How Speeding Tickets Affect Auto Insurance in 2026

Speeding tickets affect auto insurance by raising rates at least 40% on average. At $77 per month, Geico has the cheapest average car insurance for drivers with tickets. Speeding ticket penalties vary by state, and it can take up to five years for a speeding ticket to stop affecting rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated February 2026

Speeding tickets affect your auto insurance by raising your premiums, and drivers with multiple tickets may need to buy high-risk auto insurance.

- A ticket for driving over 25 mph raises rates by an average of 35% to 50%

- Matching traffic speed is the reason behind 15% of speeding tickets

- Geico and State Farm have the lowest average rates after a speeding ticket

Drivers can expect their rates to be at least 40% higher for a few years after receiving a speeding ticket, with rates starting at $77 per month.

While tickets raise drivers’ rates, those rates will start to drop again if drivers maintain a clean driving record after their speeding ticket.

Read on to learn about speeding tickets and insurance costs, including how speeding tickets affect insurance rates, plus safe driving tips to avoid rate increases.

Have a speeding ticket or two on your record? Enter your ZIP code into our free quote tool to find the most affordable auto insurance near you.

How Speeding Tickets Impact Insurance

So, how do speeding tickets affect car insurance? When insurance companies see that drivers have a speeding citation on their record, premiums will increase as they are considered riskier to insure.

If drivers are pulled over by law enforcement for driving over the posted speed limit, they will usually be issued a speeding ticket. Speeding is a moving traffic violation, so in most cases, points will also be added to a driver’s driving record.

How speeding tickets affect insurance depends on several factors, such as how fast you were going, state speeding ticket penalties, state auto insurance requirements, and more.

For instance, a speeding ticket for going five miles over the speed limit will likely have less impact than one for going 20 miles over the speed limit.

How a Speeding Ticket Affects Auto Insurance Cost| Rate Factors | Price Change | How It’s Applied |

|---|---|---|

| Active discounts | Discounts may drop | Discounts removed |

| Driver age | Age-based surcharge | Higher risk category |

| Driving history | Rates increase | Safe-driver status lost |

| Insurer guidelines | Pricing varies by insurer | Rating rules differ |

| Speed over limit | Severity-based surcharge | Risk level reassessed |

| State regulations | State rules affect pricing | Location rules apply |

| Ticket count | Multi-ticket surcharge | Repeat risk flagged |

| Time since violation | Impact decreases | Record impact fades |

| Traffic school eligibility | Increases may lessen | Course reduces impact |

Additionally, a driver’s ticket count matters when looking at how a speeding ticket impacts insurance. If it’s your first speeding ticket, rates won’t increase as much as if it were your third or fourth.

Repeat speeding offenders will have much higher rates than first-time offenders, as insurers consider them more likely to speed again or get another violation.

Insurance Rate Increases After a Speeding Ticket

One major factor that affects how much a driver pays for auto insurance after a speeding ticket is their choice of provider. Rates will not increase the same across insurance companies.

This is because providers have different prices and different policies for how speeding tickets affect car insurance.

Auto Insurance Monthly Rates Before & After a Speeding Ticket| Company | Before Ticket | After Ticket | Increase |

|---|---|---|---|

| $78 | $110 | 41% | |

| $69 | $99 | 44% |

| $56 | $80 | 43% |

| $74 | $106 | 43% | |

| $55 | $77 | 40% | |

| $82 | $118 | 44% |

| $64 | $92 | 44% | |

| $71 | $101 | 42% | |

| $59 | $83 | 41% | |

| $70 | $96 | 37% |

Travelers has the lowest increase at 37% for speeding ticket violations, but it’s not the cheapest auto insurance company on average for drivers with speeding tickets, as it has higher rates before tickets.

Instead, Geico and State Farm are best if you are looking for the cheapest companies on average after a ticket. Learn More: Geico Insurance Review & State Farm Auto Insurance Review

How Speeding Ticket Location Influences Premiums

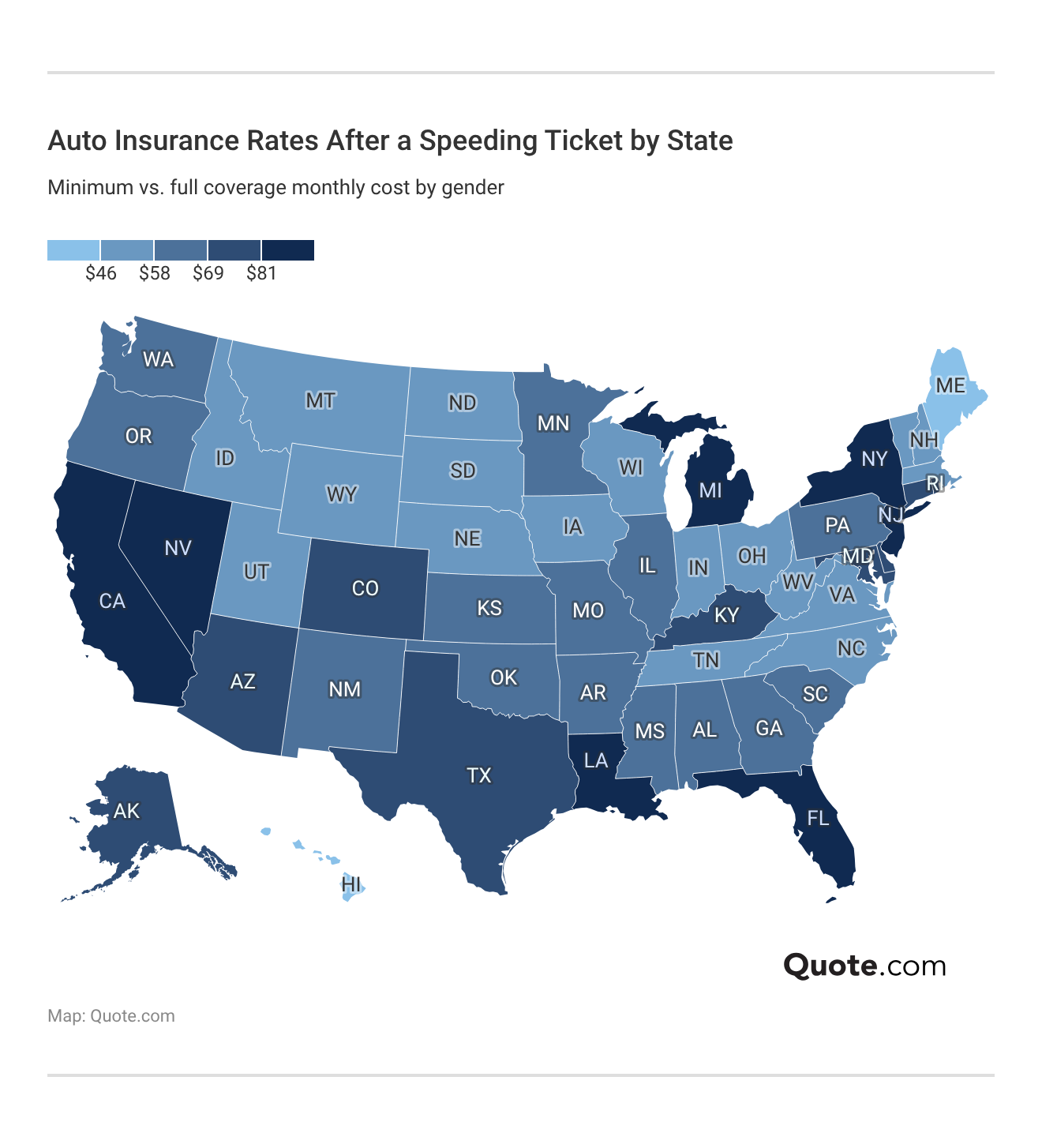

Where you live matters for speeding and insurance. Each U.S. state sets its own traffic laws, with variations in point systems, fines, and other penalties for violations. These differences in points and speeding fines affect insurance.

Even if a driver is issued a ticket outside of their state, it will affect their rates in their home state, as it will still go on their driving record.

States with high average rates after a speeding ticket include Michigan, Louisiana, Nevada, and California.

If a driver lives in a more affordable state like Maine, however, there won’t be as much impact on their speeding ticket insurance costs, especially if they are getting no-point speeding ticket insurance.

Read our article for more details: Auto Insurance Rates by State

How Speeding Ticket Type and Severity Affects Insurance Rates

While all speeding is against the law and will result in higher auto insurance rates, some types of speeding violations are worse than others.

Insurance companies will consider factors such as the number of speeding offenses, the speed at which a driver was speeding, and more when setting rates for insurance for speeding tickets.

How Auto Insurance Providers View Speeding Tickets| Ticket Type | Rate Impact |

|---|---|

| Minor speeding | Lower risk increase |

| Major speeding | Higher risk increase |

| One-time offense | Often forgiven |

| Repeat offense | Penalized more heavily |

| Speed threshold exceeded | Severity affects pricing |

| Excessive speed violation | Treated as high risk |

Repeat offenders will be charged the most. You may even be labeled high risk if you have multiple speeding tickets or a reckless driving charge from speeding. In these cases, you will have to pay more to secure the best insurance for reckless driving. Learn More: Cheap Auto Insurance for High-Risk Drivers

Compared to high-risk drivers, first-offender drivers with minor speeding tickets won’t pay nearly as much for auto insurance coverage.

The speed at which law enforcement records your driving is another major factor that influences how much auto insurance for drivers with tickets costs. For example, going a few miles over the speed limit raises auto insurance rates by only an average of 5% to 10%.

How Speeding Severity Affects Auto Insurance Rates| Speed Range | Cost Increase |

|---|---|

| 1–5 mph | 5–10% |

| 6–10 mph | 10–15% |

| 11–19 mph | 15–25% |

| 20–24 mph | 25–35% |

| 25+ mph | 35–50% |

| Reckless Speed | 40%+ |

If the speed recorded is high enough to earn a driver a reckless driving charge in their state, rates will increase on average by over 40%, and they may need to get SR-22 auto insurance, depending on their state’s laws.

Bottom line? Higher speeds on a traffic ticket will increase the amount a driver pays for auto insurance afterwards.

Time Since a Speeding Citation Matters

With all violations, rates drop the longer it has been since the violation occurred, as long as the driver has kept a clean driving record since then.

Rates for auto insurance with speeding tickets typically decline two years after the ticket is issued. After five years, a speeding ticket violation often has no impact.

How Long a Speeding Ticket Affects Insurance Rates| Ticket Age | Cost Impact |

|---|---|

| When Issued | Surcharge begins |

| 1 year | Highest increase |

| 2 years | Reduced increase |

| 3 years | Moderate impact |

| 4 years | Minimal impact |

| 5 years | Often no impact |

Of course, the impact of time on a driver’s auto insurance rates will depend on their state’s driving record laws and their auto insurance provider.

How long do speeding tickets stay on record? In most cases, however, drivers can expect tickets to have no bearing on their rates a few years after they are issued.

When applying for auto insurance, companies typically ask if you have received any traffic tickets in the last three years.

Dani Best Licensed Insurance Producer

If drivers get another speeding ticket, though, the clock will reset, and they will be back to increased rates.

And if drivers have a serious violation on their record, such as a DUI, it will take even longer for rates to drop. Don’t Miss It: Cheap Auto Insurance After a DUI

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Auto Insurance After Speeding Tickets

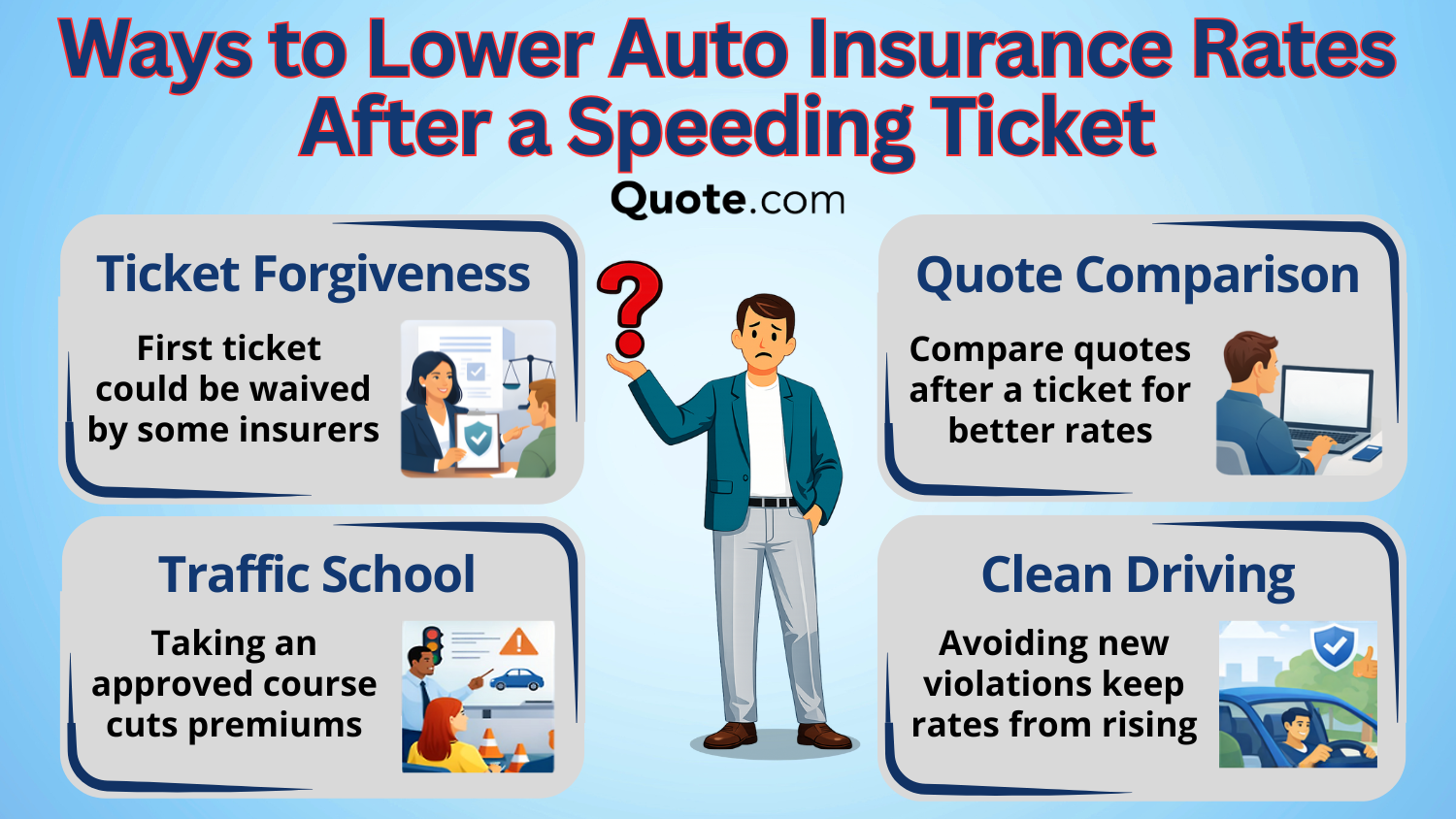

If you have a speeding ticket on your driving record, you are probably wondering, how can you lower your rate after a ticket? There are a few different things you can do after a speeding ticket insurance rate increase.

In some cases, you may be lucky enough to be with an insurance company that has ticket forgiveness, in which your first minor ticket will be waived, and there won’t be a speeding ticket insurance increase.

If your auto insurance company doesn’t offer ticket forgiveness, you may still be able to keep rates low by taking an approved driving course to earn a discount. Read our article for more details: Car Insurance Discounts You Can’t Miss

Speeding ticket effects on insurance, though, may warrant shopping around for a new auto insurance company, especially if you are labeled a high-risk driver by your insurance company.

Keeping a clean driving record after your speeding ticket will also go a long way to reducing your rates for speeding ticket insurance coverage. It shows insurance companies that your driving behavior has improved, and you are less likely to get another ticket in the future.

You can expect insurance rates to decrease slightly, or at the very least not increase, with each renewal period of clean driving. You may also want to look into how to keep a speeding ticket off your record, as contesting a minor speeding ticket in court may result in it being dropped.

Driving Tips to Avoid Speeding Tickets

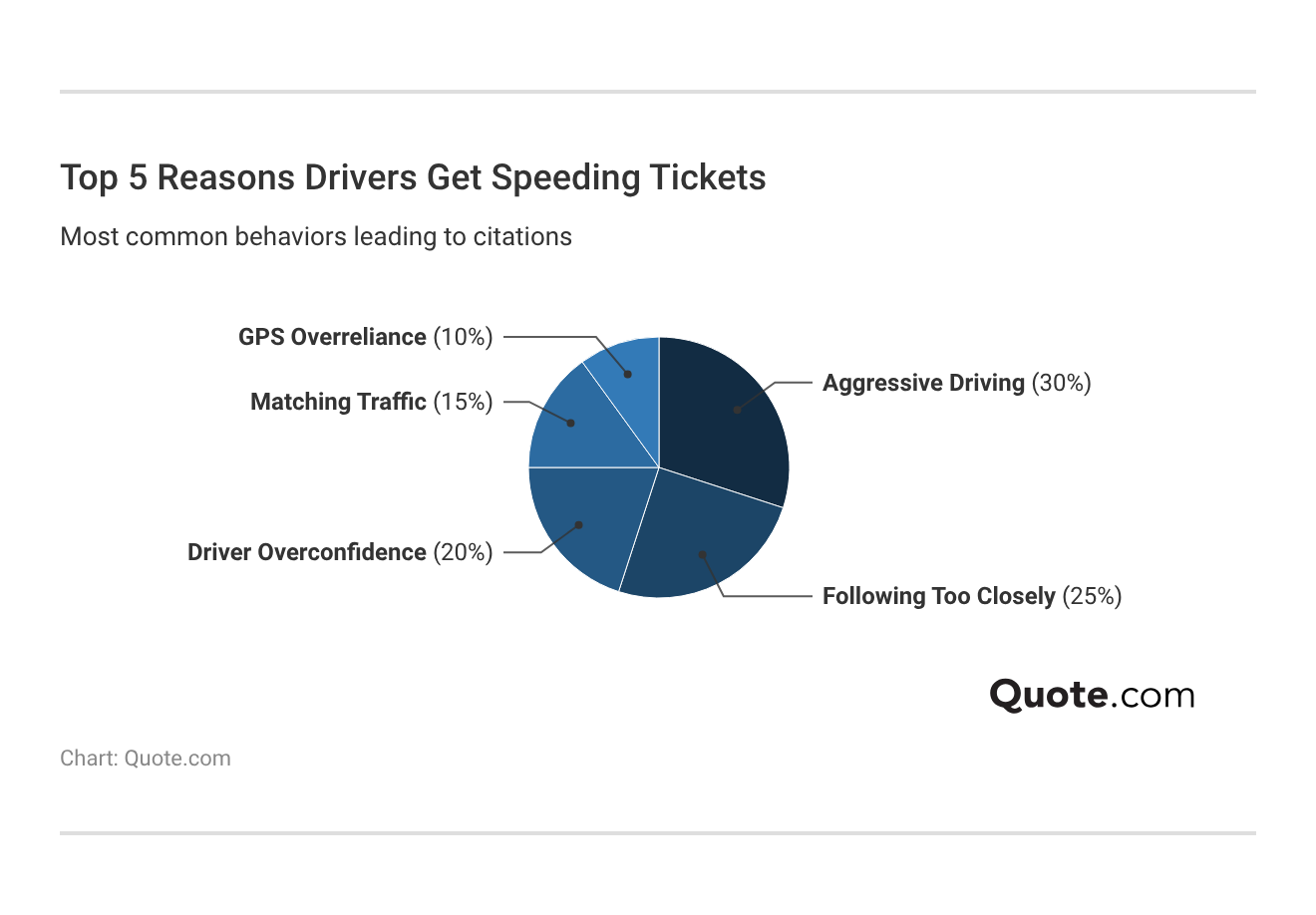

Several driving habits increase the likelihood of receiving a speeding ticket. Working on improving your driving and avoiding certain habits will help decrease the likelihood of a ticket and insurance points.

For example, matching traffic speed rather than following the speed limit is a driving habit that could result in a speeding ticket, accounting for 15% of all speeding tickets.

And while GPS systems can earn you an anti-theft discount, overreliance on a GPS system is another driving habit that could lead to a speeding ticket. See More: Best Anti-Theft Auto Insurance Discounts

This is because a GPS speed limit may not calibrate your speed correctly, or it may display the wrong speed limit. To avoid a speeding ticket due to GPS error, it is best to compare your GPS speed to your car’s speedometer for accuracy and follow posted speed limit signs.

Switching Insurance Providers After a Ticket

An increase in auto insurance rates doesn’t automatically mean you should change your current auto insurance provider.

For example, staying with your current provider may help you avoid issues if a claim or court case is involved.

If you change insurance companies with an open claim, your old company will still handle the open claim.

Daniel Walker Licensed Insurance Agent

While you can switch providers with an open claim, it is often less complicated to stick with your current provider until the claim is resolved, as it will make claims handling easier. Learn more in our guide: Best Auto Insurance Companies for Claims Handling

You may also want to stick with your current auto insurance provider if it offers forgiveness for a traffic violation, which will keep your rates the same.

When to Wait Before Switching Auto Insurance Providers| Situation | Why Wait |

|---|---|

| Accident claim still open | Prevents claim complications |

| Court outcome pending | Avoids premature pricing |

| First ticket not processed | Ensures accurate records |

| New rate not applied | Confirms actual increase |

| Policy renewal approaching | Allows full comparison |

| Provider forgiveness applies | Preserves current discount |

Keep in mind that your rates may not increase right away after you get a traffic ticket. In most cases, rates will increase at renewal when your insurance company rechecks your driving record.

Because of this, you may want to see what rate you are offered by your current company before switching. Your current company may still be the most affordable option.

Get the Details: How to Compare Auto Insurance Companies

Reasons to Leave Your Current Insurance Company

If you have a speeding ticket or two on your record, you may be tempted to switch providers to try to secure a lower rate.

There are several instances where it might be wise to start looking for another provider, such as if you lose your good driver discounts. See More: Best Good Driver Auto Insurance Discounts

When to Consider Switching Providers After a Speeding Ticket| Situation | Why Switch |

|---|---|

| Discounts recently removed | Savings no longer available |

| First violation on record | First ticket is not forgiven |

| Provider raised rates sharply | Penalty higher than average |

| Rate increased at renewal | Above-average cost increase |

| Ticket added to record | Ticket significantly affects rates |

You may also want to consider switching if there is an extremely sharp rate increase at renewal that is higher than average.

Now that you know the answer to does a speeding ticket affect your insurance, you may be able to score a cheaper rate elsewhere by shopping around. Look for cheaper auto insurance today by entering your ZIP in our free quote tool.

Frequently Asked Questions

Do speeding tickets raise insurance prices?

In most cases, a speeding ticket will raise your rates. You will know if it affects your insurance if you receive a higher rate at your next insurance renewal, making it harder to save on insurance after a ticket. Related: Hacks to Save Money on Auto Insurance

Why do insurance rates go up after a speeding ticket?

A speeding ticket increases premiums because insurance companies view drivers as riskier after a ticket or accident. If you need to find a more affordable company after rate increases, compare quotes to see if you can score a better deal. Compare quotes with our free tool today to get started.

Does a first-time speeding ticket affect insurance?

Will my insurance go up if I get one ticket? If you got a ticket and are frantically searching does a first-time speeding ticket affect insurance on Reddit, you’ll find that your rates will go up. A speeding ticket will raise your insurance rates at the majority of companies, unless your insurance company offers ticket forgiveness.

When will a speeding ticket show up on insurance?

If you’re wondering, will a speeding ticket show up on insurance on Reddit? In most cases, a speeding ticket will show up on your insurance at your next renewal. If your rates increase at renewal, you may want to comparison shop to see if you can get a better rate.

See Our Article: How to Get Multiple Auto Insurance Quotes

How long do speeding tickets stay on your record?

A speeding ticket generally stays on your record for at least three years.

When will a speeding ticket show up on insurance at Geico?

Your speeding ticket will show up on your Geico insurance at your next renewal period.

When will a speeding ticket show up on insurance at Progressive?

Your ticket will show up on your next renewal, as Progressive does not offer Progressive speeding ticket forgiveness. Learn more in our guide: Progressive Auto Insurance Review

What tickets don’t affect car insurance?

Non-moving violations usually don’t affect your car insurance rates. These include parking tickets, most equipment violations like a broken taillight, and other citations that don’t involve how you were driving.

However, moving violations can raise your premiums. Tickets for speeding, reckless driving, or running a red light show insurers you’re a higher-risk driver, which often results in higher rates. If you fail to pay a non-moving violation and it’s later treated as a moving violation, it could affect your insurance rates.

Does insurance check driving records regularly?

Yes, auto insurance companies regularly review driving records, often at every renewal. So if you’re wondering, do speeding tickets affect insurance, the answer is that they will always affect rates at your next renewal period.

Will my insurance drop me for my first speeding ticket?

Insurance shouldn’t drop you for a first speeding ticket, especially if you haven’t been involved in any recent accidents. However, if you are dropped, you should be able to easily buy a new insurance policy if all you have on your record is a speeding ticket.

Learn More: How to Buy Auto Insurance

How much do three points affect insurance?

Do I have to tell my insurance if I get points?

Do insurance companies know when you get a ticket?

How much will insurance go up after a speeding ticket?

Does a parking ticket go on your record?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.