10 Best Auto Insurance Companies in Pennsylvania (2026)

Erie, AAA, and State Farm are the best auto insurance companies in Pennsylvania, with rates starting at just $28 per month. These top three Pennsylvania providers offer strong customer satisfaction, affordable add-ons like roadside assistance, and meet the state’s 15/30/5 minimum liability coverage requirements.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated November 2025

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe best auto insurance companies in Pennsylvania are Erie, AAA, and State Farm. Erie stands out as the top overall pick for its outstanding customer service.

Our Top 10 Picks: Best Auto Insurance Companies in Pennsylvania| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 713 / 1,000 | A+ | Customer Service | Erie |

| #2 | 667 / 1,000 | A | Senior Drivers | AAA |

| #3 | 652 / 1,000 | A++ | Agency Network | State Farm | |

| #4 | 647 / 1,000 | A++ | Government Discounts | Geico | |

| #5 | 642 / 1,000 | A+ | Coverage Options | Nationwide | |

| #6 | 634 / 1,000 | A | Accident Forgiveness | Liberty Mutual |

| #7 | 628 / 1,000 | A++ | Discount Options | Travelers | |

| #8 | 624 / 1,000 | A+ | Local Agents | Allstate | |

| #9 | 624 / 1,000 | A+ | Loyalty Programs | Progressive | |

| #10 | 610 / 1,000 | A | Family Plans | Farmers |

Erie also has the cheapest car insurance in PA at just $28 per month. AAA is a strong choice for senior drivers thanks to its tailored discounts, while State Farm combines affordable rates backed by a reliable agency network.

Keep reading to compare all ten top-rated providers to find cheap car insurance companies in Pennsylvania that meet your needs.

- The best auto insurance companies in PA serve seniors and high-risk drivers

- Erie offers the cheapest rates at $28 a month and top-rated customer service

- PA insurance law requires 15/30/5 liability, $5,000 PIP, and UM/UIM coverage

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Auto Insurance Rates in Pennsylvania

Minimum PA auto insurance rates range from as low as $28 monthly to as high as $117 per month, with Erie having the lowest car insurance rates in Pennsylvania at $28 per month.

Pennsylvania Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $63 | $123 |

| $79 | $237 | |

| $28 | $96 |

| $70 | $210 | |

| $36 | $109 | |

| $117 | $351 |

| $46 | $138 | |

| $79 | $238 | |

| $41 | $122 | |

| $40 | $121 |

Geico follows with affordable monthly rates at $36 for minimum and $109 for full coverage, while State Farm also remains budget-friendly at $41 and $122 per month, respectively. However, Erie policyholders can add Rate Lock to keep their cheap rates after an accident or claim.

Compared to the top companies, AAA is more expensive, but it includes free roadside assistance and other perks that other companies on this list don’t offer. Keep reading to get more quotes and find the cheapest car insurance in PA based on your driving profile.

Read More: What to Do if You Can’t Afford Your Auto Insurance

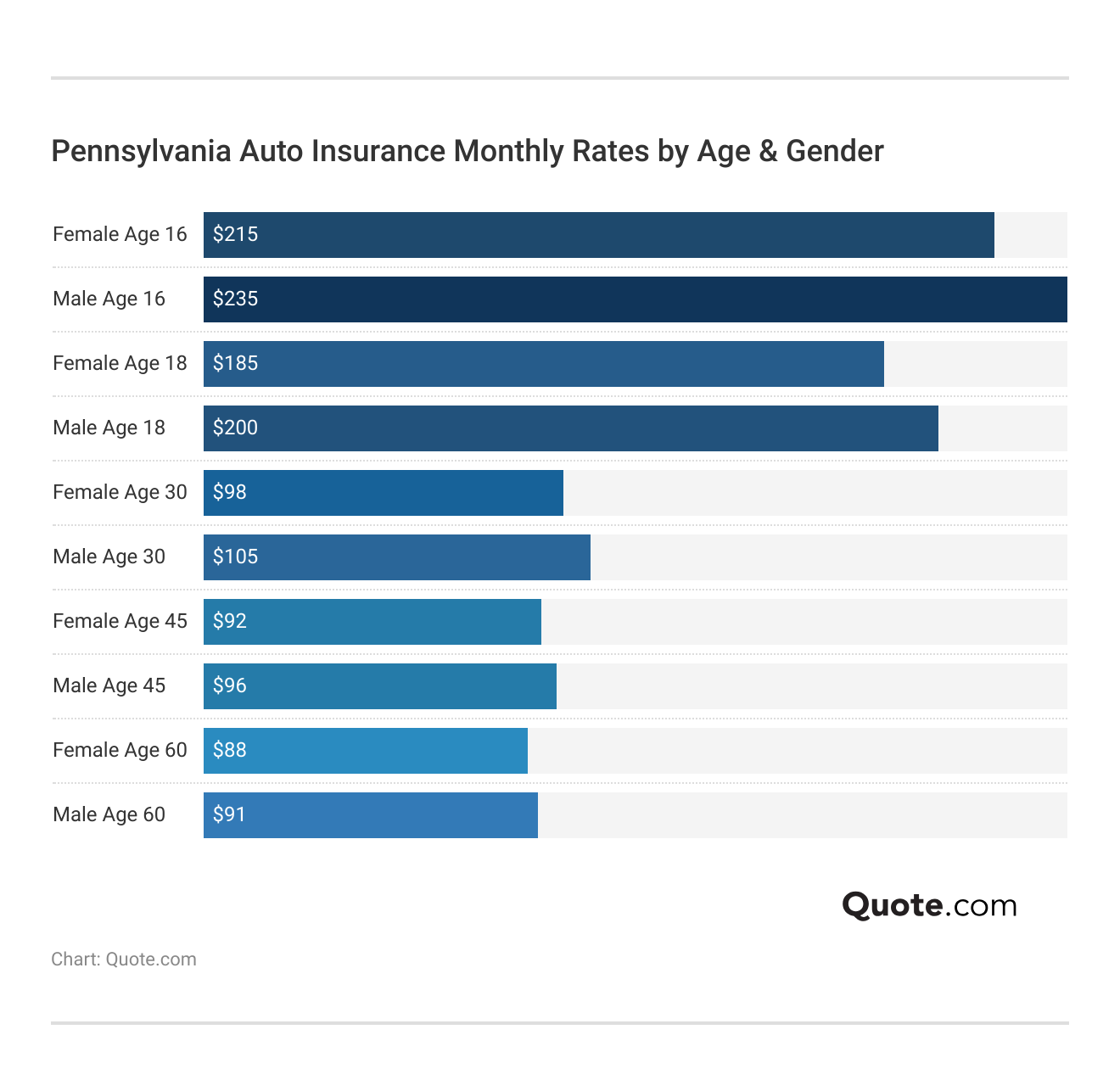

PA Auto Insurance Rates by Age and Gender

Teen drivers in Pennsylvania face the highest auto insurance costs, with 16-year-old males averaging $235 per month and females $215 monthly. Rates gradually decrease with age, dropping to $105 for 30-year-old males and $98 for females.

By age 60, premiums are significantly lower, averaging just $91 for men and $88 for women, reflecting the reduced risk associated with older, more experienced drivers. This age-based pricing highlights how Pennsylvania insurers assess risk and reward safe driving history over time. Explore our tips to pay less for car insurance to stay covered without overspending.

PA Auto Insurance Rates by Driving Record

Driving record plays a major role in determining auto insurance rates in Pennsylvania, with premiums rising sharply after violations. Erie offers the lowest rate for drivers with a clean record at just $28 per month, while State Farm remains the most forgiving overall, with only minor increases across accident, DUI, and ticket categories.

Pennsylvania Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $63 | $118 | $145 | $83 |

| $79 | $103 | $228 | $228 | |

| $28 | $117 | $172 | $117 |

| $70 | $99 | $106 | $95 | |

| $36 | $61 | $50 | $50 | |

| $117 | $160 | $144 | $144 |

| $46 | $74 | $103 | $67 | |

| $79 | $141 | $291 | $168 | |

| $41 | $48 | $45 | $45 | |

| $40 | $64 | $145 | $122 |

In contrast, Progressive and Allstate impose steep penalties, with DUI rates jumping to $291 and $228 per month, respectively. Geico stands out for maintaining relatively stable pricing even after a DUI or ticket, offering rates as low as $50. For Pennsylvania drivers, maintaining a clean record is key to keeping premiums low, especially when comparing auto insurance companies with vastly different penalty structures.

Overall, Pennsylvania earns moderate marks across several insurance risk categories. The state’s B+ grade for weather-related risks points to common winter hazards like snow and ice, while traffic density and theft rates also affect premiums.

Pennsylvania Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | B+ | Snow and ice contribute to claims |

| Traffic Density | B | High volume of cars on roads |

| Vehicle Theft Rate | B- | Theft rates slightly above average |

| Average Claim Size | C | Moderate claim amounts on average |

With an average claim size rated C, Pennsylvania drivers should consider balancing affordability with adequate coverage to handle frequent and costly incidents. Rear-end collisions and weather-related damage are the most frequent auto insurance claims in Pennsylvania, highlighting the importance of maintaining full coverage that includes comprehensive and collision auto insurance.

5 Most Common Auto Insurance Claims in Pennsylvania| Rank | Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|---|

| #1 | Rear-End Collisions | 30% | $3,500 |

| #2 | Weather-Related Damage | 25% | $4,000 |

| #3 | Parking Lot Damage | 20% | $2,500 |

| #4 | Theft or Vandalism | 15% | $6,000 |

| #5 | T-bone Collisions | 10% | $7,500 |

Claims activity directly influences auto insurance premiums in Pennsylvania. While common incidents like parking lot damage are lower in cost, more severe claims, such as theft or T-bone collisions, lead to significantly higher repair bills.

To file a car insurance claim in PA, contact your insurer, document damage, gather witness info, and submit through the app or hotline within 24 hours.

Chris Abrams Licensed Insurance Agent

Additionally, where you live in Pennsylvania plays a major role in determining your premium. When drivers file claims in one area, especially those involving high-cost damage or injuries, insurers adjust rates to account for increased risk. In areas with high traffic density, harsh winters, or elevated crime rates, like Philadelphia and Pittsburgh, drivers face more exposure to risks like rear-end collisions, icy road incidents, and vehicle theft.

Pennsylvania Annual Traffic Accidents & Claims by Major City| City | Annual Accidents | Annual Claims |

|---|---|---|

| Allentown | 5,500 | 3,000 |

| Bethlehem | 3,800 | 2,500 |

| Erie | 1,800 | 1,000 |

| Harrisburg | 5,000 | 3,500 |

| Lancaster | 4,500 | 3,000 |

| Philadelphia | 25,000 | 15,000 |

| Pittsburgh | 12,000 | 8,000 |

| Reading | 4,000 | 2,500 |

| Scranton | 3,000 | 2,000 |

| York | 3,500 | 2,500 |

Even in smaller cities like Erie, York, and Scranton, thousands of claims are still filed each year, reinforcing the importance of carrying sufficient auto insurance coverage statewide. Understanding these patterns helps explain why rates vary widely between Pennsylvania cities and even ZIP codes.

Learn More: Worst States for Filing Auto Insurance Claims

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pennsylvania Auto Insurance Requirements

Pennsylvania law requires all drivers to carry minimum levels of liability, medical, and uninsured motorist coverage. The table below outlines the required minimum coverage to remain legal and protected on Pennsylvania roads.

Pennsylvania Auto Insurance Minimum Coverage Requirements| Coverage | Limits |

|---|---|

| Bodily Injury Liability (BI) | $15,000 per person / $30,000 per accident |

| Property Damage Liability (PD) | $5,000 per accident |

| First‑Party Benefits (FPB) | $5,000 per person |

| Uninsured / Underinsured Motorist (UM/UIM) | $15,000 per person / $30,000 per accident |

These baseline limits are designed to help drivers cover essential damages and injuries resulting from an accident, including medical expenses, property damage, and losses caused by uninsured or underinsured motorists.

Pennsylvania is a no-fault insurance state, requiring drivers to use their own coverage for medical expenses after an accident, regardless of who was at fault. This includes first-party benefits (FPB), which covers at least $5,000 in medical costs. It’s similar to personal injury protection (PIP) policies in other no-fault states.

Pennsylvania Auto Insurance Coverage Options

In addition to the state’s minimum coverage requirements, the table below provides a complete list of optional coverages available to Pennsylvania drivers. These include important protections like collision and comprehensive coverage, full and limited tort options, and extras such as rental reimbursement, towing, and gap insurance.

Common Auto Insurance Coverage Options| Coverage | What It Covers |

|---|---|

| Liability | Others’ injuries or damage when at fault |

| Collision | Your car damage after a crash |

| Comprehensive | Theft, fire, weather, vandalism |

| Uninsured/Underinsured Motorist (UM/UIM) | Losses from drivers with little or no insurance |

| Medical Payments (MedPay) | Medical bills for you and passengers |

| Personal Injury Protection (PIP) | Medical bills and lost wages |

| Rental Reimbursement | Rental car costs after a claim |

| Roadside Assistance | Towing, jump-start, breakdown services |

| SR-22 | Proof of insurance for high-risk drivers |

Choosing the right mix of add-ons can significantly improve your financial protection and peace of mind in the event of an accident or vehicle loss.

Understanding your coverage options ensures you’re compliant and fully prepared for unexpected situations on the road.

Auto Insurance Discounts in Pennsylvania

Several of the Pennsylvania car insurance companies offer substantial discounts that can lead to major savings for drivers. Nationwide stands out with a generous 40% good driver discount, while State Farm offers a competitive 30% off for low mileage.

Top Auto Insurance Discounts in Pennsylvania| Company | Anti- Theft | Bundling | Good Driver | Low Mileage |

|---|---|---|---|---|

| 8% | 15% | 30% | 10% |

| 10% | 25% | 25% | 30% | |

| 15% | 25% | 23% | 30% |

| 10% | 20% | 30% | 10% | |

| 25% | 25% | 26% | 30% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 20% |

| 25% | 10% | 30% | 30% | |

| 15% | 17% | 25% | 30% | |

| 15% | 13% | 10% | 20% |

Geico and Liberty Mutual also lead in key areas, with Geico offering up to 25% off for bundling and anti-theft devices, and Liberty Mutual providing a 35% anti-theft discount, one of the highest among all providers (Read More: Best Anti-Theft Auto Insurance Discounts).

Farmers and AAA also reward safe drivers with up to 30% off, and AAA gives another 20% off for drivers who remain claim free. Comparing these discount opportunities can help Pennsylvania drivers maximize their coverage while minimizing costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Car Insurance in Pennsylvania

In addition to traditional discounts, Pennsylvania drivers can take several proactive steps to reduce their auto insurance premiums. From adjusting coverage choices to leveraging technology, these methods can lead to meaningful savings over time.

- Compare Quotes Annually: In Pennsylvania, rates can vary each year, so shopping around helps you stay on top of the best deals.

- Opt for Limited Tort: Pennsylvania’s tort system allows you to choose limited tort, which can significantly lower your rate, though it limits your ability to sue for non-economic damages.

- Raise Your Deductible: Increasing your deductible can help offset the higher average premiums in cities like Philadelphia or Pittsburgh.

- Use Telematics Programs: Many Pennsylvania insurers offer usage-based programs that reward safe drivers with lower rates, especially helpful in suburban and rural areas.

- Bundle Policies: Bundling auto with home or renters insurance is a popular way to save, especially for families and homeowners looking for the best home and auto insurance in PA.

By tailoring your coverage and using these state-specific strategies, you can reduce your premium without sacrificing protection. To start comparing providers, visit our guide on how to get multiple auto insurance quotes.

10 Best Auto Insurance Companies in Pennsylvania

Erie, AAA, and State Farm rank among the best car insurance companies in Pennsylvania, but several other top-rated providers also stand out for different strengths. Below are the full list of auto insurance companies in PA.

#1 – Erie: Top Overall Pick

Pros

- Exceptional Customer Support: Erie consistently ranks at the top in Pennsylvania for personalized agent service and responsive claims assistance, with a J.D. Power score of 713/1,000.

- Lowest Minimum Coverage Rates: Erie car insurance in PA offers the cheapest rates at just $28 a month, significantly undercutting larger national brands.

- Strong Local Presence: Founded in Pennsylvania, Erie maintains deep community ties and a dense network of local agents, making it especially convenient for in-person service across the state.

Cons

- Limited National Reach: Erie operates in only 12 states, including PA, so drivers relocating out of state often need to switch insurers. Learn more in our Erie insurance review.

- Fewer Digital Tools: While Erie excels offline, its mobile app lacks features like accident photo uploads or real-time claim tracking, which are standard with national competitors in PA.

#2 – AAA: Best for Senior Drivers

Pros

- Senior-Friendly Benefits: AAA tailors auto insurance plans with Pennsylvania seniors in mind, offering mature driver discounts, roadside medical coverage, and senior-specific claims support.

- Robust Roadside Assistance: AAA membership in Pennsylvania includes 24/7 towing, battery replacement, and lockout service, which adds value beyond typical insurance coverage.

- Competitive Minimum Rates: Minimum coverage starts at $63 a month, and bundling auto insurance with membership perks often results in meaningful savings for older PA residents.

Cons

- Membership Required: AAA is only available to club members, which adds annual dues on top of policy costs. Get more details in our AAA auto insurance review.

- Limited Online Quote Options: Pennsylvania drivers may experience delays or a lack of real-time quotes online, as AAA still emphasizes phone or in-person sales.

#3 – State Farm: Best for Agency Network

Pros

- Extensive Local Agent Network: With hundreds of agents across Pennsylvania, State Farm offers personalized support, especially in rural and suburban areas (Read More: State Farm review).

- Strong Value for Minimum Coverage: At $41 a month, State Farm’s minimum liability coverage is one of the most affordable among large national providers in Pennsylvania.

- Customizable Add-Ons: PA drivers can enhance policies with affordable options like emergency roadside service, rental car reimbursement, and rideshare coverage.

Cons

- Mixed Claims Satisfaction: State Farm scored 652/1,000 in claims satisfaction (slightly below Erie and Geico), which may concern drivers who value fast, clear claims processes in Pennsylvania.

- Limited Discounts for Tech-Savvy Users: While other PA providers offer app-based usage tracking with large savings, State Farm’s Drive Safe & Save program has limited participation and savings tiers.

#4 – Geico: Best for Government Discounts

Pros

- Government and Military Savings: Pennsylvania government employees, federal workers, and military members receive up to 15% off with Geico, making it an ideal choice for public servants.

- Affordable Minimum Coverage: Geico offers minimum liability coverage starting at $36 a month in Pennsylvania, one of the most budget-friendly rates behind Erie and State Farm.

- Strong Mobile Tools: Geico’s mobile app is among the best in the industry, letting PA users file claims, update coverage, and access ID cards anytime.

Cons

- Limited Local Agent Access: Unlike State Farm or Erie, Geico primarily operates online or by phone, which may frustrate PA drivers who prefer face-to-face service.

- Sparse Optional Coverage: Geico offers fewer customizable endorsements, such as full glass coverage or custom equipment protection in PA. See more coverage in our Geico auto insurance review.

#5 – Nationwide: Best for Coverage Options

Pros

- Customizable Policies: PA drivers can tailor Nationwide plans with options like accident forgiveness, vanishing deductibles, and gap coverage for leased vehicles.

- Usage-Based Discount Availability: SmartRide and SmartMiles telematics programs reward good driving in PA, potentially cutting premiums by up to 40%.

- Fair Minimum Coverage Rates: At $46 a month, Nationwide’s minimum coverage balances affordability and flexible policy features.

Cons

- Higher Full Coverage Premiums: Nationwide’s full coverage in PA averages $138 a month, noticeably higher than Erie and State Farm.

- Limited Availability of Local Agents: In some parts of rural Pennsylvania, drivers may struggle to find nearby agents or offices. See how it stacks up in our Nationwide insurance review.

#6 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness Perk: Liberty Mutual’s optional accident forgiveness prevents premium increases after a driver’s first accident—an appealing feature for high-mileage PA commuters.

- Convenient Online Tools: Pennsylvania policyholders benefit from Liberty Mutual’s digital platform, which includes digital ID cards, instant quote adjustments, and live chat support.

- Discount Stackability: Though rates are higher, drivers in PA can layer discounts like anti-theft, low mileage, bundling, and good student for substantial savings.

Cons

- Expensive Base Rates: At $117 a month for minimum coverage, Liberty Mutual has the highest entry-level cost among the top 10 providers in Pennsylvania.

- Inconsistent Claims Experiences: J.D. Power satisfaction is 634/1,000, with PA drivers occasionally reporting delays or unclear communication (Learn More: Liberty Mutual review).

#7 – Travelers: Best for Discount Options

Pros

- Extensive Discount Programs: Travelers offers over a dozen discount types in PA, including multi-car, hybrid vehicle, early quote, and good payer discounts.

- Affordable Minimum Coverage: At $40 a month, Travelers provides cost-effective minimum liability with generous add-on options. Compare more quotes in our Travelers auto insurance review.

- Century of Industry Experience: Travelers has more than 150 years of experience in the insurance industry and exceptional financial strength.

Cons

- Basic Mobile Experience: While functional, the Travelers app doesn’t match competitors like Geico or Progressive for digital features in PA.

- Fewer Local Offices: Pennsylvania drivers in rural counties may have to rely more on phone/email support due to sparse office locations.

#8 – Allstate: Best for Local Agents

Pros

- Strong Agent Network: Based on our Allstate insurance review, it maintains offices and agents across Pennsylvania cities and towns, offering local guidance and policy support.

- SmartDrive Telematics Savings: The Drivewise program allows safe Pennsylvania drivers to save up to 30% by using smartphone tracking.

- Digital Convenience: Allstate’s well-designed mobile platform provides real-time claim tracking and digital proof of insurance for all PA drivers.

Cons

- Higher Starting Rates: Minimum coverage starts at $79 a month in PA, well above Erie, Geico, and Travelers.

- Increased Costs for Young Drivers: Allstate’s rates for teen drivers in PA often exceed $250 a month even for minimum coverage, due to higher risk profiling.

#9 – Progressive: Best for Loyalty Programs

Pros

- Loyalty Rewards: Progressive’s loyalty benefits include small-claim forgiveness, continuous insurance rewards, and lifetime renewability in Pennsylvania.

- Top-Notch Online Quoting: The quote tool lets PA users compare Progressive tiers instantly, making it easy to find cheap car insurance in PA online with fast, convenient support.

- Fair Coverage: While not the lowest for $79 a month, base rates include flexibility for bundling and policy add-ons. Learn everything you need to know about Progressive insurance.

Cons

- High DUI and Ticket Surcharges: Drivers with one DUI or ticket can see rates double or triple, with DUI rates in PA averaging $291 a month.

- Telematics May Be Invasive: Some PA drivers report concerns about data privacy with Snapshot’s continuous tracking.

#10 – Farmers: Best for Family Plans

Pros

- Family-Centric Plans: Farmers offers multi-policy and young driver discounts ideal for households with teen or student drivers in Pennsylvania.

- Solid Minimum Coverage Rate: at $70 a month in PA, Farmers provides extra value through bundling and accident forgiveness options.

- Optional Equipment Coverage: PA drivers with upgraded sound systems or GPS units can add custom parts protection to their policy. Our Farmers Insurance review provides a full list of options.

Cons

- Limited Digital Claims Tools: Farmers’ mobile app lacks photo claims upload and live chat, which PA drivers may find inconvenient.

- Below-Average Claims Satisfaction: Farmers scored just 610/1,000 in PA claims satisfaction—the lowest among the top 10.

How to Choose the Best Car Insurance Company in Pennsylvania

Choosing the best car insurance company in Pennsylvania depends on your budget, driving habits, and the level of coverage you need. Here are key tips to help you narrow down your options:

- Know Your Coverage Needs: Consider factors like your vehicle’s value, commute distance, and whether you want limited or full tort.

- Check Financial and Customer Ratings: Look for insurers with strong A.M. Best ratings and high customer satisfaction from Pennsylvania drivers.

- Look for Local Agent Support: If you prefer in-person help, choose companies like Erie or State Farm that have a strong agent network across PA.

- Compare Available Discounts: Prioritize companies that offer savings relevant to you—such as low mileage, safe driver, or bundling discounts.

- Evaluate Optional Coverage and Digital Tools: Look for extras like accident forgiveness or a user-friendly app if convenience matters to you.

With so many options available, the easiest way to find the right policy in Pennsylvania is to compare personalized Pennsylvania car insurance quotes side by side. Check out our definitive guide to usage-based car insurance to see if this kind of savings model fits your driving habits.

In Pennsylvania, choose coverage based on your car’s value, commute distance, and whether you want full or limited tort rights after an accident.

Jeffrey Manola Licensed Insurance Agent

This ensures you’re not only meeting state requirements but also getting the best protection at the best possible price. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

Who has the best car insurance in Pennsylvania?

Erie Insurance is widely considered the best auto insurance company in Pennsylvania, thanks to its exceptional customer service, consistently low rates, and strong local presence. It combines affordability with high claims satisfaction and extensive coverage options, making it a top choice for most drivers. Learn more hacks to save money on car insurance.

Who has the lowest car insurance rates in Pennsylvania?

Erie offers the lowest minimum coverage rates in Pennsylvania at just $28 per month. Geico and State Farm also provide budget-friendly options, with minimum rates starting at $36 and $41, respectively, depending on driving history and location. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Who is the highest-rated auto insurance company?

State Farm holds the highest A.M. Best rating of A++, indicating superior financial strength and claims-paying ability. Erie and Travelers also score high in claims satisfaction among Pennsylvania drivers.

What are the minimum car insurance requirements in Pennsylvania?

Drivers in Pennsylvania must carry at least 15/30/5 liability auto insurance coverage, $5,000 in first-party medical benefits, and $15,000/$30,000 in uninsured/underinsured motorist coverage to meet the state’s legal requirements.

What is the average car insurance in Pennsylvania?

While the average cost of car insurance in Pennsylvania is around $92 per month for minimum coverage and about $165 per month for full coverage, Erie offers coverage as low as $28 a month to safe drivers. Always compare free quotes online because rates vary based on age, driving history, location, and selected insurer.

Is Pennsylvania insurance cheap?

Compared to national averages, Pennsylvania car insurance is moderately priced. While some drivers may find affordable rates with providers like Erie and Geico—two of the best home and auto insurance companies in PA—others may pay more due to factors like urban traffic density or prior violations.

What are the most common types of claims in Pennsylvania?

The most frequent claims in Pennsylvania include rear-end collisions, weather-related damage, and parking lot accidents. High-cost claims like theft or T-bone collisions also impact rates and highlight the importance of comprehensive and collision coverage. Learn how to file an auto insurance claim so you aren’t caught off guard.

Does driving record affect car insurance rates in Pennsylvania?

Yes, driving records significantly impact insurance premiums in Pennsylvania. Drivers with clean records pay the lowest rates, while those with accidents, tickets, or DUIs can see premiums more than double with certain providers.

Which insurance companies offer the best discounts in Pennsylvania?

Nationwide offers the highest good driver discount at 40%, while Geico and Liberty Mutual lead in anti-theft discounts. Erie, Allstate, and Progressive also offer up to 30% off for low mileage and safe driving (Learn more: Best Low-Mileage Auto Insurance Discounts).

Who has the cheapest full coverage car insurance in PA?

Erie offers the cheapest full coverage car insurance in Pennsylvania, with rates starting at just $96 per month. Geico and State Farm also provide competitive full coverage options at $109 and $122 per month, respectively.

How can I lower my car insurance rates in Pennsylvania?

How can I find the right car insurance policy in Pennsylvania?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.