Collision vs. Comprehensive Auto Insurance in 2026

Learn how collision vs. comprehensive auto insurance differs in coverage and cost. Collision insurance covers accident damage, while comprehensive coverage pays for theft, vandalism, and natural disasters. USAA and Geico have the cheapest comprehensive vs. collision insurance rates starting at $22 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshir...

Kristen Gryglik

Updated February 2026

Collision insurance covers incidents, like accidents with vehicles or objects, while comprehensive coverage applies to theft, vandalism, and natural disaster claims.

- Financed cars need both, but only comprehensive gets anti-theft discounts

- Comprehensive insurance covers non-driving incidents, like fire and theft

- Collision covers rollovers and hitting fixed objects, no matter the fault

This guide breaks down the difference between collision and comprehensive coverage and compares average costs by provider. USAA offers the lowest rates at $33 monthly for collision and $22 a month for comprehensive auto insurance.

Plus, discover discount opportunities and determine which coverage suits your needs based on vehicle value and risk factors. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Comprehensive vs. Collision Auto Insurance

What is comprehensive insurance vs. collision? Both are optional coverages that protect your vehicle, but they apply to different situations.

Collision versus comprehensive auto insurance is often misunderstood. Many assume comprehensive means “full coverage,” but that’s not accurate. The key difference lies in the cause of damage.

Collision auto insurance helps pay for damage to your car if you hit another vehicle or object, regardless of fault.

Comprehensive car insurance, on the other hand, covers non-collision incidents, such as theft, vandalism, fire, falling objects, natural disasters, or animal collisions (Read More: Does auto insurance cover theft?).

Comprehensive and collision coverage are often paired because together they provide broader protection. If you finance or lease your car, lenders usually require both.

Even if you own your vehicle outright, adding these coverages can help you avoid expensive repair bills after an unexpected event. The right choice depends on your car’s value, your budget, and how much financial risk you’re willing to take.

Compare quotes with different deductible options to find the right balance between monthly cost and out-of-pocket expenses.

Collision vs. Comprehensive Auto Insurance Coverage Differences| Covered Event | Collision Insurance | Comprehensive Insurance |

|---|---|---|

| Collision with another vehicle | ✓ | ✗ |

| Hitting an object (tree, pole, guardrail) | ✓ | ✗ |

| Single-car rollover | ✓ | ✗ |

| Vandalism | ✗ | ✓ |

| Theft of the vehicle | ✗ | ✓ |

| Fire damage | ✗ | ✓ |

| Natural disasters (flood, hail, etc.) | ✗ | ✓ |

| Animal collision (e.g., hitting a deer) | ✗ | ✓ |

| Broken windshield (non-collision) | ✗ | ✓ |

| Damage from falling objects (e.g., tree branch) | ✗ | ✓ |

So, do you need collision or comprehensive insurance? It depends on your lifestyle, your risk profile, and your car’s value. Most full coverage policies include both, but you can choose to carry one, both, or neither if you’re not required by a lender.

If you drive in heavy traffic or in areas with higher crash rates, collision coverage may be a better fit. If storms, theft, or animal strikes are common where you live, comprehensive coverage can offer stronger protection, especially when animals or natural disasters damage your vehicle.

The difference between collision and comprehensive coverage often comes down to the cause of damage.

Collision covers accidents with other cars or things that do not move. Comprehensive coverage protects you from theft, fire, or when animals or natural disasters damage your vehicle.

Both coverages are optional, but are often required by lenders for financed cars.

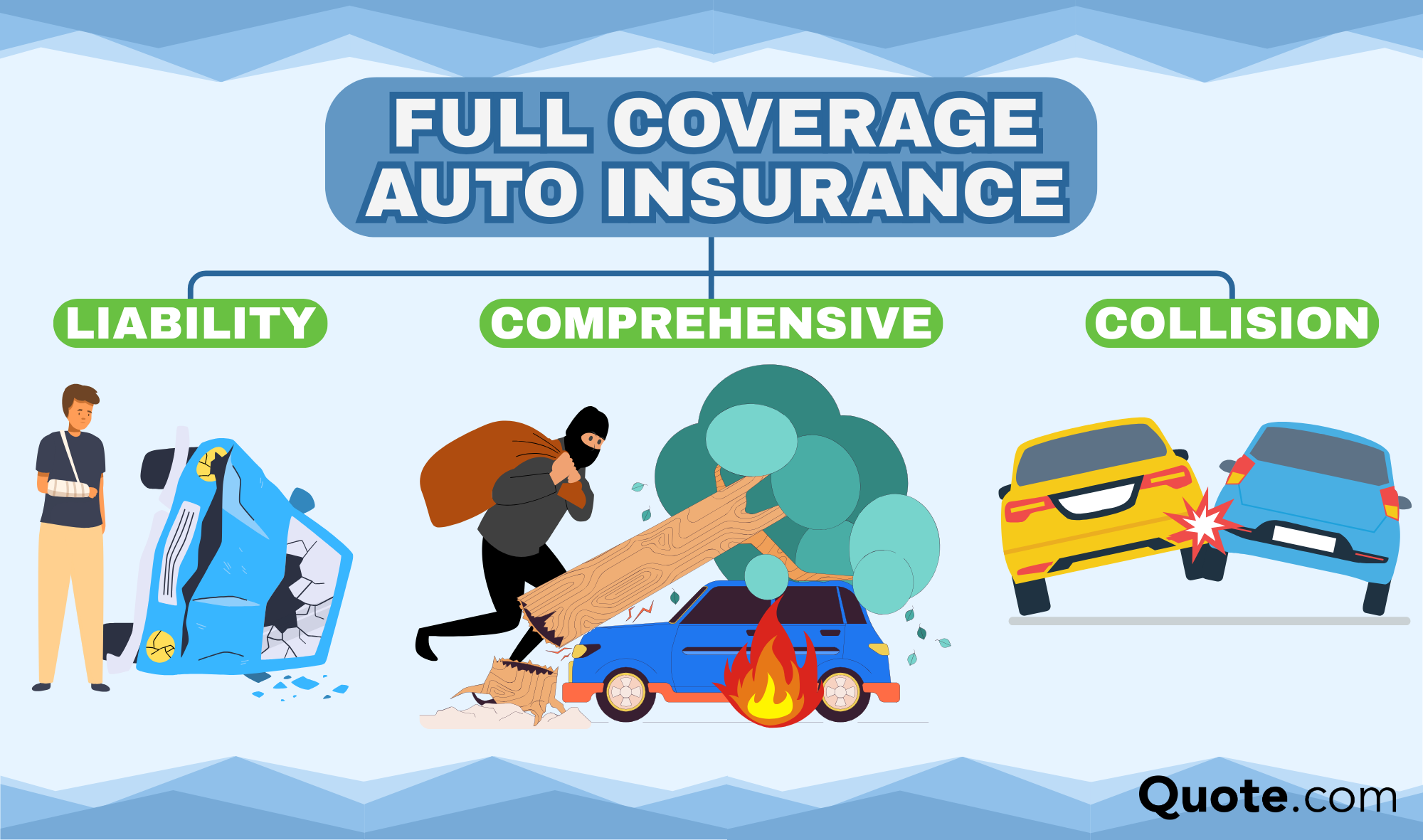

Full coverage includes both comprehensive and collision coverage, along with minimum liability insurance. It's typically required if you’re financing or leasing a vehicle.

Michelle Robbins Licensed Insurance Agent

Understanding collision vs. comprehensive car coverage helps drivers choose the right protection.

Choosing one over the other depends on how valuable your car is, where you drive, and the risks you encounter.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Collision vs. Comprehensive Insurance Costs

Looking at the coverage differences among major insurers, it’s clear there’s no one-size-fits-all answer for collision versus comprehensive car insurance.

Premiums vary, but so do policy benefits and claims satisfaction.

Collision vs. Comprehensive Auto Insurance Monthly Rates by Provider| Insurance Company | Collision | Comprehensive |

|---|---|---|

| $42 | $26 | |

| $39 | $24 |

| $36 | $23 | |

| $46 | $28 |

| $41 | $25 |

| $38 | $24 | |

| $40 | $26 | |

| $43 | $27 |

| $44 | $28 | |

| $33 | $22 |

USAA is the most affordable company overall for collision vs. comprehensive auto coverage, but it’s only available to military families. Geico and Progressive are the least expensive in most states.

It’s always best to compare auto insurance companies to ensure you’re getting both reliable coverage and fair pricing.

Save on Collision and Comprehensive Insurance

When comparing discount opportunities, having comprehensive coverage may unlock more savings, especially for safe drivers or vehicles with anti-theft features.

Collision coverage, on the other hand, may offer fewer discounts but can still qualify for savings, such as accident-free or bundling discounts.

Car Insurance Discounts From Top Providers| Company | Anti- Theft | Bundling | Defensive Driving | Good Driver | Good Student | Military | Multi- Vehicle | New Car | Paperless | Pay-in Full | Safe Driver |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 10% | 25% | 10% | 25% | 35% | 25% | 10% | 10% | 3% | 10% | 18% | |

| 25% | 25% | 5% | 25% | 25% | 12% | 23% | 15% | 4% | 20% | 18% |

| 10% | 20% | 10% | 30% | 20% | 20% | 12% | 12% | 3% | 10% | 20% | |

| 25% | 25% | 15% | 25% | 26% | 15% | 25% | 10% | 3% | 10% | 15% | |

| 35% | 25% | 10% | 20% | 12% | 10% | 25% | 8% | 3% | 12% | 20% |

| 5% | 20% | 10% | 40% | 15% | 25% | 15% | 15% | 3% | 15% | 12% | |

| 25% | 10% | 30% | 30% | 10% | 15% | 12% | 10% | 4% | 15% | 10% | |

| 15% | 17% | 15% | 25% | 25% | 25% | 20% | 15% | 3% | 15% | 20% | |

| 15% | 13% | 20% | 20% | 10% | 10% | 8% | 8% | 3% | 15% | 15% | |

| 15% | 10% | 5% | 15% | 30% | 30% | 10% | 10% | 3% | 20% | 10% |

Is it better to have collision or comprehensive coverage? That depends on your vehicle and your risk exposure.

Drivers searching for the cheapest car insurance should evaluate which coverage is essential based on their needs. Dropping unnecessary coverage can lower premiums, but only if the protection isn’t vital to their financial situation.

Deciding Between Collision vs. Comprehensive

Understanding the difference between collision vs. comprehensive auto insurance is essential for protecting your vehicle and managing your budget effectively.

Both coverages protect against different risks (Learn More: Liability Auto Insurance). Collision coverage applies to accidents involving vehicles or objects, while comprehensive coverage handles non-collision incidents, such as theft, vandalism, and acts of nature.

USAA offers the most affordable rates, starting at $33 monthly for collision coverage and $22 a month for comprehensive coverage.

Whether you need both depends on your vehicle’s value, driving environment, and financing situation. Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What is comprehensive insurance vs. collision insurance?

Collision insurance covers accident damage to your car, while comprehensive covers theft, vandalism, and natural disasters. Both are optional but often required for financed vehicles.

At what point is collision insurance not worth it?

At what point does collision insurance stop being beneficial for a consumer? Collision insurance becomes unnecessary when vehicle value drops below $4,000 or when annual premiums plus deductibles total more than 10% of the car’s actual cash value.

Should you have collision insurance on a 10-year-old car?

Consider dropping collision on a 10-year-old car if premiums exceed 10% of the car’s value annually. Many people get auto insurance right by evaluating coverage based on vehicle age and worth.

Is hitting a mailbox a comprehensive or collision insurance?

Hitting a mailbox is covered by collision insurance since it involves impacting a fixed object while operating your vehicle, regardless of who’s at fault.

Is a cracked windshield comprehensive or collision insurance?

A cracked windshield from non-collision events like falling objects or vandalism is covered by comprehensive insurance. Collision coverage applies only if the windshield cracks during an accident.

Is hitting a deer comprehensive or collision insurance?

Hitting a deer is covered by comprehensive insurance as it’s considered an animal collision, not a driving accident. This applies to all wildlife encounters on the road.

Learn More: Does auto insurance cover hitting a deer?

What is a good collision auto insurance deductible?

A good collision deductible ranges from $500 to $1,000, balancing affordable premiums with manageable out-of-pocket costs. Higher deductibles mean lower premiums but more risk during claims.

Read More: How to File an Auto Insurance Claim & Win It Each Time

Do you really need fully comprehensive auto insurance?

Comprehensive insurance is essential if financing or leasing a vehicle, but it is optional for older cars worth less than $3,000 since repair costs may exceed the car’s value. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Do you need uninsured motorist coverage if you have comprehensive insurance?

Yes, uninsured motorist coverage is necessary regardless of comprehensive insurance because it protects against injuries and damages from uninsured drivers, which comprehensive insurance doesn’t cover.

Do you need comprehensive insurance on a financed car?

Yes, comprehensive insurance is typically required by lenders when financing a car to protect their investment against theft, vandalism, natural disasters, and other non-collision damages.

When should you drop comprehensive coverage on your car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.