Return of Premium (ROP) Life Insurance in 2026

Return of premium (ROP) life insurance refunds all premiums if you outlive the policy term. It costs $27 per month, combining guaranteed protection with a tax-free refund. Transamerica is one of the best return of premium life insurance providers, offering low rates on 15-, 20-, and 30-year term policies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as ...

Justin Wright

Updated January 2026

If you have term life insurance and outlive your policy, return of premium (ROP) life insurance riders refund every premium you paid.

- Return of premium life insurance rates start at $27 a month

- ROP life insurance refunds are tax-free

- Transamerica and Pacific Life have the cheapest ROP policies

Unlike traditional term life insurance, ROP policies ensure you get your money back if the benefit isn’t used. It typically comes with 10, 20, or 30-year terms and offers tax-free refunds at the end of the coverage period.

Transamerica is one of the best term life insurance companies, offering some of the most affordable rates, starting at $27 per month.

By comparing multiple insurers, you can find the best ROP life insurance for your goals. Find cheap life insurance quotes by entering your ZIP code into our free quote comparison tool.

Return of Premium Life Insurance Defined

Return of premium life insurance is a type of term life policy that gives you all your money back if you outlive the coverage period.

Unlike regular term life insurance, which ends with no payout if you don’t file a claim, ROP refunds every premium you paid, and that refund is tax-free. Many companies also offer a return of premium rider that you can add to existing term life policies.

Policies usually come in 10, 20, or 30-year terms, and if the insured passes away during that time, the policy pays the full death benefit to the beneficiaries.

Because it includes a refund, ROP costs about 30–70% more than standard term life coverage, but many people like it because it offers financial security and a guaranteed return.

Return of Premium Life Insurance: Key Details| Feature | Description |

|---|---|

| Type | Term life policy |

| Premium Refund | Full refund if you outlive term |

| Policy Term | Usually 10, 20, or 30 years |

| Death Payout | Pays face amount at death |

| Cost | 30–70% above term cost |

| Tax Treatment | Refunds aren’t taxed |

| Cash Value | No cash value buildup |

It doesn’t build cash value like permanent life insurance, but it ensures your money isn’t lost if the coverage isn’t used. Adding a return of premium life insurance rider is also cheaper than paying for whole life insurance coverage (Read More: Whole vs. Term Life Insurance).

This makes return of premium life insurance a good option for people who want the simplicity of term life but also want their investment back.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Return of Premium Life Insurance Rates

The cost of return of premium life insurance depends on the policy term and the insurance company. On average, ROP policies are more expensive than standard term life insurance because they guarantee a full refund of premiums if you outlive the term.

Among leading providers, Transamerica stands out for offering the most affordable rates, starting at $27 per month for a 15-year term. Pacific Life and MassMutual also provide competitive pricing, with monthly rates under $30 for shorter terms.

Return of Premium Life Insurance Monthly Rates by Term| Company | 15 Yrs | 20 Yrs | 25 Yrs | 30 Yrs |

|---|---|---|---|---|

| $32 | $39 | $47 | $55 | |

| $30 | $35 | $44 | $52 | |

| $29 | $37 | $43 | $50 | |

| $31 | $36 | $45 | $51 | |

| $33 | $38 | $46 | $53 | |

| $34 | $41 | $48 | $54 | |

| $28 | $40 | $42 | $49 |

| $35 | $42 | $50 | $56 |

| $36 | $43 | $51 | $57 | |

| $27 | $34 | $41 | $48 |

For longer terms, such as 25 or 30 years, monthly ROP life insurance rates typically range from $41 to $57, depending on the provider (Learn More: Single Premium Life Insurance).

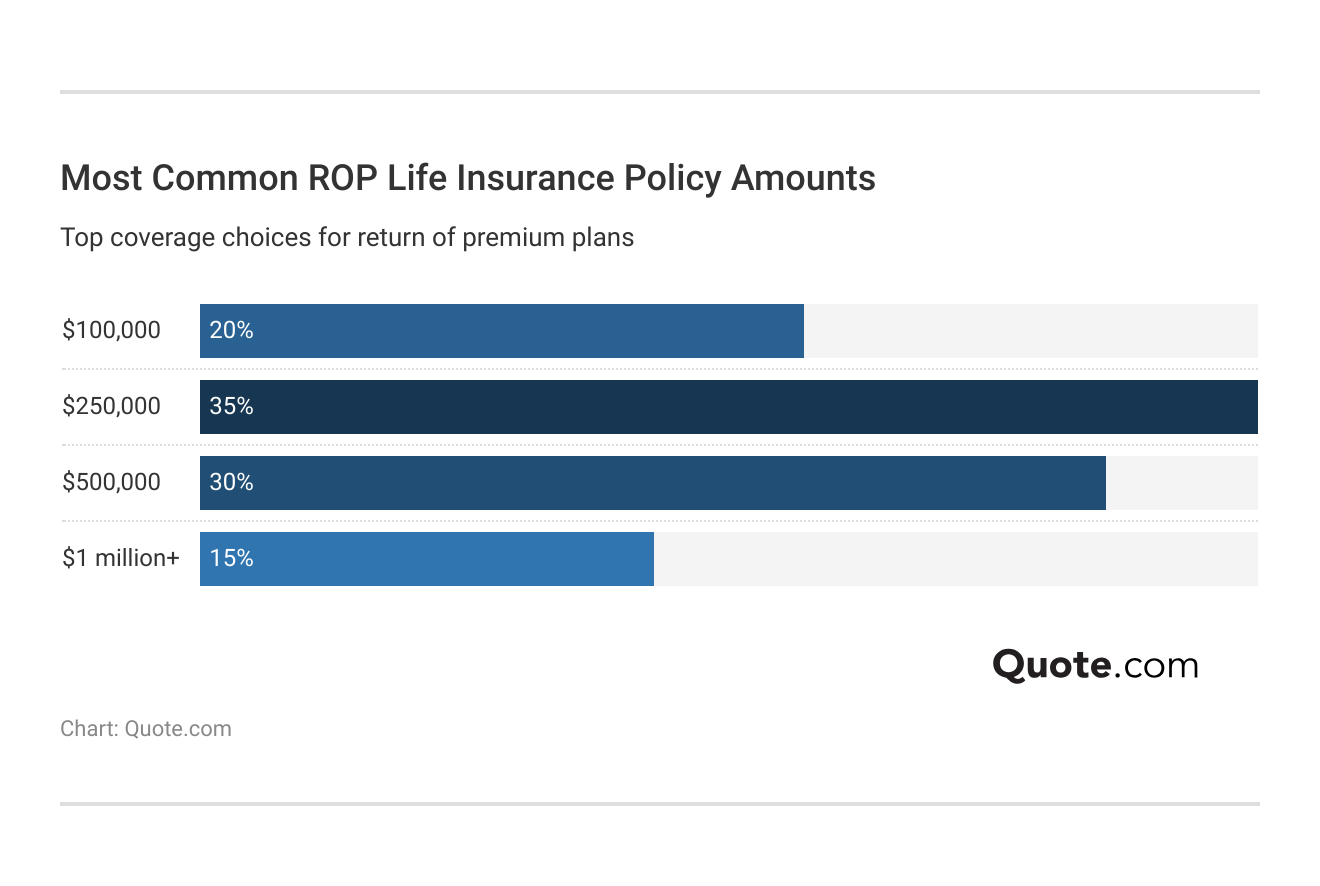

The most common coverage amount for ROP life insurance is $250,000, making up 35% of policies, followed by $500,000 at 30%. This shows many buyers choose mid-range coverage levels that balance protection and affordability.

Higher coverage amounts, like $1 million or more, are less common but remain an option for those with larger financial responsibilities.

This flexibility allows policyholders to select coverage that fits their budget and long-term goals while still receiving guaranteed refunds at the end of the term.

Read More: Best No-Exam Life Insurance

How Age Impacts the Rates of Return of Premium Life Insurance

Age plays a major role in determining the cost of return of premium life insurance, with rates increasing steadily as applicants get older.

For a 20-year term policy with $500,000 in coverage for a healthy, non-smoking male, younger applicants can lock in much lower monthly premiums.

Return of Premium Life Insurance Monthly Rates by Age| Company | Age: 25 | Age: 30 | Age: 40 | Age: 50 |

|---|---|---|---|---|

| $100 | $110 | $150 | $215 | |

| $90 | $98 | $137 | $195 | |

| $88 | $96 | $132 | $188 | |

| $92 | $100 | $139 | $197 | |

| $96 | $106 | $146 | $205 | |

| $105 | $115 | $156 | $217 | |

| $85 | $93 | $129 | $183 |

| $109 | $120 | $163 | $225 |

| $120 | $132 | $175 | $240 | |

| $83 | $91 | $125 | $178 |

At age 25, Transamerica offers one of the most affordable rates at $83 per month, followed closely by Pacific Life at $85 a month and MassMutual at $88 monthly.

By age 40, these rates rise significantly, averaging between $125 and $175 per month across top insurers. At age 50, the difference is even more noticeable, with rates almost doubling to $240 a month with State Farm.

Keep your return of premium life insurance active by paying premiums on time, since missed payments can cause the policy to lapse and forfeit your refund.

Michelle Robbins Licensed Insurance Agent

This cost increase highlights why purchasing ROP life insurance at a younger age can result in major long-term savings. Compare quotes from the cheapest life insurance companies to find the best rates.

Locking in lower premiums early not only makes the policy more affordable but also ensures a guaranteed refund at the end of the term, making it a smart strategy for cost-conscious buyers.

How Health Impacts the Rates of Return of Premium Life Insurance

Health plays a significant role in determining the return of premium life insurance rates, with premiums increasing as health risks rise. For a 20-year term policy with $500,000 in coverage, individuals in excellent health receive the lowest rates.

Transamerica offers some of the most affordable pricing, starting at $89 per month for excellent health, followed by Pacific Life at $93 monthly and MassMutual at $95 a month.

Return of Premium Life Insurance Monthly Rates by Health Condition| Company | Excellent | Good | Average | High Risk |

|---|---|---|---|---|

| $110 | $120 | $155 | $185 | |

| $98 | $108 | $140 | $170 | |

| $95 | $105 | $135 | $165 | |

| $99 | $112 | $145 | $175 | |

| $104 | $118 | $150 | $180 | |

| $111 | $127 | $160 | $190 | |

| $93 | $99 | $130 | $160 |

| $120 | $133 | $168 | $200 |

| $135 | $150 | $185 | $215 | |

| $89 | $95 | $125 | $155 |

Applicants in average health see noticeable increases across all providers, while high-risk individuals may pay $60–$100 more each month, which can affect how much life insurance you need.

This difference makes applying while in good health a smart financial move. Securing coverage early can lock in lower premiums for the entire term and still guarantee a full refund of premiums at the end of the policy.

How Tobacco Use Impacts the Rates of Return of Premium Life Insurance

Tobacco use makes a clear difference in the cost of return of premium life insurance, with smokers paying much more for the same coverage.

For a 20-year term policy with $500,000 in coverage, Transamerica charges about $95 per month for smokers and $180 monthly for non-smokers.

Return of Premium Life Insurance Monthly Rates by Tobacco Use| Company | Smoker | Non-Smoker |

|---|---|---|

| $120 | $228 | |

| $108 | $205 | |

| $105 | $200 | |

| $112 | $213 | |

| $118 | $224 | |

| $127 | $241 | |

| $99 | $188 |

| $133 | $253 |

| $150 | $285 | |

| $95 | $180 |

Pacific Life is close behind at $99 per month for smokers and $188 for non-smokers, while State Farm has some of the highest rates at $150 a month for smokers and $285 monthly for non-smokers.

Tobacco use can drive up costs over the life of the policy. Non-smokers benefit from lower monthly payments and can save thousands while still receiving a full refund of premiums at the end of the term.

This makes maintaining a tobacco-free status a smart financial move when buying ROP life insurance. See how the average cost of life insurance changes by policy type and personal factors, such as tobacco use by smokers and non-smokers.

Return of Premium Life Insurance Pros and Cons

Return of premium life insurance comes with clear benefits and trade-offs. One of its biggest advantages is that it refunds all your premiums at the end of the policy term if you outlive it.

This gives you a guaranteed financial return that traditional term life insurance doesn’t offer. The refund is also tax-free, allowing you to recover your investment without additional costs.

Return of Premium Life Insurance Pros & Cons| Pros | Cons | Notes |

|---|---|---|

| Refund when term ends | Higher cost than term life | 30–70% pricier than term |

| Provides peace of mind | No growth or earnings | Refunds don’t earn interest |

| Tax-free premium refund | Limited insurer options | Not all insurers offer ROP |

This makes ROP life insurance especially attractive to people who want coverage but also want to ensure their payments don’t go to waste if the benefit isn’t used. Learn more reasons to buy life insurance.

However, this added benefit comes with a higher price tag. ROP life insurance typically costs 30%–70% more than standard term life coverage, which can make it less accessible for those on tighter budgets.

It also doesn’t build cash value or earn interest, so while you get your money back, it doesn’t grow over time. On top of that, not all insurers offer ROP policies, so your options may be more limited compared to regular term life insurance.

This balance of guaranteed return versus higher cost is key to deciding if ROP life insurance is the right fit for your financial goals. Get cheap term life insurance rates near you by entering your ZIP code into our free quote tool.

Frequently Asked Questions

How does return of premium life insurance work?

ROP life insurance riders and policies return all of the premiums paid if the policyholder outlives the term of their policy. You typically have to call your insurer to claim your refund, and your state insurance department can help connect you with the right resources.

Is return of premium life insurance worth it?

Is it good to take term insurance with return of premium? It can be a good choice for people who want the low risk of term life insurance with the added benefit of getting their money back. However, since it costs more than standard term life, it’s most cost-effective for healthy individuals who can commit to long-term payments.

What are the disadvantages of return of premium life insurance?

The main drawbacks are higher premiums, typically 30% to 70% more than regular term life, and limited insurer availability. It also doesn’t build cash value or earn interest, so while you get your money back, it doesn’t grow over time.

Do you pay taxes on return of premium life insurance?

No, all ROP life insurance refunds are tax-free, which makes it very appealing to people who don’t want to lose money on term coverage.

Is a return premium a refund?

Yes. A return of premium rider is a refund of the premiums you paid during your term if you outlive the policy. This refund is typically tax-free since it’s not considered income or profit. Learn how to get life insurance quotes to compare options and find the best rate.

Do I get all my money back with ROP life insurance?

How much do you get back on a return of premium life insurance? You’ll typically receive a 100% refund of your premiums, excluding any additional fees or riders, if you keep the policy until the end of the term. The exact amount depends on how long you held the policy and whether all payments were made.

Can I cancel my ROP life insurance policy and get my money back?

If you cancel a return of premium policy before the term ends, you usually won’t receive a refund. The refund feature only applies when you complete the entire policy term. Before you cancel, use our free comparison tool to find more affordable life insurance coverage.

Does ROP life insurance build cash value?

Can you cash out a return of premium policy? No. Unlike whole or universal life insurance, ROP life insurance doesn’t accumulate cash value over time. It simply refunds the total premiums you’ve paid if you outlive the coverage period.

Read More: How to Finance What Your Health Insurance Won’t Cover

When can the right to return of premium be claimed?

You can claim the refund once the policy term ends, provided all premiums were paid and the policy remained active throughout the term.

Is return of premium a permanent life policy?

No. Return of premium life insurance is a term policy, not permanent life insurance. It provides coverage for a set number of years—such as 10, 20, or 30—and refunds premiums if you outlive that period.

What happens if you stop paying ROP life insurance premiums?

Can I get my life insurance money back?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.