How to Cancel an Auto Insurance Policy in 2026

The first step in how to cancel an auto insurance policy is checking your policy contract for fees and refunds. If you will still be driving, make sure to secure a new auto insurance policy. Minimum rates start as low as $32 per month at some companies. Then, you can contact your provider to cancel.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, bus...

Tracey L. Wells

Updated January 2026

Knowing how to cancel an auto insurance policy correctly will help protect you from common mishaps like auto insurance coverage gaps.

- Step #1: Review Policy – Check cancellation fees, etc.

- Step #2: Secure New Policy – Buy a new policy before canceling

- Step #3: Contact Insurer – Call or message current insurer

- Step #4: Submit Cancellation Request – Sign any necessary paperwork

- Step #5: Confirm Cancellation – Save proof of cancellation

- Step #6: Update Records – Notify your lender, if applicable

Many drivers choose to switch auto insurance policies periodically, as it can help them reduce their auto insurance rates through better deals, discounts, and more at the best car insurance companies.

If you are canceling your insurance policy and need to find a new policy quickly, use our free quote tool. It will help you quickly get and compare quotes from multiple companies in your area.

Canceling Auto Insurance Policies in 6 Easy Steps

Wondering how to cancel an auto insurance policy online? Canceling coverage is often a quick process, whether you’re looking to cancel a State Farm policy or cancel a Geico policy, but it is important to make sure you do it correctly.

For example, if you are still driving a vehicle you own, it is essential to have a new policyholder lined up before canceling. To make sure you don’t miss any important steps, we’ve outlined the auto insurance cancellation process in six easy steps.

Steps to Cancel an Auto Insurance Policy| Step | Action | Details |

|---|---|---|

| #1 | Review policy terms | Check fees, refunds, auto-renewal |

| #2 | Secure new coverage | Get new policy before cancelling old |

| #3 | Contact insurer | Call to request cancellation date |

| #4 | Submit cancellation request | Send written notice with signature |

| #5 | Confirm and pay balance | Get proof, settle dues or refund |

| #6 | Update records | Notify lender, cancel auto-payments |

We will guide you through the process of how to cancel a car insurance policy, from reviewing your policy terms to checking cancellation fees to updating your records.

Keep reading our auto insurance guide on cancellation to learn how to make sure canceling your current auto insurance policy is headache-free and there are no coverage gaps.

Step #1: Review Policy

Before canceling your current auto insurance policy, make sure that you check your policy terms to see if there are any fees for canceling before the end of your policy period (Read More: What Happens If You Cancel Auto Insurance).

Not all auto insurance companies will charge early cancellation fees if you cancel before your policy period is up, but checking before canceling will ensure you aren’t surprised by any additional charges. Likewise, see if there are any refunds for canceling early if you prepaid, as you don’t want to lose money.

If you paid in full for an insurance policy period and cancel before the end of that period, you will likely be entitled to a refund.Dani Best Licensed Insurance Producer

Another thing you should check before canceling is if you are signed up for auto-renewal at your current auto insurance company. If you are signed up for auto-renewal, make sure to change it so that you aren’t automatically enrolled again.

If you forget and are automatically enrolled in another policy period before canceling, you may be on the hook for a cancellation fee for canceling before the end of the new policy period.

Step #2: Secure New Policy

Once you’ve checked your current policy’s terms for fees and refunds, it is important to secure a new auto insurance policy before you cancel. Otherwise, you may have a coverage gap and be driving illegally without insurance.

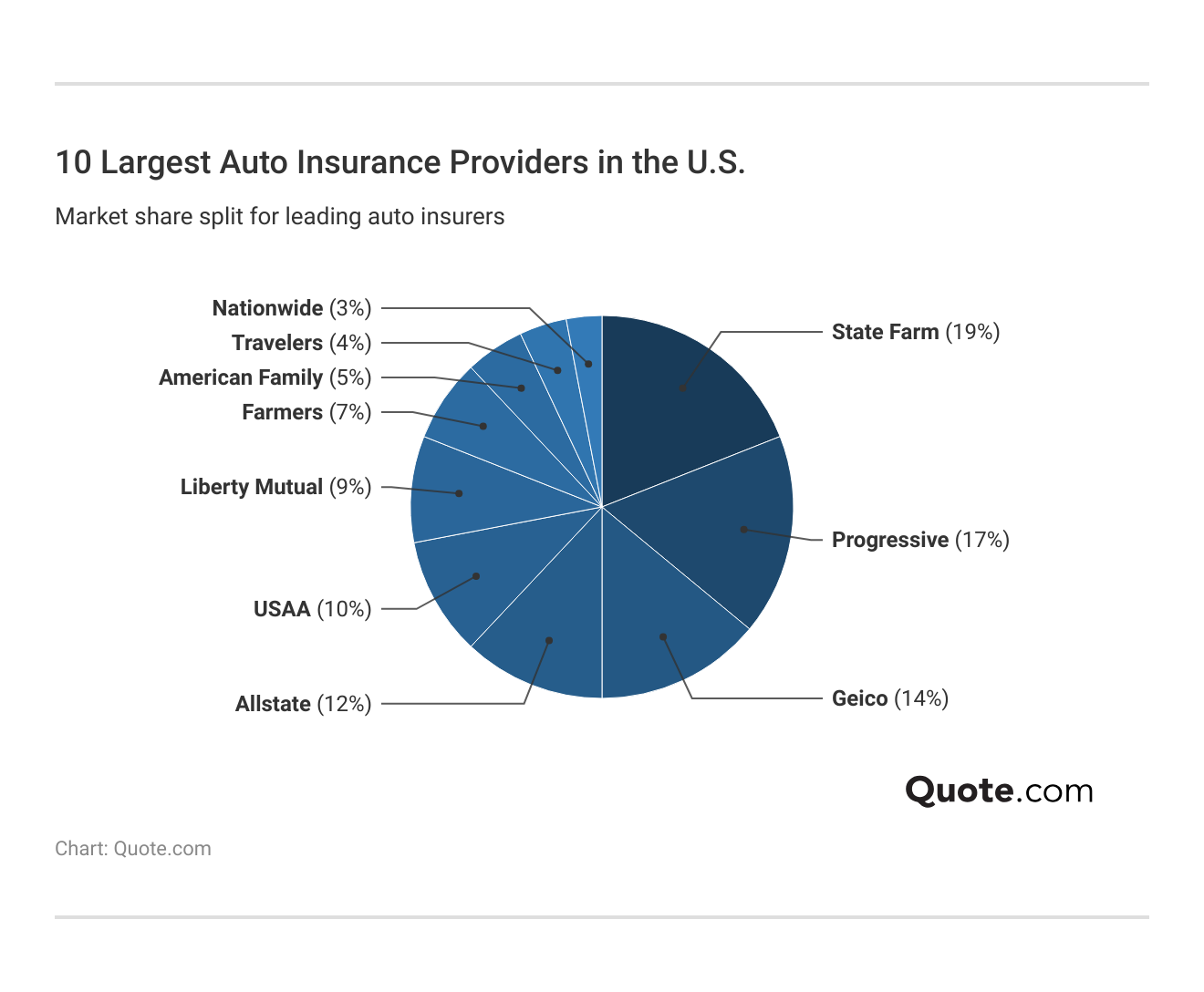

There are plenty of auto insurance providers to choose from, with companies like State Farm and Progressive dominating the auto insurance market (Learn More: State Farm vs. Progressive Auto Insurance).

Of course, don’t just pick a popular provider. Make sure to get quotes from several auto insurance companies to see which offers the best deal on auto insurance.

For example, while Allstate has 12% of the auto insurance market and is a popular company, its rates are more expensive, as minimum coverage starts at an average of $87 per month.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $76 | $141 | |

| $32 | $84 |

More affordable options for both minimum and full coverage policies among popular auto insurance companies include companies like State Farm, Geico, and USAA.

You may also be able to find a small, local provider that offers affordable rates. Just make sure to check company reviews on customer service and claims handling before committing to a company.

Step #3: Contact Insurer

Once you have a new policy start date, it is time to contact your current auto insurance provider to request cancellation. Depending on your auto insurance provider, you may be able to do this over the phone, through your online account, or by contacting your agent.

When canceling, make sure to choose a cancellation date that is after the start date of the new auto insurance policy.

Making sure your start date of your new policy is before the cancellation date ensures that there are no gaps in auto insurance that will leave you driving without insurance.

If you are caught driving without insurance, even if it is just a coverage gap of a few days, your auto insurance rates will increase substantially for years (Read More: What to Do If You Can’t Afford Your Auto Insurance).

Step #4: Submit Cancellation Request

Your auto insurance provider will request a signature on cancellation paperwork for your cancellation to go through. In most cases, you will be able to submit this online or fax it in for a quick and easy cancellation process.

If you are canceling in person with an agent, you can just sign the paperwork in the office. If you are canceling auto insurance on multiple vehicles, make sure that all vehicles are listed on the paperwork (Read More: Cheap Auto Insurance for Multiple Vehicles).

Step #5: Confirm Cancellation

You will have to pay any fees or settle refunds at this point. For example, if you paid in full for your liability auto insurance policy, you should receive a refund at this point when canceling early.

This way, if you are accidentally charged because of an auto-pay issue or something similar, you can prove that you canceled your insurance and shouldn’t have been charged.

It is important to confirm that your cancellation has gone through, so make sure you receive proof of cancellation.

Brandon Frady Licensed Insurance Agent

Without proof of cancellation, you may also be stuck paying for two policies, which could be seen as fraud by some insurance companies.

However, most companies will ask you to provide the start date of your new policy before canceling in order to ensure you have legal coverage and avoid any confusion.

Step #6: Update Records

The last step in canceling your auto insurance policy is to update your records. For example, most people have leases on their vehicles, and car insurance is a requirement in the leasing contract.

So if you have a lease on your vehicle, make sure to let your lender know that you have a new auto insurance policy so they can update their records.

You should also print off your new proof of insurance cards right away to put in your vehicle and discard your old ones.

This way, if you are pulled over, you will have your new proof of insurance on hand to show law enforcement that you are meeting the auto insurance requirements in your state. You will also need your new proof of insurance cards for vehicle inspections.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Switching Auto Insurance Policies Helps You Save

One common reason drivers look to switch auto insurance companies is service issues, which is why it’s important to always check a company’s reputation before committing to a policy with it.

However, drivers also switch in order to save on auto insurance, citing bundling deals, better coverage value, or new discounts as reasons for making the switch.

How Much Policyholders Save by Switching Providers| Switched | Savings | Time Gap | Reason |

|---|---|---|---|

| 30% | $450 | 3-5 yrs | Lower premiums |

| 41% | $500+ | 2-4 yrs | Coverage value |

| 13% | $1,000+ | 3-5 yrs | Bundle savings |

| 4% | $200+ | 3-5 yrs | New discounts |

| 92% | $350 | 4-6 yrs | Service issues |

In fact, quite a few drivers looking to switch auto insurance companies are doing so because they want cheaper rates, and hopping for a new auto insurance policy every few years can reduce rates.

Learn More: 26 Hacks to Save Money on Auto Insurance

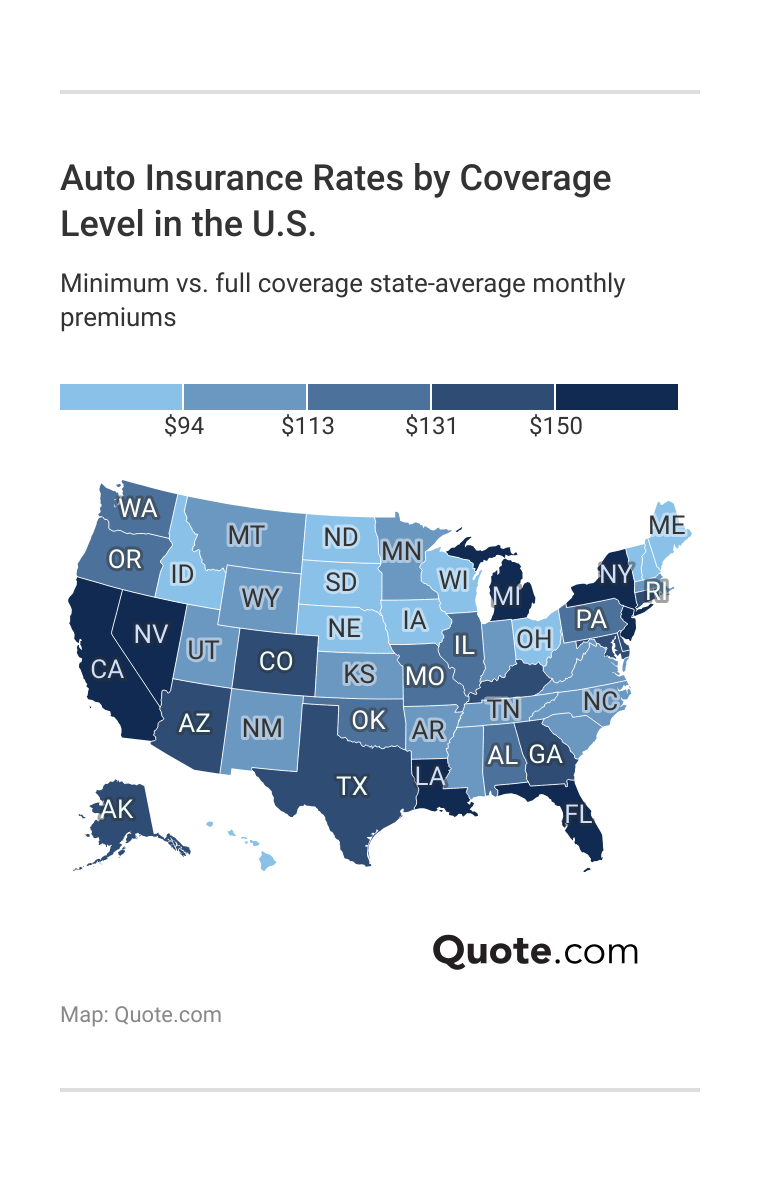

Switching an auto insurance policy can result in savings of over $200 on average, with some drivers scoring even bigger deals. If you live in a state with expensive auto insurance rates, switching auto insurance periodically can help lessen the cost burden.

For example, if you live in Michigan, you will have some of the highest average auto insurance rates in the state, starting at $163 for minimum coverage. In states like these, it is important to cost-compare regularly.

If you live in a cheaper state, however, it is less important to switch auto insurance policies as frequently, especially if you are happy with your current provider.

Buying Coverage as a High-Risk Driver

If you are considered a high-risk driver, it is even more important to check if switching auto insurance policies could help you save (Read More: Cheap Auto Insurance for High-Risk Drivers).

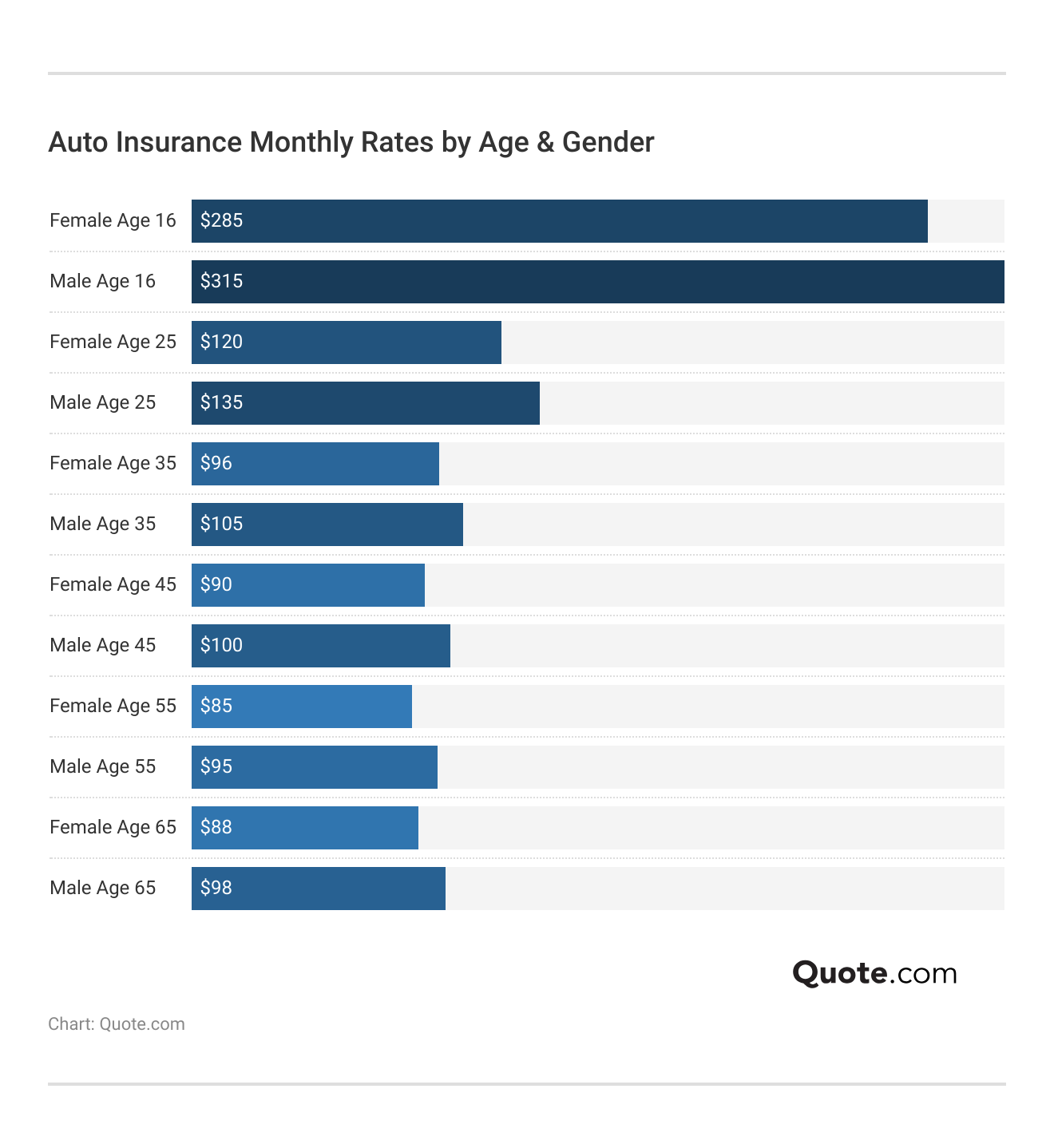

High-risk auto insurance is much more expensive, and you could be labeled as high-risk due to your age, your driving record, or other factors.

While age is outside of your control, insurance companies naturally assign younger drivers to a higher-risk category than older drivers. This is because younger drivers typically have less driving experience and are more likely to make mistakes that can lead to an accident.

For example, if you are 25 years old, you’ll pay much more than a 65-year-old driver with more driving experience.

A driving record is another big factor when shopping for auto insurance coverage. It is much easier to find savings as a good driver, but drivers with poor records can still try to reduce their auto insurance rates by looking to switch companies.

Otherwise, drivers with poor driving records could be stuck with high rates at their company for years until their driving record clears.

Auto Insurance Monthly Rates by Provider & Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $75 | $74 | |

| $56 | $98 | $65 | $53 | |

| $47 | $57 | $93 | $74 | |

| $76 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

For example, if you have a DUI, you’ll want to comparison shop among a few different companies to see if one offers a better rate. While Liberty Mutual’s DUI rates start at $178 per month, Progressive’s DUI rates start at $65 per month.

Getting quotes from companies that offer cheaper rates specifically for your driving violation, therefore, could significantly lower your long-term costs.

Other Ways to Save on Auto Insurance

Switching auto insurance companies is one of the main ways to save on auto insurance coverage, but there are a few other things you can do as well to save.

One of the first is to check that you are taking advantage of all the discounts offered at your current auto insurance company (Read More: 17 Car Insurance Discounts You Can’t Miss).

Top Auto Insurance Discounts by Provider & Savings| Company | Bundling | Claims- Free | Low Mileage | Loyalty | Usage- Based |

|---|---|---|---|---|---|

| 25% | 10% | 30% | 15% | 30% | |

| 25% | 15% | 20% | 18% | 30% |

| 20% | 9% | 10% | 12% | 30% | |

| 25% | 12% | 30% | 10% | 25% | |

| 25% | 8% | 30% | 10% | 30% |

| 20% | 14% | 20% | 13% | 40% | |

| 10% | 10% | 30% | 13% | $231/yr | |

| 17% | 11% | 30% | 7% | 30% | |

| 13% | 13% | 20% | 9% | 30% | |

| 10% | 20% | 20% | 11% | 30% |

For instance, you may want to join a usage-based insurance program at your current auto insurance company to earn a good driver discount.

You could also combine more than one type of insurance at your current provider to earn a bundling discount, such as insuring your home with the company as well as your vehicles. Some other ways to save include:

- Raising Deductibles: You can increase your deductibles to an out-of-pocket amount you feel comfortable with to lower rates.

- Dropping Coverages: If you have extra add-ons like roadside assistance or rental car reimbursement, you may wish to cut costs by dropping these coverages.

Maintaining a clean driving record will also significantly reduce your auto insurance rates, as insurance companies will view you as low risk.

If you are looking to switch your auto insurance policy to a new company, you can start by getting quotes to find the best deal on coverage. Enter your ZIP in our free quote tool to get started.

Frequently Asked Questions

Is it bad to cancel car insurance?

It is not a bad idea to cancel car insurance if you are switching to another provider, but canceling car insurance and driving without insurance is a poor decision. Driving without coverage is illegal and can lead to numerous problems, including tickets and higher insurance rates.

Can I cancel my insurance policy and get my money back?

If you paid in full for the policy period and cancel before the policy period ends, you are often entitled to a partial refund. When looking into how to cancel auto insurance at your current provider, you must check your policy’s terms to see the exact refund details.

What’s a good reason to cancel insurance?

Some good reasons to cancel your auto insurance include finding better rates elsewhere, poor customer service, or selling a vehicle. If you are looking for a better company, read our guide on how to compare auto insurance companies.

Can I cancel an insurance policy at any time?

Yes, you can choose to cancel your auto insurance at any time, but you may have to pay early cancellation fees.

What should I do before canceling car insurance?

Compare quotes online and find another policy before canceling your current coverage so you don’t risk driving uninsured. Start shopping for new coverage now with our free online comparison tool.

How much does it cost to cancel an insurance policy?

Wondering “Is there a penalty for canceling car insurance?” It depends on the company and the timing of your cancellation. Canceling an auto insurance policy early could result in a cancellation fee, but the exact fee will depend on the company.

Can you pause car insurance if you’re not driving?

No, you can not pause car insurance if you aren’t driving for a period of time. However, you may want to consider usage-based insurance if you rarely drive, as it is often much cheaper than traditional insurance (Read More: The Definitive Guide to Usage-Based Auto Insurance).

Does canceling car insurance affect my credit?

No, canceling auto insurance won’t impact your credit score, but missing insurance payments, or auto loan or lease payments, can.

What info do I need to cancel car insurance?

You will need to provide basic information for verification when canceling car insurance, such as your name, birth date, and policy number.

What is the easiest way to cancel car insurance?

The easiest way to cancel car insurance is to call your insurance provider or agent directly. While some insurance companies allow cancellations to be made online, speaking with someone directly will ensure that you have any questions about fees, refunds, and more answered promptly.

How do I cancel my Progressive policy online?

Are there car insurance cancellation laws?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.