Home Insurance Rates by State in 2026

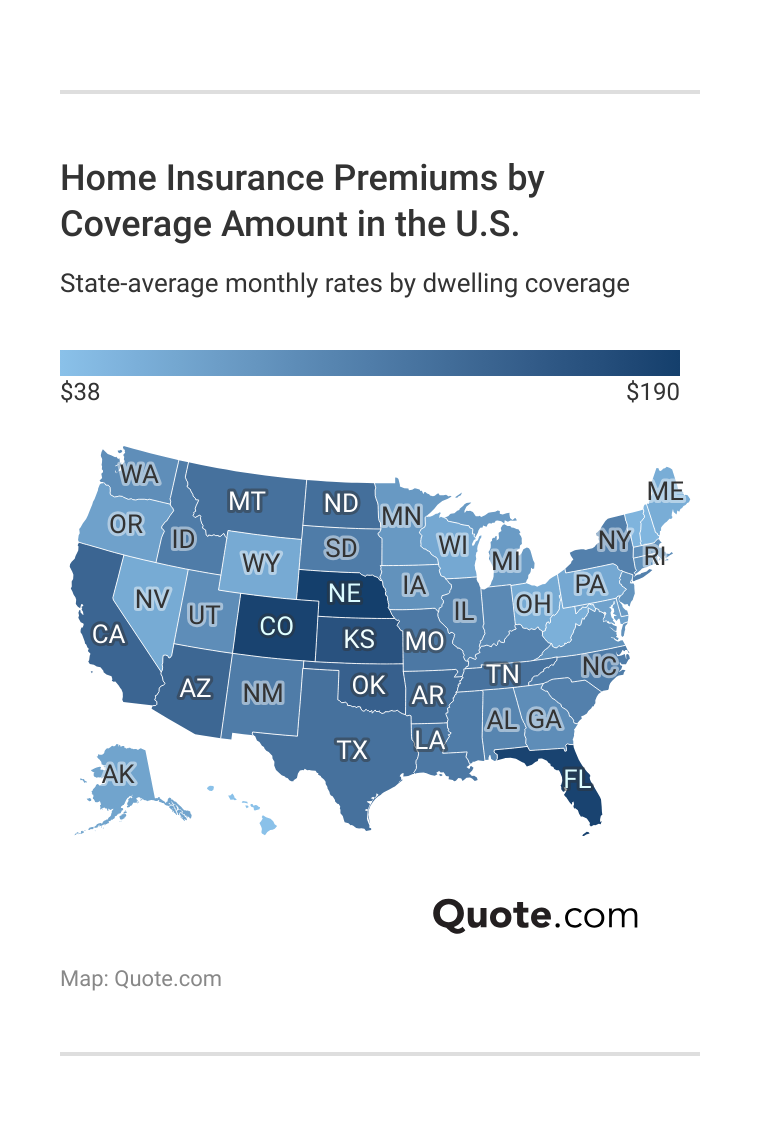

Monthly home insurance rates by state can start as low as $38, but costs go up in states with severe weather risks or high crime rates. Nebraska is the most expensive state for home insurance, with coverage on a $300,000 home averaging $471 monthly. Bundle home and auto insurance to lower your premiums.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Principal Broker

William Lemmon has been a licensed insurance agent for over 12 years. He is the principal broker and owner of Broadway Insurance Services in Los Angeles, CA. He works one-on-one with clients to create personalized plans that minimize risk and maximize savings. Being one of the foremost authorities on Airbnb and home-sharing property insurance, Lemmon offers his clients first-hand guidance on how t...

William Lemmon

Updated November 2025

If you’re shopping for homeowners insurance, you’ll find that home insurance rates by state vary widely. Local factors like severe weather, crime, and claims affect what you pay.

- Nebraska has the most expensive home insurance rates on average

- States with higher rates often have severe weather risks like wildfires

- Cheaper states often have lower crime rates and milder weather

Use this guide to learn about the various location-related factors that affect the average homeowners insurance cost by state, and find out how to estimate home insurance rates based on where you live.

Read on to learn about the average rates in your state and find affordable auto insurance companies in your state. If you are looking to get quick home insurance quotes today, enter your ZIP code in our free quote tool.

Affordable Home Insurance Rates by State

The cost of home insurance depends partly on the state in which you live. Some states have much higher home insurance costs than others.

The average home insurance cost by ZIP code is based on several factors, such as the cost of living, local weather risks, crime rate, and more.

Nebraska and Florida are some states where you can expect to pay more for home insurance, while states like Hawaii or New Hampshire have much lower rates.

While it may be tempting to skip out on home insurance if you aren’t required to have coverage and live in a state with very expensive rates, this usually isn’t the best decision (Read More: Is home insurance required?).

Home insurance is a necessary protection to purchase for your dwelling, no matter what state you live in, as it protects you financially in cases of damage, liability claims, and more.

So, unless you have a considerable sum of money saved away for home emergencies that you are willing to part with, it is best to pay for homeowners insurance to protect yourself.

Most Expensive States for Home Insurance

Where does homeowners insurance cost the most? If you live in Nebraska, you are likely paying some of the highest home insurance rates.

Nebraska home insurance rates for a $300,000 dwelling average $471 a month. Part of the reason for Nebraska’s high home insurance rates is the risk of damage from severe weather, such as hail and tornadoes.

10 States With the Most Expensive Home Insurance| State | Rank | Rate/mo | Reason |

|---|---|---|---|

| Nebraska | #1 | $471 | Severe storms, hail, and tornado risk |

| Colorado | #2 | $462 | Wildfires and hailstorms drive costs |

| Florida | #3 | $461 | High hurricane and flood exposure |

| Kansas | #4 | $403 | Tornado Alley with frequent storms |

| Oklahoma | #5 | $370 | Tornadoes, hail, and wind damage |

| California | #6 | $356 | Wildfires and earthquake risks |

| Arizona | #7 | $341 | Wildfires and extreme heat damage |

| North Dakota | #8 | $325 | Harsh winters, hail, and flooding |

| Texas | #9 | $321 | Hurricanes, floods, and hailstorms |

| Montana | #10 | $319 | Wildfires and severe winter storms |

Some of the other top 10 most expensive homeowners insurance states also have higher rates due to the severity of their weather conditions. For example, Arizona, Colorado, California, and Montana all have a higher risk of wildfires.

In high-risk states like these, you may have trouble finding home insurance coverage from a regular insurance company (Learn More: Does homeowners insurance cover wildfires?).

If you can't find home insurance, check with your state department to see what assigned risk plans they have, such as California's FAIR home insurance plans.

Daniel Walker Licensed Insurance Agent

If you have to purchase home insurance through a state plan, you can expect it to be expensive. However, it is better than being without any home insurance.

Additionally, if you live in a high-risk area, insurance companies willing to insure customers will charge high rates anyway, making state insurance potentially similar in cost.

Cheapest States for Home Insurance

Hawaii, New Hampshire, and Vermont have the top three lowest homeowners insurance rates by state. Hawaii has a milder climate than most states, which reduces the risk of home insurance claims for weather damage.

New Hampshire and Vermont also have a lower risk of weather-related claims, as well as lower crime rates.

10 States with the Cheapest Home Insurance| State | Rank | Rate/mo | Reason |

|---|---|---|---|

| Hawaii | #1 | $96 | Mild climate, low storm risk |

| New Hampshire | #2 | $124 | Few natural disasters, low crime |

| Vermont | #3 | $130 | Low crime, limited severe weather |

| Washington | #4 | $144 | Moderate climate, fewer disasters |

| Maine | #5 | $145 | Low crime, rare major storms |

| Ohio | #6 | $150 | Minimal disaster risk, affordable housing |

| Nevada | #7 | $154 | Dry climate, low storm activity |

| West Virginia | #8 | $139 | Rural areas, lower property values |

| Pennsylvania | #9 | $159 | Moderate risk, strong building codes |

| Wisconsin | #10 | $159 | Low disaster frequency, stable housing |

Where does homeowners insurance cost the least? Places with low crime rates typically have the cheapest average home insurance premiums.

Average home insurance rates will also be on the lower side if you live in a state with more affordable housing or lower-value homes (Learn More: Best Home Insurance for High-Value Properties).

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Home Insurance Rates Are Going Up

Insurance companies consider several different aspects when offering quotes, and location is just one factor that will affect what you pay for home insurance coverage.

Other factors include the age of your home, the amount of coverage you choose, your credit score, and more.

Factors That Impact Home Insurance Premiums| Factor | Effect |

|---|---|

| Location | Risk zones raise rates |

| Home Age | Older homes cost more |

| Coverage | Higher limits cost more |

| Claims | Frequent claims raise rates |

| Deductible | Higher deductible lowers rate |

| Credit | Low score raises rates |

| Security | Safety systems lower rates |

Even the security you have for your home will impact your rates, as homes with better security will likely have lower rates.

This is because having security systems reduces your risk of burglary, a common threat all homeowners face (Learn More: The 7 Most Dangerous Threats Facing American Homeowners).

The lower your home risk, the less you will pay. For example, older homes cost more because they are more prone to age-related damage or may not be up to code.

This makes them more likely to have severe damage from weather or issues with pipe flooding, electrical, and more.

Home Insurance Monthly Rate Increases by Risk Factors| Factor | Risk | Premium | Increase |

|---|---|---|---|

| Property | Standard Home | $120 | NA |

| Property | Older Home | $126 | $6 |

| Property | High-Value Home | $135 | $15 |

| Weather | Low Risk Area | $122 | $2 |

| Weather | Moderate Risk Area | $129 | $9 |

| Weather | High Risk Area | $140 | $20 |

The average home insurance rate comparison shows that an older home will cost about $6 more per month to insure than a standard home, while a high-value home will cost $15 more per month.

Living in a high-risk area for weather is also another major risk factor, with the biggest average increase of $20 per month.

More Coverage Means Higher Rates

When buying a home insurance policy, you will likely have several different types of coverage available to you. The more coverage types you add to your home insurance policy, the more you can expect to pay.

Our homeowners insurance coverage guide breaks down the following types of policies you can buy.

Types of Home Insurance Coverage| Coverage | Covers | Example |

|---|---|---|

| Dwelling Coverage | Home structure | Fire or storm damage |

| Personal Property | Personal belongings | Theft of electronics |

| Liability Protection | Legal accidents | Guest falls and sues |

| Living Expenses | Temporary housing | Hotel cost after fire |

| Medical Payments | Medical bills | Guest injury care |

However, it is important to carry basic coverages that are on all home insurance policies, like dwelling coverage.

Dwelling coverage is what most people think of when they think of home insurance, as it protects the structure of your home.

Another common coverage is personal liability, which will protect you if someone is injured on your property.

The last thing you want is to be sued and not have the money to cover a lawyer or a lawsuit payout because you don’t have personal liability insurance.

Other coverages, like living expenses, may not be as important to all homeowners and may be dropped to save on home insurance.

However, be sure to research the specific protections each home insurance coverage offers to ensure you’re not missing important coverages.

More Claims Mean Higher Rates

If you live in an area where home insurance claims are common, or you have made home insurance claims in the past, you can expect a higher home insurance rate.

One of the more common home insurance claims is wind and hail damage claims, so if you live in an area that has high winds or frequent hailstorms, rates will be higher.

Most Common Home Insurance Claims in the U.S.| Claim Type | Share | Cost per Claim | Description |

|---|---|---|---|

| Wind & Hail | 34% | $12,000 | Storm or hail damage |

| Water Damage | 29% | $11,000 | Burst pipes or leaks |

| Fire & Lightning | 26% | $78,000 | Fire or lightning loss |

| Theft | 6% | $4,000 | Stolen items |

| Bodily Injury Liability | 3% | $30,000 | Guest injuries |

| Other Damages | 1% | $6,000 | Falling items or surges |

The average amount paid out in claims in your area will also impact rates. For example, fire and lightning claims cost insurance companies an average of $78,000 per incident.

Therefore, if you have had to make a wildfire claim or if homes in your area are at a higher wildfire risk, home insurance rates will be high (Learn More: How to File a Home Insurance Claim After a Wildfire).

Homes in states with low property crime are less likely to be broken into or vandalized, which means reduced risk and cheaper rates.

Kristine Lee Licensed Insurance Agent

Theft and property damage make up a minimal amount of claims, but can still cost $10,000 or more. When a property is located in a safe area with minimal theft, vandalism, or burglary incidents, insurers view it as less likely to experience costly claims.

If you live in an area with lower overall risk, home insurance carriers often reward homeowners with reduced premiums or additional coverage perks.

How Credit Score Impacts Home Insurance Rates

One of the last factors that impacts home insurance rates is your credit score. Customers with higher credit scores will find it easier to get lower home insurance rates in their state.

For example, the average cost of home insurance in Alabama is $223 per month for customers with an excellent credit score, but $472 per month for customers with a poor credit score.

Home Insurance Monthly Rates by Credit Score| State | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| Alabama | $223 | $262 | $341 | $472 |

| Alaska | $146 | $172 | $224 | $310 |

| Arizona | $290 | $341 | $443 | $614 |

| Arkansas | $280 | $330 | $429 | $594 |

| California | $303 | $356 | $463 | $641 |

| Colorado | $393 | $462 | $601 | $832 |

| Connecticut | $192 | $226 | $294 | $407 |

| Delaware | $169 | $199 | $259 | $358 |

| Florida | $392 | $461 | $599 | $830 |

| Georgia | $204 | $240 | $312 | $432 |

| Hawaii | $82 | $96 | $125 | $173 |

| Idaho | $243 | $286 | $372 | $515 |

| Illinois | $217 | $255 | $332 | $459 |

| Indiana | $212 | $249 | $324 | $448 |

| Iowa | $188 | $221 | $287 | $398 |

| Kansas | $343 | $403 | $524 | $725 |

| Kentucky | $235 | $277 | $360 | $499 |

| Louisiana | $255 | $300 | $390 | $540 |

| Maine | $123 | $145 | $189 | $261 |

| Maryland | $151 | $178 | $231 | $320 |

| Massachusetts | $195 | $229 | $298 | $412 |

| Michigan | $171 | $201 | $261 | $362 |

| Minnesota | $172 | $202 | $263 | $364 |

| Mississippi | $240 | $282 | $367 | $508 |

| Missouri | $251 | $295 | $384 | $531 |

| Montana | $271 | $319 | $415 | $574 |

| Nebraska | $400 | $471 | $612 | $848 |

| Nevada | $131 | $154 | $200 | $277 |

| New Hampshire | $105 | $124 | $161 | $223 |

| New Jersey | $185 | $218 | $283 | $392 |

| New Mexico | $247 | $291 | $378 | $524 |

| New York | $232 | $273 | $355 | $491 |

| North Carolina | $241 | $283 | $368 | $509 |

| North Dakota | $276 | $325 | $423 | $585 |

| Ohio | $128 | $150 | $195 | $270 |

| Oklahoma | $315 | $370 | $481 | $666 |

| Oregon | $155 | $182 | $237 | $328 |

| Pennsylvania | $135 | $159 | $207 | $286 |

| Rhode Island | $168 | $198 | $257 | $356 |

| South Carolina | $228 | $268 | $348 | $482 |

| South Dakota | $241 | $283 | $368 | $509 |

| Tennessee | $264 | $311 | $404 | $560 |

| Texas | $273 | $321 | $417 | $578 |

| Utah | $204 | $240 | $312 | $432 |

| Vermont | $111 | $130 | $169 | $234 |

| Virginia | $191 | $225 | $293 | $405 |

| Washington | $198 | $233 | $303 | $419 |

| West Virginia | $118 | $139 | $181 | $250 |

| Wisconsin | $135 | $159 | $207 | $286 |

| Wyoming | $134 | $158 | $205 | $284 |

Why does credit score matter so much to home insurance companies? Customers with poor credit scores are more likely to miss payments, which can result in the cancellation of their insurance.

Working on improving your credit score can therefore help you save on your home insurance coverage at the cheapest home insurance companies.

How to Save Money on Home Insurance

Updating your home with features like storm shutters or a new roof can lower your home insurance rates, especially in high-risk weather states on the coast.

Some other ways to reduce home insurance rates by state include improving your credit score, raising your deductible, shopping for quotes, and applying for discounts.

Top Home Insurance Discounts| Feature Discounts | Policy Discounts | Personal Discounts |

|---|---|---|

| Alarm System | Auto & Home Bundle | Claims-Free History |

| Fire Sprinkler System | Early Signing | Good Credit |

| Smoke Detectors | Electronic Funds Transfer | Homeowner Loyalty |

| Fire Extinguisher | Full Payment | Married |

| Storm Shutters | Green Home Certification | Military |

| Impact-Resistant Roof | Higher Deductible | Non-Smoker |

| Deadbolt Locks | Loyalty Renewal | Occupation |

| Gated Community | Multiple Policy | Recent Homebuyer |

| New Home Construction | No Recent Claims | Retiree |

| Renovated Home | Online Policy Management | Senior Citizen |

| Roof Upgrade | Paperless Billing | Smart Homeowner |

| Utility Upgrade | Pay-in-Full | Volunteer Work |

| Water Leak Detection System | Renewal Discount | Work-from-Home |

Applying for home insurance discounts through your company is one of the easiest ways to lower your monthly costs if your home insurance rates are going up.

One easy way to receive a discount is to have your home and auto insurance with the same company, which qualifies you for a bundle discount (Read More: Best Auto and Home Insurance Bundles).

Use our free quote tool to score the best home insurance rates by state. Just enter your ZIP code to get started.

Frequently Asked Questions

What state has the highest home insurance rates?

Nebraska is the most expensive state for homeowners insurance. The average rate for a $300,000 house in NE is $471 per month. Find out which of the best home insurance companies in your area offers the best deal.

What states have the cheapest home insurance?

Hawaii, New Hampshire, and Vermont have the lowest home insurance rates. Hawaii is the cheapest for $350,000 in coverage at $96 a month.

How much is homeowners insurance on a $500,000 house?

The cost of home insurance for a half-million-dollar home depends on several factors, including your location. For example, the average rate for a $500,000 house is $129 per month in Hawaii, but it is $683 per month in Nebraska.

How much is homeowners insurance on a $300,000 house?

The cheapest rate for a $300,000 house is an average of $96 per month in Hawaii. Because rates vary by state, you should get home insurance quotes with our free quote tool to get a better idea of what you’ll pay for home insurance.

What is the 80/20 rule for home insurance?

The 80/20 rule in home insurance means that you should have a home insurance policy that covers at least 80% of your home’s replacement value (Read More: How much homeowners insurance do you need?).

Does age affect homeowners insurance?

Age typically does not affect what you pay for home insurance unless your home insurance company offers a senior discount.

Does credit score affect home insurance rates?

Yes, your credit score does affect the cost of homeowners insurance. A customer with a poor credit score will pay more for home insurance than a customer with an excellent credit score.

How can I lower my home insurance premium?

You can try to lower your home insurance cost by applying for home insurance discounts, making improvements to your home, and comparing homeowners insurance quotes to see who has the cheapest homeowners insurance in your area.

Does homeowners insurance cost more for older homes?

Yes, older homes typically cost $6 more per month to insure than standard homes.

How much is insurance on a $500,000 home in Florida?

The average cost to insure a $500,000 home in Florida is $668 per month.

Is homeowners insurance required in my state?

What factors affect home insurance premiums?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.