10 Best Auto Insurance Companies in South Dakota for 2026

State Farm, American Family, and Auto-Owners are the best auto insurance companies in South Dakota. Geico offers the cheapest car insurance in South Dakota at $36 per month. These SD auto insurers are known for their low rates, reliable local agents, and high claims satisfaction.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

State Farm, American Family, and Auto-Owners are the best auto insurance companies in South Dakota, while Geico offers the most affordable coverage starting at $36 per month.

- AmFam offers 25% discounts if you bundle home and auto

- Auto-Owners pays back dividends to drivers with full coverage

- Top providers offer savings for low mileage and clean driving records

These top ten providers offer a strong mix of trusted local support, reliable service, and budget-friendly rates far lower than the average cost of auto insurance in the state.

State Farm stands out as the best car insurance company in South Dakota for its personalized service through local agents.

Top 10 Companies: Best Auto Insurance in South Dakota| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 664 / 1,000 | A++ | Local Agents | |

| #2 | 660 / 1,000 | A | Claims Service |

| #3 | 654 / 1,000 | A++ | Reliability Focused | |

| #4 | 644 / 1,000 | A+ | Multi-Policies | |

| #5 | 641 / 1,000 | A++ | Budget Rates | |

| #6 | 641 / 1,000 | A | Safe Drivers | |

| #7 | 640 / 1,000 | A | Add-Ons |

| #8 | 637 / 1,000 | A+ | High-Risk Drivers | |

| #9 | 632 / 1,000 | A+ | Deductible Savings | |

| #10 | 628 / 1,000 | A | Roadside Assistance |

Start saving money today by comparing quotes from the best car insurance companies in South Dakota. Just enter your ZIP code to see the best rates available in your area.

Cost of Car Insurance in South Dakota

If you’re shopping for auto insurance in South Dakota, Geico stands out as the cheapest option, with minimum coverage starting at just $36 per month and full coverage at $80 per month.

Auto-Owners and Nationwide also offer solid value, keeping monthly full coverage costs under $95. On the other hand, Allstate and AAA land at the higher end, both pushing monthly full coverage auto insurance premiums over $100.

South Dakota Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $102 |

| $47 | $105 | |

| $43 | $96 |

| $41 | $92 | |

| $44 | $97 | |

| $36 | $80 | |

| $45 | $99 |

| $40 | $89 | |

| $39 | $86 | |

| $42 | $87 |

While those higher rates might come with extra features or stronger service, it’s something to weigh against your budget.

If you care about customer service or bundling perks, it’s worth looking beyond the price tag at companies like AmFam and Allstate, especially since the cheapest car insurance in South Dakota may not offer the best long-term value if support or coverage is lacking.

How Location Influences SD Car Insurance

When you’re comparing quotes, it’s smart to keep your ZIP code in mind. It can play a bigger role in your monthly rate than the SD car insurance companies you choose.

Places like Firesteel, Lodgepole, and Clear Lake will probably have lower monthly premiums, while drivers commuting in Sturgis and parts of Rapid City might pay more.

Some rural parts of South Dakota tend to have the cheapest average rates for both minimum and full coverage.

These lower costs typically reflect lower traffic volume, fewer claims, and lower population density.

Read More: Auto Insurance Rates by State

How Age Affects South Dakota Car Insurance Premiums

If you’re a younger driver, you’ll want to compare multiple options carefully, since the differences between providers can be over $40 a month.

Eighteen-year-olds pay the most, with Allstate reaching $149 per month for minimum coverage and others averaging over $100 a month (Learn More: Cheap Auto Insurance for Teens).

South Dakota Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $128 | $72 | $58 | $46 |

| $149 | $83 | $74 | $47 | |

| $109 | $59 | $61 | $43 |

| $101 | $55 | $50 | $41 | |

| $134 | $76 | $62 | $44 | |

| $105 | $53 | $49 | $36 | |

| $136 | $78 | $60 | $45 |

| $118 | $64 | $56 | $40 | |

| $130 | $66 | $53 | $39 | |

| $111 | $61 | $54 | $42 |

As you hit your mid-20s, rates start to drop. Geico stands out with just $53 per month at age 25. By age 35 and 45, most companies offer more affordable pricing, and Geico again offers the lowest at $49 and $36 per month, respectively.

Older drivers can usually lock in better rates by sticking with providers that reward a clean record and steady history, especially since the average cost of car insurance in South Dakota drops significantly after age 45.

How Your Driving History Impacts SD Car Insurance

Your driving record can seriously change what you pay for car insurance each month, and the differences between South Dakota car companies are pretty eye-opening.

If you have a clean record, Geico comes in at $36 per month. But it isn’t the cheapest car insurance if you have a DUI. Your first DUI can bump that to $77 a month with Geico or much higher with other companies.

South Dakota Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $46 | $68 | $110 | $50 |

| $47 | $65 | $94 | $47 | |

| $43 | $54 | $87 | $49 |

| $41 | $59 | $89 | $46 | |

| $44 | $79 | $79 | $56 | |

| $36 | $48 | $77 | $37 | |

| $45 | $75 | $124 | $54 |

| $40 | $56 | $60 | $48 | |

| $39 | $70 | $115 | $51 | |

| $42 | $55 | $61 | $52 |

Liberty Mutual, for example, charges $124 per month after a DUI, the highest among the group. On the other hand, Nationwide is one of the few that keeps your monthly rate relatively stable after a violation, with $60 after a DUI and $56 for an accident.

If you’ve had a few bumps in the road, it’s worth checking how each provider treats past incidents. Some South Dakota auto insurance companies are clearly more forgiving than others.

Read More: Best Auto Insurance for Good Drivers

How Credit Affects Auto Insurance Rates in South Dakota

Your credit score can have a big impact on what you’ll pay each month for car insurance in South Dakota. If your score is excellent, Geico offers the lowest monthly rate at just $36, while Auto-Owners and Nationwide follow close behind.

But if your credit drops, those prices climb quickly. AAA and Allstate are at $87 and $89 per month, respectively, while Geico remains the most budget-friendly at $68, even with a lower score.

South Dakota Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $46 | $51 | $62 | $87 |

| $47 | $52 | $64 | $89 | |

| $43 | $47 | $58 | $82 |

| $41 | $45 | $55 | $78 | |

| $44 | $48 | $59 | $84 | |

| $36 | $40 | $49 | $68 | |

| $45 | $50 | $61 | $85 |

| $40 | $44 | $54 | $76 | |

| $39 | $43 | $53 | $74 | |

| $42 | $46 | $57 | $80 |

The gap between excellent and poor credit can be as much as $50 a month, so if your credit isn’t great, comparing South Dakota auto insurance companies becomes even more important.

Some providers are more forgiving than others when it comes to credit history, and that could save you hundreds over the course of a year.

Learn More: Expert Guide To Different Loans

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

South Dakota Auto Insurance Requirements

This type of coverage helps pay for injuries and property damage you cause to others in a crash where you’re at fault. South Dakota’s minimum requirements include:

- $25,000 for bodily injury per person

- $50,000 for total bodily injury per accident

- $25,000 for property damage per accident

South Dakota’s minimum liability limits of 25/50/25 also apply to uninsured and underinsured motorist coverage.

This protects you if another driver causes an accident and doesn’t have enough coverage, or any at all.

When choosing coverage, start with South Dakota’s state minimums, then add collision or comprehensive if your car isn’t paid off or you’d struggle to cover major repairs out of pocket.

Dani Best Licensed Insurance Producer

While you can consider carrying just the minimum insurance requirements in South Dakota to drive legally, many drivers still choose higher limits.

You may also want to add extra insurance, like collision or MedPay coverage, to avoid steep out-of-pocket costs after a serious accident.

Optional Auto Insurance Coverages in South Dakota

Minimum coverage might get you on the road legally in South Dakota, but it won’t always protect you from the out-of-pocket costs that can follow an accident, a weather event, or even a stolen vehicle.

That’s where optional coverages come in. These five add-ons are worth considering depending on your vehicle, driving habits, and budget:

- Comprehensive Coverage: Covers non-collision incidents like hail, fire, theft, or hitting a deer.

- Collision Coverage: Pays to repair or replace your vehicle if you hit another car or a stationary object, regardless of fault. This is key if your car isn’t fully paid for.

- Medical Payments Coverage (MedPay): MedPay helps cover hospital bills resulting from a car accident, regardless of fault. If you have high-deductible health insurance, it’s a clever add-on.

- Roadside Assistance: Offers help with dead batteries, flat tires, and towing. Some companies include this as a perk, while others charge a small monthly fee.

- Rental Reimbursement: Covers the cost of a rental car while your vehicle’s in the shop after a covered claim, and is useful if you rely on your car daily.

These add-ons can make a real difference when the unexpected happens, but not every insurer structures these coverages the same way.

Review your policy to ensure you are covered for specific events, such as natural disasters, vandalism, or hit-and-run accidents. Minimum liability insurance will not cover such claims.

When you’re getting quotes, it’s worth checking not just the price, but also what protections are built in and what might be missing.

A little extra coverage each month can save you from a big financial hit later on (Read More: Read More: Collision vs. Comprehensive Auto Insurance).

How to Save on South Dakota Car Insurance

Even though South Dakota car insurance rates are generally affordable, the right discounts can make a noticeable difference.

Here are five effective ways drivers in South Dakota can lower their monthly costs by taking advantage of auto insurance discounts:

- Bundle Policies With One Provider: Combine your auto policy with home, renters, or life insurance to qualify for multi-policy discounts.

- Enroll in a Usage-Based Program: Let your insurer track your driving habits. Safe, low-mileage drivers often pay less.

- Claim Low-Mileage Discounts: Drive less than average? You may qualify for reduced rates based on how little you’re on the road.

- Install Anti-Theft Features: Vehicles with theft-prevention systems cost less to insure because they pose a lower risk.

- Keep a Clean Driving Record: Avoiding tickets and accidents can lower your premiums with most insurers.

Each insurer has its own rules, so it’s smart to compare multiple quotes. Discounts vary, but knowing where to look can help you get the best deal.

For example, Liberty Mutual offers one of the highest anti-theft discounts at 35%, while Nationwide gives up to 40% off for both usage-based and low-mileage drivers.

Top Auto Insurance Discounts in South Dakota| Company | Anti-Theft | Bundling | Low Mileage | Usage-Based |

|---|---|---|---|---|

| 8% | 15% | 10% | 30% |

| 10% | 25% | 30% | 40% | |

| 25% | 25% | 20% | 20% |

| 12% | 16% | 30% | 30% | |

| 10% | 20% | 10% | 30% | |

| 25% | 25% | 30% | 25% | |

| 35% | 25% | 30% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 30% | 30% |

On the bundling side, most insurers offer 15% to 25% off when you package your auto policy with home or renters coverage. American Family and Geico are especially generous here.

If you’re someone who drives less or uses a telematics app, companies like Allstate and Auto-Owners may reward that with solid usage-based savings.

And if you’re prioritizing low-mileage auto insurance discounts, Nationwide stands out with the highest savings for drivers who keep their annual mileage down.

Knowing these differences can help you match your specific driving habits with the South Dakota insurance companies offering the best value.

Top 10 Car Insurance Providers in SD

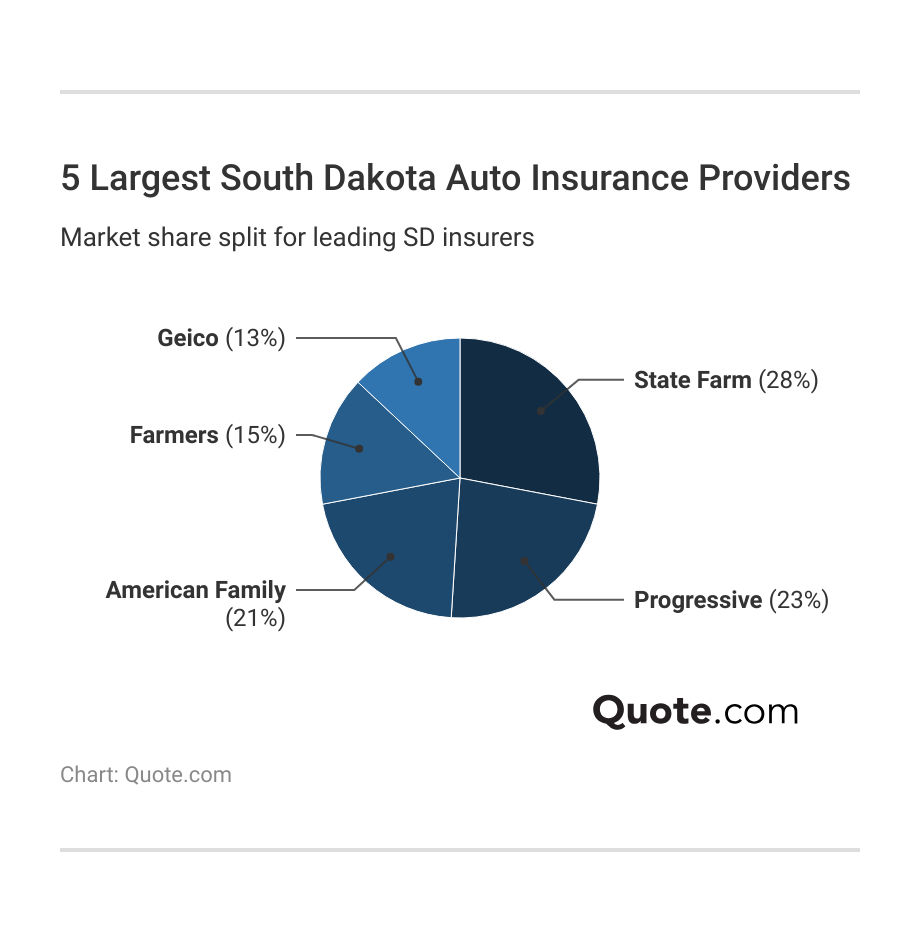

If you’re deciding between the top auto insurance companies in South Dakota, it helps to know who’s leading the market.

State Farm holds the largest share at 28%, likely because of its strong agent network and broad coverage options.

American Family isn’t far behind at 21% for its personalized coverage and reliable claims. Knowing who’s most trusted by South Dakota drivers gives you a good starting point when choosing your own provider (Learn More: State Farm vs. Farmers, Geico, Progressive, & Allstate).

When you’re shopping for coverage, it helps to know which companies most South Dakota drivers trust. Here’s a quick look at the best car insurance companies in South Dakota.

#1 – State Farm: Top Overall Pick

Pros

- Strong Agent Access: Our State Farm insurance review found that local offices across South Dakota offer drivers easy in-person access to help with claims and policy updates.

- Stable Pricing for Responsible Drivers: Drivers with a clean record often receive consistently affordable monthly premiums with very few rate surprises.

- Reliable Claims Process: The company has a strong reputation for fair, timely claims handling, especially when working through a local agent.

Cons

- Expensive for High-Risk Drivers: If you have a history of violations or poor credit, your monthly rate can increase significantly, even with basic coverage.

- Limited Tech-Driven Discounts: While there is a safe-driving program, the potential savings tend to be modest and less interactive than some customers might expect.

#2 – American Family: Best for Claims Service

Pros

- Midwestern Focus: American Family is well-established in South Dakota and understands the specific needs of local drivers, including those living in rural communities.

- Responsive Claims Handling: Based on our American Family Insurance review, many South Dakota drivers received claim updates and communication after an accident.

- Bundling Opportunities: Customers who bundle auto with a home, renters, or life policy tend to save significantly on monthly premiums.

Cons

- Higher Monthly Premiums: Drivers may find that American Family’s full coverage rates are more expensive than expected, even with discounts applied.

- Not Fully Digital: While customer service is strong, some tasks like adjusting coverage or filing claims may still require a phone call or agent visit.

#3 – Auto-Owners Insurance: Best for Reliability Focused

Pros

- Highly Rated for Service: Auto-Owners has earned a reputation for treating its customers fairly and for having helpful agents who guide you through the entire insurance process.

- Competitive Full Coverage Rates: South Dakota drivers often find that full coverage with Auto-Owners is reasonably priced, especially when bundled with other policies.

- Clear Communication: According to our Auto-Owners insurance review, customers say the company makes it easy to understand billing and coverage without hidden terms or fees

Cons

- No Online Quote Tool: Drivers looking to shop around quickly will need to speak with an agent, as quotes aren’t available online.

- Fewer Locations: While service is highly rated, the number of available agents may be limited in some smaller towns or rural areas.

#4 – Allstate: Best for Multi-Policies

Pros

- Wide Range of Coverage Options: Allstate offers a variety of policy add-ons, allowing South Dakota drivers to tailor coverage to their lifestyle.

- Loyalty Rewards: In our Allstate insurance review, we found that long-term policyholders benefit from safe-driving discounts and claim-free incentives that build over time.

- Strong Local Agent Support: Agents are available throughout the state to help with policy questions, billing concerns, and claims.

Cons

- Rates May Be Higher Than Average: Many drivers find that their monthly premiums are on the higher end, even before adding extras or increasing limits.

- Savings Programs Require Participation: Some discounts take time to apply or require extra steps, like installing a driving app or completing a review.

#5 – Geico: Best for Budget Rates

Pros

- Affordable Monthly Premiums: Many drivers in South Dakota choose Geico for its consistently low rates on both minimum and full coverage.

- Quick Online Service: You can get a quote, file a claim, and manage your policy entirely online, without speaking to an agent.

- Clear Pricing: The quote process is transparent, making it easy to see what you’re paying for and where you can adjust to save.

Cons

- No In-Person Offices Nearby: As per our Geico insurance review, drivers who prefer face-to-face support may find it lacking, as there are no in-person agents.

- Fewer Coverage Add-Ons: While it covers the basics well, there are fewer optional benefits or specialty policies available.

#6 – Farmers: Best for Safe Drivers

Pros

- Customizable Policies: Farmers offers a range of coverage options, including rental car reimbursement and glass repair, allowing drivers to tailor protection.

- Available Driver Tracking App: Safe drivers may earn long-term discounts through the company’s rewards program. Read our Farmers Insurance review to see how it works.

- Experienced Agents: Many customers appreciate working with knowledgeable agents who understand the details of their coverage.

Cons

- Premiums Can Be High: Monthly insurance rates may be more expensive than expected, especially if you don’t qualify for added discounts.

- Savings Require Engagement: Discounts often depend on continued participation in safe-driving or usage-based programs.

#7 – Liberty Mutual: Best for Add-Ons

Pros

- Strong Optional Coverage Selection: Liberty Mutual offers several useful extras, like better car replacement and new parts guarantees.

- Easy Quote Access: Drivers can view side-by-side quotes without speaking to an agent. Read our Liberty Mutual insurance review to see how the online process works.

- Well-Developed Safe Driving Tools: Liberty Mutual’s mobile app provides real-time tracking and coaching to support safer driving habits.

Cons

- Higher DUI Rates: Drivers with a history of DUI offenses in South Dakota often receive some of the steepest monthly premiums.

- Mixed Service Experiences: While some drivers report smooth claims handling, others note delays and miscommunication during the process.

#8 – Progressive: Best for High-Risk Drivers

Pros

- Flexible Policy Options: Progressive allows South Dakota drivers to personalize coverage through a wide selection of optional features.

- Usage-Based Discount Program: Safe drivers can lower their monthly rates by participating in Progressive’s Snapshot program.

- Strong Digital Experience: The website and app make it easy to get quotes, manage your policy, and file claims anytime.

Cons

- Savings Depend on Participation: Discounts often require you to use the app consistently and drive carefully to see real benefits.

- Limited Local Agent Access: In South Dakota towns, it’s harder to find in-person support. View our Progressive insurance review on how to handle claims and customer service.

#9 – Nationwide: Best for Deductible Savings

Pros

- Deductible Incentives: The company offers a program that reduces your deductible each year you go without a claim.

- Consistent Pricing After Incidents: Drivers with a recent accident or ticket may still see relatively steady monthly premiums.

- Flexible Discounts: Offers a variety of ways to save, including for bundling, safe driving, and low annual mileage.

Cons

- Fewer Local Agents: South Dakota may need to manage their policy online or by phone. See our Nationwide insurance review to learn about service without in-person agents.

- Limited Personalization Perks: While rates are stable, some drivers may find the coverage options less tailored than they’d like.

#10 – AAA: Best for Roadside Assistance

Pros

- Exceptional Emergency Services: AAA is well-known for fast, reliable roadside assistance, making it a strong pick for peace of mind on long drives.

- Member Benefits: South Dakota members receive travel discounts, identity theft protection, and savings on hotels and car rentals.

- Local Agent Availability: AAA maintains a presence in the state, offering in-person help for policy updates and questions.

Cons

- Higher Rates After Violations: A single ticket or accident can raise your rates fast. Our AAA insurance review explains how the company adjusts pricing after a violation.

- Membership Required: You must purchase an AAA membership to access their insurance offerings, which adds an extra cost for some.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Your Guide to Car Insurance in South Dakota

Choosing from the best auto insurance companies in South Dakota means finding the right mix of low rates, quality service, and coverage options.

For those who want in-person support, State Farm and Auto-Owners offer strong agent networks and consistent full coverage pricing. American Family appeals to rural drivers with responsive claims handling and bundled savings.

If you’re focused on savings, start by comparing rates in your ZIP code. Geico often offers the lowest monthly cost in South Dakota, but coverage needs vary by driver.

Daniel S. Young Managing Editor

Comparing quotes based on your driving history, location, and coverage needs is the smartest way to find the right fit. Geico has the lowest coverage at $36 per month, making it a top competitor for cost-conscious drivers.

Find the insurance companies in South Dakota near you by entering your ZIP code into our free quote tool to compare rates and coverage in your area.

Frequently Asked Questions

What is the best car insurance company in South Dakota?

State Farm is widely considered the best overall car insurance company in South Dakota due to its strong agent network, reliable claims handling, and stable rates. American Family and Auto-Owners are also top choices for service and coverage flexibility.

How much is car insurance in South Dakota per month?

Car insurance in South Dakota costs about $36 per month for minimum coverage with Geico, the state’s cheapest provider. Full coverage averages around $92 monthly, but your rate may vary based on your age, ZIP code, credit, and driving record. Enter your ZIP code to find cheaper rates.

Is Geico car insurance available in South Dakota?

Yes, Geico provides auto insurance throughout South Dakota. Although it doesn’t have local offices in the state, drivers can manage everything online, including quotes, claims, and policy updates.

What is the cheapest car insurance company in South Dakota?

Geico offers the cheapest car insurance in South Dakota, with minimum coverage starting at $36 per month and full coverage at $80 per month. It’s also among the best budget picks for those who want dependable value without sacrificing reliability.

Is car insurance mandatory in South Dakota?

Yes, you’re legally required to carry car insurance in South Dakota. The minimum required coverage includes 25/50/25 liability limits and uninsured/underinsured motorist protection, also at 25/50.

Do I need insurance to register a car in South Dakota?

Yes, proof of insurance is required before registering a vehicle in South Dakota. The policy must meet at least the state’s liability minimums of $25,000 per person and $50,000 per accident.

Can I register my car in South Dakota if I live out of state?

South Dakota lets non-residents register vehicles under certain conditions, making it a popular option for RV owners and full-time travelers. Many also explore coverage through the best travel insurance companies to stay protected on the road. Just keep in mind, your vehicle still needs to meet all state insurance and tax requirements.

How often do you have to register your car in South Dakota?

Vehicle registration in South Dakota must be renewed annually. Your renewal month is based on the first letter of your last name, and late renewals are subject to penalties.

Is South Dakota considered a cheap state for car insurance?

Yes, compared to national averages. South Dakota’s car insurance rates are lower than most states. For example, Geico’s $36 monthly rate for minimum coverage is well below the U.S. average of around $52.

Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

What is the penalty for driving without insurance in South Dakota?

Driving without insurance in South Dakota is a Class 2 misdemeanor, carrying fines up to $500, license suspension, and the possibility of jail time. You may also face SR-22 auto insurance filing requirements to reinstate your license.

Can I register my vehicle in South Dakota if I live out of state?

Is South Dakota a no-fault accident state?

Does South Dakota require vehicle inspections?

Why do people register their vehicles in South Dakota?

How often should I shop for car insurance in South Dakota?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.