Best Pet Insurance for Dogs in 2026

Prudent Pet, Fetch, and Trupanion rank among the best pet insurance for dogs that covers everything, with plans starting around $20 per month. To save more, compare wellness add-ons, deductibles, and reimbursement tiers to find pet insurance options for you that balance affordability and comprehensive coverage.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Pet Insurance Quotes Instantly

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated December 2025

Prudent Pet offers the best overall pet insurance for dogs, with flexible plans and fast reimbursements, depending on breed and location.

- Prudent Pet stands out for its top-rated claims process

- Fetch and Trupanion excel in direct vet payment coverage

- Many insurers offer multi-pet discounts and wellness add-ons

Fetch provides exceptional coverage for preventive and dental care at the cheapest rate of $20 per month. Trupanion stands out for its direct vet payment system that saves owners from paying large bills upfront.

Prudent Pet delivers the best mix of affordability, customizable options, and claim satisfaction for dog owners across the U.S.

Top 10 Companies: Best Pet Insurance for Dogs| Company | Rank | Claim Satisfaction | Healthy Pet | Best for |

|---|---|---|---|---|

| #1 | 980 / 1,000 | 10% | Competitive Pricing |

| #2 | 900 / 1,000 | 8% | Preventive Focus | |

| #3 | 860 / 1,000 | 7% | Vet Direct |

| #4 | 800 / 1,000 | 5% | Coverage Variety | |

| #5 | 770 / 1,000 | 10% | Trusted Brand |

| #6 | 760 / 1,000 | 8% | Tech Forward | |

| #7 | 728 / 1,000 | 5% | Custom Plans |

| #8 | 692 / 1,000 | 10% | Custom Deductible | |

| #9 | 691 / 1,000 | 10% | Behavioral Coverage | |

| #10 | 672 / 1,000 | 5% | Full Bundle |

These companies offer reliable and affordable pet insurance for dogs of all breeds and ages. Use this guide when buying pet insurance to compare the top-rated providers based on coverage options, customer satisfaction, and available discounts.

See how much you could save on pet insurance coverage by entering your ZIP code into our free quote comparison tool.

Getting the Best Pet Insurance Rates for Dogs

How much does pet insurance cost? Dog insurance costs depend on both the company you choose and your pet’s unique needs, and the best pet insurance companies structure their coverage for cats and dogs differently.

Dogs often cost more to insure than cats due to higher veterinary expenses, breed-specific conditions, and lifestyle risks such as injuries or chronic health issues.

Pet Insurance Monthly Rates: Cats vs. Dogs| Company | Cats | Dogs |

|---|---|---|

| $24 | $39 | |

| $20 | $35 | |

| $26 | $41 | |

| $28 | $44 | |

| $27 | $43 |

| $22 | $35 | |

| $29 | $42 | |

| $50 | $80 |

| $26 | $40 |

| $30 | $45 |

Many providers market the best pet insurance for dogs, but pricing and plan structures vary across companies.

Fetch and Pets Best have the cheapest coverage for dogs because these providers specialize in pet coverage, unlike Allstate or Geico.

When comparing providers, it’s important to consider not only monthly premiums but also what’s included in the plan, such as accident coverage, illness protection, and wellness add-ons.

The best pet insurance for you will match your budget and your dog’s unique health needs.

Age & Other Cost Factors in Pet Insurance for Dogs

In addition to species, breed, and location, age is one of the most significant factors in pet insurance costs.

Rates from top pet insurance companies show how premiums increase over time, helping pet owners understand how locking in coverage early can save money long-term.

Pet Insurance Monthly Rates for Dogs by Age| Company | Age: 2 | Age: 4 | Age: 6 | Age: 8 |

|---|---|---|---|---|

| $39 | $44 | $50 | $58 | |

| $35 | $40 | $47 | $57 | |

| $44 | $49 | $55 | $64 | |

| $37 | $42 | $48 | $56 | |

| $43 | $48 | $54 | $62 |

| $38 | $43 | $49 | $57 | |

| $35 | $40 | $46 | $54 | |

| $80 | $95 | $115 | $135 |

| $40 | $45 | $51 | $59 |

| $45 | $50 | $56 | $65 |

When deciding on coverage, consider how to compare pet insurance companies by looking beyond price. People who got insurance right focus on more than cost alone.

Look at pet insurance company details, such as coverage limits, reimbursement options, and exclusions, should always factor into your decision to ensure you get the right long-term protection for your pet.

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Pet Insurance for Dogs

Understanding coverage options is just as important as comparing monthly premiums. What matters most to pet owners often comes down to knowing exactly what’s covered, what’s excluded, and how flexible a plan can be.

Accident-only plans are the cheapest, but they only cover emergencies like broken bones or poisonings, which is why it helps to think about the key questions to ask when considering pet insurance before choosing a policy.

Pet Insurance Coverage Breakdown| Category | What’s Covered | Details |

|---|---|---|

| Accidents | Broken bones, poisoning | In most plans |

| Alternative Therapies | Acupuncture, hydro | Limited availability |

| Behavioral Therapy | Training, behavior | Select insurers only |

| Dental Care | Cleanings, extractions | Preventive excluded |

| Diagnostic Tests | X-rays, MRIs, labs | Varies by plan |

| End-of-Life Care | Euthanasia, cremation | Coverage varies |

| Genetic/Congenital | Hip dysplasia, heart | Active policy required |

| Hospitalization | ER, surgery, overnight | Usually included |

| Illnesses | Cancer, arthritis, GI | Waiting period applies |

| Prescriptions | Antibiotics, pain meds | Supplements excluded |

| Preventive Care | Vaccines, flea/tick | Optional add-on rider |

| Specialists | Oncology, cardiology | May need referral |

Accident and illness policies offer broader protection, covering conditions like cancer, allergies, and arthritis.

Some insurers include or offer wellness add-ons that cover preventive care such as vaccines, check-ups, and dental cleanings.

Locking in a policy for your dogs before health issues develop can keep premiums lower and ensure coverage for future conditions.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Some insurers offer limited coverage for curable pre-existing conditions after a waiting period. If your dog already has health issues, compare plans that allow future coverage for recovered conditions.

The best pet insurance for dogs with pre-existing conditions typically comes from providers that offer flexible terms, fair review policies, and transparent definitions of what qualifies as “curable.”

Pet Insurance Coverage Limitations| Category | Exclusions | Details |

|---|---|---|

| Age Restrictions | Policy ends at age 14 | Puppies 6-8 wks |

| Behavioral Issues | Training or therapy | Includes add-on |

| Bilateral Conditions | Hip and ligament | May skip 2nd side |

| Breeding/Pregnancy | Related issues or care | Rarely covered |

| Dental Care | Cleaning, cosmetic | Covers illness/injury |

| Elective Procedures | Ear/tail docking, declaw | Not covered |

| Experimental Treatments | Trial drugs/care | Usually excluded |

| Pre-Existing Conditions | Issues pre-coverage | Covered if curable |

| Routine/Preventive Care | Vaccines, flea/tick, food | Wellness add-on |

| Waiting Periods | 5 days to 6 months | Varies by plan |

It’s essential to know how to pick the right policy for your dog. Even the most comprehensive plans come with exclusions, waiting periods, and coverage limits that may affect your long-term costs.

Taking time to review both coverage benefits and limitations ensures you make the best choice for your pet’s needs while avoiding costly surprises later.

Since costs vary widely, checking pet insurance by state is essential because location impacts rates and coverage availability. Enter your ZIP code to compare costs in your state.

Dog Insurance Deductibles & Reimbursement Breakdown

If this is your first time buying pet insurance for your furry friend, comparing pet insurance company details side by side makes it easier to understand the true value of each plan.

Consider how deductibles, reimbursement options, and annual limits vary across providers, and these differences directly impact long-term affordability.

Pet Insurance Coverage Details by Provider| Company | Deductible | Reimbursement | Annual Limit |

|---|---|---|---|

| $100–$1K | 70–90% | Unlimited only | |

| $50–$1K | 70–90% | $5K–Unlimited | |

| $250–$2.5K | 70–90% | $5K–15K range | |

| $100–$750 | 70–100% | Unlimited only | |

| $100–$1K | 70–90% | Unlimited only | |

| $100–$750 | 70–90% | Unlimited only | |

| $250–$1K | 50–90% | $5K–10K+Unlimited |

| $250–$500 | 70–90% | $5K–Unlimited | |

| $50–$1K | 70–90% | $5K–Unlimited | |

| $50–$1K | 70–90% | $5K–Unlimited | |

| $100–$1K | 70–90% | $2.5K–Unlimited |

| $100–$1K | 70–90% | $2.5K–Unlimited | |

| $100–$500 | 70–90% | $2.5K–$10K | |

| $0–$1K | 90% (fixed) | Unlimited only |

Deductibles can range from $0 to $2,500, depending on the provider. Choosing a higher insurance deductible usually lowers your premium, but it also increases your out-of-pocket expenses when your dog needs care.

How does the reimbursement process work in pet insurance? Most companies let you choose between 70%, 80%, or 90%. A higher percentage means you’ll be reimbursed for more of your vet bill, but it comes with higher monthly premiums.

Similarly, annual limits differ widely. Some insurers cap payouts at $5,000 or $10,000, while others offer unlimited coverage.

Common Uses of Pet Insurance for Dogs

Looking at how pet insurance coverage is actually used shows why your policy can be valuable to protecting your dog and your savings.

Data reveals that most claims come from common but costly issues such as digestive problems, skin conditions, and prescription drugs.

More serious conditions like cancer or heart disease account for a smaller share but often involve much higher treatment expenses.

By seeing where claims are most frequent, dog owners can better appreciate how insurance provides protection against both everyday health concerns and unexpected emergencies.

The best pet insurance isn’t always the cheapest, it’s the one that pays fairly and quickly when your pet needs care.

Sara Routhier Senior Director of Content

While deductibles, reimbursement rates, and annual limits affect what you’ll pay, the claim process determines how smoothly you’ll be reimbursed after covering a vet bill. This is where pet owners often notice major differences between providers.

- Ease of Filing Claims: The best pet insurance companies for dogs provide mobile apps and online portals that make submitting invoices quick and simple, while some still rely on paper forms that can delay processing.

- Reimbursement Time: Certain companies issue reimbursements within a few business days, while others may take weeks, which can create financial stress when covering high vet bills.

- Claim Denials and Disputes: Companies with a reputation for fair reviews, quick approvals, and transparent communication provide greater peace of mind compared to those with frequent denials or disputes.

Considering these factors ensures you don’t just choose an affordable policy but also one that’s dependable when your dog needs care the most.

Learn more about what to do when you’re denied insurance coverage, so you can understand your options, file an appeal effectively, and ensure your pet gets the care they need without unnecessary delays.

10 Best Pet Insurance Companies for Dogs

Prudent Pet, Fetch, and Trupanion top the list with the best pet insurance for dogs. These providers offer comprehensive coverage, flexible plans, and quick claim reimbursements. Monthly premiums for dog insurance start around $20, depending on breed and age.

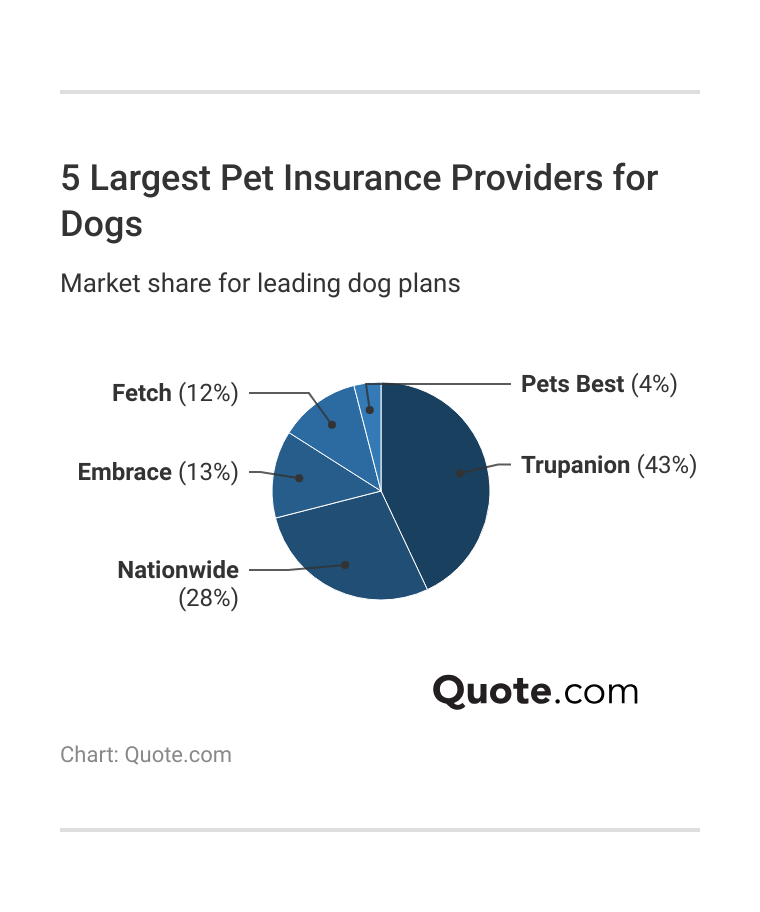

Nationwide offers the highest discount for healthy pets, 10%, and is also one of the largest pet insurance providers for dogs. Alongside Trupanion, Embrace, Fetch, and Pets Best, it holds a significant share of the market.

Fetch was formerly known as Petplan, and Mutual of Omaha offers pet insurance through Prudent Pet, combining its trusted financial reputation with Prudent Pet’s customizable coverage. Learn more in our Mutual of Omaha insurance review.

While there’s no universal pet insurance program, these trusted providers deliver the most reliable protection and value for dog owners seeking affordable, high-quality coverage.

How we rated pet insurance companies includes both savings opportunities and market presence, helping pet owners see which dog insurance providers best fit their lifestyle.

#1 – Prudent Pet: Top Pick Overall

Pros

- Flexible Coverage: Prudent Pet makes it easy to adjust deductibles and limits so you’re not overpaying for protection you don’t need.

- Helpful Support: Access a 24/7 vet chat to ask about symptoms before rushing to the clinic, which is a smart way to avoid unnecessary expenses.

- Proven Reliability: With one of the highest claim satisfaction ratings in the industry, Prudent Pet is recognized for providing quick and fair reimbursements.

Cons

- Wellness Plans Add Cost: Adding preventive care coverage increases premiums, especially if you only visit the vet occasionally.

- Limited to Cats and Dogs: Those with multiple types of pets won’t find exotic coverage here. Compare plans to get an insurance plan that works for you.

#2 – Fetch: Best for Preventive and Dental Care

Pros

- Excellent Dental Protection: Covers all teeth, which helps owners of breeds prone to dental disease save thousands over time.

- Behavioral Health Coverage: Includes treatment for anxiety or aggression, which is a rare benefit in pet insurance.

- Quick Digital Claims: The mobile app enables you to snap a photo of your bill and receive reimbursement quickly.

Cons

- No Routine Care in Some States: Vaccinations and check-ups may require a separate wellness plan, depending on the location.

- Costs Rise as Pets Age: Older dogs tend to see higher monthly rates. Compare costs by checking the best insurance comparison sites.

#3 – Trupanion: Best for Easy Vet Payments

Pros

- Pays the Vet Directly: You’ll never have to wait weeks for reimbursement, as Trupanion pays the clinic right away.

- Lifetime Deductibles per Condition: Ideal for managing long-term illnesses, such as arthritis or allergies.

- No Annual Payout Limits: Coverage doesn’t stop, no matter how high your bills get.

Cons

- Fewer Plan Options: Less customization compared to competitors that let you tweak pricing.

- No Preventive Care: Annual exams or vaccines are not included. Learn more about the best no-exam life insurance for you and your companion.

#4 – Pets Best: Best for Families with Multiple Dogs

Pros

- Customizable Plans: Choose from a wide range of deductible and reimbursement options to find your ideal balance.

- Multi-Pet Discount: Save up to 5% when covering more than one pet under the same policy.

- 24/7 Helpline: Speak with licensed veterinarians anytime for quick advice before heading to the clinic.

Cons

- Short Waiting Periods Apply: Illness coverage starts a few days after enrollment.

- Some Genetic Conditions Excluded: Breed-specific health issues may not be fully covered.

#5 – Spot Pet Insurance: Best for Flexible Limits

Pros

- Unlimited Coverage Option: Choose unlimited annual benefits for peace of mind against major medical expenses.

- Highly Adjustable Plans: Pick your deductible, reimbursement level, and coverage limit to fit your budget.

- Affordable Accident-Only Option: A solid entry-level plan for owners who just want basic protection (Read More: At-Fault Accident & How it Affects Insurance)

.

Cons

- Higher Cost for Top Plans: Unlimited benefits come with higher pet insurance premiums.

- Claims May Take Time: Processing speeds can vary depending on documentation and cooperation from the vet.

#6 – Figo: Best for Tech-Savvy Pet Parents

Pros

- Streamlined Digital Tools: Figo’s easy-to-use mobile app lets you file claims and track progress in minutes (Learn More: Best Insurance Companies for Claims Handling).

- 24/7 Virtual Vet Access: Unlimited video consultations give dog owners peace of mind when something feels off after hours.

- Flexible Reimbursement Options: Choose up to 100% reimbursement for complete coverage or scale down for lower monthly costs.

Cons

- Top-Tier Plans Get Pricey: Opting for full reimbursement can noticeably raise premiums.

- No Built-In Wellness Care: Routine visits or vaccines require an extra add-on.

#7 – Nationwide: Best for All-in-One Coverage

Pros

- Comprehensive “Whole Pet” Protection: Nationwide’s plan covers accidents, illnesses, and preventive care under one policy, simplifying your coverage decisions.

- Established Reputation: With decades in the industry, Nationwide delivers consistent claim processing and reliability that dog owners trust.

- Multi-Pet Discount: Families with more than one dog can save up to 10%, helping reduce long-term costs. Learn more in our Nationwide review.

Cons

- Premiums Reflect Coverage Breadth: Full protection plans cost more than basic accident-only options.

- Breed and Age Limitations: Certain large breeds or older pets may face limited eligibility or higher rates.

#8 – Geico: Best for Long-Term Savings and Bundles

Pros

- Deductible That Rewards You: Geico’s Healthy Pet Deductible lowers your deductible every year your dog stays claim-free, rewarding responsible pet owners.

- Bundling Benefits: Combine pet insurance with Geico’s auto or home coverage for meaningful savings.

- Plan Flexibility: Multiple deductible and reimbursement levels make it easier to tailor protection to your dog’s health needs and your budget.

Cons

- Coverage Depends on State: Certain discounts and policy details vary by region. Learn more about their coverage in our Geico review.

- Underwriting Variability: Since Geico partners with Embrace, exact benefits can differ slightly depending on where you live.

#9 – Allstate: Best for Preventive and Routine Care

Pros

- Strong Focus on Wellness: Allstate’s plans include optional preventive coverage that pays for regular vet visits, vaccines, and dental cleanings.

- Loyalty Pays Off: Deductibles can drop after claim-free years, rewarding owners who maintain consistent care. Read our Allstate review to know more.

- Bundled Savings: Home, renters, or auto policyholders can enjoy lower rates by adding pet insurance through Allstate.

Cons

- Different Partner Carriers: Policies are underwritten by third-party providers, so coverage options and rates may vary.

- Higher Premiums for Senior Pets: Older dogs can face steeper monthly costs, especially for full coverage plans.

#10 – Progressive: Best for Simple, Affordable Coverage

Pros

- Powered by Pets Best: Progressive’s pet insurance leverages Pets Best’s customizable coverage, offering trusted protection under a familiar brand.

- Fast Online Process: You can quote, buy, and manage your plan entirely online with no lengthy calls or paperwork needed.

- Suitable for Multi-Pet Homes: Progressive provides extra discounts when you insure more than one dog, helping families keep premiums manageable.

Cons

- State-by-State Variations: Coverage features and pricing can differ depending on your location. Read our State Farm vs. Progressive review to learn more.

- Limited Preventive Options: Routine care isn’t automatically included and must be purchased separately.

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Dog Insurance Deals

How do you find the best pet insurance for dogs? Start by reviewing which companies offer the most flexible savings.

Discounts can also make a real difference in lowering long-term costs, especially for dog owners insuring multiple pets or renewing coverage annually.

Top Pet Insurance Discounts for Dogs| Company | Annual Pay | Bundling | Healthy Pet | Membership |

|---|---|---|---|---|

| 5% | 5% | 10% | 5% | |

| 5% | 7% | 8% | 5% | |

| 5% | 5% | 8% | 5% | |

| 5% | 10% | 10% | 5% | |

| 5% | 5% | 10% | 5% |

| 5% | 5% | 5% | 5% | |

| 5% | 6% | 5% | 5% | |

| 10% | 8% | 10% | 10% |

| 10% | 5% | 10% | 10% |

| 5% | 5% | 7% | 5% |

The ultimate insurance cheat sheet for savings shows how different providers reward loyalty and bundled policies. These incentives help make coverage more affordable without sacrificing protection.

Whether you’re searching for pet insurance options for you or coverage best suited for multiple pets, discounts can really help you save money.

Start saving money on pet insurance coverage today with our free comparison tool. Enter your ZIP code to get free dog insurance quotes from local companies.

Frequently Asked Questions

What is the best pet insurance for dogs that covers everything?

Embrace, Trupanion, and Nationwide offer the most complete coverage options, including accidents, illnesses, hereditary conditions, and optional wellness add-ons for comprehensive protection.

How do you find the best pet insurance for dogs?

To find the best pet insurance for dogs, compare coverage types, monthly costs, and reimbursement rates. Focus on providers offering fast claims, flexible deductibles, and wellness options.

How much does pet insurance cost?

The best pet insurance for dogs typically costs $20–$45 per month. Rates depend on breed, age, and location, with accident-only plans costing the least.

What is the best pet insurance for dogs in California?

The best pet insurance for dogs in California includes comprehensive accident and illness coverage, optional wellness add-ons, and flexible deductibles from top providers like Prudent Pet and Fetch.

Is dog insurance worth it?

Yes. Dog insurance protects against costly emergencies, surgeries, and illnesses. The best pet insurance for dogs ensures financial relief and access to quality veterinary care when needed. State Farm review mentions that the company also provides worthy dog insurance.

What’s not covered by dog insurance?

Pet insurance coverage for dogs typically excludes pre-existing conditions, pregnancy-related care, and elective procedures. Always review exclusions before choosing the best pet insurance for dogs.

Does pet insurance cover pre-existing conditions?

Most dog insurance plans exclude pre-existing conditions and only cover new accidents and illnesses diagnosed after your policy’s start date.

Are routine check-ups covered by pet insurance?

Routine check-ups, vaccines, and dental cleaning aren’t included in standard dog insurance as mentioned in our in our Nationwide review, but can be added through wellness or preventive care options.

What is the best pet insurance for dogs in Texas?

The best pet insurance for dogs in Texas depends on your budget, coverage needs, and your pet’s health. Top providers like Prudent Pet, Fetch, and Trupanion offer flexible plans, comprehensive coverage, and access to any licensed veterinarian in Texas, giving dog owners both affordability and convenience.

What is the best pet insurance for dogs in Florida?

Florida dog owners often choose Trupanion, Embrace, and Healthy Paws for fast claims, direct vet payments, and coverage suited to common regional health risks.

Read More: What We Learned Analyzing 815 Insurance Companies

What is the best pet insurance for dogs in NJ?

What is the best pet insurance for dogs and cats?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.