Roadside Assistance Coverage in 2026

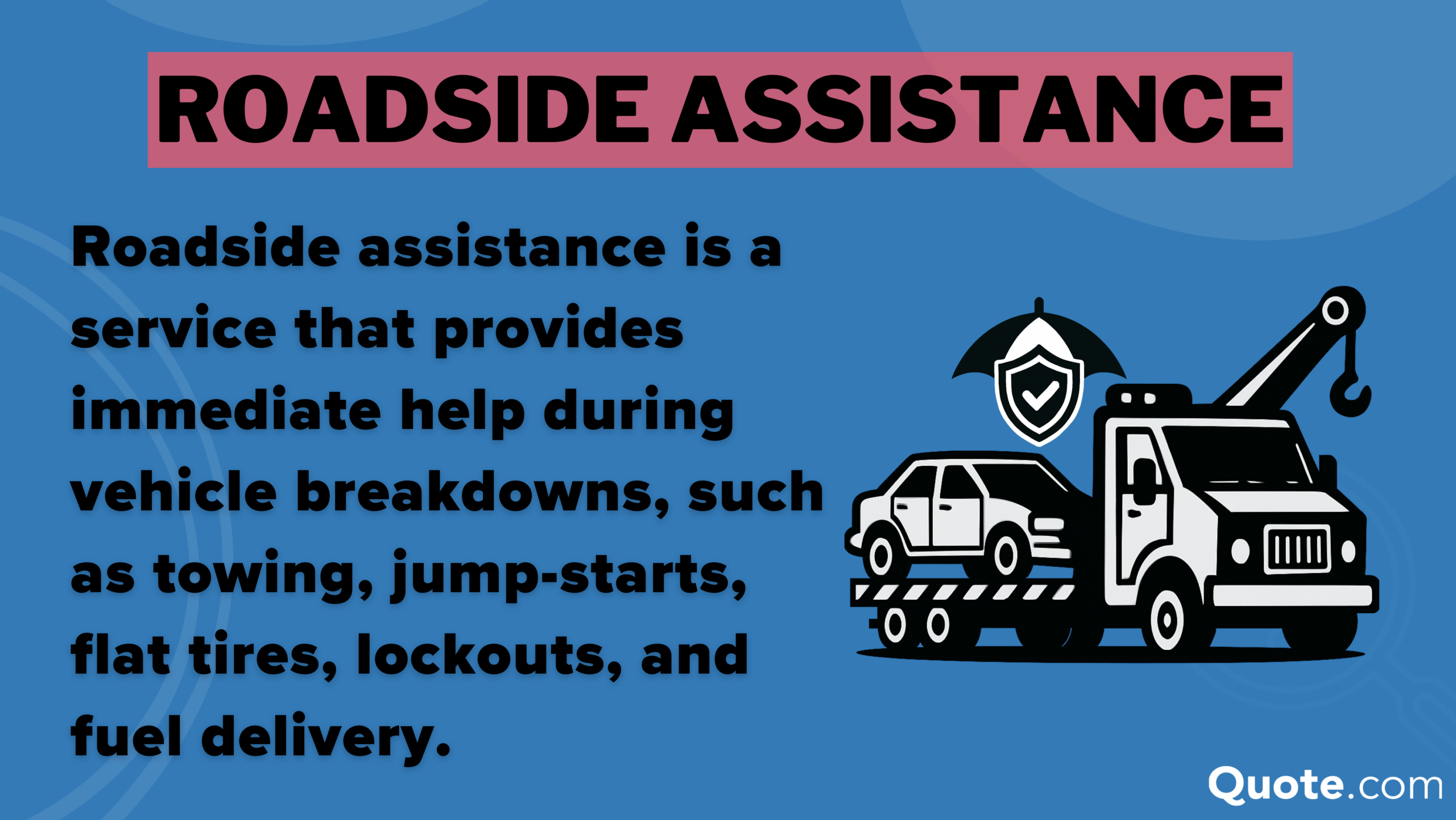

Roadside assistance coverage helps with towing, flat tires, lockouts, and dead batteries. Monthly rates range from $6 to $15, with Erie and Geico having the cheapest roadside assistance plans. State departments of transportation and some insurers, including AAA, come with membership-based free roadside assistance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

Roadside assistance coverage offers emergency help for flat tires, dead batteries, and more. It’s an optional add-on to all types of auto insurance, typically costing $6–$15 per month.

- Towing, jumpstarts, and lockouts are included in roadside assistance plans

- AAA offers up to 100+ miles of towing with 30–60 min response times

- Roadside assistance starts at $6 per month, with plans varying by provider

Explore a variety of coverage options, from basic to comprehensive, with 24/7 technician access and increased towing and trip interruption benefits. Knowing what’s covered allows you to choose the plan best suited to your budget and desired peace of mind.

Insure your vehicle against the unexpected and find cheap roadside assistance by entering your ZIP code into our free comparison tool for affordable auto insurance quotes.

How Roadside Assistance Works

Roadside assistance is designed to get you back on the road quickly when unexpected issues strike, like a flat tire, dead battery, or lockout. Instead of needing a full repair or towing on your own, these services send help directly to your location.

Most providers offer 24/7 roadside assistance through mobile apps, phone hotlines, or insurance websites, making it easy to request service anytime, anywhere.

Roadside Assistance Coverage Details| Coverage Feature | What it Includes | Typical Limit |

|---|---|---|

| Battery Jump-Start | On-site jump-start service | Included |

| Flat Tire Change | Spare tire installation | Included |

| Fuel Delivery | Fuel delivered to location | 2–3 gallons |

| Lockout Service | Unlocking doors (non-key replacement) | $50–$100 |

| Towing | Transport to nearest repair shop | 5–25 miles |

| Vehicle Recovery | Pulling from mud, snow, or ditch | 1 driver, 10–20 ft |

Towing typically includes transport to the nearest qualified repair facility, with mileage limits ranging from 5-25 miles depending on the plan. This service is essential when your vehicle can’t be fixed on-site.

Vehicle recovery services are also commonly included, especially in mid-tier to premium plans. This involves pulling a stuck vehicle out of snow, mud, or a ditch using a winch line.

It’s particularly useful in rural or winter conditions and is often recommended in auto insurance guides for those who drive in harsh environments.

Understanding Roadside Assistance Coverage Tiers

Roadside assistance comes in tiers, offering different kinds of towing, lockout help, fuel drop-offs, and trash removal. The more expensive tiers offer increased coverage, so the right plan for you depends on your driving habits and car reliability.

Basic coverage provides 5-10 miles of towing, a $50 lockout limit, two gallons of fuel, and limited recovery for the local driver. Standard coverage comes with 20-50 miles of towing, a $75 per month lockout benefit, which makes this our pick for commuters.

Roadside Assistance Service Limits by Tier| Plan Tier | Towing Limit | Lockout Limit | Fuel Delivery | Recovery |

|---|---|---|---|---|

| Basic | 5–10 miles | $50 cap | 2 gallons | Minor help |

| Standard | 20–50 miles | $75 cap | 3 gallons | Stuck vehicle |

| Premium | 100 miles | $100 cap | Unlimited | Heavy assist |

| Elite | 200+ miles | Unlimited | Unlimited | Full recovery |

Premium plans offer 100-mile towing, $100 per month lockout coverage, unlimited fuel, and enhanced recovery, suited for long-distance drivers. Elite plans include over 200 miles of towing, unlimited assistance, and full recovery services.

Roadside assistance levels vary based on driving needs. Basic plans are for local drivers, and premium plans cover out-of-town or country drives. Use how to compare auto insurance companies to find the best match.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Roadside Assistance Coverage

Roadside assistance is very budget-friendly when you add it to auto insurance, and in most cases, your monthly cost will be between $6 and $15, but the price will depend on the company issuing your policy and how much coverage you carry.

These add-ons typically include services such as towing, flat tire changes, battery jumpstarts, fuel delivery, and lockout assistance, though towing mileage limits and service networks vary. Read More: Allstate vs. Geico Auto Insurance Review

Roadside Assistance Monthly Rates by Provider| Insurance Company | Add-On Cost | Details |

|---|---|---|

| $13 | 5–100+ miles depending on tier |

| $15 | 24/7 full towing network | |

| $6 | Up to 10–15 miles per tow |

| $12 | Towing to nearest qualified shop | |

| $7 | 20–25 mile towing | |

| $9 | Up to 15–20 miles per tow |

| $9 | Up to 15–25 miles per tow | |

| $8 | 15–20 mile towing | |

| $10 | Basic towing to nearest shop | |

| $8 | Up to 15–20 miles per tow |

At the low end, Erie offers one of the best roadside assistance plans for budget-conscious drivers, starting at just $6 per month with 10–15 miles of towing.

Liberty Mutual and Nationwide charge around $9 per month for 15–25 miles of towing. State Farm roadside assistance offers basic towing for $10, while Farmers adds flexibility for $12.

These rates vary based on how much you drive and your coverage needs. Progressive roadside assistance offers a budget-friendly option with essential services.

Budget plans suit local drivers, while AAA or Allstate are better for frequent travelers. Compare roadside plans to find the best coverage and value.

Compare Roadside Assistance vs. Emergency Service Costs

Roadside assistance provides broader and cheaper coverage, even if roadside assistance customer service offerings, such as towing, can run $150 a month, plus miss basics like jumpstarts.

Highway patrol offers free safety checks but no towing or repairs, making emergency roadside assistance essential. Mobile services can cost $120, while a $15 monthly plan covers common issues at a much lower rate than the average cost of auto insurance.

Roadside Assistance vs. Emergency Services: Coverage & Cost| Service Type | Included | Not Included | Typical Cost |

|---|---|---|---|

| Emergency Tow | 1 tow to shop | No jump/lockout | $150 |

| Highway Patrol | Checks, traffic help | No tow/repairs | Free |

| Mobile Mechanic | Minor on-site fixes | Major repairs | $120 |

| Roadside Assist | Tow, jump, tire, lockout, fuel | Recovery, repairs | $15/mo |

Roadside assistance plans are the solution for drivers who want freedom from surprise auto expenses and fines when roadside mishaps occur, such as unexpected delays.

These plans make it easier to get help in emergencies, especially in remote areas or after hours. A monthly plan is a simple, cost-effective way to handle common vehicle issues.

Roadside Assistance Plans & Prices Vary by State

Roadside assistance costs in a monthly plan may vary widely, depending on your location, because of differences in insurance laws, cost of living, availability of service, and provider networks.

In Idaho, plans fall between $12 and $29 per month bundled with full coverage auto insurance, which helps demonstrate how pricing can be affected not only by the coverage type you are buying but also by service costs in your area.

Texas has higher rates, with basic plans starting at $41 and premium options reaching $59 per month. These include more towing miles, additional service calls, and quicker response times, which are helpful in large or rural areas.

Roadside assistance varies by state, making it important to compare by ZIP code. Costs may be lower in urban areas but higher in rural areas. Combine the coverage area, service area, and response time to find the best fit for your budget.

Types of Roadside Assistance Coverage

Not all roadside assistance plans are tied to your auto insurance. AAA roadside assistance and services like Good Sam offer independent, membership-based support with no insurance required.

These are great options for drivers with basic liability or no insurance who still need services like flat tire changes, jumpstarts, and fuel delivery. Some plans even come with benefits like hotel discounts or unlimited towing, while Good Sam is especially great for RVs.

Roadside Assistance: Insurance Add-Ons vs. Memberships| Provider | Monthly Cost | Tow Limit | Best for |

|---|---|---|---|

| AAA Membership | $15 | 100 mi | Frequent drivers |

| AARP Membership | $7 | 100 mi | Older drivers |

| Automaker Coverage | $0 | 20 mi | New vehicles |

| Credit Card Benefits | $0 | Refunded | Occasional use |

| Good Sam Membership | $12 | Unlimited | RVs and campers |

| Insurance Add-On | $10 | 10 mi | Budget option |

Most insurance companies require drivers to carry at least one form of physical damage coverage, such as collision vs. comprehensive auto insurance, before allowing roadside assistance to be added to a policy.

This prerequisite ensures the vehicle is already covered against specific losses, like accidents or theft, before adding roadside services such as towing, lockout help, or jump starts.

Cell phone carriers like Verizon and AT&T offer roadside assistance as a mobile plan add-on, usually under $5 per month, with services like towing, jumpstarts, and lockout help.

That’s an easy option for drivers who carry minimum liability and don’t want to switch insurance coverage or become full members.

A few state insurance or transportation departments also provide low-cost or free roadside assistance on major highways. The programs vary by state and are typically limited in scope, yet they can provide a helpful backup for drivers left stranded.

Services and availability vary, so it’s best to check with your state’s DOT or insurance department site.

How to Request Roadside Assistance

Roadside assistance isn’t filed as a traditional insurance claim; it’s initiated through a direct service request. For issues like a flat tire, dead battery, or lockout, you can request help through your provider’s 24/7 hotline, app, or website.

If the service is within your coverage limits and handled by an approved provider, your insurer typically covers the cost without requiring upfront payment.

- Contact Your Provider: Request roadside help via your provider’s app, website, or 24/7 hotline. Provide your location and issue, like “flat tire” or “dead battery.”

- Confirm Estimated Time of Arrival (ETA): Your provider should provide you with an ETA and update you on the status via text or app notifications.

- Stay Safe While Waiting: Pull over to a safe location, turn on your hazard lights, and, if possible, wait inside the car for assistance.

- Keep Your Receipts: When service is completed, take a receipt if your plan requires reimbursement.

If you use an out-of-network provider or pay out of pocket, many top insurers. Like those in the best auto insurance companies for claims handling, they offer reimbursement.

This usually requires saving your receipt, noting the service details, and submitting the information through your insurer’s online portal or app. Always review your specific policy to confirm coverage details, service limits, and eligibility for reimbursement.

Common Roadside Assistance Claims

Some roadside problems are much more frequent than others. The data on claims shows jumpstarts lead at 28%.

Flat tires, calling a tow truck, lockouts, fuel delivery, and ditch or snow recovery are among the most common roadside assistance claims.

Response times are important after a roadside claim, especially if you’re stranded on a busy highway or stuck in bad weather. Learn More: AAA Auto Insurance Review

AAA and automaker roadside assistance programs typically offer the fastest response times, averaging 30-60 minutes, thanks to large networks and efficient dispatch systems.

Roadside Assistance Response Time Comparison| Provider | Arrival Time | Speed Factors | Rating |

|---|---|---|---|

| AAA Membership | 30–60 min | Large network | Fast |

| AARP Membership | 45–75 min | AAA network | Moderate |

| Automaker Coverage | 30–60 min | Factory network | Fast |

| Credit Card Benefits | 60–120 min | Reimbursed | Slow |

| Good Sam Membership | 40–70 min | RV specialists | Fast for RVs |

| Insurance Add-On | 60–90 min | Local vendors | Slow |

Response times can be influenced by factors such as network connectivity, dispatch systems, and whether the service is delivered directly or through third parties.

Factory-built roadside plans provided by automakers often tie directly to national service centers designed for efficiency and coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Right Roadside Assistance Coverage

Roadside assistance coverage starts at $6 per month and covers common issues like flat tires and dead batteries. Erie is the cheapest, with Geico and Travelers at $7–$8 per month.

AAA and Allstate provide more comprehensive plans at $13 to $15 per month with added benefits that often go beyond what’s included in standard comprehensive auto insurance. Good Sam offers RV owners unlimited towing for just $12 a month.

Some providers stand out for value. Allstate roadside assistance offers 24/7 towing and trip coverage, AAA includes travel perks, and Erie is budget-friendly.

Some drivers may also receive free roadside assistance through new-car warranties, credit cards, or automaker programs, though these often have limitations. Enter your ZIP code in our free tool to see how much roadside assistance costs near you.

Frequently Asked Questions

What is roadside assistance coverage?

Roadside assistance is a voluntary add-on to an auto insurance policy that can help when your car breaks down. It covers flat tires, dead batteries, lockouts, fuel delivery, and towing (5–100+ miles). Starting at $6 per month, it provides quick, affordable peace of mind on the road.

What does roadside assistance coverage include?

The best roadside assistance depends on your needs. Allstate and AAA offer 24/7 help and long-distance towing, Good Sam suits RV owners, and AARP is great for seniors. Compare features to find your fit.

Cheap auto insurance quotes are easy to get. To get the best policy for you, enter your ZIP code into our free quote tool.

What is not covered by roadside assistance?

Roadside assistance does not include major repairs or extensive off-road recovery and is limited to one assist per plan year. It works for emergencies but isn’t a substitute for full maintenance.

How much does roadside assistance coverage cost?

Roadside assistance is $6–$15 per month, and benefits vary by level of coverage. Basic plans include minimal towing, while higher plans include up to 200 miles of towing. Companies such as AAA, Erie, and Good Sam offer different rates. See our Erie insurance review for more.

What is the cheapest roadside assistance service plan?

Erie offers the cheapest roadside assistance plan at just $6 per month, including 10–15 miles of towing. Geico and Travelers follow closely at $7–$8 per month, but Erie remains the most budget-friendly option for basic, reliable coverage.

Who offers the best roadside assistance coverage?

AAA and Allstate offer top roadside assistance with 24/7 support, long-distance towing, and travel perks—ranking among the best travel insurance companies. Good Sam is ideal for RV owners with unlimited towing and specialized benefits.

Is roadside assistance better as an insurance add-on or a membership?

The available insurance add-ons are inexpensive ($6–$10 monthly) and meet minimal requirements. Standalone plans are pricier, but they provide more towing, faster service, and extra benefits that could be beneficial if you drive long distances or are an RV owner.

Is AAA cheaper than roadside assistance through auto insurance?

Not always. AAA starts at $13–$15 per month with 5–100+ mile towing, while some of the cheapest car insurance providers offer roadside assistance plans for as low as $6 per month. Insurance add-ons are more affordable, but AAA may provide more value for frequent drivers.

How do roadside assistance costs and benefits vary by provider and plan?

Costs range from $6 to $15 per month, with basic plans offering limited towing and essential services, while premium plans from providers like AAA and Allstate include longer towing, trip coverage, and added perks.

How do you use roadside assistance through your insurance?

Request roadside help through your insurer’s app, website, or hotline, no claim needed. In-network services are usually covered; out-of-pocket costs may be reimbursed. Check your policy for details.

How do I check if I already have roadside assistance coverage?

What happens if I don’t have roadside assistance coverage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.