Best Pet Insurance for Cats in 2025

Healthy Paws, Trupanion, and Nationwide offer some of the best pet insurance for cats with flexible medical coverage options. Travelers has the cheapest cat insurance at $18 per month. Pet owners pay vet bills upfront, then get reimbursed, while Figo stands out as the only insurer that pays 100% of covered costs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated December 2025

Healthy Paws, Trupanion, and Nationwide have the best pet insurance for cats as they cover the conditions most owners run into and handle claims with fewer headaches.

- Healthy Paws ranks highest among the best cat insurance companies

- Travelers offers the cheapest pet insurance for cats at $18 a month

- Strong illness and accident coverage matter most for cat owners

Searching for more affordable premiums on the best pet insurance for cats? Travelers comes in at the cheapest at $18 a month.

However, deductibles, reimbursement levels, and annual limits play a big role in how much the best pet insurance companies charge for cat coverage.

Top 10 Companies: Best Pet Insurance for Cats| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 685 / 1,000 | A+ | Fast Reimbursements | |

| #2 | 676 / 1,000 | A- | Direct Payments | |

| #3 | 670 / 1,000 | A+ | Multi Coverage | |

| #4 | 663 / 1,000 | A | Comprehensive Plans | |

| #5 | 659 / 1,000 | A+ | Budget Plans | |

| #6 | 655 / 1,000 | A- | Custom Coverage | |

| #7 | 648 / 1,000 | A+ | Added Benefits | |

| #8 | 641 / 1,000 | A++ | Affordable Bundles | |

| #9 | 635 / 1,000 | A | Flexible Plans | |

| #10 | 620 / 1,000 | A++ | Established Provider |

With so many options, comparing how insurers price coverage, manage claims, and support long-term care makes it easier to choose a plan that fits your cat’s needs and your budget.

Insert your ZIP code to get started and compare the best pet insurance companies for you and your budget.

Compare Pet Insurance Rates for Cats

This pet insurance comparison highlights price differences between the best cat pet insurance options and dog coverage, and it’s clear that dogs usually cost more across insurers (Learn More: Best Pet Insurance for Dogs).

Pet Insurance Monthly Rates: Cats vs. Dogs| Company | Cats | Dogs |

|---|---|---|

| $21 | $42 | |

| $22 | $43 | |

| $20 | $40 | |

| $24 | $44 | |

| $23 | $41 | |

| $25 | $46 | |

| $19 | $38 | |

| $23 | $45 | |

| $18 | $37 | |

| $26 | $47 |

Travelers and Pets Best tend to offer lower rates, while Trupanion and Petplan fall on the higher end, especially for dogs. Kitten, adult, and senior care needs can fluctuate, so prices may also shift.

My cat owner friends all compare reviews or head to Reddit before they decide, but going through the free pet insurance quote online process helps you actually get a real price to know what coverage might cost, and find a plan with predictable costs.

How Age and Other Factors Impact Cat Insurance Costs

Travelers and Pets Best both offer pricing that doesn’t differ so much between kittenhood and the golden years, making it somewhat easier for cat owners to plan ahead.

Petplan, Healthy Paws, and Trupanion frequently bump up rates when cats are six to eight years old, as regular care becomes more regular.

Pet Insurance Monthly Rates for Cats by Age| Company | Age: 2 | Age: 4 | Age: 6 | Age: 8 |

|---|---|---|---|---|

| $21 | $23 | $26 | $29 | |

| $22 | $24 | $27 | $31 | |

| $20 | $22 | $25 | $29 | |

| $24 | $26 | $29 | $34 | |

| $23 | $25 | $28 | $32 | |

| $25 | $27 | $30 | $35 | |

| $19 | $21 | $24 | $28 | |

| $23 | $25 | $28 | $33 | |

| $18 | $20 | $23 | $26 | |

| $26 | $28 | $31 | $36 |

Comparing quotes across age groups helps you spot the best pet insurance for older cats and the best pet insurance for senior cats without overpaying.

It also makes it easier to find affordable pet insurance for cats that still fits your budget as your cat ages.

Read More: State Farm vs. Farmers, Geico, Progressive, Allstate Insurance Review

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Pet Insurance for Cats Works

A cat insurance policy works on a reimbursement basis. You choose from the best cat insurance plans by setting a deductible, a reimbursement rate, and a coverage limit that fits your budget.

When your cat visits the vet, you pay the bill and submit a claim. Once the deductible is met, the insurer reimburses covered expenses.

This setup is common across most insurance for pets and helps owners manage larger vet costs. The best pet insurance coverage for cats usually focuses on accidents and illnesses.

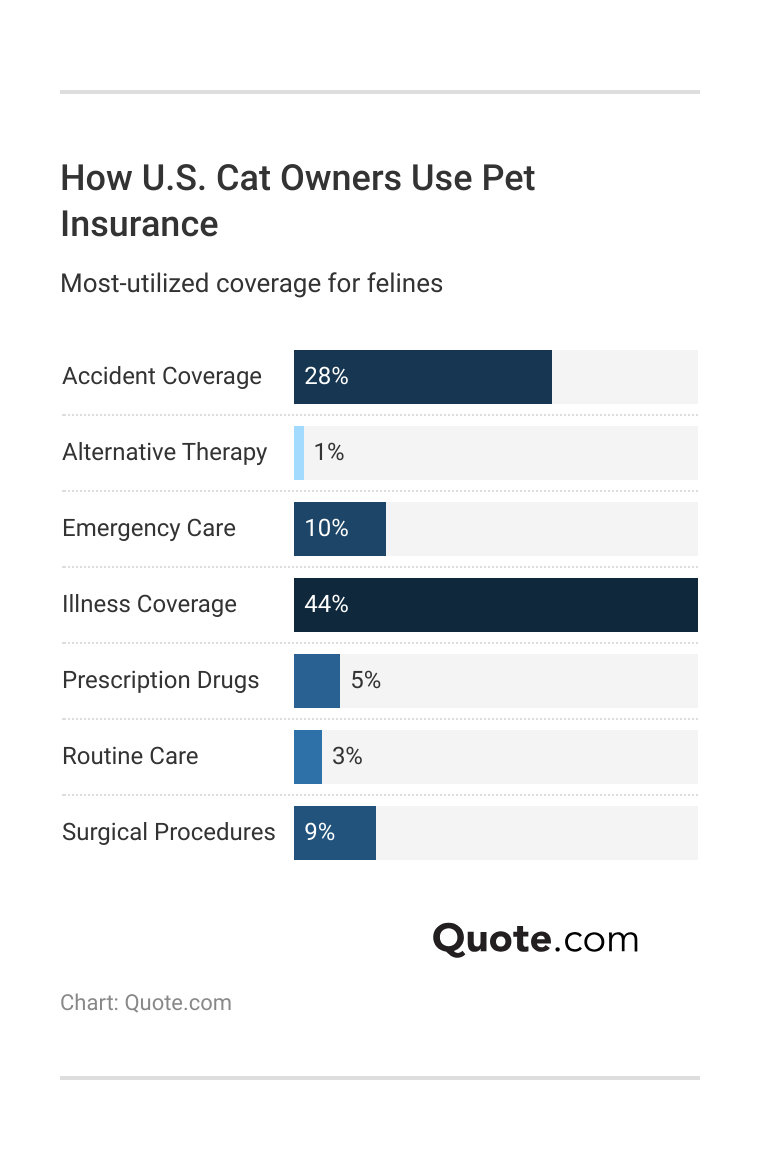

Cat owners rely on coverage most for illness-related care, especially as cats age and develop chronic conditions. Kittens also use insurance for early health issues, though treatment costs tend to be lower.

Accidents rank next, and you can expect emergency visits, surgeries, and prescriptions to pile up quickly at any point in a cat’s life. As a bonus, routine care appears less frequently in claims data but does make a difference for preventive visits and senior checkups.

When comparing the best insurance for cats, it’s worth knowing what’s not covered. Umbrella policies don’t pay vet bills unless there’s a car accident, but they can cover injury or damage your cat causes.

Best Cat Insurance Companies Compared

When you compare providers, you’ll notice how deductibles, reimbursement levels, and coverage limits change as kittens grow into adult and senior cats.

This makes it easier to sort through the best cat insurance plans, since price alone doesn’t show how well coverage holds up over time.

Pet Insurance Coverage Details by Provider| Company | Deductible | Reimbursement | Annual Limit |

|---|---|---|---|

| $100–$1K | 70–90% | Unlimited only | |

| $50–$1K | 70–90% | $5K–Unlimited | |

| $250–$2.5K | 70–90% | $5K–15K range | |

| $100–$750 | 70–100% | Unlimited only | |

| $100–$1K | 70–90% | Unlimited only | |

| $100–$750 | 70–90% | Unlimited only | |

| $250–$1K | 50–90% | $5K–10K+Unlimited |

| $250–$500 | 70–90% | $5K–Unlimited | |

| $50–$1K | 70–90% | $5K–Unlimited | |

| $50–$1K | 70–90% | $5K–Unlimited | |

| $100–$1K | 70–90% | $2.5K–Unlimited |

| $100–$1K | 70–90% | $2.5K–Unlimited | |

| $100–$500 | 70–90% | $2.5K–$10K | |

| $0–$1K | 90% (fixed) | Unlimited only |

Providers like Healthy Paws Pet Insurance, Nationwide Pet Insurance, Pet Best Cat Insurance, and Spot Pet Insurance each structure coverage differently, especially when it comes to annual limits.

Some companies, including Healthy Paws, keep things simple with unlimited annual coverage, while others place caps that can matter more for senior felines who need ongoing care.

Insurance deductibles vary from a few hundred to in excess of two thousand dollars among insurers. Companies like Trupanion, Progressive, and Farmers have lower deductibles, but higher monthly premiums.

Reimbursement rates differ greatly, too, and that will influence how much you get back after you file a claim. Figo offers reimbursement up to one hundred percent, while Nationwide starts lower than many competitors.

Pet Insurance Limits You Should Know

Consider the important questions to find the right plan for your pet by focusing on what’s actually covered, since the best pet insurance coverage for cats depends on how well a policy handles accidents, illnesses, and ongoing care needs.

Cat insurance companies offer varying levels of coverage and policy types depending on whether you’re insuring playful kittens or older cats with more specific needs. Most plans cover the core medical needs: accidents, illnesses, hospital visits, and testing.

Pet Insurance Coverage Breakdown| Category | What’s Covered | Details |

|---|---|---|

| Accidents | Broken bones, poisoning | In most plans |

| Alternative Therapies | Acupuncture, hydro | Limited availability |

| Behavioral Therapy | Training, behavior | Select insurers only |

| Dental Care | Cleanings, extractions | Preventive excluded |

| Diagnostic Tests | X-rays, MRIs, labs | Varies by plan |

| End-of-Life Care | Euthanasia, cremation | Coverage varies |

| Genetic/Congenital | Hip dysplasia, heart | Active policy required |

| Hospitalization | ER, surgery, overnight | Usually included |

| Illnesses | Cancer, arthritis, GI | Waiting period applies |

| Prescriptions | Antibiotics, pain meds | Supplements excluded |

| Preventive Care | Vaccines, flea/tick | Optional add-on rider |

| Specialists | Oncology, cardiology | May need referral |

Extras like dental cleanings, behavior support, or alternative care vary by company and often need added coverage.

For instance, you’ll want to compare the best pet insurance for cats with pre-existing conditions if you need an insurer that offers the fairest terms for cats with a medical history.

Pet Insurance Coverage Limitations| Category | Exclusions | Details |

|---|---|---|

| Age Restrictions | Policy ends at age 14 | Puppies 6-8 wks |

| Behavioral Issues | Training or therapy | Includes add-on |

| Bilateral Conditions | Hip and ligament | May skip 2nd side |

| Breeding/Pregnancy | Related issues or care | Rarely covered |

| Dental Care | Cleaning, cosmetic | Covers illness/injury |

| Elective Procedures | Ear/tail docking, declaw | Not covered |

| Experimental Treatments | Trial drugs/care | Usually excluded |

| Pre-Existing Conditions | Issues pre-coverage | Covered if curable |

| Routine/Preventive Care | Vaccines, flea/tick, food | Wellness add-on |

| Waiting Periods | 5 days to 6 months | Varies by plan |

You really start to notice the limits of a policy when you look at what isn’t covered. Things like pregnancy care, elective procedures, experimental treatments, and most pre-existing conditions are usually excluded.

Pet insurance exclusions matter even more for older cats and senior felines who already have a longer medical record and are more likely to be denied coverage.

Look at how a company handles claims and what illnesses it covers, because those two details tell you whether a pet insurance plan will actually help when your cat needs care.

Jeff Root Licensed Insurance Agent

Age limits, waiting periods, and rules around certain conditions can affect what your plan will actually cover.

This can make a big difference for kittens just getting started with insurance and for older cats who may already have a few health issues on record.

How Cat Owners Can Save on Pet Insurance

Discounts can look different from one insurer to the next, and they can make a difference whether you’re covering a single kitten, an older cat, or a senior feline. Some companies give multi-pet deals, which help families with several cats of different ages.

Preventive care discounts show up across many providers and can help cover vaccines for kittens and routine visits for older cats, which is especially useful when looking for the best pet insurance for multiple cats under one policy.

Top Pet Insurance Discounts for Cats| Company | Bundling | Multi-Pet | Neuter/Spay | Preventive Care |

|---|---|---|---|---|

| 10% | 10% | 5% | 10% | |

| 10% | 5% | 5% | 5% | |

| 10% | 10% | 10% | 10% | |

| 5% | 10% | 5% | 10% | |

| 5% | 5% | 5% | 5% | |

| 5% | 10% | 5% | 10% | |

| 5% | 5% | 5% | 5% | |

| 10% | 10% | 5% | 10% | |

| 10% | 5% | 5% | 5% | |

| 5% | 10% | 5% | 10% |

Seeing these numbers side by side makes it easier to spot which companies offer the best mix of savings for cats of all ages.

Saving on cat insurance usually comes down to knowing which discounts actually make a difference for your cat’s age and health needs. A few simple adjustments can bring your monthly costs down without cutting the protection your cat relies on.

- Consider Umbrella Coverage: Although it won’t cover vet bills, umbrella insurance offers liability protection and helps some cat owners choose a lighter pet plan at a lower price.

- Invest in Preventive Care: Some plans sell cheap bundles of preventive care to get your kitten or senior cat vaccinated and checked out.

- Raise Your Deductible: If you’d rather pay less monthly and are able to foot a larger vet bill when needed, bumping up the deductible can decrease the premium.

- Start Coverage Early: Signing up when your cat is young often locks in lower rates and avoids issues tied to pre-existing conditions later on.

- Utilizing Multi-Pet Discounts: If you share your home with two or more cats, you may be able to cover them under the same insurer’s policy for a lower monthly charge.

These small increments can add up, especially if you’re insuring kittens, adult cats, and seniors all under the same policy. Comparing pet insurance discounts side-by-side makes it easier to see where and how you’ll actually save.

A Reddit user shared spending over $6,000 on unexpected vet bills, showing how quickly cat medical costs can rise without coverage. Healthy Paws has some of the best pet insurance for cats based on Reddit discussions, especially for repeat illnesses and emergencies.

Saving on cat insurance isn’t about cutting corners. It’s about picking discounts that fit how your cats live and age, which can help avoid much bigger vet bills later.

Learn More: What We Learned Analyzing 815 Insurance Companies

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

10 Best Pet Insurance Companies for Cats

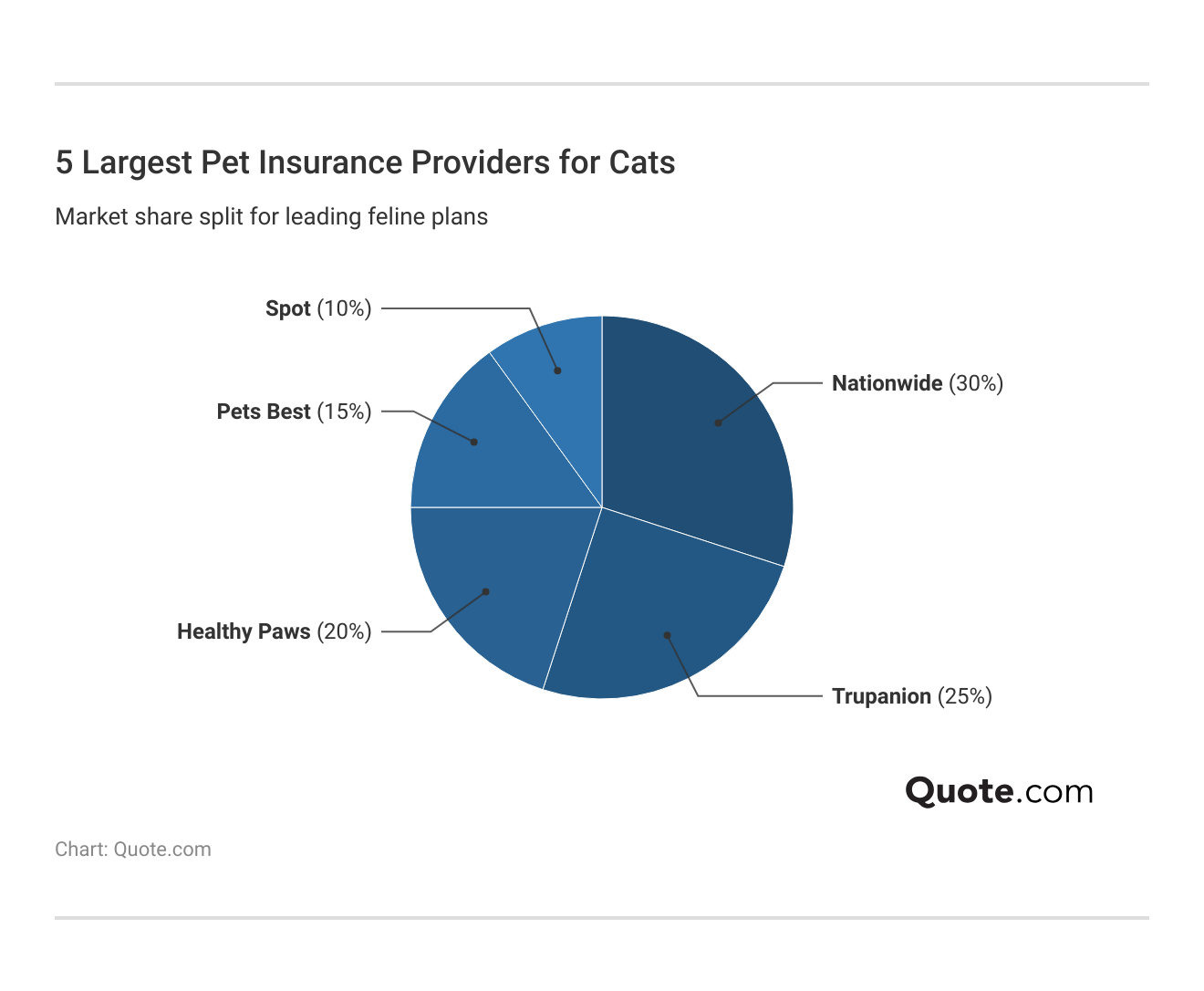

Nationwide holds the largest share of the cat insurance market, serving kittens and older felines of all ages with a wide range of coverage options.

Trupanion follows with 25%, backed by its strong reputation for covering chronic and hereditary conditions. Healthy Paws sits close behind at 20%, while Pets Best and Spot make up the remaining shares.

You can see which providers are most popular with cat parents, but that doesn’t mean the largest company is the one for you.

Cat insurance needs change whether you’re fostering kittens or a family caring for senior felines, so take some time to research a few different providers before you buy.

Pet insurance company availability will also vary by state, so always compare providers by ZIP code to find the best pet insurance near you (Learn More: Comparing Plans and Getting an Insurance Plan that Works for You).

The best cat insurance companies earned their spots by balancing coverage, cost, and customer experience, making them strong picks for the best pet insurance for cat owners who want reliable support over the long term.

#1 – Healthy Paws: Top Overall Pick

Pros

- Strong Illness Coverage: Healthy Paws is a favorite among cat owners since it handles ongoing and repeat health issues without piling on confusing limits.

- Straightforward Protection: The unlimited yearly coverage takes away the stress of running into limits when your cat needs costly treatments or a longer recovery.

- Fast Claims Processing: Cat owners value quick reimbursements for sudden or high-cost issues, a common strength among the best insurance companies for claims handling.

Cons

- No Wellness Option: Routine care isn’t available, so owners who want help with annual checkups must budget separately.

- Enrollment Restrictions: Older cats may face limited eligibility, which makes early enrollment more important.

#2 – Trupanion: Best for Direct Payments

Pros

- Immediate Payment Option: Trupanion appeals to many cat owners because it pays the vet right away, so you’re not stuck covering a big bill upfront.

- Strong Hereditary Coverage: This policy will attract people who love those kinds of cats and cover anything they might come down with for genetic reasons without any trouble.

- Simple Plan Structure: With one reimbursement level, it’s easy to understand what you’re getting without sorting through layers of upgrades.

Cons

- No Routine Care Coverage: Cat owners looking for wellness or preventive benefits won’t find those here.

- Generally Higher Premiums: Monthly costs can run higher than other insurers, especially as cats age, so it helps to compare plans to get an insurance plan that works for you.

#3 – Nationwide: Best for Multi Coverage

Pros

- Multiple Plan Types: Nationwide earns one of the spots for best cat insurance by being able to provide accident-only, illness, and wellness coverage under a single brand.

- Helpful Multi-Pet Discount: Families with more than one cat frequently save the most here compared to other providers.

- Recognizable Brand: Many owners like the stability that comes from choosing an insurer with a long history and strong financial ratings.

Cons

- Benefit Schedule Limits: Some plans use fixed payout amounts, which may not match the actual vet bill.

- Slower Claims at Times: Processing may take longer than with insurers that have fully digital systems, as noted in a Nationwide insurance review when comparing claims.

#4 – Petplan: Best for Comprehensive Plans

Pros

- Covers Hard-to-Find Issues: Petplan works well for cats with hereditary or behavioral issues since it covers many things that other insurers don’t.

- Higher Coverage Limits: Owners with cats who need extensive testing or treatment appreciate the generous annual caps.

- Exam Fee Coverage Included: This helps reduce the cost of routine sick visits, which add up quickly for indoor cats with chronic symptoms.

Cons

- Premiums Increase With Age: Older cats may see sharper rate hikes, so checking quotes through the best insurance comparison sites can help you track rising costs.

- More Documentation Requests: Some claims require extra information, which can delay reimbursement.

#5 – Pets Best: Best for Budget Plans

Pros

- Lower Monthly Costs: Pets Best is a good fit for pet parents on a budget, especially those seeking low-end premiums that reflect average insurance costs.

- Custom Deductible Choices: Cat owners can adjust deductibles to keep monthly costs manageable.

- Fast Online Claims: The digital filing system makes it easy to submit bills after vet visits.

Cons

- Wellness Plans Can Add Up: The routine care add-ons sometimes cost more than owners expect.

- Some Conditions Pay Less: Certain treatments may reimburse at a lower level depending on the plan.

#6 – Spot: Best for Custom Coverage

Pros

- Easy for First-Time Owners: Spot works well for people choosing the best pet insurance for cats for the first time because the plans are simple to understand.

- Good Multi-Pet Savings: Households with multiple cats can save noticeably through its discount structure, which fits well with money-saving tips for insurance.

- Optional Wellness Packages: Pet parents who like to have some predictability in costs can opt for additional routine care without having to change providers.

Cons

- Premiums Rise Over Time: The monthly premiums may increase faster as your cat ages.

- Inconsistent Claim Speeds: Some cat owners note that reviews can be slow during busy times.

#7 – Allstate: Best for Added Benefits

Pros

- High Bundle Value: Allstate ranks among the best pet insurance for cats when you already have auto or home policies.

- Reliable Medical Coverage: A great all-around plan, because of its accident and illness coverage, is suitable for most indoor and outdoor cats.

- Additional Benefits Available: A few plans offer support services like vet helplines for fast health questions.

Cons

- Less Specialized: It doesn’t offer the niche cat-focused features that some pet-only companies provide.

- Higher Limits Cost More: Plans with broader protection come with noticeably higher premiums, according to our Allstate auto insurance review.

#8 – Geico: Best for Affordable Bundles

Pros

- Competitive Rates: If price is the biggest factor for you, Geico tends to be one of the best pet insurance plans for cats.

- Useful Online Tools: For those homeowners who would rather it be a low-maintenance process, quoting and policy management are painless.

- Bundle Savings: Geico clients already using their insurance can combine their coverages for extra savings.

Cons

- Coverage Varies by Partner: Benefits depend on the underwriting partner, which can lead to differences in plan features.

- Limited Customization: Some owners may want more control over limits and deductibles, based on our Geico insurance review.

#9 – Farmers: Best for Flexible Plans

Pros

- Widespread Choices: Farmers will appeal to households who are looking for the best pet insurance for cats and want simple as well as comprehensive coverage options.

- Bundle and Save: Savings can be significant for households already insured with Farmers.

- Good Claims Support: Lots of owners like that insurance comes through during stressful times.

Cons

- Premiums Can Be Higher: Some plans cost more than similarly structured competitors, as explained within our Farmers Insurance review.

- Wellness Add-Ons Are Pricey: Routine care packages can noticeably raise the total monthly cost.

#10 – Travelers: Best for Established Provider

Pros

- Long-Standing Brand: Pet owners looking for a long history and strong financials in their cat insurance go with Travelers.

- Simple Plans: The way coverage is laid out is very easy to decipher without being too restrictive.

- Good Accident Coverage: Great for indoor/outdoor cats who may suffer sudden injuries.

Cons

- Limited Routine Care Options: Preventive benefits are not a strong part of its offerings.

- Lower Annual Limits: Higher coverage levels require more expensive upgrades, a point highlighted in our Travelers insurance review.

Finding the Right Insurance Plan for Your Cat

Healthy Paws, Trupanion, and Nationwide all have robust coverage and reliable claims support, and Travelers tends to offer the lowest starting price at $18 per month.

However, choosing the best pet insurance for cats also means knowing how to evaluate providers, since the list below breaks down what to look for when picking the best insurance for a cat, starting with how each insurer handles claims.

- Clarity Around Denials: Providers with transparent claim reviews and consistent approvals give you more confidence that your cat’s care will be covered when it matters.

- Ease of Filing Claims: Top insurers offer simple online portals or mobile apps that let you upload invoices quickly, while others still rely on slower, paper-based processes.

- Overall Reliability: Claim history and customer reviews give you a clear sense of how dependable an insurer is when your cat needs care, and you’re waiting for reimbursement.

- Reimbursement Time: When insurers are clear about how they review claims and stay consistent with approvals, it gives you real peace of mind that your cat’s care will be covered when you need it most.

- Support for Complex Cases: Stronger insurers handle ongoing or complicated medical issues without frequent disputes or added hurdles.

Understanding how claims work helps you pick coverage that fits kittens, adult cats, and seniors. It also helps you decide whether your cat needs insurance, especially for indoor pets.

When you look at everything together, the best pet insurance for cats is the one that meets your cat’s medical needs while staying within your comfort zone financially, a point often highlighted in the ultimate insurance cheat sheet.

The best way to choose pet insurance for cats is to check how fast claims are paid, because quick reimbursements ease the stress of sudden vet bills.

Melanie Musson Published Insurance Expert

Prices may vary based on your deductible, reimbursement rate, and your cat’s age, so it is good to compare a few options and see what feels right for you.

Once you review the exclusions and know how quickly each company processes claims, you’ll settle on a plan that genuinely provides support when your cat requires care. Enter your ZIP code to compare rates of the best providers near you.

Frequently Asked Questions

What are the best pet insurance companies for cats?

Healthy Paws, Trupanion, and Nationwide are typically the best pet insurance for cats since these companies insure common illnesses, chronic conditions, and high-cost emergencies. Healthy Paws earns a special nod for hefty paybacks and no annual limits.

What are the best pet insurance companies for indoor cats?

Indoor cat owners often choose Healthy Paws or Nationwide because they offer strong illness coverage, fast claims support, and reliable benefits for chronic conditions that indoor felines commonly develop over time.

How much is pet insurance for a cat?

Monthly premiums vary by age and provider, but many owners pay between $18 and $45. Travelers offers the lowest rates for around $18 a month. Enter your ZIP code and shop for affordable cat insurance premiums from the top companies.

What does cat insurance cover?

Plans typically cover accidents, illnesses, diagnostic tests, surgeries, and prescription medication, while routine care, dental cleanings, and alternative treatments may be optional add-ons depending on the insurer.

What is the best type of cat insurance?

Most cat owners choose accident-and-illness plans because they cover everything from stomach issues to cancer treatments, and comparing care insurance plans makes it easier to see why these fuller policies are more practical than accident-only coverage, especially for older cats who need broader protection.

How do I choose the right cat insurance plan?

The best way to pick pet insurance is to compare how each company handles claims, what illnesses they cover, and whether deductibles and reimbursement levels match your budget and your cat’s medical needs.

Learn More: Complete Guide to Health Insurance

Is it worth having pet insurance for a cat?

Insurance is often worth it when you factor in how quickly costs add up for chronic issues, emergency surgeries, and ongoing medication, especially for older cats and senior felines who face higher risks as they age.

Does age affect cat insurance premiums?

Premiums do increase when cats move from kitten to adult to senior cat. Older cats are more likely to require ongoing treatment, diagnostic testing, and expensive emergency care because of increased health-related risk factors. It’s the same reason the average life insurance costs and health insurance rates rise as people get older.

Are male or female cats more expensive to insure?

Some insurers rate male cats slightly higher because they tend to have more behavior-related injuries and issues like urinary blockages, but the difference is small compared to age or breed factors.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

How can I lower my cat insurance costs?

You can lower your premium by choosing a higher deductible, adjusting your reimbursement percentage, enrolling kittens early, or looking for companies that offer multi-pet discounts if you have several felines. Check out more easy ways to save money when managing long-term pet care costs.

What is a good deductible for cat insurance?

Does an indoor cat need pet insurance?

Is lifetime pet insurance worth it?

What are the disadvantages of pet insurance?

Is there any pet insurance that pays the vet directly?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.