Best Auto Insurance for Jeeps in 2026

Cheap Jeep insurance starts at $65 per month, but rates climb for young drivers and new models. Liberty Mutual, Nationwide, and AAA offer the best auto insurance for Jeeps, combining excellent claims handling with customizable policies. Allstate is the top pick for off-road Jeep insurance despite its higher rates.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Liberty Mutual, Nationwide, and AAA have the best auto insurance for Jeeps. Monthly rates start at $65 for minimum coverage.

- Liberty Mutual is the top pick with customizable policies

- AAA has the best roadside assistance for Jeep drivers

- Jeep owners with Nationwide UBI can save up to 40%

Jeep auto insurance is more expensive than average, especially insurance for Jeep Wrangler and Jeep Wagoneer drivers. Minimum coverage can cost over $100 a month.

You can stack savings from these top companies through multi-policy discounts and safe-driving incentives to lower your Jeep insurance costs.

Our Top 10 Company Picks: Best Auto Insurance for Jeeps| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 730 / 1,000 | A | Customizable Polices |

| #2 | 729 / 1,000 | A+ | Usage Discount |

| #3 | 720 / 1,000 | A+ | Online App |

| #4 | 716 / 1,000 | A++ | Accident Forgiveness | |

| #5 | 702 / 1,000 | A | Young Drivers | |

| #6 | 697 / 1,000 | A++ | Multiple Vehicles | |

| #7 | 693 / 1,000 | A+ | Off-Road Coverage | |

| #8 | 691 / 1,000 | A++ | Safe Drivers | |

| #9 | 690 / 1,000 | A | Aftermarket Parts | |

| #10 | 673 / 1,000 | A+ | Innovative Tools |

Liberty Mutual offers the biggest savings to homeowners who bundle, and Nationwide has the best discounts for safe drivers. Keep reading for more tips to pay less for auto insurance and perks from different companies tailored to Jeep drivers.

You can find the lowest insurance rates with a Jeep quick quote using our free comparison tool.

Jeep Insurance Rates From Top Providers

The cheapest Jeep insurance starts with State Farm at $65 a month for minimum coverage, followed by Geico at $66 per month and Allstate at $68 per month.

Rates skyrocket for full coverage. State Farm has the cheapest full coverage Jeep car insurance at $175 a month, but Allstate more than doubles its rates to $185 a month.

Jeep Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $70 | $185 |

| $68 | $182 | |

| $72 | $188 |

| $75 | $193 | |

| $66 | $178 | |

| $71 | $186 |

| $69 | $183 |

| $75 | $193 | |

| $65 | $175 | |

| $78 | $198 |

Minimum coverage offers the lowest Jeep insurance price, but most Jeep owners prefer full coverage for extra protection against theft and weather-related damage.

Full coverage car insurance for Jeeps is also eligible for roadside assistance, which is important if you drive your Jeep often or like to go off-road. Learn what to consider before you buy auto insurance for your Jeep.

Geico stays competitive with a Jeep insurance price at $178 a month for full coverage.

Even though Farmers has the highest full coverage rate at $193 a month, it still makes the cut thanks to perks like $1,000 in aftermarket parts coverage for modified Jeeps.

High-Risk Car Insurance Rates for Jeeps

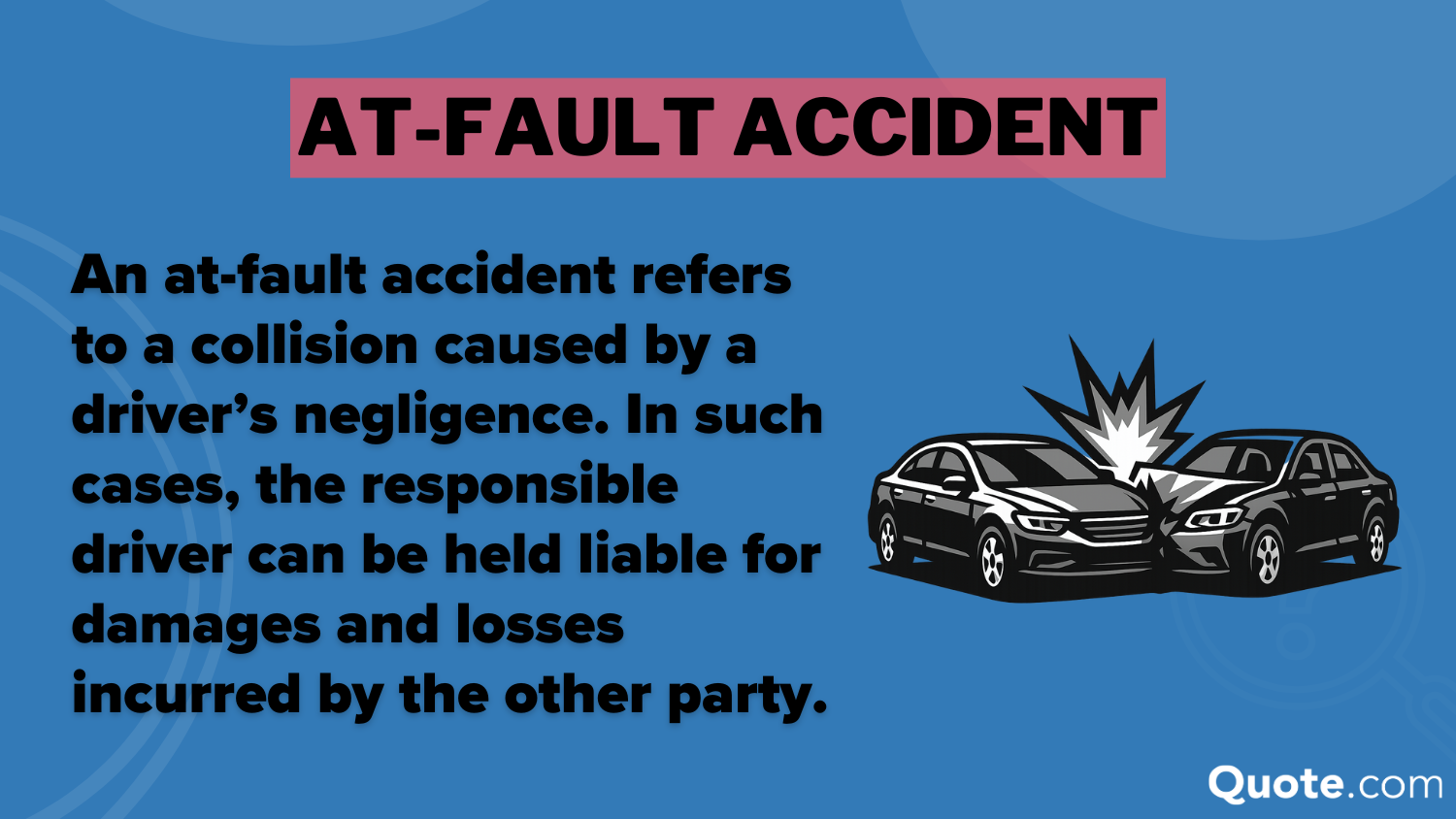

Along with your coverage level, providers consider your age and driving history, which significantly affects what you’ll pay to insure a Jeep.

Teens and drivers with accidents or DUIs are considered high-risk and have the highest premiums. Sixteen-year-old drivers pay as much as $185 a month for minimum coverage.

Jeep drivers in their mid-40s see a noticeable drop with clean records, averaging around $70 a month. Drivers 55 and older enjoy the best Jeep auto insurance rates. However, DUIs consistently push all rates to their highest points, regardless of age.

One DUI pushes minimum coverage insurance for Jeeps over $150 per month. If you have a DUI, check out these hacks to save more money on car insurance this year.

Jeep Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $70 | $108 | $122 | $153 |

| $68 | $106 | $120 | $150 | |

| $72 | $110 | $125 | $157 |

| $75 | $114 | $130 | $161 | |

| $66 | $103 | $118 | $146 | |

| $71 | $109 | $124 | $156 |

| $69 | $107 | $122 | $153 |

| $75 | $114 | $130 | $161 | |

| $65 | $101 | $115 | $145 | |

| $78 | $118 | $133 | $168 |

Allstate, Geico, and State Farm have the cheapest high-risk auto insurance for Jeep drivers, starting at $145 a month after a DUI and $101 a month after a speeding ticket.

If you’re a high-risk driver, try choosing a cheaper model to insure. For instance, Jeep Cherokee insurance rates tend to be lower than other models, helping you save money while you clean up your record.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Insurance Costs for Different Jeeps

Jeep insurance costs vary based on the model you drive. The cost to insure Jeep Wranglers will be higher than a Jeep Cherokee or Compass because of its expensive repair costs and increased risk of off-road claims.

How much is insurance for Jeep Wranglers? Car insurance for a Jeep Wrangler starts at $82 a month, which is right in the middle, compared to the Jeep Wagoneer, which is the most expensive Jeep to insure.

Jeep Auto Insurance Monthly Rates by Model| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Jeep Cherokee | $72 | $165 |

| Jeep Compass | $68 | $155 |

| Jeep Gladiator | $85 | $195 |

| Jeep Grand Cherokee | $90 | $210 |

| Jeep Grand Wagoneer | $115 | $260 |

| Jeep Wagoneer | $108 | $240 |

| Jeep Wagoneer S | $95 | $225 |

| Jeep Wrangler | $82 | $185 |

Wondering how much to insure a Jeep Wrangler compared to other cars? Jeep Wrangler insurance rates remain competitive, especially compared to auto insurance for luxury and exotic vehicles like Land Rover.

Jeep Wrangler car insurance is as affordable as Ford Bronco rates and Nissan X-Terra insurance, which is why it’s the most popular Jeep model to drive.

Jeep Wrangler vs. Similar Models: Auto Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Jeep Wrangler | $82 | $185 |

| Audi Q5 | $95 | $225 |

| BMW X3 | $98 | $235 |

| Ford Bronco | $85 | $195 |

| Land Rover Defender | $115 | $265 |

| Mazda CX-5 | $70 | $155 |

| Mercedes G-Class | $150 | $340 |

| Nissan X-Terra | $78 | $170 |

| Subaru Outback | $68 | $150 |

| Toyota 4Runner | $88 | $200 |

However, Jeep Wrangler Unlimited insurance will cost more because of pricier repairs, added tech, and higher value. Newer Jeeps have more expensive premiums for the same reasons.

Comparing auto insurance companies online can help you find the best insurance for Jeep Wranglers or any model you own.

How much you drive matters. Sometimes, a newer Jeep with low mileage is cheaper to insure than an older one that's used daily.

Heidi Mertlich Licensed Insurance Agent

If you’re in the market for a new Jeep, expect to pay more than these averages. You can bring your rate down by bundling with home insurance or choosing a higher deductible.

See immediate steps to take to lower your Jeep car insurance cost in our breakdown of the best time to buy a new car.

Best Ways to Save on Jeep Car Insurance

Auto insurance for Jeeps will be higher than average, especially for younger drivers, but you can still find ways to reduce your rates and save money.

Start by comparing premiums for different models. When it comes to insurance, Jeep Wranglers and Wagoneers have the priciest coverage. Use these tips to get better quotes:

- Increase Your Deductible: If you want cheaper full coverage auto insurance for Jeeps, increase your deductible to $1,000. You’ll pay more after a claim, but it will lower your monthly rates.

- Shop Around for Discounts: Jeep owners can earn discounts for safe driving, automatic payments, usage-based insurance (UBI) programs, and more.

- Take a Defensive Driving Class: Because Jeep insurance is associated with a higher risk of claims, improving your driving habits with an online or in-person driving course can reduce premiums by 5%-10%.

- Track Your Mileage: If you don’t drive your Jeep as an everyday vehicle, you can sign up for pay-as-you-go auto insurance, like Nationwide SmartMiles, which sets rates based on how often you actually drive.

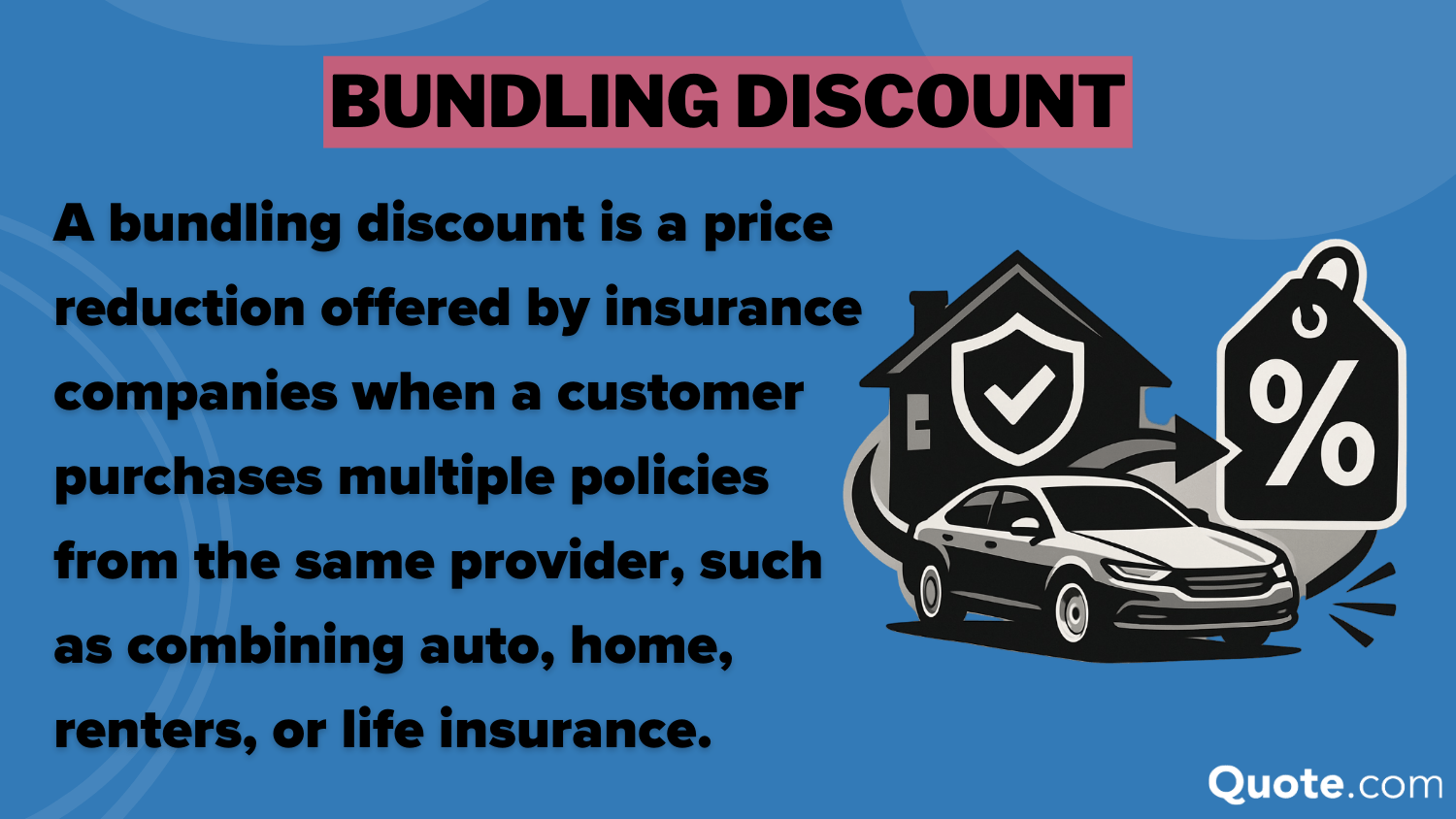

To reduce Jeep insurance costs, drivers should bundle home and auto for up to 25% off, enroll in UBI programs, or pay in full to save up to 20%.

Look for the car insurance discounts you can’t miss to find the best cheap auto insurance for Jeeps and cut your monthly costs.

Jeep Auto Insurance Discounts From Top Providers| Company | Bundling | Military | Pay-in-Full | Usage Based |

|---|---|---|---|---|

| 15% | 10% | 15% | 30% |

| 25% | 25% | 10% | 40% | |

| 25% | 12% | 20% | 20% |

| 20% | 20% | 10% | 30% | |

| 25% | 15% | 10% | 25% | |

| 25% | 10% | 12% | 30% |

| 20% | 25% | 15% | 40% |

| 10% | 15% | 15% | $231/yr | |

| 17% | 25% | 15% | 30% | |

| 13% | 10% | 15% | 30% |

State Farm not only offers the lowest entry rate but also ranks high with a 17% bundling discount. Allstate remains competitive with a 25% bundling discount.

Liberty Mutual and Geico car insurance also offer the highest bundling discounts at 25%, which is ideal for Jeep drivers with home or renters insurance.

Nationwide leads with UBI discounts at 40%, rewarding Jeep owners who drive safely with SmartRide.

Paying your premium upfront can knock up to 20% off with American Family, while most other providers cap that at 10%-15%.

Getting the Right Jeep Insurance Coverage

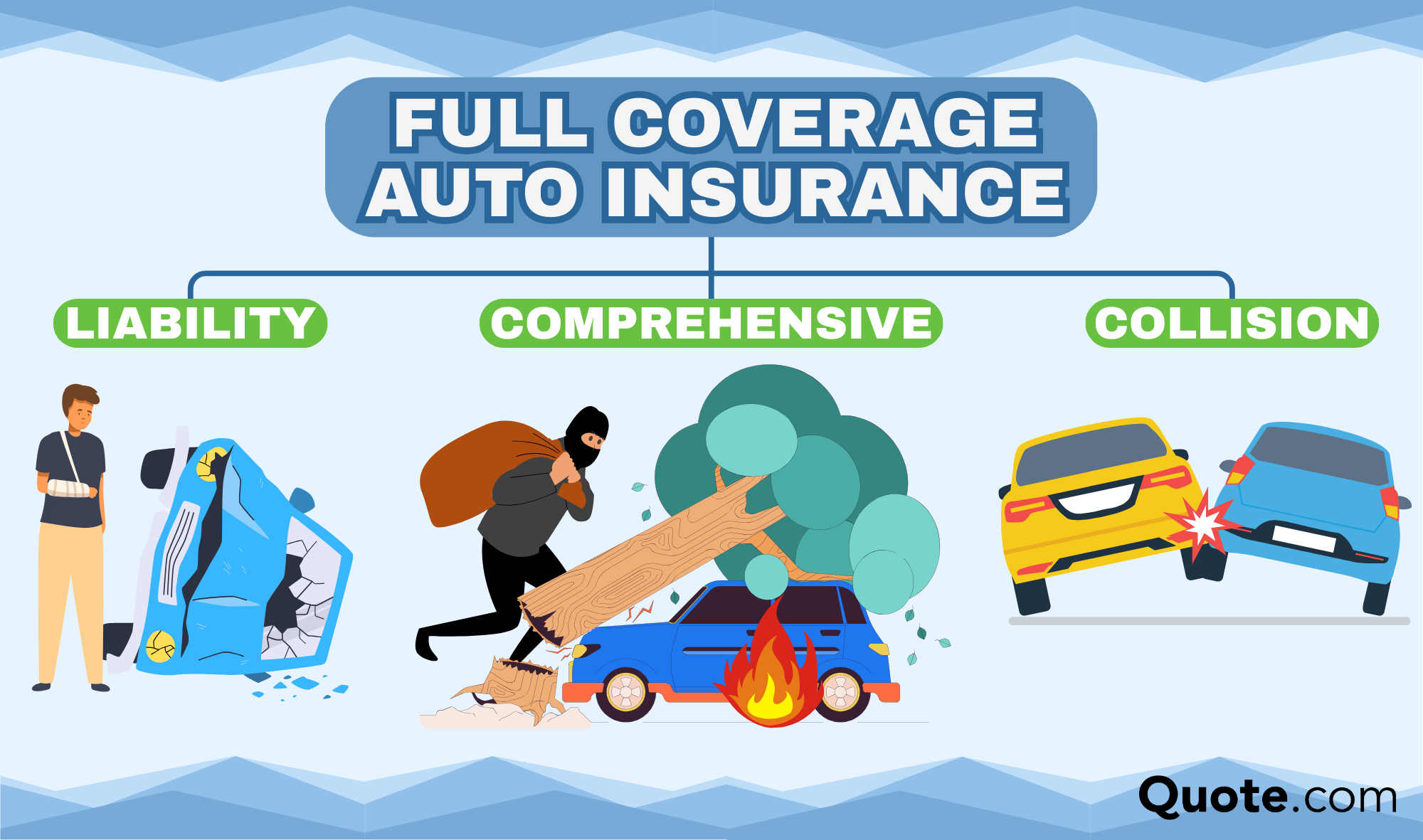

Driving a Jeep means you’ve got more to think about than just basic coverage. Jeep drivers often go for full coverage auto insurance because basic liability won’t cut it.

You’ll definitely need full coverage with additional add-ons for custom parts, especially if your Jeep has pricey upgrades like lift kits, custom wheels, or winches.

Auto Insurance Coverage Options for Jeeps| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damage to others if you're at fault |

| Collision Coverage | Covers damage to your car in an accident |

| Comprehensive Coverage | Covers non-collision damage, like theft |

| Personal Injury Protection (PIP) | Covers medical expenses & lost wages |

| Uninsured/Underinsured Motorist | Covers you if the other driver lacks insurance |

| Medical Payments Coverage | Covers medical bills for you and passengers |

| Roadside Assistance | Provides towing, battery fixes, and repairs |

| Rental Reimbursement | Covers rental car costs while yours is repaired |

| Gap Insurance | Pays lease or loan balance if car is totaled |

| Custom Parts Coverage | Covers aftermarket parts and custom equipment |

Whether it’s off-roading, custom parts, or staying prepared, these coverage types help protect you where it matters most.

Custom parts coverage protects all the aftermarket gear that isn’t included in the car’s original value. Off-roading isn’t covered under standard policies, so drivers add on special endorsements to cover damage from rough terrain.

Don’t assume all roadside assistance covers off-roading. Check if your provider includes off-road winching like Allstate does before you hit the trails.

Jeff Root Licensed Insurance Agent

Roadside assistance coverage is important if you’re trail driving or exploring remote areas in your Jeep. When you’re far from main roads, a dead battery, flat tire, or mechanical issue can leave you stranded without easy access to help.

Not all providers offer roadside assistance that extends to off-road locations, so Jeep drivers, especially those comparing car insurance for Jeep Wranglers, should compare companies to verify which offer recovery from trails or non-paved areas.

If you don’t mind paying more for off-road insurance, Jeep drivers should consider Allstate. Although more expensive, Allstate’s $245 full coverage monthly rate includes off-road towing and trip interruption perks.

These add-ons are super useful, but can raise your rates since they increase the risk and repair costs. Find out what to do when you’re denied insurance coverage and need options fast.

Jeep Auto Insurance Coverage Options by Provider| Company | Claim Forgiveness | Custom Parts | Gap Plans | Roadside Assistance |

|---|---|---|---|---|

| ✅ | ✅ | ❌ | ✅ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ |

| ✅ | ✅ | ❌ | ❌ | |

| ❌ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ❌ | ✅ |

| ❌ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

Farmers is the only Jeep insurance company that doesn’t offer roadside assistance, but it still may be available in your state.

Always compare car insurance companies online to get a better idea of the policy options and prices in your local area.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Jeep Auto Insurance Companies

Liberty Mutual, Nationwide, and AAA have the best auto insurance for Jeeps, thanks to their high claims satisfaction. These top companies offer custom parts and equipment coverage and convenient roadside assistance packages.

State Farm is the largest Jeep insurance company with the cheapest minimum coverage at $122 a month (Read More: State Farm vs. Farmers, Allstate, Progressive, & Geico Insurance).

Allstate may be more expensive, but it remains a popular choice among Jeep owners for its 24/7 off-road towing and $500 in trip interruption coverage.

Comparing car insurance companies online helps pinpoint the best car insurance for Jeeps by rate, discounts, and policy options. Compare Jeep insurance quotes quickly with our free comparison tool.

#1 – Liberty Mutual: Top Pick Overall

Pros

- Bundling Discount: Drivers can save 25% by combining their Jeep insurance with home, renters, or condo coverage. See how it compares in our Liberty Mutual review.

- Custom Parts & Equipment Coverage: Optional insurance add-on for Jeeps to cover modifications like lifted suspensions, LED bars, and winches on Jeeps.

- Better Car Replacement: If your Jeep is totaled, the plan provides a newer model with fewer miles when you join the program.

Cons

- No OEM Parts Guarantee: Jeeps may receive aftermarket components unless you add OEM Parts Coverage, which is more expensive than at other companies.

- Limited Off-Road Recovery: Standard roadside assistance doesn’t include trail winching or off-road Jeep recovery unless upgraded.

#2 – Nationwide: Best for Usage-Based Discounts

Pros

- SmartRide Savings: Drive safely, and you could save up to 40% on your Jeep insurance with this usage-based insurance (UBI) program.

- Bundling Discount: Pair your auto and home insurance to knock up to 20% off your Jeep premiums. Find more discounts in our Nationwide auto insurance review.

- OEM Parts Option: Add the OEM endorsement to make sure your Jeep gets factory-original parts if it’s ever in the shop.

Cons

- Base Rate Starts High: Jeep full coverage car insurance before SmartRide and bundling begins at $196 per month.

- Off-Road Coverage Not Included: Nationwide auto insurance for Jeeps requires a separate endorsement if you drive off-road.

#3 – AAA: Best Online App

Pros

- AAA Auto Club App: Provides digital ID cards, Jeep-specific policy access, and GPS-based roadside assistance requests.

- AAA Membership Roadside Perks: Includes towing and off-road recovery options specific to Jeep vehicles.

- Multi-Policy Discount: Bundling auto with home or life insurance reduces Jeep car insurance monthly costs by 15%. Get more savings tips in our AAA auto review.

Cons

- Membership Required: Jeep owners must maintain an active AAA membership to access auto insurance services.

- Limited Aftermarket Coverage: Custom Jeep mods like off-road lighting or tube doors are not covered without add-ons.

#4 – State Farm: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Your first accident won’t raise your rates, which is great if your Jeep sees a lot of action. See what sets it apart in our State Farm auto insurance review.

- Vanishing Deductibles: Stay claim-free, and your Jeep insurance deductible drops by $50 every six months.

- Drive Safe & Save Discount: If you’re a careful Jeep driver, you could score up to 30% off with its UBI tracking app.

Cons

- No Equipment Coverage Without Endorsement: Custom Jeep add-ons like lift kits or winches aren’t covered without a policy upgrade.

- Limited Off-Roading Coverage: State Farm doesn’t offer off-road recovery unless you add it manually, which may concern adventurous Jeep owners.

#5 – American Family: Best for Young Drivers

Pros

- Exclusive Savings for Young Drivers: Jeep drivers under 25 get discounts for attending an out-of-state college, volunteering, and maintaining a 3.0 GPA.

- Generational Discounts: Teens added to an existing policy or who can prove other family members have AmFam coverage will get discounts on Jeep insurance.

- Costco Membership Rewards: Jeep owners with Costco memberships get access to lower rates, exclusive discounts, and policy options.

Cons

- Higher Average Rates: The average Jeep insurance cost with AmFam is more expensive than with other providers, like AAA and State Farm.

- Limited Availability: American Family Jeep insurance is not available in every state. See if it’s available near you in our American Family Insurance review.

#6 – Geico: Best for Multiple Vehicles

Pros

- Multi-Vehicle Savings: Insure multiple vehicles, including Jeeps, to get a 25% discount. Learn everything you need to know about Geico here.

- Mechanical Breakdown Insurance (MBI): Acts as an extended warranty for new Jeeps under 15 months old, and Geico offers the lowest rates for this add-on.

- Highly Rated Mobile App: Supports online Jeep policy management, digital ID cards, and instant claim tracking.

Cons

- No Default Jeep Mod Coverage: Jeeps with aftermarket features require Custom Equipment Coverage, which raises rates.

- Minimal Local Agent Access: Geico operates primarily online, which may not suit Jeep owners wanting face-to-face guidance.

#7 – Allstate: Best for Off-Road Coverage

Pros

- Off-Road Vehicle Add-On: Jeeps that become stuck on trails or rough terrain can be winched off-road as part of Allstate’s roadside help package.

- Trip Interruption Add-On: Covers $500 for transportation, food, and housing in the event that your Jeep breaks down more than 100 miles from home.

- Deductible Rewards Program: Lowers deductibles by $100 instantly and adds $100 each claim-free year up to $500 total.

Cons

- Modifications Not Standard: Coverage for aftermarket Jeep accessories must be added via the Custom Equipment Coverage endorsement.

- Premium Increases After First Year: Your monthly Jeep insurance price may rise at renewal, even without claims. Take a closer look at rates in our Allstate review.

#8 – Travelers: Best for Safe Drivers

Pros

- Responsible Driver Plan: Protects Jeep drivers from premium increases after their first at-fault accident and lowers rates with safe-driving discounts.

- Multi-Policy Discount: Bundling home or umbrella insurance with your Jeep policy can reduce rates by 13%.

- New Car Replacement: If your Jeep is totaled early in the policy, Travelers replaces it with a brand-new model.

Cons

- No Jeep Mod Coverage in Base Policy: Aftermarket mods like lift kits and steel bumpers must be added through Special Equipment Coverage.

- Limited Off-Road Recovery: Standard roadside assistance excludes trail rescues for off-roading Jeeps. See how it compares in our full Travelers auto insurance review.

#9 – Farmers: Best for Aftermarket Coverage

Pros

- Aftermarket Equipment Coverage: Automatically includes up to $1,000 in coverage for custom Jeep parts under its Customized Equipment Endorsement.

- OEM Parts Coverage: Included in Farmers Guaranteed Repair Program, Jeep owners get repairs with original parts at certified repair shops.

- Signal App Discount: Jeep drivers can get up to 15% off premiums for safe driving tracked through Farmers’ Signal UBI app.

Cons

- Higher Starting Rate: Jeep insurance starts at $95 per month with Farmers. Check out our Farmers Insurance review to compare more rates.

- Limited Mobile Access: Digital claims tools and mobile servicing options are less robust, which may affect Jeep owners who need quick off-grid help.

#10 – Progressive: Best for Innovative Tools

Pros

- Name Your Price Tool: Helps Jeep owners set a monthly budget and filter plans accordingly. Learn more in our guide to everything you need to know about Progressive.

- UBI Discount: Save up to 30% on Jeep insurance by driving safely and sharing data through the Progressive Snapshot tracking device and mobile app.

- Bundling Discount: Drivers bundling home, renters, or motorcycle insurance can reduce their Jeep auto rates by 10%.

Cons

- OEM Coverage Requires Upgrade: Factory Jeep parts are not guaranteed without purchasing the OEM Parts Endorsement.

- Snapshot Penalties Possible: Poor driving habits tracked via Snapshot can lead to rate hikes on Jeep policies.

Frequently Asked Questions

Who offers the best auto insurance for Jeeps?

Liberty Mutual, Nationwide, and AAA have the best car insurance for Jeeps. Liberty Mutual and Nationwide cover customized Jeeps and offer big discounts for bundling and safe driving, while AAA provides off-road roadside assistance with the cheapest full coverage rates.

Are Jeeps expensive to insure?

Yes, insurance is higher on a Jeep due to factors like off-road capability, custom modifications, and repair costs, especially for newer models. How much is car insurance per month for Jeeps? Depending on the model, most drivers pay between $68 and $115 a month for minimum coverage.

What is the cheapest insurance for a Jeep?

The cheapest insurance for a Jeep is offered by State Farm, starting at $84 per month for minimum liability coverage, along with a 17% bundling discount (Read More: State Farm vs. Progressive Auto Insurance).

What are the four recommended types of insurance for Jeeps?

The four recommended types of insurance for a Jeep are liability coverage, collision coverage, comprehensive coverage, and custom parts/equipment coverage for aftermarket modifications.

Which insurance company is the most popular for Jeeps?

State Farm is the most popular insurance for Jeep, offering affordable premiums, accident forgiveness, and the lowest base rate of $84 per month.

How much is Jeep Patriot insurance?

Jeep Patriot insurance rates average $68 to $155 per month, depending on the driver’s age, driving record, and selected coverage level. The Compass replaced the Patriot model in 2016, so its rates are similar.

What is umbrella insurance coverage for Jeeps?

Umbrella insurance coverage for Jeep provides an extra $1 million or more in liability protection, which is useful for Jeep owners who drive frequently or use their vehicle off-road. It’s often offered by some of the cheapest car insurance companies for added peace of mind.

How much is car insurance for a Jeep Wrangler?

Jeep Wrangler insurance is on the higher end, starting at $82 a month. Insurance rates for Jeep Wrangler full coverage climb to $185 a month, higher than car insurance for Jeep Cherokee or Jeep Compass drivers. Enter your ZIP code to get a free Jeep Wrangler insurance quote.

How much is insurance on a Jeep Wrangler for a 16-year-old?

Age will have the biggest impact on your Jeep Wrangler insurance price. Teens pay more due to higher risk, and Jeep Wrangler auto insurance for a 16-year-old costs about $200 per month for minimum coverage. Enrolling in UBI, or staying on a parent’s policy, can significantly lower costs.

How much is insurance for a Jeep Cherokee?

Jeep Cherokee insurance typically ranges from $72 to $165 per month. Rates may drop with a clean driving record, bundling discounts up to 25%, or usage-based car insurance programs.

How much is Jeep Liberty car insurance?

How do you shop for the best auto insurance for a Jeep?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.