10 Best Auto Insurance Companies in Florida (2026)

Geico, Allstate, and AAA are the best auto insurance companies in Florida, with rates starting at $40 per month. Florida is a no-fault state requiring $10,000 in personal injury protection and property damage liability, but Geico offers cheap car insurance in Florida for drivers who need more than minimum coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

The best auto insurance companies in Florida are Geico, Allstate, and AAA, with rates starting at $40 a month.

- Florida no-fault laws require $10,000 in PDL and $10,000 in PIP

- Geico has the cheapest car insurance in Florida at $40 a month

- Allstate has the best Florida auto insurance for rideshare drivers

AAA is known for its trusted name in roadside assistance and strong policy benefits for members, making it a solid choice for Florida drivers who already have memberships.

Allstate is one of the more expensive Florida car insurance companies, but it has the highest claims satisfaction and discount rewards for safe drivers, including accident forgiveness.

Our Top 10 Picks: Best Auto Insurance Companies in Florida| Company | Rank | Claims Satisfaction | A.M. Best | Best For |

|---|---|---|---|---|

| #1 | 660 / 1,000 | A++ | Low Premiums | |

| #2 | 660 / 1,000 | A+ | Rideshare Drivers | |

| #3 | 649 / 1,000 | A | Roadside Assistance |

| #4 | 640 / 1,000 | A | Personalized Policies | |

| #5 | 639 / 1,000 | A++ | Customer Service | |

| #6 | 635 / 1,000 | A+ | Senior Benefits |

| #7 | 630 / 1,000 | A++ | Financial Stability | |

| #8 | 620 / 1,000 | A++ | Industry Experience | |

| #9 | 606 / 1,000 | A+ | Budget Shopping | |

| #10 | 606 / 1,000 | A | Accident Forgiveness |

This guide breaks down Florida insurance rates, discounts, and coverage requirements to help drivers buy auto insurance in one of the most expensive states for car insurance.

Get fast and cheap FL auto insurance coverage today with our quote comparison tool.

Comparing Auto Insurance Rates in Florida

Geico offers the cheapest car insurance in Florida, starting at just $40 monthly for minimum coverage and $119 per month for full.

State Farm and Auto-Owners remain competitive, keeping minimum monthly rates under $50.

Florida Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $82 | $245 | |

| $43 | $134 | |

| $102 | $304 | |

| $40 | $119 | |

| $72 | $216 |

| $69 | $205 | |

| $44 | $132 | |

| $63 | $168 |

| $75 | $223 |

AAA is pricier for minimum policies at $65 a month, but it has cheap full coverage car insurance in Florida for $122 a month.

On the higher end, Farmers and Allstate have the most expensive full coverage options at $304 and $245 a month, respectively.

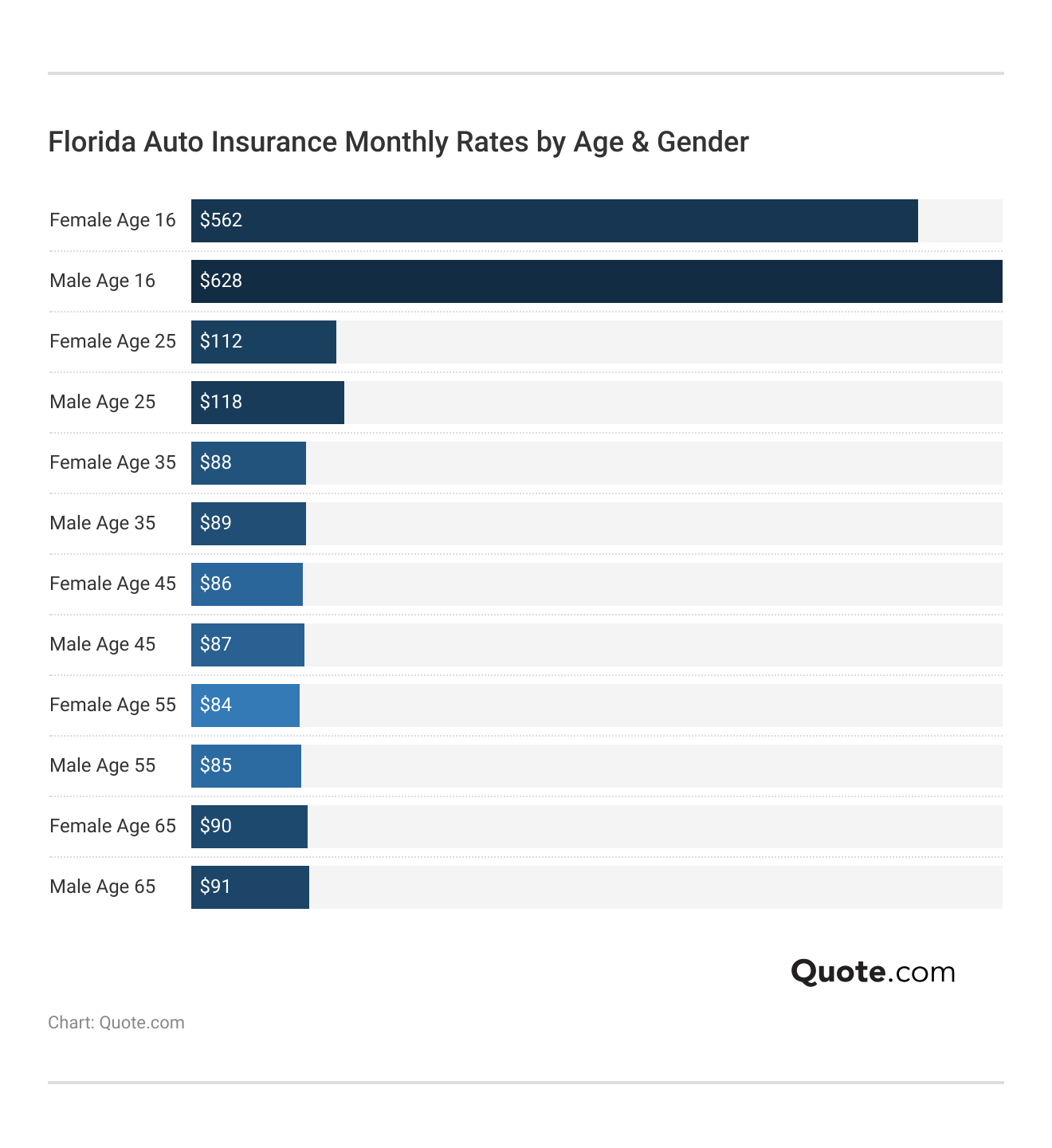

Teen Auto Insurance in Florida vs. Adult Drivers

Young drivers in Florida face the steepest insurance costs, with 16-year-old males paying the highest rate. Rates drop significantly by age 30, with monthly premiums stabilizing around $88 and remaining steady through ages 45 and 60.

Notably, 60-year-olds pay the lowest average rate at $85 per month. The Hartford has cheap auto insurance for seniors in Florida with AARP memberships, with rates well below the state average at $63 a month.

However, Florida drivers are more likely to find cheap teen car insurance with Geico and Progressive.

Geico has the highest claims satisfaction in the state, making it the top choice for new drivers just starting out who may need help setting up a policy or filing their first claim.

Overall, Geico is one of the best options for affordable auto insurance in Florida, and teens can get lower rates if they’re added to an existing policy.

Florida Car Insurance for High-Risk Drivers

Because Florida is already a high-risk state for car insurance due to weather-related claims and uninsured drivers, having a citation on your driving record can double or triple your rates.

Farmers tops the list with DUI rates surging to $142 per month, compared to State Farm at $48 a month (Read More: Cheap Auto Insurance for High-Risk Drivers).

Florida Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $78 | $81 | $71 |

| $82 | $109 | $103 | $90 | |

| $43 | $55 | $62 | $50 | |

| $102 | $145 | $142 | $127 | |

| $40 | $55 | $87 | $70 | |

| $72 | $88 | $127 | $94 |

| $69 | $125 | $94 | $106 | |

| $44 | $51 | $48 | $48 | |

| $63 | $95 | $110 | $78 |

| $75 | $105 | $155 | $102 |

Auto-Owners and Geico also offer budget-friendly options after an accident, making them ideal choices for Florida drivers with blemished records.

How Claims Affect Florida Insurance Costs

Florida’s auto insurance costs are shaped by moderate theft rates, high traffic congestion, and slightly above-average claim sizes (Learn More: The Worst States for Filing an Auto Insurance Claim).

Despite its storm reputation, the state sees relatively low year-round weather-related risks, helping to balance premium costs.

Florida Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Low weather impact |

| Average Claim Size | B+ | Slightly above average claims |

| Vehicle Theft Rate | B | Moderate theft rates |

| Traffic Density | C | High traffic congestion |

Urban traffic plays a major role in Florida’s insurance rates, and cities like Tampa and Miami lead in accident and claim volume.

That’s why car insurance in Miami is more expensive than in other parts of the state.

Florida Annual Traffic Accidents & Claims by Major City| City | Annual Accidents | Annual Claims |

|---|---|---|

| Fort Lauderdale | 40,200 | 28,000 |

| Jacksonville | 34,000 | 24,000 |

| Miami | 63,800 | 45,000 |

| Orlando | 43,700 | 31,000 |

| Tampa | 80,000 | 56,000 |

High traffic density in these cities drives up local premiums and reflects the greater risk that city drivers face, including rear-end collisions, vandalism, and theft.

The majority of Florida auto insurance claims stem from rear-end collisions, which account for 30% of all claims and cost an average of $3,500 each.

5 Most Common Auto Insurance Claims in Florida| Rank | Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|---|

| #1 | Rear-End Collisions | 30% | $3,500 |

| #2 | Intersection Accidents | 25% | $4,000 |

| #3 | Windshield Damage | 20% | $1,000 |

| #4 | Damage to Parked Vehicles | 15% | $2,500 |

| #5 | Vandalism | 10% | $2,000 |

Frequent windshield damage and parked car incidents further highlight the everyday risks drivers face statewide.

Drivers in places like Miami, Tampa, and Orlando should compare car insurance by ZIP code to find the best provider based on the local risks unique to them.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Florida Auto Insurance Coverage Requirements

Florida follows a no-fault insurance system, which means all drivers must carry personal coverage for their own injuries regardless of who caused the accident.

To drive legally, Florida motorists are required to maintain the following minimum coverages (Read More: Personal Injury Protection (PIP)).

Florida Minimum Auto Insurance Coverage Requirements| Coverage | Limits |

|---|---|

| Property Damage Liability | $10,000 per accident |

| Personal Injury Protection (PIP) | $10,000 per person |

Florida’s minimum coverage keeps you legally compliant, but it may not cover costs in a serious accident.

That’s why many Florida drivers opt to include additional coverages for more complete protection.

No-fault laws require drivers to use their own insurance for injuries and repairs, but this system often leaves gaps, especially for vehicle damage and serious injuries.

Adding these optional protections can shield you from major financial loss in a state known for traffic congestion, extreme weather, and high accident rates.

- Bodily Injury Liability (BIL): Covers injuries you cause to others in an accident; not required in Florida unless you have certain violations, but strongly recommended for added financial protection.

- Comprehensive Coverage: Pays for non-collision damage from events like hurricanes, floods, theft, or vandalism, which is recommended due to Florida’s weather risks.

- Collision Coverage: Collision auto insurance covers the repair or replacement of your vehicle after an at-fault accident, essential for newer cars or high-traffic areas in Florida.

- Uninsured/Underinsured Motorist Coverage: Helps pay your medical expenses if you’re hit by a driver with no or too little insurance—important in Florida, where many drivers are underinsured.

Choosing the best full coverage car insurance in Florida helps fill in gaps and ensures that you’re financially equipped to cover the costs after an accident.

You may also be required to carry full coverage by your lender if you lease your vehicle or have an auto loan.

To choose the right coverage in Florida, consider your car’s value, driving habits, and ability to cover costs beyond the state’s minimums.

Scott W. Johnson Licensed Insurance Agent

Adding Florida car insurance or increasing policy minimums will raise your rates, but safe driving habits and discounts can help you save money on the coverage you need.

Ways to Save on Florida Auto Insurance

Florida drivers can unlock major savings by choosing insurers with generous discount programs.

Liberty Mutual offers the biggest anti-theft discount at 35%, while Geico, Progressive, and Auto-Owners lead with 30% off for low mileage, ideal for retirees or remote workers in Florida.

Top Auto Insurance Discounts in Florida| Company | Anti- Theft | Bundling | Claims Free | Good Driver | Low Mileage |

|---|---|---|---|---|---|

| 8% | 15% | 20% | 30% | 10% |

| 10% | 25% | 10% | 25% | 30% | |

| 12% | 16% | 10% | 25% | 30% | |

| 10% | 20% | 9% | 30% | 10% | |

| 25% | 25% | 12% | 26% | 30% | |

| 35% | 25% | 8% | 20% | 30% |

| 25% | 10% | 10% | 30% | 30% | |

| 15% | 17% | 11% | 25% | 30% | |

| 10% | 5% | 12% | 15% | 10% |

| 15% | 13% | 13% | 10% | 20% |

For safe drivers, AAA and Progressive reward good driving habits with up to 30% discounts, while Allstate and Geico provide strong bundling options at 25%.

These are car insurance discounts you can’t miss to make it easier for Florida policyholders to lower premiums without sacrificing coverage.

In Florida’s high-cost insurance market, finding ways to save goes beyond stacking discounts. One effective strategy is to drop collision or comprehensive coverage on older vehicles that may not be worth the extra cost.

Raising your deductible is another smart move. Opting for a $1,000 deductible instead of $500 can noticeably lower your monthly premium.

Lastly, maintaining a clean driving record is one of the most reliable ways to keep rates low, especially in a no-fault state like Florida, where claims frequency tends to drive up costs.

10 Best Florida Auto Insurance Companies

Geico, Allstate, and AAA are the top three companies offering the best auto insurance in Florida.

However, all ten Florida providers bring unique strengths, from low rates to specialized coverage options. Compare them below to find the right Florida auto insurance company for you.

#1 – Geico: Top Pick Overall

Pros

- Lowest Minimum Coverage: Geico car insurance in Florida has the lowest rates at just $40 a month for minimum liability policies.

- Excellent Digital Experience: Geico’s mobile app and online services give FL drivers 24/7 access to their policy. Learn everything you need to know about Geico.

- Aggressive Discount Opportunities: Florida drivers can save up to 30% with Geico’s good driver and low-mileage discounts.

Cons

- Less Personalized Attention: Geico’s direct-to-consumer model may not suit FL drivers who prefer local agents.

- No Gap Insurance: Florida drivers with new cars will have to shop elsewhere if they want gap coverage to protect their auto loan or lease.

#2 – Allstate: Best for Rideshare Drivers

Pros

- Excellent for Rideshare: Allstate’s Ride for Hire coverage is ideal for Uber and Lyft drivers in FL. Explore policy benefits in our Allstate auto insurance review.

- Safe Driving Bonus Options: Florida drivers may benefit from Allstate’s Safe Driving Bonus and accident forgiveness features.

- Local Agent Access: Allstate provides strong in-person support for FL customers through a wide network of agents and high claims satisfaction ratings.

Cons

- Higher Starting Rates: Florida minimum coverage starts at $82 a month, which is on the higher end for budget-focused drivers.

- Discount Eligibility: It’s more difficult to qualify for Allstate discounts than for savings programs with other Florida auto insurance companies.

#3 – AAA: Best for Roadside Assistance

Pros

- Top Roadside Support: AAA is known for its unmatched roadside assistance benefits, which are especially valuable for Florida drivers.

- Comprehensive Policy Bundling: Florida customers can bundle auto with home and membership perks for added savings. Get full policy details from our AAA insurance review.

- Strong Claims Score: AAA earns a claims satisfaction score of 649/1,000 in FL, making it a dependable choice for coverage and service.

Cons

- Membership Required: AAA requires a paid membership to access its auto insurance in Florida, which adds an extra cost.

- Higher Minimum Rates: AAA’s pricing is higher than several competitors, starting at $65 a month for minimum coverage in Florida.

#4 – Farmers: Best for Personalized Policies

Pros

- Highly Personalized Policies: Farmers provides tailored coverage for Florida drivers, including home-auto bundling and specialty vehicle options.

- Rideshare and Custom Parts Coverage: Florida drivers can add rideshare or custom equipment protection to their minimum or full policies.

- Extensive Agent Network: Farmers offers dedicated agent support throughout Florida communities. Find everything you need to know about Farmers Insurance.

Cons

- Expensive Minimum Coverage: Farmers has one of the highest base rates for Florida minimum coverage, starting at $102 a month.

- Complex Coverage Options: Drivers who just want basic Florida car insurance policies could be overwhelmed by Farmers’ customization options.

#5 – State Farm: Best for Customer Service

Pros

- Excellent Customer Service: State Farm consistently receives strong customer satisfaction ratings from its Florida agents. Learn more in the State Farm Insurance review.

- Balanced Value: State Farm offers Florida drivers minimum coverage for just $44 a month, ideal for budget-conscious drivers.

- Generous Safe Driving Discounts: Florida drivers can save significantly through State Farm’s Drive Safe & Save program.

Cons

- Limited Coverage Customization: Some Florida drivers may find State Farm’s policy customization options less flexible than smaller insurers.

- Average Claims Experience: With a score of 639/1,000, State Farm’s claims satisfaction is solid but not the highest in Florida.

#6 – The Hartford: Best for Senior Benefits

Pros

- Senior-Focused: The Hartford offers exclusive AARP perks like lifetime policy renewability, new car replacement, and priority claims support.

- Solid Financial Strength: With an A+ rating from A.M. Best, The Hartford ensures stable backing for Florida policies.

- Competitive Full Coverage: Florida drivers can get full coverage from The Hartford starting at $168 a month. See more quotes in The Hartford Insurance review.

Cons

- Limited to AARP Members: Most benefits are only available to Florida AARP members, which restricts eligibility.

- Weak Bundling Discount: The Hartford only offers a 5% bundling discount in Florida, far less than most competitors.

#7 – Auto-Owners: Best for Financial Stability

Pros

- Superior Financial Strength: Auto-Owners holds an A++ rating from A.M. Best, making it one of the most financially secure insurers in Florida. See full details in our Auto-Owners review.

- Affordable Rates: With minimum coverage starting at just $43 a month, Auto-Owners offers some of the most competitive pricing for Florida drivers.

- Deductible Waivers: Auto-Owners waives collisions deductibles for Florida policyholders who are in an accident with other Auto-Owners policyholders.

Cons

- Poor Claims Support: Auto-Owners’ claim satisfaction rating fell to 630/1,000, trailing behind top competitors in FL for claims handling.

- Fewer Discounts Available: Florida drivers may find fewer discount opportunities than larger national competitors, especially for usage-based savings.

#8 – Travelers: Best for Industry Experience

Pros

- Over 160 Years in Insurance: Florida drivers benefit from Travelers’ extensive experience and reliability in the industry.

- Strong Financial Stability: With an A++ rating, Travelers is one of the most financially secure options in Florida. Browse more ratings in our expert Travelers insurance review.

- Flexible Coverage Options: Travelers offers comprehensive endorsements in Florida, including accident forgiveness and gap coverage.

Cons

- Above-Average Rates: Minimum coverage starts at $75 a month in Florida, which is higher than many competitors.

- Fewer Local Agents: Florida drivers may experience limited access to in-person assistance compared to agent-based companies.

#9 – Progressive: Best for Budget Shopping

Pros

- Great for Budget Shoppers: Progressive provides customizable and affordable policies starting at $69 a month for minimum coverage in Florida.

- Robust Telematics Program: Florida drivers can earn big discounts with Snapshot usage-based insurance. Read everything you need to know about Progressive.

- Multiple Discount Stacking: FL customers can combine bundling, multi-car, and online quote discounts for added savings.

Cons

- Claims Score Below Competitors: Progressive earns just 606/1,000 in claims satisfaction among Florida drivers.

- Premium Spikes for Accidents: Florida drivers may see steep rate increases after a single claim.

#10 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual’s accident forgiveness can help prevent rate hikes after your first at-fault crash in FL.

- Broad Discount List: Florida drivers may access up to 35% off for anti-theft devices, safe driving, and low mileage. See more in our Liberty Mutual insurance review.

- Custom Add-On Coverages: Liberty Mutual offers unique options for FL drivers, including deductible funds and new car replacement.

Cons

- Moderate Claims Score: With a 580/1,000 rating, Liberty Mutual ranks lowest among Florida’s top 10 in satisfaction.

- Minimum Coverage is Pricey: Liberty Mutual’s entry-level rate is $72 a month, above many rivals for minimum coverage in Florida.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Securing the Best Auto Insurance in Florida

Getting the right auto insurance in Florida is crucial due to the state’s no-fault system, high accident rates, and dense urban traffic (Read More: Liability Auto Insurance).

With only $10,000 in required personal injury protection (PIP) and property damage liability, many drivers choose to add more coverage to stay protected.

Compare quotes from at least three insurers, use Florida discounts like low mileage and safe driving, and bundle policies to save more.

Michelle Robbins Licensed Insurance Agent

Top companies like Geico and Allstate offer affordable rates and financial reliability, while AAA provides excellent customer service and roadside assistance to its members in Florida.

Comparing Florida auto insurance quotes and customizing coverage ensures local drivers get the protection they need at a price that fits their budget. Start saving on car insurance today by entering your ZIP code.

Frequently Asked Questions

Which is the best car insurance company in Florida?

Which company is best for car insurance? Auto-Owners ranks as the best car insurance company in Florida thanks to its A++ financial strength rating, high claims satisfaction, and low rates of $43 per month for minimum coverage. It consistently performs well for both customer service and affordability.

What is the most used insurance company in Florida?

State Farm is one of the most widely used insurance companies in Florida, known for its large market share, local agent network, and low-cost coverage. State Farm car insurance in Florida starts at $44 per month for minimum liability and $132 per month for full coverage.

What is the ideal car insurance coverage in Florida?

The ideal coverage in Florida includes more than the state minimum of $10,000 PIP and $10,000 property damage liability. Most experts recommend adding bodily injury liability, uninsured motorist coverage, and collision and comprehensive auto insurance for full protection.

Who is the largest auto insurer in Florida?

State Farm is the largest auto insurer in Florida by market share, offering wide availability, strong financial backing, and consistently affordable pricing across different driver profiles.

Who is the highest-rated auto insurance company in Florida?

Auto-Owners is the highest-rated auto insurance company in Florida with an A++ financial rating from A.M. Best and a 654/1,000 claims satisfaction score, beating many local and national competitors.

What is the best auto insurance company in Florida for seniors?

The Hartford has the cheapest auto insurance for seniors in Florida, with additional perks exclusive to drivers with AARP memberships.

What is the most cost-effective car insurance in Florida?

What is the most reasonable auto insurance in Florida? Geico offers the most reasonable minimum coverage in Florida at just $40 per month, followed closely by Auto-Owners at $43 per month and State Farm at $44 per month. Enter your ZIP code to find the cheapest car insurance company near you.

How much should I pay for car insurance in Florida?

Florida drivers typically pay $40–$75 per month for minimum coverage and $119–$245 per month for full coverage, depending on the insurer, driving record, and location. Discover ways to pay less for car insurance.

Why is Florida car insurance so expensive?

Florida’s high insurance costs are driven by its no-fault system, dense urban traffic, frequent accidents, uninsured drivers, and seasonal weather risks like hurricanes, which lead to higher claims. Try these hacks to save money on car insurance in Florida.

What insurance companies don’t insure in Florida?

Some smaller or regional carriers may not operate in Florida due to high risk and regulatory challenges. Additionally, certain national providers, like State Farm, may restrict new policies in hurricane-prone areas or ZIP codes.

How do I know if an insurance company is good?

Is Geico or Progressive better in Florida?

How do I choose the best car insurance company in Florida?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.