Best Anti-Theft Auto Insurance Discounts in 2026

Geico, Progressive, and American Family offer the best anti-theft auto insurance discounts, with savings up to 25% for factory-installed or approved anti-theft devices. Geico applies the discount via VIN verification, while Progressive and AmFam offer savings for vehicles with passive anti-theft features.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated November 2025

The best anti-theft auto insurance discounts come from Geico, Progressive, and American Family. All three companies offer up to 25% off for qualifying security devices.

Our Top 10 Company Picks: Best Anti-Theft Auto Insurance Discounts| Company | Rank | A.M. Best | Anti-Theft | Recognized Devices |

|---|---|---|---|---|

| #1 | A++ | 25% | Factory or aftermarket alarms | |

| #2 | A+ | 25% | Factory or aftermarket alarms | |

| #3 | A | 25% | Active or passive disabling devices |

| #4 | A++ | 15% | Tracking devices like LoJack | |

| #5 | A++ | 15% | Factory-installed alarms | |

| #6 | A+ | 15% | Factory-installed alarms |

| #7 | A+ | 10% | Alarm or vehicle recovery system | |

| #8 | A+ | 10% | Built-in or aftermarket alarm or tracker |

| #9 | A | 10% | Active or passive disabling system | |

| #10 | A+ | 5% | Alarm or tracking system |

Geico is the top pick for its easy qualification process for passive or active factory-installed devices and broad availability across states. Scroll down to find out everything you need to know about Geico.

Progressive rewards drivers with advanced systems, including professional installations, while AmFam offers generous savings for both active and passive setups. If your car has built-in protection, these three companies can help you turn it into real savings.

- Factory-installed devices qualify for the best anti-theft insurance discounts

- Save more with insurers that accept passive, active, or GPS tracking systems

- Geico offers 25% off for passive disabling or alarm systems

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare rates from top insurers.

How to Qualify for Anti-Theft Auto Insurance Discounts

Anti-theft devices are an easy way to save money on car insurance, but you’ll get the most savings by meeting specific conditions insurers look for. Whether your car came equipped with built-in protection or you added aftermarket security, these steps can help you qualify for the full discount available:

- Install a Verified Anti-Theft Device: Choose a factory-installed immobilizer, alarm, or GPS tracker. If your car didn’t come with one, a professional installation can help you qualify.

- Check With Your Insurer: Not every device will earn you a discount. Call your insurance company to confirm your system meets their requirements before you install it.

- Keep Proof of Installation: If you added the device later, save your receipt, installation certificate, or a clear photo. Some insurers verify built-in devices by checking your VIN.

- Ask Your Provider to Apply the Discount: Some insurers apply it automatically, but others need you to ask. Call your agent or update your policy online once your device is installed.

- Review Your Policy: Once your insurer processes the request, check your billing statement or quote to make sure the discount shows up. If it doesn’t, follow up.

Pairing these steps with a top insurer like Geico, Progressive, or American Family Insurance can help you unlock up to 25% in anti-theft savings.

If your car has an approved anti-theft device, ask your insurer directly which documentation is needed to apply the discount. It’s often overlooked but easy to qualify for.

Jeff Root Licensed Insurance Agent

Just make sure your device is eligible, your paperwork is ready, and your insurer supports the type of system you’re using. Before committing, get multiple auto insurance quotes to see which provider offers the best discount for your setup. With the right combination, those premium reductions can add up quickly.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Companies With The Best Anti-Theft Auto Insurance Discounts

If you’re trying to save on car insurance with an anti-theft discount, start by making sure your device qualifies for an anti-theft device car insurance discount and that your paperwork is in order. This means confirming your security system meets your insurer’s requirements and providing proof of installation when needed.

Auto Insurance Monthly Rates With Anti-Theft Discount| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $98 | $88 | |

| $100 | $75 |

| $93 | $79 |

| $97 | $87 | |

| $102 | $77 | |

| $96 | $91 | |

| $99 | $74 | |

| $95 | $81 | |

| $94 | $85 |

| $92 | $78 |

Geico offers some of the biggest savings, dropping rates from $102 to $77 a month when you have the right security system. American Family and Erie follow close behind, cutting rates to around $75 and $79. Larger insurers like State Farm and Nationwide also lower your costs, though their after-discount rates sit a little higher at $81 and $91.

Top Auto Insurance Discounts| Company | Anti-Theft | Bundling | Claims-Free | Good Driver | Low Mileage |

|---|---|---|---|---|---|

| 10% | 25% | 10% | 25% | 30% | |

| 25% | 25% | 15% | 25% | 20% |

| 15% | 25% | 10% | 23% | 30% |

| 10% | 20% | 9% | 30% | 10% | |

| 25% | 25% | 12% | 26% | 30% | |

| 5% | 20% | 14% | 40% | 20% | |

| 25% | 10% | 10% | 30% | 30% | |

| 15% | 17% | 11% | 25% | 30% | |

| 10% | 5% | 12% | 15% | 10% |

| 15% | 13% | 13% | 10% | 20% |

If you’re a safe driver, you could save even more. Companies like American Family and Progressive offer some of the best auto insurance for good drivers, with up to 30% off for safe driving and extra discounts for avoiding accidents and claims.

No matter which company you’re considering, it’s smart to check for other savings you can combine with your anti-theft discount to lower your rate even further.

Types of Anti-Theft Devices That Get You a Discount

If you’re serious about saving on your policy, focus on the car insurance discounts you can’t miss—and anti-theft savings are one of them. But not every device qualifies. Insurers reward features that either stop a theft from happening or help recover your car quickly. Here are five of the most common options they’ll accept:

- VIN Etching: Marking your vehicle’s VIN on the windows makes your car harder to resell, and some insurers give you a discount for it.

- GPS Tracking Systems: Tools like LoJack and OnStar help recover your car if it’s stolen, often earning you bigger savings.

- Engine Immobilizers: Built into many modern vehicles, these prevent your engine from starting without the right key or code.

- Disabling Devices: Car alarms, kill switches, and steering wheel locks make it harder for thieves to drive off with your car.

- Remote or Passive Disabling Systems: These activate automatically when you turn off your car or allow you to disable the engine remotely if it is stolen.

If you want to cut your insurance bill, these devices are a great place to start. The more secure your car is—and the easier it is for your insurer to confirm that protection—the better your chances of getting a meaningful discount.

Always check with your insurance company to make sure your specific device qualifies. With the right anti-theft setup, you’re not just protecting your car; you’re also taking a simple, smart step toward lowering your monthly payments.

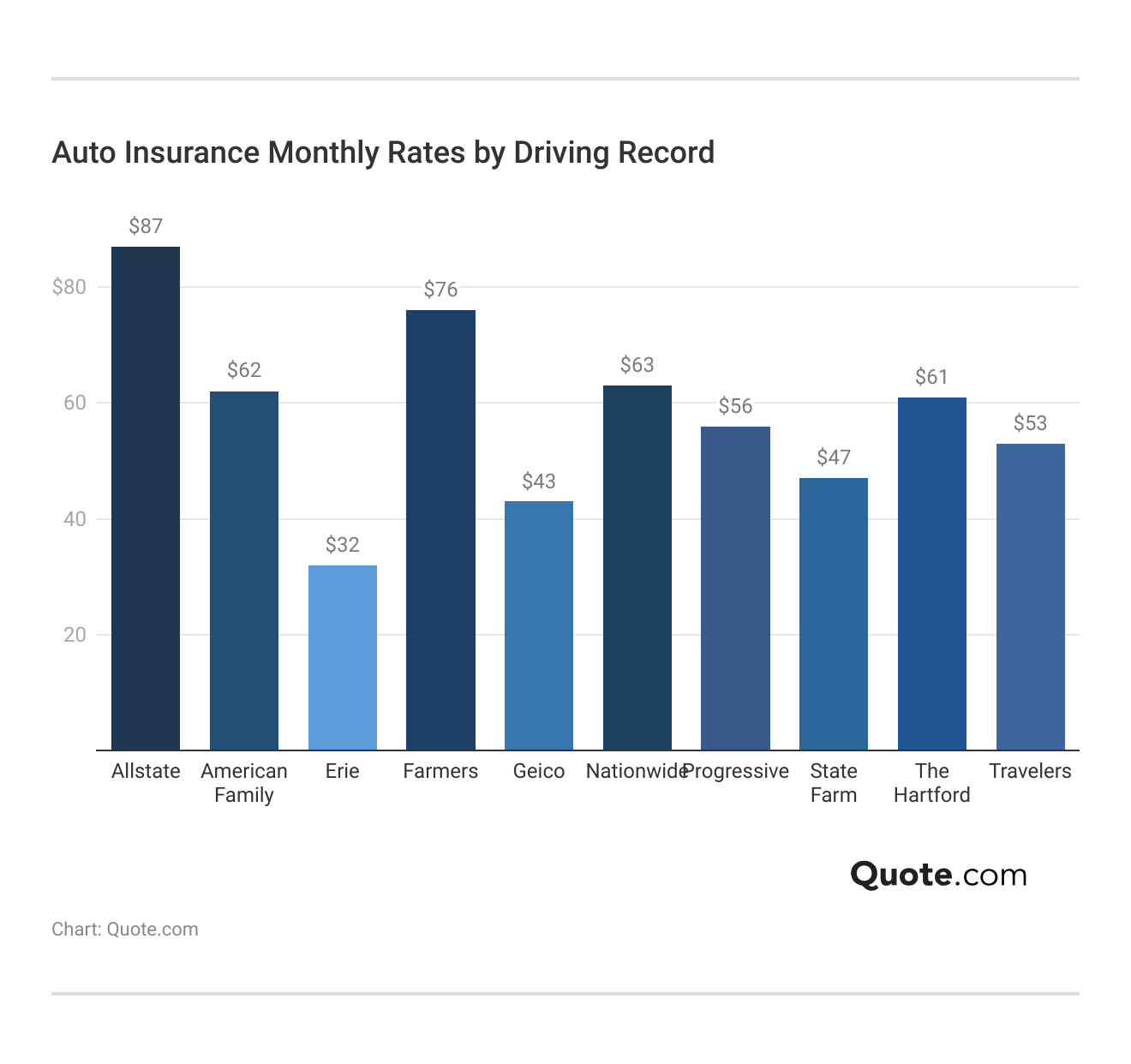

Anti-Theft Insurance Rate Comparison by Driving Record

The best anti-theft auto insurance discounts can lower your monthly rates, even if you have a less-than-perfect driving record. Geico, American Family, and Progressive lead the way by offering strong 25% anti-theft discounts along with affordable rates.

After applying the discount, Geico’s rates average around $72 a month for a clean record, $88 with a ticket, and $91 after a DUI. American Family offers similar savings, with rates of about $62 a month for clean drivers and $73 with a ticket.

Progressive stays competitive too, dropping rates to $56 a month with a clean record, $98 with an accident, and $75 after a DUI. If you’re searching for cheap auto insurance for high-risk drivers, these three companies deliver some of the best savings when you combine anti-theft discounts with other available offers.

Anti-Theft Insurance Rate Comparison by Age & Gender

If you’re searching for the best anti-theft auto insurance discounts, some companies stand out for giving younger and older drivers the lowest rates after savings are applied. Erie, Geico, and American Family lead the pack for young drivers. With the anti-theft discount included, Erie’s rates drop to $311 per month for 18-year-old females and $332 for males, while rates for seniors fall as low as $82 per month.

Auto Insurance Monthly Rates by Age & Gender With Anti-Theft Discount| Company | Female: Age 18 | Male: Age 18 | Female: Age 30 | Male: Age 30 | Female: Age 45 | Male: Age 45 | Female: Age 65 | Male: Age 65 |

|---|---|---|---|---|---|---|---|---|

| $740 | $640 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 |

| $311 | $332 | $90 | $94 | $84 | $83 | $82 | $82 |

| $1,156 | $1,103 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $425 | $445 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $586 | $679 | $177 | $194 | $161 | $164 | $158 | $160 | |

| $156 | $147 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $444 | $498 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $787 | $824 | $180 | $190 | $164 | $161 | $159 | $156 |

| $1,026 | $1,298 | $142 | $154 | $139 | $141 | $136 | $138 |

American Family Insurance also offers strong savings across age groups, lowering rates to $435 for 18-year-old females and $163 for 65-year-old males. Geico’s 25% anti-theft discount keeps it competitive too—young drivers under 30 pay between $425 and $445 a month, while rates for 65-year-olds drop to around $112.

Even for middle-aged drivers, savings hold up: rates range from $114 to $128 per month. If you’re looking to stretch your budget, these companies deliver some of the best anti-theft auto insurance discounts available, helping drivers of all ages lower their monthly payments with qualifying security features.

Types of Anti-Theft Devices

When it comes to protecting your car and lowering your insurance bill, anti-theft devices actually help. Some are built into newer cars, while others you can add yourself. Here’s how the most common ones work and why they matter to your insurer:

- Engine Immobilizers: Built into most modern cars, these stop the engine from starting without the right key or chip, making hotwiring nearly impossible.

- Car Alarms: Alarms use motion and door sensors to detect break-in attempts. If someone tries to force their way in, the alarm triggers a loud siren to scare off the thief and alert anyone nearby.

- GPS Tracking Systems: Tools like LoJack or OnStar help locate your car quickly if it’s stolen. Some systems allow you to track your vehicle in real-time, while others can disable the engine remotely.

- Steering Wheel Locks and Kill Switches: These manual devices block the steering wheel or shut off the car’s power, making it harder for thieves to steal your car.

- VIN Etching and Window Security Film: VIN etching makes your car harder to resell, while security film strengthens windows to prevent easy break-ins.

If you’re piecing together your own guide to auto insurance, anti-theft devices and other safety features in your vehicle belong near the top of your checklist.

They protect your car, reduce your theft risk, and help you qualify for some of the easiest discounts available. Always confirm with your insurer to make sure your device qualifies for savings.

How to Get an Anti-Theft Discount

One of the easiest ways to save money on car insurance is by adding anti-theft features to your vehicle. By protecting your car with the right security features and letting your insurer know, you can cut your rates and lower your theft risk at the same time.

Installing a factory-equipped or insurer-approved anti-theft device is one of the easiest ways to qualify for a 25% discount without changing your coverage.

Melanie Musson Published Insurance Expert

These discounts aren’t automatic for everyone, so understanding how to confirm eligibility with your insurer is key. The more proactive you are about protecting your vehicle through verified devices, proper documentation, and policy coverage, the more likely you are to benefit from anti-theft discounts on car insurance.

With the right setup, you’re not only improving your car’s security but also putting yourself in a stronger position to lower your premium over the long term. Enter your ZIP code into our free quote tool to find the best auto insurance companies with anti-theft discounts near you.

Frequently Asked Questions

Is insurance cheaper if you have anti-theft devices?

Yes, adding anti-theft devices can lower your car insurance rates by 5% to 25%, depending on the insurer and the type of device. For example, Geico applies up to 25% off when your vehicle has a qualifying factory-installed immobilizer or GPS tracker, while State Farm and Progressive offer smaller discounts for alarms and disabling systems.

Is vehicle theft protection worth it?

Vehicle theft protection is worth it if you want to lower both your theft risk and your car insurance premium. On average, insurers like Progressive and American Family give up to 25% off for verified anti-theft devices. Plus, vehicles with theft protection are less likely to be stolen, saving you from paying a deductible or replacing your car.

How much does an anti-theft device save on insurance?

Discounts typically range from 3% to 25%, depending on your insurer and the type of anti-theft device installed. For example, Geico offers up to 23% off for verified systems, helping drivers access some of the cheapest car insurance available. Erie also reduces full coverage rates by about $15 per month for qualifying devices.

What is the best insurance for car theft?

Geico, Progressive, and State Farm are among the best companies for car theft protection. Geico offers up to 25% off for qualifying anti-theft devices, Progressive rewards drivers with advanced systems like LoJack, and State Farm includes theft protection under comprehensive coverage with available anti-theft discounts.

Does car insurance cover auto theft?

Yes, but only if you have comprehensive coverage. This protection covers the value of your car if it’s stolen, minus your deductible. Adding anti-theft devices can lower your comprehensive premium. Geico, for example, applies up to a 25% discount for factory-installed security systems that meet their eligibility criteria.

Do anti-theft devices for cars actually work?

Yes, and insurers track the data. Cars with active or passive anti-theft systems are less likely to be stolen, which is why providers like Geico and Progressive auto insurance offer tiered premium reductions for qualifying security features.

What is the anti-theft discount at State Farm?

The anti-theft discount State Farm offers is typically up to 15%, depending on your state and the type of security device installed. Factory-installed alarms and engine immobilizers are the most commonly accepted devices, but some tracking systems may also qualify.

How does the Progressive anti-theft discount work?

The Progressive anti-theft discount applies when you install a qualifying security system like an immobilizer or GPS tracker. Savings can reach up to 25%, but the exact amount varies by location and the system type. Progressive may require proof of installation to apply the full discount.

Which anti-theft device is best for getting an insurance discount?

The best car insurance companies typically offer the largest discounts — some up to 25% off — for professionally installed GPS tracking systems and passive immobilizers, especially when these systems are factory-installed and supported by proper documentation. Choosing a top-rated provider ensures you’re more likely to qualify for the full discount.

What’s on the State Farm discounts list besides anti-theft savings?

The State Farm discounts list includes anti-theft savings (up to 15%), multi-policy savings (up to 17%), safe driver discounts (up to 25%), and low-mileage discounts (up to 30%). These discounts can be stacked to reduce your premium further if you qualify.

Find the best auto insurance rates by entering your ZIP code into our comparison tool today.

Is the State Farm senior discount worth it if I have anti-theft protection?

How much is theft protection on car insurance?

What is the Geico anti-theft device 25 combination?

What are the Geico anti-theft device categories?

What is the best anti-theft device for car insurance discounts?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.