damage your vehicle, only comprehensive insurance covers these costs. With 1.25 million animal collisions occurring annually in the U.S., get the proper car insurance coverage for animal damage and auto insurance that covers natural disasters.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated December 2025

When animals or natural disasters damage your vehicle, comprehensive insurance is essential, with 1.25 million animal collisions occurring annually in the U.S. alone.

- Comprehensive insurance covers 1.25 million annual animal collisions in the U.S.

- Natural disaster coverage includes floods, hail damage, and tornado-related losses

- Some insurers waive deductibles for minor windshield repairs from animal impacts

This coverage goes beyond basic collision auto insurance to protect against wildlife impacts, severe weather, and natural disaster-related car insurance claims. Premiums average $143 nationwide, ranging from $90 in Oregon to $238 in Kansas.

You may wonder what happens if you are caught in such a freak accident. Does car insurance cover acts of nature? What is the procedure for dealing with such an accident on the spot? And does car insurance cover animal damage?

This article is here to answer your concerns regarding auto damage as a result of random animal accidents and natural disaster events. Stop overpaying for auto insurance. Enter your ZIP code to compare comprehensive car insurance rates.

Insurance Covers Animal and Natural Disasters

Obviously, animals and weather do not have insurance. Even though it may entirely be their fault for damaging your automobile, you cannot put the blame on the “other” party. In cases of animal damage car insurance claims, many people assume that their collision policy will cover the loss and repair.

Even though the accident is a collision, collision coverage only covers repairs from a collision that involves two or more automobiles or crashing into an inanimate object.

Read More: A Visual Guide to Auto Insurance

In other words, if you’re wondering whether car insurance covers bear damage or damage from animals, the answer is yes, but only with comprehensive insurance, not collision coverage.

When a collision with an animal occurs, comprehensive coverage is essential, as this is the only policy that helps you get reimbursed for the loss and repair.

Similarly, if you’re asking if car insurance covers natural disasters, comprehensive coverage is again the answer for protection against both wildlife and weather damage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Comprehensive Auto Policies

If you are unfamiliar with coverage terms, here is a quick explanation of the 3 types of insurance offered by providers:

- Liability: Legally required for all drivers except those in New Hampshire. It pays for damages to another person’s property or automobile in an accident where you are at fault.

- Collision: Although your state may not demand that you have collision auto insurance, it is often required if it is leased or paid in installments. In any accident, whether you are at fault or not, it covers the cost of collision-specific repair to your own vehicle.

- Comprehensive: Sometimes referred to as other-than-collision coverage (OTC), it covers non-collision-related expenses.

Is comprehensive insurance mandatory? Although it is not mandatory by the state’s regulation, it may be a requirement if you are leasing or paying for it in installments.

If you do not comply with the agreement, your auto lender or leaseholder does have the right to void the contract and take back the automobile, as you have not fulfilled your end of the deal to secure sufficient financial protection for the automobile.

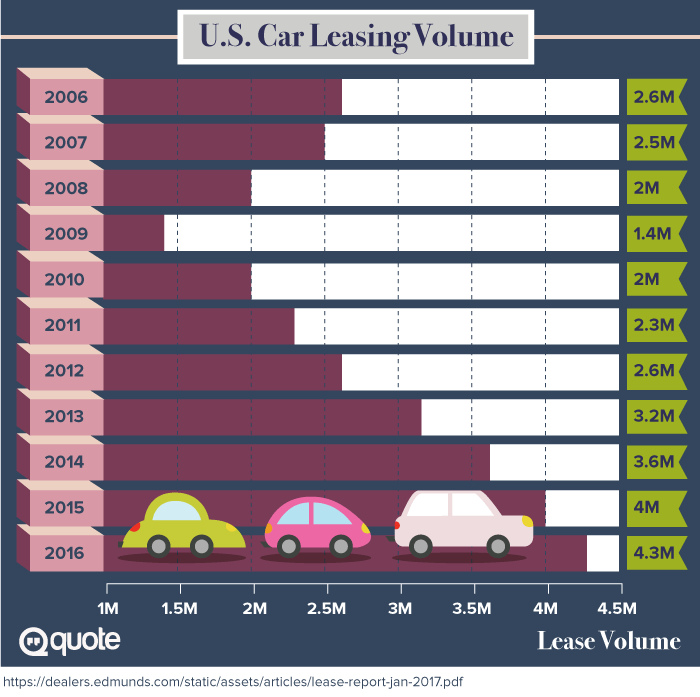

On the other hand, even if you own your car outright, there are still benefits of having this option. According to a survey in 2016, about 70% of the United States insurance policyholders have bought OTC car insurance coverage along with their liability policy.

In general, it is an add-on option purchased by brand-new or expensive auto owners. Because in cases where the automobile is totaled, the owner will be reimbursed the full price of the automobile’s market value.

But what about owners of older or economic cars? Depending on where you live, it may be a great coverage to have, particularly when considering the best vehicle for natural disaster protection.

For example, if you live in an area where certain natural disasters are common occurrences such as floods, hail storms, and tornados; or you live in rural country areas where particular large creatures roam in the surroundings such as elks, deer, moose, and bears, you are much more likely to experience automobile destruction that is not related to collisions.

When you constantly have to pay out-of-pocket for car maintenance disasters, the costs can add up to more than the annual premium. In extreme cases where your automobile suffers a total loss in a car vs. animal encounter, you will not be reimbursed for any money unless you have OTC coverage.

The Cost of Comprehensive Car Insurance

Just like any auto insurance application, the premium rate depends on factors such as the vehicle model, age, mileage, credit history, and driving record. One important deciding factor you should not overlook when it comes to premiums is that where you reside plays a significant role in determining how much you have to pay.

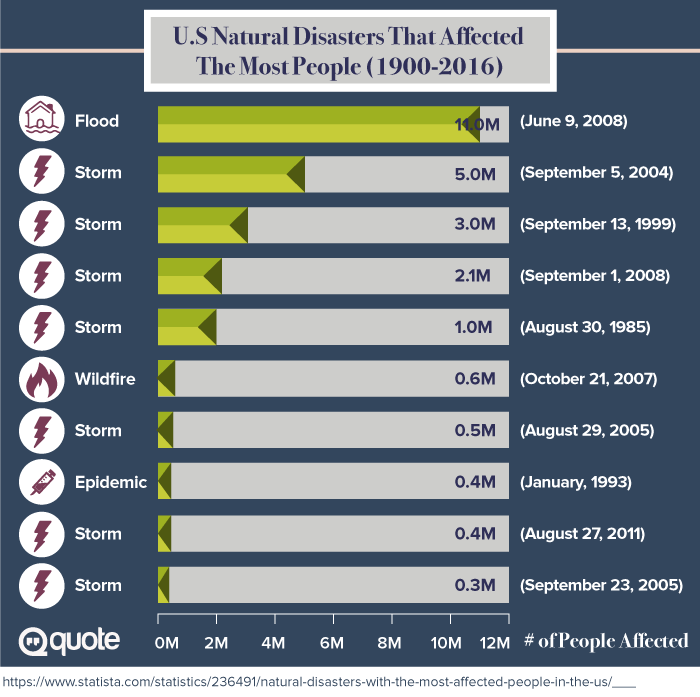

For example, certain states have a higher rate because they are more prone to various natural disasters, such as floods and tornadoes. This explains why many drivers ask if car insurance covers natural disasters and if animal damage is also covered, which can affect their premiums.

Comprehensive Car Insurance Monthly Premiums by State| State | Monthly Premium |

|---|---|

| Alabama | $13 |

| Alaska | $12 |

| Arizona | $15 |

| Arkansas | $16 |

| California | $8 |

| Colorado | $14 |

| Connecticut | $11 |

| Delaware | $10 |

| D.C. | $19 |

| Florida | $9 |

| Georgia | $13 |

| Hawaii | $8 |

| Idaho | $10 |

| Illinois | $10 |

| Indiana | $10 |

| Iowa | $15 |

| Kansas | $20 |

| Kentucky | $11 |

| Louisiana | $18 |

| Maine | $8 |

| Maryland | $12 |

| Massachusetts | $11 |

| Michigan | $12 |

| Minnesota | $15 |

| Mississippi | $17 |

| Missouri | $15 |

| Montana | $18 |

| Nebraska | $19 |

| Nevada | $10 |

| New Hampshire | $9 |

| New Jersey | $11 |

| New Mexico | $14 |

| New York | $14 |

| North Carolina | $11 |

| North Dakota | $19 |

| Ohio | $10 |

| Oklahoma | $18 |

| Oregon | $8 |

| Pennsylvania | $12 |

| Rhode Island | $10 |

| South Carolina | $15 |

| South Dakota | $20 |

| Tennessee | $12 |

| Texas | $16 |

| Utah | $9 |

| Vermont | $10 |

| Virginia | $11 |

| Washington | $9 |

| West Virginia | $17 |

| Wisconsin | $11 |

When evaluating quotes, it’s important to know the worst states for filing an auto insurance claim, and consider how natural disasters affect animals in your area—displaced wildlife can increase collision risks, leading to higher premiums.

Understanding whether comprehensive coverage of total loss incidents from these events helps you make informed decisions about your coverage needs.

Buying Comprehensive Protection

Before contacting your agent, ask yourself these several questions, do some calculations, and avoid ways you’re wasting money on your car:

Is this your only vehicle, and do you depend on it as your daily ride to work and other essential daily activities?

If this is your only way to get to work, you should definitely get the protection as it helps out with the repair cost and makes sure you can get back on the road as soon as possible without affecting your life. This is especially important when considering insurance coverage for animal damage and car incidents that could leave you stranded.

In cases where your automobile is totaled from a collision, a comprehensive animal coverage can quickly reimburse you and get a new car for your essential needs.

How old is your car, and what is its current market value?

If it is quite old, where the providers will pay you very little money in the event of it being totaled, you may want to skip the coverage. This is especially true if you are using your current old automobile as a beater and plan to drive it into the ground before selling it to the junkyard.

However, if your auto is relatively new and expensive to fix, buying the optional coverage will be a wise investment. To make it even simpler, OTC auto insurance coverage is for you if:

- You lease

- You are paying it in installments and have not finished paying for the whole sum

- You took out a car loan on your automobile for various reasons

- Your area is known for the high frequency of vandalism and/or theft

- Your area is known for severe natural disaster problems (e.g., hail, tornadoes, tsunamis, floods, etc.).

- Your area is known for having an abundant amount of wildlife roaming in your neighborhood or highways

- You cannot afford to fix the damage or replacement

You probably don’t need it if your automobile is old and not worth much based on market value (you can quickly check the price on the Kelley Blue Book website). If the payout is less than the annual comprehensive premium, it is an easy choice to just skip the add-on option and save the money.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Should Be Aware Of When Purchasing a Comprehensive Policy

Here are six essential factors to consider when purchasing comprehensive insurance to ensure you’re adequately protected against animal collisions and natural disasters without overpaying for unnecessary coverage:

- Not all policies from each provider are the same. Make sure that your company offers the coverage you actually need.

- Like other coverage, you are required to pay your insurance deductible before your insurer starts paying for the rest of the repair. So, before you start the claiming process, you may want to bring your automobile to a repair shop for a quote to decide whether it is worth it to make a claim. If the estimated job is less than your deductible, you may as well pay for it out of your pocket.

- Most insurers will waive your deductible if your windshield repair is only for a crack or pit hole smaller than a dollar coin. Anything bigger will require the whole glass to be replaced, and you will need to pay your deductible in such circumstances.

- Some providers require that you buy both collision and comprehensive coverage as a package, whereas other companies will allow you to buy one without the other, so that you do not need to pay extra for something you do not need.

- If it is totaled in the accident, you’re policy will only pay you the estimated fair market value of the auto.

- If you have a loan or lease, you may want to consider getting gap coverage. This add-on option will cover the difference between what you owe and the car’s cash value.

Remember, comprehensive insurance is your primary protection against unpredictable animal and weather-related damage, so choose your coverage carefully and know how to compare auto insurance companies.

How to Keep Your Premiums Low

There are several ways to get the cheapest car insurance, depending on your scenario. The following tips may help you slash your annual rate to the bare minimum:

If you cannot afford to make major repairs and/or replacements, but you live in an area where encounters with beasts and other situations that require over-the-counter (OTC) protection are rare, you may opt for a higher deductible. The usual deductibles are on average $500.

However, if you choose to increase it to $800 or even $1,000, you can see the rate significantly decrease. This way, there is always an assurance that if you do total your auto, your insurer will take care of you.

Shop around for local deals. Sometimes, local insurers will give you a better quote because they understand the common OTC claims in your area. That being said, make sure the provider is reputable and has a strong financial standing. Even if the premium is low, if they cannot reimburse your claim, it makes the policy equally useless.

If you live in a state that has relief funding for natural disaster losses, you may use that in combination with comprehensive coverage. This way, you can choose a lower quality insurance package and still receive the benefits.

How OTC Increases Premiums

Compared to the other two types of policies, this type of coverage does not reflect upon you as a high-risk driver, as these accidents are more to do with the freak of nature run of the luck occurrences.

Even though one expensive claim can increase your rates, it is likely to increase by 2%. If you are wondering what the typical average claim loss is, it's $1,585 on average.

Michael Vereecke Commercial Lines Coverage Specialist

As mentioned earlier, some companies are even willing to overlook the deductible if your windshield issue is minor (you are required by law to fix a windshield dent or crack that is on the driver’s sid,e as it obstructs the view, making it dangerous to drive on the road).

So, if the repair is more than your deductible, it’s definitely worth claiming the accident and keeping your automobile rated at a higher market value.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Should Do When You Hit an Animal

Does auto insurance cover hitting a deer? Yes, when you have comprehensive insurance on your policy, it will cover if you hit a deer or another animal.

Hitting an animal while driving can be frightening and dangerous. With approximately 1.25 million animal collisions occurring annually in the United States, knowing the proper response is crucial for your safety and insurance claims.

- Move to Safety: Pull over to the side of the road, turn on hazard lights, and avoid standing in traffic.

- Don’t Approach Injured Animals: They can be unpredictable and dangerous when wounded, even if they appear helpless.

- Call Police Immediately: File an official report for insurance purposes, especially if there are injuries or property damage.

- Document Everything: Take photos of damage, injuries, road conditions, and save the GPS location for your claim. One of the key points is how to file an auto insurance claim & win it each time.

- Contact Your Insurance Agent: Report the incident promptly, providing your policy number, vehicle details, and the location of the accident.

Always err on the side of caution after an animal collision. Even if the damage appears minimal, have your vehicle inspected professionally before driving it again.

Remember, deer collisions peak during mating season (October to December) and often occur at dawn or dusk, when visibility is poor.

Harvesting a Fresh Roadkill

If you are one of the people who believe that eating fresh roadkill is both ethical and sensible, you need to contact your local DMV concerning the issue. In certain states, such as Texas, Tennessee, California, and Washington, it is illegal to harvest or collect a carcass in any way after it has been killed in an auto accident.

This is to prevent poachers from using it as a loophole to illegally hunt for animals during the off-season. However, for other states such as West Virginia, it is legal for you to harvest the carcass as long as you report the accident within 12 hours.

There are other states, such as Wyoming and Vermont, that do require you to have a game warden to examine the carcass and tag the animal as roadkill before you can harvest the meat. So, to avoid unnecessary legal trouble, it is best to first consult with your local DMV or law enforcement officers before collecting the carcass.

Hail: Cosmetic Dilemma

Hail is a tricky issue. Even though the damage is almost always cosmetic, you never know what can of worms you will open. For minor hail blemishes, most people would choose to live with the ugly minor dents and opt out on repair.

Get hail coverage, and learn more in our 21st Century insurance review, as they offer protection for your car against hail.

But when hail rains down in the size of golf balls or even baseball sizes, people may decide to claim. In these cases, people may be surprised to find that their insurers see the dents to be severe enough to label their auto as “totaled”. Under such circumstances, your state will allow the company to declare it a total loss and mark it with a salvage title.

How Providers Calculate the “Totaled” Formula

In general, automobiles are regarded as “totaled” when the repair cost is higher than the car’s actual cash value (It is often referred to as ACV which stands for the value of your auto based on comparing the market value of the same automobile in mint condition and the wear and tear condition of yours).

However, in some cases, such as flood and hail, where it is not practical to fix a car due to the extensive cosmetic blemishes, as mentioned in our AAA auto insurance review, AAA deems an automobile “totaled” even if the repair cost is less than the ACV.

In these circumstances, the state laws and the company guidelines become the determining factor on whether a vehicle is regarded as totaled. For insurers, the “damage ratio” (also known as “total loss ratio”) is the deciding factor. This ratio is calculated by dividing the cost of repair by the ACV.

Total Loss Ratio = Repair Cost / ACV

This percentage is then compared to the company and/or state law minimum ratio limits to qualify for the salvage title (this limit is known as the total loss threshold, or commonly known as TLT). For certain states that have a firm regulation to TLT, the total loss ratio must exceed the TLT in order to qualify for the salvage title.

These states have the following TLT threshold mandated by law:

Total Loss Threshold (TLT) Requirements by State Law| State | TLT Threshold |

|---|---|

| Arkansas | 70% |

| Colorado | 100% |

| Florida | 80% |

| Indiana | 70% |

| Iowa | 50% |

| Kansas | 75% |

| Kentucky | 75% |

| Louisiana | 75% |

| Maryland | 75% |

| Michigan | 75% |

| Minnesota | 70% |

| Missouri | 80% |

| Nebraska | 75% |

| Nevada | 65% |

| New Hampshire | 75% |

| New York | 75% |

| North Carolina | 75% |

| North Dakota | 75% |

| Oklahoma | 60% |

| Oregon | 80% |

| South Carolina | 75% |

| Tennessee | 75% |

| Texas | 100% |

| Virginia | 75% |

| West Virginia | 75% |

| Wisconsin | 70% |

| Wyoming | 75% |

For other states that have more flexible regulations, the carrier will decide based on their Total Loss Formula (TLF):

Cost of Repair + Salvage Value > Actual Cash Value

If the restoration cost and the salvage car value are greater than the ACV value, the car can then be declared as a total loss.

You Can Still Drive A Hail-Totaled Vehicle

If you intend to keep the “totaled” automobile despite the salvage title and the severe cosmetic blemishes, you can ask your provider to buy it for its salvage value. For example, your provider is Esurance, and if your auto was worth $20,000 before the incident and Esurance places the salvage price at $8,000, they will send you a check for the difference minus your deductible.

Read More: Everything You Need to Know About Esurance

Depending on your state’s regulations, your auto may require an inspection to prove that it is safe to drive before you can get back on the road. Please note that a salvage title car is difficult to insure for future crashes and OTC coverage because its value is particularly difficult to determine.

Always Purchase Comprehensive Coverage for Rental Cars

If you’re on vacation, comprehensive coverage is a must. For any nicks and dings on the rental, the rental company has the right to fine you for all the wear and tear. It is sad, but it is a common practice for many car rental companies to swipe renters without OTC protection.

To an increasing number of unfortunate vacationers, this can become quite an astonishing fee, as these repair costs can run into thousands if not tens of thousands.

In extreme cases where a severe hailstorm strikes while you are driving, the company can charge you for the total loss. If you do not have coverage, you will have to pay the whole fee out of your pocket. So, to avoid being dragged through phone tags, arguments, and even lawsuits, obtaining a comprehensive policy can help you concentrate on having fun.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to File a Claim for Damage From Natural Disasters

You may wonder what happens if your automobile gets flushed away by the flood or flies away like the Wizard of Oz scenario. No, you do not need to hunt down your vehicle before you can file a claim. But how do you file a claim when you have no evidence, and what do you do when you’re denied insurance coverage? These tips will help you assess the situation much more easily:

- Don’t worry about evacuation damage. Collision coverage protects you if you hit something while fleeing from tornadoes or tsunamis.

- Make temporary repairs immediately. Cover broken windows with tarps to prevent further damage, keeping all receipts for reimbursement.

- Be patient with insurers. Major companies have 24/7 emergency teams but expect delays as they process thousands of claims simultaneously.

- Document everything possible. Photograph damage, record your car’s last known location, and use GPS tracking if your vehicle disappears.

- Never start water-damaged vehicles. Check for wet seats and air filters; saltwater damage can be catastrophic to electronics and metal components.

Insurance companies understand that during natural disasters, your priority is safety, not filing claims. They offer special hotlines and extended grace periods for reporting. If your vehicle is completely lost, insurers will typically declare it totaled and reimburse you according to the terms of your policy.

Protecting Yourself Against Acts of Nature in Auto Insurance

When animals or natural disasters damage your vehicle, comprehensive auto insurance is your essential protection against acts of nature. Understanding the difference between acts of nature vs. acts of God in insurance terminology helps drivers navigate coverage options effectively.

While both terms often refer to similar events, acts of nature, such as animal collisions, floods, hail, and tornadoes, specifically fall under comprehensive coverage, not collision. When wondering, “Is an act of God covered by car insurance?” remember that only comprehensive coverage provides this protection.

If you’re looking to lower your act of nature insurance claims, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Frequently Asked Questions

What animals do you have to report if you hit one?

Report any animal collision that causes injury, property damage, or obstructs traffic. Call the police for large animals like deer, moose, or bears, and get an official report.

Does insurance cover bear damage?

Yes, comprehensive insurance covers bear damage to vehicles, not collision coverage. This includes damage from bear attacks, scratches, broken windows, or interior damage while foraging.

What natural calamities are covered in car insurance?

Comprehensive insurance covers floods, hail, tornadoes, tsunamis, falling objects, sinkholes, and other natural disasters. Collision coverage won’t protect against weather-related damage or acts of nature.

Read More: What We Learned Analyzing 815 Insurance Companies

Does shelter insurance cover rental cars?

Comprehensive coverage is essential for rental cars to avoid costly repair fines from rental companies. Rental companies can charge thousands for minor damage if you don’t have proper coverage. If you’re just looking for coverage to drive legally, enter your ZIP code to compare cheap auto insurance quotes near you.

Why should you be afraid of legal problems after a collision that was your fault, even if you have insurance?

State laws may require salvage titles after significant damage, which can affect future insurance eligibility. Some states prohibit harvesting roadkill, which can create potential legal issues if you collect carcasses. Additionally, traffic collision reconstruction may reveal liability issues not initially apparent, potentially exposing you to legal consequences beyond your insurance coverage.

Will car insurance cover a natural disaster?

Yes, comprehensive insurance covers damage from natural disasters, including floods, hail, tornadoes, and wind. Collision coverage only protects against crashes involving other vehicles or objects.

What is the difference between full coverage, comprehensive, and collision insurance?

Collision coverage covers damage from hitting vehicles or objects. Comprehensive coverage covers non-collision damage like animal impacts, weather, theft, vandalism, and natural disasters.

What does Allstate full coverage cover?

Allstate’s full coverage includes comprehensive protection for natural disasters, animal collisions, theft, vandalism, plus collision coverage. They offer 24/7 emergency teams for major disaster claims.

Read More: Allstate Auto Insurance Review

What agency deals with natural disasters in the US?

Insurance companies have dedicated emergency teams for natural disasters. Some states also offer relief funding for natural disaster losses.

Is it better to have a $500 deductible or a $1000?

Choose higher deductibles ($1,000) if you can’t afford major repairs but live in low-risk areas. This significantly lowers premiums while maintaining catastrophic coverage.

What does fully comprehensive insurance cover?

Who responds to natural disasters in the US?

What is the difference between a disaster and an emergency?

Does home insurance cover natural disasters?

Which agency is responsible for disaster prevention?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.