Contingent Beneficiary (2025)

A contingent beneficiary is a designated person or entity who inherits life insurance benefits if your primary beneficiary cannot. The average life insurance payout is $169,000, and this secondary beneficiary acts as backup so funds can be distributed. Contingents are also used in retirements, wills, and trusts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2025

If your primary beneficiary is unable to receive life insurance benefits as stated in your policy, you can designate a contingent beneficiary to receive assets.

- Name your contingent beneficiary with a form from your provider

- They apply to life insurance, retirement accounts, wills, and trusts

- Spouses and family members are common contingent beneficiaries

Your contingent beneficiary ensures your financial plans remain secure and your assets are distributed as intended. This distinction helps avoid delays, legal disputes, or unwanted outcomes (Read More: Cheapest Million-Dollar Life Insurance Policies).

Contingent beneficiaries are commonly named in life insurance policies, retirement accounts, wills, and trusts. Adding one provides an extra layer of protection and clarity to your estate and financial planning.

Free instant life insurance quotes are just a click away. Enter your ZIP code to get started.

Contingent Beneficiary Explained

A contingent beneficiary in life insurance is a backup heir who receives the death benefits if the primary beneficiary can’t.

Sometimes called a secondary beneficiary, this person or entity only inherits when the primary has died, refused the assets, or is legally disqualified.

Contingent Beneficiary Overview: Key Details| Aspect | Details |

|---|---|

| Definition | Gets assets if primary can’t |

| Other name | Secondary beneficiary |

| When it applies | If primary dies, refuses, or is disqualified |

| Who you can choose | Spouse, family, friends, charity, trust |

| Legal status | Only inherits if primary can’t |

| Multiple allowed? | Yes, can split assets |

| Main purpose | Backup to ensure smooth transfer |

| Example | If spouse dies, sibling receives assets |

| Typical uses | Life insurance, wills, trusts |

| Best practice | Update after major life events |

The contingent designation matters because it ensures your assets go where you intend, even if something happens to your primary beneficiary.

You can choose a spouse, family member, friend, charity, or even a trust as your contingent life insurance beneficiary. Learn what a life insurance beneficiary is and how beneficiaries claim payouts.

There is no difference between the contingent beneficiary vs. secondary beneficiary designation. Both help avoid delays in probate, prevent legal disputes, and provide a financial safety net for your backup heirs.

Many insurers and estate planners require or recommend naming a contingent beneficiary. Naming more than one is allowed, and assets can be divided among them.

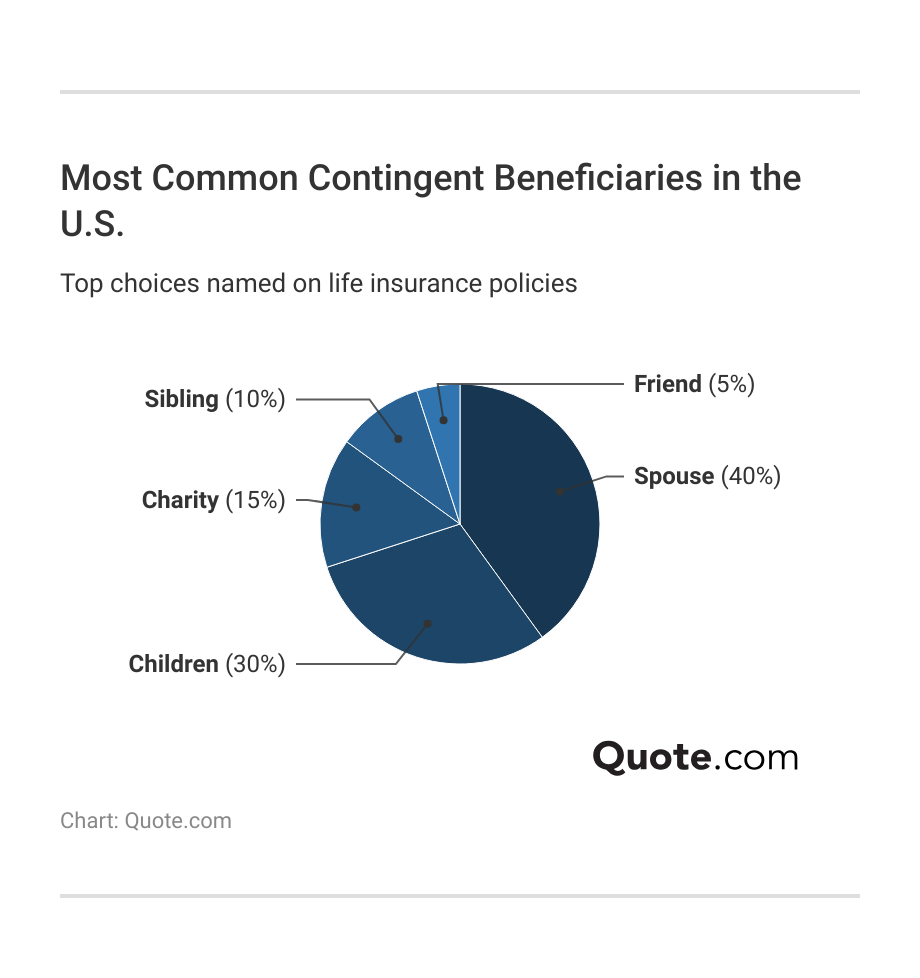

In practice, most people name someone close to them as their contingent beneficiary. Spouses are chosen most often, followed by children, which reflects how families typically want to keep financial security within their household.

Others choose charities, siblings, or trusted friends, ensuring someone they care about will benefit if the primary can’t. You should update your life insurance beneficiary after major life changes to keep your plans secure and clear.

Understanding Primary vs. Contingent Beneficiary Meaning

A primary beneficiary is the first person or entity to receive your assets, while a contingent beneficiary acts as a backup if the primary can’t. This structure ensures your estate is distributed without delays or confusion.

Common choices for primary beneficiaries are spouses or children, while contingent beneficiaries often include siblings, friends, charities, or trusts.

Primary vs. Contingent Beneficiary Comparison| Aspect | Primary | Contingent |

|---|---|---|

| Common Picks | Spouse or child | Sibling, friend, or charity |

| Definition | Gets payout or assets first | Gets assets if primary can’t |

| Eligibility | Must qualify at claim time | Only if primary can’t claim |

| Legal Rights | Immediately after claim | Only if primary ineligible |

| Quantity Limit | One or more | One or more |

| Payout Order | Receives payment first | Receives payment second |

| Purpose | Directs funds to main heir | Backup to ensure payout |

| Activation | Automatically at death | When primary unavailable |

| Use | Insurance, wills, accounts | Used as backup designation |

There are some important limitations to keep in mind. For example, naming minors as beneficiaries may require a custodian or setting up a trust to manage the funds until they reach legal age.

If you want to name multiple contingent beneficiaries, you can do so by dividing the benefit into specific shares or percentages. This gives you flexibility and helps avoid disputes among heirs, ensuring your wishes are honored exactly as intended.

Read More: How to Get Life Insurance Quotes

How to Choose Contingent Beneficiaries

Designating a contingent beneficiary is a simple but important step in protecting your financial plans. Start by choosing someone you trust. This could be a family member, close friend, or charity.

If you’re naming more than one contingent beneficiary, clearly specify the percentage or share each person or entity will receive.

How to Name a Contingent Beneficiary| Step | Specifics | Description |

|---|---|---|

| #1 | Choose beneficiary | Pick a trusted backup |

| #2 | Get form | Request from provider |

| #3 | Fill primary info | Add beneficiary details |

| #4 | Add contingent info | Add backup name & contact |

| #5 | Assign shares | Divide if multiple |

| #6 | Add SSN/Tax ID | Provide ID if needed |

| #7 | Review & sign | Check and sign |

| #8 | Submit form | Send to provider |

| #9 | Keep copy | Store with estate docs |

| #10 | Update after changes | Revise if life changes |

Once you’ve made your choice, request a beneficiary form from your insurance provider or financial institution to start the process.

Fill out your primary and contingent beneficiary information carefully and follow these tips to ensure there are no delays:

- Include full identifying details for your beneficiary, such as their name, contact information, social security number, or tax ID

- Review the form thoroughly to ensure all details are correct before you submit it to your provider

- Keep a copy of the completed form with your estate documents for easy reference

- Always review and update your beneficiary designations regularly

After filling out the form, review it and update it regularly, especially after major life events like marriage, divorce, or the birth of a child.

Depending on how much life insurance you need, you may always want to update your policy limits and coverage after a major life change.

Updating Your Contingent Beneficiary

Updating your beneficiaries is an easy but important step to keep your plans clear. Big life changes like getting married, divorced, having a child, or losing someone close can affect who you want to receive your assets.

It’s best to review your beneficiary list after these events to make sure it still matches your wishes. If you have an irrevocable beneficiary, you will need their permission to make any changes to their inheritance.

Always name a contingent beneficiary to make sure your assets go exactly where you want them to.

Kristen Gryglik Licensed Insurance Agent

Most insurance companies and financial providers let you update this information quickly online or with a simple form.

The process is simple, and keeping your policy current helps avoid confusion and makes sure your money goes to the right people.

Read More: How to Finance What Your Health Insurance Won’t Cover

How Contingent Beneficiary Payouts Work

Contingent beneficiary designations work with different types of insurance and financial plans. In a term life policy, the contingent beneficiary gets the payout if the primary dies first, which is common for families who want a clear backup.

Whole life insurance works similarly but can also include cash value, so the contingent may receive the payout if no primary is listed. With universal life insurance, they can receive either the payout or the policy’s cash value, giving more flexibility.

Where Contingent Beneficiaries Apply| Policy | How It Works | Key Details |

|---|---|---|

| Term Life | Pays contingent if primary dies | Common in family policies |

| Whole Life | Pays contingent if no primary | Lifelong coverage & savings |

| Universal Life | Backup gets payout or cash | Flexible premiums & benefits |

| Group Life | Employer assigns contingent | May limit beneficiaries |

| Accidental Death | Pays only for accidental death | Covers accidents only |

For group life insurance, usually offered by employers, the contingent beneficiary can be named, but the options may be limited.

Accidental death policies also allow contingents, but only if the claim meets the accident rules and the primary beneficiary can’t receive the benefit.

Contingent Beneficiary Payout Process

The beneficiary payout process begins when the policyholder dies and a claim is made. What are the main situations that trigger a contingent payout?

If the primary beneficiary can’t receive the payout, either because they passed away first, can’t be found, or refuse the money, the funds automatically go to the contingent beneficiary.

Life insurance death benefits can be given as a lump sum or divided by percentage if there are multiple contingent beneficiaries.

Schimri Yoyo Licensed Agent & Financial Advisor

This clear payout order helps make sure assets are distributed smoothly and according to the policyholder’s wishes.

Learn more about the main types of life insurance to secure the right coverage for yourself and your loved ones.

Top Contingent Beneficiary Mistakes to Avoid

If not addressed early, life insurance beneficiary mistakes can lead to serious legal and financial problems. One of the most common errors is forgetting to name a contingent beneficiary, which leaves no clear backup if the primary can’t receive the payout.

Another frequent mistake is naming minors without setting up a custodian or trust, which can delay access to funds and involve the court.

Common Beneficiary Mistakes to Avoid| Mistake | Why it Matters |

|---|---|

| Leaving blank | Delays probate process |

| No contingent | No backup if primary fails |

| Not updating | Wrong person gets payout |

| Vague names | Causes confusion/disputes |

| No percentages | Leads to uneven payouts |

| Naming minors | Court controls the funds |

| Skipping advice | Causes tax or legal issues |

Many people also forget to update their beneficiaries after major life events like marriage, divorce, or the birth of a child, which can result in assets going to the wrong person.

It’s also a mistake to assume that a will overrides beneficiary designations. In most cases, the designation on your policy or account takes priority. Learn the top reasons to buy life insurance before buying a policy.

Vague names or missing percentages can create confusion, disputes, and uneven payouts. Taking the time to name a clear contingent, assign proper shares, and keep your designations current helps protect your assets and the people you care about.

Don’t settle for high life insurance rates. Shop for low rates and ensure your loved ones are protected by entering your ZIP code.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.