Best Final Expense Life Insurance in 2026

The best final expense life insurance companies are Mutual of Omaha, Nationwide, and Guardian. MassMutual offers rates starting at $17 a month. Lincoln Financial provides guaranteed final expense coverage for declined applicants. Final expense insurance pays for funerals, burial costs, and medical bills.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

The best final expense life insurance comes from Mutual of Omaha, Nationwide, and Guardian, with rates starting at $17 per month.

- Guardian is one of the best companies for its stable lifetime benefits

- MassMutual offers the cheapest final expense rates starting at $17 a month

- Coverage compares health rules, waiting periods, and payout timing

Final expense life insurance plans come with limited benefit amounts designed to cover funeral costs, burial expenses, and unpaid medical bills.

Many applicants qualify without an exam, but if you’re looking for life insurance quotes based on your age and health, Mutual of Omaha’s final expense insurance will cover most applicants with pre-existing conditions.

Top 10 Companies: Best Final Expense Life Insurance| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 707 / 1,000 | A+ | Easy Approval | |

| #2 | 695 / 1,000 | A+ | Flexible Plans | |

| #3 | 679 / 1,000 | A | Stable Benefits | |

| #4 | 677 / 1,000 | A++ | Lifetime Security | |

| #5 | 671 / 1,000 | A++ | Long-Term Value | |

| #6 | 656 / 1,000 | A++ | Strong Stability | |

| #7 | 653 / 1,000 | A | Instant Coverage | |

| #8 | 652 / 1,000 | A+ | Claims Support | |

| #9 | 635 / 1,000 | A+ | Guaranteed Benefit | |

| #10 | 604 / 1,000 | A+ | Broad Acceptance |

Final expense insurance is an affordable option for many families, and Nationwide offers different payment plans that fit most budgets.

You can get free quotes for final expense life insurance and secure financial protection for your loved ones by entering your ZIP code into our tool.

Final Expense Life Insurance Cost Comparison

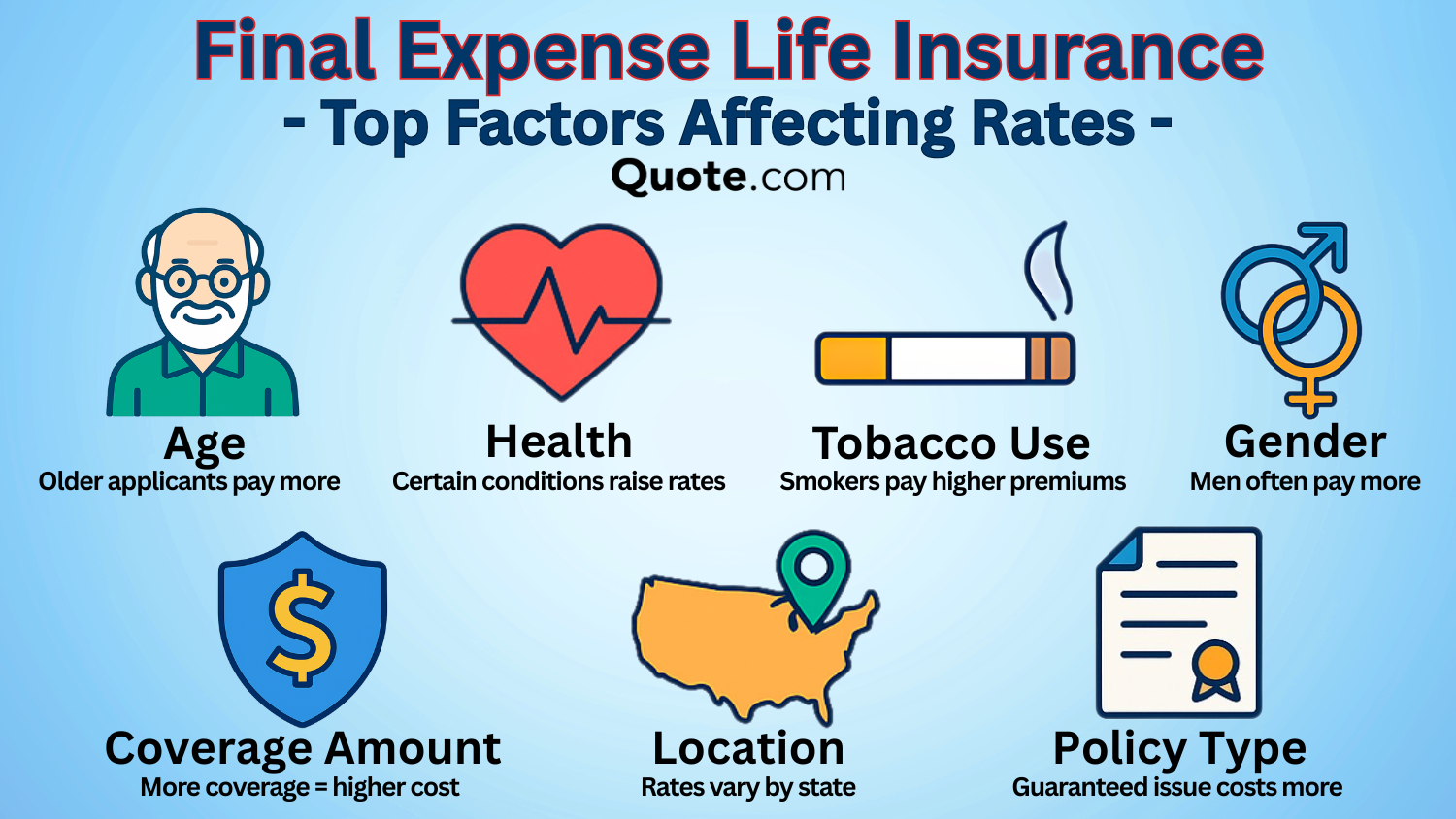

Final expense life insurance prices mostly come down to age. Burial insurance costs rise as you get older, which is one of the clear reasons to buy life insurance earlier and lock in lower monthly rates.

Most burial insurance policies stay fairly affordable in your 30s and 40s. Prices begin to climb in your 50s, and by age 60, the same burial coverage can cost close to double what it did years earlier.

Final Expense Life Insurance Monthly Rates by Age| Company | Age: 30 | Age: 40 | Age: 50 | Age: 60 |

|---|---|---|---|---|

| $19 | $24 | $37 | $54 | |

| $18 | $23 | $36 | $52 | |

| $21 | $27 | $42 | $61 | |

| $17 | $22 | $34 | $50 | |

| $20 | $25 | $39 | $56 | |

| $20 | $26 | $40 | $59 | |

| $22 | $28 | $43 | $63 | |

| $23 | $29 | $45 | $65 | |

| $23 | $30 | $47 | $68 | |

| $24 | $31 | $48 | $70 |

Younger buyers often pay less for final expense insurance policies because insurers expect to collect premiums over a longer period before paying out a benefit.

Graded and modified final expense policies get more expensive as you age because full burial benefits aren’t available right away. Guaranteed issue final expense insurance costs the most at any age since approval doesn’t depend on your health history at all.

Final Expense Life Insurance Monthly Rates by Policy Type| Company | Graded Benefit | Guaranteed Issue | Modified Benefit | Simplified Issue |

|---|---|---|---|---|

| $32 | $52 | $42 | $22 | |

| $33 | $53 | $43 | $23 | |

| $34 | $54 | $44 | $24 | |

| $35 | $55 | $45 | $25 | |

| $36 | $56 | $46 | $26 | |

| $37 | $57 | $47 | $27 | |

| $38 | $58 | $48 | $28 | |

| $39 | $59 | $49 | $29 | |

| $40 | $60 | $50 | $30 | |

| $41 | $61 | $51 | $31 |

Simplified issue final expense insurance is usually the cheapest option because it asks fewer health questions. Globe Life often leads this category, with simplified issue burial coverage starting around $22 per month.

Higher benefit totals increase the cost of final expense policies, and premiums are different in each state. Health history continues to matter when it comes to pricing, despite fast approval, and tobacco use drives rates up on all policy types.

Severe medical conditions raise costs for insurers, so Mutual of Omaha and Nationwide may charge more at the start, but they often keep final expense rates more stable as policyholders get older.

To sort through the process of getting final expense insurance quotes that compare location and health profile information, we’re going to identify which companies remain competitive with the rising cost of burial.

Final Expense Life Insurance Costs by State

Don’t assume final expense insurance prices are uniform statewide. Monthly final expense costs vary more by location than many people expect.

In some states, the average cost of life insurance can be as low as $43. But in higher-cost regions, that same coverage can run between $63 and $73 a month.

States with more restrictive insurance regulations, higher medical costs, or larger populations, like Texas, generally have higher prices.

Be aware of how rates change from state to state, and compare the average final expense life insurance cost near you with our free comparison tool.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Final Expense Death Benefits Work

The payout is usually used for funeral services, burial or cremation, medical bills, and other burial expense coverage needs left unpaid at the time of death.

The final expense program provides support for smaller yet urgent expenses, like utility bills, short-term debts, and travel costs associated with arranging a funeral.

The size of coverage is important because the price jumps significantly as benefits rise. Even relatively small jumps in coverage can raise monthly costs more than people had realized.

That’s why many buyers, especially those considering final expense life insurance for parents, focus on how much life insurance you need to cover real expenses instead of planning for worst-case scenarios.

Most policies fall between $10,000 and $20,000. That range tends to cover funeral costs and essential medical bills without breaking the bank.

Premium policies offer higher benefit amounts — typically a base of about $30,000 and add-on benefits for things like accidental death or hospice treatment.

Choosing $10,000 to $20,000 in final expense coverage keeps premiums manageable while covering funeral costs, so families aren’t left paying out of pocket.

Tim Bain Licensed Insurance Agent

Final expense insurance is most useful when the amount of the payout and the funds spent align with what things really cost at life’s end. Lower amounts handle essentials only. Larger sums allow for the possibility of debts or additional assistance.

Because final expense insurance only pays for funerals and burial, think about your lifestyle. If you want more wide-ranging coverage for long-term care or terminal diagnosis.

Final Expense vs. Other Types of Life Insurance

Final expense insurance is a form of final expense whole life insurance, and it’s usually one of the simplest types of coverage to get approved for.

It covers you for life, but the coverage amounts are pretty small. Most policies fall somewhere between $5,000 and $30,000.

Monthly costs tend to land in the high-20s to low-30s range. Most policies provide $10,000 to $50,000 in coverage, with the monthly cost generally in the range of $22-$30.

Term life insurance provides more coverage; you might be able to get up to $500,000 for around $10–$15 a month. But it lasts only 10 to 30 years, and qualifying is more difficult.

Final Expense vs. Term vs. Whole Life Insurance| Feature | Final Expense | Term Life | Whole Life |

|---|---|---|---|

| Approval Difficulty | Easy | Strict | Moderate |

| Coverage Amount | $5K-$30K | $50K-$500K | $10K-$50K |

| Coverage Period | Lifetime | 10-30 Years | Lifetime |

| Monthly Rate | $28-$32 | $10-$15 | $22-$30 |

| Waiting Period | 0-2 Years | None | None |

Laid out side by side, the policies help you see which one truly suits your needs. For some people, the lower-cost, short-term coverage makes the most sense.

Others would rather have something that stays in place for life, even if the benefit isn’t as large.

Ways to Save on Final Expense Life Insurance

Qualifying for multiple discounts can significantly lower your monthly cost for final expense coverage.

Non-smoker discounts produce the greatest monthly savings by far across almost all providers, while family history discounts are also significant, at companies like Northwestern Mutual and Guardian.

Top Final Expense Life Insurance Discounts| Company | Auto-Pay | Bundling | Family History | Non-Smoker |

|---|---|---|---|---|

| 5% | 4% | 12% | 12% | |

| 2% | 5% | 12% | 15% | |

| 2% | 6% | 12% | 15% | |

| 6% | 10% | 6% | 15% | |

| 5% | 5% | 7% | 10% | |

| 2% | 8% | 5% | 12% | |

| 3% | 3% | 10% | 10% | |

| 2% | 4% | 20% | 10% | |

| 3% | 6% | 10% | 10% | |

| 2% | 8% | 6% | 11% |

Policy bundling drops the monthly cost even further, especially with MassMutual and Nationwide, while autopay discounts offer up slightly smaller but consistently reliable savings that can really add up.

Some insurers also offer lower base rates for early enrollment. Comparing all available discounts for which you qualify can impact whether another company is more affordable.

Eligibility rules differ by insurer, so it makes a difference to ask which discounts may be combined when you are shopping around.

Beyond just discounts, small choices can lead to real monthly savings if you know where to look:

- Ask About Non-Smoker Rates: If you are a non-tobacco user, this can be the biggest possible monthly discount.

- Bundle Policies When Possible: If you bundle life insurance with other types of insurance, your monthly rates can be cheaper.

- Choose Auto-Pay: A lot of insurers offer an automatic-payment method that lowers the monthly premium.

- Compare More Than One Provider: Monthly rates and discounts for comparable coverage can range widely.

- Review Family History Discounts: Some organizations charge less on a monthly basis, depending on the longevity of the family.

When these family history discounts stack together, they can lower monthly premiums enough to shift which insurer ends up being the most affordable option.

Taking a few minutes to confirm which discounts apply to you, as outlined in this life insurance guide that compares different types of life insurance, can make final expense coverage more affordable without reducing the benefit your family receives.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

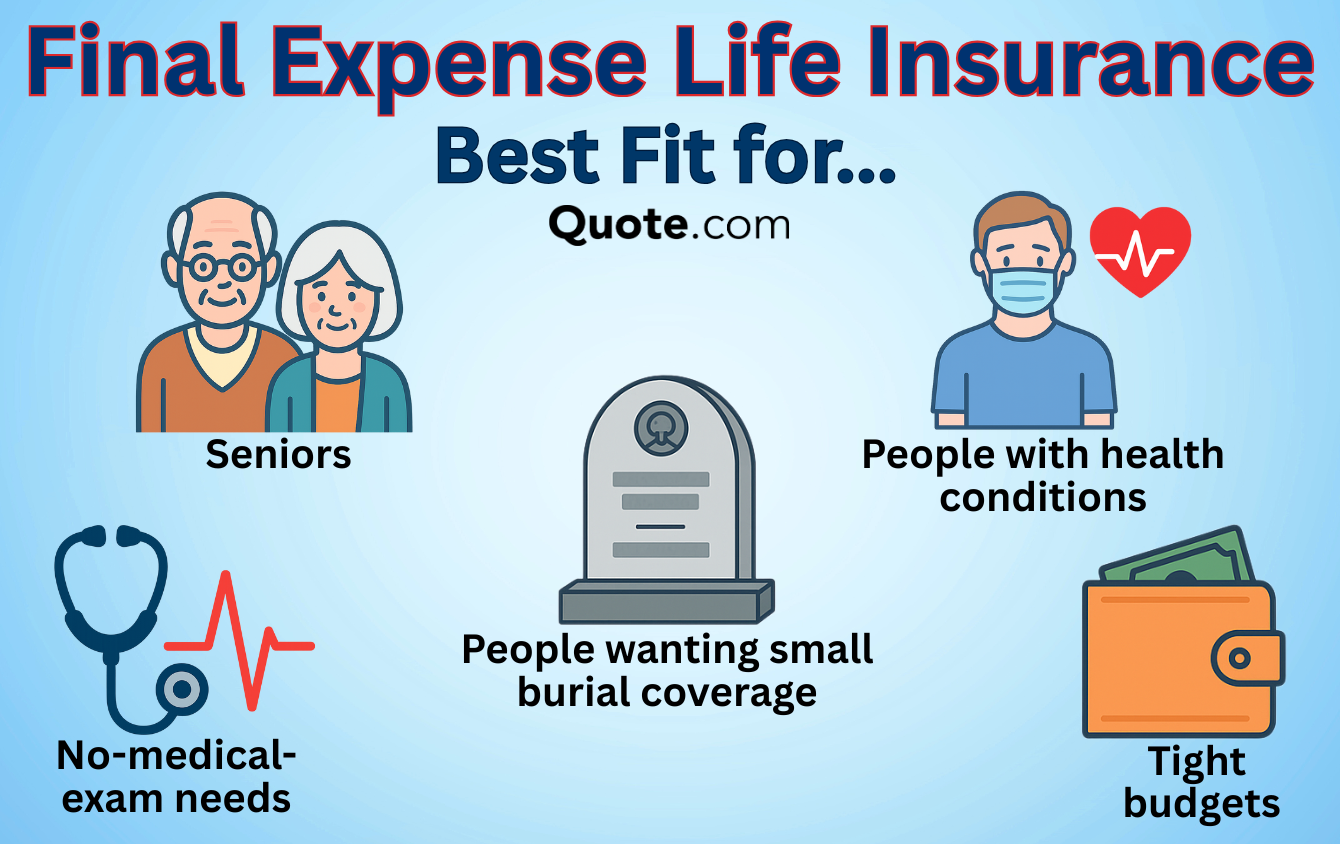

Qualifying for Final Expense Life Insurance

If you have pre-existing health conditions or a terminal disease, final expense plans may be the only life insurance option available to you.

It works best for older applicants, making final expense life insurance for seniors a practical option for those who have been declined for other types of life insurance coverage.

Final expense life insurance is one of the most affordable plans and provides much-needed coverage for funerals without any medical questions.

However, health conditions directly affect which final expense insurers will even consider an application. Lincoln Financial is the most flexible option, accepting applicants with dementia, heart failure, lung disease, and prior stroke history.

Globe Life, Mutual of Omaha, Nationwide, and Transamerica will usually cover people with lung disease or a past stroke, but they generally don’t accept applicants with dementia or heart failure.

Final Expense Insurance Eligibility by Health Condition| Company | Dementia | Heart Failure | Lung Disease | Stroke History |

|---|---|---|---|---|

| ❌ | ❌ | ✅ | ✅ | |

| ❌ | ❌ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | |

| ❌ | ❌ | ❌ | ✅ | |

| ❌ | ❌ | ✅ | ✅ | |

| ❌ | ❌ | ✅ | ✅ | |

| ❌ | ❌ | ❌ | ❌ | |

| ❌ | ❌ | ❌ | ✅ | |

| ❌ | ❌ | ❌ | ❌ | |

| ❌ | ❌ | ✅ | ✅ |

If health issues are a concern, this breakdown shows which companies work alongside health insurance gaps and which insurers are likely to decline coverage.

Guardian, MassMutual, and Northwestern Mutual have stricter restrictions on the most serious conditions. New York Life and Pacific Life have the lowest eligibility overall, rejecting coverage for all of the conditions listed.

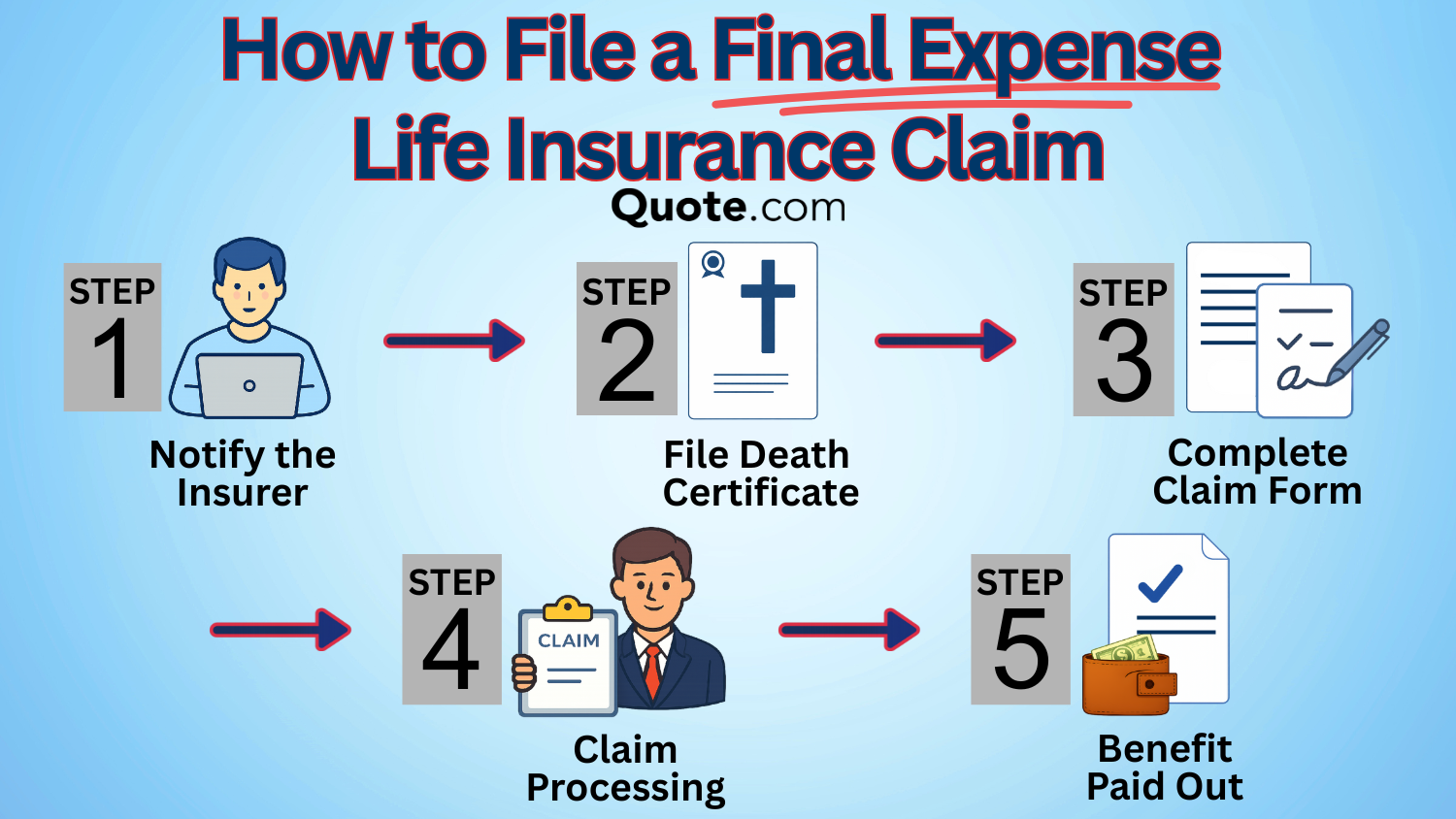

Filing a Final Expense Life Insurance Claim

Filing a final expense life insurance claim follows a simple process, especially with final expense life insurance with no waiting period, in which families simply notify the carrier, provide a copy of the death certificate, and fill out a short claim form.

Once documents are received, the claim moves into review. Claim timing depends on the policy and any waiting period, but any delay can make a difference when a family needs cash quickly.

No medical exam life insurance with simplified issue and level benefit whole life insurance is one popular option available for this, so you don’t have to take an examination and can receive full benefits from the first day.

Some carrier plans are graded issue or guaranteed issue, meaning they come with long waiting periods and graded benefits that can have your beneficiaries waiting a year or more to receive the full death benefit.

Final Expense Insurance Waiting Periods by Policy Type| Policy Type | Immediate | Delayed | Refund | Full Benefit |

|---|---|---|---|---|

| Accidental Death | ✅ | ❌ | ❌ | Day 1 |

| Graded Benefit | ❌ | 1-2 Years | 1-2 Years | 2 Years |

| Guaranteed Issue | ❌ | 2 Years | 1-2 Years | 3 Years |

| Level Benefit | ✅ | ❌ | ❌ | Day 1 |

| Modified Benefit | ❌ | 1-2 Years | 1-2 Years | 2-3 Years |

| Return of Premium | ❌ | 1-2 Years | 1-2 Years | 2-3 Years |

| Simplified Issue | ✅ | ❌ | ❌ | Day 1 |

Companies that eliminate medical exams frequently pay claims more quickly. Mutual of Omaha and Nationwide are among the fastest and clearest. Guardian is concerned with long-term reliability, and keeping records organized can save time later.

Mutual of Omaha, Nationwide, and Guardian are the best final expense insurance companies with low wait periods for a policy.

Best Final Expense Life Insurance Companies

Most of the market share for final expense insurance is held by a small group of the best burial insurance companies, which dominate pricing, underwriting rules, and policy availability.

Lincoln Financial is highly competitive and holds the largest market share, meaning favorable acceptance guidelines and availability. Mutual of Omaha is a close second, with competitive rates and eligibility.

Transamerica, AIG, and Gerber Life all have substantial blocks of this business as well, with streamlined underwriting and guaranteed issue final expense insurance options.

Check the pros and cons of final expense insurance to see what each company does well and where trade-offs may matter for your situation.

#1 – Mutual of Omaha: Top Pick Overall

Pros

- Liberal Underwriting: Mutual of Omaha will underwrite many applicants with controlled diabetes, heart disease, or COPD, even into their early 80s.

- Higher Coverage Caps: Final expense plans usually go up to $40,000, exceeding the industry standard for simplified issue policies.

- Straightforward Claims Process: According to J.D. Power reviews, claims are quickly paid with little or no dispute at the end of the graded period.

Cons

- Benefits are Graded: Most plans pay only a portion in the first one or two years, a point often noted in our Mutual of Omaha life insurance review.

- Spiking Age-Based Pricing: If you compare final expense insurance rates by age, the cost jumps sharply after age 75, compared with earlier enrollment.

#2 – Nationwide: Best for Flexible Plans

Pros

- Different Benefit Structures: Nationwide provides level, graded, and guaranteed issue structures for an exact fit to health history.

- Balanced Pricing Model: Rates are competitive across all ages up to 80, starting at $20 a month.

- Handled Claims Experience: Policyholders describe that instructions were easy to understand and that follow-up is the same.

Cons

- Common Waiting Periods: Graded plans can take up to 2 years to pay out final expense life insurance benefits, as outlined in our Nationwide insurance review on waiting periods.

- Not Same-Day Coverage: Approval doesn’t usually come on the same day, but may take a couple of days.

#3 – Guardian: Best for Stable Benefits

Pros

- Contract-Based Payouts: Guardian will not change or reduce benefits if your health changes as you get older.

- Claims Accuracy: Guardian is consistently listed as one of the best providers for getting claims paid on time and in full.

- Financially Conservative: Established more than 160 years ago, Guardian boasts a solid financial grade from A.M. Best.

Cons

- Health Restrictions: Guardians rarely approve applicants with heart failure or lung disease, which limits its place among the best no-exam life insurance options.

- Smaller Discounts: Many final expense life insurance companies offer bigger discounts than Guardian, especially for automatic payments and bundling policies.

#4 – Northwestern Mutual: Best for Lifetime Security

Pros

- Level Life Policies: Premiums and benefits are locked in for the life of the policy, so you won’t be surprised by any rate increases as you get older.

- Full Payout at Once Options: Some policies pay out full benefits right away, not after a graded amount of time.

- Stability You Can Bank On: Northwestern Mutual has operated for over 165 years with one of the highest financial security ratings in the industry.

Cons

- Medical Review: Some plans include exams or full underwriting, and applicants with dementia or lung diseases are unlikely to get coverage.

- Limited Budget Options: Pricing runs higher than most simplified issue carriers, making single premium life insurance a better fit for some buyers.

#5 – MassMutual: Best for Long-Term Value

Pros

- Designed to Last a Lifetime: Policies are designed to last for life, and premiums will not go up.

- Top Financial Ratings: MassMutual has held A++ ratings for decades, supporting the claim’s credibility down the road.

- Coverage Flexibility: Provides more face amounts than most final expense competitors.

Cons

- Stricter Health Review: Applicants with multiple conditions may face declines.

- Higher Monthly Costs: Premiums exceed fast-approval carriers, a point often noted in our MassMutual insurance review when comparing long-term value.

#6 – New York Life: Best for Financial Stability

Pros

- Generous Capital Reserves: As the biggest mutual life insurance company, New York Life has significant reserve resources to cover claims.

- Immediate Cover Options: Some policies do away with graded benefit periods altogether.

- Higher Benefit Limits: Great for larger families that need more final expense coverage.

Cons

- Frequent Medical Exams: Underwriting can delay approval and slow access to coverage when timing matters.

- High Premiums: More expensive than no-exam options, especially when compared with instant life insurance policies.

#7 – Globe Life: Best for Instant Coverage

Pros

- Quick Approval Model: The majority of the applications are approved within a short period with few health queries.

- Lower Up Front Pricing: Monthly costs begin lower than most of the plans offered by traditional insurers.

- Easy Policy Construction: Sensible coverage without any complicated riders.

Cons

- Coverage Caps are Lower: There is a cap on the maximum benefits, which may not meet higher end-of-life cost needs.

- Limited Customization: Not much opportunity to tailor coverage options compared with choices discussed in whole vs. term life insurance.

#8 – Pacific Life: Best for Claims Support

Pros

- Reputation for Claims-First: Pacific Life has a reputation for paying claims smoothly and quickly.

- Substantial Financial Resources: Longevity backed by exceptional insurer ratings.

- Transparent Policy Language: Policies rely on clear, straightforward wording, a key strength discussed in our Pacific Life insurance review.

Cons

- Increased Age for Entry: Fewer options are available to younger applicants.

- Higher Premiums: Prices are usually higher than simplified issue plans.

#9 – Lincoln Financial: Best Guaranteed Benefit Options

Pros

- Issue Guaranteed Access: If you’ve been turned down elsewhere on account of very serious health problems.

- Limited Health Screening: No medical questionnaire, which appeals to buyers seeking high-coverage life insurance options with fewer barriers.

- Simple Language: Policy structure written in clear, easy-to-understand language.

Cons

- Increased Rates: Guaranteed acceptance is going to cost you every month.

- Graded Benefits: Full coverage is delayed.

#10 – Transamerica: Best for Broad Acceptance

Pros

- Broad Range of Health Tolerance: Breadth of accepted medical profiles.

- Variety of Policy Types: Provides graded, modified, and guaranteed issue policies.

- Nationwide Availability: Policies can be purchased in all states.

Cons

- Common Waiting Periods: Most plans make you wait for full benefits.

- Costs Go Up With Age: Quote prices rise sharply as you get older, even when compared with the cheapest life insurance companies.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buying Final Expense Life Insurance

The best final expense life insurance is going to provide coverage, approval, and payment that are quick, easy, and dependable.

Mutual of Omaha has the most coverage and easiest claims process, Nationwide is top for multi-health profiles, and Guardian prioritizes long-term stability.

Provider Comparison: Final Expense Life Insurance Details| Company | Coverage | Issue Age | Benefit Begins | Medical Exam? |

|---|---|---|---|---|

| $5K-$20K | 40-80 | Immediate | ❌ | |

| $5K-$25K | 45-80 | 1-2 Years | ❌ | |

| $5K-$20K | 40-85 | 2-Year Delay | ❌ | |

| $5K-$35K | 45-85 | Immediate | ❌ | |

| $5K-$40K | 45-85 | 1-2 Years | ❌ | |

| $5K-$30K | 45-80 | 1-2 Years | ❌ | |

| $10K-$50K | 45-80 | Immediate | ✅ | |

| $10K-$25K | 45-80 | Immediate | ✅ | |

| $5K-$25K | 50-80 | 1-2 Years | ❌ | |

| $5K-$30K | 45-85 | 1-2 Years | ❌ |

Available options will differ between insurers, and the latter category may be most important for that scheduling aspect. Globe Life and MassMutual both provide instant coverage with no medical exam.

A few insurers offer shorter waiting periods as a risk-management tool. New York Life and Northwestern Mutual both do require medical exams, but they offer more coverage immediately.

Pick final expense life insurance with immediate payouts that match funeral costs, so your family can file a simple claim and avoid delays when expenses need to be paid.

Michelle Robbins Licensed Insurance Agent

By comparing policies side by side, you can select the coverage that meets your needs without overbuying. The best insurance comparison sites can help you figure out which insurers fit your budget and coverage needs.

Safeguard your family’s future while saving on coverage. Enter your ZIP code to compare final expense life insurance quotes with our free tool today.

Frequently Asked Questions

Who has the best final expense life insurance?

The best final expense insurance is whole life, offering lifetime coverage, fixed premiums, and a guaranteed payout. Mutual of Omaha, Nationwide, and Guardian stand out for stability, pricing, and financial strength.

What expenses does final expense life insurance help cover?

What are the four types of expenses covered by final expense insurance? Final expenses usually include funeral and burial costs, cremation, medical bills, hospice care, and small outstanding debts. Most families use final expense life insurance to cover costs ranging from $10,000 to $20,000, so loved ones aren’t forced to pay out of pocket.

Stop overspending on life insurance. Use our tool to compare final expense life insurance rates from top providers near you.

Does final expense life insurance have cash value?

Yes, final expense life insurance builds cash value over time. While the growth is modest, policyholders can borrow against it if needed, adding flexibility beyond the death benefit.

Learn More: Cash Value Life Insurance

How much does final expense life insurance cost?

Final expense policies typically cost between $28 and $32 a month, with the price varying by age, health, coverage amount, and type of policy. Simplified issue policies typically remain under $30, while guaranteed issue policies might be over $50 a month.

What is the waiting period for final expense life insurance?

Wait periods usually range from a year to two years for graded or guaranteed issue policies. During this time, the policies may refund premiums or pay benefits in part. Whole life level benefit policies typically pay the full benefit in a lump sum.

Which insurance is best for death benefit payouts?

Level benefit whole life insurance offers a dependable death benefit by paying in full from day one, unlike many term or whole life insurance options. Guardian and Northwestern Mutual stand out for strong claims handling and financial stability.

What are the best states to sell final expense life insurance?

Generally, the greater the senior population and the more average insurance regulation in states such as Florida, Texas, Arizona, and Pennsylvania, the higher the final expense demand. Many of these markets exhibit steady policy expansion and price competition.

What are the alternatives to final expense life insurance?

Options include term life, whole life, prepaid funeral plans, and savings. Term life costs less but lapses after 10 to 30 years. Whole life is forever, but costs more. Final expense life insurance is in-force and pays cash directly to the beneficiary for funeral expenses.

Is final expense life insurance worth it?

Final expense life insurance is a good buy if you’re looking for inexpensive, lifetime coverage and don’t like enduring rigid medical underwriting. Monthly rates start as low as $17, and comparing insurance plans can help you decide how much coverage to buy.

How much final expense life insurance coverage do most families need?

Most families spend between $10,000 and $20,000 on final expense life insurance. That generally will cover funeral arrangements, burial or cremation, and basic medical bills, so that a grieving family is not left with the tab for those costs. Greater amounts can make sense if you have debts or other end-of-life expenses to take into account.

What deaths are not covered by life insurance?

How much does a $1,000,000 life insurance policy cost per month?

What are the tax implications of final expense life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.