Best Auto Insurance for Mercurys in 2026

Erie, USAA, and Nationwide have the best auto insurance for Mercurys. Erie starts at $32 a month, making it the cheapest car insurance for a Mercury. Each company stands out for its customer service when handling Mercury auto insurance claims, but USAA offers exclusive discounts to military members with Mercurys.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated January 2026

Erie, USAA, and Nationwide have the best auto insurance for Mercurys. Erie stands out with the cheapest coverage at $32 a month.

- Affordable Mercury insurance starts at just $32 per month

- Amica is the best insurance company for customer service

- Older Mercurys qualify for classic car insurance at lower rates

Erie is also the cheapest company for full coverage Mercury car insurance at $83 monthly. Nationwide earns its spot for generous multi-policy discounts for drivers who bundle home and auto insurance.

Each provider delivers strong coverage options and unique savings opportunities tailored to Mercurys, but getting multiple auto insurance quotes is the easiest way to find the best fit for your budget.

Our Top 10 Company Picks: Best Auto Insurance for Mercurys| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743/1,000 | A+ | Full Coverage |

| #2 | 741/1,000 | A++ | Military Members | |

| #3 | 729/1,000 | A+ | Multi-Policy Savings | |

| #4 | 718/1,000 | A+ | Dividend Payments | |

| #5 | 716/1,000 | A++ | Customer Service | |

| #6 | 716/1,000 | A+ | AARP Members |

| #7 | 702/1,000 | A | Young Drivers |

| #8 | 691/1,000 | A++ | Hybrid Vehicles | |

| #9 | 690/1,000 | A | Classic Autos | |

| #10 | 672/1,000 | A | Coverage Variety |

Mercury stopped producing vehicles in 2011, leading to lower insurance costs. Compare the top ten Mercury auto insurance companies to find out if you’re getting the cheapest rates on your Mercury.

Enter your ZIP code into our free quote tool to instantly compare prices from companies near you.

Compare Cheap Mercury Auto Insurance

Before you buy auto insurance, compare quotes from multiple providers to lock in the best rate for your specific Mercury model. Erie and USAA stand out as the most affordable providers, offering minimum coverage starting at just $32 per month.

Other insurers with competitive rates include Safeco at $38 monthly and State Farm at $47 per month for minimum coverage.

Mercury Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $166 |

| $65 | $215 | |

| $32 | $83 |

| $76 | $198 | |

| $63 | $164 | |

| $38 | $101 | |

| $47 | $123 | |

| $61 | $161 |

| $53 | $141 | |

| $32 | $84 |

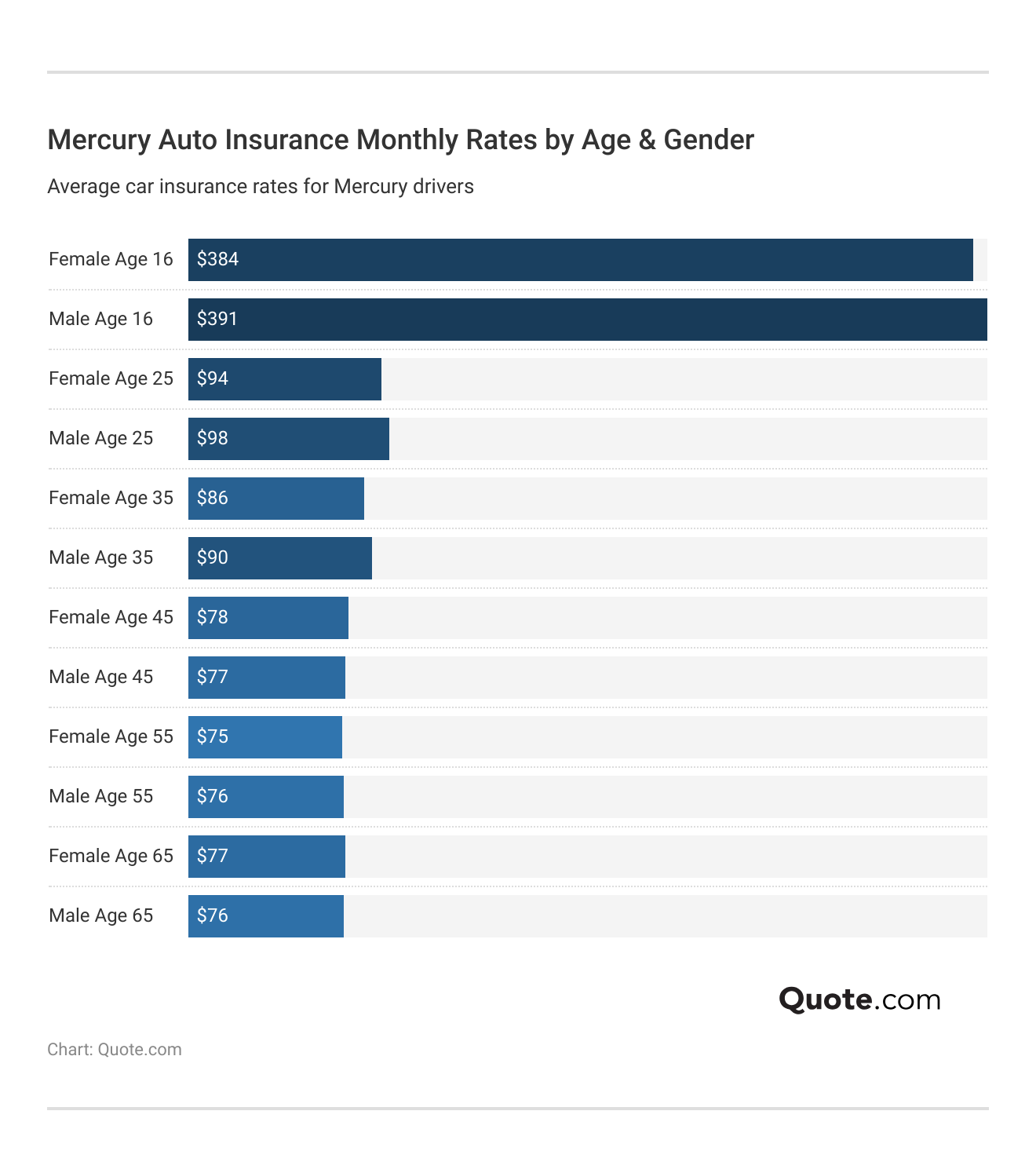

Erie is the cheapest for full coverage at $83 monthly. However, younger drivers often pay much more for Mercury car insurance. Monthly premiums for teens are over $300.

Mercury auto insurance rates drop by the time drivers turn 25, and seniors pay the lowest rates at around $76 per month.

Top companies like The Hartford can offer eligible seniors even lower rates, while American Family has cheap auto insurance for teens, with student discounts and driver education rewards.

Your Mercury insurance quotes will fluctuate based on the model you drive. The Mercury Capri is the cheapest to insure at $71 per month. Mercury Tracer insurance is also very affordable, followed by the Mercury Cougar.

Mercury Auto Insurance Monthly Rates by Model| Mercury Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Mercury Cougar | $74 | $141 |

| Mercury Grand Marquis | $81 | $158 |

| Mercury Mariner | $78 | $152 |

| Mercury Milan | $76 | $148 |

| Mercury Montego | $79 | $153 |

| Mercury Mountaineer | $83 | $162 |

| Mercury Sable | $80 | $155 |

| Mercury Tracer | $72 | $138 |

| Mercury Villager | $77 | $150 |

| Mercury Capri | $71 | $137 |

Mercury Milan car insurance is around average, starting at $76 a month, while Mercury Mountaineer and Mercury Grand Marquis auto insurance tend to cost more. That’s likely due to the size of these models and their higher repair costs.

Since Mercury models were phased out of production in 2011, carrying just a minimum liability or classic auto policy can often lower the cost of Mercury Grand Marquis car insurance and other pricier models.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Mercury Auto Insurance Policies

The right Mercury car insurance policy protects you from out-of-pocket costs after an accident, theft, or other unexpected events.

Your state laws require liability coverage, while your auto loan or lease may ask for additional coverage. Here are the main coverage types to consider.

Auto Insurance Coverage Options for Mercurys| Coverage Type | Description |

|---|---|

| Liability | Covers injuries and property damage to others |

| Collision | Covers damage to your car in a crash |

| Comprehensive | Covers theft, fire, vandalism, etc. |

| Uninsured Motorist | Covers you if the other driver is uninsured |

| Medical Payments | Pays for your medical expenses |

| Personal Injury (PIP) | Covers medical + lost wages (some states) |

| Classic/Collector | Covers the agreed value of older vehicles |

| Roadside Assistance | Covers towing and minor roadside help |

| Rental Reimbursement | Covers rental car while yours is repaired |

Mercury vehicles were discontinued in 2011, so many models now qualify for classic or collector coverage, depending on their age, condition, and how often you drive them.

Classic auto insurance is a type of policy designed for older or collectible cars that aren’t used as daily drivers.

Unlike standard auto insurance, classic policies typically base coverage limits on the agreed value rather than the depreciated market value.

Many companies, including Farmers, will include travel expenses and roadside assistance in their classic coverage for drivers who take their Mercurys on the road to car shows and conventions.

Classic auto coverage and collector's policies have allowances for restoration, spare parts, and limited-use driving.

Dani Best Licensed Insurance Producer

If you want a cheaper Mercury auto insurance quote, consider a classic or collector policy to save money, especially if you have another car you drive more often than your Mercury.

Choosing the right mix of coverage depends on your budget and driving habits, but switching to a classic policy can lower monthly rates.

Read More: What to Do When You’re Denied Insurance Coverage

Lower Your Mercury Auto Insurance Rates

Mercury drivers are afforded lower rates than many other people on the road because they drive an older car or a collector model, but there are many different ways to save on coverage.

If you drive a 2011 model or older, follow these tips to get even cheaper Mercury insurance quotes:

- Join a Car Club: If you drive a classic Mercury, many insurers will offer discounted rates when you join a recognized classic or collector car club.

- Park in a Garage: Keeping your Mercury in a locked garage or storage facility reduces risk and can earn discounts.

- Reduce Your Coverage: Those who drive older Mercurys but don’t qualify for classic car insurance can reduce coverage to liability-only for the lowest rates.

- Increase Your Deductible: Agreeing to pay more out of pocket in the event of a claim can help bring down your monthly Mercury insurance rates.

You can also compare quotes online to find affordable Mercury auto insurance. Online comparison tools allow you to see quotes from multiple companies near you.

The best insurance comparison sites let you adjust coverage and deductible levels as needed to find the best auto insurance company that fits your budget.

As you shop for quotes, don’t forget to ask about discounts. Discounts can lower Mercury car insurance rates without you having to reduce coverage.

Many providers offer exclusive savings to classic autos. Keep reading to compare more Mercury car insurance discounts.

Stack Mercury Auto Insurance Discounts for Big Savings

If you’re looking to lower your Mercury insurance costs, several top providers offer generous discounts.

Amica stands out with the most substantial savings for multiple policies and low-mileage drivers at 30% and 25% off.

Top Auto Insurance Discounts for Mercury Drivers| Company | Anti-Theft | Bundling | Low Mileage | Loyalty |

|---|---|---|---|---|

| 25% | 25% | 20% | 15% |

| 18% | 30% | 25% | 13% | |

| 15% | 25% | 30% | 10% |

| 10% | 20% | 10% | 12% |

| 5% | 20% | 40% | 8% | |

| 20% | 15% | 25% | 15% | |

| 15% | 17% | 30% | 6% | |

| 10% | 5% | 10% | 7% |

| 15% | 13% | 20% | 9% | |

| 15% | 10% | 20% | 11% |

Erie and Nationwide are also great picks for low-mileage Mercury drivers, offering 30% and 40% off, respectively.

Anti-theft discounts are the next biggest savings opportunities, with American Family, Safeco, and Amica offering competitive savings up to 25%.

Ask about bundling, low-mileage, and anti-theft discounts to lower your Mercury vehicle insurance costs.

Justin Wright Licensed Insurance Agent

While Safeco, Nationwide, and USAA offer slightly lower percentage discounts, they still provide valuable savings across categories like auto-pay, loyalty, and anti-theft.

Mercury drivers who qualify for multiple discounts can maximize savings by comparing offers across providers.

Read More: 17 Car Insurance Discounts You Can’t Miss

Top 10 Insurance Companies for Mercurys

Top auto insurance companies like Erie, USAA, and Nationwide offer affordable rates, helpful customer service, and valuable ways to save on Mercury car insurance.

They may not be the largest providers, so compare several providers to ensure you’re getting the right Mercury auto insurance coverage at the best price.

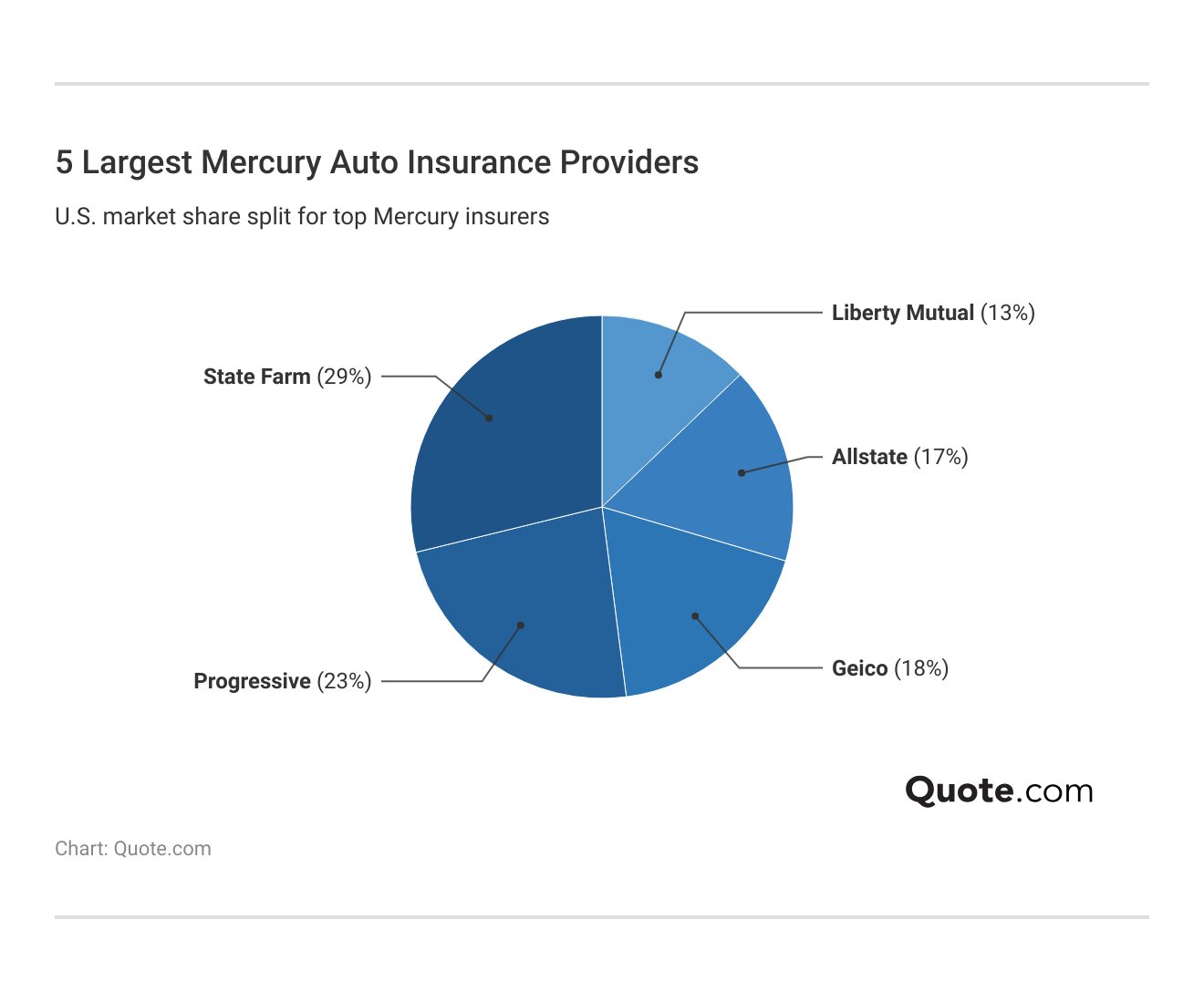

State Farm and Progressive are the largest and most popular car insurance companies for Mercurys, but USAA and Erie have higher claims satisfaction ratings.

Nationwide offers bigger discounts to safe drivers, but State Farm and Progressive remain competitive with convenient online tools and competitive rates. Scroll down to see how the top ten providers compare.

#1 – Erie: Top Pick Overall

Pros

- Full Coverage Policies: Erie offers the cheapest full coverage insurance for Mercurys at $83 a month, which includes pet insurance and covers travel expenses.

- Bundling Deals: Mercury owners who bundle with Erie renters or homeowners save up to 25% off (Read More: Best Homeowners Insurance Companies).

- Lock-In Rates: Drivers can lock in cheap Mercury insurance rates for the life of their policy, or until major policy changes are made, like moving or adding a driver.

Cons

- Limited Availability: Erie only sells car insurance in 12 states.

- Fewer Add-Ons: Mercury drivers looking for features like rideshare coverage may need to look elsewhere.

#2 – USAA: Best for Military Members

Pros

- Military Discounts: Active-duty and retired military members receive exclusive Mercury insurance discounts for garaging, deployment, and storage.

- Low Premiums: Military members with USAA get the cheapest rates, starting at $32 per month for minimum coverage and full coverage at $84 a month.

- Claims Reputation: USAA earns consistently high customer satisfaction and financial stability ratings. Read our USAA insurance review for more details.

Cons

- Eligibility Limits: Only military members and their immediate families can buy Mercury car insurance through USAA.

- Smaller Discounts: USAA offers much smaller discounts for bundling and loyalty, especially compared to insurers like Nationwide or Amica.

#3 – Nationwide: Best for Multi-Policy Savings

Pros

- Bundling Benefits: Mercury drivers can save up to 20% by bundling with their Nationwide home or life insurance policy. Learn how in our Nationwide insurance review.

- Reasonable Rates: Minimum coverage starts at $63 per month and includes options like accident forgiveness.

- Low-Mileage Discounts: Mercury owners who don’t drive their vehicles often can save up to 40%, and there’s no annual cap on mileage.

Cons

- Agent Access: Nationwide has fewer local offices than competitors like State Farm and Farmers for Mercury owners who prefer in-person support.

- Lower App Ratings: The Nationwide insurance app gets mixed reviews from users, which could impact your online service experience.

#4 – Amica: Best for Dividend Payments

Pros

- Dividend Policies: Amica’s dividend auto policies can return up to 20% of premiums to Mercury vehicle owners.

- Affordable Rates: Minimum auto insurance coverage for Mercurys starts at $65 a month. Compare quotes in our Amica insurance review.

- Bundling Discount: Mercury drivers can save up to 30% when combining auto with home, renters, or life insurance.

Cons

- Claims Access: Mercury owners in some states may need to file claims by phone or mail, which can slow response times.

- Expensive Full Coverage: Amica is the most expensive company for full coverage Mercury car insurance at $215 per month.

#5 – State Farm: Best for Customer Service

Pros

- Local Support: Over 19,000 agents nationwide give Mercury drivers in all 50 states easy access to personalized assistance.

- Competitive Rates: Minimum insurance starts at $47 per month. Get a free Mercury insurance quote in our State Farm insurance review.

- Claims Satisfaction: State Farm earns above-average satisfaction from J.D. Power for Mercury auto insurance claims handling year after year.

Cons

- Expensive Full Coverage: State Farm is affordable for minimum coverage, but Mercury full coverage at $123 monthly is among the most expensive.

- Limited Digital Tools: The State Farm insurance app doesn’t have as many policy management features for Mercury owners as other providers.

#6 – The Hartford: Best for AARP Members

Pros

- AARP Perks: Mercury drivers over 65 with AARP memberships get unique policy add-ons, like RecoverCare and lifetime renewals.

- Competitive Discount Rates: The Hartford minimum coverage for Mercurys starts at $161 per month, but seniors can lower rates with exclusive discounts.

- Automatic Policy Renewals: Qualified Mercury owners with clean driving records who avoid filing claims can maintain coverage for life with few rate increases.

Cons

- Age Restriction: Only AARP members can access Mercury insurance coverage from The Hartford, excluding younger drivers.

- Small Discount: The Hartford’s bundling discount is just 5%, the lowest among the best Mercury auto insurance companies (Read More: How to Compare Auto Insurance Companies).

#7 – American Family: Best for Young Drivers

Pros

- Youth Discounts: Mercury owners under 25 can qualify for up to 25% off with good student discounts and driver training courses (Learn More: The 17 Best Tips to Pay Less for Car Insurance).

- Bundling Rates: AmFam offers one of the biggest discounts for bundling at 25% when you buy Mercury auto insurance with renters or home policies.

- Starting Price: Minimum car insurance for Mercurys starts at $62 per month, competitive for younger drivers insuring older models.

Cons

- Mixed Regional Reviews: Drivers in some states report inconsistent Mercury car insurance claims service and limited agent responsiveness.

- Regional Limitations: American Family is only available to Mercury drivers in 26 states. Find it near you in our American Family Insurance review.

#8 – Travelers: Best for Hybrid Vehicles

Pros

- Hybrid Discounts: As mentioned in our Travelers auto insurance review, Mercury owners with hybrid models get exclusive discounts and lower deductibles.

- Competitive Rates: Minimum car insurance for Mercurys is affordable, starting at $53 per month.

- Industry Experience: Travelers is one of the most reliable Mercury car insurance companies, with over 100 years in the industry and an A++ A.M. Best rating.

Cons

- Complex Discounts: Mercury drivers may need to meet multiple criteria before they qualify for Travelers insurance discounts.

- Customer Service: In many states, customer satisfaction scores for Mercury auto insurance claims and billing are just average or below average.

#9 – Farmers: Best for Collector Cars

Pros

- Classic & Collector Auto Perks: Farmers classic car coverage for older Mercurys includes full coverage, guaranteed value, roadside assistance, and original parts coverage.

- Bundle Options: Mercury drivers can save up to 20% by bundling with other Farmers policies. For full details, read everything you need to know about Farmers Insurance.

- Strong Claims Support: Farmers is known for its local agents who handle Mercury repairs often within 48 hours.

Cons

- Higher Premiums: Minimum auto insurance for Mercurys starts at $76 per month, among the highest on the list.

- Limited Digital Tools: The Farmers insurance app and website have limited digital policy access compared to other Mercury insurance companies.

#10 – Safeco: Best for Coverage Variety

Pros

- Coverage Variety: Safeco offers unique add-ons for Mercury vehicles, including OEM parts coverage and accident forgiveness.

- Affordable Rates: Minimum coverage for Mercurys starts at $38 per month, and full coverage is competitive at $101 monthly.

- Rideshare Policies: Mercury owners using their vehicles to work for Uber, Lyft, or DoorDash can get affordable coverage through Safeco.

Cons

- Digital Convenience: Safeco relies on agents to manage Mercury auto insurance policies, limiting online and mobile flexibility for drivers.

- Discount Limits: Fewer discounts are available to Mercury drivers compared to top competitors. Find out what to do if you can’t afford your auto insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buy the Right Mercury Auto Insurance

Erie, USAA, and Nationwide are our top picks, but getting the best auto insurance for Mercurys means finding a good balance between price, coverage, and discounts.

USAA stands out for its competitive rates and excellent claims service. It also rewards military members with exclusive discounts, including 10% for veterans who bundle home and auto insurance.

Mercurys were discontinued in 2011, so you can get a pretty affordable Mercury car insurance quote based on its cheap repair costs and classic auto perks (Read More: 26 Hacks to Save More Money on Car Insurance).

Whether you drive a Grand Marquis or need affordable Mercury Mariner car insurance, you can get fast and cheap insurance coverage today with our free tool. Enter your ZIP code to get started.

Frequently Asked Questions

What is the best Mercury auto insurance company?

Amica is often rated the best auto insurance company for Mercurys, thanks to low rates, dividend policies, and strong customer satisfaction, followed closely by State Farm and Nationwide.

Why is Mercury auto insurance so cheap?

Mercury car insurance rates remain affordable because the vehicles are easy and inexpensive to repair after claims. And since Ford discontinued the brand in 2011, older models have lower insurance rates than new vehicles.

When is Mercury auto insurance more expensive?

Mercury insurance quotes can be more expensive if you have prior violations, live in high-risk ZIP codes, or miss out on key discounts.

Read More: Top 7 Ways You’re Wasting Money On Your Car

How much is Mercury Grand Marquis auto insurance?

Auto insurance for Mercury Grand Marquis starts at $81 per month for minimum coverage. Enter your ZIP code to see how much it costs near you.

Which Mercury auto insurance company is cheaper?

Which company has the most affordable car insurance? Among companies that insure Mercury vehicles, Erie offers the lowest minimum coverage at $32 per month, with other affordable options from USAA and Safeco.

How do you shop for the best Mercury auto insurance?

To find the best car insurance for Mercurys, compare quotes from top providers, evaluate bundling discounts, and check coverage options that match your driving needs.

Read our guide titled, “Ultimate Guide on the Best Time to Buy a New Car.”

Is Geico or Progressive cheaper for Mercury auto insurance?

For Mercury vehicles, Geico is often cheaper for safe drivers, while Progressive may be more affordable for high-mileage or telematics users.

How much is Mercury insurance per month?

Depending on the coverage level and the model you drive, your Mercury auto insurance rates could be anywhere between $32 and $215 per month. The Mercury Capri is one of the more affordable models at $71 monthly. Compare auto insurance rates by vehicle to learn more.

What is the #1 insurance provider for Mercurys?

State Farm is the number one auto insurer in the U.S. and a top choice for Mercury owners due to its customer service and wide agent network. Enter your ZIP code to find the top insurance providers in your area.

What is the most trusted Mercury auto insurance company?

Amica is frequently ranked as the most trusted provider for Mercury vehicles due to its responsive claims service, transparent policies, and customer-first approach.

What mileage makes Mercury auto insurance cheaper?

Is there a cancellation fee for Mercury auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.