Home Insurance Rates in 2026

Home insurance rates start as low as $60 per month and vary based on location, home size, and coverage. USAA, Geico, and Nationwide offer some of the cheapest homeowners insurance rates. Factors like your home’s age, building materials, and local weather risk also affect your homeowners insurance premiums.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Mortgage Loan Originator

Steve Crowell is a New Hampshire based mortgage loan originator with Luminate Home Loans, Inc. After graduating from the University of New Hampshire in 2003 with a BS in Business and Economics and a BA in History, he went on to get his broker license in 2005. In 2021, he was recognized as a Luminate Home Loans “Circle of Excellence” top agent. Steve works as a trusted resource for clients w...

Steve Crowell

Updated February 2026

Home insurance rates usually costs anywhere from $60 to $175 a month on average, depending on factors like location, coverage limits, and your deductible.

- Home insurance costs range from $60 to $90 a month for a $200K policy

- Rates vary by home type, location, coverage, credit score, and claims history

- Lower your home insurance premiums by comparing quotes and discounts

We compared homeowners insurance rate information from several top-rated insurers to show typical home insurance costs from the best home insurance companies. If you want to see how those rates compare to what you may pay, you can quickly compare free insurance quotes and see real prices in 2 minutes or less.

We’ll also explain how homeowners insurance works, and what you’ll likely pay based on where you live.

Average Cost of Homeowners Insurance

Home insurance rates vary based on several factors tied to your home and you as the homeowner, including location, the age and construction of the property, replacement value, claims history, credit score, and the coverage limits and deductibles you choose.

The average cost of home insurance for a $200K dwelling ranges from $60 to $90 a month. USAA has the cheapest home insurance, starting at just $60 a month.

Home Insurance Monthly Rates by Dwelling Coverage| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $85 | $175 | $258 | $400 | |

| $81 | $115 | $175 | $310 |

| $86 | $120 | $150 | $179 |

| $90 | $266 | $366 | $570 | |

| $75 | $110 | $170 | $300 | |

| $79 | $115 | $140 | $168 | |

| $88 | $151 | $189 | $300 | |

| $80 | $129 | $156 | $184 | |

| $86 | $175 | $280 | $425 | |

| $70 | $126 | $209 | $335 |

Comparing home insurance quotes can help you find the best rate for the coverage you need.

Your dwelling coverage has a big impact on what you pay. Homes with higher replacement costs usually cost more to insure, since rebuilding after a covered loss is more expensive.

As dwelling coverage limits go up, monthly premiums usually rise as well.

While higher deductibles can reduce monthly premiums, choosing a deductible that’s too high could create financial strain after a claim.

Michelle Robbins Licensed Insurance Agent

Your deductible also plays a key role in your homeowners insurance rate.

Choosing a higher deductible often lowers your monthly cost since you’re agreeing to pay more out of pocket when you file a claim. A lower deductible typically means higher monthly premiums but less upfront expense after a loss.

Home Insurance Monthly Rates by Deductible Amount| Company | $500 | $1K | $1.5K | $2K |

|---|---|---|---|---|

| $85 | $80 | $76 | $72 | |

| $81 | $76 | $72 | $68 |

| $86 | $81 | $77 | $73 |

| $90 | $85 | $81 | $77 | |

| $75 | $70 | $67 | $64 | |

| $79 | $74 | $70 | $67 | |

| $88 | $83 | $79 | $75 | |

| $80 | $75 | $71 | $68 | |

| $86 | $81 | $77 | $73 | |

| $70 | $66 | $63 | $60 |

Credit score is another factor many insurance companies use when setting homeowners insurance rates. Homeowners with higher credit scores often pay less, while lower scores can lead to higher monthly costs.

Insurers use credit-based information to help predict overall risk. Fortunately, homeowners with improving credit scores may see lower home insurance rates over time.

Home Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $94 | $97 | $101 | $108 | |

| $91 | $94 | $98 | $105 |

| $96 | $99 | $104 | $110 |

| $101 | $104 | $109 | $117 | |

| $84 | $87 | $91 | $97 | |

| $99 | $102 | $107 | $114 | |

| $99 | $102 | $107 | $114 | |

| $98 | $101 | $106 | $113 | |

| $92 | $95 | $100 | $107 | |

| $80 | $82 | $86 | $92 |

Maintaining continuous homeowners insurance coverage without gaps can help keep rates lower, since insurers often see uninterrupted coverage as a sign of lower risk.

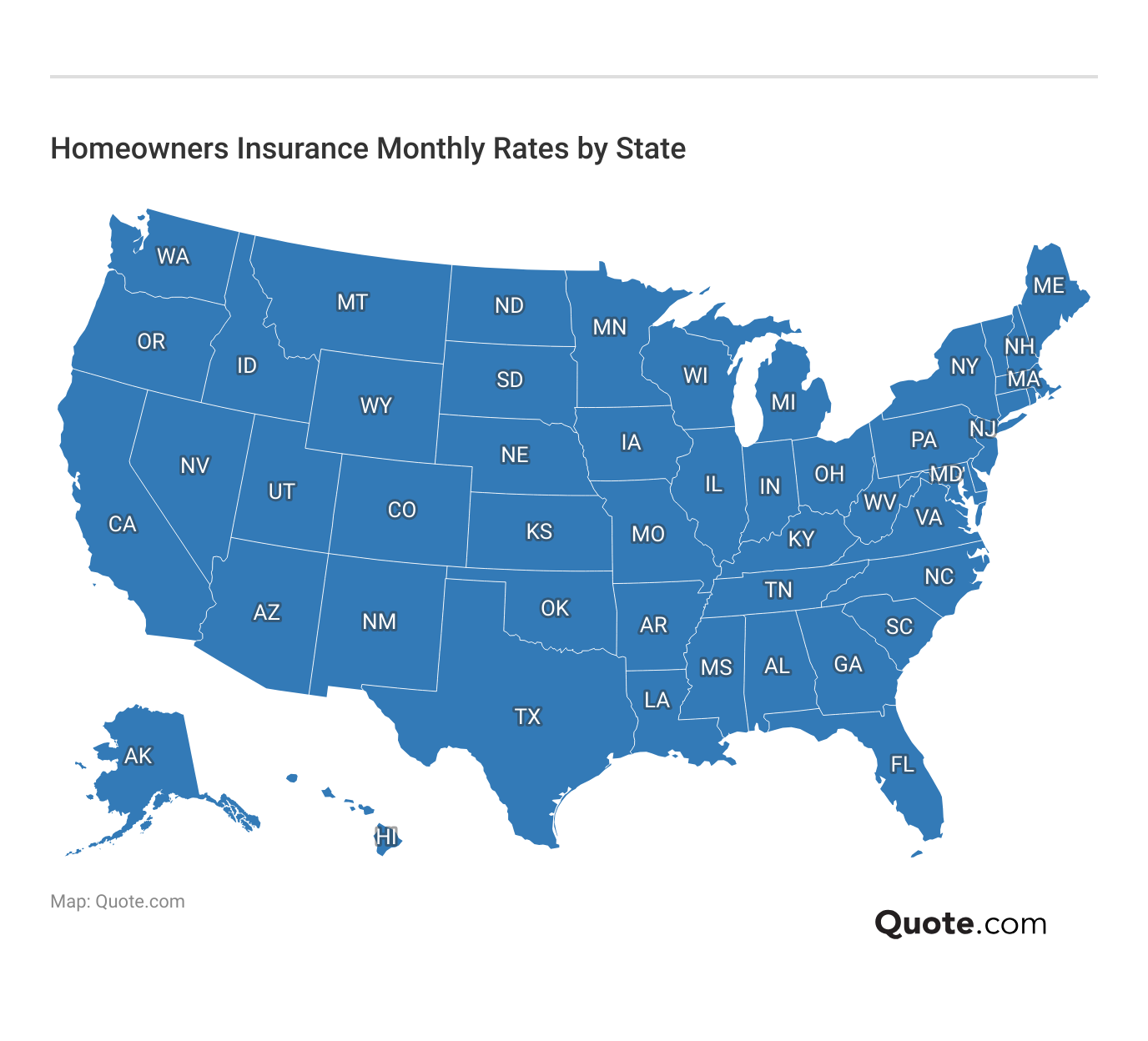

Where you live also has a major impact on your home insurance premiums. Regional weather risk, claim frequency, and state laws all affect what homeowners pay. Often, states with frequent storms or other natural disasters see higher rates.

Compare Costs: Home Insurance Rates by State

The age of your roof, plumbing, electrical systems, and HVAC equipment can affect your premium, since older or poorly maintained systems are more likely to fail and lead to claims.

Updating major systems or providing proof of recent upgrades may help lower your home insurance rate with some insurers.

Looking at these factors together helps explain your homeowners insurance quote and how you could lower your rate. Comparing quotes with different coverage limits and deductibles can help you find a homeowners insurance policy that fits your budget while still giving your home the protection it needs.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Impact Home Insurance Premiums

The cost of home insurance can vary based on several factors. Here are the most common ones that you can expect to affect how much you pay:

- Weather Risk: Insurers consider where your home is located. Some areas and states face higher risks from hurricanes, floods, earthquakes, or tornadoes, leading to higher home insurance rates.

- Crime Rates: The level of crime in your area can influence your premium. Homes in areas with higher theft or vandalism rates usually cost more to insure.

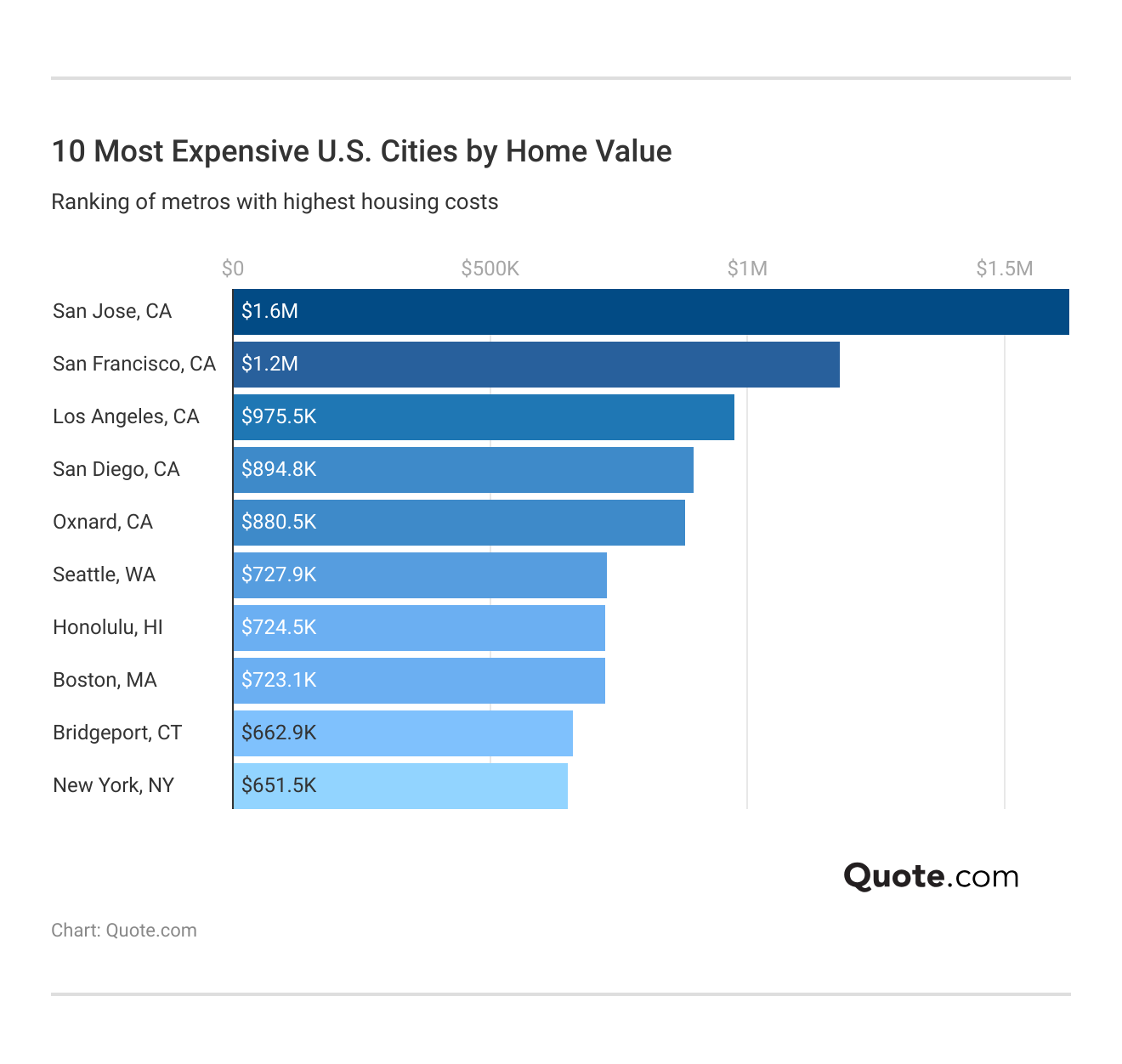

- Home Value: Your home’s value and rebuild cost strongly impact rates, especially when comparing the best home insurance for high-value properties.

- Home’s Age: Older homes are often more expensive to insure because aging materials, plumbing, or electrical systems are more likely to fail and cause damage.

- Claims History: Insurance companies review how often you’ve filed claims in the past. A history of frequent claims can signal higher risk and lead to higher premiums.

How much homeowners insurance you need also plays a big role in what you’ll pay. Higher dwelling limits, more personal property coverage, and optional endorsements give you more protection, but they also raise your premium.

Another factor is your insurance score. Simply put, it reflects how likely you are to file a future claim based on your claims history and credit score.

William Lemmon Principal Broker

Choosing only the coverage that fits your situation can help keep home insurance rates more affordable.

Statistically, it’s proven that the lower your credit score, the more likely you are to file an insurance claim, so insurers offer lower rates if you have good credit.

In the end, your insurance score plays a huge role in how much you’re ultimately charged for insurance.

To get the most favorable rates, limit the number of claims you file, and work to improve your credit before you enter into homeownership.

How to Estimate Homeowners Insurance Rates

Estimating home insurance premiums is a smart move when you’re preparing to buy a home. Understanding the key factors that affect cost can help you choose the right coverage and avoid surprises when it’s time to buy home insurance.

Step #1: Review Your Home’s Details

Start by estimating your home’s replacement cost. This is how much it would cost to rebuild your home today, not what you paid for it. Replacement cost matters more than the purchase price, especially for older homes, since construction and labor costs tend to rise over time.

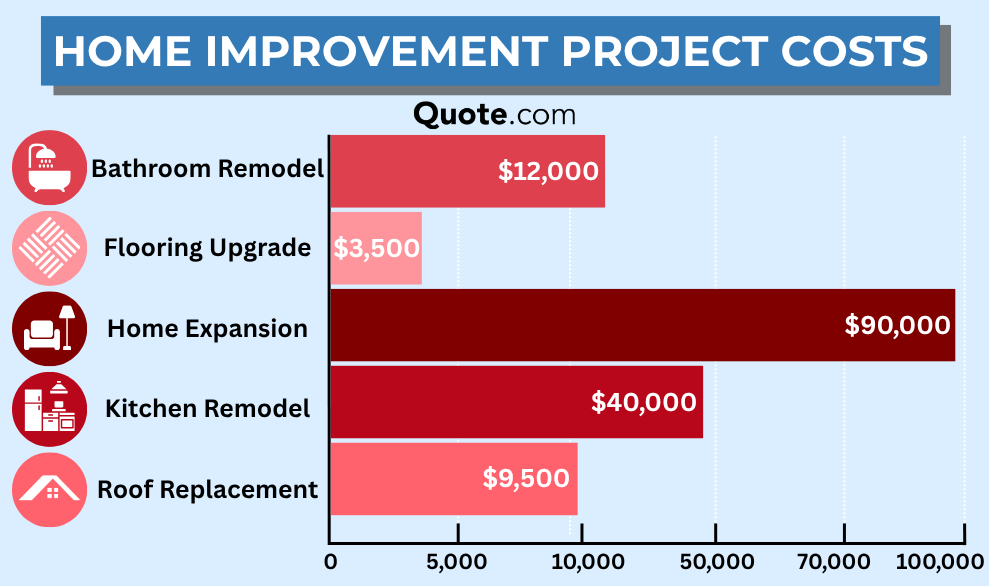

Major upgrades like kitchen remodels, home expansions, or roof replacements can significantly increase your home’s replacement cost, which is why these project costs matter when estimating coverage. Learn More: Walk-In Tubs & Home Insurance

Using real-world renovation figures helps ensure you don’t underinsure your home and end up paying out of pocket after a covered loss. An insurance agent can calculate this for you, or you can do a home insurance estimate by multiplying local building costs per square foot by your home’s total size.

Step #2: Choose the Right Coverage Levels

Next, decide how much coverage you need for personal property and liability. Make a list of items you’d want to replace after a loss, such as furniture, electronics, clothing, and valuables.

You’ll also want to check whether your policy covers personal property at replacement cost or actual cash value, since replacement cost usually offers better protection after a loss.

Personal liability coverage matters just as much because it helps protect you financially if someone is injured on your property and files a claim or lawsuit.

Choosing the right deductible also matters. A higher deductible can lower your premium, but it means you’ll pay more out of pocket if you file a claim.

Step #3: Compare Multiple Insurance Quotes

When comparing homeowners insurance quotes, make sure each quote uses the same coverage limits and deductible so you’re comparing policies accurately. Once you know your coverage needs, use an online home insurance calculator to compare quotes from top providers.

Many insurers offer discounts for bundling home and auto insurance, installing security systems, or maintaining a claims-free history, which can significantly reduce your premium.

Get a free homeowners insurance estimate with our online quote tool and see how much you could save by comparing rates from top insurance companies. Reviewing your homeowners insurance coverage every six months or after major life changes also helps ensure your policy still matches your needs and home value.

Types of Homeowners Insurance Coverage

The final thing you should know is that homeowners insurance isn’t a one-size-fits-all kind of deal.

There are different types of homeowners insurance for different needs, ranging from HO-1 to HO-8. HO-3 policies are the most popular, covering a wide range of perils like fire, wind, and theft. It insures your home, any attached structures, your belongings, and also includes personal liability coverage.

Types of Home Insurance Policies| Type | Policy | What it Covers |

|---|---|---|

| HO-1 | Basic | Perils like fire, theft, & falling objects |

| HO-2 | Broad | HO-1 perils + water damage, surges |

| HO-3 | Special | All perils except noted exclusions |

| HO-4 | Contents | Renters: Covers items and liability |

| HO-5 | Comprehensive | HO-3 perils at replacement value |

| HO-6 | Unit-Owners | Condos: Covers items and liability |

| HO-7 | Mobile Home | Mobile home coverage like HO-3 |

| HO-8 | Modified | Homes 40+ years old or historic |

Since different factors that could change throughout the life of your home, it’s always a good idea to review your insurance policy every six months. For example, the crime rate in your area might change, or your home may become older and become more prone to damage and repairs.

Most homeowners insurance policies include a standard set of coverages designed to protect your home, your belongings, and your finances.

While coverage details can vary by insurer, these are the most common types you’ll find in a typical policy:

- Dwelling: Pays to repair or rebuild your home’s structure, including walls, roof, plumbing, electrical wiring, heating, and central air systems.

- Loss of Use: Covers additional living expenses if your home becomes uninhabitable after a covered loss, such as hotel stays and temporary housing.

- Medical Payments: Pays medical expenses, up to a set limit, for guests who are injured on your property, regardless of fault.

- Other Structures: Covers structures on your property that aren’t attached to your home, such as sheds, fences, and detached garages.

- Personal Liability: Protects you financially if someone is injured on your property and files a claim or lawsuit against you. Read More: Personal Liability Insurance

- Personal Property: Helps replace items in your home, such as furniture, electronics, appliances, clothing, and personal belongings.

Standard homeowners insurance coverage generally doesn’t cover floods or earthquakes, so you’ll need a separate policy or endorsement for protection against those risks.

When choosing coverage, make sure your dwelling limit is high enough to cover 100% of your home’s rebuild cost so you’re fully protected if the worst happens.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get a Free Home Insurance Quote Today

Homeowners insurance premiums start at just $60 per month but vary based on factors like home value, location, and claims history.

To get an accurate estimate for how much you’ll pay, find out how much it would cost to replace your home and cover liability costs. Also, consider how much your valuables are worth to ensure they’re properly covered.

Of course, if you’re paying more than you’d like for coverage that doesn’t meet your needs, you can always find a better deal by comparing quotes. That’s where our free homeowners insurance quote tool might come in handy.

Frequently Asked Questions

How much does home insurance cost?

The average cost of home insurance typically ranges from $60 to $175 for most homeowners, based on common dwelling coverage amounts. Homes insured for around $200K often fall near the lower end, while $300K homes trend closer to the middle of that range.

Higher coverage levels and lower deductibles can push monthly costs above $200. Your final home insurance rate depends on location, coverage options, claims history, and other factors.

How much is home insurance on a $200,000 house?

Home insurance on a $200,000 house usually costs between $60 and $90 per month, though it varies by coverage and other factors.

How much is home insurance on a $300,000 house?

For a $300,000 home, monthly home insurance rates often range from $110 to $266. However, the exact price depends on rebuild costs, not just market value.

How much is home insurance on a $500,000 house?

Home insurance for a $500,000 house commonly runs from $140 to $366 per month. Higher-value homes cost more to rebuild, which raises coverage limits and premiums. Custom features, high-end materials, and added liability coverage can also increase costs.

Learn More: Best Home Insurance for High-Value Properties

What is homeowners insurance?

You’ve heard of car insurance, health insurance, but what is homeowners insurance? Homeowners insurance is a type of insurance policy that protects your house if something unexpected happens.

For example, if your house gets flooded, is burglarized, or a natural disaster, like a hurricane, strikes it, your homeowners’ policy would kick in. Comparing quotes with our free comparison tool can help you quickly see personalized rates and uncover potential savings.

How much home insurance do I need?

You need enough home insurance to cover the full cost to rebuild your home, not its market value. Most insurers recommend coverage equal to at least 100% of your home’s replacement cost.

Your personal property and personal liability limits should also reflect your financial situation and risk exposure. An insurance agent or online homeowners insurance calculator can help you fine-tune the right coverage amounts.

Who has the best home insurance rates?

USAA, Geico, and Nationwide often offer some of the best home insurance rates, though pricing still depends on your location, home type, and personal profile.

Large national insurers may have lower base rates, while regional companies can offer competitive local pricing.

Bundling home and auto insurance can unlock discounts of 10% or more. To find the lowest provider, compare home insurance quotes from several companies.

How can I estimate the cost of home insurance?

You can estimate home insurance costs with our free online quote tool, but it helps to start with the right details. Base your estimate on your home’s replacement cost, not its market value, since this reflects what it would cost to rebuild after a covered loss.

Next, choose coverage limits for personal property and liability, along with a deductible that fits your budget. To get a realistic price range, compare home insurance quotes from multiple insurers using the same coverage levels and look for discounts that could lower your premium.

How can I lower my home insurance rates?

You can lower your home insurance rates by choosing a higher deductible or bundling your home and auto insurance with the same company. Making safety upgrades, such as installing security systems, updating your roof, or installing smoke detectors, can also reduce your premium.

Keeping good credit often helps you qualify for lower rates. It’s also smart to review your homeowners insurance coverage every year to make sure you’re not paying for more protection than you need.

Why are home insurance rates going up?

Home insurance rates are rising because the cost to repair or rebuild homes has increased. Construction materials and labor have become more expensive due to inflation, which raises replacement costs for insurers.

Severe weather, including storms, wildfires, and floods, is also occurring more frequently and resulting in more insurance claims. Read More: Best Insurance for High-Risk Homes

When insurers pay out more claims, they often pass those higher costs on to policyholders through higher premiums.

How does location affect home insurance rates?

How does credit affect home insurance rates?

What is the 80% rule in home insurance?

Does home insurance cover damage by rats?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.