Life Insurance Beneficiaries in 2026

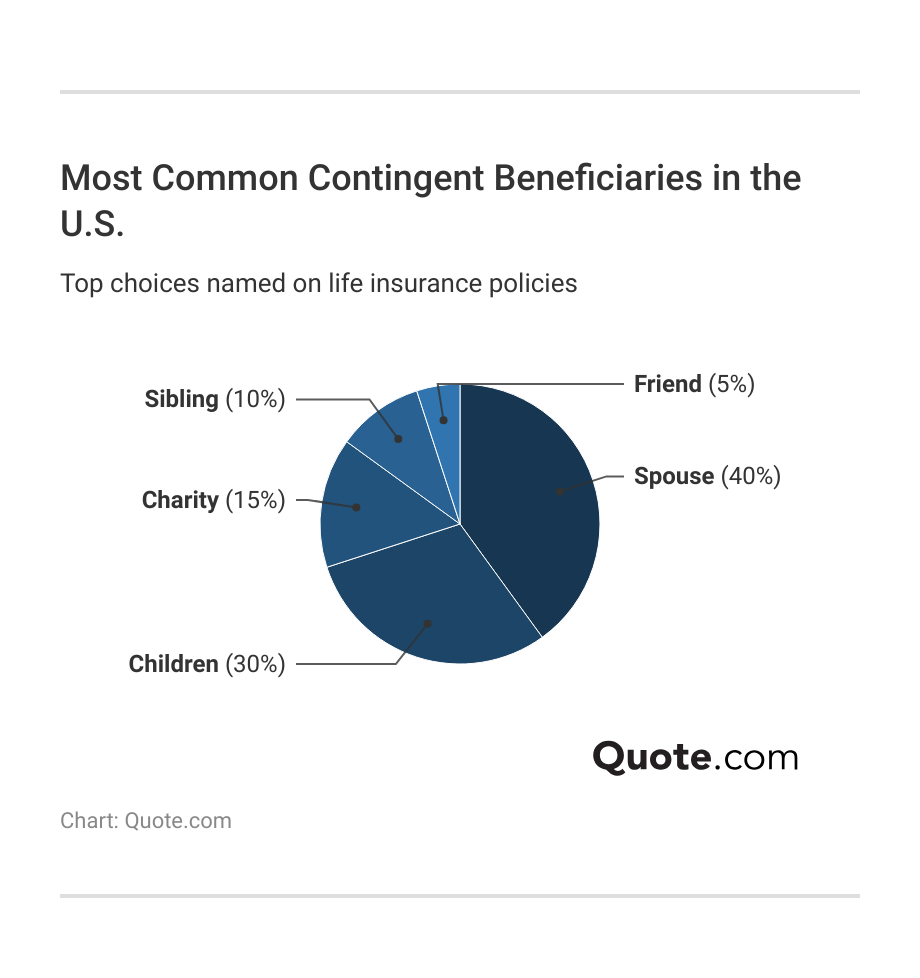

Life insurance beneficiaries receive the death benefit from your policy after you pass away. Around 40% of people name their spouse, but some choose to name their children, trusts, or charities instead. You may also pick a contingent beneficiary to receive the payout if the primary beneficiary can’t.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

A life insurance beneficiary is the person or entity you choose to receive your policy’s death benefit when you pass away, and about 40% of policyholders name their spouse.

- Be sure to update beneficiary information after major life changes

- Name beneficiaries clearly to avoid confusion or claim delays

- Consider a trust if a beneficiary is a minor to manage payouts properly

You can name a primary beneficiary and also a contingent beneficiary, who would receive the payout if the primary beneficiary can’t be located or has already passed away.

Whether you’re purchasing life insurance to protect your family, support a loved one, or leave a legacy, understanding how beneficiaries work is essential to making sure your wishes are carried out. Start comparing quotes for life insurance today.

What is a Life Insurance Beneficiary?

A life insurance beneficiary is the person or organization you choose to receive a death benefit after you pass away, and the payout rules can vary depending on the type of life insurance you have.

Naming a beneficiary helps ensure the money goes to the right recipient and can provide financial support, pay expenses, or help meet long-term goals.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Life Insurance Beneficiaries

Different beneficiary types serve different purposes based on your financial goals, family situation, and how much control you want over future changes.

Choosing the right beneficiary for life insurance helps make sure the death benefit goes where you want and helps prevent delays or disputes.

Common Types of Beneficiaries for Life Insurance| Beneficiary Type | What it Means |

|---|---|

| Contingent Beneficiary | Receives the payout if the primary beneficiary can’t |

| Irrevocable Beneficiary | Can’t be changed without beneficiary approval |

| Primary Beneficiary | First person or entity to receive the payout |

| Revocable Beneficiary | Can be changed at any time by the policy owner |

| Trust Beneficiary | Trust receives and manages the payout as directed |

Most policies start with a primary beneficiary, who is first in line to receive the payout. Naming a contingent beneficiary adds an important layer of protection by ensuring the benefit is still distributed according to your wishes if the primary beneficiary is unable to receive it.

Certain beneficiary designations, such as irrevocable beneficiaries, require additional legal steps to change, while revocable beneficiaries allow you to make updates at any time.

Ty Stewart Licensed Insurance Agent

If no contingent beneficiary is named and the primary beneficiary cannot receive the payout, the proceeds may be directed to your estate, which can trigger probate.

Each beneficiary type affects who receives the payout and whether changes are allowed. Reviewing these options helps you choose a primary recipient, name a backup, and decide how flexible your policy should be.

Who Should be Your Life Insurance Beneficiary?

To pick the right beneficiary for your situation, consider who relies on you financially and your goals. Common beneficiary choices include:

- Family: A spouse, children, parents, or domestic partner who may rely on your income

- Trusts: Useful for supporting minors, managing distributions, or meeting estate planning needs

- Charities or Nonprofits: A meaningful option if you want to leave a legacy or support a cause you care about

- Businesses or Business Partners: Often used for buy-sell agreements or to protect a company from financial loss

You can name more than one beneficiary and assign a percentage of the payout to each.

Naming both a primary and contingent beneficiary on life insurance helps ensure your payout goes to the right person if your first choice passes away before you.

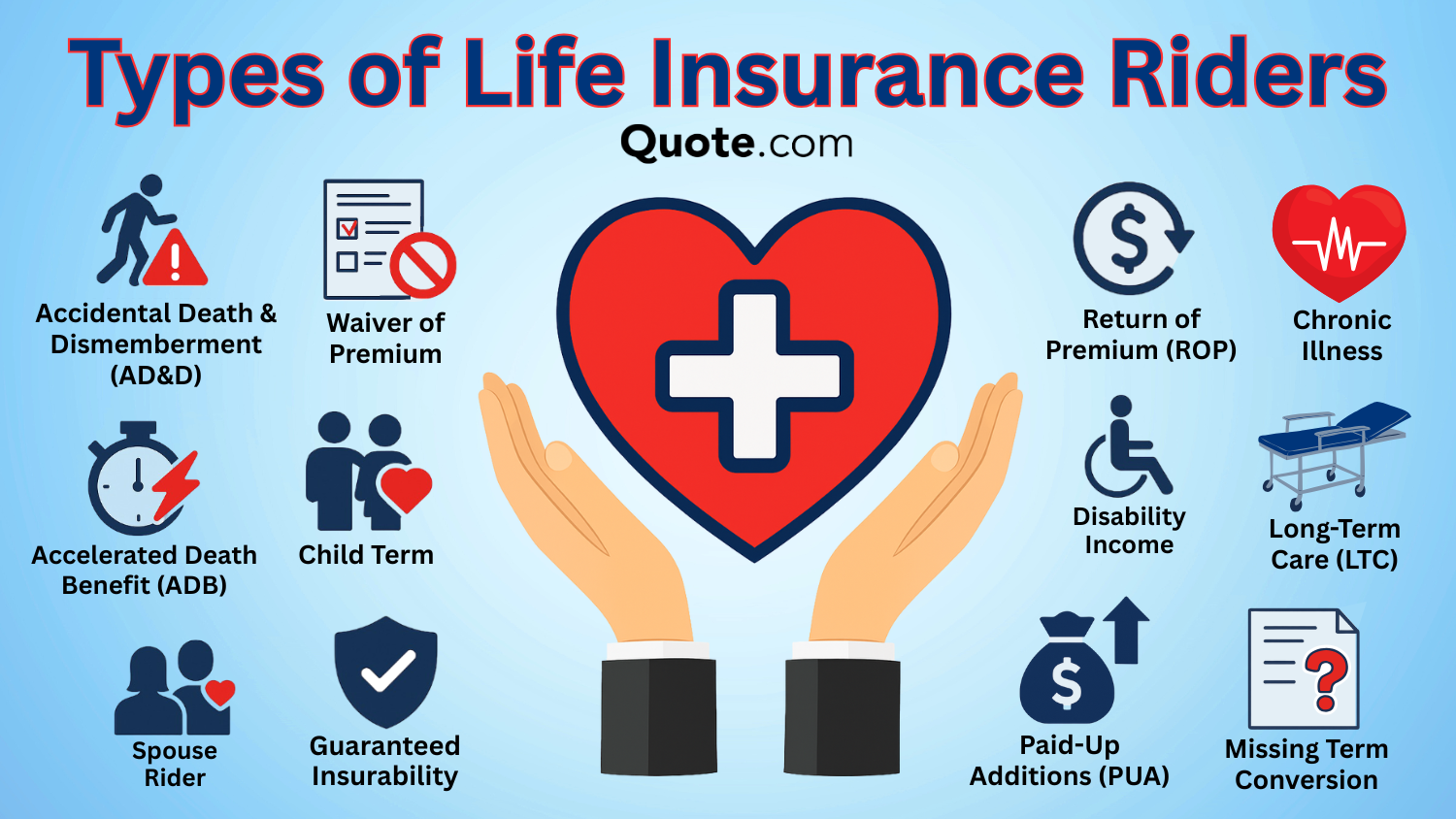

How Life Insurance Riders Affect Beneficiary Eligibility

Generally, beneficiaries of life insurance can be anyone you choose, regardless of citizenship or residency. However, certain life insurance riders or policies may have different rules, so it’s important to review eligibility requirements with your insurer.

Life insurance riders usually don’t restrict who you can name as a beneficiary, but they can affect when benefits are paid and what conditions must be met for a payout.

For example, certain accelerated death benefit or long-term care riders may require additional documentation or residency verification before benefits are issued, even if the beneficiary designation itself is valid.

Since life insurance beneficiary rules can vary by policy, it’s smart to review rider eligibility details with your insurer before making final decisions.

How to Name a Life Insurance Beneficiary

When purchasing a policy, you’ll be asked to name your beneficiaries. You can also change or add beneficiaries later by filling out a form with your insurer.

Be sure to include:

- Full legal names

- Relationship to you

- Contact information, and Social Security number if available

- Exact % shares if naming multiple beneficiaries

Avoid vague labels like “my children” or “my spouse,” since they can lead to confusion, delays, or legal disputes during the claims process.

Changing a Life Insurance Beneficiary

You can usually update your beneficiary at any time if they are designated as revocable. To do so:

- Request a beneficiary change form from your insurer.

- Complete and sign the form.

- Submit it according to your provider’s instructions.

Irrevocable beneficiaries require their written consent to make any changes. This is often used in divorce settlements or legal agreements.

With term life insurance, beneficiary changes are typically straightforward during the policy term, while whole life insurance policies may involve additional planning considerations due to their permanent nature and long-term value.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mistakes to Avoid When Naming a Beneficiary

Choosing a life insurance beneficiary may seem simple, but small mistakes can cause big problems later.

An outdated or unclear beneficiary designation can delay the payout or send the money to someone you didn’t intend.

Not Naming a Contingent Beneficiary

Not naming a contingent beneficiary can create problems if your primary beneficiary passes away before you.

In that case, the payout may go to your estate, which can lead to probate delays and added legal costs before the money reaches your loved ones.

Not Updating Beneficiaries After Major Life Changes

Marriage, divorce, or having a child are all important reasons to review your beneficiary designations. If you leave outdated information on your policy, benefits could end up going to the wrong person.

The top life insurance companies follow the policy paperwork, not your intentions, even if your personal circumstances have clearly changed.

Naming a Minor Without a Custodian or Trust

Minors cannot receive life insurance proceeds directly. Life insurance companies typically require a court-appointed conservatorship before releasing funds to a minor beneficiary.

If you name a child as a beneficiary without setting up a trust or legal guardian, the court may have to step in, which can delay access to the money when it’s needed most.

Heidi Mertlich Licensed Insurance Agent

Naming a life insurance trust beneficiary allows you to control how and when the money is used for the child’s benefit.

Without planning ahead, the payout could be locked up until the child reaches the legal age, usually 18 or 21, depending on the state. In some cases, a judge may also step in to choose who controls the money, which may not reflect what you would have wanted. Related: Best Life Insurance for Children

Using Incorrect or Outdated Names

Misspelled names or missing legal details can slow down the life insurance claims process. Always use full, accurate legal names to help ensure a smooth and timely payout.

Double-check names after marriages, divorces, or legal name changes to keep records current. Make sure beneficiaries’ names match the names on official documents, such as birth certificates or IDs.

How Life Insurance Beneficiaries Are Notified

Life insurance companies do not proactively contact beneficiaries when someone passes away. Here’s how beneficiaries typically find out:

- A beneficiary reaches out to the insurance company to report the death and start a claim.

- The insurer uses contact information on file to notify beneficiaries after learning of the death.

- An executor, attorney, or financial advisor informs beneficiaries about the policy.

- If beneficiaries aren’t located, the benefit may be turned over to the state until claimed.

Policyholders should store their insurance documents in a secure but accessible location and inform their beneficiaries where to find them.

Why Life Insurance Beneficiaries Matter

Choosing the right life insurance beneficiaries ensures your money goes to the people you actually want it to support. Updating them after life changes like marriage, divorce, or having kids helps prevent delays or legal problems later.

Getting legal help can be useful if you’re naming a trust or dealing with a complicated family situation.

Use our free quote tool to compare policies, get expert insights, and make the right beneficiary life insurance decision. Read More: How to Get Life Insurance Quotes

Frequently Asked Questions

What is a life insurance beneficiary?

A life insurance beneficiary is the person or organization you choose to receive your policy’s death benefit when you pass away. You name your beneficiary when you buy the policy, whether it’s term life insurance or another policy, and you can usually update it later if your situation changes.

Naming beneficiaries helps ensure the payout goes directly to the right people, often faster and without going through probate.

Who should be my beneficiary for life insurance?

Your life insurance beneficiary should be someone who would be financially affected by your death or who you want to support. For most people, this is a spouse, children, or other close family members who rely on their income.

Your choice may also depend on the type of life insurance you have and how you want the money used. Compare life insurance options and get personalized rates with our free quote tool.

What’s the difference between a primary and contingent beneficiary?

A primary beneficiary is the person or organization first in line to receive the life insurance payout when the policyholder dies. You can name one primary beneficiary or split the death benefit among multiple people by assigning a specific life insurance beneficiary percentage to each.

A contingent beneficiary is the backup. This person or organization receives the life insurance beneficiary payout only if the primary can’t, for example, if they pass away before the policyholder or can’t be located.

Can multiple people be named as beneficiaries?

Yes, naming multiple people as beneficiaries is very common. Most life insurance policies let you name several beneficiaries and decide exactly how the payout is divided. You can:

- Split the benefit evenly, such as 50% to each person.

- Assign custom percentages, like 60% to your spouse and 40% to your child.

- Combine people and organizations, for example, 80% to a child and 20% to a nonprofit.

Just be sure your total allocation adds up to 100% so the benefit is paid as intended.

Can a life insurance beneficiary be under 18?

Yes, but minors cannot legally receive a life insurance payout directly. Instead, the death benefit will be managed by:

- A court-appointed guardian, or

- A trust or custodian named by the policyholder

Creating a trust is often the preferred option for leaving life insurance to children, since the best life insurance for children focuses on long-term protection and control.

This is especially important with whole life insurance, which is often used for long-term planning.

Can you name a trust or charity as a life insurance beneficiary?

Yes. Naming a trust can provide control over how the money is distributed, especially if you’re leaving funds to minors or individuals with special needs. A charity can also be named to support a cause you care about, often with potential estate tax benefits.

What if a beneficiary dies before the policyholder?

If a life insurance beneficiary is deceased and no other primary beneficiaries remain, the policy’s death benefit goes to the contingent beneficiary, if one is named. If no contingent beneficiary exists, the payout may default to your estate and go through probate.

How do you find out who the beneficiary of a life insurance policy is?

To find out who the beneficiary of a life insurance policy is, start by reviewing the policy documents or contacting the life insurance company directly. If you’re unsure which insurer issued the policy, check bank statements, employer benefits records, or old mail for policy details.

If the policyholder has passed away, an executor, attorney, or the insurance company can help confirm beneficiary information once a claim is filed.

Can you change your life insurance beneficiary?

Yes, you can usually change your beneficiary of life insurance at any time. Most life insurance policies, including term life insurance, allow updates as long as the policy is active and you’re mentally competent.

Can a life insurance beneficiary be changed after death?

No, a life insurance beneficiary cannot be changed after death. Once the policyholder passes away, the beneficiary listed on the policy at that time is legally entitled to receive the payout.

Life insurance companies follow the beneficiary designation on file, even if the policyholder’s wishes changed later or a will says otherwise. This is why it’s important to review and update beneficiaries regularly while the policy is active.

Can a life insurance beneficiary be irrevocable?

What can override a life insurance beneficiary designation?

How often should you review or update your beneficiaries?

What are common beneficiary mistakes?

What happens if no beneficiary is named?

Does life insurance go through probate?

How long does it take for a beneficiary to receive money from life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.