10 Best Auto Insurance Companies in Washington for 2026

American Family, Allstate, and Progressive are the best auto insurance companies in Washington. USAA has the cheapest car insurance in Washington at $26 a month. AmFam stands out for accident forgiveness and student discounts, while Progressive Snapshot cuts rates for good, low-mileage drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated October 2025

The top three best auto insurance companies in Washington are American Family, Allstate, and Progressive. American Family takes the top spot with accident forgiveness, a low-mileage discount for drivers under 7,500 miles a year, and perks that grow longer you stay.

- AmFam covers emergency travel expenses for out-of-area accidents

- Progressive offers strong mobile app tools in Washington

- Washington drivers can rely on Farmers to always use OEM parts

Allstate stands out for its deductible rewards, knocking $100 off each year you go without a claim, plus it offers custom replacement that includes sound systems.

Our Top 10 Picks: Best Auto Insurance Companies in Washington| Company | Rank | Loyalty Discount | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 18% | A | Loyalty Rewards |

| #2 | 15% | A+ | Deductible Rewards | |

| #3 | 13% | A+ | Innovative Tools | |

| #4 | 12% | A | OEM Coverage | |

| #5 | 11% | A++ | Military Benefits | |

| #6 | 10% | A++ | Big Discounts | |

| #7 | 10% | B++ | Local Favorite |

| #8 | 9% | A++ | Hybrid/EVs | |

| #9 | 8% | A+ | UBI Savings |

| #10 | 6% | A++ | Local Agents |

Progressive earns its place with the Snapshot app, which tracks driving, gap insurance to cover balances if your car is totaled, and autopay savings.

Enter your ZIP code to unlock cheap car insurance options from the best auto insurance companies in Washington state. You can save immediately.

Compare Auto Insurance Rates in Washington

The best car insurance companies in Washington charge very different rates depending on how much coverage you want.

These price differences aren’t random — premiums reflect how each company views risk, loyalty, and driving habits.

Washington Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $149 | |

| $52 | $119 |

| $58 | $132 | |

| $42 | $97 | |

| $40 | $91 |

| $62 | $152 |

| $34 | $78 | |

| $39 | $90 | |

| $46 | $106 | |

| $26 | $59 |

USAA’s full coverage at $59 a month is tough to beat if you qualify, especially for military families who drive less or store vehicles. Progressive keeps things affordable at $78 monthly, especially for safe drivers using its Snapshot program. American Family’s monthly $119 for full coverage is higher, but it comes with discounts. Learn more hacks to save money on car insurance.

PEMCO’s $152 monthly rate is the most expensive, which might reflect its focus on covering more local risks. Companies like State Farm and Nationwide land near $90 a month, which works well if you want reliable rates and perks like accident forgiveness.

Ultimately, what you pay depends on how you drive, who you are, and what kind of protection gives you peace of mind.

How Credit Score Impacts Your Monthly Rate in WA

Even with the best auto insurance companies in Washington, your credit score can seriously shift your monthly rate.

The difference between good and poor credit isn’t small — it can mean paying nearly double for the same coverage.

Washington Full Coverage Insurance Monthly Rates by Credit Score| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $100 | $130 | $160 | |

| $98 | $128 | $158 |

| $105 | $135 | $170 | |

| $85 | $110 | $140 | |

| $110 | $140 | $175 |

| $102 | $132 | $162 |

| $90 | $115 | $145 | |

| $95 | $125 | $155 | |

| $108 | $138 | $168 | |

| $80 | $100 | $130 |

USAA keeps things the most balanced, going from $80 to $130 per month, which is still a solid deal even with poor credit, but only available to military families in Washington. Progressive offers the best auto insurance rates by credit score for most drivers, and softens the hit with Snapshot, giving drivers a discount no matter their score.

If you’re worried about rising premiums, learning what to do if you can’t afford your auto insurance is just as important as knowing how to find the best car insurance in Washington based on your credit and driving habits.

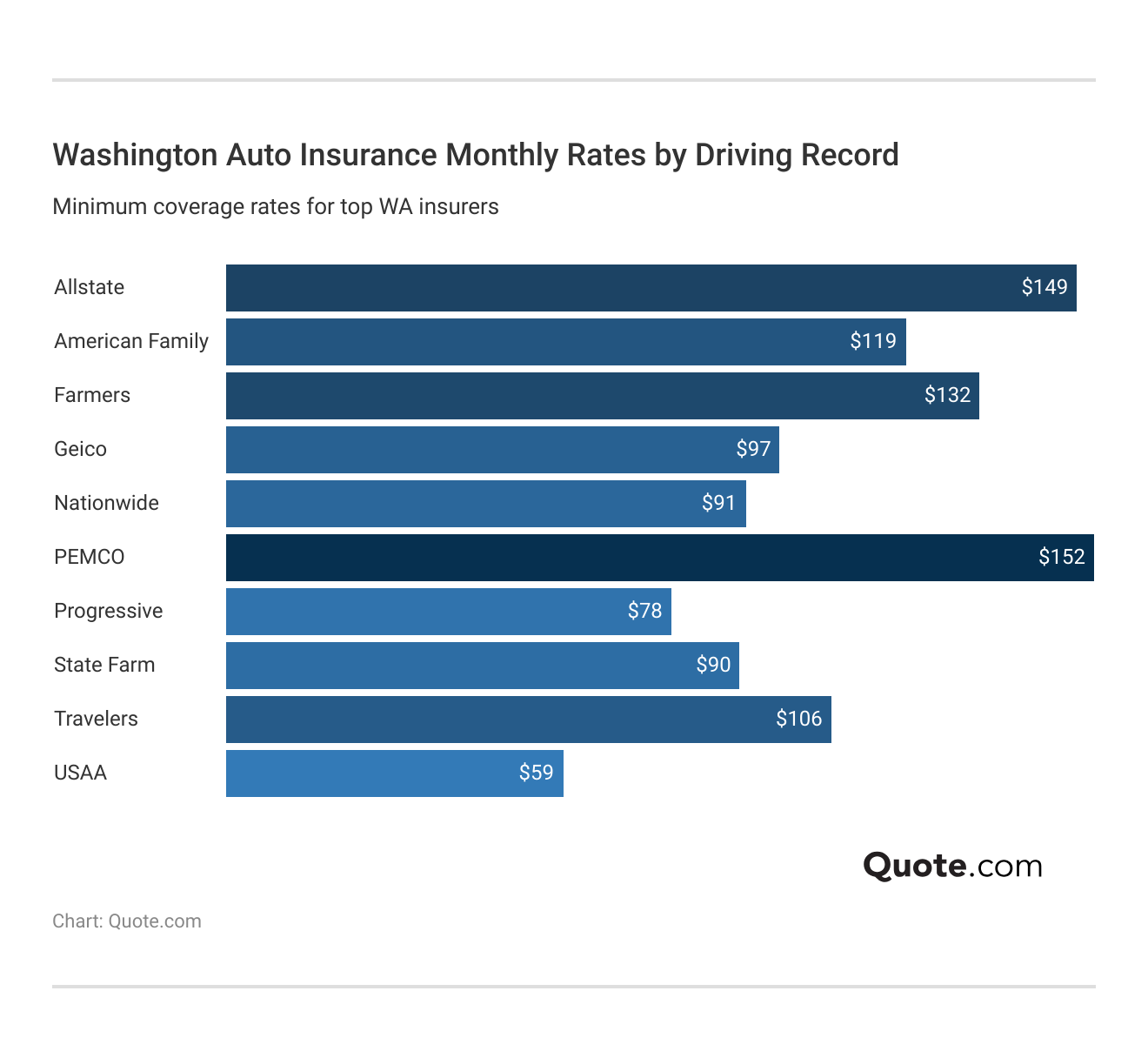

How Driving Record Impacts Monthly Rates in WA

Your driving record affects how much you pay every single month.

In Washington, even one ticket or accident can push your rate up fast, and some insurers hit harder than others.

Travelers barely changes after a ticket but charges $149 a month with a clean record and $192 per month after an accident, nearly a $50 jump.

Geico keeps things reasonable at first, but if you get a DUI, expect your monthly rate to spike to $265, the highest of all.

USAA is easily the most forgiving, going from $59 monthly for a clean record to just $119 per month with a DUI, which is rare.

If your record isn’t perfect, knowing what to do if you can’t afford your auto insurance and exploring tips to pay less for car insurance can make a big difference in staying covered without overspending.

How Vehicle Type Shapes Your Insurance Cost in WA

SUVs and trucks cost more to insure with most Washington car insurance companies.

While minivans sound like a safe bet, many providers still charge $125 a month or more — unless you’re with USAA, where it drops to $100 monthly.

Washington Full Coverage Insurance Monthly Rates by Vehicle Type| Company | Sedan | SUV | Truck | Minivan |

|---|---|---|---|---|

| $120 | $140 | $150 | $125 | |

| $112 | $137 | $147 | $122 |

| $118 | $140 | $155 | $125 | |

| $100 | $120 | $135 | $105 | |

| $125 | $145 | $160 | $130 |

| $122 | $142 | $152 | $127 |

| $105 | $125 | $140 | $110 | |

| $110 | $130 | $145 | $115 | |

| $115 | $135 | $150 | $120 | |

| $95 | $115 | $130 | $100 |

Some vehicles are simply riskier or more expensive to fix, and insurers price that into your premiums.

If you’re trying to cut costs, it helps to compare auto insurance companies side by side and look for those that reward your vehicle type.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Washington Car Insurance

The best auto insurance companies in Washington offer a wide mix of savings, but not all of them work the same for every driver.

American Family knocks 25% off for bundling and anti-theft, ideal for homeowners with garage-kept vehicles.

Top Auto Insurance Discounts in Washington| Company | Anti-Theft | Bundling | Claims-Free | Good Driver |

|---|---|---|---|---|

| 10% | 25% | 10% | 25% | |

| 25% | 25% | 15% | 25% |

| 10% | 20% | 9% | 30% | |

| 25% | 25% | 12% | 26% | |

| 5% | 20% | 14% | 40% |

| 10% | 25% | 10% | 20% |

| 25% | 10% | 10% | 30% | |

| 15% | 17% | 11% | 25% | |

| 15% | 13% | 13% | 10% | |

| 15% | 10% | 20% | 30% |

Geico spreads out the savings nicely—25% for bundling, 26% for safe driving—helping everyday drivers stack up discounts easily.

These are the kinds of car insurance discounts you can’t miss if you’re trying to lower your monthly bill.

If you’re adding a young driver, look for companies that offer family-focused discounts to offset those steep first-time premiums.

Jeff Root Licensed Insurance Agent

On the flip side, loyalty discounts from Progressive, Travelers, and State Farm are much lower than the competition. If you’ve been sticking around for that reason alone, it might be worth reevaluating your options.

If you want to lower your rates, try bundling your home and auto, signing up for autopay, or choosing comprehensive auto insurance, especially if you live somewhere like Tacoma or Spokane, where theft or weather damage is more common.

Must-Have Coverages for Washington Drivers

Knowing what your auto insurance covers can make a huge difference when something goes wrong.

In Washington, liability insurance is required, but the minimum limits don’t always go far, especially if you’re in a serious accident. That’s why many drivers choose to bump up their coverage for more peace of mind.

Auto Insurance Coverage Options| Coverage | What it Covers |

|---|---|

| Liability | Injuries to others in accidents you cause |

| Collision | Harm to your vehicle in a collision |

| Comprehensive | Destruction from non-collision events |

| Personal Injury Protection (PIP) | Medical expenses for you and passengers |

| Uninsured/Underinsured Motorist (UIM) | Protection from uninsured drivers |

| Medical Payments (MedPay) | Medical costs regardless of fault |

| Rental Reimbursement | Rental car costs while yours is repaired |

| Towing and Labor | Towing and roadside assistance |

| Roadside Assistance | Tire changes, lockouts, fuel delivery |

| Gap Insurance | Difference between car's value and loan balance |

Collision coverage helps cover the cost if you crash into something, which really matters if your car’s new or still has a loan on it. Comprehensive comes in handy for things like wildfire damage, falling trees, or theft, real risks across both rural and city areas in the state.

Personal injury protection is helpful if you or your passengers get hurt and need coverage for medical bills or missed work, especially if your health insurance has a high deductible.

Washington insurance companies are required by law to add personal injury protection insurance to auto policies, but drivers can reject this coverage in writing.

Washington Auto Insurance Claim Trends

Auto insurance premiums in Washington stay fairly stable, and that’s largely thanks to how the state scores in key risk areas.

While it’s not the cheapest state, it’s definitely not among the most expensive either.

Washington Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | A | High but manageable traffic |

| Average Claim Size | B | Moderate claim amounts |

| Vehicle Theft Rate | B | Moderate theft incidents |

| Weather-Related Risks | B | Occasional severe weather |

Traffic might seem heavy around Seattle, but crash rates stay low enough that insurers don’t overcharge for liability.

Car theft happens, sure, but it’s mostly in certain cities, and rural areas help balance it out. And storms and wildfires aren’t constant enough to cause big insurance spikes.

Auto insurance claims in Washington directly affect what you’ll pay and which coverages actually matter.

Some claim types show up more often, and others just cost a lot more when they do. Claims aren’t too pricey in Washington, so safe drivers usually get better rates.

Common Auto Insurance Claims in Washington| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collisions with Other Vehicles | 40% | $3,000 |

| Weather-Related Damage | 25% | $2,500 |

| Vehicle Theft | 15% | $7,000 |

| Animal Collisions | 10% | $2,200 |

| Vandalism | 10% | $2,000 |

Crashes make up 40% of claims and cost about $3,000, so having collision coverage really helps, especially if you drive near the I-5. Weather damage runs around $2,500 and hits hardest during wildfire season or winter storms.

Cities with more crashes and claims tend to come with higher rates, even if you’ve never filed one yourself. If you’ve never had to use your policy, it’s smart to understand how to file an auto insurance claim before you’re caught off guard.

Washington Accidents & Claims per Year by City| City | Accidents per Year | Claims per Year |

|---|---|---|

| Bellevue | 1,500 | 1,200 |

| Everett | 2,800 | 2,200 |

| Kent | 2,200 | 1,800 |

| Seattle | 15,000 | 12,000 |

| Spokane | 3,500 | 2,800 |

| Tacoma | 5,000 | 4,000 |

| Vancouver | 2,000 | 1,600 |

Seattle has about 15,000 accidents a year, so it makes sense that rates there run high. Tacoma’s not far behind, which can mean fewer discounts. Bellevue sees fewer crashes, so insurance tends to cost a bit less.

In places like Everett and Kent, your exact ZIP code can really impact what you pay based on local traffic and claims. Since rates depend on where you live, the easiest way to save is to enter your ZIP code and check a few quotes online.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Washington Car Insurance Companies

American Family, Allstate, and Progressive are the best auto insurance companies in Washington because they actually help you save.

American Family gives loyal customers up to 18% off, Allstate cuts $100 off your deductible for every year you go without a claim, and Progressive offers up to 30% off through its Snapshot UBI program if you drive safely.

#1 – American Family: Top Overall Pick

Pros

- Loyalty Discount: Long-term Washington policyholders qualify for up to 18% off premiums after five consecutive renewal years. For the full discount list, see our American Family Insurance review.

- KnowYourDrive Discount: Washington drivers save up to 20% for low annual mileage tracked through the KnowYourDrive telematics program.

- Teen Safe Driver Program: Families in Washington with teen drivers receive free safety tech and rate reductions for clean driving.

Cons

- Limited Rideshare Coverage: American Family does not offer rideshare endorsement for Washington drivers working with Uber or Lyft.

- Digital Claims Lag: Washington users report slow upload times and document glitches using the MyAmFam mobile app during claims.

#2 – Allstate: Best for Deductible Rewards

Pros

- Deductible Rewards: Allstate reduces collision deductibles by $100 annually for Washington drivers with no at-fault claims, up to $500. See what makes it stand out in our Allstate insurance review.

- New Car Replacement: Totaled vehicles under two years old in Washington qualify for full replacement without depreciation deduction.

- Custom Equipment Protection: Washington drivers adding aftermarket audio or visual components can ensure them through Sound System Coverage.

Cons

- Drivewise Required for Savings: Washington drivers must use the Drivewise mobile app to unlock key safe-driving and behavior-based discounts.

- Higher Base Rates: Monthly premiums before discounts often exceed $130 for Washington drivers under 25 or with recent claims.

#3 – Progressive: Best for Innovative Tools

Pros

- Snapshot UBI Program: Progressive gives Washington drivers up to 30% off for smooth braking, low miles, and avoiding late-night drives.

- Name Your Price Tool: Washington users can input their monthly budget (starting at $26) to view plans that fit. Learn everything you need to know about Progressive insurance in one place.

- Loan/Lease Payoff Coverage: Washington drivers with financed vehicles benefit from gap insurance that pays loan balances after total loss.

Cons

- High Post-Claim Surcharge: Washington drivers without accident forgiveness see rate increases between 20% and 40% after a single claim.

- Sparse Agent Access: Progressive’s direct model limits face-to-face support in smaller Washington towns and rural counties.

#4 – Farmers: Best for OEM Coverage

Pros

- OEM Parts Coverage: Farmers guarantees original manufacturer part replacements in Washington for covered repairs on newer vehicles.

- Signal Discount: Safe driving in Washington, tracked via the Signal app, earns up to 15% off after 10 trips with steady habits. Get everything you need to know about Farmers Insurance here.

- Accident Forgiveness Add-On: Washington drivers remain rate-protected after a first at-fault accident once they’ve been claim-free for three years.

Cons

- Digital Discount Ceiling: Washington customers cannot stack Signal, good student, and multi-car discounts beyond a 25% threshold.

- App Stability Issues: Signal users in Washington often report connectivity issues and inaccurate trip detection on Android devices.

#5 – USAA: Best for Military Benefits

Pros

- Stored Vehicle Discount: Deployed Washington service members save up to 60% when storing cars on base or in secured garages.

- SafePilot App: Washington drivers tracking smooth acceleration, low speeds, and daytime travel get up to 30% off.

- Superior Claims Rating: With an A++ A.M. Best rating, USAA processes most Washington claims in under five business days. Find out what to expect in our USAA auto insurance review.

Cons

- Military Restriction: USAA policies in Washington are only available to active military, veterans, and their immediate family.

- Few Physical Locations: Washington policyholders needing walk-in support may struggle due to limited branch offices statewide.

#6 – Geico: Best for Big Discounts

Pros

- DriveEasy App Savings: Washington drivers can earn up to 25% off by enrolling in Geico’s DriveEasy telematics program.

- Multi-Vehicle Discount: Washington households insuring two or more vehicles save up to 25% automatically.

- Defensive Driver Discount: State-certified safety course grads in Washington get 10%–15% off liability premiums. Get the facts in our guide to everything you need to know about Geico.

Cons

- Basic Coverage Focus: Geico offers fewer optional protections, such as gap, rideshare, OEM parts, and new car replacement in Washington.

- Repair Delay Complaints: Washington customers occasionally report long wait times at ARX repair facilities under Geico’s claims network.

#7 – PEMCO: Best Local Favorite

Pros

- Customer Satisfaction: PEMCO is the #1 company in the Northwest U.S. in J.D. Power customer service and claims satisfaction surveys.

- Educator Discount: Washington K-12 and college faculty receive exclusive premium reductions under PEMCO’s Educator Advantage.

- Home and Auto Bundle: Washington residents bundling policies receive up to 15% off both lines. See what to compare before you buy auto insurance online.

Cons

- State-Bound Coverage: Drivers relocating outside Washington or Oregon must switch carriers due to PEMCO’s regional license limitation.

- Lower Financial Rating: PEMCO’s B++ A.M. Best rating trails behind most national providers for long-term financial strength in Washington.

#8 – Travelers: Best for Hybrid/EVs

Pros

- Hybrid Vehicle Discount: Washington residents with electric or hybrid cars like the Prius or Bolt receive rate cuts.

- Premier New Car Replacement: Totaled vehicles less than 5 years old in Washington are replaced with brand-new equivalents.

- IntelliDrive Program: After 90 days of tracked trips, safe drivers in Washington save up to 20%. Learn what sets it apart in our Travelers auto insurance review.

Cons

- Quote Complexity: Washington shoppers report needing agent assistance to combine IntelliDrive, hybrid, and multi-line discounts accurately.

- Variable ZIP Pricing: Quotes differ by 30%–40% between Washington urban and rural ZIP codes due to risk tiering.

#9 – Nationwide: Best for UBI Savings

Pros

- SmartRide Program: Tracks braking, mileage, and idle time to reward safe driving with up to 40% off, the biggest usage-based discount on Washington car insurance.

- Accident Forgiveness Option: You can add coverage that keeps your rate from jumping after your first accident in Washington.

- Vanishing Deductible: Washington policyholders see $100 yearly reductions in deductibles, maxing out at $500 after five clean years.

Cons

- Few Niche Endorsements: No OEM parts or rideshare coverage available under standard auto policies in Washington. See how it stacks up in our Nationwide insurance review.

- Smaller Bundling Return: Compared to Travelers or Allstate, home and auto bundling in Washington yields a lower average discount.

#10 – State Farm: Best for Local Agents

Pros

- Extensive Agent Network: Over 200 agents across Washington provide direct, in-person support statewide. Get the full breakdown in our State Farm insurance review.

- Drive Safe & Save App: Washington drivers tracking seatbelt use, hard stops, and night travel can earn up to 30% back.

- Accident Forgiveness: Available after 9 years with no claims, Washington drivers won’t see a surcharge after their first accident.

Cons

- High-Risk Driver Limitations: Washington motorists with multiple violations or DUIs may not qualify for standard plans.

- Bundling Cap: Home and auto bundles top out at a 17% discount, which is competitive but lower than other Washington auto insurance companies.

Frequently Asked Questions

What is the best auto insurance in Washington?

The best car insurance in Washington comes from companies like American Family, Allstate, and Progressive. American Family offers up to 18% loyalty savings, Allstate provides $100 deductible reductions per claim-free year, and Progressive gives up to 30% off with its Snapshot program. Rates start as low as $26 for minimum coverage, depending on your ZIP code and driving record.

What are the top-rated home and auto insurance companies in Washington?

Top-rated home and auto insurance companies in Washington include American Family, which offers a 25% bundling discount, Allstate for reliable home coverage and deductible rewards, and Progressive for flexible policy tools and strong multi-policy savings. These providers consistently score well in customer satisfaction and financial stability.

Do you have to have auto insurance in Washington state?

Yes, you are legally required to have car insurance in Washington state. The minimum liability auto insurance limits are $25,000 for injury to one person, $50,000 per accident, and $10,000 for property damage. Driving without insurance can result in a $550 fine, license suspension, and being personally liable for any damages you cause.

Can auto insurance companies use my credit score in Washington?

Yes, Washington car insurance companies can use your credit score to set your rate. Does a credit score affect car insurance in Washington? Yes, it does — drivers with good credit may pay $85 a month with Geico, while those with poor credit could pay up to $175 with Nationwide. Improving your credit and using telematics programs like Progressive’s Snapshot can help reduce premiums.

Which insurance company in Washington is best at paying claims?

State Farm and USAA are top-rated for claims handling in Washington, backed by A++ A.M. Best ratings and high J.D. Power scores for customer satisfaction and payment speed.

Is Progressive good for auto insurance in Washington?

Yes, Progressive is a solid choice in Washington. It offers up to 30% off through its Snapshot program, plus competitive full coverage rates around $78 monthly for safe drivers. For more details on how it works, check out our definitive guide to usage-based car insurance to see if this kind of savings model fits your driving habits.

How do I find the right car insurance company in Washington?

Start by comparing quotes using your ZIP code, look for companies offering specific discounts you qualify for (like low mileage or defensive driving), and check their complaint index for red flags.

Is State Farm better than Geico in Washington?

State Farm may be better for drivers wanting personal agent support and perks like accident forgiveness, while Geico often wins on price with full coverage starting near $97 and 25% bundling discounts.

Why is State Farm so expensive in Washington?

State Farm’s premiums are often higher in Washington due to fewer large discounts and elevated base rates in cities like Seattle or Tacoma, where accident claims are more frequent. While Washington isn’t among the worst states for filing an auto insurance claim, high-traffic areas can still drive up premiums due to increased risk.

What insurance company has the highest customer satisfaction in Washington?

USAA leads in customer satisfaction in Washington, but is limited to military families. American Family and State Farm also rank highly for claim handling and policyholder service.

Is State Farm good at paying claims in Washington?

Who normally has the cheapest car insurance in Washington?

Which car insurance company has the lowest complaint index in Washington?

How can insurance prices in Washington be reduced?

At what age do auto insurance rates drop in Washington?

What are the disadvantages of Geico in Washington?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.