Cheap Auto Insurance for Low-Income Drivers in 2026

Auto-Owners, Geico, and State Farm have cheap auto insurance for low-income drivers, with rates starting at $62 per month. Drivers may also benefit from Nationwide's usage-based savings of up to 40%, while AAA offers discounts and affordable low-income car insurance with free roadside assistance for $78 a month.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

We found the best cheap auto insurance for low-income drivers with Auto-Owners, Geico, and State Farm. Minimum coverage starts at $62 monthly with Auto-Owners.

- Auto-Owners leads auto insurance for low-income drivers at $62

- Usage-based discounts cut low-income driver costs by up to 40%

- Poor credit raises low-income car insurance by $25–$40 monthly

Auto-Owners is known for approving drivers with a range of credit scores, while Geico stays affordable if you’ve had a lapse in coverage and want easy-to-use digital tools for managing your policy.

State Farm provides cheap auto insurance for low-income families who want to save money, offering insurance discounts for students and usage-based programs that reward safe driving.

10 Best Companies: Cheapest Auto Insurance for Low-Income Drivers| Company | Rank | Monthly Rates | Claims Satisfaction | Best for |

|---|---|---|---|---|

| #1 | $62 | 711 / 1,000 | Poor Credit | |

| #2 | $66 | 697 / 1,000 | Online Tools | |

| #3 | $71 | 716 / 1,000 | Teen Savings | |

| #4 | $77 | 729 / 1,000 | Driver Rewards | |

| #5 | $78 | 720 / 1,000 | Member Benefits |

| #6 | $83 | 702 / 1,000 | Safe Drivers |

| #7 | $84 | 691 / 1,000 | Structured Rates | |

| #8 | $89 | 690 / 1,000 | Local Service | |

| #9 | $94 | 693 / 1.000 | Bundling Deals | |

| #10 | $98 | 730 / 1,000 | Flexible Discounts |

You can find affordable insurance that fits your budget when you compare companies online. Use this guide to compare rates from multiple providers by coverage, driving record, age, credit, and payment options.

Unlock cheap car insurance for low-income drivers by entering your ZIP code and reviewing real monthly price differences.

Finding Car Insurance for Low-Income Drivers

Carrying your state’s minimum insurance requirements will be the cheapest, but your monthly insurance costs can rise quickly when you choose coverage above the state minimum.

Auto-Owners is a top choice, offering minimum coverage for about $62 a month and full coverage for around $144. Geico and State Farm minimum plans cost between $66 and $71 per month, but their prices increase more gradually as you add coverage.

Low-Income Driver Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $176 |

| $94 | $210 | |

| $83 | $188 |

| $62 | $144 | |

| $89 | $206 | |

| $66 | $163 | |

| $98 | $223 |

| $77 | $181 | |

| $71 | $172 | |

| $84 | $192 |

When picking an insurance company, it’s important to look at how much they raise prices for full coverage, not just who offers the lowest minimum rate.

Some companies almost double your monthly payment when you switch to full coverage, raising costs above $200 and making it harder for those on a tight budget.

Read More: How to Compare Auto Insurance Companies

Driving History Can Raise Rates for Low-Income Drivers

If you’re a 45-year-old man with fair credit and a clean driving record, picking minimum coverage is a good way to keep your insurance costs down.

Auto-Owners stands out because its rates for drivers with clean records are the lowest, and even after an accident, rate increases are smaller than with most other companies.

Low-Income Driver Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $78 | $106 | $133 | $95 |

| $94 | $126 | $160 | $113 | |

| $83 | $112 | $142 | $101 |

| $62 | $85 | $108 | $76 | |

| $89 | $120 | $152 | $108 | |

| $66 | $89 | $113 | $79 | |

| $98 | $134 | $169 | $120 |

| $77 | $104 | $132 | $94 | |

| $71 | $96 | $120 | $85 | |

| $84 | $113 | $143 | $100 |

Geico and State Farm are also good options for drivers on a budget, since a single ticket leads to a slow increase in costs rather than a big jump.

An at-fault accident will raise your monthly bill with any insurer, but some companies increase rates by $40 to $60 more quickly than many budget-minded drivers expect.

Insurers often review rates after approved driver courses, and even with past violations, completing one can reduce points at renewal.

Melanie Musson Published Insurance Expert

A DUI leads to the biggest rate hikes, often raising monthly payments above $120. This can put extra strain on a tight household budget.

At 45, having a clean driving record is more important than your age, because insurers offer more stable minimum rates to drivers who show steady, safe habits.

How Age Affects Car Insurance for Low-Income Drivers

Age is a key factor in how much low-income drivers pay for minimum coverage auto insurance across the country.

Male drivers usually see their insurance costs drop as they get older, especially between ages 18 and 25, and again between 35 and 45.

Low-Income Driver Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $169 | $102 | $85 | $78 |

| $206 | $122 | $102 | $94 | |

| $178 | $108 | $91 | $83 |

| $138 | $83 | $69 | $62 | |

| $198 | $116 | $97 | $89 | |

| $143 | $86 | $72 | $66 | |

| $220 | $130 | $108 | $98 |

| $167 | $101 | $84 | $77 | |

| $154 | $92 | $77 | $71 | |

| $184 | $109 | $90 | $84 |

Auto-Owners stands out because its rates go down more quickly as drivers age, which helps keep monthly costs steady over time.

Geico and State Farm remain competitive by giving more credit for driving experience instead of heavily penalizing younger drivers for a long time.

These results are based on a male driver with minimum coverage, which is how insurers often assess households when they add young drivers.

Adding a teen to your policy increases costs. However, companies such as State Farm, Auto-Owners, and Geico have teen programs and driver training discounts that can help families save money over time.

How Credit Score Impacts Low-Income Drivers’ Rates

Credit scores play a big role in how much low-income, middle-aged drivers pay for affordable auto insurance across the country.

For 45-year-olds with clean driving records, the cost of minimum coverage goes up a lot if their credit score falls below a fair rating anywhere in the country.

Low-Income Driver Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $56 | $72 | $78 | $89 |

| $67 | $87 | $94 | $107 | |

| $59 | $77 | $83 | $95 |

| $44 | $58 | $62 | $71 | |

| $64 | $83 | $89 | $102 | |

| $47 | $61 | $66 | $75 | |

| $70 | $91 | $98 | $112 |

| $55 | $73 | $77 | $88 | |

| $51 | $66 | $71 | $81 | |

| $60 | $78 | $84 | $96 |

Auto-Owners is the best option for budget-focused households, since drivers with poor credit see smaller price increases compared to other companies in most states.

Geico and State Farm are also good choices because the extra cost for fair credit stays reasonable, usually between $66 and $71 per month for many drivers.

Having poor credit can add $25 to $40 to your monthly bill, so staying on top of payments is especially important for low-income households over the long term.

Raising your credit score by even one level can help keep your insurance costs steady more effectively than switching companies often, especially for middle-aged male drivers.

Learn more: How to Get Multiple Auto Insurance Quotes

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

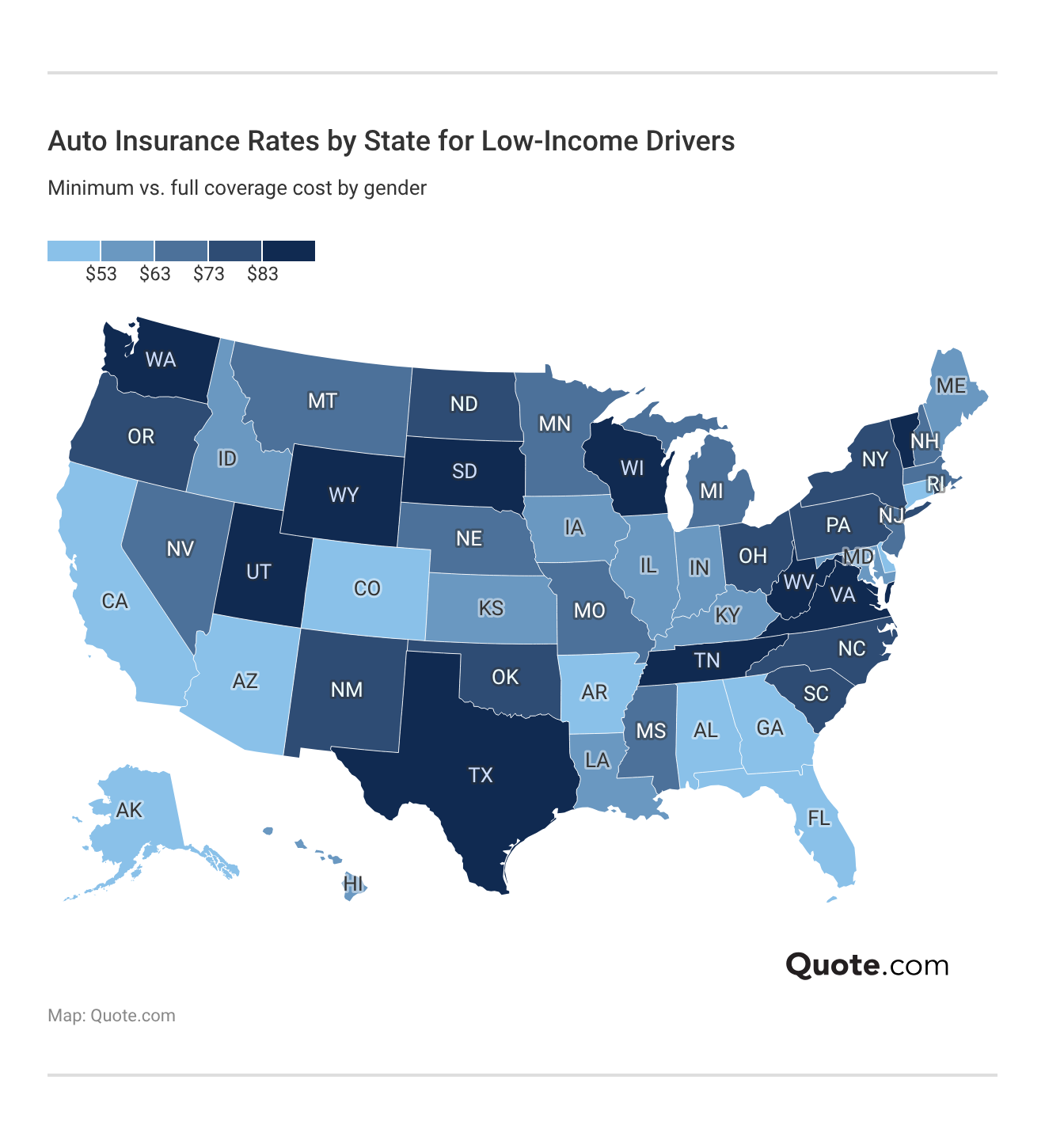

Low-Income Driver Auto Insurance by State

Where you live has a big impact on how much you pay for auto insurance if you have a low income. Minimum and full coverage prices can be very different depending on the state.

Southern states such as Texas and Mississippi tend to have lower minimum insurance rates, while drivers in coastal areas often face bigger differences in full coverage costs.

Full coverage costs rise more quickly for low-income drivers, especially men, because of higher repair costs and legal risks in many states.

Midwestern states usually offer the best balance for affordability, keeping minimum plans around $63 and avoiding big jumps in full coverage costs for families on a budget.

Read More: Auto Insurance Rates by State

State Insurance Programs With the Lowest Costs

Some states have special programs that provide affordable auto insurance for low-income drivers. These programs help drivers meet the minimum legal requirements for coverage.

California stands out because the CLCA program keeps monthly insurance costs around $25 for households with modest vehicles that meet the program’s requirements.

State Low-Income Auto Insurance Programs, Eligibility, & Price| State | Program | Income Limit | Max Car Value | Monthly Cost |

|---|---|---|---|---|

| California | California Low Cost Auto (CLCA) | $31.9K | $25K | $25 |

| Hawaii | AABD Auto Insurance Program | $35K | $30K | $40 |

| New Jersey | Special Automobile Insurance Policy (SAIP) | $28K | No Limit | $31 |

New Jersey’s SAIP program is notable because it does not have vehicle value limits, so even older cars can qualify if drivers meet the income requirements. Explore auto insurance requirements by state and required coverage.

Hawaii’s AABD program offers flexibility for island residents by providing $40 monthly rates and allowing higher income limits than similar programs on the mainland.

How Low-Income Drivers Can Save on Car Insurance

For low-income drivers, auto insurance can become costly as small problems add up and gradually increase monthly payments. Lower costs by checking the best insurance comparison sites online.

The biggest increases come from gaps in coverage and low credit scores, which can add $50 to $100 each month until drivers improve their records.

Top Reasons Auto Insurance Is Unaffordable for Low-Income Drivers| Reason | Affected Drivers | Monthly Increase | Impact Period |

|---|---|---|---|

| Coverage Lapse | 20-40% | +$50-$100 | Until insured |

| Limited Discounts | 40-60% | +$10-$25 | Until applied |

| Low Credit | 40-55% | +$50-$100 | Until improved |

| Older Vehicle | 25-45% | +$10-$25 | Until replaced |

| Prior Accidents | 10-25% | +$50-$100 | 3-5 years |

| Traffic Violations | 20-35% | +$25-$50 | 3 years |

Accidents and traffic violations can affect your rates for three to five years, even if your driving improves during that time.

Having an older car can also raise your premiums because insurers worry about reliability and the chance of more frequent or uncertain repairs.

Find the cheapest low-income car insurance by entering your ZIP code into our free quote comparison tool.

Insurance Approval Rules for Low-Income Drivers

For low-income drivers, getting approved for auto insurance can be harder than finding a low price. Acceptance rules often have a bigger impact than cost across the country.

Geico is a good choice for approval because it does not check credit and allows recent coverage gaps, making it easier to get minimum coverage anywhere in the country.

Auto Insurance Acceptance Requirements by Provider| Company | Credit Based | Flex Pay | Recent Lapse | UBI Option |

|---|---|---|---|---|

| ✅ | ❌ | ❌ | ✅ |

| ✅ | ✅ | ❌ | ✅ | |

| ✅ | ❌ | ❌ | ✅ |

| ✅ | ❌ | ❌ | ❌ | |

| ✅ | ❌ | ❌ | ✅ | |

| ❌ | ❌ | ✅ | ✅ | |

| ✅ | ❌ | ❌ | ✅ |

| ✅ | ✅ | ❌ | ✅ | |

| ❌ | ❌ | ✅ | ✅ | |

| ✅ | ❌ | ❌ | ✅ |

State Farm also helps drivers who have had coverage lapses. Its usage-based programs can reward safer driving habits after you restart your policy, no matter where you live.

Auto-Owners is stricter because it uses credit checks for approval, even though it offers low rates to applicants with steady coverage and clean records across the country.

Low-Income Driver Insurance Payment Flexibility

Flexible payment options are important for low-income drivers looking for affordable auto insurance, since upfront costs often decide if they can keep their coverage each month.

Geico is a good choice because its 15-25% down payments and no online fees help reduce the financial burden when starting a policy (Read More: State Farm vs. Farmers, Geico, Progressive, & Allstate).

Auto Insurance Payment Options for Low-Income Drivers by Provider| Company | Down Payment | Bill Schedule | Service Fees |

|---|---|---|---|

| 25-40% | Monthly | $5-$10 |

| 25-35% | Monthly or every 6mo | $0-$5 | |

| 20-30% | Monthly or every 6mo | $0 |

| 25-30% | Monthly | $5-$8 | |

| 25-35% | Monthly or every 6mo | $5 | |

| 15-25% | Monthly or every 6mo | $0 online, $5 agent | |

| 20-30% | Monthly or every 6mo | $0-$5 |

| 15-25% | Monthly or every 6mo | $0-$5 | |

| 20-30% | Monthly or every 6mo | $0 | |

| 20-25% | Monthly or every 6mo | $0-$5 |

Nationwide and State Farm help low-income drivers by offering monthly billing with no penalties, which is useful when budgets are tight or change suddenly.

Flexible payment schedules help low-income drivers avoid coverage lapses, but it’s important to watch out for service fees. Those $5-$10 charges can add up fast for households with minimum coverage and tight budgets.

Lower down payments of 15%-25% can help struggling drivers keep their policies active longer than some six-month plans.

Learn More: What to Do If You Can’t Afford Your Auto Insurance

Coverage Options for Low-Income Drivers

Low-income drivers should review the insurance options that are required or commonly offered. Picking the right coverage helps you follow state laws and protects you from large expenses after an accident.

Instead of thinking in broad terms, drivers should learn about each type of coverage and pick what fits their car’s value, their budget, and their driving habits.

- Bodily Injury Liability Coverage: Pays for injuries you cause to others and is required in most states if you want to drive legally.

- Collision Coverage: Pays for repairs to your car after an accident, no matter who was at fault. This is especially important if your car is financed.

- Comprehensive Coverage: Pays for damage from theft, fire, vandalism, or weather. This helps protect cars that are parked outside (Read More: Collision vs. Comprehensive).

- Medical Payments or PIP Coverage: Helps pay medical bills for you and your passengers after an accident, depending on your state’s rules.

- Property Damage Liability Coverage: Pays for damage you cause to other vehicles or property. Nearly every state requires this coverage.

- Uninsured Motorist Coverage: Pays for injuries caused by drivers who do not have insurance. This is especially important in states with many uninsured drivers.

Knowing about these options makes it easier to choose the right coverage and avoid gaps that could lead to debt after an accident.

Low-income drivers should start with the required liability coverage and add more protection only if their car’s value makes it worthwhile.

Read More: Types of Auto Insurance

Low-Income Drivers Coverage Limits

Coverage limits play a key role in affordable auto insurance for low-income drivers. They decide how much you might have to pay after an accident and what legal protection you need.

Choosing minimum coverage costs less each month, but it can leave you at risk if injuries go over $25,000 or if your car has major damage. Understand how liability auto insurance protects against injury claims.

Auto Insurance Coverage Limits Available to Low-Income Drivers| Coverage Level | Bodily Injury | Property Damage | Uninsured | Risk |

|---|---|---|---|---|

| Minimum | $25K / $50K | $25K | ❌ | High |

| Basic | $30K / $60K | $25K | ❌ | Upper-Mid |

| Standard | $50K / $100K | $50K | ✅ | Moderate |

| Enhanced | $100K / $300K | $100K | ✅ | Low |

Standard coverage is often the best balance. It adds protection against uninsured drivers and keeps premiums affordable for low-income households.

Higher coverage limits lower your risk the most, but the monthly costs go up a lot. This can be tough for people on tight or fixed budgets.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Savings for Low-Income Drivers

Discounts are important for making auto insurance more affordable for low-income drivers with different budgets across the country.

Auto-Owners is a good choice because its usage-based program can save disciplined drivers up to 30% on their monthly costs without lowering their coverage.

Top Auto Insurance Discounts for Low-Income Drivers| Company | Multi-Policy | Safe Driver | Usage-Based | Vehicle Safety |

|---|---|---|---|---|

| 15% | 10% | 30% | 15% |

| 25% | 18% | 40% | 20% | |

| 25% | 18% | 20% | 18% |

| 16% | 8% | 30% | 15% | |

| 20% | 20% | 30% | 15% | |

| 25% | 15% | 25% | 15% | |

| 25% | 20% | 30% | 12% |

| 20% | 12% | 40% | 18% | |

| 17% | 20% | 30% | 20% | |

| 13% | 15% | 30% | 17% |

Nationwide and Allstate stand out because their telematics programs can offer up to 40% off for drivers who keep good driving habits.

Safe driver discounts of 15% to 20% reward drivers with clean records, which helps make insurance more affordable in the long run.

Driving under 8,000 miles a year lowers risk because less time on the road means fewer accident opportunities, which leads to lower base rates.

Jeff Root Licensed Insurance Agent

Bundling policies can save up to 25%, but low-income drivers get the most benefit by combining different discounts to fit their tight budgets. Discover how best auto and home insurance bundles improve coverage value.

Picking the right combination of discounts can save more money than switching insurance companies, so comparing options is important for low-income drivers.

Other Ways to Reduce Low-Income Driver Rates

Low-income drivers can save the most by building good habits and making policy choices that insurers reward.

The tips below are practical steps drivers can use without needing to buy a new car or take on more financial risk.

- Choose the Minimum Required Coverage: Minimum liability insurance can lower your monthly payments if you do not need full coverage for legal or financial reasons.

- Keep Your Insurance Active: Keeping your insurance without any gaps helps you avoid monthly penalties of $50 to $100.

- Look at Different Payment Plans: Picking a monthly billing option with a lower down payment can help you avoid missed payments and extra fees.

- Sign Up for Usage-Based Programs: These programs track your safe driving and can lower your rates by up to 40%.

- Work on Improving Your Credit: If you raise your credit from poor to fair, you could lower your monthly costs by $25 to $40.

Even small changes can add up to real savings over time if you stick with them. Using more than one strategy usually works better than just making a single change.

Checking your rates regularly helps make sure your policy still fits your needs and budget. Taking these steps can help low-income drivers keep coverage affordable over time.

Top Companies for Low-Income Drivers

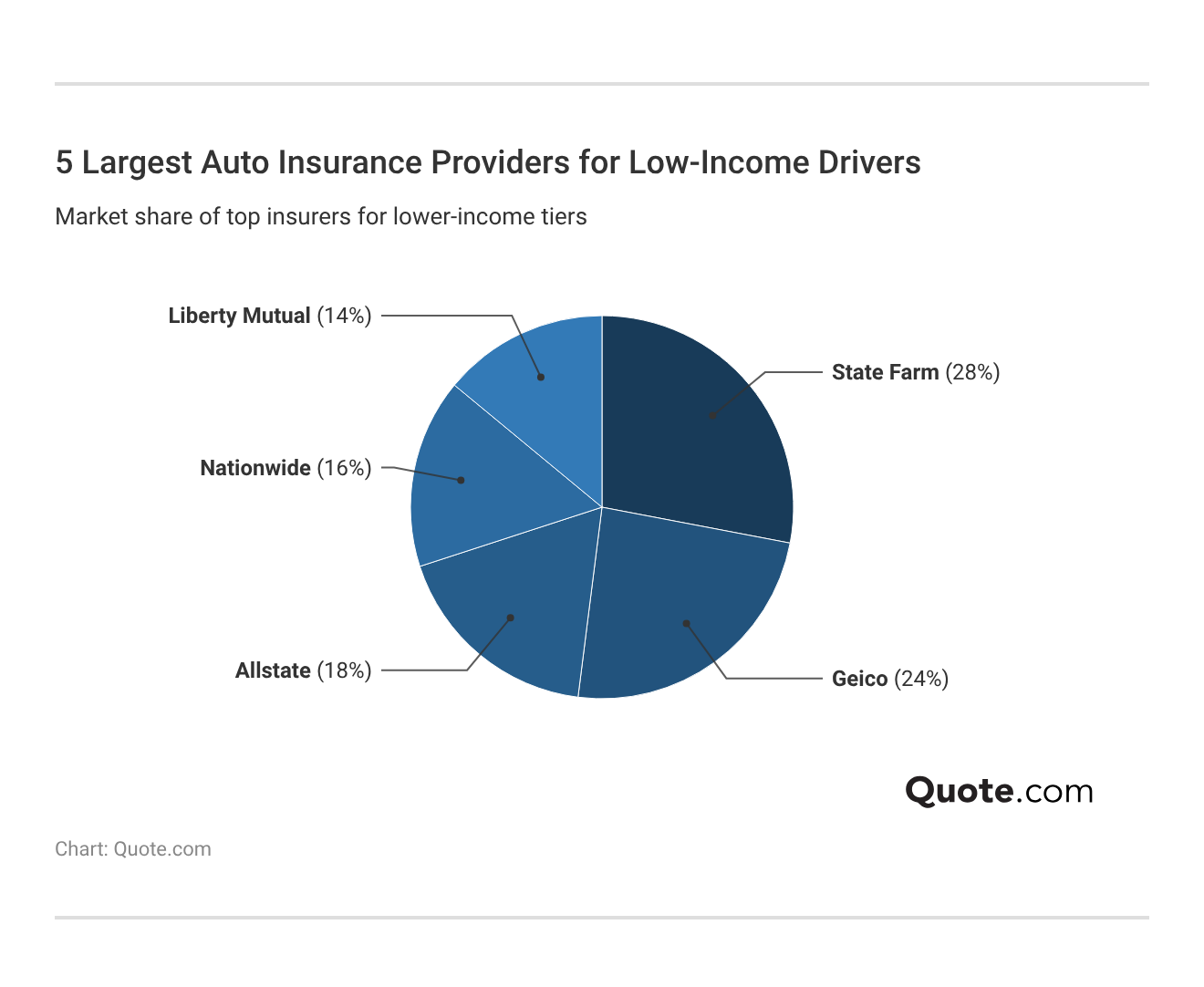

Low-cost auto insurance is popular with drivers on a tight budget because affordable monthly payments help them keep their coverage when money is scarce.

Insurance companies that offer lower base rates tend to attract more drivers, as even a $10 or $20 difference can make coverage affordable.

Other insurers compete by offering usage-based discounts of up to 40% or by making the claims process easier, which can help reduce stress after an accident.

The best option is one that offers a good price and also handles claims well when you need them.

Check Out: What We Learned Analyzing 815 Insurance Companies

#1 – Auto-Owners: Top Pick Overall

Pros

- Lowest Base Pricing: Auto-Owners offers minimum coverage to low-income drivers starting at $62 per month.

- Above-Average Claims Service: Auto-Owners scores 711 out of 1,000. A steady claims process helps reduce uncertainty for drivers after unexpected repairs.

- Controlled Accident Surcharges: After one accident, low-income drivers pay about $85 per month (Read More: Auto-Owners Insurance Review).

Cons

- Strict Approval Criteria: Auto-Owners uses credit-based underwriting, so low-income drivers with recent financial problems may have trouble getting approved.

- No Usage-Based Discounts: Low-income drivers cannot lower their costs with telematics programs, while some competitors offer up to 40% savings through these discounts.

#2 – Geico: Best for Online Tools

Pros

- Convenient Mobile Management: Drivers can manage their policy from anywhere through the mobile app, plus file claims, add coverage and drivers, and sign up for UBI.

- Lapse-Friendly Enrollment: Geico allows drivers with recent coverage gaps to restart policies at about $66 per month (Learn More: Geico Insurance Review).

- Low Down Payment Flexibility: Geico makes it easier for low-income drivers to start coverage by keeping initial payments low.

Cons

- Steeper Credit Penalties: Low-income drivers with poor credit pay about $75 per month, which is a faster increase than with Auto-Owners or State Farm.

- Full Coverage Cost Creep: Low-income drivers who choose full coverage pay up to $163 per month, which can make it harder to afford insurance for financed vehicles.

#3 – State Farm: Best for Teen Savings

Pros

- Teen Discount Programs: Low-income drivers with teens can access discounts that keep minimum rates near $71 per month (Read More: State Farm Insurance Review).

- Gradual Ticket Increases: After one ticket, low-income drivers pay about $85 per month, which is more forgiving than most national insurers.

- Usage-Based Rewards: Safe-driving programs let low-income drivers earn discounts up to 30%, which helps lower long-term costs.

Cons

- Moderate Credit Impact: Low-income drivers with poor credit pay $81 per month, which is higher than some other similar companies.

- Higher Entry Costs Than Leaders: Base rates for low-income drivers are $5 to $9 higher per month than those of Auto-Owners and Geico.

#4 – Nationwide: Best for Driver Rewards

Pros

- Top Telematics Savings: Nationwide gives usage-based discounts of up to 40%, so careful low-income drivers can lower their monthly bills.

- Balanced Credit Pricing: Low-income drivers with fair credit pay about $77 per month, which helps them avoid big changes in price (Check Out: Nationwide Insurance Review).

- Flexible Payment Terms: Nationwide asks for a 15% to 25% down payment and offers monthly billing, which helps low-income drivers keep their coverage.

Cons

- Higher Accident Costs: If you have an accident, your rate goes up to about $104 per month, which can be hard for low-income drivers after a claim.

- Full Coverage Premiums: Low-income drivers who choose full coverage pay about $181 per month.

#5 – AAA: Best for Member Benefits

Pros

- Exclusive Member Benefits: Low-income drivers with AAA memberships qualify for cheaper rates, free roadside assistance, and travel discounts on hotels and rental cars.

- Predictable Minimum Coverage: AAA keeps minimum coverage for low-income drivers at about $78 per month. Compare costs that match your budget in our AAA review.

- Strong Claims Service: AAA earns 720 out of 1,000. Guided claims support makes it easier for low-income drivers to handle paperwork and estimates.

Cons

- Higher Upfront Costs: Low-income drivers must pay 25% to 40% up front, which can make starting a policy tough for those on a tight budget.

- Regional Availability: Low-income car insurance with AAA is not available everywhere. Discounts and membership perks also vary by state.

#6 – American Family: Best for Safe Drivers

Pros

- Moderate Entry-Level Pricing: American Family offers minimum coverage starting at about $83 per month (Read More: American Family Insurance Review).

- Accident Cost Containment: If you have one at-fault accident, the average monthly cost for low-income drivers is $112.

- Telematics Savings Access: Usage-based programs can give drivers up to 20% off, so low-income drivers with safe habits can lower their ongoing costs.

Cons

- Credit-Based Underwriting: Low-income drivers with poor credit may pay around $95 per month, which can make American Family less affordable than some companies.

- No Lapse Flexibility: If you have had a recent gap in coverage, you may not get approved, which can make it harder for low-income drivers to get back into the insurance market.

#7 – Travelers: Best for Structured Rates

Pros

- Minimum Coverage Pricing: Travelers offers minimum coverage for about $84 per month, giving low-income drivers steady and predictable pricing.

- Structured Rate Scaling: If you get one ticket, the monthly cost is about $100 for low-income drivers. This helps avoid the big price jumps that some smaller insurers have.

- Strong Financial Backing: Travelers has an A.M. Best A++ rating, so low-income drivers will be paid reliably (Read More: Travelers insurance review).

Cons

- Higher DUI Penalties: If you have a DUI, your monthly cost goes up to about $143, which can make it harder for low-income drivers to recover compared to some other companies.

- Payment Flexibility: Travelers require higher down payments, which can put a strain on low-income drivers’ budgets.

#8 – Farmers: Best for Local Service

Pros

- Coverage Structure: Farmers’ local agents work with low-income drivers to adjust coverage (Learn More: Farmers Insurance Review).

- Robust Safe Driver Discounts: Drivers with clean records can get discounts of up to 20%, which rewards low-income drivers who avoid violations.

- Usage-Based Participation: Telematics programs can lower premiums by up to 30%, so careful low-income drivers can save more on their base costs.

Cons

- Cost Pressure: If you have an accident, your monthly rate goes up to about $120, which can put more financial pressure on low-income drivers.

- Credit Sensitivity: Low-income drivers with poor credit may pay more than $102 per month, which is higher than what some other companies charge.

#9 – Allstate: Best for Bundling Deals

Pros

- Multi-Policy Leverage: If you bundle renters or homeowners insurance with your car policy, you could save up to 25% (Check Out: Allstate Insurance Review).

- High Discount Ceiling: Allstate’s Drivewise program can save drivers up to 40% based on how they drive.

- Flexible Billing Options: Allstate lets you choose between monthly or six-month billing, so you can adjust your payments if your income changes.

Cons

- Base Pricing: Minimum coverage with Allstate starts at about $94 per month, which makes it one of the more expensive choices for low-income drivers.

- DUI Increases: If you get a DUI, your monthly cost can jump to around $160, which can make it hard for low-income drivers to recover financially.

#10 – Liberty Mutual: Best for Flexible Discounts

Pros

- Adjustable Discounts: Liberty Mutual lets you combine discounts for things like safe driving, vehicle safety features, and bundling, which can add up to 30% in savings.

- Claims Experience: Liberty Mutual scores 730 out of 1,000. Faster repair approvals help low-income drivers avoid long waits and extra costs.

- Coverage Flexibility: You can customize your policy with Liberty Mutual, so low-income drivers can choose desired liability limits (Learn More: Liberty Mutual Insurance Review).

Cons

- Highest Entry Costs: Minimum coverage with Liberty Mutual costs about $98 per month, which can be too high for low-income drivers who need the lowest rates.

- Credit Penalties: If you have poor credit, your rate can go up to about $112 per month. This makes Liberty Mutual less affordable for households with financial challenges.

Where to Find Affordable Auto Insurance

Auto-Owners stands out with the best cheap auto insurance for low-income drivers. Its monthly rates stay steady at about $62, and it helps drivers avoid large rate hikes after accidents or credit problems.

Geico and State Farm are good choices, too, especially for low-income drivers under 25. Rates go down as you gain experience behind the wheel, but Auto-Owners and Geico keep rates under $150 a month for 18-year-olds (Read More: Allstate vs. Geico Auto Insurance).

Usage-based programs are more important than many people think. If you drive safely, you could cut your bill by 20% to 40% without losing any coverage. Compare the best auto insurance for good drivers to find consistent savings.

And if you improve your credit score, you might save $25 to $40 each month as a low-income driver.

Approval matters as much as price after coverage gaps. For instance, lapse-friendly insurers avoid surcharges.

Michelle Robbins Licensed Insurance Agent

The best choice gives you flexible approval, a reasonable payment plan, and accident forgiveness features, not just the lowest starting price.

Compare cheap car insurance for low-income individuals near you by entering your ZIP code to see which local companies fit your budget best.

Frequently Asked Questions

What is the best auto insurance for low-income drivers?

The best car insurance for low-income drivers usually comes from insurers offering minimum coverage near $60 to $70 per month, flexible payments, and forgiveness for minor issues like tickets or credit challenges. Find hacks to save money on auto insurance that control rising rates.

Can you get cheaper car insurance if you’re on SNAP?

Being on SNAP does not directly qualify someone for cheaper car insurance, but it often overlaps with eligibility for low-mileage plans, state programs, or minimum coverage options under $70 per month.

Can I use my EBT for car insurance?

EBT cards cannot be used to pay car insurance bills, but enrollment in assistance programs may help drivers qualify for state-sponsored auto insurance plans costing as little as $25 to $40 per month. Find cheap low-income car insurance by entering your ZIP code into our free quote comparison tool.

Who has the lowest auto insurance rates in the U.S.?

The lowest auto insurance rates in the U.S. are typically found with regional or national insurers offering minimum coverage between $60 and $65 per month for drivers with clean records and steady coverage.

Is there low-income auto insurance in Washington state?

Low-income car insurance in Washington state is not provided by the government, but minimum liability policies from private insurers often start at $60 to $75 per month. Explore the best auto insurance companies in Washington for savings.

How can I lower my car insurance rates?

Drivers can lower car insurance costs by choosing minimum coverage, avoiding coverage lapses, improving credit, and enrolling in usage-based programs that reduce monthly bills by 20% to 40%.

What is the bare minimum car insurance in the U.S.?

The bare minimum car insurance in the U.S. is liability-only coverage, which most states require and often costs around $50 to $70 per month, depending on location and driving record.

Is low-income auto insurance available in Virginia?

Low-income car insurance in Virginia is offered only through private insurers, with minimum coverage commonly costing about $65 to $80 per month, depending on driving history. Compare the best auto insurance companies in Virginia to lower costs.

Can my credit score affect my car insurance?

Credit scores affect car insurance in most states, where moving from poor to fair credit can reduce monthly premiums by about $25 to $40 for many drivers.

When should you stop putting full coverage on your car?

Full coverage is usually dropped when a car’s market value falls below $4,000 to $5,000, and monthly premiums no longer justify potential claim payouts. Should you keep full coverage on a 10-year-old vehicle? Full coverage on a 10-year-old vehicle is usually not worth it when monthly premiums exceed the car’s value recovery, especially if rates run $120 or more per month.

Learn More: Liability vs. Full Coverage Auto Insurance

Is it better to pay monthly or all at once for car insurance?

Is low-income auto insurance available in Illinois?

At what age does car insurance usually go down?

Is there free government auto insurance for low-income drivers?

Does the DMV offer low-income auto insurance?

Is there government auto insurance for low-income individuals near me?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.