10 Best Auto Insurance Companies in Wisconsin (2026)

Erie, Nationwide, and American Family are the best auto insurance companies in Wisconsin, offering the strongest customer satisfaction. At just $39 a month, Progressive has the cheapest WI car insurance. WI drivers can save 40% with usage-based discounts and bundle insurance policies for 25% off.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

The best auto insurance companies in Wisconsin are Erie, Nationwide, and American Family.

- Erie is the top overall pick for customer satisfaction and reliability

- WI requires liability coverage of at least 25/50/10

- Safe driver discount can lower WI premiums by up to 20%

Auto insurance in Wisconsin starts at $39 per month. Understanding how to compare auto insurance companies can help drivers choose the one that offers the best overall value.

Wisconsin’s top insurers stand out for pricing, flexible coverage, and how they handle rate increases based on driving record and credit score.

Top 10 Companies: Best Auto Insurance in Wisconsin| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 684 / 1,000 | A | Affordable Premiums |

| #2 | 674 / 1,000 | A+ | Policy Bundling | |

| #3 | 653 / 1,000 | A | Local Service |

| #4 | 646 / 1,000 | A++ | Usage Based | |

| #5 | 642 / 1,000 | A | Affinity Discounts |

| #6 | 634 / 1,000 | A+ | Broad Network | |

| #7 | 634 / 1,000 | A+ | Discount Flexibility | |

| #8 | 623 / 1,000 | A | Unique Benefits | |

| #9 | 607 / 1,000 | A | Tailored Policies | |

| #10 | 596 / 1,000 | A++ | Overall Value |

Drivers in WI can compare the affordability, service quality, and coverage options offered by the top Wisconsin auto insurance companies featured in this guide.

Discover which Wisconsin car insurance companies are best for your needs. Enter your ZIP code to get a personalized car insurance quote in Wisconsin that fits your budget and coverage preferences.

Compare Wisconsin Car Insurance Rates

Progressive, State Farm, and Nationwide offer the cheapest car insurance in Wisconsin. Progressive leads with rates from $39 per month for minimum coverage.

State Farm adds strong service and agent support at $40 per month. Nationwide, at $41 and $89 per month, balances affordability with flexible coverage and personalized reviews.

Wisconsin Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $47 | $105 | |

| $44 | $97 |

| $46 | $104 |

| $43 | $96 | |

| $45 | $99 |

| $41 | $89 | |

| $39 | $86 | |

| $52 | $108 | |

| $40 | $87 | |

| $42 | $92 |

You can get cheaper auto insurance in Wisconsin if you choose minimum coverage, especially if you drive an older vehicle.

Full coverage is often required on new vehicles and for Wisconsin drivers leasing vehicles, but you can get lower rates by reducing coverage limits or unnecessary policies.

Higher coverage raises monthly rates, but reviewing overlap can cut costs. For example, drop MedPay if health insurance already covers accident injuries.

Melanie Musson Published Insurance Expert

While Allstate, Erie, and American Family have slightly higher monthly rates, they stand out for their added value. They are frequently cited as the best car insurance in Wisconsin on Reddit threads (Read More: Geico vs. Allstate Auto Insurance).

Allstate adds value to Wisconsin auto insurance rates with perks like Drivewise, vanishing deductibles, and strong local support beyond just offering low premiums.

Driver Age & Auto Insurance Rates in Wisconsin

Several Wisconsin insurers offer low rates by age, especially when compared to the average cost of auto insurance.

Nationwide stands out for drivers in their 30s and 40s with premiums as low as $52 per month at age 35 and $41 per month at 45, making it a top pick for full coverage.

Wisconsin Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $149 | $83 | $60 | $47 | |

| $109 | $59 | $47 | $44 |

| $180 | $110 | $65 | $46 |

| $134 | $76 | $55 | $43 | |

| $136 | $78 | $56 | $45 |

| $118 | $64 | $52 | $41 | |

| $130 | $75 | $54 | $39 | |

| $145 | $80 | $58 | $52 | |

| $111 | $61 | $48 | $40 | |

| $137 | $79 | $59 | $42 |

Progressive is another strong contender, particularly for older drivers, offering competitive pricing such as $54 per month at age 35 and $39 per month at age 45, and it often rewards safe driving with additional discounts.

American Family offers low rates starting at age 25 and stays affordable as drivers age, making it a strong choice for low-income car insurance in Wisconsin. These providers offer consistent savings and flexible coverage across age groups.

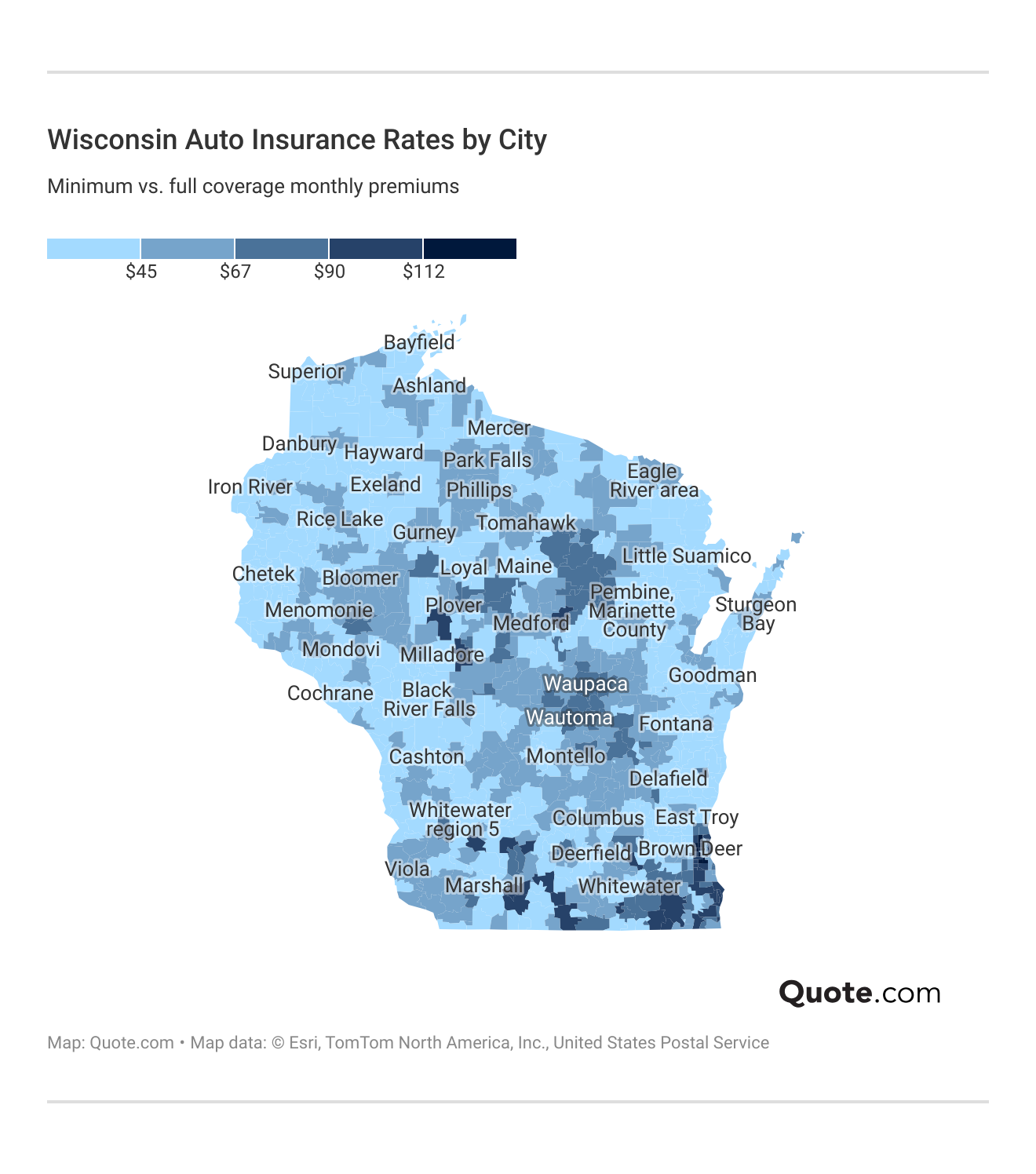

Cheapest Cities for Car Insurance in Wisconsin

Auto insurance premiums in Wisconsin differ based on where drivers live, and small towns often have the cheapest insurance.

Coloma and Arcadia stand out with minimum coverage rates as low as $35 and $37 per month, thanks to lower traffic and fewer claims.

Cities like Ashland see higher rates, but getting multiple auto insurance quotes can help local drivers find cheaper Wisconsin car insurance companies.

For instance, Progressive, State Farm, and Nationwide often have better deals, especially in low-cost areas.

Auto Insurance in Wisconsin for All Driving Records

Progressive, State Farm, and Nationwide offer low, stable rates in Wisconsin for drivers with clean or imperfect records.

Progressive leads with $39 per month for clean records and stays competitive after a DUI at $57 per month.

Wisconsin Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $47 | $66 | $94 | $48 | |

| $44 | $65 | $87 | $50 |

| $46 | $78 | $126 | $57 |

| $43 | $56 | $86 | $52 | |

| $45 | $64 | $124 | $54 |

| $41 | $54 | $61 | $50 | |

| $39 | $50 | $57 | $47 | |

| $52 | $80 | $129 | $60 | |

| $40 | $53 | $60 | $49 | |

| $42 | $55 | $98 | $44 |

State Farm remains steady with minor price increases after violations, while Nationwide offers one of the lowest DUI rates at $61 per month.

It can be hard to find cheap auto insurance after a DUI in Wisconsin, but Nationwide keeps coverage affordable for high-risk drivers.

Erie, Safeco, and Liberty Mutual raise rates sharply after violations, making them less attractive for high-risk drivers.

Progressive, State Farm, and Nationwide keep premiums low even after accidents or DUIs, with rates starting around $39 per month.

Credit Score & Wisconsin Insurance Rates

Solid-priced insurers can offer savings for Wisconsin drivers of all credit levels. Progressive is a money leader with monthly rates ranging from $39 for excellent credit and up to just $68 with poor credit.

State Farm and Nationwide also offer competitive pricing. State Farm maxes out at $69 per month, and Nationwide at $70 monthly for drivers with poor credit.

Wisconsin Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $47 | $56 | $67 | $80 | |

| $44 | $52 | $62 | $74 |

| $46 | $55 | $65 | $78 |

| $43 | $51 | $60 | $72 | |

| $45 | $54 | $64 | $76 |

| $41 | $49 | $59 | $70 | |

| $39 | $47 | $57 | $68 | |

| $52 | $63 | $74 | $88 | |

| $40 | $48 | $58 | $69 | |

| $42 | $50 | $61 | $73 |

In contrast, providers like Safeco and Erie show steeper increases as credit scores drop, making them less ideal for those with lower credit scores (Read More: Erie Auto Insurance vs. MetLife).

However, Erie offers its exclusive Rate Lock that can lock in cheap rates no matter how your driving record or credit score changes, as long as you don’t add a new vehicle, new driver, or move out of state.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Wisconsin Car Insurance Requirements

All Wisconsin drivers must carry a minimum amount of auto insurance to legally operate a vehicle. These required coverages help ensure drivers can cover basic costs from injuries or property damage in an at-fault accident.

Not meeting these minimum requirements can result in monetary penalties, licenses being revoked, and other legal implications. The required minimum limits are:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $10,000 for property damage per accident

Minimum coverage provides basic financial responsibility, but often comes up short in serious accidents. A lot of drivers opt for full coverage or extras such as collision and comprehensive to provide more protection (Learn More: Auto Insurance Rates by State).

Picking the Right Wisconsin Car Insurance Coverage

Many drivers choose full coverage, which includes collision auto insurance coverage and comprehensive coverage. These added protections help you avoid out-of-pocket costs for repairs or vehicle replacement after unexpected events.

- Liability Insurance: Covers damage you cause to others. Wisconsin requires at least 25/50/10 for injuries and property damage.

- Collision Coverage: Covers the costs to fix your car when you’re in an accident, no matter who caused it, and is frequently mandatory for lessees and purchasers with auto loans.

- Comprehensive Coverage: Covers non-collision damage like theft, vandalism, weather, and animal strikes. Ideal for newer or high-value vehicles.

Buying all three types together will be a full coverage auto insurance policy that provides better protection for you, your passengers, and your vehicle in the event of an accident.

In Wisconsin, drivers also have the option to add underinsured motorist coverage for collisions with hit-and-run drivers or someone with insufficient policy limits.

Medical payments coverage (MedPay) is also available to cover post-accident medical costs, regardless of fault, with quick access to emergency funds.

These extra safeguards would pay for your own car’s repairs, medical treatments, and claims against you that go beyond another driver’s policy limits, offering fuller protection than the state requires.

Ways to Save on Car Insurance in Wisconsin

Saving on car insurance in Wisconsin takes more than just applying standard discounts like bundling or safe driving.

While that helps, many motorists neglect other tactics that can lead to big savings in monthly premiums.

- Raise Your Deductible: Raising your collision or comprehensive deductible can lower your monthly premium if you can pay more out of pocket after a claim.

- Shop Around at Renewal Time: Insurance rates shift often. Compare quotes from multiple insurers each year to make sure you’re still getting the best price.

- Maintain or Improve Your Credit Score: Many Wisconsin insurers use credit‑based insurance scores, so improving your credit history can lead to lower premiums over time.

- Avoid Gaps in Coverage: Keeping continuous insurance without lapses prevents you from being treated as high‑risk and helps you retain lower rates.

With Wisconsin’s competitive insurance market, regularly comparing auto insurance quotes in Wisconsin and adjusting your coverage can help you find better rates.

Whether you’re a new or experienced driver, taking a proactive approach can help reduce costs while maintaining solid protection.

Top Auto Insurance Discounts in Wisconsin| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 15% | 25% | 23% | 30% |

| 10% | 20% | 30% | 30% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 20% | 15% | 20% | 30% | |

| 15% | 17% | 25% | 30% | |

| 15% | 13% | 10% | 30% |

You can lower car insurance costs in Wisconsin by using both common and lesser-known discounts.

Small changes, such as raising your insurance deductibles, maintaining continuous coverage, or improving your credit score, can lead to long-term savings.

Reviewing your policy regularly and comparing the best car insurance in Wisconsin reviews before each renewal helps ensure you’re not overpaying.

Always compare multiple Wisconsin car insurance companies online to see which one offers the best price based on deductibles, driving record, and discount options.

Best Car Insurance Companies in Wisconsin

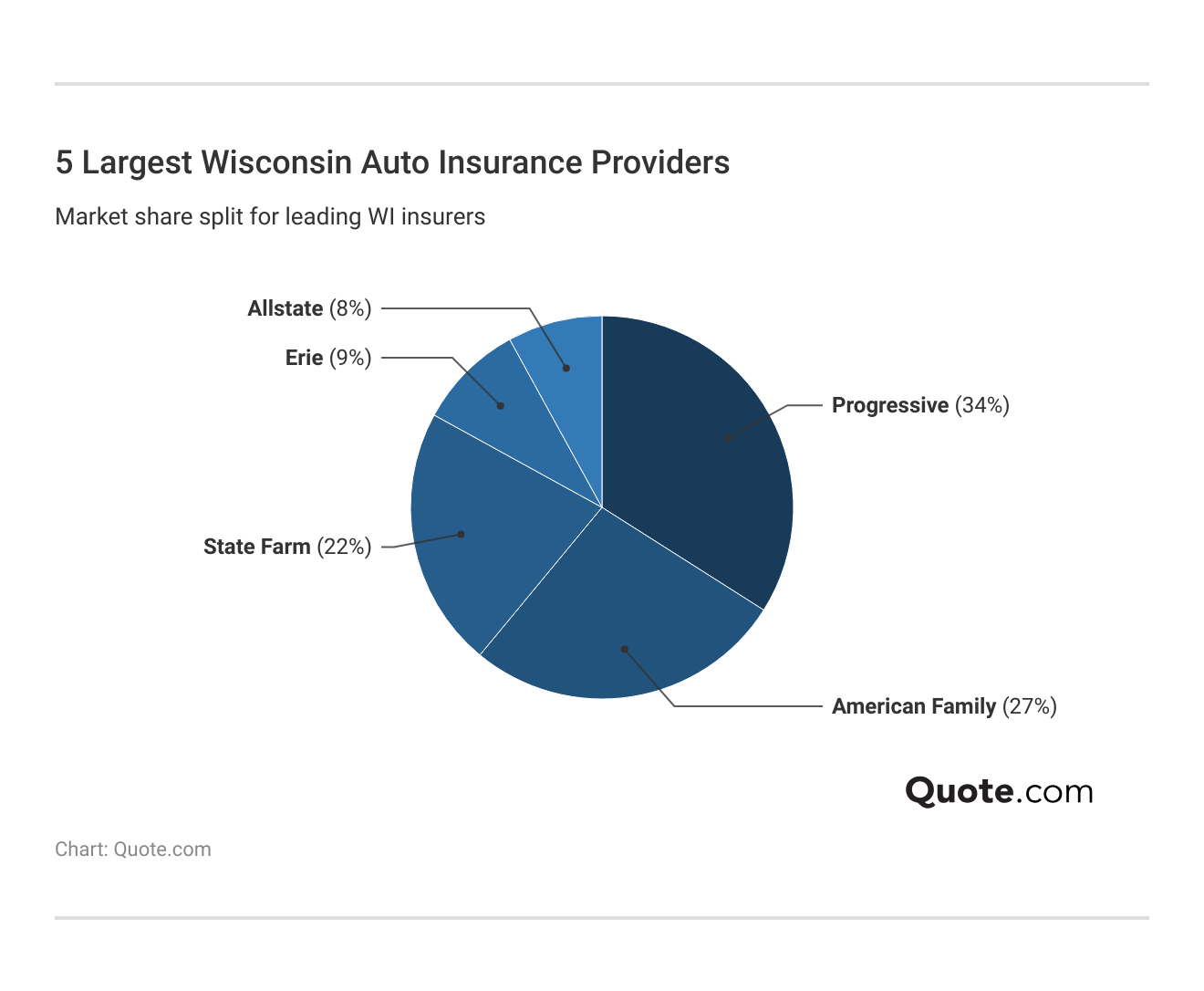

Among the top auto insurance companies in Wisconsin are Progressive with 34% market share, American Family with 27%, State Farm with 22%, Erie with 9%, and Allstate with 8%.

These companies lead the market with a strong mix of affordability, trusted service, and comprehensive auto insurance coverage.

American Family offers strong local support, State Farm is known for service and options, Erie rewards safe drivers, and Allstate attracts with bundling.

Compare these top insurers to see which meet Wisconsin drivers’ needs with reliable coverage and value.

#1 – Erie: Top Overall Pick

Pros

- Low Full Coverage Rates: Erie’s full coverage in Wisconsin averages $103 per month, making it a top budget option. Find more quotes in our Erie insurance review.

- Unique Value Features: Erie car insurance in Wisconsin offers free glass repair, pet injury coverage, and diminishing deductibles for added value.

- Customer Satisfaction Leader: Erie earns high marks in Wisconsin for claims handling, with strong J.D. Power scores and fewer customer complaints than most competitors.

Cons

- Limited Digital Features: Erie’s website and mobile tools may feel outdated for Wisconsin drivers used to tech-first insurers like Progressive.

- No Online Quotes: Erie usually requires agent interaction for quotes in Wisconsin, slowing down the comparison process.

#2 – Nationwide: Best for Policy Bundling

Pros

- Solid Multi‑policy Discount: Nationwide, one of the best home and auto insurance companies in Wisconsin, offers up to a 15% bundling discount.

- Strong Statewide Presence: Nationwide’s Wisconsin auto insurance program offers localized service and coverage tailored to the state’s driving needs and regulations.

- Bundling Adds Value: Bundling in Wisconsin offers perks like accident forgiveness and SmartRide rewards. Learn more in our Nationwide auto insurance review.

Cons

- Locked Into One Carrier: Wisconsin drivers may lose discounts if they switch to another insurer for better rates.

- Limited Local Access: Nationwide has fewer walk-in offices in Wisconsin than some competitors, which may impact those who prefer in-person support.

#3 – American Family: Best for Local Service

Pros

- Strong Local Presence: American Family is headquartered in Madison, Wisconsin, helping it deliver personalized agent support across the state.

- Competitive Premiums for Many Drivers: In Wisconsin, American Family averages $111 per month for full coverage, making it a budget-friendly choice.

- Family‑Friendly Discount Programs: Offers usage-based and teen driver discounts for safe driving in Wisconsin. See a full list in our AmFam insurance review.

Cons

- Higher Rates for Risky Drivers: Wisconsin drivers with a DUI or accident may see premiums rise by 52% to 74%.

- Weaker Digital Tools: American Family’s online experience in Wisconsin lags behind digital-first competitors.

#4 – State Farm: Best for Usage-Based Discounts

Pros

- Usage-Based Discounts: State Farm has Drive Safe & Save in Wisconsin that rewards safe driving with discounts of up to 30%. Check out our State Farm auto insurance review for more information.

- Low Starting Rates: The minimum coverage in Wisconsin is one of the cheapest at around just $21 per month, which is perfect for frugal motorists.

- No Signup Penalty: Wisconsin drivers can join the program without premium increases just for enrolling.

Cons

- Savings Depend on Profile: In Wisconsin, usage-based discounts vary by ZIP code, vehicle, and habits, so not all drivers see full savings.

- Not Always Cheapest: Wisconsin drivers without usage-based discounts may find lower rates with price-focused insurers.

#5 – Liberty Mutual: Best for Affinity Discounts

Pros

- Affinity Group Savings: Liberty Mutual offers exclusive discounts for Wisconsin drivers in professional or alumni groups.

- Wide Discount Options: Wisconsin drivers can save with bundling, multi-policy, and usage-based programs like RightTrack. See our Liberty Mutual insurance review for more.

- Flexible Coverage Add-Ons: Optional features like accident forgiveness and new-car replacement enhance value for Wisconsin drivers.

Cons

- Discounts Offset by Risk: A WI driver with violations or bad credit might have higher rates than average, negating some of those savings overall.

- Quotes Not Always Lowest: Wisconsin drivers without special discounts may find cheaper base rates elsewhere.

#6 – Allstate: Best for Broad Network

Pros

- Wide Agent Network: Allstate is widely represented throughout WI, which provides strong local support and convenient claims filing.

- Robust Coverage Choices: WI drivers can tailor policies with features such as accident forgiveness and rideshare coverage. Discover more in our Allstate insurance review.

- Digital Convenience: Allstate combines in-person help in Wisconsin with easy online tools for quotes and policy management.

Cons

- Higher Premiums: Allstate’s full coverage in Wisconsin averages around $182 per month, which is higher than many local competitors.

- Limited Rural Access: Some rural areas in Wisconsin may have fewer Allstate walk-in offices, reducing in-person service options.

#7 – Progressive: Best for Discount Flexibility

Pros

- Multiple Discount Options: Progressive offers Wisconsin drivers savings like paperless billing and up to 12% off for bundling auto and home.

- Non-Traditional Discounts: Progressive gives WI drivers discounts for full pay, paperless, or owning a home. Get a complete view in our Progressive auto insurance review.

- Flexibility to Customize Coverage: Progressive lets Wisconsin drivers tailor policies to fit their budget and driving needs with tools like “Name Your Price.”

Cons

- Usage-Based Risk: Snapshot can help Wisconsin drivers save, but risky driving may lead to higher premiums.

- Discount Complexity: Multiple discount rules can confuse Wisconsin drivers and lead to missed savings.

#8 – Farmers: Best for Unique Benefits

Pros

- Customizable Coverage: Farmers offers personalized policies in Wisconsin and provides add-ons such as roadside assistance and rental reimbursement.

- Clear Policy Terms: Wisconsin drivers find Farmers’ coverage details easy to understand and transparently explained. Find more in our Farmers insurance review.

- Limited Discount Access: Some top discounts in Wisconsin, like Signal, require specific driving habits or program enrollment.

Cons

- Above-Average Base Premiums: Farmers’ full coverage premiums in Wisconsin average $100–$110 per month, which is above cheaper options.

- Higher Add-On Costs: While customization is a benefit, adding extra protections like rental reimbursement or new car replacement can raise monthly premiums in Wisconsin.

#9 – Safeco: Best for Tailored Policies

Pros

- Customized Coverage Designs: Safeco offers highly adjustable policy options for Wisconsin drivers, enabling tailored protection based on vehicle type and usage.

- Low Minimum Premiums: Safeco averages about $60 per month for minimum coverage in Wisconsin for clean-record drivers. Check out our Safeco auto insurance review.

- Independent Agent Access: Safeco sells policies through independent agents, giving Wisconsin drivers local support and choice when configuring their tailored coverage.

Cons

- Selective Discount Eligibility: Some Wisconsin drivers may not qualify for top savings without joining telematics programs like RightTrack.

- Digital Experience Lag: Some Wisconsin policyholders report that Safeco’s online quote tool and self‑service portal are less advanced than those of fully digital insurers.

#10 – Travelers: Best for Overall Value

Pros

- Outstanding Rate Leader: Travelers Insurance in Wisconsin offers full coverage from $85 per month, making it one of the state’s most affordable options.

- Wide Discount Portfolio: WI drivers can save with discounts for safe driving, bundling, low mileage, and IntelliDrive. Find the full list in our Travelers auto insurance review.

- Strong for Clean Records: Travelers delivers lower-than-average rates in Wisconsin for drivers with clean histories, offering excellent value.

Cons

- Telematics Required Discounts: Some of the deepest savings in Wisconsin depend on usage‑based programs like IntelliDrive, which may not appeal to all drivers.

- Less Favorable for High‑Risk Profiles: Travelers’ rates rise sharply for Wisconsin drivers with accidents or DUIs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Explore Affordable Auto Insurance in Wisconsin

Erie, Nationwide, and American Family stand out among the best auto insurance companies in Wisconsin. Erie offers the best full coverage car insurance in Wisconsin, with competitive pricing and free pet protection.

Nationwide and AmFam both offer comprehensive coverage options, reliable customer service, and a long list of auto insurance discounts.

With rates from $39 per month, drivers can choose from various types of auto insurance with flexible features, local agent support, and discounts for safe driving, bundling, and low mileage.

Premiums vary by credit, driving history, and location. Enter your ZIP code to compare Wisconsin car insurance quotes and find the best coverage.

Frequently Asked Questions

Who has the best car insurance in Wisconsin?

Erie, Nationwide, and American Family are considered the best car insurance companies in Wisconsin, offering strong local support, competitive rates, and flexible coverage options.

What is the cheapest car insurance in Wisconsin?

Progressive offers the cheapest car insurance in Wisconsin, with rates starting at $39 per month for minimum coverage and around $86 per month for full coverage. Use our free quote comparison tool to find the cheapest coverage in your area.

What is the average cost of auto insurance in Wisconsin?

The average cost of auto insurance in Wisconsin is about $39 per month for liability and between $86 to $92 for full coverage. Compare liability vs. full coverage auto insurance for more quotes.

Is it illegal not to have car insurance in Wisconsin?

Yes, it is illegal to drive a vehicle without insurance or other approved financial responsibility in Wisconsin. Convictions can lead to fines up to $500, and suspensions of your driver’s license and vehicle registration.

What is the minimum auto insurance limit in Wisconsin?

The minimum auto liability coverage requirements in WI include $25,000 for injuries to or death of one person, $50,000 for injuries or deaths of two or more people arising out of a single accident, and $10,000 for property damage.

What is the best auto and home insurance bundle in Wisconsin?

The best auto and home insurance bundles in Wisconsin include State Farm, offering about $135 per month with notable savings when policies are combined.

Can you insure a car you don’t own in Wisconsin?

Yes, in Wisconsin, you can get a non‑owner car insurance policy, which covers you for liability when driving a vehicle you don’t own.

What kind of car insurance do I need in Wisconsin?

In Wisconsin, you are legally required to have liability coverage of $25,000 for injury to one person, $50,000 for multiple people, $10,000 for property damage, and uninsured motorist coverage of $25,000 per person and $50,000 per accident.

Is Wisconsin a no-fault state?

No, Wisconsin is not a no-fault state. It follows a tort-based system in which the at-fault driver is liable for damages, and many drivers choose more than the minimum required by the auto insurance requirements by state for better protection.

What happens if you are hit by an uninsured driver in Wisconsin?

If you are hit by an uninsured driver in Wisconsin, your uninsured motorist (UM) coverage will cover your bodily injuries up to the state-required minimums of $25,000 per person and $50,000 per accident, but it does not cover vehicle damage unless you have collision coverage or additional property damage protection.

How long does an accident stay on your record in Wisconsin?

What is the recommended car insurance coverage in Wisconsin?

How do you clean your driving record in Wisconsin?

What is considered full coverage auto insurance in Wisconsin?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.