Pay-Per-Mile Auto Insurance in 2026

Low-mileage drivers can find quotes as low as $30 per month when they buy a pay-per-mile auto insurance policy. Pay-per-mile (PPM) car insurance charges a flat rate plus per-mile charges to offer lower rates than a standard policy. PPM auto insurance is a great option if you drive fewer than 10,000 miles annually.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated February 2026

Pay-per-mile auto insurance (PPM) is a policy that offers significant savings for low-mileage drivers by charging for miles driven rather than a flat monthly fee.

- Pay-per-mile auto insurance is also called pay-as-you-go insurance

- Nationwide and Allstate have some of the best PPM insurance.

- The average low-mileage car insurance policy costs $30 per month

A pay-per-mile insurance policy is a good alternative to traditional plans, but only if you don’t put too many miles on your car. The best pay-as-you-go auto insurance can help you save hundreds or even thousands on your coverage.

Read on to learn more about pay-per-mile car insurance, including which companies have the best options and how much it might cost you. Then, when you’re ready to compare PPM auto insurance quotes, enter your ZIP code into our free comparison tool.

Understanding Pay-Per-Mile Car Insurance

Pay-per-mile auto insurance, also known as pay-as-you-go auto insurance, is a type of policy designed to help infrequent drivers save on their coverage.

Every plan is different, so it’s important to read pay-per-mile auto insurance reviews to find the right fit for your needs. Important Details: Best Auto Insurance Companies for Claims Handling

While pay-per-mile insurance can be a great way to save money on your coverage, it’s not for everyone. You should carefully consider pay-per-mile insurance before signing up.

However, an easy way to know if pay-per-mile auto insurance is right for you is to look at your annual mileage. If you drive more than 10,0000 miles per year, it may not be the right choice for you.

Pay-Per-Mile Auto Insurance: Key Tradeoffs| Pros | Cons |

|---|---|

| Can reward safer driving habits | Requires mileage tracking tools |

| Clear cost-to-driving link | Monthly costs can fluctuate |

| Flexible for infrequent driving | Less predictable for daily driving |

| Helpful for remote workers | Limited availability by state |

| Lower costs for low mileage | Higher costs for high mileage |

| Pay based on miles driven | Costs rise as miles increase |

One of the key complaints about a pay-per-mile auto insurance program is that many drivers dislike having their vehicles tracked by their insurers.

Additionally, many drivers fear that taking a lengthy road trip will make their rates skyrocket. Most PPM plans have a daily mileage cap, however, so you can take the occasional long drive without having to worry.

Comparing Pay-Per-Mile Plans and Standard Insurance

Pay-per-mile insurance offers most of the coverage options a standard policy provides, including the minimum and full coverage auto insurance you need. You can usually buy add-ons too, including roadside assistance and gap insurance.

Unlike a standard policy, your monthly pay-per-mile rates will change every month. With a standard policy, your six-month policy is split into six monthly payments. With a pay-per-mile policy, the amount you pay is directly affected by how many miles you drive.

Because you pay for what you drive, finding cheap pay-per-mile auto insurance can be much easier to find than standard coverage.

Pay-Per-Mile vs. Traditional Auto Insurance| Feature | Pay-Per-Mile | Traditional Plan |

|---|---|---|

| Availability | Available in some states | Available nationwide |

| Best Fit | Low-mileage drivers | Frequent drivers |

| Cost Risk Factors | Costs rise with miles | Mileage not considered |

| Coverage Scope | Standard coverage | Broad coverage options |

| Discount Options | Low-mileage discounts | Bundling and loyalty |

| Mileage Tracking | App or device tracking | No tracking required |

| Monthly Cost | Costs vary by miles | Fixed monthly cost |

| Pricing Flexibility | Adjusts with driving | Fixed over time |

| Pricing Structure | Base + per-mile charge | Flat monthly premium |

| Savings Potential | Best for low mileage | Better for high mileage |

This insurance model has become increasingly popular as remote work, flexible schedules, and urban living reduce many drivers’ annual mileage.

Along with other types of usage-based insurance, PPM insurance offers a more personalized pricing approach, especially for people who feel they’re overpaying for traditional auto insurance.

While availability varies by state and insurer, pay-per-mile coverage is usually offered by both major and smaller insurance companies. If you own a car that you don’t drive very often, pay-per-mile insurance might be your best option for coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Pay-Per-Mile Auto Policies Work

Pay-per-mile auto insurance typically splits your premium into two parts: a base rate and a per-mile rate.

The base rate is a fixed monthly charge that takes into account factors such as your driving record, location, and the type of vehicle you drive. The per-mile rate is then multiplied by the number of miles you drive during the billing period, which is usually a month.

Most pay-per-mile programs track mileage using a small device plugged into your car or a mobile app on your phone. Some cars also come with built-in technology that allows you to transmit your driving data directly to an insurance company.

These tools usually record mileage automatically, so drivers don’t have to submit manual readings. Problems with mileage tracking are rare, but you should keep an eye on it. If you do have a problem, contact your insurance company for help.

Some programs may also collect limited driving data, such as trip times or hard braking, depending on the insurer.

Scott W. Johnson Licensed Insurance Agent

At the end of each month, your insurer adds the base rate to your mileage charge to calculate your total premium. For example, say your base rate is $30 per month, and your per-mile charge is $.05. If you drive 400 miles in a month, your bill would be $50.

Many companies cap the number of miles you’ll be charged for each month, which helps prevent unexpectedly high bills during road trips or busy periods.

Check out our auto insurance visual guide to learn more about how your monthly premiums are calculated for both pay-per-mile and standard insurance to see which is best for you.

Who Should Use Pay-Per-Mile Coverage

The people who get the cheapest pay-per-mile insurance are those who put fewer miles on their cars each year than the average driver.

This often includes remote workers, retirees, students, stay-at-home parents, and people who rely on public transportation or ridesharing for most trips.

If you drive fewer than 7,000 to 10,000 miles per year, this type of policy could offer you the best savings on your insurance.

It can also be a smart option for households with a second vehicle that’s only used occasionally. Pay-per-mile policies are also among the best auto insurance options for good drivers because of their lower rates, but only if they don’t put too many miles on their car.

Instead of paying full traditional premiums for a car that sits in the driveway most days, pay-per-mile insurance allows low-mileage drivers to pay less than they normally would.

However, this coverage may not be ideal for frequent commuters, rideshare drivers, or people who regularly take long road trips. Essentially, if you drive over 10,000 miles per year, a standard policy might serve you better.

Another thing to consider is which insurance company to shop with. Companies like Metromile only sell pay-per-mile plans, making it a good choice for consistently low-mileage drivers.

However, if your mileage fluctuates, shopping at a company like Allstate, which sells standard and pay-per-mile insurance, could be a better fit.

See More: Metromile Auto Insurance Review

How Much Pay-Per-Mile Insurance Costs

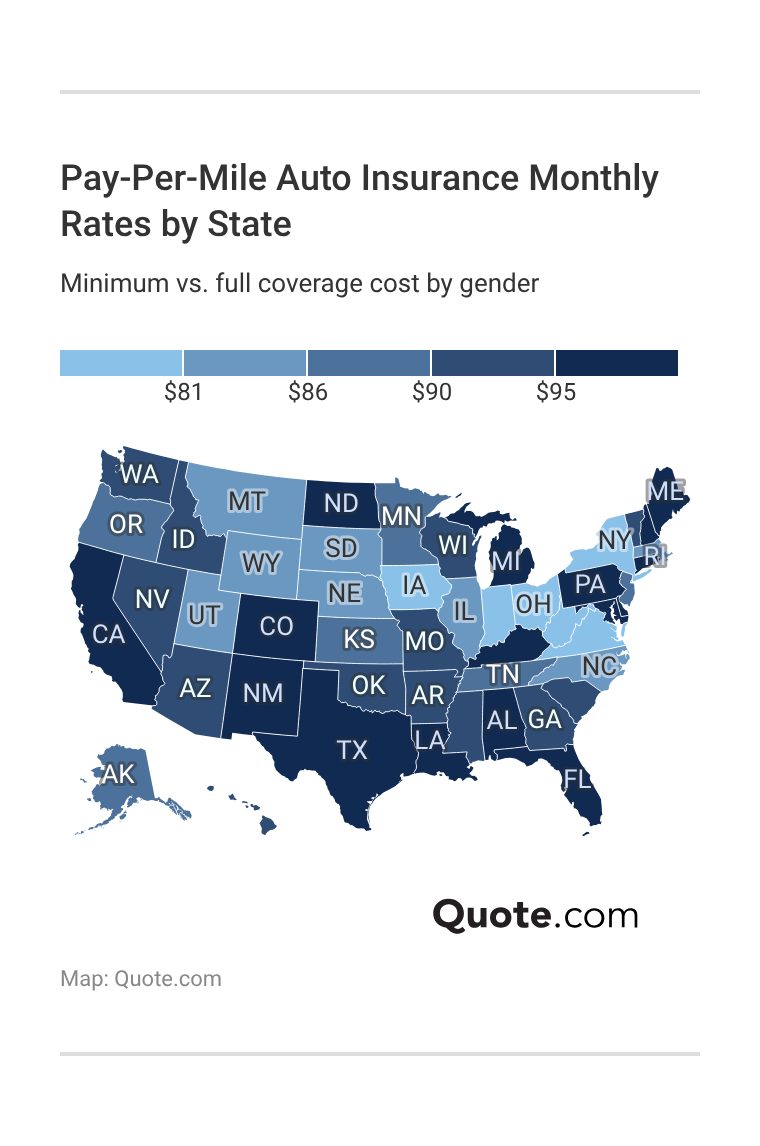

Pay-per-mile auto insurance rates vary widely by insurer, state, and driver profile. Base rates often range from $20 to $60 per month, while per-mile charges typically range from 2 to 10 cents per mile.

Like standard insurance, the amount you pay for your pay-per-mile plan depends on a variety of factors, like your age, ZIP code, and what type of car you drive.

Pay-Per-Mile Auto Insurance Monthly Rates (100 Miles)| Company | Base | Per Mile | Total |

|---|---|---|---|

| $38 | $0.06 | $44 | |

| $32 | $0.05 | $37 |

| $34 | $0.06 | $40 | |

| $31 | $0.05 | $36 | |

| $25 | $0.05 | $30 | |

| $34 | $0.06 | $40 |

| $35 | $0.07 | $42 | |

| $30 | $0.05 | $35 | |

| $33 | $0.05 | $38 | |

| $36 | $0.06 | $42 |

It can be hard to estimate how much you’ll pay for pay-per-mile car insurance if you don’t have an idea of how many miles you put on your car every month. For example, a driver who logs 100 miles in a month might pay significantly less than someone driving 500 miles.

Because mileage is only one factor, drivers with clean records, safe vehicles, and lower coverage needs tend to benefit the most.

Compared to the traditional average cost of auto insurance, pay-per-mile coverage can result in substantial savings for low-mileage drivers, but it’s still important to compare quotes.

If you’re interested in low-mileage quotes, it will be extremely helpful to have an idea of the average number of miles you drive per month.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

More Ways for Low-Mileage Drivers to Save

Drivers who don’t qualify for pay-per-mile insurance, or prefer not to use mileage tracking, can still save through low-mileage auto insurance discounts.

Many traditional insurers offer discounts for drivers who stay under a certain annual mileage threshold, even if they don’t sell strictly pay-per-mile auto insurance policies.

Best Pay-Per-Mile Auto Insurance Discounts| Discount | Eligibility | Savings |

|---|---|---|

| Anti-Theft | Theft protection installed | 5–10% |

| Auto Payments | Enrolled in autopay | 3–5% |

| Bundled Plans | Multiple policies held | 10–20% |

| Good Student | Qualifying student grades | 5–15% |

| Low Mileage | Low annual mileage | 10–15% |

| Pay-in-Full | Paid in full annually | 5–10% |

| Safe Driver | Clean driving record | 10-25% |

| Vehicle Safety | Safety features installed | 5–10% |

Other savings opportunities include usage-based car insurance programs that monitor driving behavior rather than mileage alone, making them a good option for safe drivers.

Usage-based insurance programs also use tracking devices to monitor your driving behaviors, but they look at more information than just how many miles you drive.

UBI programs reward safe habits like driving the speed limit, smooth braking, avoiding phone use while operating your car, and limited nighttime driving.

Michelle Robbins Licensed Insurance Agent

Additional discounts that commonly pair well with low-mileage driving include multi-policy discounts, vehicle safety discounts, defensive driving course discounts, and good driver discounts.

Some companies even offer discounts on pay-per-mile insurance on electric cars, including Allstate and Nationwide.

Combining several of these options can help reduce premiums even without switching to a pay-per-mile policy. There are also plenty of alternative ways to save on your insurance beyond discounts, including:

- Bundle Policies: Most major insurance companies offer a variety of products, and you can usually save if you buy more than one policy from the same provider.

- Increase Your Deductible: Your deductible is what you pay when you file a claim before your coverage kicks in. Picking a higher deductible will lower your monthly premiums.

- Lower Your Coverage: While it’s never a bad thing to add protection to your policy, having coverage you won’t ever use unnecessarily increases your rates.

- Shop Around: The easiest way to save on your coverage is to compare auto insurance quotes from multiple companies.

One of the most important steps to take when you’re looking for affordable coverage is to compare quotes. If you skip this step, you’ll likely end up overpaying for your coverage.

The good news is that comparing quotes is simple. You can visit individual provider websites to get an individualized quote, or look at multiple companies at once by entering your ZIP code into our free comparison tool.

Find the Best Pay-Per-Mile Insurance Company

Pay-per-mile auto insurance offers a flexible, affordable alternative for drivers who spend less time behind the wheel.

By aligning premiums with your actual driving habits, PPM insurance can provide real savings for low-mileage drivers while still delivering the protection they need on the road.

Whether you choose a true pay-per-mile policy or take advantage of low-mileage discounts from traditional insurers, learning how to get multiple auto insurance quotes is the key to finding coverage that fits your budget and driving style.

To see how much you might pay for pay-per-mile coverage, enter your ZIP code into our free tool now.

Frequently Asked Questions

What is pay-per-mile auto insurance?

Pay-per-mile car insurance is a type of policy that offers lower rates to low-mileage drivers. Pay-per-mile auto insurance charges a base monthly rate plus a per-mile fee based on how much you actually drive. It’s designed to lower costs for drivers who spend less time on the road.

Is pay-per-mile insurance worth it?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.