The Best States for Employer-Provided Health Insurance in 2026

Find out the best states for employer-provided health insurance and how the cost of employer-sponsored health plans compare across U.S. states.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as ...

Justin Wright

Updated January 2026

Call it the Era of Insurance Uncertainty. Between Washington’s inconclusive battles over the healthcare law and continually rising premiums, many Americans feel more concern than clarity about affording healthcare in the future.

However, amidst all the policy and politics, an essential component of our health insurance marketplace is often overlooked: employer-provided health insurance plans. These are the plans that jobs offer their employees, and they’re the single largest source of insurance for Americans, far ahead of federal programs like Medicare and Medicaid. In fact, if you’re currently of working age, you may already be covered by one.

If so many of us are covered by these plans, why don’t we talk about them more often? For one thing, workers don’t get much of a say when it comes to picking the benefits their employers will offer. Another reason may be that the costs of employer plans seem relatively stable: While they typically increase slightly every year, we don’t necessarily realize when those hikes hit our wallets. Compare that to projected spikes in “Obamacare” premiums, and folks with employer plans are sitting pretty, right?

Not quite, unfortunately. Around the country, employees are taking on a greater percentage of the cost of their plans every year, as employers shift more of the shared expense onto their workers. If you haven’t already noticed the increase, that’s probably because it’s coming directly from your paycheck.

Plus, the average employee deductible for single coverage has increased to $1,787 in recent years, according to the Kaiser Family Foundation. That means you could be looking at a massive bill if you actually use that plan you’re paying for. These deductible increases are particularly concerning for young people who may have chosen high-deductible plans because they’re relatively healthy, only to be hit with substantial debt when an accident or illness strikes.

Feeling a little uncertain about your employer-provided health plan, yet? Well, we’re right there with you. That’s why we set out to determine which states offer the best employee health insurance plans.

Top States for Employer-Provided Health Insurance

Comparing data from across the nation, we’ve found where residents are getting a relatively good deal on health insurance from their jobs, and where they’re paying quite a lot relative to their average income. We’ve also factored politics into our analysis, comparing the employer-provided insurance prices for states that lean left and right.

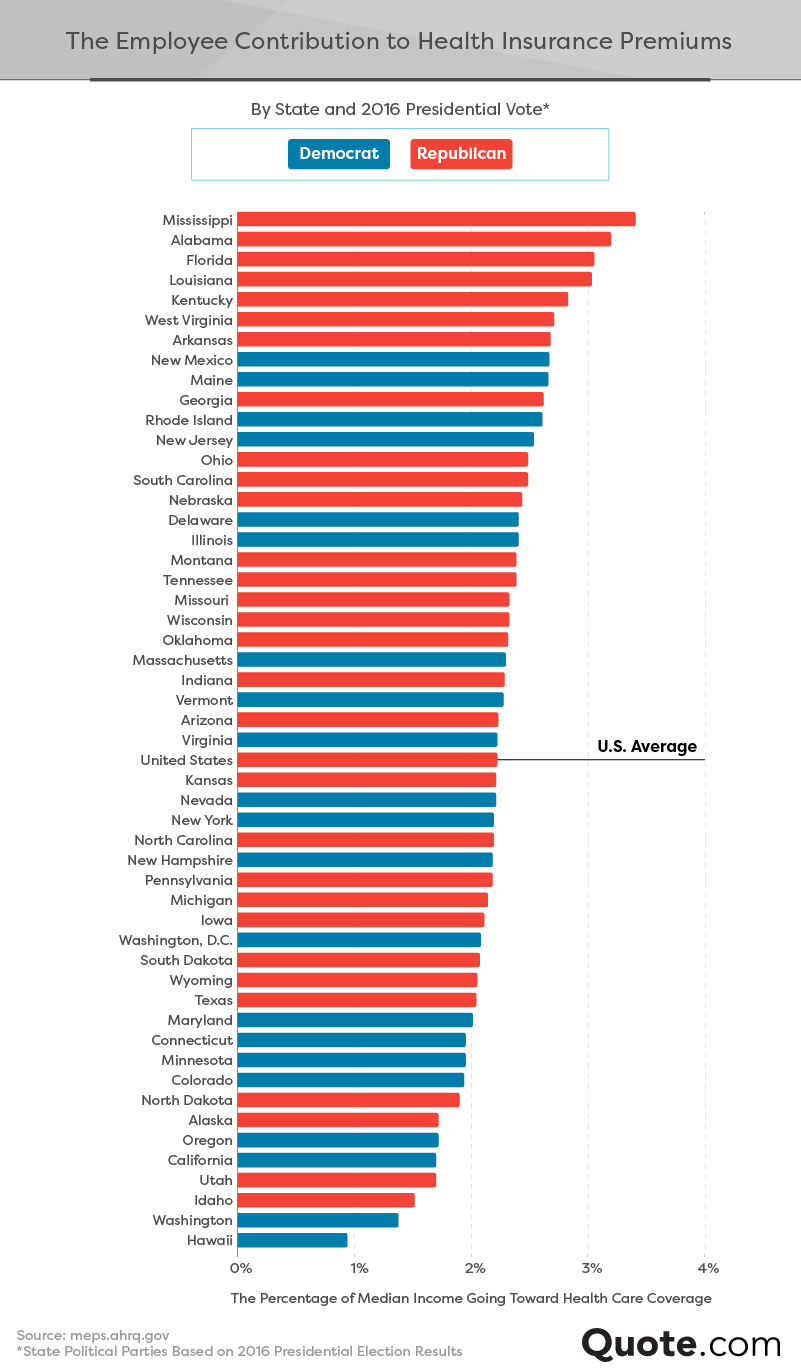

Our first state ranking revolves around a simple question: How much of what people make in each state goes toward employer-provided plan premiums? That’s an essential concern for families trying to make ends meet and a good indication of where employer plans stand nationwide. If you live in a Southeastern state, you might not like our answers.

The Percentage of Health Insurance Premiums Paid by Employees, by State

In all but a handful of states, the average employee contribution was equal to at least 2 percent of their median income. If that doesn’t sound like a lot, think again: Average contributions total $1,500 or more in many states. We’ll take a deeper dive into cost data in a moment, but let’s first consider some of the striking regional trends visible above.

Our best states for employee contributions relative to income were concentrated near the West Coast, with states like Washington, California, and Idaho spending less than 1.75 percent of their incomes on premiums. By contrast, states surrounding the Gulf of Mexico shelled out roughly twice as much of their paychecks annually. Employee contributions in Louisiana, Mississippi, Alabama, and Florida all exceeded 3 percent of each state’s median annual income.

These rates may reflect health challenges experienced throughout the Southeastern region. Louisiana, Alabama, and Mississippi fell among the least healthy states in a recent United Health Foundation ranking, and Florida wasn’t much better. Poor health indicators could push premiums higher for all residents of these states, with businesses passing along costs to their workers.

Perhaps because contributions were so pricey, these states also had some of the lowest rates of participation in these plans. We’ll explore price and the percentage of residents covered by employer plans in more detail below.

Employer-Sponsored Health Insurance Statistics, By State

Not only do states vary significantly in average contribution relative to income, they also demonstrate significant differences in how much of the plan’s cost employees must cover themselves. In Hawaii, for instance, contributions aren’t just low because insurance premiums are cheap overall – employees pay on average less than 1 percent of the median Hawaiian’s income. Compare that to Alabama or New Jersey, where the percentage of plan costs paid by employees is more than twice as high, and you’ll realize just how much that statistic matters.

Interestingly, the percentage of residents covered by an employer-provided plan in each state did not consistently correlate with the average contribution as a percentage of income. In Utah, for example, contributions are relatively inexpensive, and 60 percent of residents are covered by an employer-provided plan. Yet in California, where contributions represent an identical percentage of income, the percentage covered by employer-provided plans was just 46 percent.

On the other end of the spectrum, however, the relationship between high costs and low participation was far clearer. In each of the 10 states where contributions represented the highest percentage of income, less than half of residents were covered by an employer-provided plan. Perhaps workers in these states are looking elsewhere for cheaper options, or simply deciding to go uninsured altogether.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Obligation: The Politics of Who Pays for Employer-Provided Plans

At this point, you may be wondering what might influence employers in a given state to be more or less generous about the percentage of insurance costs they cover. While every employer’s circumstances are unique, could political preference in different parts of the country explain some of the geographical differences we’ve observed thus far?

On the conservative side of the spectrum, it’s easy to imagine a preference for individual responsibility and a lesser burden on businesses. More liberal states, conversely, might emphasize a company’s responsibility to its employees more heavily. Perhaps the political affiliation of each state’s residents and regulators might influence how employer-provided health plans operate.

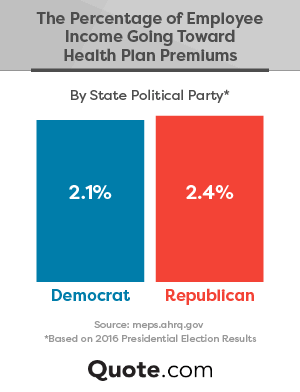

To test this hypothesis, we compared the average contribution as a percentage of median income in states that swung Republican or Democrat in the 2016 presidential election.

As we expected, employer-provided plan contributions represented a lower percentage of median income in more liberal states. Could this conclusion be a mere coincidence? A closer look at each state’s stats might suggest otherwise.

Each of the seven states where average contributions represented the largest portion of median income voted for the Republican candidate in 2016. In fact, with the exception of New Mexico and Maine, the top 10 locations were entirely composed of states that went red in the last presidential election. And it appears that historically conservative states are concentrated above the national average, with a greater number of liberal states falling below that 2.24 percent metric.

Our findings aren’t entirely uniform, however: Residents of some left-leaning states spent a strikingly high percentage of their income on their contributions as well. These outliers may owe their rates to local political turbulence. New Mexico’s superintendent of insurance approved a significant rate surge in 2016, while Maine’s insurance marketplace has been thrust into turmoil by the departure of insurers.

Though many local regulators have addressed their recent health insurance concerns to Congress, state governments are limited in that they can only pass legislation that regulates insurance laws, including regulating rates. To consider this element of political influence, we compared the party composition of state legislatures to the percentage of income residents are spending on contributions to their employer-provided health plans.

Conclusion

As our findings clearly show, Americans are paying vastly different amounts for coverage from their employers – differences that can have a significant impact on their financial security. Still, many of us assume we’re powerless when it comes to our employee health plan – we may be able to select from among a few options, but we’re stuck with the premiums our jobs offer. You may not be able to convince your boss to select a plan that works better for you (or cover more of its cost), but you probably have more flexibility than you realize to find coverage you need at an affordable price.

If you’re paying more than you’d like for coverage that doesn’t meet your needs, you may find a better deal by shopping around the individual health insurance market. It never hurts to learn your options, and you might be surprised by how much you could save.

That’s where our free health insurance quote tool might come in handy, giving you personalized rates from the nation’s best insurers. At Quote.com, that’s what we’re all about – helping you find the best prices for just about anything.

Methodology

We analyzed 2016 data from the U.S. Census Bureau, as well as data from the Medical Expenditure Panel Survey (MEPS), produced by the Agency for Healthcare Research and Quality. To calculate the percentage of median income going toward an employee’s health plan, we compared reported data to median income levels for each state, as reported by the U.S. Census Bureau as of 2016. State government partisan compositions were gathered from the National Conference of State Legislatures. Nebraska is the only state with a nonpartisan state senate, so it wasn’t included in the state-level government comparison.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Sources

- U.S. Census Bureau – CPS Annual Social and Economic Supplement

- Agency for Healthcare Research and Quality

- National Conference of State Legislatures

- The Henry J. Kaiser Family Foundation

Fair Use

Unlike healthcare, sharing is one form of caring that won’t cost a thing. We hope you’ll do so with our content, so feel free to share any of the images, facts, and text above for noncommercial purposes. When you do, credit Quote.com with a link back to this page.

Frequently Asked Questions

Which employers have the best health insurance benefits?

Companies like Google and Microsoft are recognized for offering comprehensive health plans in conjunction with benefits such as mental health tools, flexible schedules, and caregiver support.

What are the states with the best health insurance for workers?

Based on the affordability of employer-sponsored plans, the top states include Hawaii, Oregon, Idaho, California, and North Dakota.

What are the employer health insurance laws by state?

Employer health insurance rules differ by state. Some impose mandates like Hawaii’s compulsory employer coverage and contribution caps, while others have more relaxed or mixed regulations, especially for small businesses

How does employer health insurance differ across states?

Hawaii offers particularly affordable employer-sponsored plans thanks to a law requiring nearly universal employer coverage and caps on employee contributions. Oregon, Idaho, California, and North Dakota also rank well due to favorable laws, healthier populations, and expanded access.

What are the best employer health insurance plans available today?

While specific plans vary by employer and region, national carriers such as Kaiser Permanente, UnitedHealthcare, Aetna, Molina Healthcare, and Humana are frequently rated among the best for factors like accessibility, affordability, and chronic care support.

What is the cost of employer-provided health insurance?

In 2024, the average annual cost of employer-provided health insurance in the U.S. was approximately $8,951 for single coverage and $25,572 for family coverage.

What are the largest health insurance companies in the U.S.?

By market share, the top players include:

- UnitedHealth Group (~16%)

- Elevance Health (Anthem) (~7%)

- Centene, Humana, Kaiser Permanente (~6–7% each)

How to compare employer health plans?

Evaluate key factors such as network provider access, coverage for known health needs (e.g., prescriptions or specialist visits), premiums, insurance deductibles, copays, etc.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.