Clearcover Auto Insurance Review for 2026

Clearcover is a digital-first provider serving drivers in 19 states, with minimum coverage rates starting at $30 a month. Our Clearcover auto insurance review found that drivers enrolled in the usage-based Smart Driving Score program can save 20%. Most policies also include alternate transportation coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

This Clearcover auto insurance review shows how drivers who prefer managing everything from their phones can get coverage starting at just $30 monthly.

Clearcover Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.6 |

| Business Reviews | 3.5 |

| Claims Processing | 4.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 2.7 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 1.7 |

| Digital Experience | 4.5 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 3.1 |

| Savings Potential | 3.9 |

That budget-friendly rate includes helpful perks like alternate transportation, which pays up to $30 daily for rideshare if your car’s in the shop.

You can earn up to 20% off by driving safely, thanks to Clearcover’s Smart Driving Score tracked through the app. Add autopay and a clean record, and you’ll save another $10 monthly.

- Alternate transportation reimbursement covers Lyft or Uber up to $30 daily

- Honk roadside service reaches drivers in under 30 minutes

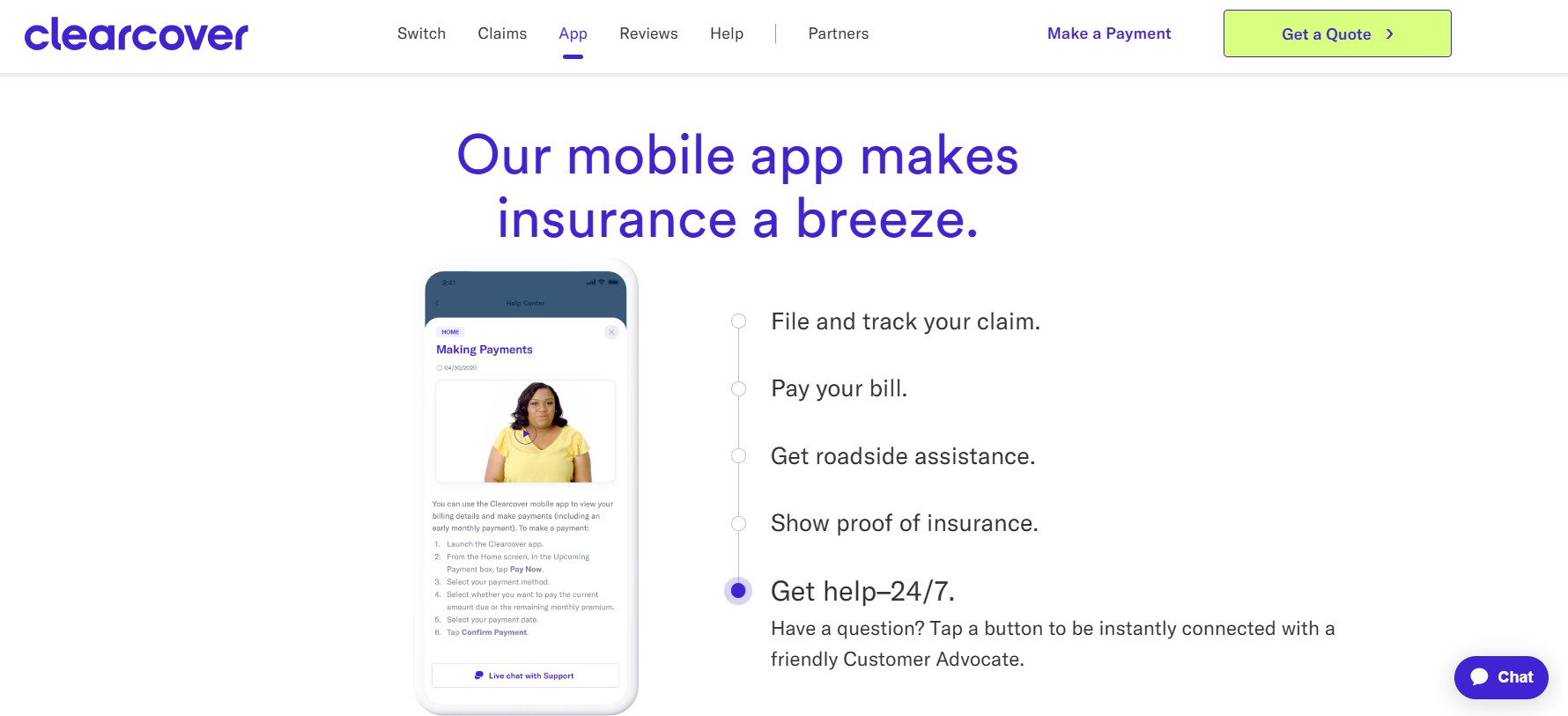

- Clearcover’s insurance app provides mobile ID cards and instant policy updates

The claims process is just as quick, taking about 6.8 minutes on average from start to finish. If speed matters too, use our free comparison tool and explore your options (Read More: How to File an Auto Insurance Claim & Win It Each Time).

Comparing Clearcover Auto Insurance Rates

This table gives you a clear look at how much your monthly Clearcover premium changes as you get older—and what those changes mean for your wallet. Knowing how age and gender affect your rate can help you make smarter choices and plan ahead.

If you’re 18, you’re looking at the highest cost, with teen boys paying $160 a month. That’s because insurers see young drivers as the riskiest on the road—something to keep in mind if you’re a parent insuring a teen. By the time you hit 30, rates drop by more than $120 a month, which shows just how much safe driving pays off over time.

Drivers in their 40s and 50s enjoy some of the lowest and most stable rates, proving that consistency really does matter. Even at 60, rates stay affordable, which is great if you’re retired and on a fixed income. For you, this means staying ticket-free early on can save you big later (Read More: Cheap Auto Insurance for Seniors).

Wondering how much your driving habits affect your Clearcover insurance quotes? Even one speeding ticket can bump your rates and knock you out of discount programs. Meanwhile, keeping a clean record lowers your base rate and makes you eligible for Clearcover’s safe driving rewards.

Clearcover Auto Insurance Monthly Rates by Driving Record| Driving Record | Minimum Coverage | Full Coverage |

|---|---|---|

| Clean Record | $32 | $88 |

| One Ticket | $40 | $111 |

| One Accident | $49 | $136 |

| One DUI | $56 | $152 |

After an accident, full coverage rates jump sharply, reflecting the risk of another claim. A DUI pushes your premium to $152 a month, showing how costly a serious violation can be.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Clearcover Insurance Rates vs. Top Companies

Clearcover stands out as one of the most accessible options for drivers trying to secure the cheapest car insurance without sacrificing digital convenience.

Clearcover vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $88 | |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Its $45 monthly minimum coverage might not be the absolute lowest, but it’s still $16 less than Liberty Mutual and a noticeable $13 below Farmers, making a real difference over a full year. While USAA’s rates are technically lower, it’s only available to military families, so many drivers won’t qualify.

Best Clearcover Insurance Discounts

The table clearly shows where savings come from and who benefits the most. Military and safe drivers get a 15% break, but in different ways — service members qualify automatically, while safe drivers earn it by maintaining clean habits tracked through the app.

Clearcover Auto Insurance Discounts| Discount | |

|---|---|

| Military | 15% |

| Safe Driver | 15% |

| Multi-Vehicle | 10% |

| Good Student | 10% |

| Paid-in-Full | 10% |

| Anti-Theft | 5% |

| Paperless Billing | 5% |

| Safety Features | 5% |

If you’re a student with solid grades, that 10% discount could bring a $134 monthly full coverage plan down to around $120 a month.

Paying in full or adding a second car can lower your rate even more, which helps if you’re in a higher-risk category like a young adult driver. And if you’ve got anti-theft features, paperless billing, or built-in safety tech, those 5% discounts can add up fast, knocking $15 or more off your monthly bill without lifting a finger.

Drivers with multiple cars can often get better pricing by insuring both under one policy rather than splitting coverage.

Michael Leotta Insurance Operations Specialist

If you’re looking for realistic tips to pay less for car insurance, stacking these savings is a smart and straightforward place to start.

Coverage Options From Clearcover Insurance

Clearcover auto insurance includes the standard liability coverage that’s required by law to take care of any damage or injuries you cause to someone else, as well as collision and comprehensive coverage to pay for different types of damage to your vehicle. It also includes medical payments and personal injury protection, which might be required where you live.

Clearcover Auto Insurance Coverage Options| Coverage | What It Covers |

|---|---|

| Liability | Injuries or damage you cause |

| Collision | Repairs from collision-related damage |

| Comprehensive | Non-collision events like theft, fire |

| Medical Payments (MedPay) | Medical costs for you, passengers |

| Personal Injury Protection (PIP) | Medical and wage loss coverage |

| Uninsured/Underinsured Motorist (UM/UIM) | Losses from drivers with little or no insurance |

| Roadside Assistance | Towing, lockouts, flat tire help |

| Alternate Transportation | Rideshare or rental reimbursement coverage |

| Rideshare Endorsement | Gaps in ridesharing companies' coverage |

Clearcover stands out with its roadside assistance for lockouts or dead batteries and its alternate transportation package, which reimburses rideshare or rental costs while your car is being fixed. For rideshare drivers, affordable endorsements extend personal coverage so you don’t have to buy a separate commercial policy to cover you while at work.

Other Insurance Products

Clearcover keeps its focus on car insurance, but thanks to a partnership with Goosehead Insurance, you can still shop for other types of coverage if you need them.

Goosehead’s licensed agents help you compare homeowners insurance quotes and find the right fit without overcomplicating things. You can just use your Clearcover insurance login to hop into your account and keep track of these extra coverages, too.

- Homeowners Insurance: Protects your house, everything inside it, and covers you if someone gets hurt on your property.

- Renters Insurance: Helps pay to replace your stuff if it’s stolen or damaged, and even covers temporary housing if you can’t stay in your place.

- Umbrella Insurance: Adds an extra $1 million or more in protection in case of a big lawsuit that goes beyond your regular policy limits.

This way, you can keep your car insurance simple with Clearcover while still getting help with other policies—and even compare homeowners insurance quotes—when you need them.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Clearcover Insurance Reviews & Ratings

This breakdown gives you a clearer view of how Clearcover performs in terms of finances, service, and real-world satisfaction. An A- from A.M. Best means Clearcover has the financial stability to pay claims without delay, which is something you don’t want to gamble with in a serious accident.

Clearcover Insurance Business Ratings & Consumer Review| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 82/100 Positive Customer Feedback |

|

| Score: 0.45 Fewer Complaints Than Avg. |

The A+ from the Better Business Bureau shows Clearcover handles complaints professionally, which matters when dealing with billing issues or delays. Clearcover insurance reviews on the Better Business Bureau also highlight positive customer experiences, with many noting fast claims processing and how easy the app is to use.

Similarly, Clearcover insurance reviews from Consumer Reports show strong customer satisfaction, earning a score of 82 out of 100, which appeals to tech-savvy drivers who prefer managing everything online.

A low complaint index means smoother service. Look for companies rated below 1.0 by NAIC if you want fewer billing or claim delays.

Melanie Musson Published Insurance Expert

Clearcover insurance reviews on Reddit echo many of these themes. One Reddit user said filing a claim through the app was quick and painless—something they didn’t expect from an online-only provider.

Experiences with Clearcover auto insurance

byu/Awkward_Distance476 inInsurance

However, they also pointed out that live support was hard to reach, which is a common thread. Based on Reddit’s feedback, Clearcover hits the mark for app-friendly users who prefer speed over phone time.

Read More: These 3,000 People Got Auto Insurance Right

Pros and Cons of Clearcover Insurance

Clearcover is a great fit if you want fast, digital-first service without paying extra for outdated overhead. It stands out with fewer complaints, competitive prices, and modern tools that really work for app-loving drivers. On top of that, Clearcover’s A.M. Best insurance rating of A– proves they’re financially solid and ready to handle claims when you need them.

- Fewer Complaints Than Average: With a 0.45 complaint index from the NAIC, Clearcover receives less than half the expected volume of customer complaints for its size, indicating smoother claims and billing experiences.

- Good Student Discount: Students who maintain qualifying grades can save 10% on their premiums, helping offset Clearcover’s already low $45 minimum coverage rate for budget-conscious households with teen drivers.

- Rideshare Coverage Add-Ons: Drivers who work for Lyft, Uber, or other rideshare and delivery companies can add an affordable endorsement to their personal policies (Learn More: Best Auto Insurance for DoorDash Drivers).

Clearcover delivers real savings through discounts while minimizing complaints. However, drivers outside its service states or those who value agent-based service may need to look elsewhere for a more personalized experience.

- Limited Availability: Clearcover car insurance is only available in 19 states: AL, AZ, GA, IL, IN, KY, LA, MD, MO, MS, NE, OH, OK, PA, TX, UT, VA, WV, WI.

- No In-Person Support: All interactions, from quotes to claims, must be handled digitally, either online or via the mobile app.

Despite its strengths, Clearcover has limitations that can affect accessibility and user satisfaction for certain drivers. However, the company does have plans to expand and may be available in your state soon.

How Clearcover Delivers Services Through Partnerships

Clearcover keeps things straightforward by focusing on what it does best—affordable, app-based, usage-based auto insurance that rewards you for safe driving—and partnering with others to handle the rest.

Since Clearcover doesn’t have its network of agents, it works with Goosehead, so you can still talk to a licensed agent if you’d rather get personal advice before buying a policy. And because it doesn’t run a full 24/7 call center, Clearcover customer service is powered by Ada’s AI technology through ClearAI®, making it easy to file a claim, check your policy, or get quick answers anytime, even late at night.

These partnerships enable Clearcover to stay focused on delivering smart, usage-based savings while still providing you with the option to speak with real people and receive help whenever you need it.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save on Auto Insurance With Clearcover

Clearcover Insurance works best for drivers who want app-based convenience and AI-driven support. Our Clearcover auto insurance review found standout savings, including up to $30 daily for alternate transport while your car is in the shop. You can even get a Clearcover insurance quote online in minutes to see how much you’ll save. Pay your premium in full or use paperless billing to unlock additional discounts.

Clearcover offers several more ways to cut down your premium. You can save 10% just by paying your policy in full for the year, and students with strong grades get another 10% off. Safe drivers can earn up to 20% off using the Smart Driving Score, which tracks driving behavior through the Clearcover app.

You’ll also find perks for tech-savvy drivers, like 5% off if your car has built-in smart safety features. Stack all these discounts, and you could save more than $30 a month, which really adds up over time. Clearcover even offers cheap auto insurance for multiple vehicles—perfect if you’ve got more than one car at home.

Its solid Clearcover insurance rating reflects how well it balances low prices with dependable service, giving drivers peace of mind. Before you buy auto insurance, use our free comparison tool to explore your options. It’s the easiest way to find the best rates and ensure Clearcover is right for you.

Frequently Asked Questions

Is Clearcover a good insurance company?

Yes, if you’re comfortable using an app-first insurer, Clearcover is a great pick thanks to its reliability, with just 0.45 NAIC complaints—well below the national average, an A- rating from A.M. Best, and an 82/100 from Consumer Reports for its digital experience and customer satisfaction.

Who is Clearcover insurance owned by?

You’re buying from a privately held company, as Clearcover is owned by its founders and major investors like American Family Ventures and OMERS Ventures, which gives it strong financial backing without being tied to a traditional insurer.

Does Clearcover pay claims well?

Yes, you can count on Clearcover to pay claims quickly and reliably, with most resolved through the app in under 7 minutes—especially helpful if you live in one of the worst states for filing auto insurance claims, where delays are common.

Does Clearcover have accident forgiveness?

No, Clearcover doesn’t offer accident forgiveness, so your rate could increase if you file a claim, especially after an at-fault accident.

Does Clearcover cover windshield replacement?

Yes, if you add glass coverage, Clearcover auto insurance will pay for windshield repair or full replacement, depending on the damage.

What states does Clearcover cover?

Clearcover is currently available in 19 states, including Texas, Illinois, and Arizona. Compare it with the best auto insurance companies in Arizona to find the best rates.

How long has Clearcover Insurance been around?

Clearcover has been in business since 2016 and is backed by investors like American Family Ventures and OMERS Ventures.

Does Clearcover insure Teslas?

Yes, Clearcover car insurance insures Teslas, and while premiums vary, a Model 3 full coverage policy typically starts around $158 per month based on internal data.

Does Clearcover offer glass coverage?

Yes, it’s available as an optional add-on under comprehensive auto insurance. It’s great if you drive frequently on highways where chips and cracks are common.

Does Clearcover insurance cover rental cars?

Yes, Alternate Transportation coverage reimburses rideshare or rental car costs up to your policy limit during covered claims.

How do I contact Clearcover car insurance?

How do I cancel Clearcover insurance?

Does Clearcover partner with Ada AI?

Does Clearcover offer gap insurance?

How do you purchase and manage a Clearcover auto insurance policy?

How do you file a claim with Clearcover auto insurance?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

Yes, if you’re comfortable using an app-first insurer, Clearcover is a great pick thanks to its reliability, with just 0.45 NAIC complaints—well below the national average, an A- rating from A.M. Best, and an 82/100 from Consumer Reports for its digital experience and customer satisfaction.

You’re buying from a privately held company, as Clearcover is owned by its founders and major investors like American Family Ventures and OMERS Ventures, which gives it strong financial backing without being tied to a traditional insurer.

Does Clearcover pay claims well?

Yes, you can count on Clearcover to pay claims quickly and reliably, with most resolved through the app in under 7 minutes—especially helpful if you live in one of the worst states for filing auto insurance claims, where delays are common.

Does Clearcover have accident forgiveness?

No, Clearcover doesn’t offer accident forgiveness, so your rate could increase if you file a claim, especially after an at-fault accident.

Does Clearcover cover windshield replacement?

Yes, if you add glass coverage, Clearcover auto insurance will pay for windshield repair or full replacement, depending on the damage.

What states does Clearcover cover?

Clearcover is currently available in 19 states, including Texas, Illinois, and Arizona. Compare it with the best auto insurance companies in Arizona to find the best rates.

How long has Clearcover Insurance been around?

Clearcover has been in business since 2016 and is backed by investors like American Family Ventures and OMERS Ventures.

Does Clearcover insure Teslas?

Yes, Clearcover car insurance insures Teslas, and while premiums vary, a Model 3 full coverage policy typically starts around $158 per month based on internal data.

Does Clearcover offer glass coverage?

Yes, it’s available as an optional add-on under comprehensive auto insurance. It’s great if you drive frequently on highways where chips and cracks are common.

Does Clearcover insurance cover rental cars?

Yes, Alternate Transportation coverage reimburses rideshare or rental car costs up to your policy limit during covered claims.

How do I contact Clearcover car insurance?

How do I cancel Clearcover insurance?

Does Clearcover partner with Ada AI?

Does Clearcover offer gap insurance?

How do you purchase and manage a Clearcover auto insurance policy?

How do you file a claim with Clearcover auto insurance?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

Yes, you can count on Clearcover to pay claims quickly and reliably, with most resolved through the app in under 7 minutes—especially helpful if you live in one of the worst states for filing auto insurance claims, where delays are common.

No, Clearcover doesn’t offer accident forgiveness, so your rate could increase if you file a claim, especially after an at-fault accident.

Does Clearcover cover windshield replacement?

Yes, if you add glass coverage, Clearcover auto insurance will pay for windshield repair or full replacement, depending on the damage.

What states does Clearcover cover?

Clearcover is currently available in 19 states, including Texas, Illinois, and Arizona. Compare it with the best auto insurance companies in Arizona to find the best rates.

How long has Clearcover Insurance been around?

Clearcover has been in business since 2016 and is backed by investors like American Family Ventures and OMERS Ventures.

Does Clearcover insure Teslas?

Yes, Clearcover car insurance insures Teslas, and while premiums vary, a Model 3 full coverage policy typically starts around $158 per month based on internal data.

Does Clearcover offer glass coverage?

Yes, it’s available as an optional add-on under comprehensive auto insurance. It’s great if you drive frequently on highways where chips and cracks are common.

Does Clearcover insurance cover rental cars?

Yes, Alternate Transportation coverage reimburses rideshare or rental car costs up to your policy limit during covered claims.

How do I contact Clearcover car insurance?

How do I cancel Clearcover insurance?

Does Clearcover partner with Ada AI?

Does Clearcover offer gap insurance?

How do you purchase and manage a Clearcover auto insurance policy?

How do you file a claim with Clearcover auto insurance?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

Yes, if you add glass coverage, Clearcover auto insurance will pay for windshield repair or full replacement, depending on the damage.

Clearcover is currently available in 19 states, including Texas, Illinois, and Arizona. Compare it with the best auto insurance companies in Arizona to find the best rates.

How long has Clearcover Insurance been around?

Clearcover has been in business since 2016 and is backed by investors like American Family Ventures and OMERS Ventures.

Does Clearcover insure Teslas?

Yes, Clearcover car insurance insures Teslas, and while premiums vary, a Model 3 full coverage policy typically starts around $158 per month based on internal data.

Does Clearcover offer glass coverage?

Yes, it’s available as an optional add-on under comprehensive auto insurance. It’s great if you drive frequently on highways where chips and cracks are common.

Does Clearcover insurance cover rental cars?

Yes, Alternate Transportation coverage reimburses rideshare or rental car costs up to your policy limit during covered claims.

How do I contact Clearcover car insurance?

How do I cancel Clearcover insurance?

Does Clearcover partner with Ada AI?

Does Clearcover offer gap insurance?

How do you purchase and manage a Clearcover auto insurance policy?

How do you file a claim with Clearcover auto insurance?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

Clearcover has been in business since 2016 and is backed by investors like American Family Ventures and OMERS Ventures.

Yes, Clearcover car insurance insures Teslas, and while premiums vary, a Model 3 full coverage policy typically starts around $158 per month based on internal data.

Does Clearcover offer glass coverage?

Yes, it’s available as an optional add-on under comprehensive auto insurance. It’s great if you drive frequently on highways where chips and cracks are common.

Does Clearcover insurance cover rental cars?

Yes, Alternate Transportation coverage reimburses rideshare or rental car costs up to your policy limit during covered claims.

How do I contact Clearcover car insurance?

How do I cancel Clearcover insurance?

Does Clearcover partner with Ada AI?

Does Clearcover offer gap insurance?

How do you purchase and manage a Clearcover auto insurance policy?

How do you file a claim with Clearcover auto insurance?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

Yes, it’s available as an optional add-on under comprehensive auto insurance. It’s great if you drive frequently on highways where chips and cracks are common.

Yes, Alternate Transportation coverage reimburses rideshare or rental car costs up to your policy limit during covered claims.

How do I contact Clearcover car insurance?

How do I cancel Clearcover insurance?

Does Clearcover partner with Ada AI?

Does Clearcover offer gap insurance?

How do you purchase and manage a Clearcover auto insurance policy?

How do you file a claim with Clearcover auto insurance?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

Does Clearcover partner with Ada AI?

Does Clearcover offer gap insurance?

How do you purchase and manage a Clearcover auto insurance policy?

How do you file a claim with Clearcover auto insurance?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

How do you purchase and manage a Clearcover auto insurance policy?

How do you file a claim with Clearcover auto insurance?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

What factors affect my Clearcover auto insurance rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What kind of insurance does Clearcover have?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.