10 Best Auto Insurance Companies in Colorado (2026)

Auto-Owners, American Family, and State Farm are the best auto insurance companies in Colorado. Auto-Owners offers reliable claims handling and the cheapest car insurance in Colorado at just $38 a month. American Family delivers great customer service, and State Farm provides trusted support through local agents.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated November 2025

The best auto insurance companies in Colorado are Auto-Owners, American Family, and State Farm, with starting rates as low as $38 per month. Auto-Owners ranks first for its reliability and top-tier A++ financial strength.

- The cheapest car insurance in Colorado starts at $38 per month

- Auto-Owners offers flexible plans and an A++ financial strength rating

- Colorado drivers must carry 25/50/15 minimum liability coverage

American Family comes in second for its excellent customer service, a wide range of local agents, and valuable car insurance discounts you can’t miss for good drivers.

State Farm rounds out the top three with high customer satisfaction scores, strong agent support, and low rates.

Our Top 10 Picks: Best Auto Insurance Companies in Colorado| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 659 / 1,000 | A++ | Reliability Focused | Auto-Owners | |

| #2 | 656 / 1,000 | A | Customer Service | American Family |

| #3 | 646 / 1,000 | A++ | Agent Support | State Farm | |

| #4 | 633 / 1,000 | A+ | Rideshare Drivers | Allstate | |

| #5 | 618 / 1,000 | A++ | Senior Discounts | Geico | |

| #6 | 618 / 1,000 | A+ | Vanishing Deductible | Nationwide | |

| #7 | 614 / 1,000 | A+ | High-Risk Drivers | Progressive | |

| #8 | 613 / 1,000 | A | Comprehensive Policies | Liberty Mutual |

| #9 | 606/ 1,000 | A | Online Tools | Safeco | |

| #10 | 599 / 1,000 | A | DUI Drivers | Farmers |

We’ve ranked the best auto insurance companies in Colorado to help you compare top providers.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Auto Insurance Rates in Colorado

Auto-Owners, Liberty Mutual, and Safeco lead the pack in Colorado for affordable monthly premiums. However, the top three companies have higher customer satisfaction despite more expensive premiums.

Colorado Auto Insurance Monthly Rates by Coverage| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $74 | $240 | |

| $52 | $174 |

| $38 | $245 | |

| $72 | $140 | |

| $42 | $139 | |

| $41 | $178 |

| $48 | $135 | |

| $54 | $158 | |

| $40 | $101 | |

| $42 | $130 |

State Farm remains one of the cheapest car insurance companies in Colorado, with $42 monthly rates for minimum coverage and $130 per month for full coverage. While affordable for minimum coverage, Auto-Owners is on the higher end for full coverage, exceeding $200 monthly.

However, Auto-Owners is a top choice because it does a good job with claims, has coverage people can count on, and is in strong financial shape. It’s a solid option for Colorado drivers who want to feel secure for the long run..

American Family also justifies its higher rates with award-winning customer service and personalized support, while State Farm combines affordability with trusted local agents and strong multi-policy discounts.

Colorado Auto Insurance Rates by Age

Auto insurance rates in Colorado drop significantly with age. At age 35, monthly premiums start at $39 per month.

Seniors also enjoy some of the most affordable rates, with rates as low as $40 per month (Read More: Cheap Auto Insurance for Seniors).

Colorado Auto Insurance Monthly Rates by Age| Insurance Company | Age: 16 | Age: 25 | Age: 35 | Age: 45 | Age: 55 | Age: 65 |

|---|---|---|---|---|---|---|

| $339 | $90 | $78 | $74 | $69 | $72 | |

| $208 | $67 | $60 | $52 | $49 | $52 |

| $195 | $62 | $53 | $49 | $46 | $50 | |

| $452 | $89 | $80 | $72 | $68 | $71 | |

| $146 | $40 | $39 | $42 | $40 | $41 | |

| $164 | $44 | $42 | $41 | $38 | $40 |

| $248 | $64 | $56 | $48 | $44 | $47 | |

| $407 | $67 | $58 | $54 | $50 | $53 | |

| $218 | $71 | $62 | $58 | $54 | $56 | |

| $186 | $58 | $46 | $42 | $40 | $41 |

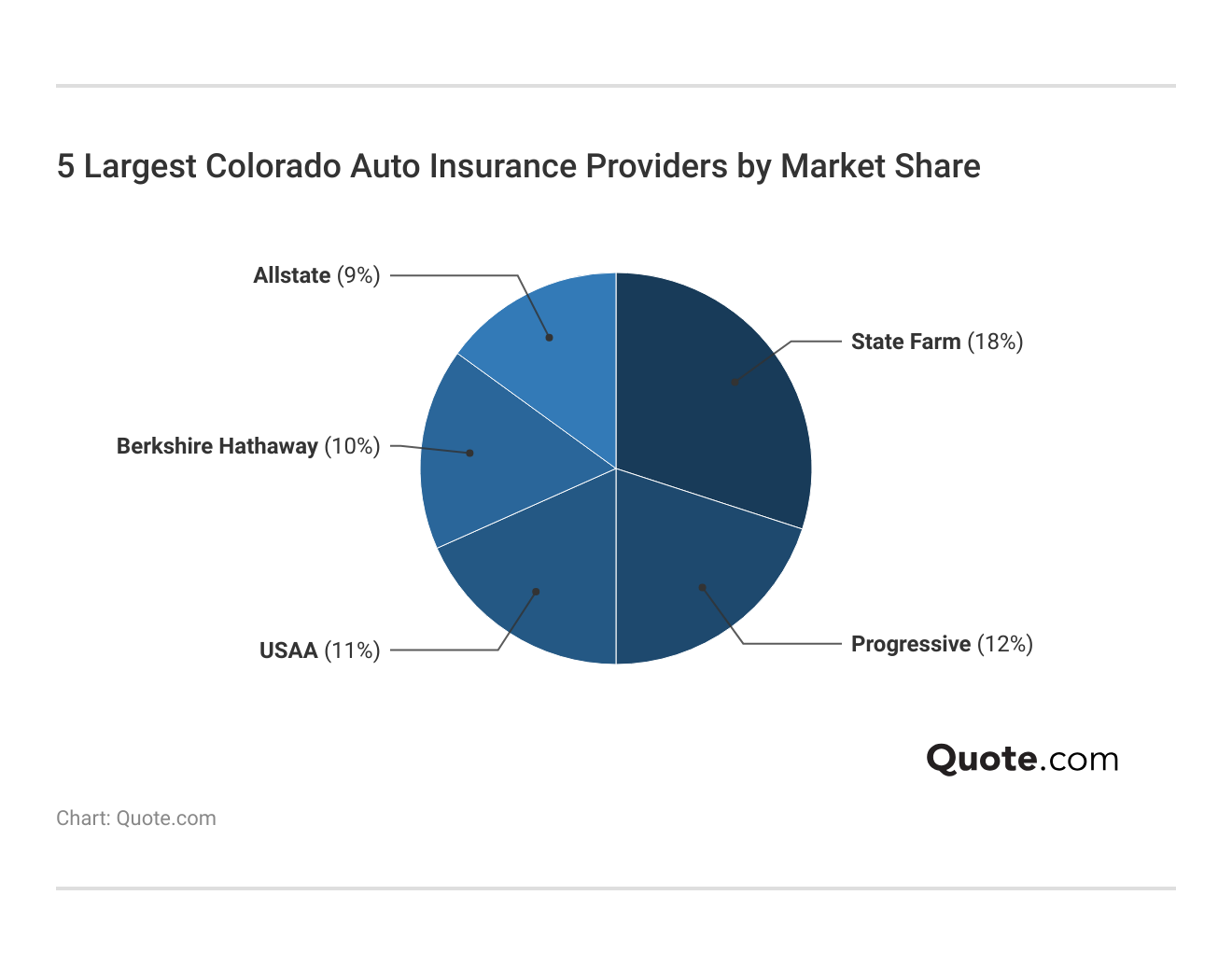

While rates vary by age , the provider you choose also plays a major role. According to market share data, State Farm leads Colorado with 18% of the market, followed by Progressive (12%), USAA (11%), Berkshire Hathaway (10%), and Allstate (9%).

These top companies offer competitive pricing and broad availability, but it’s still important to compare quotes based on your driving profile to find the best rate.

Colorado Auto Insurance Rates by Driving Record

Auto-Owners offers the best minimum rates across all driving records in Colorado, with clean record drivers paying just $38 per month and DUI-affected drivers only $61.

Colorado Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $74 | $92 | $101 | $83 | |

| $52 | $80 | $93 | $62 |

| $38 | $49 | $61 | $44 | |

| $72 | $102 | $101 | $92 | |

| $42 | $64 | $72 | $53 | |

| $41 | $49 | $50 | $49 |

| $48 | $81 | $112 | $55 | |

| $54 | $92 | $61 | $69 | |

| $40 | $59 | $74 | $48 | |

| $42 | $49 | $46 | $46 |

State Farm is also competitive, charging just $42 for drivers with a clean record and $46 for those with a DUI, the lowest DUI rate among all listed providers. On the opposite end, Nationwide charges up to $112 a month for DUI drivers, and Farmers and Allstate both exceed $100 per month for high-risk categories.

While most companies raise rates after violations, Auto-Owners and State Farm remain the most forgiving, making them smart choices for both safe and high-risk drivers in Colorado.

Larger cities like Denver and Colorado Springs see the most traffic-related claims, which means premiums are often higher in these cities. Smaller cities still show notable claim volumes, making location a key factor in Colorado insurance rates.

Annual Traffic Accidents & Claims by Colorado Cities| City | Accidents | Claims |

|---|---|---|

| Aurora | 7,500 | 6,000 |

| Boulder | 2,000 | 1,600 |

| Colorado Springs | 9,000 | 7,000 |

| Denver | 14,000 | 11,000 |

| Fort Collins | 3,500 | 2,800 |

| Greeley | 1,800 | 1,400 |

| Lakewood | 3,200 | 2,500 |

| Pueblo | 2,500 | 2,000 |

| Thornton | 2,800 | 2,200 |

| Westminster | 2,400 | 1,900 |

In addition to urban accidents, Colorado’s unpredictable weather and mountainous terrain play a major role in driving up insurance costs. Snow, ice, hail, and steep mountain roads increase the risk of single-vehicle and rollover accidents, which are among the most expensive claim types in the state.

That’s why comprehensive auto insurance is so important for Colorado drivers — it covers non-collision damage like hail, falling trees, animal strikes, and flood-related losses, all of which are common across the state.

5 Most Common Auto Insurance Claims in Colorado| Rank | Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|---|

| #1 | Rear-End Collisions | 43% | $53,356 |

| #2 | Angle (Side-Impact) Collisions | 18% | $54,231 |

| #3 | Sideswipe Collisions | 12% | $10,183 |

| #4 | Single‑Vehicle Accidents | 10% | $57,740 |

| #5 | Rollover Accidents | 5% | $100,000 |

Rear-end and angle collisions are the most frequent claim types, suggesting Colorado drivers face heavy stop-and-go traffic and intersection risks. Single-vehicle and rollover accidents highlight weather and terrain challenges.

Colorado Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | B | Moderate theft, rising in cities |

| Average Claim Size | C | Repairs and medical costs above average |

| Traffic Density | C | Congestion in Denver and Boulder |

| Weather-Related Risks | D | Frequent hail, snow, and wildfires |

Weather risks and traffic congestion drive up premiums across Colorado. Urban theft rates and high repair costs also contribute to average or below-average scores in key pricing categories.

Learn More: How to File a Claim and Win it Each Time

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Colorado Auto Insurance Requirements

Colorado requires all drivers to carry a basic level of auto insurance to legally operate a vehicle. These minimum requirements are designed to ensure drivers can cover damages or injuries they cause in an at-fault accident. Failing to meet these standards can result in fines, license suspension, and added fees.

Colorado Minimum Auto Insurance Requirements| Required Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $15,000 per accident |

While the state minimums help drivers stay legal, they may not provide enough financial protection in a serious accident.

To choose the right coverage in Colorado, consider your car’s value, commute, and accident risk. Full coverage is smart if you drive often or live in hail-prone or high-traffic areas.

Daniel Walker Licensed Insurance Agent

Many drivers in Colorado get more than the basic coverage or add extra protection to help avoid big costs from repairs or medical bills.

Coverage Options in Colorado

Beyond the required liability coverage, Colorado drivers can choose from a variety of optional insurance types that offer more comprehensive protection (Read More: Liability vs. Full Coverage Auto Insurance).

Colorado Auto Insurance Coverage Options| Coverage | What it Covers |

|---|---|

| Bodily Injury Liability | Injuries you cause to other people |

| Collision Coverage | Damage from hitting another vehicle |

| Comprehensive Coverage | Theft, vandalism, weather, or animal damage |

| Gap Insurance | Difference between car’s value and loan balance |

| Medical Payments (MedPay) | Your medical bills from an accident |

| Personal Injury Protection | Medical and lost wages regardless of fault |

| Property Damage Liability | Damage you cause to another person’s property |

| Rental Reimbursement | Cost of a rental car during vehicle repairs |

| Roadside Assistance | Towing and help for breakdowns |

| Umbrella Insurance | Additional liability coverage beyond standard limits |

| Uninsured/Underinsured Motorist | Injuries from a driver with no or not enough coverage |

These extra coverages can help pay for medical bills, car damage from crashes or bad weather, and things like towing or a rental car.

Adding optional coverages is especially valuable in Colorado, where weather-related risks like hail and snow are common. Features like gap insurance and personal injury protection (PIP) offer added financial security and peace of mind, making them smart additions for many CO drivers.

Ways to Save on Auto Insurance in Colorado

Several top auto insurance companies in Colorado offer generous discounts that can lead to major savings for drivers. Liberty Mutual stands out with the highest anti-theft discount at 35%, while Nationwide offers the largest good driver discount at 40%.

Top Auto Insurance Discounts in Colorado| Company | Anti- Theft | Bundling | Good Driver | Low Mileage |

|---|---|---|---|---|

| 10% | 25% | 25% | 30% | |

| 25% | 25% | 25% | 20% |

| 12% | 16% | 25% | 30% | |

| 10% | 20% | 30% | 10% | |

| 25% | 25% | 26% | 30% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 20% | |

| 25% | 10% | 30% | 30% | |

| 20% | 15% | 20% | 25% | |

| 15% | 17% | 25% | 30% |

Progressive and Farmers reward safe driving with 30% good driver discounts, and Geico, Auto-Owners, and State Farm each offer up to 30% for low-mileage drivers, ideal for those who work from home or commute less. These discounts can stack up quickly, making a significant impact on your total premium.

Besides using discounts from insurance companies, Colorado drivers can lower their car insurance costs with a few simple steps. These tips can help you look less risky to insurance companies and save money over time, especially in places where rates are higher.

- Increase Your Deductible: Choose a higher deductible if you’re comfortable covering more out-of-pocket in the event of a claim.

- Pass a Defensive Driving Course: Take a state-approved class to qualify for additional discounts from many Colorado insurers (Read more: Best Defensive Driving Insurance Discounts).

- Install Anti-Theft Devices: Reduce your vehicle’s risk profile and qualify for added savings, especially in high-theft areas like Denver.

- Maintain Continuous Coverage: Avoid insurance gaps, which can lead to higher premiums when restarting a policy.

- Compare Rates by ZIP Code: Shop around annually, as rates can vary widely across different parts of Colorado.

Even with rising costs and unique risks like hail and wildfires, these steps can help you stay protected while saving money on your auto insurance in Colorado. Find out how to compare auto insurance companies beyond just price to find the right provider for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

10 Best Auto Insurance Companies in Colorado

Auto-Owners, American Family, and State Farm are the top three companies offering the best auto insurance in Colorado. However, all ten providers bring unique strengths, from reliable claims handling to top-tier discounts and digital tools. Compare them below to find the right Colorado auto insurance company for your needs and budget.

#1 – Auto-Owners: Top Overall Pick

Pros

- Reliable Claims Handling: Auto-Owners leads in reliability across Colorado, with a strong claims satisfaction score of 659/1,000 and financial backing rated A++.

- Affordable Rates in CO: Offers minimum coverage in Colorado starting at just $38 a month, ideal for budget-conscious drivers who still want top-tier reliability.

- Strong Financial Stability: With an A++ rating, Auto-Owners provides peace of mind to Colorado policyholders looking for long-term coverage security. Get full ratings in our Auto-Owners review.

Cons

- Higher Full Coverage Costs: Full coverage in Colorado can reach $245 a month, which may be expensive compared to competitors offering similar protections.

- Limited Online Features: CO drivers may find Auto-Owners’ digital tools and account management options less advanced than other insurers.

#2 – American Family: Best for Customer Service

Pros

- Top-Rated Customer Support: Known for excellent customer service and strong local agent availability across Colorado.

- Budget-Friendly Rates: Offers minimum coverage in Colorado from $52 a month, making it a solid option for affordable yet personalized service.

- Wide Range of Discounts: Colorado drivers benefit from bundling, loyalty, and good driver discounts, maximizing savings. See the list of discounts in our American Family insurance review.

Cons

- Claims Satisfaction Slightly Lower: While still solid, American Family’s score of 656/1,000 is slightly behind Auto-Owners in Colorado.

- Agent-Dependent Service: CO drivers preferring a digital-first experience may find the agent-focused model less convenient.

#3 – State Farm: Best for Agent Support

Pros

- Strong Agent Network: State Farm excels in agent availability and in-person policy support across Colorado. Learn more in our State Farm review.

- Low Minimum Coverage Rates: Offers Colorado drivers minimum coverage from $42 a month, with solid full coverage options at $130 a month.

- Bundling Discounts: Offering discounts of up to 17% or more for combining coverage under one provider, ranking among the best home and auto insurance companies in Colorado.

Cons

- Limited Digital Customization: CO users looking for flexible online policy adjustments may find fewer options than competitors like Progressive.

- Multi-Policy Discount Gaps: While bundling is available, the discount isn’t as high as Nationwide’s 20–40% in Colorado.

#4 – Allstate: Best for Rideshare Drivers

Pros

- Strong Rideshare Coverage: Offers one of the most comprehensive rideshare endorsements available in Colorado, ideal for Uber and Lyft drivers.

- High-Mileage Savings Rates: Colorado drivers who drive more than 8,000 miles per year but less than 12,000 can still qualify for low-mileage discounts through Allstate Milewise Unlimited.

- Robust Claim Support Tools: Allstate’s QuickFoto and mobile claims tools are a time-saver for busy Colorado rideshare operators (Read More: Allstate Auto Insurance Review).

Cons

- Higher Full Coverage Premiums: At $240 a month for full coverage in CO, Allstate may not suit all budgets.

- Discount Opportunities Are Limited: CO drivers may find fewer bundling and telematics-based savings compared to rivals like Geico or Progressive.

#5 – Geico: Best for Senior Discounts

Pros

- Senior Discount Leader: Geico offers some of the best discount options for older drivers in Colorado, including up to 30% for low mileage.

- Low Minimum Coverage Rates: Geico car insurance in Colorado offers minimum coverage starting at just $42 a month, among the lowest in the state.

- Efficient Digital Tools: The Geico app allows Colorado policyholders to manage claims, make payments, and adjust coverage easily. Read everything you need to know about Geico.

Cons

- Limited Agent Support: Drivers who prefer face-to-face help may find Geico’s service model lacking in Colorado.

- Lower Claims Satisfaction: With a 618/1,000 claims score, Geico performs lower than top competitors like Auto-Owners in Colorado.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: CO drivers earn deductible reductions over time with safe driving, up to $500 total.

- Affordable Minimum Rates: Nationwide offers Colorado drivers minimum coverage starting at $48 a month, making it a low-cost option with strong benefits.

- High Good Driver Discounts: Safe drivers in Colorado can save up to 40% through usage-based SmartRide tracking. Find more discounts in our Nationwide auto insurance review.

Cons

- Average Claims Satisfaction: A 618/1,000 claims score places Nationwide mid-pack for CO customers needing quick resolutions.

- Telematics May Not Suit Everyone: Colorado drivers who are uncomfortable sharing driving behavior may not fully benefit from SmartRide.

#7 – Progressive: Best for High-Risk Drivers

Pros

- High-Risk Coverage Access: CO drivers with accidents, DUIs, or tickets can get competitive rates from Progressive without being turned away.

- Strong Telematics Tools: Progressive’s Snapshot program can cut rates by up to 30% for Colorado drivers who demonstrate safe habits. Learn how to qualify in our Progressive auto insurance review.

- Solid Minimum Coverage Pricing: Offers Colorado minimum coverage starting at $54 a month, even for high-risk profiles.

Cons

- Inconsistent Rates: Some high-risk drivers in Colorado report significant rate increases after the first policy term, even without further infractions.

- Customer Service Ratings Lag: Progressive’s claims satisfaction score of 614/1,000 is among the lowest on this Colorado list.

#8 – Liberty Mutual: Best for Comprehensive Policies

Pros

- Customizable Policies: CO drivers can tailor coverage with add-ons like GAP, accident forgiveness, and OEM parts coverage.

- Competitive Starting Rates: Offers Colorado minimum coverage at $41 a month, with several discount layers available.

- Strong Theft Protection Discounts: CO policyholders with anti-theft devices can save up to 35%. Read more in our Liberty Mutual review.

Cons

- Average Claims Experience: With a 613/1,000 score, claims satisfaction in Colorado may lag behind more specialized providers.

- Steeper Learning Curve: Colorado drivers may find Liberty’s customization options overwhelming without agent guidance.

#9 – Safeco: Best for Online Tools

Pros

- Easy Online Management: Safeco’s online quote, claim, and billing tools are ideal for tech-savvy CO drivers. Get more details in our Safeco auto insurance review.

- Lowest Monthly Rates in CO: Offers minimum coverage in Colorado starting at $40 a month, one of the lowest available statewide.

- Optional Diminishing Deductible: CO policyholders can reduce their deductible over time by staying claim-free.

Cons

- Low Claims Satisfaction: At just 606/1,000, Safeco ranks near the bottom in Colorado for claims resolution speed and customer feedback.

- Fewer Local Agents: CO drivers looking for in-person service may find limited agent access.

#10 – Farmers: Best for DUI Drivers

Pros

- DUI-Friendly Coverage Options: Farmers offers flexible underwriting for Colorado drivers with a DUI on record. Our Farmers Insurance review details the options.

- Wide Discount Variety: CO drivers can stack savings with multi-vehicle, good student, and low mileage options.

- Crash Assistance: For drivers using Farmers Signal, the app can detect if you are in an accident and quickly contact emergency services.

Cons

- High Accident Rates: Minimum coverage for CO drivers rises to $102 a month after an at-fault accident.

- Customer Service Scores Lag: A 599/1,000 claims satisfaction score makes Farmers the lowest-rated on this Colorado list.

How to Choose the Best Auto Insurance Company in Colorado

Choosing the right auto insurance company in Colorado comes down to finding the best mix of affordability, reliable coverage, and customer support that fits your lifestyle. Whether you’re navigating Denver’s traffic or commuting through snowy mountain roads, you’ll want a provider that not only meets Colorado’s 25/50/15 liability auto insurance requirements but also offers extra protection when you need it most.

Top providers like Auto-Owners, American Family, and State Farm may not always have the lowest base rates, but they consistently earn high marks for claims satisfaction, financial strength, and long-term reliability.

Bundle your auto and home insurance, maintain a clean driving record, and shop quotes yearly to keep your Colorado insurance rates low.

Rachael Brennan Licensed Insurance Agent

While liability auto insurance is the legal minimum, many Colorado drivers choose to add comprehensive and collision coverage, especially given the state’s risks from hail, snow, and wildlife-related crashes.

Many of the best home and auto insurance companies in Colorado also offer bundling discounts of up to 17%, along with savings for safe drivers, low-mileage commuters, and those with continuous coverage.

Start saving on your Colorado auto insurance by entering your ZIP code and comparing quotes.

Frequently Asked Questions

What is the best car insurance company in Colorado?

The best auto insurance company in Colorado overall is Auto-Owners. It ranks highest for claims satisfaction, financial strength (A++ rating), and policy reliability, with competitive rates for drivers with clean records.

Who is the most trusted Colorado auto insurance company?

State Farm is widely regarded as one of the most trusted auto insurance companies in Colorado and nationwide. It has an A++ financial rating, a long-standing reputation, and a strong network of local agents offering personalized service. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Is Progressive insurance good in Colorado?

Yes, Progressive is a solid option in Colorado, especially for high-risk drivers. It offers competitive rates, strong discounts for safe driving through its Snapshot program, and easy-to-use digital tools. However, claims satisfaction scores are slightly lower than top competitors.

Learn More: State Farm vs. Progressive Auto Insurance

Which Colorado insurance company is best for a vehicle?

The best insurance company for your vehicle in Colorado depends on your needs, but State Farm and American Family are excellent choices. State Farm provides great support through agents, while American Family offers strong customer service and customizable coverage, both with the cheapest full coverage car insurance in Colorado for various car types.

Why is car insurance in Colorado so high?

Rates from Colorado car insurance companies are higher due to frequent hailstorms, snow, and wildfire risks, especially in areas like Denver and Colorado Springs. Other contributing factors include rising vehicle repair costs, increased traffic congestion, and a growing number of uninsured drivers.

What is the recommended auto insurance coverage in Colorado?

While Colorado’s minimum legal requirement is 25/50/15 for liability coverage, most experts recommend increasing those limits and adding comprehensive auto insurance, collision, uninsured motorist, and MedPay or PIP coverage. This offers better protection, especially given the state’s high accident rates and weather-related risks.

Who has the best coverage in Colorado?

It depends on what you value most. Auto-Owners is better for reliability, American Family excels in service, State Farm is best for agent support, and Geico leads for affordability. Comparing quotes based on your unique driving needs and coverage preferences is the best way to decide. Enter your ZIP code into our free quote tool now.

Which is the best and cheapest car insurance in Colorado?

Geico, Nationwide, and Safeco offer the cheapest car insurance in Colorado, starting from $38 to $42 a month. Geico also offers generous discounts for seniors and low-mileage drivers, making it one of the best and most affordable options for cost-conscious drivers.

How much should I pay for car insurance in Colorado?

On average, minimum coverage in Colorado ranges from $38 to $74 per month, depending on the insurer and your driving profile. Full coverage can cost between $101 and $245 per month. Factors like your age, ZIP code, driving history, and coverage level all impact your rate.

Read More: Best Low-Mileage Auto Insurance Discounts

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.