Best Pay-as-You-Go Auto Insurance in 2026

Nationwide, Liberty Mutual, and State Farm have the best pay-as-you-go auto insurance. Pay-as-you-go insurance charges based on driving habits and miles driven. Rates start at $45 monthly, and safe drivers can earn up to 40% off. High-mileage drivers should compare pay-as-you-go car insurance to get lower rates.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated September 2025

Get the best pay-as-you-go auto insurance with Nationwide, Liberty Mutual, and State Farm, providing coverage as low as $45 per month.

Top 10 Companies: Best Pay-as-You-Go Auto Insurance| Company | Rank | Claims Satisfaction | A.M. Best | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 728/1,000 | A+ | Safe Drivers | Nationwide | |

| #2 | 717/1,000 | A | Competitive Discounts | Liberty Mutual |

| #3 | 710/1,000 | A++ | Reliable Service | State Farm | |

| #4 | 706/1,000 | A | Budget Conscious | Farmers | |

| #5 | 701/1,000 | A+ | AARP Benefits | The Hartford |

| #6 | 692/1,000 | A++ | Digital Management | Geico | |

| #7 | 692/1,000 | A | Teen Drivers | American Family |

| #8 | 691/1,000 | A+ | High-Mileage Drivers | Allstate | |

| #9 | 684/1,000 | A++ | Electric/Hybrid Cars | Travelers | |

| #10 | 672/1,000 | A+ | Custom Tracking | Progressive |

Pay-as-you-go insurance is a type of usage-based car insurance (UBI) that calculates premiums based on mileage and driving habits, allowing companies to offer the lowest rates to safe, low-mileage drivers.

- You can buy pay-as-you-go insurance if you drive less than 10,000 miles annually

- Pay-as-you-go minimum coverage starts at $45 and goes up to $62 a month

- Nationwide rewards safe pay-as-you-go drivers with 20% discounts

This guide ranks the best companies for pay-as-you-go car insurance. Compare providers now to determine whether you qualify. Get the best rates possible by entering your ZIP code into our free comparison tool.

Cheap Pay-as-You-Go Auto Insurance Rates

Pay-as-you-go car insurance costs are based on mileage and not other factors, like driving record or credit score. It’s a type of usage-based policy where premiums are based on how much you drive. State Farm is the best pay-as-you-go car insurance company for low rates. Compare State Farm vs. Farmers, Geico, Progressive, and Allstate for more quotes.

Pay-as-You-Go Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $48 | $135 | |

| $50 | $140 |

| $47 | $125 | |

| $54 | $157 | |

| $62 | $165 |

| $55 | $150 | |

| $58 | $155 | |

| $45 | $130 | |

| $60 | $160 |

| $52 | $145 |

How much you pay depends on the company and coverage. Each pay-as-you-go insurance provider uses different program names, tracking methods, and discount structures. The cost of pay-as-you-go car insurance can also reflect the tech used, with smartphone apps often more efficient than vehicle-installed devices.

Most Popular Pay-as-You-Go Auto Insurance Programs| Company | Program | Savings | System |

|---|---|---|---|

| Drivewise & Milewise | 40% | Mobile App | |

| DriveMyWay & MilesMyWay | 20% | Mobile App / Odometer Photo |

| Signal | 30% | Mobile App | |

| DriveEasy | 25% | Mobile App | |

| RightTrack | 30% | Mobile App / In-Vehicle Device |

| SmartRide & SmartMiles | 40% | Mobile App / In-Vehicle Device | |

| Snapshot | 30% | Mobile App / In-Vehicle Device | |

| Drive Safe & Save | 30% | Mobile App / In-Vehicle Device | |

| TrueLane | 25% | Mobile App / In-Vehicle Device |

| IntelliDrive & IntelliDrivePlus | 20% | Mobile App |

American Family is the only company that gives drivers the option not to be tracked with certain pay-as-you-go programs. AmFam also offers the best pay-as-you-go car insurance for young drivers, with programs designed to help teens improve their driving habits and save money.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Pay-as-You-Go Auto Insurance Works

Pay-as-you-go car insurance works by tracking driving habits and mileage through apps or in-car devices. This means your monthly premiums will be based on how you actually drive, so you could get lower rates than you would with a standard policy that considers things like gender and credit score.

Some companies only track mileage, while some track mileage and driving habits, raising rates or shrinking discounts for bad habits like speeding or driving at night. Research the types of pay-as-you-go car insurance available in your state to see which policy fits your lifestyle. For instance, if you work at night, you may want to choose pay-per-mile car insurance that only tracks distance, not time of day.

You must drive less than 10,000 miles a year to qualify for pay-as-you-go car insurance, and some providers require that you drive less than 7,000 miles annually. Consider your driving habits and how often you drive before you buy pay-as-you-go auto insurance.

Read More: 26 Hacks to Save Money on Auto Insurance

Pay-as-You-Go vs. Usage-Based vs. Pay-Per-Mile Insurance

There are different types of pay-as-you-go insurance, such as usage-based insurance (UBI) and pay-per-mile. Each tracks different behaviors, which impact your rates. For example, pay-per-mile car insurance only tracks miles driven, while UBI tracks driving habits.

Types of Pay-as-You-Go Auto Insurance: Key Differences| Features | Pay-as-You-Go | Usage-Based | Pay-Per-Mile |

|---|---|---|---|

| What's Tracked | Miles driven, driving habits, or both | Driving habits, like speed, braking, and time of day | Miles driven per month or per trip |

| Device Type | Odometer, mobile app, or OBD-II device | Mobile app or OBD-II device | Odometer or OBD-II device |

| Premiums | Based on mileage, driving habits, or both | Based on how you drive and how often | Based on how far you drive |

| Savings | up to 40% | up to 40% | up to 60% |

| Who Benefits | Low-mileage drivers with good driving habits | Safe drivers without speeding tickets or accidents | Drivers on the road less than 10,000 miles a year |

Pay-as-you-go can track one or both and is used interchangeably by some providers to describe their UBI and low-mileage programs. Always compare multiple pay-as-you-go companies to find the program that’s compatible with your lifestyle.

Pay-as-you-go policies can be the cheapest car insurance for students, remote workers, or retirees since these programs track specific driving patterns.

Michelle Robbins Licensed Insurance Agent

The best pay-as-you-go car insurance options come from companies like Nationwide, which offer multiple types of policies for different types of drivers. Compare Liberty Mutual vs. Nationwide auto insurance to learn more.

Pay-as-You-Go Policy Options

Pay-as-you-go automobile insurance contains the same types of basic coverages as conventional car insurance policies. Knowing what each coverage guards enables you to select the proper level of protection for your driving requirements.

- Liability Coverage: Covers injuries and property damage you inflict on other people, such as bodily injury and property damage liability that most states require.

- Collision Coverage: Pays for repairs to your vehicle after collisions with other vehicles or objects, whether at fault or not, with a deductible you pay upfront.

- Comprehensive Coverage: Covers non-collision damage such as theft, vandalism, weather damage, and animal collision with a deductible factor.

- Personal Injury Protection (PIP): Pays for medical bills, lost earnings, and necessary services for you and passengers, regardless of fault, in respective states.

- Uninsured/Underinsured Motorist Coverage: Insures you against accidents involving drivers with not enough insurance to pay for damages they cause.

When comparing pay-as-you-go car insurance, it’s important to consider the types of add-ons or coverage options available. While roadside assistance and rental reimbursement are common, not every insurer offers the same types or levels of coverage.

Pay-as-You-Go Auto Insurance Add-Ons by Provider| Company | Roadside Assistance | Rental Reimbursement | Accident Forgiveness | Gap Insurance |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ❌ | |

| ✅ | ✅ | ❌ | ✅ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ❌ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ |

State Farm and Geico do not offer gap insurance, which means drivers with auto loans or leases would need to finance coverage from another provider, and Liberty Mutual is the only company that doesn’t extend its rideshare coverage to pay-as-you-go policies. Always compare pay-as-you-go car insurance from top providers before you buy to ensure you get the coverage you need.

Easy Ways to Save on Pay-as-You-Go Auto Insurance

Is pay-as-you-go car insurance cheaper? Yes, because it offers drivers a flexible way to save money by tailoring premiums to actual driving habits and miles driven. It’s particularly beneficial for those who drive less frequently, and you can save even more money by driving an older vehicle and avoiding night driving.

- Drive an Older Car: Older vehicles made before 2015 are cheaper to insure, and you can reduce coverage to liability-only for cheaper rates.

- Avoid Driving at Night: Night driving can reduce discounts on some usage-based and pay-as-you-go plans, so driving during the day can score you a bigger discount.

- Increase Your Deductibles: If you aren’t driving as often, consider increasing your insurance deductibles to $1,00o-$1,500 to lower your rates.

Pay-as-you-go drivers also qualify for additional discounts, such as those for safe driving, loyalty, or bundling policies. With multiple options from top companies, it’s important to consider how discounts can enhance the savings.

Top Pay-as-You-Go Auto Insurance Discounts| Company | Usage- Based | Low Mileage | Garaging | Loyalty | Bundling |

|---|---|---|---|---|---|

| 30% | 30% | 18% | 15% | 25% | |

| 30% | 20% | 10% | 18% | 25% |

| 30% | 10% | 12% | 12% | 20% | |

| 25% | 30% | 8% | 10% | 25% | |

| 30% | 30% | 11% | 10% | 25% |

| 40% | 40% | 10% | 8% | 20% | |

| 20% | 30% | 15% | 13% | 10% | |

| 30% | 30% | 7% | 6% | 17% | |

| 20% | 10% | 10% | 7% | 5% |

| 30% | 20% | 9% | 9% | 13% |

Take advantage of these discounts by maintaining a clean driving record and saving additional money with safe driving habits. Most top companies, like Nationwide and Liberty Mutual, let drivers stack pay-as-you-go discounts with safe driver discounts for savings of up to 60% or more.

Since driving habits have a major influence over pay-as-you-go insurance rates, safe drivers often get the biggest discounts on their policy. The better driver you are, the lower your rates will be. However, customer reviews reveal mixed opinions on this kind of insurance. As one user shared, finding the best pay-as-you-go car insurance on Reddit depends largely on individual mileage and habits.

Comment

byu/candy_burner7133 from discussion

inInsurance

This review highlights that while pay-as-you-go works for some, it may not beat traditional plans for every driver. Always get multiple auto insurance quotes from different companies based on your mileage to see if pay-as-you-go auto insurance is right for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best Pay-as-You-Go Auto Insurance Companies

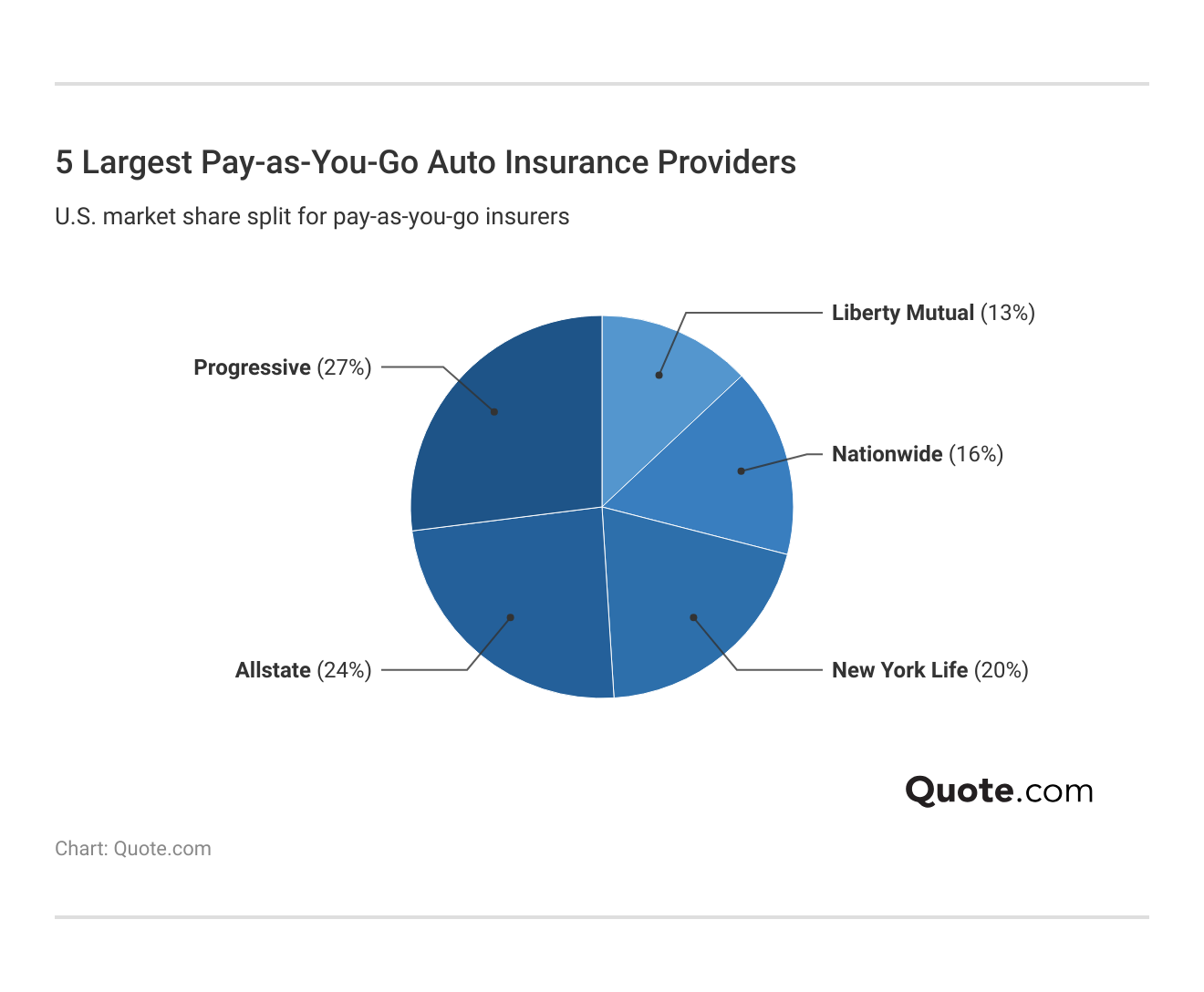

Nationwide, Liberty Mutual, and State Farm are the best companies for pay-as-you-go car insurance. State Farm has the cheapest car insurance for low-mileage drivers, but Nationwide has the biggest discounts of up to 40%. Nationwide is also one of the most popular providers for pay-as-you-go policies.

State Farm, Allstate, and Progressive also top the list of the largest companies, but being the biggest doesn’t necessarily mean the best. You might find better coverage and more mileage flexibility with a smaller provider. Compare the top ten pay-as-you-go auto insurance companies to find the right plan for you.

#1 – Nationwide: Top Pick Overall

Pros

- Superior Pay-as-You-Go Rewards: Safe drivers receive up to 40% discounts when enrolled in either SmartRide UBI or SmartMiles pay-per-mile auto insurance.

- Low Complaint Frequency: Customer ratings show fewer disputes with Nationwide’s pay-as-you-go claims than most rivals (Read More: Nationwide Insurance Review).

- Tracks Only Mileage: Unlike some of its competitors, Nationwide SmartMiles only tracks your monthly mileage and won’t raise rates for things like speeding or driving at night.

Cons

- Higher Entry Cost: The minimum coverage rate of $55 makes Nationwide’s pay-as-you-go auto insurance more expensive than State Farm’s $45 entry-level option.

- Limited Mileage Flexibility: Pay-as-you-go drivers exceeding 11,000 annual miles see diminishing returns on their SmartMiles benefits compared to specialized high-mileage providers like Allstate.

#2 – Liberty Mutual: Best for Competitive Discounts

Pros

- Comprehensive Discount Portfolio: Liberty Mutual pay-as-you-go customers receive up to 30% low-mileage discounts, 30% UBI discounts for safe driving behavior, and 35% for anti-theft devices.

- Exclusive Military Discounts: Active and retired service members receive additional reductions on their pay-as-you-go rates. Explore more discounts in our Liberty Mutual insurance review.

- High Claims Satisfaction: Liberty Mutual improved its customer satisfaction ratings and is one of the top five providers for claims, according to J.D. Power.

Cons

- Premium Entry Cost: Liberty Mutual’s pay-as-you-go minimum coverage starts at $62, exceeding State Farm’s comparable protection by a substantial $17 per month.

- Critical Protection Gap: Military personnel enrolled in pay-as-you-go programs cannot access accident forgiveness, exposing them to significant rate increases after even minor incidents.

#3 – State Farm: Best for Reliable Service

Pros

- Unmatched Local Support: State Farm maintains 19,000+ local agents nationwide who provide personalized guidance for optimizing your pay-as-you-go savings opportunities.

- Industry-Leading Premiums: Its pay-as-you-go minimum coverage rate of $45 is the lowest among all top ten providers. Compare more quotes in our State Farm auto insurance review.

- Competitive Discount Structure: Drivers can earn up to 30% in usage-based discounts by maintaining excellent records in State Farm Drive Safe & Save.

Cons

- Significant Protection Gaps: State Farm’s pay-as-you-go program excludes gap insurance, creating potential financial vulnerabilities for certain drivers.

- Not Renewing Policies: State Farm may not renew or underwrite new pay-as-you-go insurance policies for drivers in high-risk states like Florida and Rhode Island.

#4 – Farmers: Best for Full Coverage

Pros

- Budget-Friendly Full Coverage: Farmers offers full coverage with a pay-as-you-go rate of $125, the lowest comprehensive option on this list. Learn more in our Farmers review.

- Stackable Discount Structure: Drivers can combine pay-as-you-go savings with up to seven other concurrent discounts, a compatibility level unmatched by other providers.

- Above Average Claims Service: Farmers agents are well known for exceptional customer service when handling pay-as-you-go car insurance claims.

Cons

- Lower Financial Rating: Farmers’ A rating from A.M. Best means its pay-as-you-go claims backing is less secure than Travelers’ or Geico’s superior A++ strength.

- Technology Performance: Customer feedback indicates Farmers pay-as-you-go tracking has more technical issues than smartphone-based alternatives from competitors.

#5 – The Hartford: Best for AARP Benefits

Pros

- Exclusive Senior Benefits: The Hartford specializes in pay-as-you-go insurance for drivers over 50 with AARP memberships, which includes recovery assistance and accident forgiveness.

- Affordable Entry Point: With minimum coverage starting at just $50, The Hartford provides competitive pay-as-you-go rates (Read More: Best Auto Insurance for Good Drivers).

- Specialized Coverage: Hartford’s pay-as-you-go program includes specialized benefits, including accident forgiveness, that other providers charge extra for.

Cons

- Age Restrictions: The Hartford’s pay-as-you-go program primarily targets older drivers, limiting availability for younger customers. Learn more in our Hartford insurance review.

- Limited Technology Integration: The Hartford’s pay-as-you-go tracking relies on older monitoring methods compared to smartphone-based competitors like Progressive.

#6 – Geico: Best for Digital Management

Pros

- Streamlined Digital Management: Geico’s mobile app allows complete management of pay-as-you-go car insurance without requiring agent interactions.

- Rock-Solid Financial Foundation: Our Geico auto insurance review verifies that its pay-as-you-go policies are backed by the highest possible A++ financial rating.

- Competitive Discounts: Customers can combine their pay-as-you-go program with home insurance to receive up to 30% low-mileage discounts and 25% UBI discounts beyond usage-based savings.

Cons

- Limited Coverage Options: Geico’s pay-as-you-go program lacks comprehensive add-ons like accident forgiveness and rideshare coverage that competitors include.

- Technology Learning Curve: Some customers report difficulty navigating Geico’s digital-first approach without traditional agent support for pay-as-you-go questions.

#7 – American Family: Best for Teen Drivers

Pros

- Generational Discounts: Teens and new drivers added to an existing AmFam policy automatically receive a loyalty discount on pay-as-you-go auto insurance.

- Competitive Student Discounts: Young drivers under 25 who maintain a B average in high school and college can save 20% on pay-as-you-go insurance.

- Won’t Raise Rates: MilesMyWay only tracks monthly mileage, locking in pay-as-you-go discounts regardless of driving habits.

Cons

- Limited Availability: American Family only sells pay-as-you-go car insurance in 26 states. Read our AmFam Insurance review to find it near you.

- Below-Average Claims Service: Although not the worst pay-as-you-go auto insurance company, it does rank slightly below the national average for claims satisfaction.

#8 – Allstate: Best for High-Mileage Drivers

Pros

- Advanced Telematics Analysis: Allstate utilizes 15 distinct driving metrics in its pay-as-you-go programs, providing drivers more opportunities to save money.

- High-Mileage Driver Benefits: Drivers on the road for more than 10,000 miles per year can still save with Allstate Milewise Unlimited (Learn More: Allstate Insurance Review).

- Progressive Loyalty Benefits: Customers earn increasing pay-as-you-go discounts that grow by 3% annually up to 15% after five years.

Cons

- Regional Service Inconsistency: Allstate’s pay-as-you-go program receives average to below-average consumer ratings due to varying customer experiences across different states.

- Steep Coverage Jump: The $87 monthly difference between minimum and full pay-as-you-go coverage rates represents the third-largest price gap among the top providers.

#9 – Travelers: Best for EVs and Hybrid Cars

Pros

- Green Discounts: Tavelers offers one of the biggest discounts (up to 10%) on pay-as-you-go car insurance for electric and hybrid vehicles.

- Two Program Options: Travelers IntelliDrive tracks driving habits, while IntelliDrivePlus also tracks mileage to provide even bigger pay-as-you-go discounts.

- Wide Variety of Coverage: Travelers pay-as-you-go policies come with a variety of add-on options. Read our Travelers Insurance review for a full list.

Cons

- Poor Claims Service: Travelers pay-as-you-go customer service is below the national average and lower than many other companies on this list.

- Higher Monthly Rates: Travelers is one of the most expensive pay-as-you-go auto insurance companies.

#10 – Progressive: Best for Custom Tracking

Pros

- Customizable Tracking Methods: Drivers can choose between smartphone apps or traditional plug-in devices for their pay-as-you-go monitoring, unlike most competitors that offer only one option.

- Complete Coverage Ecosystem: Progressive’s pay-as-you-go includes all five key add-ons, unlike many competitors (Learn More: Everything You Need to Know About Progressive Insurance).

- Unique Pricing Structure: Progressive offers pay-as-you-go drivers up to 30% low-mileage discounts and annual savings of $231 for safe driving behavior.

Cons

- Premium Price Point: At $155 for full coverage, Progressive’s pay-as-you-go program costs $30 more than Farmers while offering comparable protection levels.

- Worst Claims Service: Out of the ten best pay-as-you go auto insurance companies, Progressive has the lowest claims sataisfaction score.

How to Choose the Best Pay-as-You-Go Auto Insurance Company

If you can’t afford your auto insurance, the best pay-as-you-go auto insurance companies offer flexible alternatives with potential savings of up to 40% for safe, low-mileage drivers. Nationwide stands out for safe drivers with comprehensive add-ons and superior safety rewards.

Who should consider pay-as-you-go car insurance? It’s ideal for infrequent drivers, remote workers, students, urban commuters, and budget-conscious customers looking to pay only for the way they drive.

Pay attention to what your provider is tracking. Some only consider miles driven, while others track hard braking, rapid acceleration, and late-night driving.

Brandon Frady Licensed Insurance Agent

Explore your options and see if you qualify to save money with mileage-based pay-by-the-day car insurance by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

Who is pay-as-you-go auto insurance best for?

Pay-as-you-go, including usage-based and pay-per-mile car insurance, is ideal for remote workers, retirees, urban residents who use public transportation frequently, college students, secondary vehicle owners, and seasonal drivers. When you’re denied insurance coverage, this option provides an affordable alternative.

What is the best pay-as-you-go auto insurance?

What is the best pay-as-you-go provider? Nationwide, Liberty Mutual, and State Farm lead with the best pay-as-you-go car insurance. Enter your ZIP code into our free quote tool to find an insurer that fits your needs and budget.

Does Allstate have pay-as-you-go car insurance?

Allstate Drivewise and Milewise are its two pay-as-you-go insurance plans. Allstate Milewise Unlimited offer two mileage tiers to help those who drive more than 10,000 miles a year save money.

What variables does pay-as-you-go insurance measure?

Pay-as-you-go programs measure mileage, driving times, and night driving. Some programs use additional telematics to track acceleration, braking habits, cornering speed, phone usage, and overall driving patterns.

Is pay-per-mile auto insurance worth it?

Pay-per-mile car insurance is worth it if you drive less than 10,000 miles annually, potentially saving up to 60% compared to traditional policies. Tips to pay less for car insurance include choosing this option if you’re a low-mileage driver.

What are the disadvantages of pay-as-you-go insurance?

Some pay-as-you-go car insurance companies can raise your rates if you drive over the mileage limits or tend to speed or brake hard. Other disadvantages of pay-as-you-go auto insurance include limited availability. If you move out-of-state, you may not be able to take your policy wth you.

Who has the cheapest pay-as-you-go insurance?

Pay-as-you-go car insurance rates depend on your monthly mileage and driving habits. State Farm has the overall lowest rate at $45 per month. Use our free comparison tool to see how much insurance costs near you.

How many miles is considered low mileage for auto insurance?

Most insurance companies consider low mileage to be under 10,000 miles per year, although thresholds vary. Metromile and other specialized providers typically offer their best rates to drivers who drive under 7,500 miles per year.

What is a low-mileage discount, and is it different from pay-as-you-go auto insurance?

A low-mileage auto insurance discount is a fixed percentage off for driving below a threshold (usually 7,500-10,000 miles annually). Pay-as-you-go is more dynamic, charging based on driving habits and actual miles driven rather than offering a static discount.

How is pay-per-mile auto insurance different from usage-based telematics?

Pay-per-mile focuses primarily on the distance driven, charging per mile. Telematics measures comprehensive driving behavior, including braking, acceleration, and time of day. Most pay-as-you-go programs combine both approaches. Hugo car insurance offers competitive rates for drivers seeking usage-based coverage alternatives.

How do insurance companies verify mileage?

Is it bad to cancel pay-as-you-go auto insurance?

What car insurance can you get immediately?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.