Best Electric Vehicle (EV) Insurance Discounts in 2025

The best electric vehicle insurance discounts come from Travelers, Nationwide, and The Hartford, saving drivers up to 10%. Green car discounts are usually available for both electric and hybrid models. If you’re looking for cheap car insurance for electric cars, Geico has the lowest rates starting at $43 monthly.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated October 2025

Travelers, Nationwide, and The Hartford offer the best electric vehicle (EV) insurance discounts. EV car insurance discounts from these top companies can help you save up to 10% on your policy.

Our Top 10 Company Picks: Best Electric Vehicle Insurance Discounts| Company | Rank | A.M. Best | Green Vehicle | Who Qualifies? |

|---|---|---|---|---|

| #1 | A++ | 10% | Drivers of hybrid or electric vehicles | |

| #2 | A+ | 10% | Policyholders with an electric or hybrid vehicle | |

| #3 | A+ | 10% | AARP members with hybrid or electric cars |

| #4 | A | 8% | Owners of hybrid or electric vehicles | |

| #5 | A | 8% | Drivers of EVs, hybrids, or alt-fuel vehicles |

| #6 | A+ | 7% | Electric or hybrid vehicle drivers in select states | |

| #7 | A++ | 5% | Policyholders with eligible EVs or hybrids | |

| #8 | A++ | 5% | Drivers of qualifying alternative fuel vehicles | |

| #9 | A+ | 5% | EV or hybrid drivers where discounts apply | |

| #10 | A | 5% | EV/hybrid owners in participating states |

You don’t need to know how electric cars work to save on your EV insurance. You just need to drive a qualifying hybrid or fully-electric vehicle to qualify.

Not many companies offer EV discounts, but Travelers offers the best savings. Keep reading to learn where to find the best electric vehicle insurance discounts.

- The biggest electric car insurance discounts are between 8%-10%

- EV auto insurance discounts apply to hybrid and electric cars

- Electric vehicle auto insurance quotes start at $43 per month

When you’re ready to find cheap electric vehicle auto insurance, enter your ZIP code into our free quote comparison tool.

How to Qualify for an Electric Vehicle Discount

Qualifying for an electric vehicle discount can be relatively simple, but it depends on your insurance provider. Here are a few common requirements:

- Drive an Eligible Vehicle: Most companies have a list of qualifying electric or hybrid models. If your car’s on the list, you’re already halfway there.

- Have High Fuel Efficiency: Vehicles with high fuel efficiency are often eligible for a green vehicle insurance discount, particularly if you drive a hybrid or electric car.

- Live in a Participating State: Not all discounts are available nationwide. Some states have more EV-friendly policies than others.

- Combine Green Discounts: Some insurers may offer extra savings if you charge your car using solar power or drive fewer miles.

- Minimize Emissions: Vehicles that meet certain low-emissions requirements often qualify for EV insurance discounts. As a bonus to drivers with environmental concerns, these cars are also better for the environment.

If you’re unsure whether you qualify, it’s always a good idea to check with your insurer. Sometimes, just letting them know you drive an EV can uncover auto insurance discounts you didn’t know existed.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

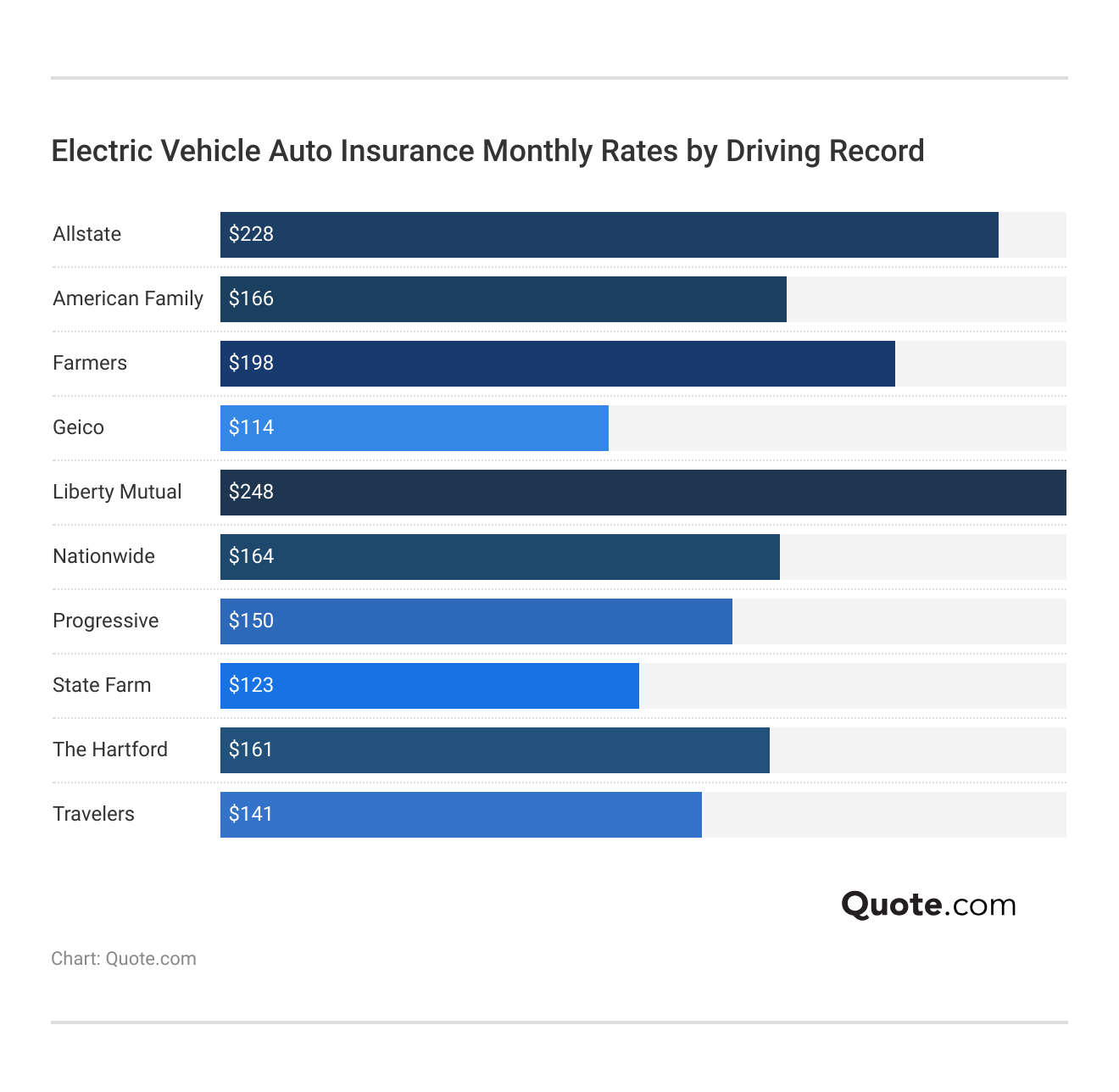

Electric Vehicle Auto Insurance Rates

Electric vehicles (EVs) are becoming more common on the road, and that’s great news for the environment. However, when it comes to car insurance, EVs can sometimes be more expensive to insure than gas-powered cars. Check out how much you might pay for electric car insurance.

Electric Vehicle Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $61 | $161 |

| $53 | $141 |

As you can see, age and gender play a significant role in how much you’ll pay for car insurance. Insurance providers use statistics when determining how much to charge you. Younger, less experienced drivers file more claims than older ones, which is why teens and young adults typically pay more.

Another crucial factor in your insurance premiums is the type of car you drive. For example, a car that costs $40,000 is typically cheaper to insure than one that costs $100,000. Check below to see average rates for some of the most popular electric and hybrid cars.

Electric & Hybrid Vehicle Insurance Costs per Month| Make/Model | Cost |

|---|---|

| Mini Cooper Electric | $175 |

| Nissan Leaf | $130 |

| Tesla Model 3 | $289 |

| Tesla Model Y | $314 |

| Jaguar I‑Pace | $244 |

| Jaguar F‑Type | $290 |

| Mercedes‑AMG EQS | $471 |

| Hyundai Kona Electric | $449 |

| Hyundai Kona (gas/hybrid trims) | $194 |

While the type of car you drive is an important factor in your car insurance rates, it’s not the only thing providers look at. Your driving record also plays a crucial role in determining the cost of your electric vehicle car insurance. Here’s how your driving record might affect your electric vehicle car insurance quotes.

Electric vehicle auto insurance can be costly, especially if your driving record includes marks such as DUIs or speeding tickets. However, there are steps you can take if you can’t afford your auto insurance. Finding EV auto insurance discounts is a great start, as many insurance companies offer savings options for electric vehicles.

The primary reason EVs come with higher insurance rates is that they cost more to repair or replace, especially the batteries.

Jeffrey Manola Licensed Insurance Agent

You can also look for other discounts, lower your coverage, and compare quotes with other companies to help you find the lowest rates possible.

Best Auto Insurance Companies for an Electric Vehicle Discount

Some insurance providers go the extra mile to support eco-conscious drivers. Here are a few companies known for offering electric vehicle insurance discounts:

- Travelers: As our top pick for EV discounts, Travelers offers exceptional customer service. Take a look at our Travelers insurance review for more information.

- Progressive: Drivers seeking modern insurance tools for their electric vehicles may be impressed with Progressive. Read our Progressive insurance review to learn more.

- Liberty Mutual: According to our Liberty Mutual review, the company offers electric car insurance discounts to most alternative fuel vehicles.

- Nationwide: Nationwide offers a variety of ways to save aside from its electric vehicle discount. Explore your savings options in our Nationwide insurance review.

- The Hartford: Although it has membership requirements, The Hartford offers one of the best EV discounts. To qualify for insurance from The Hartford, you’ll need to be an AARP member.

With electric vehicles becoming increasingly popular on American roads, more companies than ever before are offering green car discounts. Be sure to thoroughly compare your options before purchasing a policy to ensure you save every penny possible.

The good news is that it’s easier than ever to get a car insurance quote for electric vehicles. Simply fill out the quote request form on a provider’s website to get personalized quotes. Or, if you don’t want to waste time filling out individual forms, you can use our free tool to instantly provide multiple quotes by entering your ZIP code.

Other Ways to Save on Auto Insurance for Electric Vehicles

Beyond EV-specific discounts, there are several tried-and-true ways to lower your auto insurance premiums. Many of these savings options are available no matter what kind of car you drive, and when combined, they can really add up.

Other ways for EV drivers to save include reducing coverage in your policy, increasing your deductible, and maintaining a clean driving record.

Rachel Brennan Licensed Insurance Agent

There are many hacks to save money on auto insurance, but one of the easiest is to find additional discounts. EV drivers can find a variety of discounts for which they qualify, but the most popular are listed below.

Best Electric Vehicle Insurance Discounts| Company | Anti-Theft | Bundling | Multi-Car | Green Vehicle |

|---|---|---|---|---|

| 10% | 25% | 25% | 7% | |

| 25% | 25% | 20% | 5% |

| 10% | 20% | 20% | 8% | |

| 25% | 25% | 25% | 5% | |

| 35% | 25% | 25% | 8% |

| 5% | 20% | 20% | 10% | |

| 25% | 10% | 12% | 5% | |

| 15% | 17% | 20% | 5% | |

| 10% | 5% | 25% | 10% |

| 15% | 13% | 8% | 10% |

These savings are popular electric vehicle discounts for many reasons. For example, since EVs often come with the latest technology, many automatically qualify for an anti-theft device discount.

Liberty Mutual has the biggest anti-theft EV discount at 35%.

You can also take advantage of other car insurance discounts to help you save. Most companies allow you to combine discounts to maximize your savings. To get more information about some of the biggest money-saving discounts available, check out the savings listed below.

Good Driver Auto Insurance Discount

If you’ve got a clean driving record, with no accidents, speeding tickets, or claims, you may qualify for a good driver discount.

Most insurers offer a discount for staying safe behind the wheel, making it easy to find the best auto insurance for good drivers. EV drivers who are careful behind the wheel may be eligible for a good driver discount, which can make a noticeable dent in insurance premiums and help you find the best insurance for electric cars.

New Car Auto Insurance Discount

Driving a new EV? You may qualify for a discount simply for owning a newer model. Newer cars, including EVs, often come equipped with advanced safety features that reduce the risk of accidents and injuries—something insurers love to see.

If you have a newer vehicle, you may want to consider adding new car replacement coverage to your policy. This coverage can help you find the best insurance for hybrid cars because it ensures you’ll be able to replace your vehicle with a similar model.

Read more: Car Buying Guide: The Best Time to Buy a New Car

Bundling Auto Insurance Discount

One of the secrets in our ultimate auto insurance cheat sheet is to bundle policies whenever you can. If you already have homeowners, renters, or another type of insurance, consider bundling it with your auto policy to save money.

Many companies offer significant discounts when you combine multiple policies, including auto, home, renters, and life insurance.

Usage-Based Insurance

If you don’t drive your EV very often, a usage-based insurance (UBI) plan might be perfect for you. These programs use a mobile app or a small device in your car to track how much and how safely you drive.

If you’re a low-mileage or safe driver, UBI could lead to significant savings, especially when paired with the typical efficiency of an EV.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Electric Vehicles Insurance Discounts Today

Auto insurance for electric vehicles may cost more on average, but that doesn’t mean you’re stuck with higher rates. Taking easy steps, such as finding the best discounts for electric vehicle auto insurance, selecting the right coverage, and comparing quotes, can help you save.

Now that you have a better idea of how electric vehicle insurance works and which companies have the best electric vehicle (EV) insurance discounts, your next step is to learn how to get multiple auto insurance quotes. The fastest way to compare quotes is to enter your ZIP code into our free comparison tool — try it today.

Frequently Asked Questions

Is there an auto insurance discount for electric vehicles?

Yes, many insurers offer discounts for driving electric or hybrid vehicles. However, some of the largest insurance companies don’t. If you want the best auto insurance for your EV, make sure to research the best options first.

Who has the best auto insurance discount for electric vehicles?

Companies like Travelers, Nationwide, and The Hartford are known for offering substantial EV discounts, though availability can vary by state. Other companies offer excellent EV policies, even if their insurance discounts for electric cars aren’t the best. For example, Geico EV insurance offers affordable coverage for electric and hybrid vehicles.

Does auto insurance cover electric vehicles?

Yes, standard auto insurance policies cover electric vehicles just as they do gas-powered cars. If you have both an EV and a traditional car, you can get cheap auto insurance for multiple vehicles by taking advantage of multi-car discounts.

Do you need special car insurance for an electric vehicle?

No, you don’t need a special policy, but some insurers offer optional coverage or discounts specifically for EVs.

How much does auto insurance for electric vehicles cost?

You can get auto insurance for electric vehicles starting as low as $43 per month. The actual amount you’ll pay depends on several factors, including whether you can find the best discounts for electric vehicle car insurance. To see which companies have the lowest rates in your area, enter your ZIP code into our free comparison tool.

Are insurance rates lower for electric cars?

It depends on the car, but electric car insurance costs are often higher than those for traditional vehicles. When you compare insurance for electric cars vs. gas-powered vehicles, providers look at how much it will cost to repair or replace them. Since electric vehicles can be expensive to repair, even the best insurance for electric vehicles can be pricy.

How do you save on electric vehicle car insurance?

You can save by shopping around, bundling policies, enrolling in usage-based insurance, and asking about EV-specific or good driver discounts. For more inspiration, check out our visual guide to auto insurance for everything you need to know about your coverage.

What other discounts can electric vehicle owners take advantage of?

EV owners may qualify for new-car, low-mileage, multi-policy, and safe-driver discounts, in addition to EV-specific savings.

What is the cheapest electric car to insure?

Although many factors affect car insurance rates, the Nissan Leaf typically has the cheapest. With rates starting as low as $130 per month, the Nissan Leaf usually comes with affordable coverage. When it comes to average hybrid car insurance costs, the Hyundai Kona hybrid trim costs about $194 per month.

What is the biggest problem with electric cars?

The biggest challenge is still the limited charging infrastructure in some areas, which can make long-distance travel or rural charging more difficult.

Which is the best electric car to buy?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.