10 Best Auto Insurance Companies in New York for 2025 (Top NY Providers)

Geico, Allstate, and Liberty Mutual are the best auto insurance companies in New York. The cheapest car insurance in New York starts at $51 per month, and Geico delivers budget-friendly rates. Allstate provides advanced digital tools, and Liberty Mutual specializes in customizable policies for every NY driver.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: May 24, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: May 24, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in NY

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in NY

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage in NY

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsThe best auto insurance companies in New York are Geico, Allstate, and Liberty Mutual. Geico ranks first with budget-friendly rates starting at $51 per month for minimum coverage.

Our Top 10 Picks: Best Auto Insurance Companies in New York| Company | Rank | A.M. Best | Multi-Car Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 25% | Budget-Friendly Rates | Geico | |

| #2 | A+ | 25% | Digital Tools | Allstate | |

| #3 | A | 25% | Customizable Policies | Liberty Mutual |

| #4 | A++ | 20% | Safe Drivers | State Farm | |

| #5 | A | 20% | Group Discounts | Farmers | |

| #6 | A++ | 15% | High-Risk Drivers | Kemper | |

| #7 | A+ | 12% | ccident Forgiveness | Progressive | |

| #8 | A++ | 10% | Military Families | USAA | |

| #9 | A+ | 10% | Customer Satisfaction | Erie |

| #10 | A++ | 8% | Claims Satisfaction | Travelers |

Allstate stands out with powerful digital tools like its mobile app and online claims management that help drivers track repairs and payouts.

Liberty Mutual offers fully customizable policies, allowing drivers to add coverage options like accident forgiveness, new car replacement, and deductible savings benefits (Read More: Liberty Mutual vs. Nationwide Auto Insurance).

- Geico has the best car insurance in NY, starting at $51 a month

- Allstate has a Safe Driver Bonus for drivers who avoid accidents

- All three top companies offer the biggest multi-vehicle discounts

Keep reading to compare the top ten car insurance companies in NY to find tailored features and competitive pricing. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Lowest Rates in NY: Geico leads New York car insurance companies with the cheapest minimum coverage starting at just $51 per month, making it the most budget-friendly option.

- High Multi-Car Discount: It offers up to 25% off for multiple vehicles, helping NY families and households save even more. See more discounts in our Geico auto insurance review.

- Wide Availability: As one of the largest insurance companies in New York, Geico provides easy online access to policies, claims, and quotes.

Cons

- Limited Specialized Coverage: While Geico excels in affordability, it lacks unique add-ons like new car replacement coverage that other companies in New York may offer.

- Mixed Claims Service Reviews: Some NY customers report slower claims resolution compared to higher-rated providers.

#2 – Allstate: Best for Digital Tools

Pros

- Advanced Digital Features: Allstate stands out among companies in New York with its convenient mobile app, online claims tracking, and digital ID cards.

- Safe Driving Bonus: Safe drivers in New York who avoid accidents and claims get a credit toward their premiums every six months. Learn more in our Allstate auto insurance review.

- Bundling Savings: Allstate offers up to 25% bundling discounts, making it a strong choice for NY drivers with multiple policies.

Cons

- Higher Premiums for Some Profiles: Allstate auto insurance rates in New York may climb for high-risk or young drivers compared to Geico.

- Limited Local Agent Access: Despite its digital strengths, NY drivers may find fewer in-person agent locations compared to competitors like State Farm.

#3 – Liberty Mutual: Best for Customizable Policies

Pros

- Flexible Coverage Options: Liberty Mutual surpasses other companies in New York with its customizable add-ons, like better car replacement.

- Multi-Car Discount: NY drivers can save up to 25% when insuring multiple vehicles with Liberty Mutual.

- Online Policy Management: Liberty Mutual offers NY customers 24/7 digital policy management for added convenience. Learn how it handles claims in our Liberty Mutual review.

Cons

- High Starting Rates: Minimum coverage starts at $130 per month, making it one of the more expensive car insurance companies in New York for basic policies.

- Fewer Discounts: Liberty Mutual’s discount offerings may not be as robust as those of competitors in New York, like Geico or Farmers.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Safe Drivers

Pros

- Safe Driver Savings: State Farm rewards safe drivers in New York with a 25% discount and additional savings of up to 15% for taking a qualifying defensive driver course.

- Competitive Full Coverage: NY drivers can get full coverage for $172 per month, which is cheaper than Allstate, Liberty Mutual, and Farmers. Compare rates in our State Farm review.

- Extensive Agent Network: State Farm’s large agent presence across NY offers personalized service not easily matched by online-only providers.

Cons

- Limited High-Risk Driver Options: State Farm may not be the best choice for NY drivers with recent accidents or DUIs.

- Modest Bundling Discounts: Its 17% bundling discount is lower than Geico’s 25%, making it less appealing for multi-policy customers in NY.

#5 – Farmers: Best for Group Discounts

Pros

- Group-Based Savings: Farmers excels among companies in New York by offering exclusive discounts for affinity groups and professionals.

- Long List of Discounts: Farmers offers more discounts than the best New York car insurance companies on this list.

- Robust Policy Options: Provides NY drivers with add-ons like custom equipment coverage for personalized policies. See a full list of options in our Farmers review.

Cons

- Above-Average Pricing: Farmers’ rates in NY are higher than top picks like Geico, making it less ideal for budget shoppers.

- Limited Digital Tools: Farmers lags behind competitors like Allstate in offering mobile apps and online claims management for NY drivers.

#6 – Kemper: Best for High-Risk Drivers

Pros

- Low-Cost Coverage Options: Kemper offers affordable rates in NY for high-risk drivers with accidents or DUIs. Minimum coverage starts at $75 per month.

- Flexible Payment Plans: NY drivers benefit from Kemper’s flexible monthly billing and payment options.

- Discount Opportunities: Kemper provides up to 20% anti-theft discounts for NY drivers with qualifying vehicles (Read more: Cheap Auto Insurance for Multiple Vehicles).

Cons

- Limited Availability: Kemper’s presence in NY is smaller than larger companies, limiting agent and service locations.

- Basic Online Services: Kemper lacks the advanced digital tools found with companies like Allstate in New York.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Progressive automatically enrolls NY drivers in small accident forgiveness when buying a policy and offers two more tiers available as add-ons.

- Low Starting Rates: Minimum coverage starts at $63 per month, making it accessible to a range of NY drivers.

- Strong Discount Programs: Progressive offers up to 30% good driver discounts, rewarding safe NY drivers. Find more ways to save in our Progressive auto insurance review.

Cons

- Limited Local Support: NY drivers may find Progressive’s online-focused service lacks in-person agent availability.

- Mixed Customer Satisfaction: Progressive receives mixed reviews for claims handling among NY customers.

#8 – USAA: Best for Military Families

Pros

- Exclusive Military Benefits: USAA provides NY military members and families with specialized coverage and customer service.

- Affordable Minimum Coverage: Rates start at $55 per month, and it often has the cheapest car insurance in NYC for military families.

- Top Claims Satisfaction: USAA consistently earns high marks for claims handling among NY policyholders. Get full ratings in our USAA review.

Cons

- Membership Restrictions: Only military members, veterans, and their families qualify for USAA car insurance in NY.

- Limited Physical Locations: USAA primarily operates online, with fewer in-person services available in New York.

#9 – Erie Insurance: Best for Customer Satisfaction

Pros

- Highly Rated Customer Service: Erie ranks among the top companies in New York for policyholder satisfaction.

- Affordable Rates: Erie offers minimum coverage starting at $85 per month, balancing service and cost in NY. Compare quotes now in our Erie insurance review.

- Broad Coverage Options: NY drivers can customize policies with add-ons like gap coverage and roadside assistance.

Cons

- Limited NY Availability: Erie’s service area in New York is smaller compared to national providers like Geico.

- No Online Claims Filing: Erie lacks digital claims tools, making the process slower for tech-savvy NY drivers.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Claims Satisfaction

Pros

- Top Claims Handling: Travelers excels among companies in New York for smooth, reliable claims service.

- Flexible Policy Options: NY drivers can add features like accident forgiveness and new car replacement. Learn more in our Travelers auto insurance review.

- Low-Mileage Discounts: New York drivers on the road less than 11,000 miles a year can save up to 30% with Travelers.

Cons

- Higher Starting Rates: Minimum coverage starts at $114 per month, which is higher than several other companies in New York.

- Limited Discounts: Travelers provides fewer discount options compared to top picks like Geico and Allstate in NY.

Auto Insurance Rates in New York

Car insurance prices in New York vary a lot depending on the company and coverage you choose. Geico has the cheapest rates, with minimum coverage starting at just $51 per month, followed by USAA at $55 per month for military families.

Auto Insurance Monthly Rates in New York by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $96 | $185 | |

| $85 | $160 |

| $108 | $208 | |

| $51 | $98 | |

| $75 | $146 | |

| $130 | $252 |

| $63 | $121 | |

| $89 | $172 | |

| $114 | $220 | |

| $55 | $107 |

Other low-cost options include Kemper at $75 per month and Erie Insurance at $85 per month. On the expensive side, Liberty Mutual has the highest prices, starting at $130 per month for minimum coverage and going up to $252 per month for full coverage.

Shopping around and comparing quotes from different companies in New York can help you save money and find the right coverage.

Learn More: How to Buy Auto Insurance

NY Auto Insurance Rates by Age and Gender

Age and gender play a big role in car insurance prices in New York. Teen drivers pay the highest rates, with Kemper and Liberty Mutual charging over $350 per month.

Auto Insurance Monthly Rates in New York by Age & Gender| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $320 | $325 | $200 | $201 | $180 | $185 | $185 | $187 | |

| $300 | $310 | $220 | $230 | $200 | $210 | $175 | $180 |

| $310 | $320 | $259 | $270 | $235 | $245 | $180 | $192 | |

| $250 | $260 | $97 | $111 | $95 | $105 | $94 | $94 | |

| $360 | $375 | $180 | $185 | $170 | $180 | $210 | $215 | |

| $350 | $355 | $259 | $296 | $240 | $255 | $227 | $227 |

| $260 | $265 | $175 | $172 | $160 | $165 | $103 | $105 | |

| $250 | $260 | $197 | $209 | $180 | $190 | $148 | $148 | |

| $330 | $340 | $241 | $247 | $225 | $235 | $201 | $213 | |

| $230 | $240 | $147 | $162 | $140 | $145 | $98 | $98 |

Prices drop as drivers age, and Geico offers some of the cheapest rates, including $97 per month for 25-year-olds and $94 per month for drivers in their 30s and 60s.

USAA is also a good choice for military families, with prices as low as $98 per month for older drivers. See who has better car insurance, USAA or Farmers, because comparing prices by age and gender from top companies can help you find the best deal in New York.

NY Auto Insurance Rates by Credit Score

Your credit score is one of the biggest things that can raise or lower your car insurance price in New York. Drivers with good credit get the best prices, while drivers with fair or bad credit usually pay a lot more.

New York Auto Insurance Monthly Rates by Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $185 | $220 | $260 | |

| $175 | $205 | $250 |

| $180 | $215 | $250 | |

| $94 | $120 | $150 | |

| $210 | $240 | $280 | |

| $227 | $260 | $310 |

| $103 | $130 | $160 | |

| $147 | $170 | $210 | |

| $201 | $230 | $270 | |

| $98 | $120 | $150 |

Geico has the cheapest rates for all credit scores, starting at $94 per month for drivers with good credit and $150 per month for drivers with bad credit. Liberty Mutual and Kemper have some of the highest prices, charging up to $310 per month for drivers with bad credit in New York.

Read More: Top 7 Ways You’re Wasting Money on Car Insurance

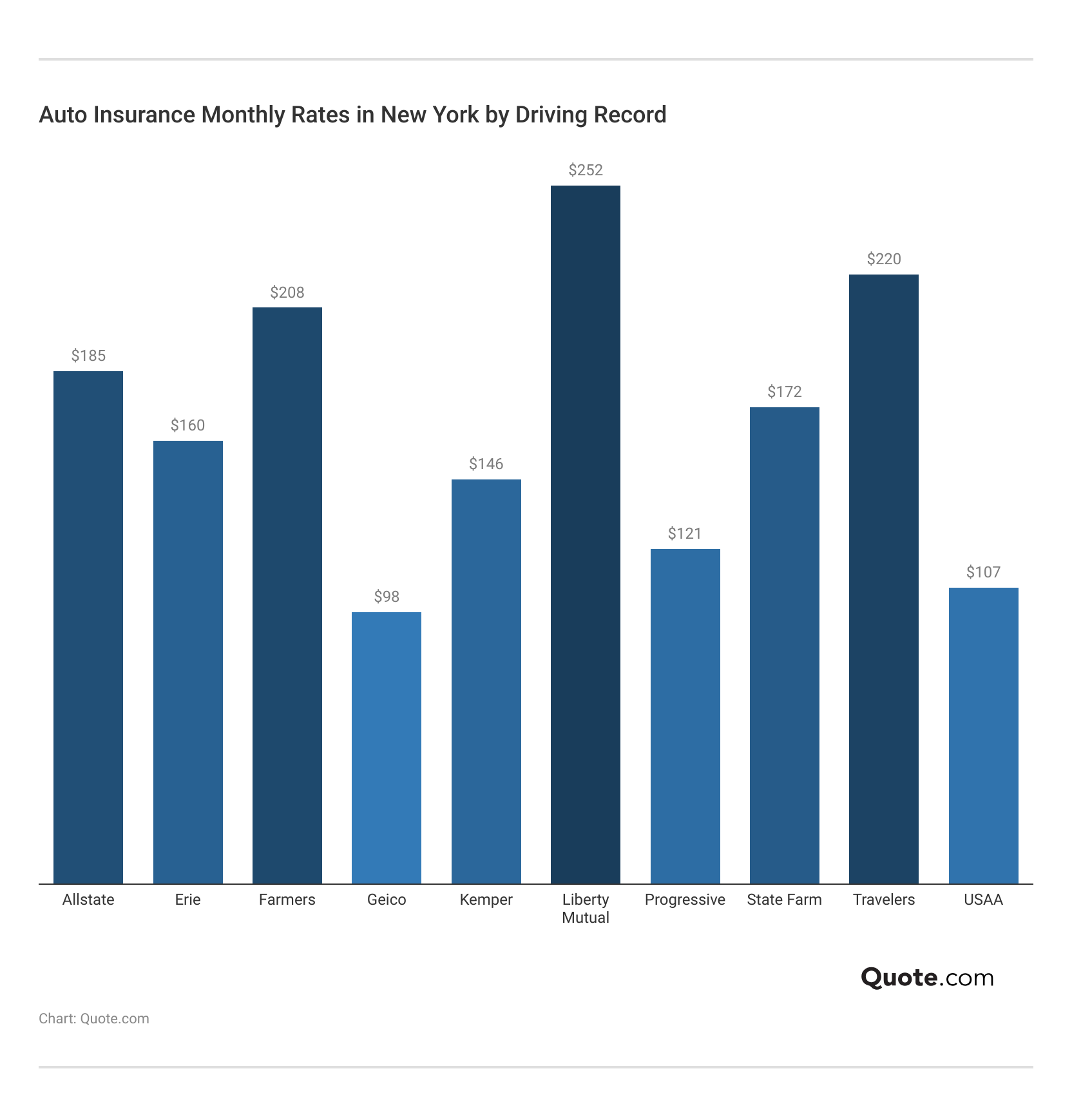

NY Auto Insurance Rates by Driving Record

Your driving record has a big impact on how much you pay for car insurance in New York. Drivers with clean records usually get the lowest rates, while drivers with accidents, tickets, or DUIs often pay much more.

Keeping a clean record is one of the best ways to save money on car insurance in NY. Insurance companies see risky drivers as more likely to file claims, which raises their prices. But don’t cancel auto insurance. Shop with companies that specialize in nonstandard insurance, like Geico and Kemper.

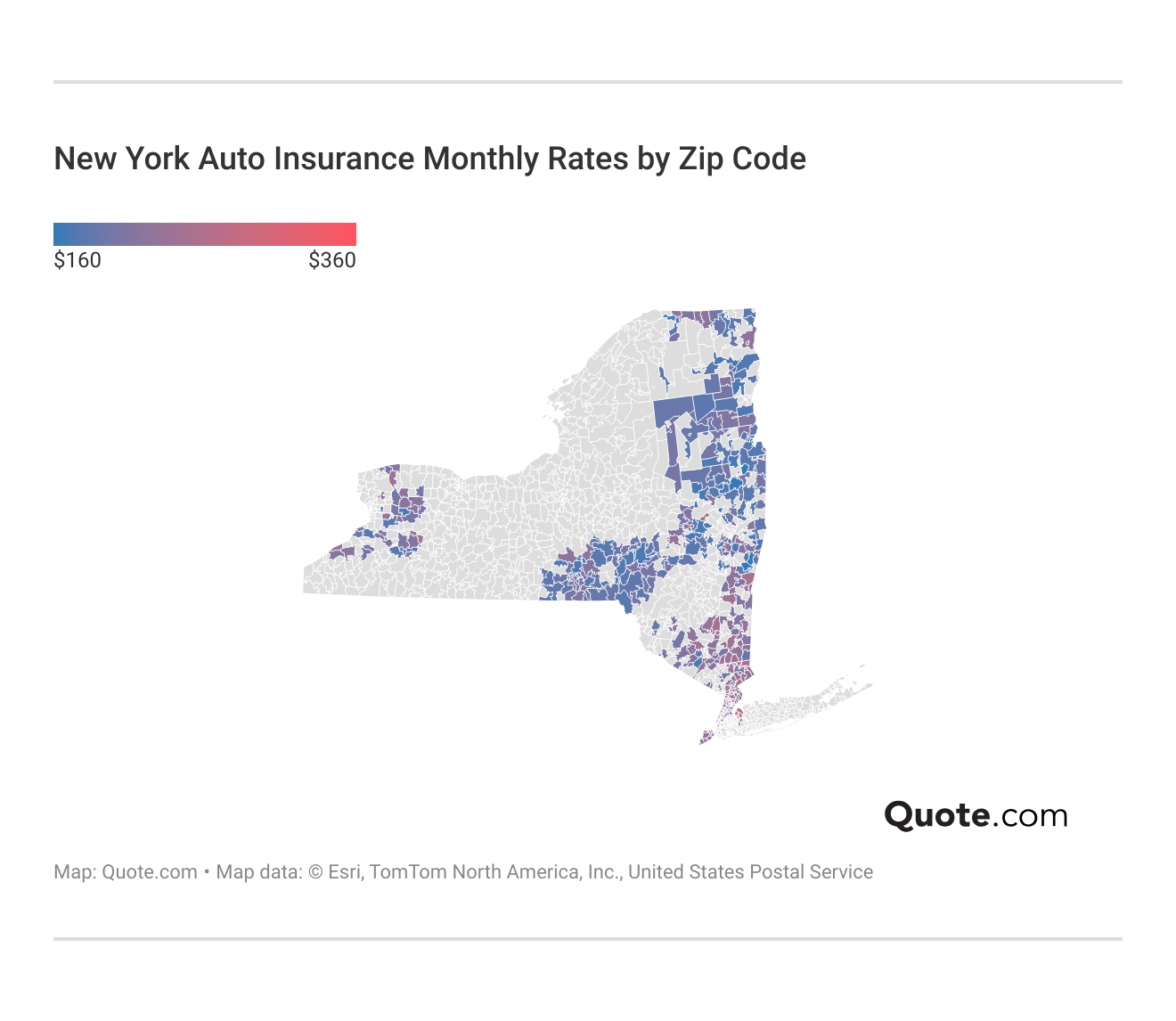

NY Auto Insurance Rates by Zip Code

Where you live in New York can make a big difference in your car insurance price. Drivers in busy areas like New York City or Brooklyn often pay higher rates because of more traffic, accidents, and theft.

People in smaller cities or rural areas usually pay less since there is less risk on the road. This is why your location is one of the biggest factors insurance companies use to set your rates.

Read More: 3,000 People Got Auto Insurance Right

New York Auto Insurance Risk Factors

Several factors affect how much drivers in New York pay for auto insurance. From heavy traffic in busy cities to seasonal weather risks, insurers consider many details when setting rates. Below is a quick report card showing how these risk factors impact premiums in New York.

New York Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | A | High traffic in urban areas |

| Average Claim Size | B | Claims tend to be moderately high |

| Weather-Related Risks | B | Moderate risk from snow and storms |

| Vehicle Theft Rate | C | Average theft rates across state |

Heavy traffic and frequent claims in urban areas can raise costs, while theft and weather risks add to the factors insurers review (Read More: Ultimate Guide on the Best Time to Buy a New Car).

Most Common Auto Insurance Claims in New York

Knowing the most common claims in New York can help drivers understand their risks and choose the right coverage. From accidents to theft, these claim types are the ones New York drivers file most often.

Auto Insurance Claims Costs in New York| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 40% | $3,500 |

| Comprehensive | 25% | $2,000 |

| Property Damage | 15% | $2,500 |

| Bodily Injury | 10% | $15,000 |

| Theft/Vandalism | 10% | $1,500 |

Collision claims are the most common and the most costly for many drivers. Understanding these risks makes it easier to choose coverage like comprehensive or collision insurance to protect your car and your wallet.

Would you know what to do if someone hit your parked car? Here are some tips on what to do if this happens to you. https://t.co/jGoBYAFD12 pic.twitter.com/hsrMs9Qka5

— Liberty Mutual (@LibertyMutual) October 19, 2023

Moreover, where you live and drive in New York can also affect your risk. Big cities like New York City, Brooklyn, and Queens have the most reported accidents and claims, while smaller cities see fewer incidents (Learn More: How to File a Claim and Win it Each Time).

New York Accidents & Claims per Year by City| City | Accidents per Year | Claims per Year |

|---|---|---|

| Albany | 10,000 | 5,000 |

| Bronx | 30,000 | 15,000 |

| Brooklyn | 40,000 | 20,000 |

| Buffalo | 25,000 | 12,000 |

| Ithaca | 2,000 | 1,000 |

| Long Island | 20,000 | 10,000 |

| New York | 300,000 | 150,000 |

| Queens | 35,000 | 17,500 |

| Rochester | 15,000 | 7,500 |

| Staten Island | 8,000 | 4,000 |

| Syracuse | 12,000 | 6,000 |

| Syracuse | 10,000 | 5,000 |

| Troy | 4,000 | 2,000 |

| Yonkers | 5,000 | 2,500 |

Drivers in larger cities face more risk, which often means higher insurance prices. If you live in or near these high-traffic areas, comparing quotes from the best auto insurance companies in New York can help you find affordable coverage despite the added risk.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

New York Auto Insurance Policy Options

New York drivers have several car insurance coverage options to meet legal requirements and protect themselves on the road.

To figure out what coverages you need, start with New York’s required liability limits and add extra protection based on your car’s value and your budget.

Kristine Lee Licensed Insurance Agent

While liability coverage is the minimum required by law, adding extra coverage can help you avoid high out-of-pocket costs after an accident.

- Liability Insurance: Covers damage or injuries you cause to others in an accident and is required by New York law.

- Personal Injury Protection (PIP): Pays for your medical expenses after an accident, no matter who is at fault, and is required in New York.

- Collision Coverage: Pays to repair or replace your vehicle if it’s damaged in a crash, even if you’re at fault.

- Comprehensive Coverage: Covers damage from theft, vandalism, weather, or other non-crash events.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver who doesn’t have enough insurance or no insurance at all.

Choosing the right coverage depends on your budget, vehicle, and personal needs. Comparing quotes with different coverage levels from the best and cheapest auto insurance companies in New York can help you balance protection and price.

How to Save Money on New York Auto Insurance

New York drivers can save a lot on car insurance by taking advantage of company discounts. Geico is one of the top providers for savings, offering up to 25% off for bundling, multi-car policies, and anti-theft devices, plus 12% claims-free and 26% good driver discounts.

Auto Insurance Discounts From Top New York Providers| Insurance Company | Anti-Theft | Bundling | Claims-Free | Good Driver | Multi-Car |

|---|---|---|---|---|---|

| 10% | 25% | 10% | 25% | 25% | |

| 15% | 25% | 10% | 23% | 10% |

| 10% | 20% | 9% | 30% | 20% | |

| 25% | 25% | 12% | 26% | 25% | |

| 20% | 10% | 10% | 25% | 15% | |

| 35% | 25% | 8% | 20% | 25% |

| 25% | 10% | 10% | 30% | 12% | |

| 15% | 17% | 11% | 25% | 20% | |

| 15% | 13% | 13% | 10% | 8% | |

| 15% | 10% | 20% | 30% | 10% |

Liberty Mutual also stands out with the highest anti-theft discount, 35%, and up to 25% off for bundling and multi-car coverage. Farmers and Progressive both offer 30% good driver discounts, making them great options for drivers with clean records who want to lower their monthly payments.

Other companies like Erie, State Farm, and USAA also provide solid savings, especially for claims-free and multi-car policies. USAA offers the best claims-free discount at 20%, along with 30% off for good drivers, making it a top pick for military families in New York.

While Kemper and Travelers have fewer overall discounts, they still provide valuable savings on specific features like anti-theft and claims-free driving. Comparing these discounts from the best auto insurance companies in New York can help you get the most value for your money.

Read More: 26 Hacks to Save More Money on Car Insurance

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Frequently Asked Questions

What is the best car insurance company in NY?

Geico is considered the best car insurance company in New York for its low rates starting at $51 per month, strong coverage options, and high customer satisfaction.

Read more: What to Do If You Can’t Afford Your Auto Insurance

What is the recommended auto insurance coverage in NY?

Experts recommend carrying more than the state minimum by adding collision, comprehensive, and uninsured motorist coverage to fully protect yourself and your vehicle.

What insurance companies are available in New York?

Top insurance companies in New York include Geico, Allstate, Liberty Mutual, State Farm, Farmers, Kemper, Progressive, USAA, Erie, and Travelers.

What is the cheapest car insurance in NYC?

Geico offers the cheapest car insurance in NYC, with minimum coverage rates starting as low as $51 per month. Enter your ZIP code to find the cheapest provider near you.

Is auto insurance in New York expensive?

Yes, car insurance in New York is more expensive than in many other states due to high traffic, accident rates, and the cost of living, especially in NYC.

Read More: The Worst States for Filing an Auto Insurance Claim

Who is cheaper in New York, Geico or Progressive?

Geico is generally cheaper than Progressive in New York, with rates starting at $51 per month compared to Progressive’s $63 per month for minimum coverage.

What is the new law in NY about car insurance?

New York recently updated its electronic proof of insurance law, allowing drivers to show proof of coverage on a smartphone or digital device.

What is the average car insurance in NY?

The average cost of car insurance in New York is around $150 to $200 per month for full coverage, depending on your driving profile and location.

How can I lower my car insurance in NY?

New York drivers can lower their insurance by comparing quotes, bundling policies, maintaining a clean driving record, and asking about discounts like multi-car or safe driver.

Read More: 17 Car Insurance Discounts You Can’t Miss

How many insurance companies are there in New York?

There are dozens of licensed auto insurance companies serving New York drivers, including both national and regional providers.

Does Geico insure cars in NY?

Yes, Geico insures cars in New York and is one of the most popular providers in the state with some of the lowest starting rates.

What borough in NYC has the cheapest car insurance?

Staten Island generally has the cheapest car insurance rates among the five boroughs of NYC, compared to higher rates in Manhattan, Brooklyn, and the Bronx.

Learn More: How to Compare Auto Insurance Companies

Which auto brand is the best?

Toyota is often ranked as the best auto brand due to its reliability, safety ratings, and lower insurance costs compared to luxury or sports brands.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.