Best Home Insurance for Veterans in 2026

Armed Forces, USAA, and State Farm rank among the best home insurance for veterans with rates starts $130 a month. Each company offers coverage built for military families, dependable claims help, and discounts of up to 30% that make it easier for veterans to keep costs low without cutting coverage.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Principal Broker

William Lemmon has been a licensed insurance agent for over 12 years. He is the principal broker and owner of Broadway Insurance Services in Los Angeles, CA. He works one-on-one with clients to create personalized plans that minimize risk and maximize savings. Being one of the foremost authorities on Airbnb and home-sharing property insurance, Lemmon offers his clients first-hand guidance on how t...

William Lemmon

Updated January 2026

Armed Forces, USAA, and State Farm offer the best home insurance for veterans, with plans starting at $130 a month.

- Home insurance rates for veterans start at $130 a month

- Save up to 30% through bundling and military discounts

- Coastal states have higher premiums due to hurricane exposure

Armed Forces stands out for dependable claims service and policies built for military families, while USAA gives veterans and their families up to 30% off on coverage.

State Farm has a deal with a 25% discount for service members and deep savings options outside of military discounts. Collectively, these providers provide cost-effective quotes, reliable cover, and perks crafted exclusively for veterans.

Top 10 Companies: Best Home Insurance for Veterans| Company | Rank | Claims Satisfaction | Military Discount | Best for |

|---|---|---|---|---|

| #1 | 746 / 1,000 | 15% | Claims Service |

| #2 | 737 / 1,000 | 30% | Military Families | |

| #3 | 643 / 1,000 | 25% | Extensive Discounts | |

| #4 | 641 / 1,000 | 25% | Custom Coverage | |

| #5 | 634 / 1,000 | 15% | Budget Flexibility | |

| #6 | 631 / 1,000 | 25% | Bundling Options | |

| #7 | 609 / 1,000 | 20% | Home Discounts | |

| #8 | 609 / 1,000 | 10% | Valuable Items | |

| #9 | 596 / 1,000 | 10% | Inflation Protection |

| #10 | 594 / 1,000 | 10% | Online Convenience |

Protecting one of your most valuable assets doesn’t need to be expensive. Comparing quotes is the best way to secure the cheapest home insurance for veterans. Members can also compare quotes through Navy Federal Home Insurance.

Enter your ZIP code into our free comparison tool to find the lowest home insurance rates for veterans from local compaies.

The Best Veteran Home Insurance Rates

Armed Forces stands out for its dependable claims service and coverage built around military families. USAA homeowners insurance is another strong option, giving veterans and their families up to 30% off on coverage.

Its coverage options are designed to fit the unique needs of military members, whether they own a new home or are relocating after service, making it a great option for disabled veterans homeowners insurance as well.

Veteran Home Insurance Monthly Rates by Dwelling Coverage| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $150 | $180 | $230 | $390 | |

| $135 | $162 | $210 | $355 |

| $145 | $174 | $225 | $380 | |

| $140 | $168 | $220 | $375 | |

| $155 | $186 | $240 | $400 |

| $145 | $174 | $225 | $380 | |

| $143 | $172 | $220 | $370 | |

| $147 | $176 | $228 | $385 | |

| $153 | $184 | $238 | $395 | |

| $130 | $156 | $205 | $350 |

Compare that to Liberty Mutual, which costs $400 a month for $1 million in coverage, $50 more than USSA and Armed Forces. Companies like Nationwide, Farmers, and Progressive fit in a middle ground of relatively good value that sits between cost-competitive and flexibility (Read More: State Farm vs Farmers, Geico, Progressive, and Allstate Review).

This is just an example of how the cost of homeowners insurance can increase substantially depending on the provider. Veterans reading discussions in the best home insurance for veterans Reddit often mention that comparing quotes directly through trusted tools provides a clearer picture of long-term costs.

Veterans should start by listing their home’s rebuild value, personal belongings, and potential risks, then match those needs with a provider that offers clear coverage details and an easy claims process.

Michelle Robbins Licensed Insurance Agent

Veterans shopping around from more than one insurer can save even with a more restrictive focus on military-related providers.

USAA home insurance for veterans and Armed Forces is often listed among the best home insurance providers for military families. They keep premiums low and focus on coverage that fits the everyday needs of service members.

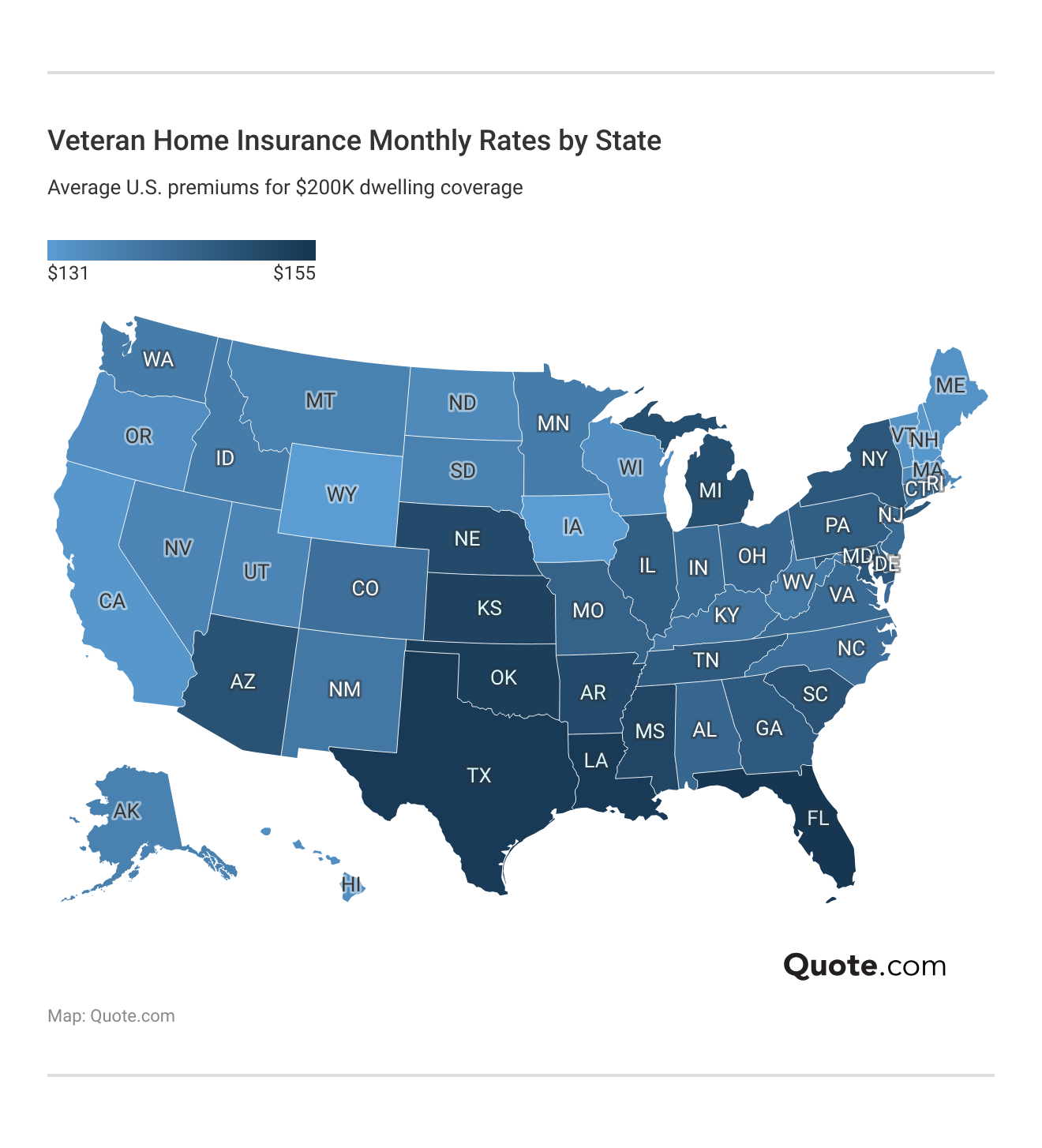

How Local Risks Impact Veteran Home Insurance Rates

Veterans face varying home insurance costs based on property type and weather risks. Average homes run $150 per month, older ones $165 a month, and high-value properties $180 a month.

To see how the cost of homeowners insurance for veterans can vary, let’s take a look at comparisons that show how location and property type can impact the overall cost.

Veteran Home Insurance Monthly Rates by Risk Factor| Factor | Risk | Premium | Increase |

|---|---|---|---|

| Property | Standard Home | $150 | NA |

| Property | Older Home | $165 | $15 |

| Property | High-Value Home | $180 | $30 |

| Weather | Low Risk Area | $145 | NA |

| Weather | Moderate Risk Area | $165 | $20 |

| Weather | High Risk Area | $185 | $40 |

Coverage for high-value homes in high-risk zones averages $185 per month due to higher rebuild costs. The comparisons illustrate how home condition and exposure to weather can add $15–$40 a month to premiums.

Keep reading to see how age and location affect home insurance costs for veterans. States like Florida, Texas, and Louisiana face higher premiums from storm risks, making it important to compare the best homeowners insurance for veterans in Florida for dependable hurricane coverage.

In contrast, Arkansas and Iowa are among the most affordable states, often costing hundreds less each month. States like South Dakota and West Virginia typically stay under $150 per month, reflecting the lower risks in the Midwest and Appalachia.

However, Arizona, Colorado, and Alaska see higher premiums due to wildfires, extreme temperatures, and severe weather patterns.

Read more: Does homeowners insurance cover wildfires?

How Driver Age Impacts Home Insurance Rates for Veterans

USAA and Armed Forces both have low costs for veterans of all ages and higher rates as customers age. Both have very predictable pricing and are usually good candidates for additional coverage.

By age 70, Travelers and Liberty Mutual can charge as much as $170 a month, more than $20 a month when compared to the cheapest homeowners insurance companies.

Veteran Home Insurance Monthly Rates by Age| Company | Age: 40 | Age: 50 | Age: 60 | Age: 70 |

|---|---|---|---|---|

| $150 | $160 | $165 | $175 | |

| $135 | $140 | $145 | $150 |

| $145 | $155 | $160 | $170 | |

| $140 | $150 | $155 | $165 | |

| $155 | $165 | $170 | $180 |

| $145 | $155 | $160 | $170 | |

| $143 | $153 | $158 | $168 | |

| $147 | $157 | $162 | $172 | |

| $153 | $163 | $168 | $178 | |

| $125 | $138 | $142 | $148 |

Most other providers, like Allstate, Nationwide, and State Farm, sit in the middle, offering moderate increases over time.

What this shows is that veterans can expect premiums to rise gradually with age, but choosing from the best home insurance companies for veterans and military members often helps keep costs lower in the long run.

Read More: How to Estimate Home Insurance Costs Based on Where You Live

How Credit History Impacts Home Insurance Rates for Veterans

Though veterans with bad credit can get access to prices less than $200 from USAA and Armed Forces.

Their flexible pricing ensures that military families don’t face high penalties.

Veteran Home Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $150 | $165 | $185 | $215 | |

| $135 | $150 | $170 | $200 |

| $145 | $160 | $180 | $210 | |

| $140 | $155 | $175 | $205 | |

| $155 | $170 | $190 | $225 |

| $145 | $160 | $180 | $210 | |

| $143 | $158 | $178 | $208 | |

| $147 | $162 | $182 | $212 | |

| $153 | $168 | $188 | $218 | |

| $130 | $142 | $160 | $185 |

In comparison, Liberty Mutual and Travelers quote more than $220 per month to veterans with low credit.

Carriers such as State Farm, Farmers, and Nationwide fit in the middle of the spectrum with modest rate hikes from excellent to poor credit but below more expensive insurers.

Veterans with lower scores typically save even more by selecting military-focused insurers like USAA and Armed Forces, which are also known for offering the best homeowners insurance for disabled veterans with flexible rates and accessible support.

Learn More: Expert Guide To Different Loans

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Home Insurance Coverage Veterans Need

Is home insurance required? Yes, and veterans looking for the best home insurance should know what types of coverage matter most.

Home insurance policies aren’t one-size-fits-all, so it helps to understand the core protections and add-ons that can make a big difference.

- Dwelling Protection: It protects your home’s structure, the walls, roof, and built-in systems, from damage caused by fire, storms, or vandalism.

- Personal Property Coverage: Protects personal items like furniture, clothing, and electronics in case of theft, fire, or other covered incidents.

- Liability Insurance: Provides financial protection if someone is injured on your property or if you’re held responsible for accidental damage to others.

- Loss of Use Coverage: Pays for temporary housing, meals, and other living expenses if your home becomes unlivable after a covered loss.

- Additional Endorsements: Offers flexible add-ons, such as flood protection or extended replacement cost, to fit unique needs and risks.

Understanding coverage options helps veterans choose policies that fit their needs and adapt to specific risks. Check your mortgage to see which types of coverage are required and where you may want to add a bit more protection.

Comparing top home insurance companies highlights those with the best mix of cost, military benefits, and coverage.

Ways Veterans Can Save on Home Insurance

Veterans can lower their home insurance bills in several practical ways beyond just choosing the right provider.

Luckily, being a military member comes with its own perks, but here are some more of the most effective strategies:

- Leverage Military Benefits: Use your military status to unlock exclusive veteran discounts.

- Upgrade Security: Opt for monitored alarms, smoke detectors, or even smart security systems to get the premiums based on lower risk.

- Stay Loyal: Keep coverage with the same insurer over time to unlock loyalty-based savings.

- Choose Newer Homes: Secure lower rates by insuring homes built recently, since they carry fewer structural risks.

- Bundle Coverage: Combine home insurance with auto or other policies to get the benefit of multi-policy discounts.

For veterans, the key to lowering home insurance costs is knowing which discounts apply and stacking them where possible.

Whether it’s bundling coverage, taking advantage of military-only savings, or adding security upgrades, the right strategy can make coverage more affordable without sacrificing protection.

Top Home Insurance Discounts for Veterans| Company | Bundling | Loyalty | Military | Security |

|---|---|---|---|---|

| 15% | 8% | 25% | 8% | |

| 12% | 6% | 15% | 10% |

| 12% | 7% | 20% | 15% | |

| 18% | 12% | 15% | 7% | |

| 14% | 6% | 10% | 12% |

| 11% | 9% | 25% | 10% | |

| 16% | 10% | 15% | 8% | |

| 20% | 12% | 25% | 9% | |

| 13% | 8% | 10% | 9% | |

| 10% | 11% | 30% | 10% |

Veterans have access to meaningful home insurance discounts, and the savings can differ widely depending on the provider. USAA leads with the strongest military discount at 30%, while Nationwide, State Farm, and Allstate also stand out with military savings at 25%.

State Farm and Geico provide some of the biggest bundling and loyalty benefits, reaching as high as 20%. Farmers offers one of the best security system discounts at 15%, while Liberty Mutual provides 12% in that category.

Veterans can cut costs significantly by combining policies, taking advantage of loyalty rewards, and leveraging military-focused perks.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Always determine how much homeowners insurance you need before you buy to avoid overpaying for coverage and keep monthly rates manageable.

These choices also tie into special considerations for military home insurance, such as relocation needs, deployment coverage, and benefits unique to service members.

Top Home Insurance Providers for Veterans

Understanding each insurer’s pros and cons is key when comparing the best home insurance for veterans. Each provider offers distinct discounts, benefits, and claims support.

Evaluating these differences helps veterans find coverage that fits their goals (Learn More: Understanding the 8 Types of Homeowners Insurance Policies).

#1 – Armed Forces Insurance: Top Overall Pick

Pros

- Strong Claims Satisfaction: Scores 746 out of 1,000, giving veterans confidence that claims will be resolved quickly and fairly.

- Veteran-Centered Coverage: Policies tailored for active duty, disabled veterans, and military families provide protection that meets the specific needs of veteran households.

- Affordable Entry Rate: A 15% military discount helps keep monthly premiums affordable for those looking for dependable coverage.

Cons

- Smaller Discounts: Military savings are less competitive than those offered by providers like USAA, reducing potential long-term savings.

- Fewer Coverage Options: Offers fewer customization options than major national insurers, which can limit flexibility.

#2 – USAA: Best for Military Families

Pros

- Highest Military Discount: Offers up to 30% savings, the largest discount available for veterans, a key point often highlighted in USAA insurance reviews.

- Exclusive to Military Families: Tailored policies offer key benefits for service members and rank among the top home insurance options.

- Reliable Claims Experience: A 737 satisfaction score reflects dependable claims service for veterans.

Cons

- Restricted Eligibility: Coverage is limited to military members, veterans, and their families.

- Limited Local Offices: Fewer in-person support locations than many national insurers.

#3 – State Farm: Best for Extensive Discounts

Pros

- Military Savings Up to 25%: Veterans benefit from one of the highest military discounts in the market, a strength often emphasized in State Farm insurance reviews.

- Wide Range of Discounts: Beyond military, policyholders can stack multiple savings opportunities for lower rates.

- Trusted National Brand: Strong reputation provides veterans with long-term stability and financial security.

Cons

- Lower Claims Satisfaction: A score of 643 indicates mixed reviews for claim handling compared to military-focused providers.

- Less Specialized for Veterans: Coverage isn’t tailored to military lifestyles in the same way as USAA or Armed Forces Insurance.

#4 – Nationwide: Best for Custom Coverage

Pros

- Competitive Military Discount: Veterans can get 25% off, meaning policies are very affordable.

- Customizable Coverage Options: Plans are customizable, so veterans can pick and choose their coverage based on the value of their home and risks.

- National Presence: Strong availability across states ensures support for veterans who often relocate, a point frequently highlighted in a Nationwide insurance review.

Cons

- Average Claims Score: With 641 out of 1,000, claims service is not as highly rated as top-ranked providers.

- Inconsistent Discounts: Some add-on discounts may not be available in every state.

#5 – Progressive: Best for Budget Flexibility

Pros

- Affordable Options: Offers very competitive prices, so it’s great for service members who are looking to get the most out of their coverage on a budget.

- Digital Tools: Progressive’s strong online platform and mobile app help veterans manage coverage and claims with ease, a feature often praised in Progressive insurance reviews.

- Military Discount: Offers a 15% savings for veterans, adding value to already flexible pricing.

Cons

- Lower Claims Satisfaction: Scoring 634, the service may not be as dependable as veteran-focused insurers.

- Smaller Military Savings: Discount is less generous than competitors like State Farm and USAA.

#6 – Allstate: Best for Bundling Options

Pros

- Up to 25% Military Discount: Allstate offers savings for veterans who bundle home and auto policies. See our Allstate review for details.

- Bundling Advantage: Combining home and auto policies can reduce overall insurance costs.

- Agent Network: A Large number of agents across the country offer in-person support for veterans.

Cons

- Mixed Claims Experience: A score of 631 reflects average satisfaction with claims handling.

- Regional Price Differences: Rates can be higher in some areas even after discounts.

#7 – Farmers: Best for Home Insurance Discounts

Pros

- Military Discount at 20%: Farmers provides one of the strongest veteran discounts in the market, giving service members meaningful savings compared to standard civilian rates.

- Security-Focused Discounts: Rewards veterans for protective features like alarms and updated systems.

- Broad Coverage Availability: Accessible in most states, making it easier for veterans nationwide, as noted in our Farmers insurance review.

Cons

- Claims Satisfaction Below Average: Scoring 609, customer feedback highlights slower resolutions.

- Discounts Less Competitive: Military savings trail behind USAA and State Farm.

#8 – Travelers: Best for Valuable Items

Pros

- Valuable Item Coverage: Highly-rated protection for your high-value belongings such as jewelry, fine art, or heirlooms.

- Flexible Endorsements: Enables veterans to purchase additional coverage for valuables that exceeds common limits.

- National Availability: Policy is available in multiple states for vets moving from state to state. Read our Travelers insurance review for similar comparisons on coverage and price.

Cons

- Smaller Discount Savings: Discount levels are modest compared to top veteran-focused providers.

- Average Claims Experience: With a score of 609, claims satisfaction is limited.

#9 – Liberty Mutual: Best for Inflation Protection

Pros

- Inflation Guard: Keeps veterans safe from increased costs to rebuild their homes by increasing coverage levels.

- Home Safety Discounts: Rewards veterans who have protective devices such as alarms or security systems installed in their homes.

- Large Company Resources: Liberty Mutual’s financial strength ensures reliable claim payouts and steady support, as noted in our Liberty Mutual insurance review.

Cons

- Discounts Not as Strong: Military savings lag behind higher-ranking competitors.

- Lower Claims Score: At 596, satisfaction levels are below many other insurers.

#10 – Safeco: Best for Online Convenience

Pros

- Digital Convenience: An online platform makes managing policies and claims easier for veterans. Based on our Safeco insurance review, the company also provides digital tools that simplify coverage management.

- Flexible Payment Options: Provides veterans with online billing and payment schedules that fit their budget.

- Simple Policy Management: Tools help veterans handle coverage without needing frequent agent support.

Cons

- Lowest Claims Satisfaction: With a score of 594, claims service may not meet expectations.

- Limited Discounts: Fewer savings opportunities compared to larger competitors.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Right Home Insurance for Veterans

The best home insurance for veterans would be one that can provide low rates and reliable coverage to accommodate families of the military.

Armed Forces Insurance has great claims satisfaction and tailored policies for veterans, so it’s a solid option for any new veteran who wants to feel confident their coverage will hold up its end of the deal.

USAA offers the largest military discount at 30% along with exclusive benefits for service members and their families, while State Farm appeals to those looking for broad savings programs and dependable nationwide support.

Which is best for you can depend on whether you prioritize claims service, additional discounts, or lower savings options. The best idea overall is to compare homeowners insurance quotes from the top companies to find a balance between cost and coverage.

If you’re looking for the cheapest homeowners insurance for veterans that still provides reliable protection, enter your ZIP code into our quote comparison tool to find affordable, military-friendly options near you.

Frequently Asked Questions

What’s the best home insurance for veterans?

Armed Forces, USAA, and State Farm are among the top home insurance companies for veterans. Both provide 15%–30% in military discounts, with good coverage. USAA appeals for its military-exclusive membership, but you can find both affordability and reliable service with State Farm and Armed Forces.

Who has the cheapest homeowners insurance for veterans?

USAA offers the lowest homeowners insurance for veterans at $130 for $200,000 in coverage. Armed Forces follows at $135, and State Farm at $147 per month. Learning about different types of homeowners insurance policies helps veterans choose the right coverage.

Do veterans get discounts on home insurance?

Yes, military members, including veterans, get discounts on home insurance. Top providers offer up to 30% off for active-duty and retired service members. These savings make homeowners insurance for military and veterans more affordable and accessible.

Does the VA help with homeowners insurance?

The Department of Veterans Affairs (VA) doesn’t offer homeowners insurance but helps veterans find affordable coverage through approved lenders and local offices. Its home loan programs and resources guide veterans to insurers that provide military-friendly options.

Who has the best homeowners insurance for veterans in VA?

In Virginia, Armed Forces and USAA consistently provide the best homeowners insurance for veterans, with entry-level rates starting around $130–$135 per month. What is the average homeowners insurance in VA? The average Virginia homeowners insurance in Virginia costs between $144 and $160 per month, making USSA one of the cheapest options.

What’s the best home insurance for veterans in Texas?

The best home insurance for veterans in Texas comes from USAA and Armed Forces.Veterans should also know how to file a home insurance claim for faster recovery after severe storms.

What’s the best home insurance for veterans in Florida?

For veterans in Florida, USAA provides some of the most affordable storm-focused protection that addresses Florida’s hurricane risk. Armed Forces and State Farm also offer competitive options, though premiums are higher due to coastal exposure.

How do you choose the best homeowners insurance for veterans?

To choose the best homeowners insurance, start by comparing rates, coverage levels, and discounts. Veterans should look at military-specific providers like USAA and Armed Forces for the most savings, and consider factors such as claims satisfaction scores and state-specific risks.

What’s the best home insurance for veterans in California?

Veterans in California often benefit most from USAA and State Farm. State Farm balances affordability with coverage flexibility for high-risk wildfire areas, making it one of the best homeowners insurance companies for veterans living in fire-prone regions.

Is it worth using a broker for home insurance?

Using a broker can help veterans compare providers beyond USAA or Armed Forces, but it may not always be necessary. Military-focused insurers often provide the best rates and benefits directly, so a broker is more useful if you’re exploring non-military providers.

What is the most popular type of home insurance for veterans?

Is USAA good for veterans?

Does Allstate offer veteran discounts?

Is USAA homeowners insurance only for veterans?

How much is homeowners insurance for a $200,000 house?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.