Cheap Rideshare Insurance in 2026

Mercury, Geico, and State Farm offer cheap rideshare insurance. Rates start at $42 a month. Get lower premiums with 20% safe driver discounts from Farmers, or 25% multi-vehicle discounts from Amica. The best rideshare insurance combines personal coverage with a hybrid policy to cover the gaps while you work.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated February 2026

Cheap rideshare insurance starts at $42 per month with Mercury, which also offers low rates for high-risk drivers and excellent accident forgiveness perks.

- Mercury keeps monthly rates under $90, even for drivers with poor credit

- Coverage gaps make rideshare endorsements or hybrid policies essential

- State Farm offers 25% safe driver discounts on rideshare policies

Geico excels by providing hybrid coverage to remove the gap between personal and rideshare use, plus competitive full coverage for only $114 per month.

State Farm stands out for its strong post-claim rate stability, high availability, and near-nationwide rideshare endorsement, making it a top bet for full-time or part-time drivers.

10 Best Companies: Cheapest Rideshare Insurance| Company | Rank | Monthly Rates | Claims Satisfaction | Best for |

|---|---|---|---|---|

| #1 | $42 | 701 / 1,000 | Young Drivers | |

| #2 | $43 | 697 / 1,000 | Budget Drivers | |

| #3 | $47 | 716 / 1,000 | Driver Support | |

| #4 | $53 | 691 / 1,000 | Trip Coverage | |

| #5 | $62 | 702 / 1,000 | Policy Perks |

| #6 | $63 | 729 / 1,000 | Claim Stability | |

| #7 | $65 | 718 / 1,000 | Service Quality | |

| #8 | $76 | 690 / 1,000 | Coverage Options | |

| #9 | $87 | 693 / 1.000 | Ride Protection | |

| #10 | $96 | 730 / 1,000 | Accident Benefits |

These companies offer a nice balance between rates, coverage, and driver-specific coverages, making them a top choice for rideshare professionals who don’t want to pay for traditional commercial auto insurance.

Finding cheap rideshare insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare rideshare insurance rates near you.

Compare Rideshare Insurance Rates

Mercury, Geico, and State Farm have the lowest rideshare insurance rates, starting at $42 per month for minimum coverage, but they stand out for more than just price.

Mercury leads overall with consistently low rates, strong accident benefits, and competitive options even for drivers with past violations, such as DUIs.

Rideshare Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $65 | $215 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $42 | $110 | |

| $63 | $164 | |

| $47 | $123 | |

| $53 | $141 |

State Farm offers both affordability and top-notch customer service, plus rideshare endorsements that continue coverage between your personal and app-on time for full-time drivers.

Geico offers cheap full coverage auto insurance at $114 per month, plus a hybrid policy that eliminates gaps between personal and commercial use, streamlining coverage for gig workers.

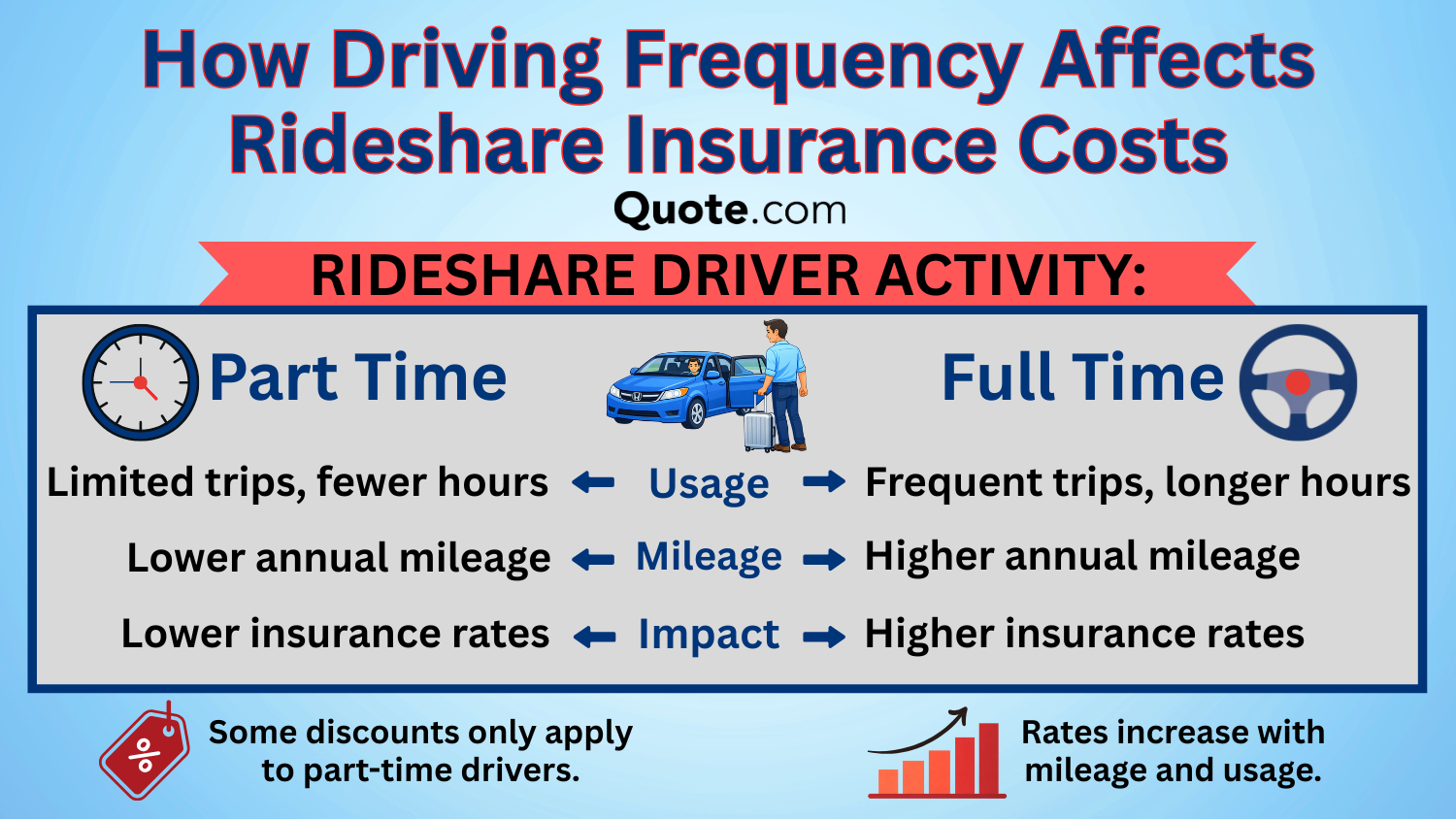

Rideshare insurance costs increase as coverage rises. Match your limits to how often you drive.

Dani Best Licensed Insurance Agent

American Family, while slightly more expensive than some competitors, stands out for its flexible and customizable coverage options.

Unlike insurers that lock you into rigid online-only policies, AmFam connects you with local agents who can tailor your policy to fit your exact needs, whether you’re a part-time gig worker or a full-time rideshare driver.

Your rideshare insurance rates will fluctuate depending on how often you work and when. Not every insurer is as flexible with their rideshare coverage, so shop around for a provider that fits your driving habits.

Insurance for rideshare drivers should offer long-term dependability and support beyond just price. Use our free comparison tool to find the right company for you.

Minimum Age and Insurance Costs for Rideshare Drivers

Before reviewing rideshare insurance rates by age, it’s important to understand how age affects eligibility and the average cost of auto insurance.

Most rideshare companies, including Uber, require drivers to be 21, but many set the minimum at 25, making it harder for younger drivers to get cheap rideshare insurance for Uber.

While 21 is the technical minimum, many drivers may not meet all qualifications until 25, for both regulatory and affordability reasons. Many states raise the age to 25 to meet commercial insurance rules, local regulations, and underwriting standards.

Age has a big impact on how much you’ll pay for rideshare insurance, especially if you’re under 25. Request that your policy be rerated next time you renew.

Melanie Musson Published Insurance Expert

Assuming you meet the age criteria, a valid U.S. license (usually for one year), a clean driving record and background check, an eligible vehicle, and an insurance policy are required to be a rideshare driver.

How do rideshare insurance costs vary by age? Motorists under 25 often pay higher rates, while experienced drivers often receive lower rates. Geico and Mercury are among the cheapest rideshare insurance providers for drivers of all ages.

Rideshare Auto Insurance Monthly Rates by Age| Company | Age: 21 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $121 | $102 | $93 | $87 | |

| $92 | $78 | $69 | $62 |

| $96 | $81 | $72 | $65 | |

| $116 | $98 | $87 | $76 | |

| $59 | $50 | $46 | $43 | |

| $141 | $119 | $107 | $96 |

| $61 | $52 | $46 | $42 | |

| $96 | $81 | $71 | $63 | |

| $71 | $60 | $53 | $47 | |

| $74 | $62 | $56 | $53 |

However, while these two companies top the charts in price, State Farm and American Family offer more than just cost savings. State Farm offers strong value with seamless rideshare coverage and support.

American Family offers flexible coverage and local support, making it a great option for cheap auto insurance for teens. While Mercury and Geico lead on price, these top picks balance value and reliability.

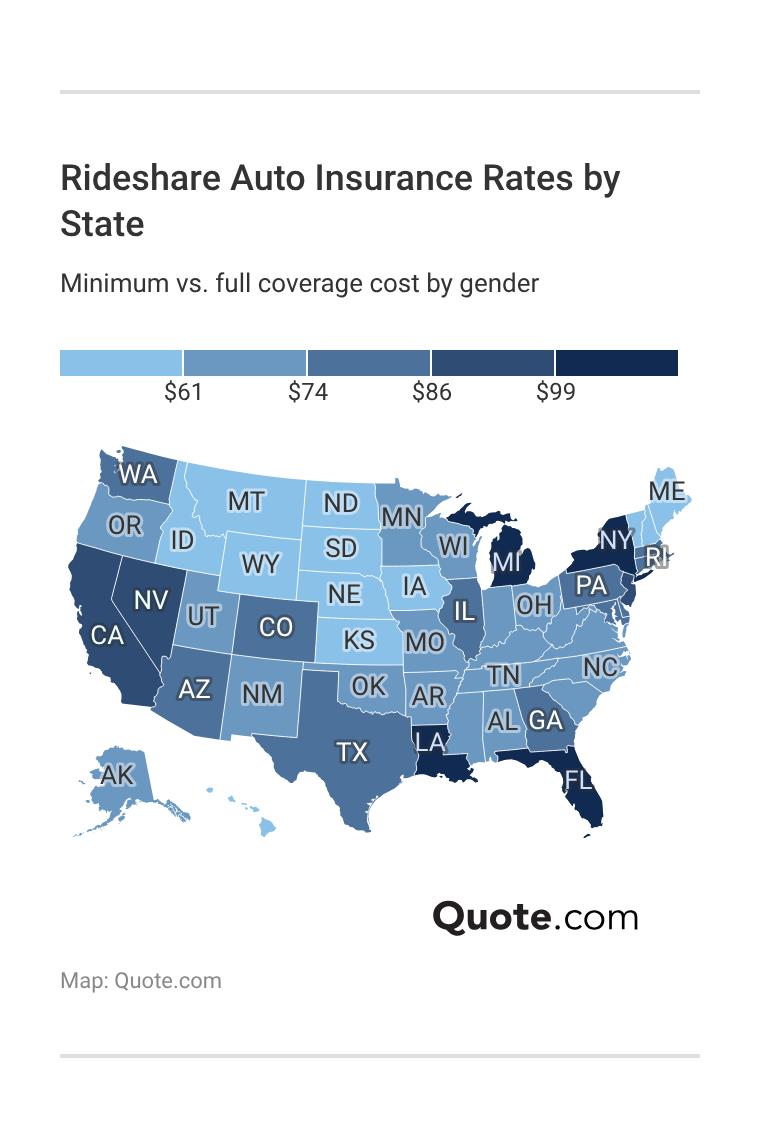

Rideshare Insurance Costs by State

Finding cheap rideshare insurance for drivers can differ substantially by state and gender. Regional laws, claims data, and insurer underwriting practices all account for the different prices.

In every state, minimum and full coverage costs more for male drivers since they are considered riskier and more likely to file claims than women. Learn More: Auto Insurance Rates by State

In Wyoming, both male and female drivers enjoy some of the lowest rideshare insurance rates nationwide, with full coverage auto insurance under $115 a month.

California has the highest rideshare rates, with premiums up to $199 per month. Illinois offers mid-range pricing, with full coverage averaging $160–$170 per month.

How Driving Record Affects Rideshare Insurance Costs

Mercury, Geico, and State Farm offer the cheapest rideshare insurance policies for all types of driving records, so they’re good options whether you have a clean record or have had past incidents.

Mercury leads with the lowest rates overall, offering cheap auto insurance after a DUI at just $70 per month, well below most competitors.

Rideshare Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $65 | $99 | $123 | $81 | |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $42 | $62 | $70 | $52 | |

| $63 | $88 | $129 | $75 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 |

Geico is another budget-friendly option, especially for those with clean records or a single ticket, with rates starting at $43 per month and remaining relatively low for minor violations.

State Farm really shines with exceptionally consistent pricing across each infraction. DUI rates are the lowest at $65 a month.

Consistency in pricing like that is uncommon, and it’s especially valuable for drivers looking for reliable coverage without a dramatic rate increase.

Some rideshare companies may require high-risk drivers to carry higher limits, so shop around with multiple companies to find the best price on your policy.

Credit Score Impact on Rideshare Insurance Rates

Mercury, Geico, and State Farm have the cheapest rideshare insurance rates for everyone, from those with poor credit to those with excellent scores.

Mercury comes in the lowest across the board, with a minimum of $42 per month for excellent credit and staying below $90 a month even with poor credit.

Rideshare Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $87 | $102 | $128 | $171 | |

| $62 | $74 | $93 | $126 |

| $65 | $78 | $99 | $136 | |

| $76 | $90 | $117 | $158 | |

| $43 | $51 | $66 | $92 | |

| $96 | $113 | $144 | $198 |

| $42 | $49 | $62 | $88 | |

| $63 | $75 | $95 | $131 | |

| $47 | $55 | $70 | $99 | |

| $53 | $63 | $80 | $113 |

State Farm could be more expensive, but it provides long-term stability in your costs, strong customer satisfaction ratings, and highly available rideshare endorsements consistently across credit levels.

Though Mercury and Geico lead on pricing, State Farm remains a top choice for those seeking more than just the cheapest car insurance by offering strong support and stable coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Recommended Rideshare Insurance Coverage

Rideshare drivers operate somewhere between personal and commercial service, so it’s crucial to have coverage that addresses the gray area left by most auto insurance.

Your personal policy will not cover you as a rideshare driver. Full-time drivers may need full commercial insurance, while part-time drivers may be eligible for a cheaper add-on policy.

Rideshare endorsements or hybrid policies are essential for continuous protection. Providers offer different types of rideshare car insurance coverage, each tailored to match a driver’s level of gig activity and coverage needs.

Commercial auto insurance is the most comprehensive option, typically required for full-time rideshare drivers, and comes with the highest premiums due to its extended coverage for business use.

Types of Rideshare Insurance Policies| Policy Type | Driver Use | Cost Impact |

|---|---|---|

| Commercial Auto | Full-time rideshare | Highest premiums |

| Rideshare Add-On | Part-time rideshare | Moderate increase |

| Personal Auto | Personal driving only | Lowest premiums |

| Platform Coverage | Active app-based trips | Included during trips |

For those who drive part-time or occasionally, a rideshare add-on, also known as a rideshare endorsement, can be added to a standard personal auto policy, offering necessary protection with only a moderate increase in cost.

Most personal policies exclude coverage during any app-on activity, and while platforms like Uber and Lyft provide some insurance, it’s often limited, especially during Period 1, when the app is on, but no ride has been accepted.

In these moments, your rideshare endorsement or hybrid policy kicks in to extend your personal coverage to business use. If you have liability, it will pay for damages or injuries you cause to someone else, but add comprehensive and collision to pay for your car.

- Collision Coverage: This covers repairs or replacement of your car if you’re in a crash, regardless of who caused it. Read More: Collision vs. Comprehensive Auto Insurance

- Comprehensive Coverage: Protects you against non-crash incidents such as theft, vandalism, or weather damage. Optional, but it will provide better overall security.

- Liability Coverage: Protects you in the event that you cause injury or damage to another person or their property.

- Rideshare/Commercial Endorsement Coverage: It provides coverage when the app is on, but before a ride has been accepted.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Helps pay for your expenses if you’re struck by a driver with insufficient or no insurance.

Meanwhile, most rideshare platforms like Uber and Lyft offer platform-provided coverage, which is automatically activated during active trips and while en route to pickups.

However, this coverage often includes high insurance deductibles and limited protection between rides. Drivers will want to consider adding more coverage options to have a plan that is as strong and dependable.

Rideshare Insurance Providers for Uber & Lyft

Lyft and Uber rideshare insurance availability depends greatly on the insurer. Some providers offer broad nationwide coverage, while others offer coverage only in certain states or only through an add-on option.

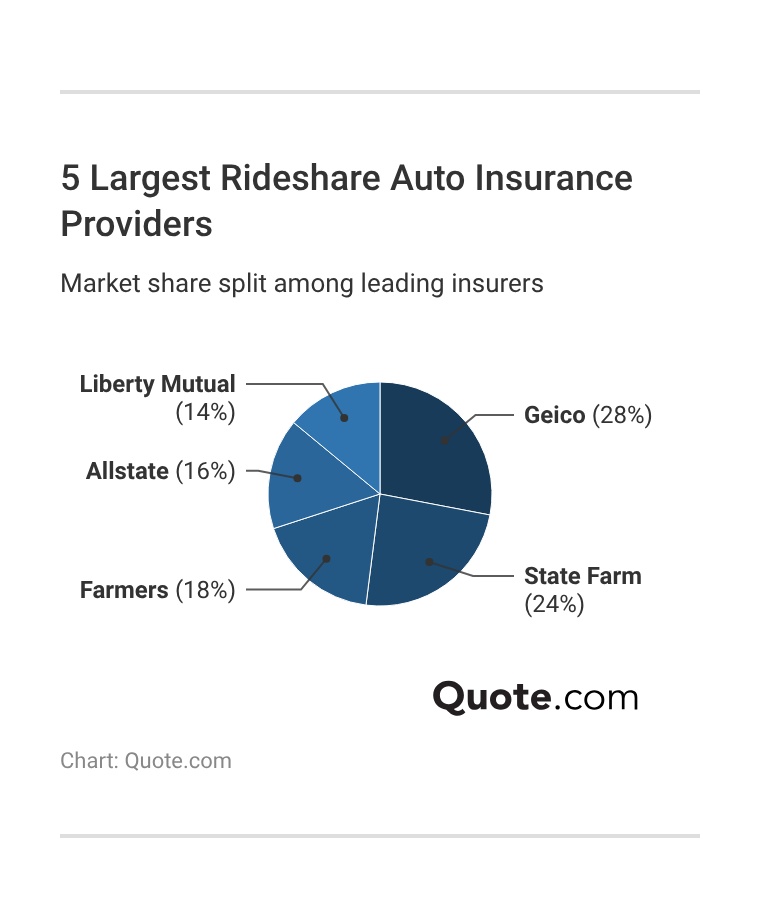

Allstate, Farmers, Travelers, and Progressive rideshare insurance stand out by providing full rideshare coverage for Lyft and Uber drivers, making them strong, widely accessible options. Learn More: State Farm vs. Farmers, Geico, Progressive, & Allstate

Lyft vs. Uber Insurance Coverage Availability by Provider| Insurance Company | ||

|---|---|---|

| ✅ | ✅ | |

| ⚠️ Many States | ⚠️ Most States |

| ❌ | ❌ | |

| ✅ | ✅ | |

| ⚠️ Few States | ⚠️ Many States | |

| ⚠️ Many States | ⚠️ Many States |

| ⚠️ Few States | ⚠️ Many States | |

| ⚠️ Add-on Plan | ✅ | |

| ⚠️ Most States | ⚠️ Most States | |

| ✅ | ⚠️ Add-on Plan |

American Family, Liberty Mutual, and State Farm offer rideshare insurance in most states, but drivers should check locally because coverage may vary depending on local laws.

Geico and Mercury both have limited rideshare policy availability, which can limit eligibility for a few drivers despite their fair pricing.

Nationwide supports Uber directly, making it one of the best insurance for Uber drivers, while Travelers offers Lyft coverage with Uber support through an add-on. Amica does not offer rideshare insurance for either platform.

Ultimately, while some companies offer broad coverage to start, often in favour through endorsements or state-specific, drivers need to check the coverage provided based on location and platform of choice.

Ways to Save on Rideshare Auto Insurance

Qualifying for multiple discounts can really add up to significant long-term savings by reducing your premiums and helping you get more favorable pricing tiers over time.

For more savings opportunities, check out our guide to 17 car insurance discounts you can’t miss.

Top Rideshare Auto Insurance Discounts| Company | Loyalty | Multi-Vehicle | Safe Driver | Usage-Based |

|---|---|---|---|---|

| 15% | 10% | 18% | 30% | |

| 18% | 23% | 18% | 25% |

| 13% | 25% | 15% | 25% | |

| 12% | 12% | 20% | 20% | |

| 10% | 25% | 15% | 30% | |

| 10% | 25% | 20% | 30% |

| 10% | 20% | 8% | 20% | |

| 8% | 15% | 12% | 40% | |

| 6% | 20% | 20% | 30% | |

| 9% | 8% | 15% | 20% |

Combining your auto, home, renters, and life insurance policies with a single provider can deliver significant savings and make managing your policies easier.

Another smart move is adjusting your deductible. Choosing a higher deductible typically lowers your monthly premium, but you should only do so if you have the savings to cover a potential out-of-pocket cost.

- Bundle Policies: Combine rideshare insurance with home, renters, or life coverage to earn a multi-policy discount

- Increase Your Deductible: Opting for a higher deductible will reduce your monthly premium. Just be sure you have the out-of-pocket cost in case of a claim.

- Limit Driving During High-Risk Hours: Driving less at night or during heavy traffic can reduce risk and lower rates in some programs.

- Maintain a Clean Claims History: There can be a claim-free discount and favourable renewal pricing for fewer claims.

- Take a Defensive Driving Course: Completing an approved defensive driving class can help you qualify for safe driver discounts and assist in clearing your record.

Telematics or usage-based insurance programs can further lower rates by tracking safe driving habits, such as avoiding late-night or rush-hour driving, which are considered higher risk.

Ultimately, a clean claims and driving history over time will secure the lowest insurance rates for rideshare drivers by demonstrating their status as low risk.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Rideshare Insurance Companies

Geico, State Farm, and Allstate stand out for their wide range of affordability, coverage options, and customer service.

Although it doesn’t have the lowest starting price, Geico is already the most affordable for people who just want a minimal policy and need to get covered quickly without an agent.

State Farm is also the best rideshare insurance option because of its unmatched agent network, strong customer service, and competitive pricing.

Allstate, Farmers, and Liberty Mutual have higher premiums but offer more comprehensive auto insurance options for rideshare drivers with new cars or unique coverage needs.

#1 – Mercury: Top Pick Overall

Pros

- Lowest Base Rate: Mercury offers one of the lowest minimum coverage rates at $42 per month for rideshare drivers. See how quotes compare in our Mercury insurance review.

- Consistent Age Rates: Mercury offers affordable rideshare coverage for drivers of all ages, ranging from $42 a month for 45-year-old drivers to $61 a month for 21-year-olds.

- DUI-Friendly Pricing: With or without a DUI, Mercury’s $70 per month premium is a low-cost choice for high-risk rideshare drivers.

Cons

- Low Discount Range: Mercury rideshare insurance discounts are limited 8% safe drivers and 20% usage-based.

- Agent Reliant: Mercury’s rideshare insurance often requires working with an agent for quotes and policy changes, which can be slower compared to fully online providers.

#2 – Geico: Best for Budget Drivers

Pros

- Low Entry Rates: Geico offers affordable rideshare insurance from $43 per month for excellent credit. Find cheap rates in our Geico insurance review.

- Hybrid Policy Option: Geico’s rideshare insurance blends personal and commercial coverage, reducing the risk of app-on coverage gaps.

- Efficient Online Tools: Geico’s rideshare insurance is easy to manage online, with fast digital claims and quick policy updates for budget drivers.

Cons

- Sharp DUI Increases: A single DUI can raise rideshare insurance rates to $117 per month, which is a steep jump compared to clean-driver pricing.

- Higher Post-Accident Rates: With Geico rideshare insurance, one at-fault accident can raise premiums to $71 per month, reducing the savings for some drivers.

#3 – State Farm: Best for Driver Support

Pros

- Reliable Customer Support: Known for strong agent support, which can be beneficial in explaining rideshare insurance options available to drivers in most U.S. states.

- Smooth Claims Handling: State Farm’s consistent service makes it ideal for full-time rideshare drivers. See why drivers trust the claims process in our State Farm review.

- Widely Available Endorsements: Rideshare endorsements are offered in most states, helping to bridge the coverage gap between personal and app-on driving periods.

Cons

- Higher Poor Credit Rates: State Farm rideshare insurance can reach $99 per month for poor credit, often higher than Mercury or Geico.

- Limited Usage Discounts: State Farm rideshare insurance may not match 30%–40% telematics savings offered by some competitors.

#4 – Travelers: Best for Trip Coverage

Pros

- App-On Protection: Rideshare insurance covers Period 1, reducing gaps before you’re matched with a rider. This protection is explained in our Travelers auto insurance review.

- Trip-to-Trip Continuity: Coverage begins when the trip starts and continues through drop-off, reducing gaps in coverage when a ride is not accepted.

- Accident Flexibility: Travelers’ rideshare insurance covers claims during the time you are driving, which can help avoid a denial based on app usage during an accident.

Cons

- State Restrictions Apply: Trip coverage rideshare insurance may not be available in all states, restricting some drivers from access based on location.

- Limited Customization: Some rideshare insurance policies offer more flexible trip coverage options than what’s currently available through this provider.

#5 – American Family: Best for Policy Perks

Pros

- Customizable Coverage Options: Provides rideshare insurance benefits and optional coverage options that drivers are able to customize.

- Multi‑Vehicle Savings: Get up to 23% off rideshare insurance by insuring multiple vehicles on one policy. Find the full list of discounts in our American Family review.

- Bundle Incentives: Offers of discounts to drivers who bundle their rideshare insurance with other policies (home, renters insurance, etc.) for additional premium benefits.

Cons

- Mid‑Tier Rewards: American Family’s rideshare insurance benefits might be more limited than the best available with competitors, especially for high-mileage rideshare drivers.

- Limited Telematics Benefits: Its rideshare insurance options may offer fewer usage‑tracking rewards for safe or low‑mileage rideshare insurance drivers.

#6 – Nationwide: Best for Claim Stability

Pros

- Post-Claim Reliability: After one accident, Nationwide’s rideshare insurance rate rises to $88 per month. Learn more in our Nationwide auto insurance review.

- Moderate DUI Impact: Even after a DUI, rideshare insurance remains manageable at $129 per month, while higher rates reflect a predictable claims-based adjustment.

- Stable Renewal Rates: Nationwide’s rideshare insurance has lower claim-related rate fluctuations at renewal, offering more predictable costs in the long run.

Cons

- Limited Reward Drop: Nationwide rideshare insurance rates don’t drop much after years of clean driving, often staying around $63–$75 per month.

- Minimal First-Time Forgiveness: Nationwide rideshare insurance may not offer strong first-accident forgiveness compared to some competitors.

#7 – Amica: Best for Service Quality

Pros

- Highly Rated Support: Amica offers quick, reliable help for rideshare insurance drivers. Uncover what sets support apart in our Amica insurance review.

- Responsive Claim Team: Rideshare insurance customers report smooth, courteous claims handling, especially after stressful incidents.

- Low Complaint Volume: Amica’s complaint ratio is just 0.39 per 1,000 policies (NAIC), reflecting strong service quality for rideshare insurance customers.

Cons

- Outdated Digital Tools: Amica’s online experience for rideshare insurance users isn’t as seamless or efficient as leading competitors.

- Delayed Policy Updates: Changes to rideshare insurance coverage or details can take extra time to process, creating friction for drivers needing quick adjustments.

#8 – Farmers: Best for Coverage Options

Pros

- Comprehensive Protection: Drive confidently with rideshare insurance that covers you on every trip, including liability, collision, and off-trip protection.

- Custom Add‑Ons: Rideshare insurance can be customized with extras such as accident forgiveness or roadside assistance. Explore add-ons in our Farmers insurance review.

- Passenger Coverage Clarity: Farmers’ rideshare covers the injuries and damage to riders involved in an accident, so you need not think twice.

Cons

- Higher Base Pricing: Coverage has its price; rideshare insurance premiums (e.g., higher for low-cost carriers versus ultra‑low-cost carriers) are higher for better benefits.

- Rigid Bundling Requirements: Some Farmers add-ons may require bundling, limiting standalone rideshare insurance options.

#9 – Allstate: Best for Ride Protection

Pros

- Trusted National Brand: Allstate rideshare insurance builds driver confidence with trusted coverage from a well-known insurer.

- Local Agent Access: Customize your rideshare insurance with in-person support, available through Allstate agents. Get personalized help in our Allstate insurance review.

- Flexible Coverage Options: Allstate Ride Protection can be customized with multiple options for part‑time and full‑time rideshare drivers.

Cons

- Poor‑Credit Impacted: Drivers with a lower score might experience significantly higher rideshare insurance rates, thereby losing cost-effectiveness.

- Smaller Market Presence: Ride Protection’s smaller rideshare insurance footprint may mean fewer rideshare-specific tools.

#10 – Liberty Mutual: Best for Accident Benefits

Pros

- Post‑Accident Support: The accident benefits in Liberty Mutual’s rideshare insurance can help cover crash costs, but rates increase after one accident.

- Broad Incident Aid: Offers additional payments after an incident for a rideshare insurance rider, effective when there are coverage gaps in the standard policy.

- Injury Expense Help: Rideshare insurance accident benefits can cover medical costs. See how accident benefits cover medical costs in our Liberty Mutual insurance review.

Cons

- Costly Poor Credit Pricing: With accident benefits factored in, rideshare insurance rates for drivers with poor credit are significantly higher.

- Rate Increase Risk: After filing for accident benefits under rideshare insurance, premiums tend to rise more sharply than with some competitors.

Find Cheap Rideshare Insurance Today

Mercury, Geico, and State Farm offer reliable rideshare coverage starting at $42 per month. Mercury stands out for its low rates and flexible high-risk auto insurance options, though it’s not available in all states.

Geico offers strong value with a hybrid policy and up to 30% in usage-based discounts, but not everyone can take advantage of its rideshare coverage.

State Farm earns praise for its stable post-claim pricing and low DUI rate at $65 per month, making it ideal for full-time drivers, though premiums may be slightly higher for those with clean records.

For drivers looking for cheap rideshare insurance, the balance between cost, protection, and long-term value, these three companies are still the best overall picks for drivers. Find cheap car insurance quotes by entering your ZIP code here.

Frequently Asked Questions

Who has the cheapest rideshare insurance?

Mercury offers the cheapest rideshare insurance, which is perfect for budget-conscious drivers. It also offers alternatives for high-risk drivers, including those with previous offenses, but these may not be available to all in every state.

How much does rideshare insurance cost?

Rideshare insurance rates will depend on a driver’s profile and coverage level, but in some cases, drivers pay an average of $42 per month for state minimum coverage. Full coverage typically runs higher, around $114 per month with providers like Geico, while rates can increase with age, credit, or driving record.

What does rideshare insurance cover?

While you’re driving during app-on times, rideshare insurance covers coverage gaps, including liability auto insurance, collision, and uninsured motorist protection that many standard personal policies won’t handle.

Can I do Uber without rideshare insurance?

No, you probably shouldn’t drive for Uber without rideshare insurance or some type of gap coverage that kicks in when the app is activated. Otherwise, you may be uninsured during key periods and risk major out-of-pocket costs or platform issues.

Take the first step toward cheaper rideshare insurance rates. Enter your ZIP code to compare savings near you.

What happens if I get into an accident ridesharing?

If you get into an accident while ridesharing, platform coverage may apply during active rides, but gaps can exist between trips, and rideshare insurance helps fill those gaps.

How do I get rideshare insurance?

To get rideshare insurance, ask your current insurer about a rideshare endorsement or shop for hybrid or best commercial auto insurance from Mercury, Geico, or State Farm.

Learn More: How to Buy Auto Insurance

Do I need to tell my car insurance company that I’m a rideshare driver?

Yes, you should tell your car insurance company if you’re a rideshare driver, as most personal auto policies don’t cover accidents during rideshare activity. Failing to disclose this can lead to denied claims or even policy cancellation.

Does personal car insurance cover my rideshare trips?

Your personal car insurance policies typically can’t be used while you’re driving for a ridesharing service. You will also need a rideshare endorsement or standalone rideshare insurance for full protection.

What should I do if rideshare insurance isn’t available in my state?

If rideshare insurance isn’t available in your state, you will have to buy coverage through your rideshare company. Uber and Lyft provide policies, and other companies work with local insurers to get their drivers properly covered.

Does rideshare insurance apply to delivery services like Grubhub and DoorDash?

Yes, rideshare insurance can cover delivery services like Grubhub and DoorDash, but only if the policy or endorsement includes delivery use, especially from the best auto insurance for DoorDash drivers that offer hybrid or add-on coverage specifically for gig work.

What types of insurance do you need for rideshare businesses?

Can I use ridesharing insurance to avoid Uber or Lyft’s $2,500 deductible?

Is insurance cheaper if you do rideshare?

How can I lower my rideshare insurance premiums?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.