10 Best Auto Insurance Companies in West Virginia 2026

Erie, AAA, and State Farm are the best auto insurance companies in West Virginia for comprehensive coverage. Rates start as low as $36 a month. Nationwide offers up to 40% in safe-driver savings, while Progressive’s Snapshot program cuts rates by 30%, helping West Virginia drivers save more each month.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

The best auto insurance companies in West Virginia are Erie, AAA, and State Farm. Erie’s Rate Lock helps keep your premiums steady even after a claim.

- Erie offers new car replacement and pet protection

- AAA and State Farm make claims easy with local agents

- West Virginia requires drivers to carry liability limits of 25/50/25

AAA adds value with member rewards, 24/7 roadside help, 30% safe-driver discounts, and travel perks that make it a favorite among West Virginia drivers.

State Farm’s Drive Safe & Save uses real driving data to reward safe drivers who live in high-risk cities like Lenore or Beverly with cheaper premiums.

Top 10 Companies: Best Auto Insurance in West Virginia| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 706 / 1,000 | A | Competitive Rates |

| #2 | 676 / 1,000 | A | Roadside Assistance |

| #3 | 673 / 1,000 | A++ | Flexible Policies | |

| #4 | 643 / 1,000 | A++ | Safe Drivers | |

| #5 | 636 / 1,000 | A+ | Simple Claims | |

| #6 | 636 / 1,000 | A | Group Discounts | |

| #7 | 633 / 1,000 | A++ | Industry Experience | |

| #8 | 632 / 1,000 | A+ | Customer Satisfaction | |

| #9 | 625 / 1,000 | A+ | Accident Forgiveness | |

| #10 | 618 / 1,000 | A+ | Senior Drivers |

Although some of these companies may not offer the cheapest car insurance, West Virginia drivers can find dependable coverage and smart ways to save to get better rates.

Find the best car insurance in West Virginia fast using our free quote tool to compare trusted providers in minutes.

How WV Auto Insurance Rates Stack Up

Auto insurance prices in West Virginia can vary a lot depending on the provider. Each company looks at your driving record, coverage preferences, and local risks differently.

Erie car insurance in WV is a popular pick for drivers who want affordable protection, while companies like Allstate and The Hartford often cost more because they include extra features and wider coverage.

West Virginia Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $50 | $120 |

| $59 | $131 | |

| $36 | $88 |

| $51 | $113 | |

| $43 | $96 | |

| $46 | $103 | |

| $47 | $104 | |

| $48 | $105 | |

| $55 | $125 |

| $49 | $107 |

Lower prices do not always mean fewer benefits, though, since many companies like AAA still offer perks like roadside assistance or accident forgiveness.

Paying a little more can give drivers extra coverage or more flexibility. Taking time to compare auto insurance companies is the best way to find a policy that fits your needs without breaking the bank.

Why West Virginia Insurance Costs Change With Age

Younger drivers in West Virginia tend to pay more since they’re new to the road and considered higher risk, while more experienced drivers see lower rates as they prove they can drive safely.

The Hartford is very expensive for teens, but one of the best auto insurance companies in West Virginia for seniors (Read More: Best Auto Insurance for Seniors).

West Virginia Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $182 | $98 | $63 | $50 |

| $167 | $97 | $68 | $59 | |

| $140 | $82 | $52 | $36 |

| $150 | $89 | $57 | $51 | |

| $118 | $62 | $46 | $43 | |

| $132 | $74 | $53 | $46 | |

| $146 | $65 | $49 | $47 | |

| $125 | $71 | $54 | $48 | |

| $160 | $91 | $63 | $55 |

| $153 | $85 | $56 | $49 |

Teens can earn discounts through good grades or safe-driving programs, including usage-based insurance plans.

Older drivers can save by renewing with the same company or combining auto and home coverage.

Auto insurance rates in West Virginia drop after age 25. In particular, drivers in their 40s often see the best monthly savings.

Jeff Root Licensed Insurance Agent

Drivers with clean records and years of safe driving usually pay lower premiums, so keeping a solid driving history at any age is one of the best ways to save over time.

Comparing multiple providers in West Virginia makes it easier to find affordable insurance that grows with your driving experience. To make the process simple, you can compare car insurance quotes in West Virginia online and see which company offers the best rate for your age and driving profile.

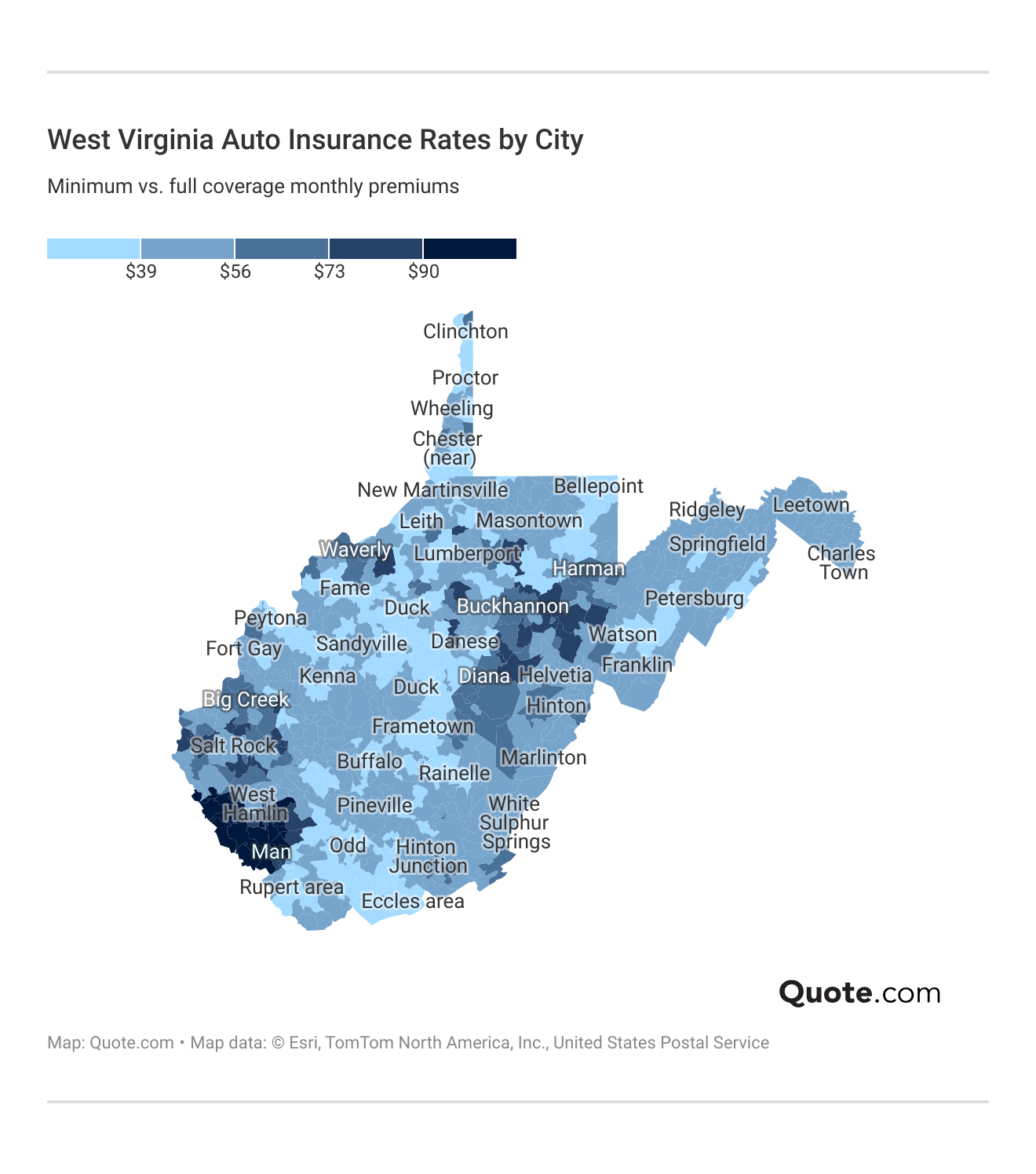

ZIP Code & Your West Virginia Auto Insurance Rates

What you pay for car insurance in West Virginia depends on where you live. Cities with more traffic and claims usually have higher premiums. Learn more in our guide to auto insurance rates by state.

If you live in a busier area, you can still keep costs manageable by using safe-driver discounts, signing up for telematics programs, or bundling your auto and home insurance.

At the same time, smaller towns and rural communities tend to have lower minimum coverage premiums because there are fewer accidents and less congestion.

When you buy auto insurance, it’s a good reminder that your ZIP code can affect your rate just as much as your driving record. Compare cheap car insurance in WV online to find local deals that fit your budget.

WV Car Insurance Rates Across Different Driving Records

Insurers base premiums on how much risk they associate with your driving habits and how likely you are to file a claim. Even the best auto insurance companies in WV may increase your premium after an accident or traffic ticket.

Drivers with spotless records usually enjoy lower rates because insurers see them as dependable, while violations, accidents, or DUIs tend to raise premiums.

West Virginia Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $50 | $82 | $118 | $60 |

| $59 | $87 | $109 | $62 | |

| $36 | $64 | $93 | $49 |

| $51 | $89 | $128 | $64 | |

| $43 | $57 | $69 | $46 | |

| $46 | $59 | $95 | $55 | |

| $47 | $88 | $117 | $63 | |

| $48 | $63 | $92 | $59 | |

| $55 | $91 | $135 | $66 |

| $49 | $94 | $142 | $56 |

Keeping your record clean is one of the best ways for West Virginia drivers to save money on car insurance.

Those with past violations can start rebuilding by taking defensive driving courses, staying claim-free, and comparing quotes from multiple insurers. Over time, showing safe, consistent driving can help lower your rates again.

How Credit Score Impacts Car Insurance Rates in West Virginia

Credit scores play a big role in what West Virginia drivers pay for auto insurance, often more than people expect. Insurers view higher credit scores as a sign of reliability, so drivers with strong scores often get lower rates and good driver auto insurance discounts.

Those with fair or poor credit, though, tend to pay more because insurers associate lower scores with a greater chance of missed payments or claims.

West Virginia Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $50 | $55 | $61 | $74 |

| $59 | $65 | $72 | $86 | |

| $36 | $40 | $46 | $58 |

| $51 | $57 | $64 | $78 | |

| $43 | $47 | $52 | $64 | |

| $46 | $50 | $56 | $69 | |

| $47 | $52 | $59 | $73 | |

| $48 | $53 | $59 | $72 | |

| $55 | $61 | $68 | $82 |

| $49 | $54 | $60 | $75 |

Paying bills on time, reducing balances, and checking your score regularly can help improve your West Virginia auto insurance rates over time.

Even if your credit’s not great, you can still score fair auto insurance rates by comparing different companies, getting multiple quotes, and asking about safe-driver or multi-policy discounts that can help balance out higher costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

West Virginia Auto Insurance Requirements

Knowing West Virginia’s minimum auto insurance requirements helps drivers stay legal and protected. West Virginia law requires all drivers to carry the following car insurance coverages:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured Motorist Bodily Injury: $25,000 per person / $50,000 per accident

- Uninsured Motorist Bodily Injury: $25,000 per accident

Liability auto insurance coverage helps pay for someone’s medical bills or property repairs if you’re found at fault in a car accident. Uninsured and underinsured motorist coverage helps when the other driver doesn’t have enough insurance to pay for the damage, keeping you from paying out of pocket.

West Virginia drivers must carry enough liability coverage to pay for medical and property costs if they’re at fault. Meeting state auto insurance requirements helps avoid costly expenses after a crash and keeps drivers financially protected and confident on the road, no matter who’s responsible.

More Car Insurance Coverage Options in WV

In West Virginia, drivers have plenty of optional coverages to choose from beyond the state’s minimum requirements. Knowing how each works can help you build a plan that fits your needs without paying for extras you won’t use.

Collision coverage takes care of repairs if your car is damaged in an accident, no matter who caused it. Comprehensive coverage protects against common risks such as theft, hail, flooding, and animal collisions, which are prevalent in rural areas.

Uninsured and underinsured motorist coverage helps out if the other driver doesn’t have enough insurance to cover the damage. Medical payments coverage helps with hospital bills for you and your passengers after an accident, even if you weren’t at fault.

Other useful options include rental reimbursement to cover the cost of a temporary car and roadside assistance that provides towing, jump-starts, or flat-tire help when you need it most.

By combining these coverages, West Virginia drivers can stay financially protected, avoid surprise costs, and feel more secure every time they hit the road.

Tips to Lower West Virginia Insurance Rates

You don’t have to give up good coverage to save more money. Small adjustments, like how you pay or how much you drive, can make a real difference in your premium.

These small steps can go a long way in helping West Virginia drivers maintain strong coverage, save consistently, and pay less for car insurance.

- Stick with the Basics: If your car is older or fully paid off, removing extras like collision or comprehensive coverage and keeping the required liability can help you save.

- Take a Driver Safety Course: Completing a West Virginia-approved defensive driving class can sharpen your skills and may earn you an additional discount.

- Drive Less if You Can: The fewer miles you put on your car, the lower your risk, and many West Virginia insurers offer cheaper rates for low-mileage drivers.

- Pay Upfront or Go Autopay: Paying in full or using autopay helps you avoid fees and save more.

- Shop Around Each Year: Comparing quotes from different West Virginia insurance providers helps you stay aware of better coverage or new savings opportunities.

Auto insurance discounts in West Virginia also show how insurers reward safe and consistent drivers. Providers use these discounts to encourage good driving habits and customer loyalty.

Drivers with clean records or who use technology to monitor safe driving habits are often seen as lower risk and may qualify for greater savings.

Top Auto Insurance Discounts in West Virginia| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 8% | 15% | 30% | 30% |

| 10% | 25% | 25% | 40% | |

| 15% | 25% | 23% | 30% |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 10% | 5% | 15% | 20% |

| 15% | 13% | 10% | 30% |

Bundling home and auto policies, or adding safety features such as anti-theft systems, can lead to noticeable discounts.

It all comes down to proving you’re a careful, dependable driver who makes smart insurance choices that pay off over time.

Best Car Insurance in West Virginia Reviews

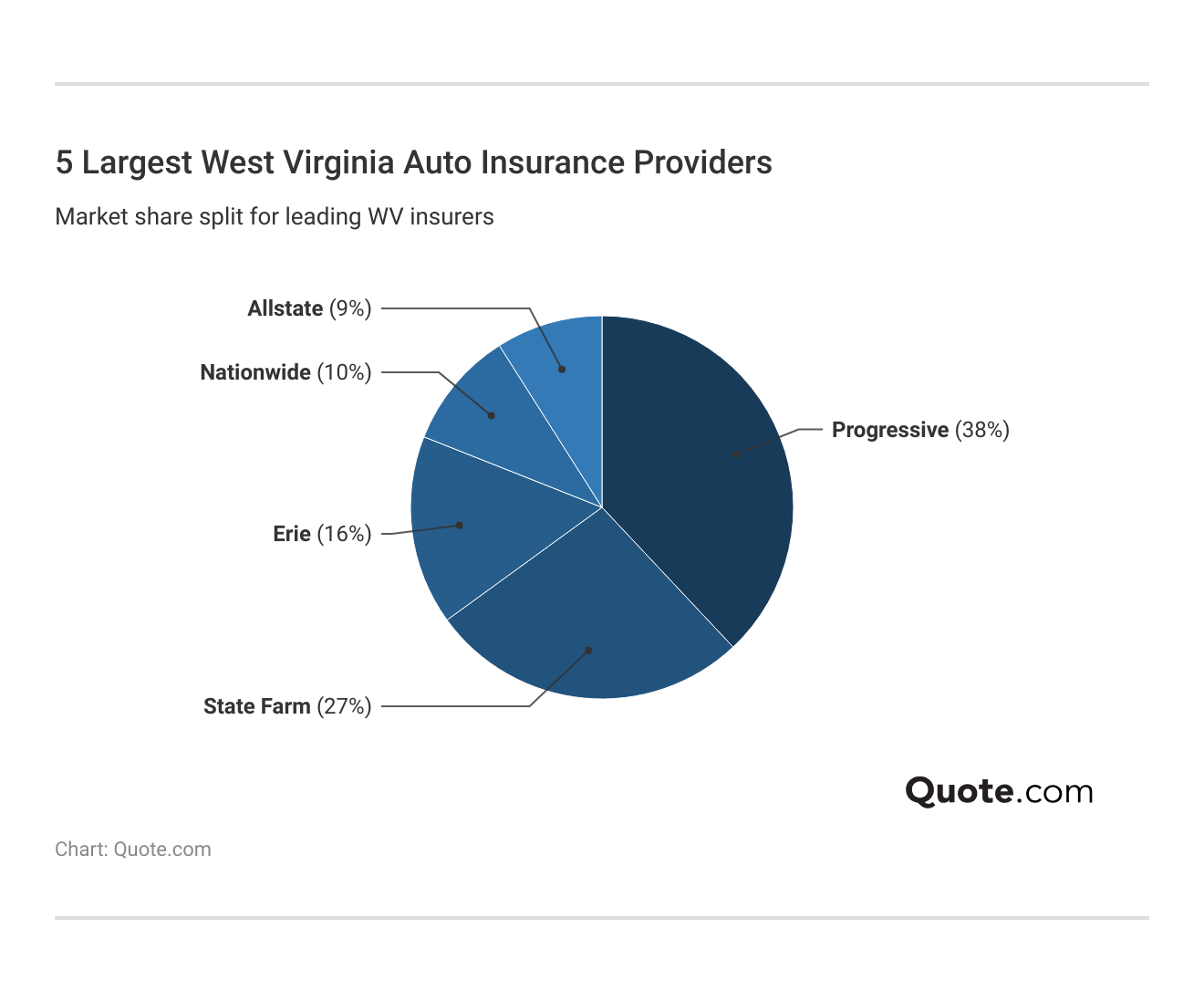

Progressive leads West Virginia’s auto insurance market with 38%, followed by State Farm at 27% and Erie at 16%.

Nationwide and Allstate follow with 10% and 9%, keeping the competition strong among the best car insurance companies in the state.

Progressive’s easy-to-use online tools and flexible coverage make it a favorite among tech-savvy West Virginia drivers, while State Farm and Erie keep locals happy with personal service and quick help from nearby agents.

Erie car insurance in WV might be smaller, but drivers love it for its fair prices, fast claims, and customer support that actually feels local. To find the best deal for your needs, compare multiple WV car insurance quotes and see which provider fits your budget and coverage preferences.

#1 – Erie: Top Pick Overall

Pros

- Competitive Pricing: Erie offers some of West Virginia’s lowest rates at just $36 a month for liability coverage.

- Rate Lock Feature: Erie’s Rate Lock keeps West Virginia drivers’ premiums steady unless they change cars, drivers, or coverage.

- Accident Forgiveness: Erie rewards safe driving in West Virginia with accident forgiveness, helping keep rates low even after a first at-fault incident.

Cons

- Limited Availability: Erie only serves 11 states, so you may not be able to renew coverage if you move out of West Virginia. Our Erie review shows state coverage.

- Fewer Online Services: West Virginia drivers have limited access to mobile account tools and digital claims features compared to larger national platforms.

#2 – AAA: Best for Roadside Assistance

Pros

- 24/7 Roadside Assistance: AAA keeps West Virginia drivers covered day or night with towing up to 100 miles, jump-starts, fuel delivery, and flat-tire help when needed.

- Membership Discounts: West Virginia members can save up to 10% on their auto policies through loyalty renewals and policy bundling.

- Reliable Claims Service: Backed by an A rating and an above-average claims score, AAA gives West Virginia drivers confidence in reliable protection.

Cons

- Membership Fee Required: West Virginia drivers pay about $64–$119 per year for an AAA membership before getting access to benefits.

- Higher Base Premiums: AAA’s coverage in West Virginia costs about 12% more than the state’s average base rate. Compare quotes in our review of AAA.

#3 – State Farm: Best for Flexible Policies

Pros

- Flexible Coverage Options: State Farm’s auto insurance in West Virginia offers add-ons, including rideshare insurance and roadside assistance.

- Telematics Savings: Our State Farm insurance review shows that the Drive Safe & Save program rewards safe West Virginia drivers with up to 30% off their premiums.

- Top Financial Strength: Backed by an A++ rating from A.M. Best, State Farm ensures long-term dependability in West Virginia.

Cons

- High Teen Rates: Teen drivers in West Virginia usually pay about 24% more for coverage since insurers see them as higher risk with less driving experience.

- Limited Local Agent Access: Some rural West Virginia communities have fewer State Farm branches for in-person support.

#4 – Geico: Best for Safe Drivers

Pros

- Safe-Driver Incentives: The DriveEasy app helps West Virginia policyholders earn up to 25% discounts for good driving behavior.

- Low-Cost Coverage: Geico offers affordable liability-only plans in West Virginia for $43 a month. Compare quotes in our Geico insurance review.

- Excellent Claims Service: Geico’s A++ rating and high claims score reflect strong claims handling in West Virginia.

Cons

- Fewer Add-Ons: West Virginia customers have limited upgrade options, such as OEM parts or new car replacement coverage.

- Basic Policy Features: Geico’s plans in West Virginia skip extras like accident forgiveness or gap insurance that many drivers like having.

#5 – Nationwide: Best for Simple Claims

Pros

- Streamlined Claim Process: Nationwide’s SmartRide app lets West Virginia drivers file and track claims easily from their phones, cutting wait times by about 20%.

- On Your Side Review: With this annual review, West Virginia policyholders can check for new discounts, update their coverage, and ensure their plan still fits their needs.

- Financial Strength: Nationwide Insurance reviews show an A+ rating, confirming strong stability for West Virginia claims and customer protection.

Cons

- Moderate Claims Score: With a 636/1,000 claims satisfaction rating, Nationwide ranks mid-tier among West Virginia insurers.

- High Premiums for High-Risk Drivers: West Virginia motorists with multiple violations may face surcharges above Progressive’s average.

#6 – Farmers: Best for Group Discounts

Pros

- Group Discount Programs: Farmers helps West Virginia drivers save through employer, alumni, and military group discounts, cutting premiums by around 5–10%.

- OEM Parts Coverage: Farmers ensures West Virginia customers get original manufacturer parts for covered repairs under collision or comprehensive claims.

- Accident Forgiveness: Farmers offers West Virginia policyholders accident forgiveness after three claim-free years, helping prevent premium increases after minor incidents.

Cons

- Higher Premiums: Our Farmers Insurance review shows that full coverage from Farmers in West Virginia tends to cost more because of its wide range of policy benefits.

- Inconsistent Claim Times: Some West Virginia drivers say claim responses can take a bit longer depending on how busy their local agent is.

#7 – Travelers: Best for Industry Experience

Pros

- More Than a Century of Service: Travelers car insurance has served West Virginia for over 100 years, providing exceptional service and insight.

- Superior Financial Security: Backed by an A++ A.M. Best rating, Travelers gives West Virginia drivers confidence that their coverage is secure.

- Responsible Driver Plan: This program helps West Virginia policyholders avoid rate hikes after their first minor accident, giving them peace of mind.

Cons

- Higher Deductibles: West Virginia drivers often need to select deductibles of $1,000 or more, which can increase upfront costs.

- Few Loyalty Rewards: There are fewer savings perks for West Virginia customers who renew yearly. See more discounts in our Travelers review.

#8 – Allstate: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Allstate earns strong reviews for quick claims and friendly support, giving West Virginia drivers confidence in their coverage.

- Drivewise Savings: Safe West Virginia drivers can earn up to 40% off through Allstate’s telematics-based Drivewise program.

- Strong Agent Network: Over 80 licensed agents in West Virginia provide personalized local service.

Cons

- Premium Jumps After Claims: Rates in West Virginia may increase up to 18% after an at-fault accident. Compare rates in our Allstate insurance review.

- Discount Restrictions: Not all West Virginia drivers qualify for the Early Signing or FullPay discounts.

#9 – Progressive: Best for Accident Forgiveness

Pros

- Accident Forgiveness Benefit: Progressive helps West Virginia drivers avoid rate hikes by forgiving their first at-fault accident after five claim-free years.

- Snapshot Program: The telematics tool rewards West Virginia drivers with savings up to 30% based on actual driving data.

- Financial Reliability: With an A+ rating, Progressive gives West Virginia customers peace of mind with dependable claims handling.

Cons

- Limited Local Agents: Progressive insurance reviews mention that some West Virginia drivers find it harder to get in-person support from local agents.

- Complex Discount Structure: Some West Virginia customers say Progressive’s discount options can be tricky to understand and vary by eligibility.

#10 – The Hartford: Best for Senior Drivers

Pros

- Senior-Focused Benefits: The Hartford partners with AARP to give West Virginia seniors perks like lifetime renewability and new car replacement protection.

- Accident Forgiveness Coverage: After five clean years, West Virginia drivers can skip rate increases for their first minor accident.

- Financial Strength: Backed by an A+ rating, The Hartford provides older West Virginia drivers with dependable coverage and consistent claims support.

Cons

- Restricted Eligibility: Coverage in West Virginia is available mostly to AARP members age 50 or older.

- Limited Tech Features: Our The Hartford insurance review breaks down how the company’s telematics app is basic compared to other WV insurance companies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Insurance in West Virginia

Erie, AAA, and State Farm stand out as the best auto insurance companies in West Virginia, offering affordable rates, reliable protection, and great perks for local drivers.

Erie’s Rate Lock keeps your premium steady even after a claim, AAA includes 24/7 roadside help and member rewards, and State Farm gives safe drivers big savings through its Drive Safe & Save usage-based insurance program.

You can lower your premiums further by bundling your auto and home insurance, taking a defensive driving course, or increasing your deductible for cheaper monthly payments.

Finding the right car insurance company in West Virginia depends on how and where you drive. Whether you’re in busy Charleston or quieter areas, the best choice offers good rates, solid protection, and dependable service.

- Check A.M. Best Ratings: Stick with companies rated A or higher to ensure they’re financially reliable when it comes to paying claims.

- Read Local Reviews: See what other West Virginia drivers say about response times, billing, and how easy it is to file a claim.

- Ask About Regional Discounts: Some insurers give extra savings for safe driving, low mileage, or bundling home and auto policies.

- Compare Coverage Options: Make sure your policy includes what matters where you live, like roadside assistance in rural areas or protection from storm damage.

- Get a Few Quotes: Comparing at least three West Virginia insurers side by side helps you find the best value for your budget.

When it comes down to choosing the best auto insurance in WV, following this auto insurance guide can help you make smarter choices, cut unnecessary costs, and feel secure every time you drive.

Finding the right fit doesn’t have to be complicated. Just enter your ZIP code to see affordable West Virginia auto insurance companies near you.

Frequently Asked Questions

What is the best car insurance company in West Virginia?

Erie has the best auto insurance in West Virginia, offering full coverage from $36 per month, an A rating from A.M. Best, and its unique Rate Lock feature that keeps premiums steady unless you change vehicles or drivers.

What is the cheapest car insurance company in West Virginia?

Erie provides the cheapest car insurance in West Virginia, averaging about $88 monthly for full coverage and $36 for minimum coverage. Use our free comparison tool to find cheap WV auto insurance companies near you.

Why is car insurance so high in West Virginia?

Car insurance is high in West Virginia because of frequent weather damage and uninsured drivers, which have pushed the average cost of auto insurance higher statewide.

Who is cheaper for auto insurance in West Virginia: Geico or Progressive?

Geico is typically cheaper than Progressive in West Virginia, offering minimum coverage starting around $43 monthly, compared to Progressive’s $47 a month. However, both companies provide strong discounts for safe drivers and low-mileage use.

What insurance company has the highest customer satisfaction in West Virginia?

Erie leads in customer satisfaction in West Virginia with a 706/1,000 claims satisfaction score and top reviews for quick claims resolution and responsive local agents that simplify the claims process.

Can you drive without insurance in WV?

No, driving without insurance in West Virginia is illegal and can result in license suspension, a $200 fine, and vehicle registration revocation. You’ll need at least 25/50/25 liability coverage to stay legal. Learn more about auto insurance requirements by state.

How much is the average car insurance in West Virginia?

The average driver in West Virginia spends about $92 a month for full coverage and around $48 for minimum coverage. Your exact cost depends on factors such as your driving record, credit score, and even your age.

What information do I need to get car insurance in West Virginia?

You’ll need your driver’s license number, vehicle identification number (VIN), proof of address, and driving history details. Having prior insurance documentation helps get faster, more accurate quotes from local providers.

Should I add my teenager to my WV insurance policy or purchase a separate policy?

It’s usually cheaper to add your teenager to your existing West Virginia policy. Insurers like State Farm and Erie offer student discounts up to 25% for good grades or completion of courses that qualify for defensive driving insurance discounts.

What is the best car insurance in West Virginia for young drivers?

State Farm offers the best car insurance for young West Virginia drivers, featuring the Drive Safe & Save telematics program that can reduce premiums by up to 30% for consistent safe driving. Enter your ZIP code to compare car insurance quotes by age.

What is the best car insurance company in West Virginia for customer service?

What is the best car insurance in West Virginia if you have driving offenses?

Which insurance company has the most complaints in West Virginia?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.