High-Risk Auto Insurance (2026 Guide)

High-risk auto insurance covers drivers with violations, past claims, or credit issues. State Farm has the cheapest high-risk coverage, with rates at $140 a month after a ticket and $155 a month after an at-fault accident. Drivers with multiple accidents or a DUI typically pay the most for high-risk car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

High-risk auto insurance provides coverage for drivers with violations, claims, or credit issues, and the lowest monthly rate starts at $140 with State Farm.

- High-risk auto insurance monthly rates range from $140 to $460

- State rules may require SR-22 for high-risk car insurance

- High-risk violations can stay on your record for 3-10 years

Discover which of the best car insurance companies provides the strongest options for high-risk profiles and how different states and credit tiers shape pricing.

Enter your ZIP code to compare affordable high-risk insurance rates from top providers near you.

High-Risk Auto Insurance Explained

High-risk car insurance is a specialized type of coverage designed for drivers considered more likely to file claims due to their driving history, age, credit profile, or prior coverage gaps. This includes serious violations or multiple claims.

Because insurers rely heavily on risk-based pricing, at-fault accidents and insurance rates are closely connected, with drivers who have caused collisions typically placed into higher-risk tiers.

How much does high-risk insurance cost a month? High-risk policies may cost more or require additional documentation, such as an SR-22, because insurers assume greater financial exposure when covering these drivers.

High-risk auto insurance typically costs more because insurers view these drivers as more likely to file claims, making it essential to carefully compare coverage options.

High-Risk Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $185 | $415 | |

| $170 | $395 |

| $210 | $455 | |

| $160 | $380 | |

| $195 | $440 |

| $175 | $405 | |

| $200 | $430 | |

| $155 | $370 | |

| $205 | $460 |

| $190 | $420 |

Comparing multiple insurers is one of the best ways to find cheap auto insurance for high-risk drivers, since each company evaluates risk differently.

High-risk auto insurers charge different rates based on policy choices, but State Farm and Geico remain the most affordable options. Dairyland is competitive for high-risk drivers who need non-standard auto insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of High-Risk Insurance Coverage

Driving history is the most critical factor shaping high-risk premiums. Even a single accident can significantly increase car insurance costs for drivers.

Similarly, car insurance costs for drivers with a DUI rise sharply due to the severe risk associated with impaired driving. Even State Farm doubles its monthly rates from $124 to $248 after the first DUI.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $148 | $185 | $296 | $160 | |

| $136 | $170 | $272 | $145 |

| $168 | $210 | $357 | $180 | |

| $128 | $160 | $256 | $140 | |

| $156 | $195 | $312 | $165 |

| $140 | $175 | $280 | $150 | |

| $160 | $200 | $320 | $170 | |

| $124 | $155 | $248 | $140 | |

| $164 | $205 | $328 | $175 |

| $152 | $190 | $304 | $160 |

Securing cheap auto insurance for teens can also be challenging, since insurance companies consider young drivers under 21 to be high-risk.

Younger drivers face the steepest charges due to limited experience and higher claim frequency. As drivers get older, insurers typically see them as lower risk and gradually decrease rates.

High-Risk Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $280 | $220 | $200 | $185 | |

| $260 | $205 | $185 | $170 |

| $310 | $240 | $225 | $210 | |

| $250 | $200 | $180 | $160 | |

| $290 | $225 | $205 | $195 |

| $265 | $210 | $190 | $175 | |

| $295 | $230 | $210 | $200 | |

| $240 | $190 | $170 | $155 | |

| $305 | $235 | $215 | $205 |

| $285 | $220 | $200 | $190 |

Teens and drivers with excessive traffic violations fall into the high-risk category because repeated infractions signal ongoing unsafe behavior. Maintaining a clean record is one of the most effective ways to keep costs down.

Many violations can stay on your driving record for years, but avoiding any more claims or citations will help lower your rates over time.

Maintain consistent coverage and practice safe driving habits to steadily improve your risk profile and qualify for lower premiums over time.

Michelle Robbins Licensed Insurance Agent

Always compare high-risk auto insurance quotes online to see how risk influences pricing in your area, especially if you recently got a ticket or filed a claim.

Despite the higher premiums, high-risk car insurance companies ensure that drivers who fall outside standard underwriting guidelines can still meet state insurance requirements and maintain legal driving privileges.

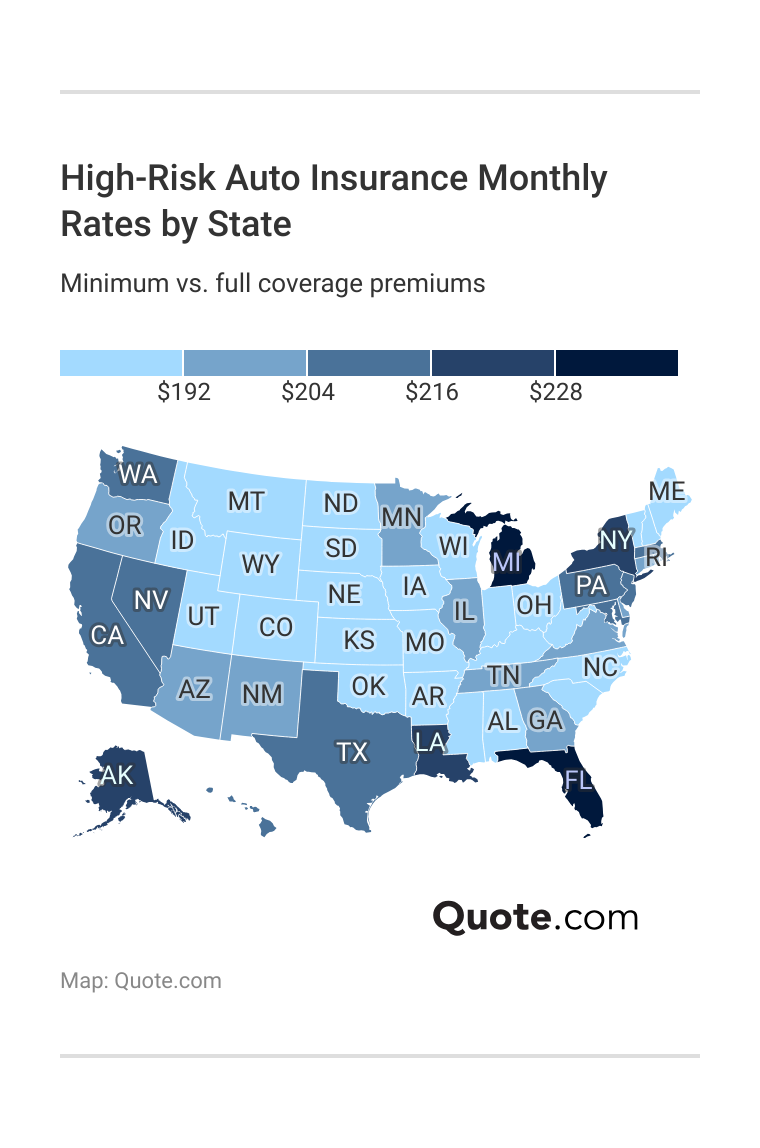

High-Risk Insurance Rates Depend on Where You Live

State-by-state differences play a major role in high-risk auto insurance pricing, as each state sets its own insurance regulations, claim frequencies, and risk factors.

Areas with higher accident rates, dense traffic, or expensive medical and repair costs often show higher premiums. This is why shopping for high-risk auto insurance near you is essential.

Local conditions heavily influence rates, and some states may offer more favorable pricing than others. Learn more by comparing auto insurance rates by state.

For drivers who struggle to find coverage, if no car insurance company will accept you, specialized state insurers and online high-risk auto insurance options can provide alternative solutions.

Your Credit Score Can Make You a High-Risk Driver

Depending on where you live, credit score is another major component of high-risk pricing. Insurers use credit-based insurance scores to predict the likelihood of claims.

The cost of car insurance with bad credit can be significantly higher than for those with strong credit histories.

High-Risk Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $150 | $185 | $225 | $265 | |

| $138 | $170 | $205 | $245 |

| $168 | $210 | $255 | $305 | |

| $130 | $160 | $195 | $235 | |

| $155 | $195 | $235 | $285 |

| $145 | $175 | $210 | $255 | |

| $160 | $200 | $245 | $295 | |

| $125 | $155 | $185 | $225 | |

| $165 | $205 | $250 | $300 |

| $150 | $190 | $230 | $280 |

Understanding how insurers evaluate credit helps drivers anticipate the average cost of auto insurance and identify which companies are more credit-friendly.

Strengthening your credit over time can directly expand your access to better policy choices and lower-risk classifications.

Who Needs High-Risk Car Insurance

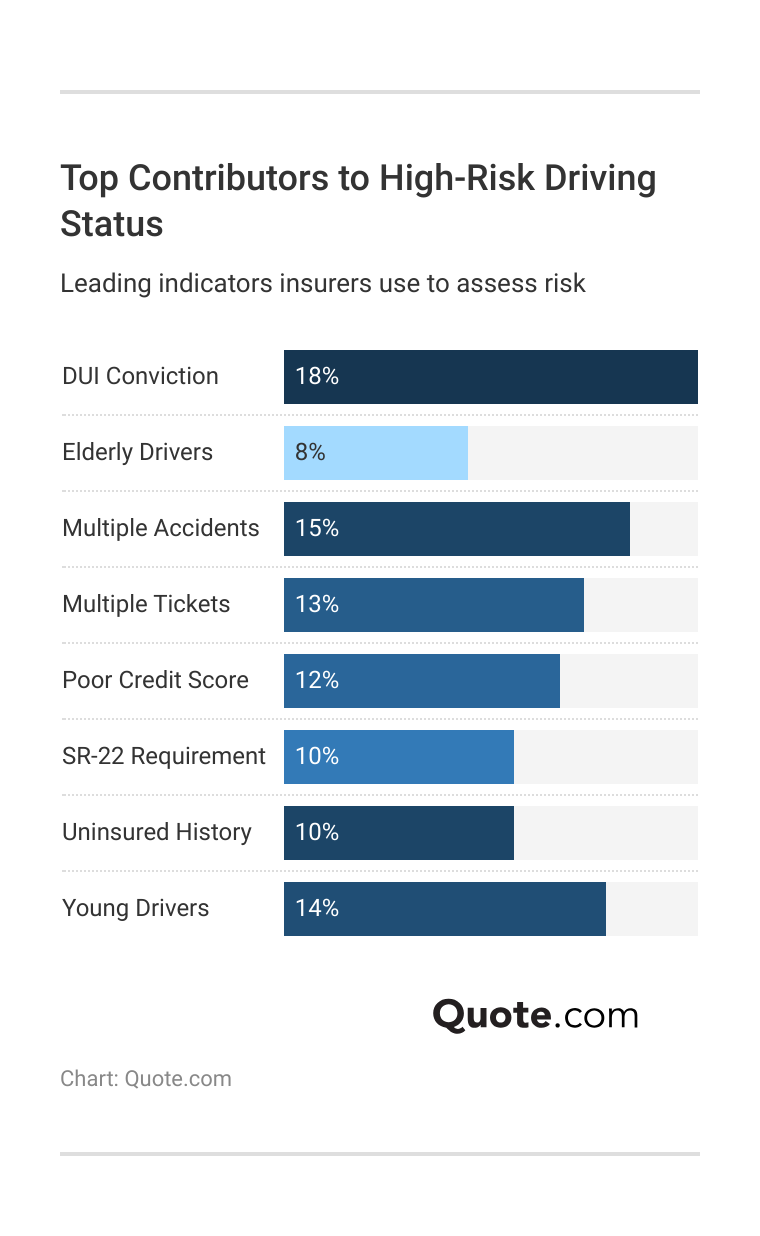

DUIs, repeated violations, and multiple at-fault accidents are among the strongest predictors of future claims, making them key elements in high-risk underwriting.

Age groups also play a role, particularly among new drivers with little to no experience, and elderly drivers statistically face a higher likelihood of accidents.

Top Reasons for High-Risk Driver Classification| Category | What it Means |

|---|---|

| DUI Conviction | Drivers with alcohol or drug-related violations |

| Elderly Drivers | Over age 70 sometimes classified as higher risk |

| Multiple Accidents | More than two at-fault accidents in 3–5 years |

| Multiple Tickets | Several speeding or moving violations |

| No Insurance History | Gaps in coverage or first-time insurance buyers |

| Poor Credit Score | Below-average credit increases risk classification |

| SR-22 Requirement | Mandated proof of insurance after major violation |

| Young Drivers | Age 18–24 often considered higher risk |

A poor credit score can further increase risk classification, while drivers required to file an SR-22 auto insurance typically have serious violations that signal higher financial and safety risk.

DUI convictions and young drivers represent significant portions of high-risk classifications, reflecting their strong correlation with crash statistics.

Multiple accidents and repeated tickets also make up a large share, confirming insurers’ emphasis on past behavior as an indicator of future claims.

Poor credit scores and no insurance history also contribute meaningfully, underscoring that financial responsibility and continuous coverage are essential for reducing your risk and lowering your premiums.

Maintaining good driving habits after your violation or drop in your credit score is the easiest thing you can do to lower your high-risk insurance rates.

Eventually, as you get more experience behind the wheel and avoid future claims, your monthly premiums will return to normal. A defensive driving discount can also help teen and elderly drivers lower their high-risk costs.

Finding Affordable High-Risk Auto Insurance

Age, driving history, state regulations, and credit score all shape high-risk auto insurance. Understanding how these elements impact rates helps drivers save money on coverage.

Among the best high-risk auto insurance companies, State Farm offers the cheapest car insurance for high-risk drivers at $140 per month after a speeding ticket.

Fortunately, high-risk status is not permanent. Improving your driving habits, maintaining continuous coverage, and strengthening your credit can gradually lower car insurance premiums.

Finding cheap auto insurance rates can be difficult for high-risk drivers. Enter your ZIP code to find the most affordable quotes in your area.

Frequently Asked Questions

What is high-risk auto insurance?

High-risk auto insurance covers drivers more likely to file claims due to violations, accidents, poor credit, or SR-22 requirements. These drivers pay higher premiums because insurers view them as elevated risks. This coverage ensures they meet state minimum insurance laws and stay legally insured.

Who needs high-risk auto insurance?

Drivers with DUIs, repeated violations, poor credit, multiple claims, or lapses in coverage typically need high-risk auto insurance. Young and elderly drivers may also qualify due to higher accident risk. This coverage keeps them legally insured while rebuilding their driving history.

Does a DUI automatically require high-risk auto insurance?

Most states require high-risk auto insurance after a DUI, often with an SR-22 filing. Some insurers offer cheap auto insurance after a DUI to help reduce costs while drivers work on improving their record.

How long are you considered a high-risk driver?

Most drivers remain in the high-risk category for three to five years, depending on the violation. DUIs, major accidents, and SR-22 filings may last longer. Maintaining continuous coverage and improving driving habits can help shorten the duration of high-risk auto insurance.

Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Is high-risk auto insurance more expensive?

Yes, high-risk auto insurance is more expensive because drivers pose a higher likelihood of claims. DUIs, major accidents, and repeated violations all raise premiums. Rates can improve over time with safer driving and consistent coverage.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

How much is high-risk insurance a month?

High-risk insurance costs between $155 and $460 a month, depending on factors like age, driving record, state, and credit score. State Farm provides the lowest average cost, offering the cheapest insurance for high-risk drivers starting at $155 per month.

Do credit scores affect high-risk auto insurance rates?

Yes, poor credit can significantly raise high-risk auto insurance costs because insurers link low scores to higher claim risk. Improving credit over time can help drivers qualify for better rates.

How can high-risk drivers lower their auto insurance rates?

High-risk auto insurance rates can be lowered by keeping a clean driving record, improving credit, avoiding lapses in coverage, and completing defensive driving courses. Comparing insurers regularly also helps since each company evaluates high-risk factors differently.

What coverage do high-risk drivers usually need?

High-risk auto insurance must meet state minimums, but many drivers choose full coverage auto insurance for broader protection. Full coverage includes liability, collision, and comprehensive insurance.

Does high-risk auto insurance include different coverage types?

Yes, high-risk auto insurance can include liability, collision, and comprehensive coverage. Selecting the right types of auto insurance ensures proper protection based on your driving risk.

Are there discounts for high-risk auto insurance?

How can I compare high-risk insurance companies?

Can you buy high-risk auto insurance online?

How do I get high-risk car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.