10 Best Auto Insurance Companies in Texas for 2025 (Top TX Providers)

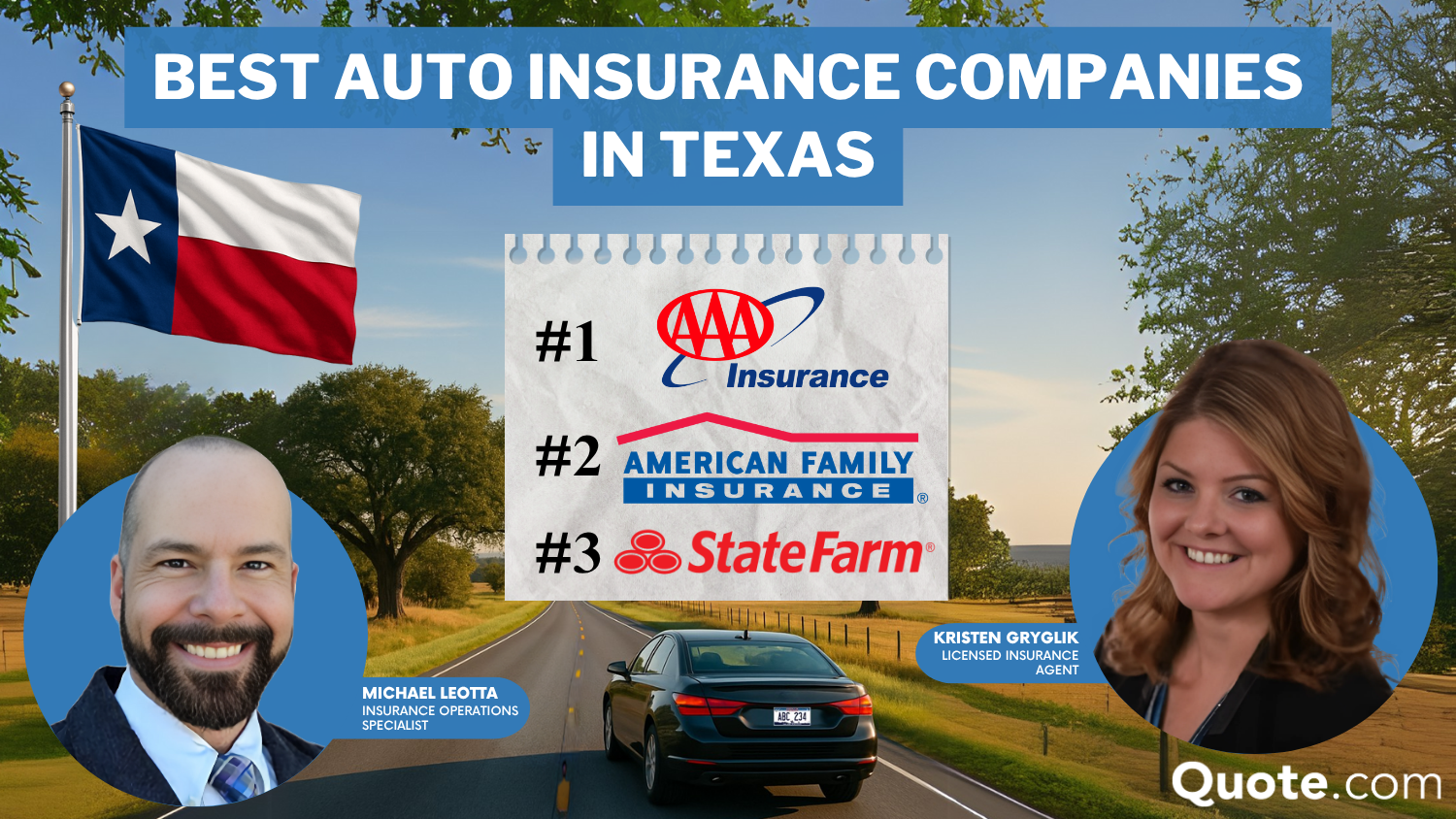

The best auto insurance companies in Texas are AAA, American Family, and State Farm. American Family ranks high in customer service reviews, but AAA and State Farm are the cheapest auto insurance companies, offering rates as low as $52 a month. AAA also includes 24/7 roadside assistance with every policy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshir...

Licensed Insurance Agent

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in Texas

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Texas

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Texas

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsAAA, American Family, and State Farm are the best auto insurance companies in Texas, with rates starting at just $52 a month. See more rates in our State Farm vs. Farmers, Geico, Progressive, and Allstate review.

Our Top 10 Picks: Best Auto Insurance Companies in Texas| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 662 / 1,000 | A | Roadside Assistance | AAA |

| #2 | 656 / 1,000 | A | Customer Satisfaction | American Family |

| #3 | 654 / 1,000 | A++ | Local Agents | State Farm | |

| #4 | 653 / 1,000 | A++ | Young Drivers | Geico | |

| #5 | 646 / 1,000 | A+ | Reliable Coverage | Allstate | |

| #6 | 639 / 1,000 | A+ | Custom Policies | Nationwide | |

| #7 | 637 / 1,000 | A++ | Discount Variety | Travelers | |

| #8 | 624 / 1,000 | A | Broad Coverage | Farmers | |

| #9 | 617 / 1,000 | A | Accident Forgiveness | Liberty Mutual |

| #10 | 616 / 1,000 | A+ | Digital Tools | Progressive |

AAA offers 24/7 roadside assistance and competitive claims satisfaction, ideal for long commutes and highway travel, while American Family excels in customer support, making it easier for Texas drivers to manage claims and coverage.

State Farm’s extensive local agent network helps drivers in both rural and urban areas get personalized service. These providers combine affordability with the tools and support Texas drivers need most.

- Texas requires minimum liability coverage of 30/60/25 for all drivers

- The best car insurance companies in Texas start at just $52 a month

- AAA is the top pick for roadside assistance and claims satisfaction

To find out if you can get the best TX auto insurance rates, enter your ZIP code into our free quote tool to instantly compare prices and buy auto insurance that suits you.

Best Auto Insurance Rates in Texas

Choosing the right auto insurance in Texas starts with understanding how rates vary by coverage level. State Farm offers the cheapest car insurance overall, with minimum coverage starting at just $52 per month and full coverage at $140 per month, making it an excellent choice for budget-conscious Texans.

Auto Insurance Monthly Rates in Texas by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $57 | $172 |

| $116 | $313 | |

| $101 | $274 |

| $79 | $214 | |

| $61 | $164 | |

| $103 | $277 |

| $89 | $240 | |

| $70 | $188 | |

| $52 | $140 | |

| $58 | $157 |

At the higher end, Allstate and American Family charge more, with full coverage premiums of $313 per month and $274 per month, reflecting their added features and service models.

These price differences highlight the importance of comparing both coverage types and insurer benefits when selecting a policy.

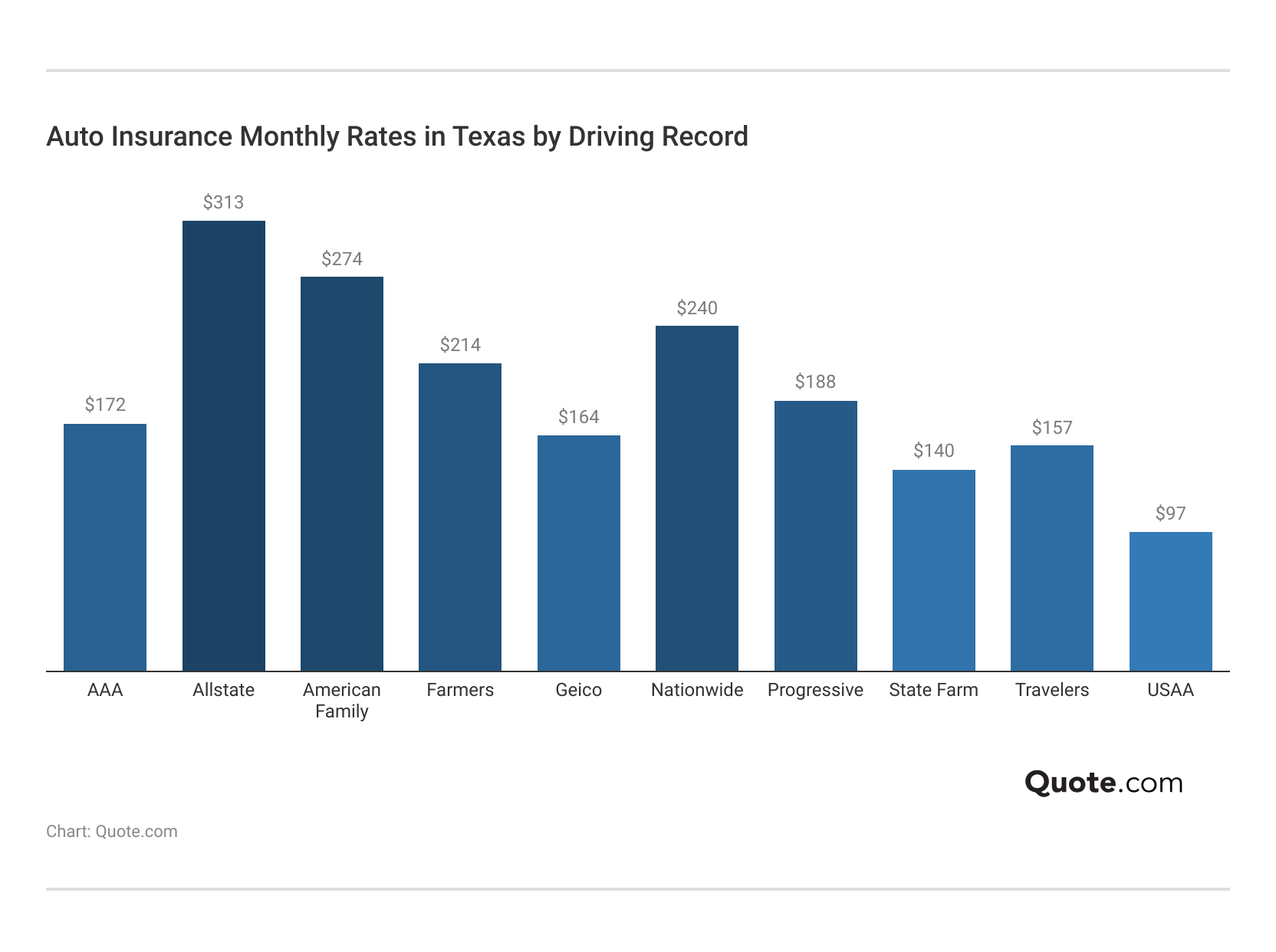

One of the most influential factors in Texas auto insurance pricing is your driving record. The chart shows that drivers with clean records receive the best rates, with State Farm offering the lowest price for drivers with a clean record at just $52 a month.

The higher rates may reflect added coverage options or brand positioning, but can strain budgets for low-risk drivers. If you maintain a clean driving history, insurers like State Farm, Travelers, and Geico give you the best opportunity to save in Texas without compromising coverage.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How Texas Auto Insurance Claims Impact Rates

Several statewide risk factors contribute to Texas’ above-average auto insurance rates. As a result, insurers raise premiums to offset the heightened risk. Understanding how these environmental and economic pressures affect pricing helps Texas drivers make more informed decisions when selecting coverage.

Texas Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | C | Rising repair costs elevate claims |

| Traffic Density | D | Urban congestion raises accident risk |

| Vehicle Theft Rate | D | High theft rate increases premiums |

| Weather-Related Risks | D | Frequent storms increase claims |

Accident frequency and claims volume vary widely across Texas cities, playing a major role in how insurance is priced by ZIP code. Urban hotspots drive up insurance costs due to dense traffic, higher claim rates, and increased vehicle damage risk. Insurers rely heavily on localized data when setting rates, so where you live and drive in Texas truly matters.

Texas Auto Accidents & Insurance Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Arlington | 20,000 | 17,000 |

| Austin | 35,000 | 30,000 |

| Corpus Christi | 14,000 | 12,000 |

| Dallas | 58,000 | 50,000 |

| El Paso | 25,000 | 21,000 |

| Fort Worth | 32,000 | 27,500 |

| Houston | 65,000 | 55,000 |

| Lubbock | 11,000 | 9,500 |

| Plano | 12,000 | 10,000 |

| San Antonio | 40,000 | 34,000 |

Understanding what types of claims are most common in Texas can help drivers select the right coverage. Rear-end collisions top the list, followed by weather-related damage a reflection of Texas’ severe storm patterns.

5 Most Common Auto Insurance Claims in Texas

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-End Collisions | 28% | $4,000 |

| Weather-Related Damage | 22% | $3,500 |

| Theft or Vandalism | 18% | $2,000 |

| Intersection Accidents | 17% | $5,500 |

| Single-Vehicle Accidents | 15% | $6,000 |

Theft and vandalism account for claims, while intersection accidents and single-vehicle crashes round out the list, with the latter being the most expensive.

Texas drivers can lock in the lowest rates by maintaining a clean driving record, avoiding at-fault accidents or tickets, and comparing quotes from multiple providers every 6 to 12 months.

Brad Larson Licensed Insurance Agent

Average highway speeds are also faster in the Lone Star State, which is why collision insurance rates in Texas are higher than in other states. These patterns show why Texas drivers should consider comprehensive and collision auto insurance coverage, even if it’s not required.

Texas Auto Insurance Coverage Requirements

Texas auto insurance coverage requirements mandate that all drivers carry at least 30/60/25 liability auto insurance coverage. This means $30,000 in bodily injury liability per person, $60,000 per accident, and $25,000 in property damage liability.

These minimums help cover costs if you’re at fault in an accident, but they may not fully protect you in serious collisions or multi-vehicle incidents. Texas drivers should review their policy limits carefully, as rising repair and medical costs can quickly exceed the state’s minimum requirements.

More Auto Insurance Coverage Options in Texas

While Texas only requires liability insurance, many drivers add extra coverage to protect their finances, vehicles, and health, especially given Texas’s accident rates, severe weather, and heavy traffic. Here are the most common auto insurance coverage options available in Texas:

- Collision Coverage: Collision auto insurance pays to repair or replace your vehicle if it’s damaged in a crash, regardless of who’s at fault.

- Comprehensive Coverage: Comprehensive auto insurance covers non-collision damage such as theft, hail, flooding, or falling objects, especially useful during Texas storm season.

- Uninsured/Underinsured Motorist Coverage: Helps cover your costs if you’re hit by a driver in Texas who doesn’t have enough or any insurance.

- Personal Injury Protection (PIP): Covers medical expenses and lost income for you and your passengers, regardless of fault.

- Medical Payments Coverage (MedPay): An optional alternative to PIP that helps pay medical costs after an accident in Texas.

These additional coverage options give Texas drivers more complete protection on and off the road. With unpredictable weather, busy highways, and rising repair costs, expanding your coverage beyond the minimum can be a smart investment.

Top Auto Insurance Discounts in Texas

Texas drivers can save significantly by taking advantage of auto insurance discounts offered by top providers. Nationwide stands out with the highest good driver discount at 40%, making it ideal for Texans with clean records.

Auto Insurance Discounts in Texas From Top Providers| Insurance Company | Accident-Free | Bundling | Claims-Free | Good Driver | Multi-Vehicle |

|---|---|---|---|---|---|

| 15% | 15% | 20% | 30% | 25% |

| 25% | 25% | 10% | 25% | 25% | |

| 25% | 25% | 15% | 25% | 20% |

| 20% | 20% | 9% | 30% | 20% | |

| 22% | 25% | 12% | 26% | 20% | |

| 20% | 25% | 8% | 20% | 25% |

| 20% | 20% | 14% | 40% | 20% | |

| 10% | 10% | 10% | 30% | 12% | |

| 17% | 17% | 11% | 25% | 20% | |

| 13% | 13% | 13% | 10% | 8% |

American Family and Allstate also lead the pack with strong bundling and accident-free discounts up to 25%, allowing policyholders to save more by combining home and auto policies.

Always ask about discounts for bundling, safe driving, low mileage, and full payment to lower your auto insurance premium in Texas.

Michelle Robbins Licensed Insurance Agent

Farmers and Progressive offer competitive 30% good driver discounts, while AAA provides a balanced mix of savings, including 20% for claims-free drivers and 25% for multi-vehicle policies. With so many discount opportunities available, comparing providers can help unlock car insurance discounts you can’t miss on monthly Texas premiums.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Other Ways to Save on Auto Insurance in Texas

Beyond standard discounts, Texas drivers have several ways to pay less for car insurance premiums. Raising your deductible is one simple way to reduce your monthly rate. Just make sure you can afford the out-of-pocket cost in the event of a claim.

Shopping around and comparing quotes by ZIP code can also reveal major pricing differences between providers. Maintaining a clean driving record and improving your credit score are two key factors that insurers in Texas use to assess risk and set rates.

You can also save by driving fewer miles each year or enrolling in usage-based programs like telematics apps, which track safe driving habits. For those with older or low-value vehicles, dropping collision or comprehensive coverage may also lead to lower premiums without sacrificing essential protection.

Top-rated choices like AAA, American Family, and State Farm stand out for their strong combination of value, service, and support, but finding the best auto insurance companies in Texas starts with getting quotes from multiple providers. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

10 Best Auto Insurance Companies in Texas

AAA, American Family, and State Farm are the best auto insurance companies in Texas, offering strong coverage and service. Learn how to get multiple auto insurance quotes to see how quickly you can save money.

#1 – AAA: Top Overall Pick

Pros

- Roadside Assistance Leader: AAA offers 24/7 roadside assistance across Texas, a key benefit for long-distance drivers at $57 a month for minimum coverage.

- Strong Claims Satisfaction: AAA scored 662/1,000 in claims satisfaction in TX, ensuring reliable service for policyholders. Explore customer satisfaction in our AAA auto insurance review.

- Travel Perks for Texans: AAA members in Texas get travel discounts and identity theft monitoring included with coverage.

Cons

- Higher Full Coverage Rates: Full coverage car insurance in Texas averages $172 a month, which is higher than many competitors for similar protections.

- Fewer Digital Tools: AAA’s digital experience in Texas lags behind tech-focused insurers like Progressive.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

#2 – American Family: Best for Customer Satisfaction

Pros

- Top-Rated Service: Texas drivers report high satisfaction with claims and customer service; rates start at $101 a month for minimum coverage.

- Customizable Discounts: American Family offers student, safe driver, and low-mileage discounts widely available in TX. Get full policy details from our American Family auto insurance review.

- DriveMyWay Program: Texans using this telematics app can earn substantial savings based on actual driving behavior.

Cons

- Limited Availability: American Family has fewer offices and agents in rural TX areas, affecting service access.

- Above-Average Premiums: Minimum coverage at $101 a month in Texas is more expensive than providers like State Farm or Geico.

#3 – State Farm: Best for Local Agents

Pros

- Agent Support Network: State Farm has a large network of Texas agents, offering face-to-face help with policies starting at $52 a month for minimum coverage.

- Strong Financial Ratings: With an A++ A.M. Best rating, TX drivers can count on long-term policy stability.

- Steer Clear for Teens: Texas teens can lower premiums with safe driving education and app monitoring. See what TX drivers are saying in the State Farm auto insurance review.

Cons

- Limited Online Customization: Texas users may find fewer online tools for building or adjusting policies compared to digital-first providers.

- Mediocre Claims Score: State Farm’s 654/1,000 claims satisfaction score in TX falls below top-rated competitors like AAA.

#4 – Geico: Best for Young Drivers

Pros

- Great Value Option: Geico offers strong value in Texas with reliable coverage and rates from $61 a month for minimum coverage.

- Quick Digital Claims: Texas drivers benefit from Geico’s app-based claims system and virtual policy management. Get everything you need to know about Geico in our review for claims handling.

- Military Discounts: Military members and veterans in TX can unlock special pricing through Geico’s affiliation programs.

Cons

- Limited Agent Access: In-person service in rural Texas areas is limited due to Geico’s mostly digital model.

- Fewer Customization Options: Policy add-ons in Texas are more limited than competitors like Nationwide or Travelers.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Reliable Coverage

Pros

- Reliable Claims Payouts: Allstate’s consistent service in Texas makes it a reliable choice at $116 a month for minimum coverage.

- Safe Driving Bonuses: Texas drivers can use Drivewise to reduce premiums through real-time tracking of safe habits. Learn about policy benefits and savings in the Allstate auto insurance review.

- Comprehensive Coverage Options: Strong selection of add-ons like gap insurance and accident forgiveness for Texas drivers.

Cons

- Pricey Base Rates: At $116 a month for minimum coverage, Allstate is one of the most expensive insurers in TX.

- Mixed Customer Service Ratings: Some Texas policyholders report delays and inconsistencies in post-claim support.

#6 – Nationwide: Best for Custom Policies

Pros

- Flexible Coverage: Nationwide lets Texas drivers tailor policies with rare add-ons like total loss deductible waivers at $89 a month minimum coverage.

- SmartRide UBI Discounts: TX drivers using SmartRide can earn up to 40% off based on real-time driving feedback. Explore savings and features in this Nationwide insurance review.

- Solid Claims Record: Nationwide maintains a 639/1,000 claims satisfaction score in Texas with quick turnaround times.

Cons

- Higher Full Coverage Costs: Full coverage averages $240 a month in TX, which may deter budget-conscious drivers.

- Limited Local Support: Fewer physical offices in Texas could inconvenience those needing in-person help.

#7 – Travelers: Best for Discount Variety

Pros

- Wide Discount Options: Travelers offers Texas drivers bundling, safe driver, and hybrid/electric vehicle discounts; minimum coverage starts at $58 a month.

- Strong Financial Backing: A++ A.M. Best rating ensures financial stability for TX policyholders. See what stands out in our expert Travelers auto insurance review.

- Reliable Telematics Tools: IntelliDrive in TX adjusts premiums based on actual driving, helping safe drivers save.

Cons

- Weak Multi-Vehicle Savings: At only 8%, Travelers’ multi-car discount in Texas is lower than other top insurers.

- Average Claims Satisfaction: Score of 637/1,000 in Texas suggests room for improvement in the claims process.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Broad Coverage

Pros

- Extensive Policy Features: Farmers offers strong coverage options for Texans, including accident forgiveness and new car replacement at $79 a month for minimum coverage.

- Strong Agent Support: Texas drivers can access personalized help from Farmers’ extensive agent network. Find everything you need to know about Farmers Insurance in one place.

- Home & Auto Bundles: Farmers provides extra discounts to TX residents who combine home and auto coverage.

Cons

- Limited Claims Discounts: Farmers offers only 9% claims-free discount in Texas, less than most competitors.

- Slightly Lower Claims Score: At 624/1,000, claims satisfaction in Texas ranks behind top-tier options like AAA or State Farm.

#9 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness Coverage: Liberty Mutual offers first-accident forgiveness in TX, a major benefit at $103 a month for minimum coverage.

- Robust App Tools: Texas users get easy access to claims, documents, and policy management via Liberty Mutual’s app. See full details about Liberty Mutual auto insurance review.

- Discounts for Teachers and Military: Liberty Mutual offers unique discounts for educators and service members in TX.

Cons

- Expensive Minimum Coverage: At $103 a month, Liberty Mutual is among the pricier options for Texas drivers.

- Lower Claims Satisfaction: Texas score of 617/1,000 shows performance lagging behind many competitors.

#10 – Progressive: Best for Digital Tools

Pros

- Tech-Friendly Platform: Progressive’s digital interface allows Texas drivers to manage everything online; rates start at $70 a month for minimum coverage.

- Snapshot Savings: Snapshot lets TX drivers save up to 30% based on their real driving habits. Before buying, browse everything you need to know about Progressive Insurance.

- Fast Online Quotes: Progressive’s quote tool quickly compares rates for Texas residents shopping for affordable coverage.

Cons

- Lower Satisfaction Score: 616/1,000 in TX claims satisfaction puts Progressive at the bottom of this top 10 list.

- Fewer Physical Locations: Texas customers needing in-person help may have limited access to offices.

Frequently Asked Questions

What is the best auto insurance company in Texas?

The best car insurance company in Texas is AAA, which ranks highest for overall value, roadside assistance, and claims satisfaction. American Family and State Farm are also top choices for their strong customer service and agent support. Learn how it works in our guide to usage-based auto insurance.

What is the recommended auto insurance coverage in Texas?

What is the average auto insurance coverage in Texas? While Texas only requires liability coverage (30/60/25), most experts recommend higher limits along with comprehensive and collision coverage to protect against weather-related damage, theft, and high medical or repair costs. Use our free comparison tool to see what auto insurance quotes look like in your area.

Who is the best company to get Texas car insurance with?

AAA is the best company for most Texas drivers due to its combination of affordable rates, roadside assistance, and high customer satisfaction. State Farm and Geico are also excellent for drivers seeking local agents or low premiums.

What are the five best auto insurance companies in Texas?

The five best auto insurance companies in Texas are AAA, American Family, State Farm, Geico, and Travelers. These providers stand out for affordability, coverage flexibility, and customer service.

Who is #1 in auto insurance?

State Farm is the largest auto insurance provider in most states, but it ranks #3 in Texas after AAA and American Family for claims satisfaction. Compare State Farm vs. Progressive auto insurance to learn more.

Who is the better car insurance company?

Among top-rated companies in Texas, AAA is considered better for full-featured policies and roadside help, while State Farm is better for in-person agent access and affordable minimum coverage rates.

What is the most popular auto insurance in Texas?

Progressive is the most popular car insurance company in Texas based on market share. However, it has the lowest claims satisfaction on our list, and many drivers complain about rate increases at policy renewal despite a clean record.

How much insurance coverage do I need in Texas?

At a minimum, Texas drivers must have 30/60/25 liability coverage, but to better protect your assets and vehicle, higher liability limits and optional coverage like collision and comprehensive are strongly recommended. Get fast and cheap auto insurance coverage today with our quote comparison tool.

What is the cheapest auto insurance rate in Texas?

The cheapest car insurance rate in Texas is offered by State Farm, with minimum coverage starting at just $52 per month. Travelers and AAA follow closely with rates under $60 per month. Browse more hacks to save money on car insurance in Texas.

Who has the cheapest car insurance in Texas?

State Farm currently has the cheapest car insurance in Texas for minimum coverage, but rates vary by ZIP code, age, and driving history, so it’s important to compare quotes and get more insight when considering the best time to buy a new car.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshir...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.